TreeHouse Foods (THS)

We wouldn’t recommend TreeHouse Foods. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think TreeHouse Foods Will Underperform

Whether it be packaged crackers, broths, or beverages, Treehouse Foods (NYSE:THS) produces a wide range of private-label foods for grocery and food service customers.

- Below-average returns on capital indicate management struggled to find compelling investment opportunities, and its falling returns suggest its earlier profit pools are drying up

- Organic revenue growth fell short of our benchmarks over the past two years and implies it may need to improve its products, pricing, or go-to-market strategy

- Sales stagnated over the last three years and signal the need for new growth strategies

TreeHouse Foods doesn’t fulfill our quality requirements. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than TreeHouse Foods

High Quality

Investable

Underperform

Why There Are Better Opportunities Than TreeHouse Foods

TreeHouse Foods’s stock price of $24.30 implies a valuation ratio of 13x forward P/E. This multiple is lower than most consumer staples companies, but for good reason.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. TreeHouse Foods (THS) Research Report: Q3 CY2025 Update

Private label food company TreeHouse Foods (NYSE:THS) missed Wall Street’s revenue expectations in Q3 CY2025, with sales flat year on year at $840.3 million. Its non-GAAP profit of $0.43 per share was 23.9% below analysts’ consensus estimates.

TreeHouse Foods (THS) Q3 CY2025 Highlights:

- TreeHouse Foods announced it will be acquired by Investindustrial for a total of $2.9 billion. In light of the pending transaction, TreeHouse Foods will not host its conference call previously scheduled for today, and the Company is withdrawing guidance, which it will no longer provide moving forward.

- Revenue: $840.3 million vs analyst estimates of $849.3 million (flat year on year, 1.1% miss)

- Adjusted EPS: $0.43 vs analyst expectations of $0.56 (23.9% miss)

- Adjusted EBITDA: -$202.1 million vs analyst estimates of $98.83 million (-24.1% margin, significant miss due to $298 million non-recurring impairment charge)

- Operating Margin: -30.2%, down from 3.8% in the same quarter last year due to $298 million non-recurring impairment charge

- Free Cash Flow Margin: 0.3%, similar to the same quarter last year

- Sales Volumes fell 11.6% year on year (-0.8% in the same quarter last year)

- Market Capitalization: $962 million

Company Overview

Whether it be packaged crackers, broths, or beverages, Treehouse Foods (NYSE:THS) produces a wide range of private-label foods for grocery and food service customers.

Private-label products refer to goods that are produced by one company (Treehouse) and then branded and sold under another company's brand (a grocer’s store brand, for example). The grocer’s rationale for offering private label products is usually control over product design and production as well as the higher margins associated with private label goods.

TreeHouse Foods was founded in 2005 as a spin-off of dairy company Dean Foods. Today, the company’s private label production capabilities encompass crackers, creamers, single-serve beverages, broths/stocks, and in-store bakery items like cookies, among other products. Overall, though, cereals, pasta, and dressings are its top-selling categories.

TreeHouse Foods’ customers are mainly grocery stores and food service businesses such as corporate cafeterias. These customers typically choose TreeHouse because of its expertise in the private label arena and its broad portfolio of offerings. End consumers may not be familiar with the TreeHouse brand but if you’ve ever purchased a store brand or picked up an unbranded item at a cafeteria, chances are you’ve consumed one of the company’s products.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors in the private label manufacturing business include B&G Foods (NYSE:BGS), J&J Snack Foods (NASDAQ:JJSF), and private company Cott Corporation.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

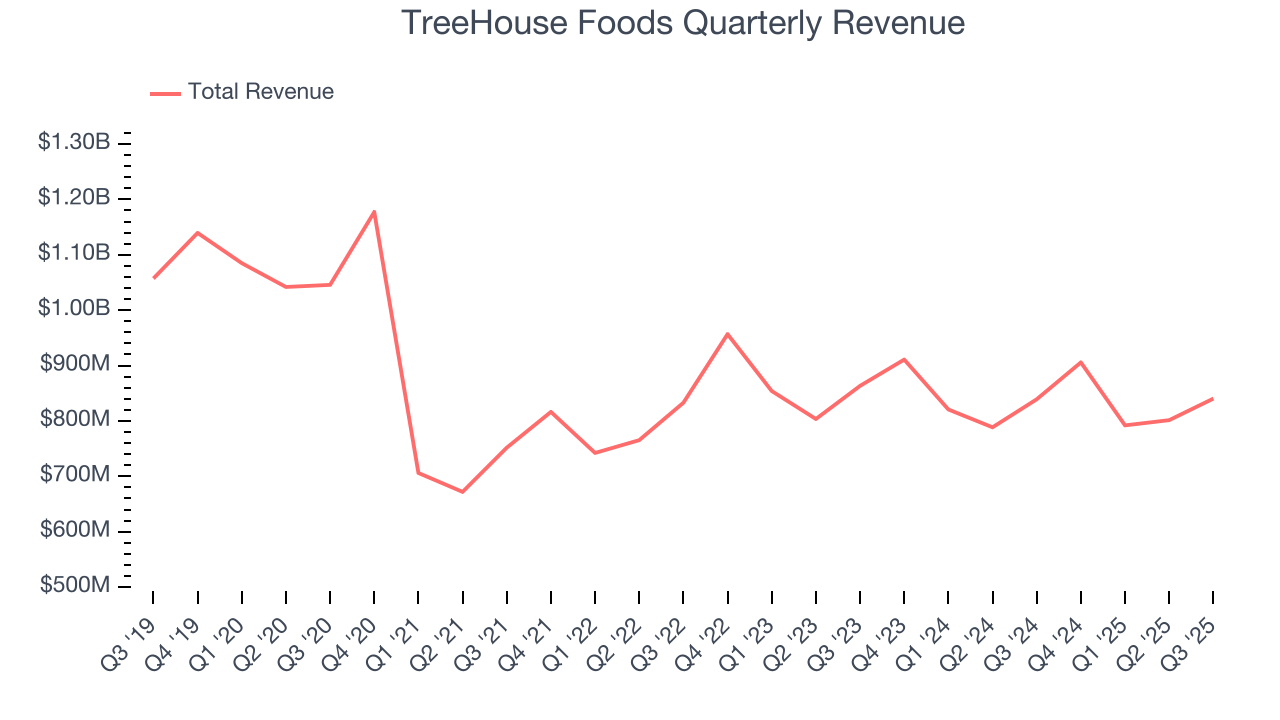

With $3.34 billion in revenue over the past 12 months, TreeHouse Foods carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, TreeHouse Foods grew its sales at a sluggish 1.9% compounded annual growth rate over the last three years as consumers bought less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, TreeHouse Foods’s $840.3 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months, similar to its three-year rate. This projection is underwhelming and implies its newer products will not accelerate its top-line performance yet.

6. Volume Growth

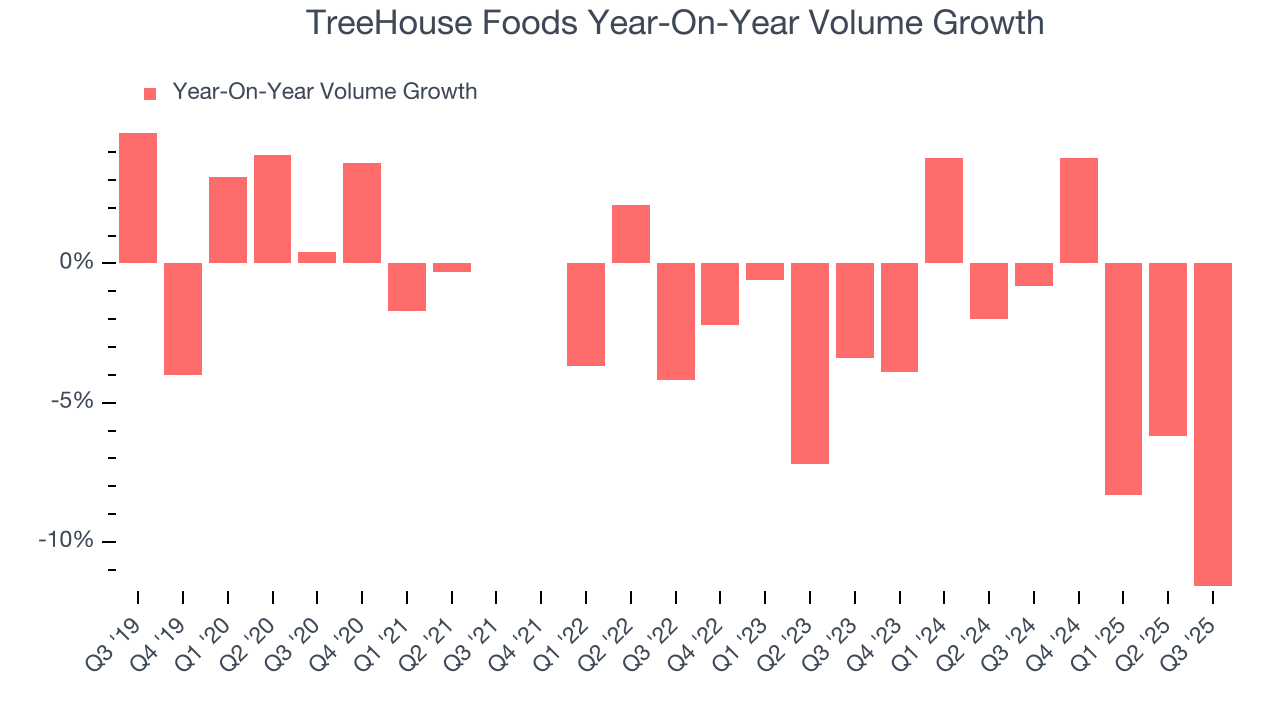

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

TreeHouse Foods’s average quarterly sales volumes have shrunk by 3.2% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In TreeHouse Foods’s Q3 2025, sales volumes dropped 11.6% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

7. Gross Margin & Pricing Power

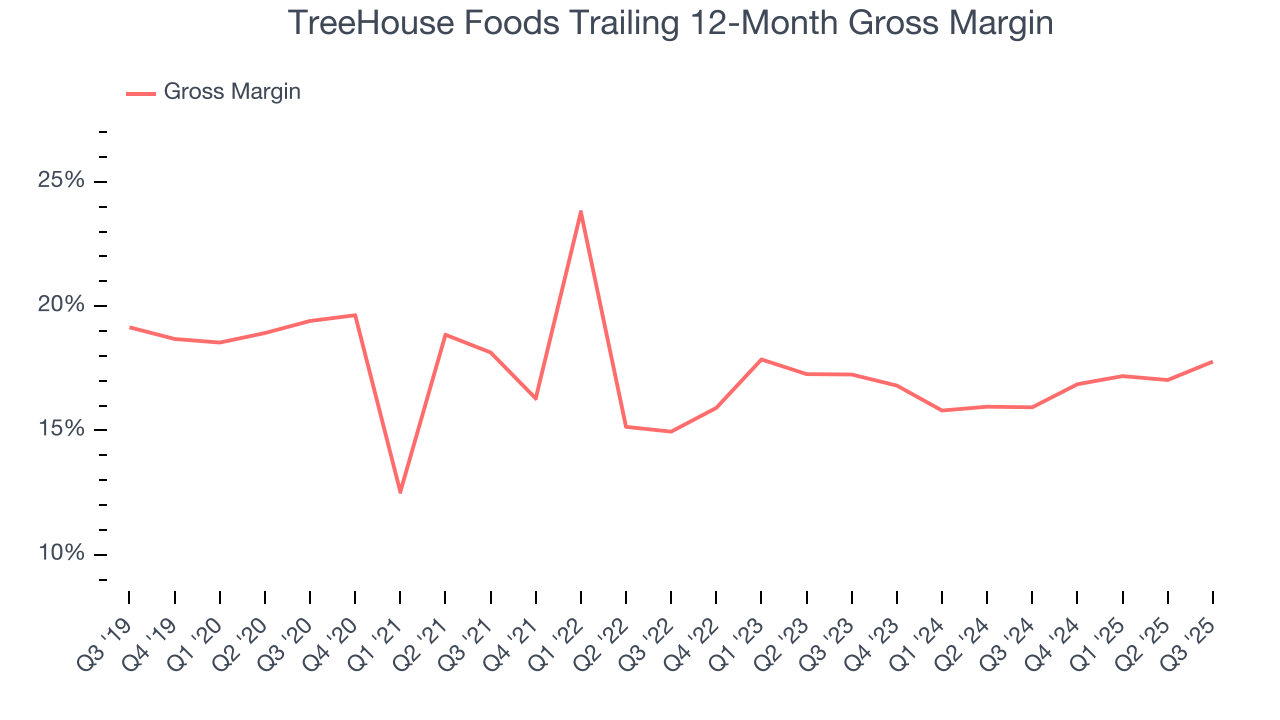

TreeHouse Foods has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 16.8% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $83.15 went towards paying for raw materials, production of goods, transportation, and distribution.

In Q3, TreeHouse Foods produced a 18.8% gross profit margin, marking a 2.9 percentage point increase from 15.9% in the same quarter last year. TreeHouse Foods’s full-year margin has also been trending up over the past 12 months, increasing by 1.8 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

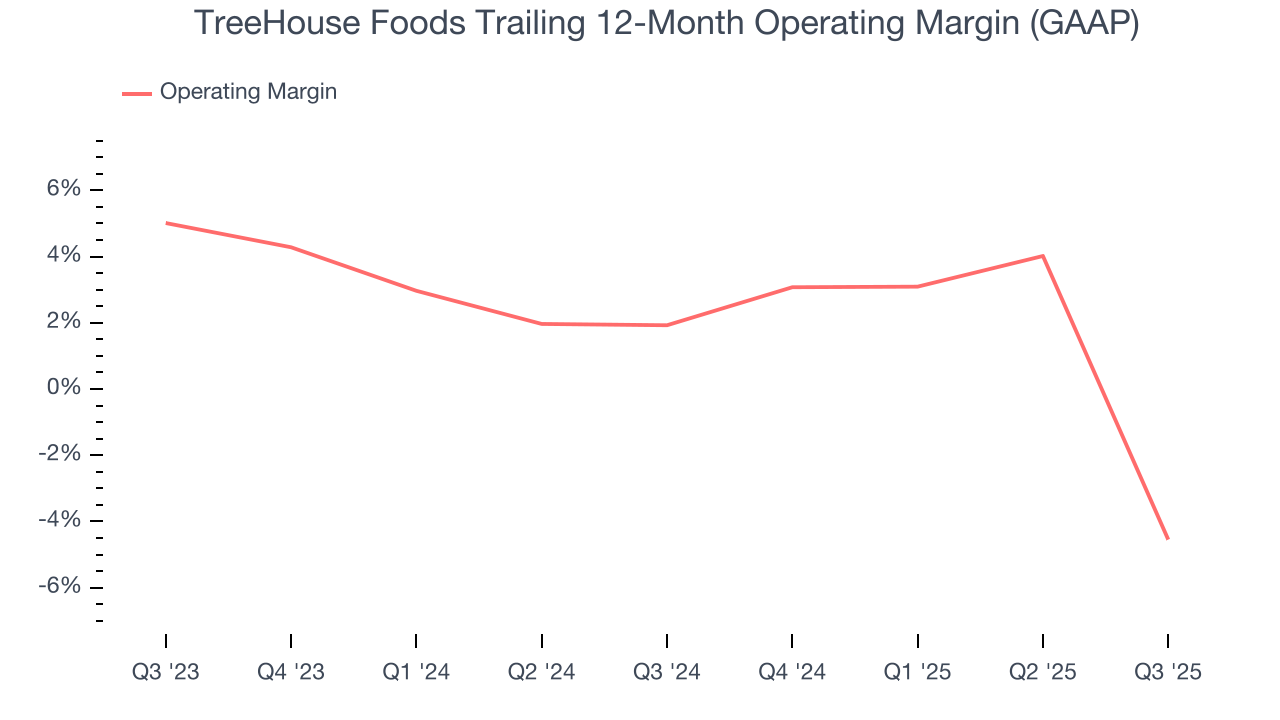

8. Operating Margin

Unprofitable public companies are rare in the defensive consumer staples industry. Unfortunately, TreeHouse Foods was one of them over the last two years as its high expenses contributed to an average operating margin of negative 1.3%.

Looking at the trend in its profitability, TreeHouse Foods’s operating margin decreased by 6.5 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. TreeHouse Foods’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

TreeHouse Foods’s operating margin was negative 30.2% this quarter due to $298 million non-recurring impairment charge.

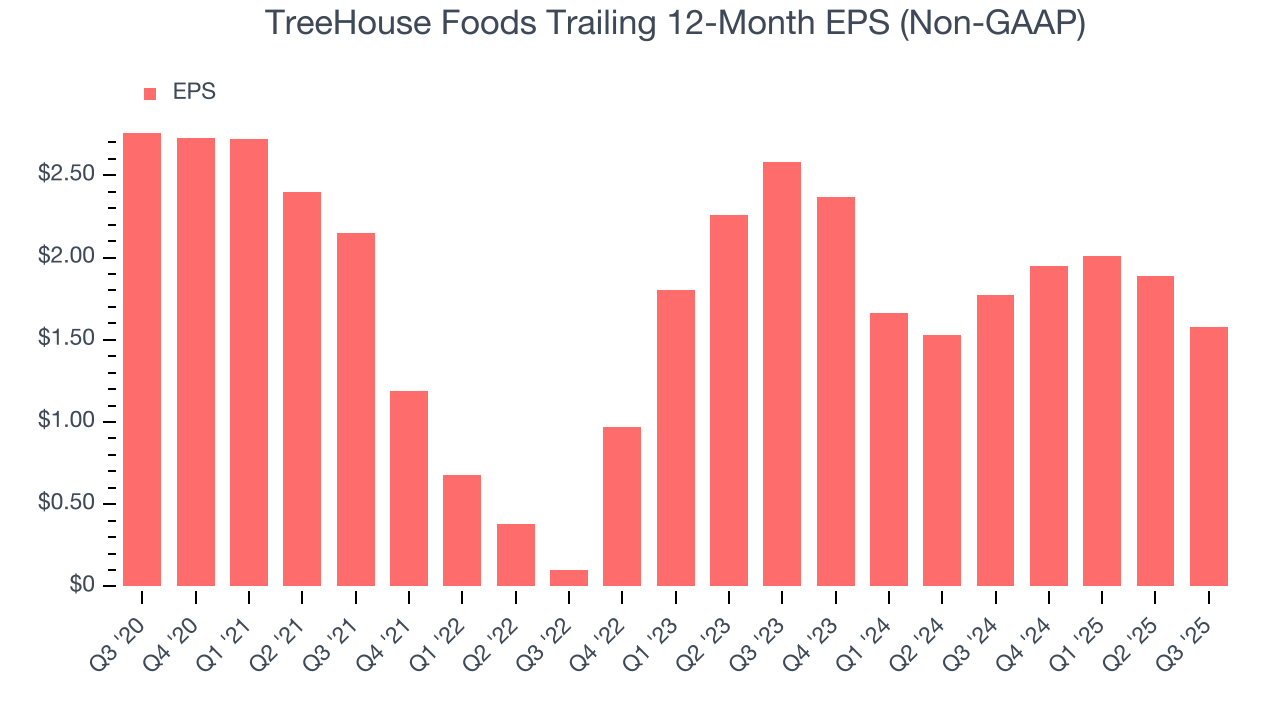

9. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, TreeHouse Foods reported adjusted EPS of $0.43, down from $0.74 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects TreeHouse Foods’s full-year EPS of $1.58 to grow 23.8%.

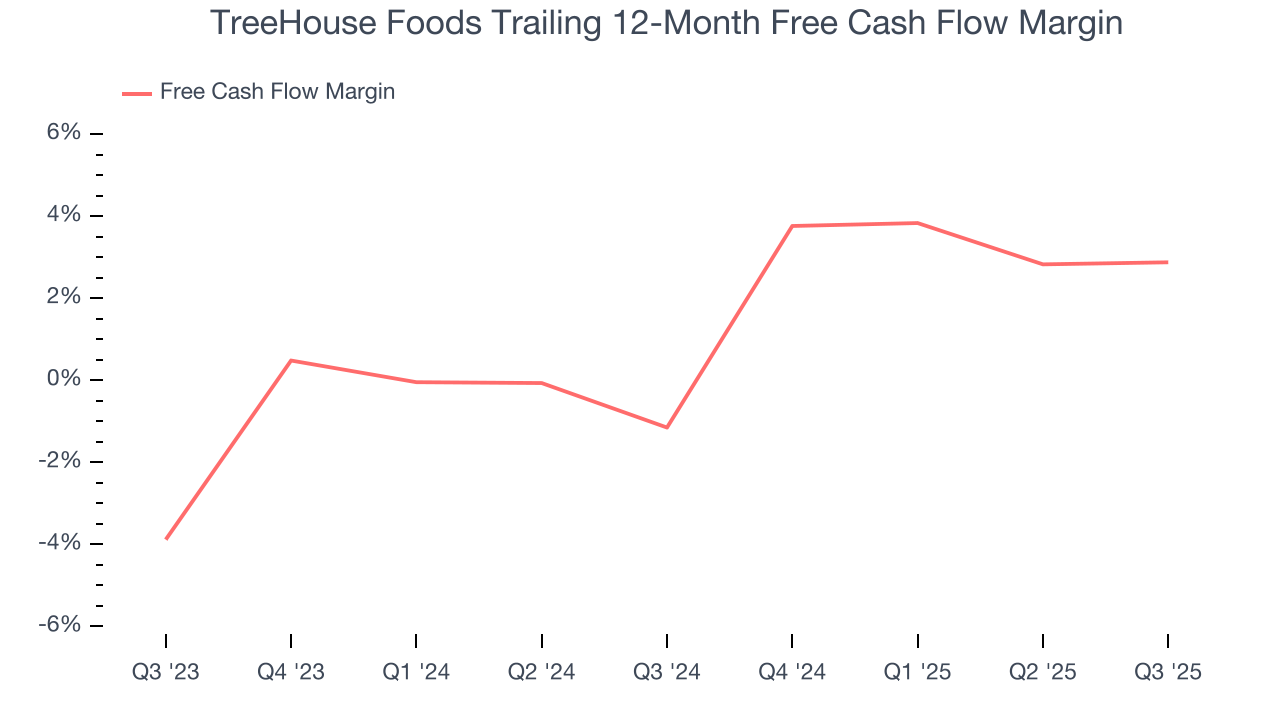

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

TreeHouse Foods broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that TreeHouse Foods’s margin expanded by 4 percentage points over the last year. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

TreeHouse Foods broke even from a free cash flow perspective in Q3. This cash profitability was in line with the comparable period last year and its two-year average.

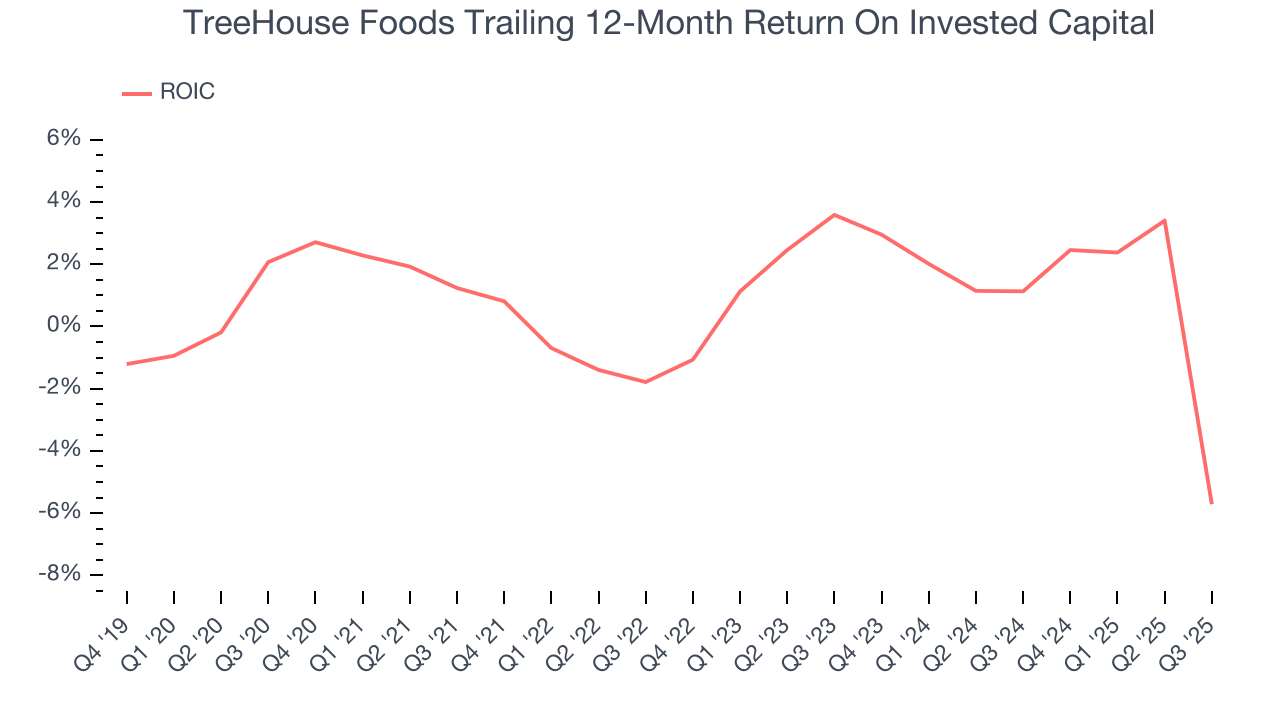

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

TreeHouse Foods’s five-year average ROIC was negative 0.3%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

12. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

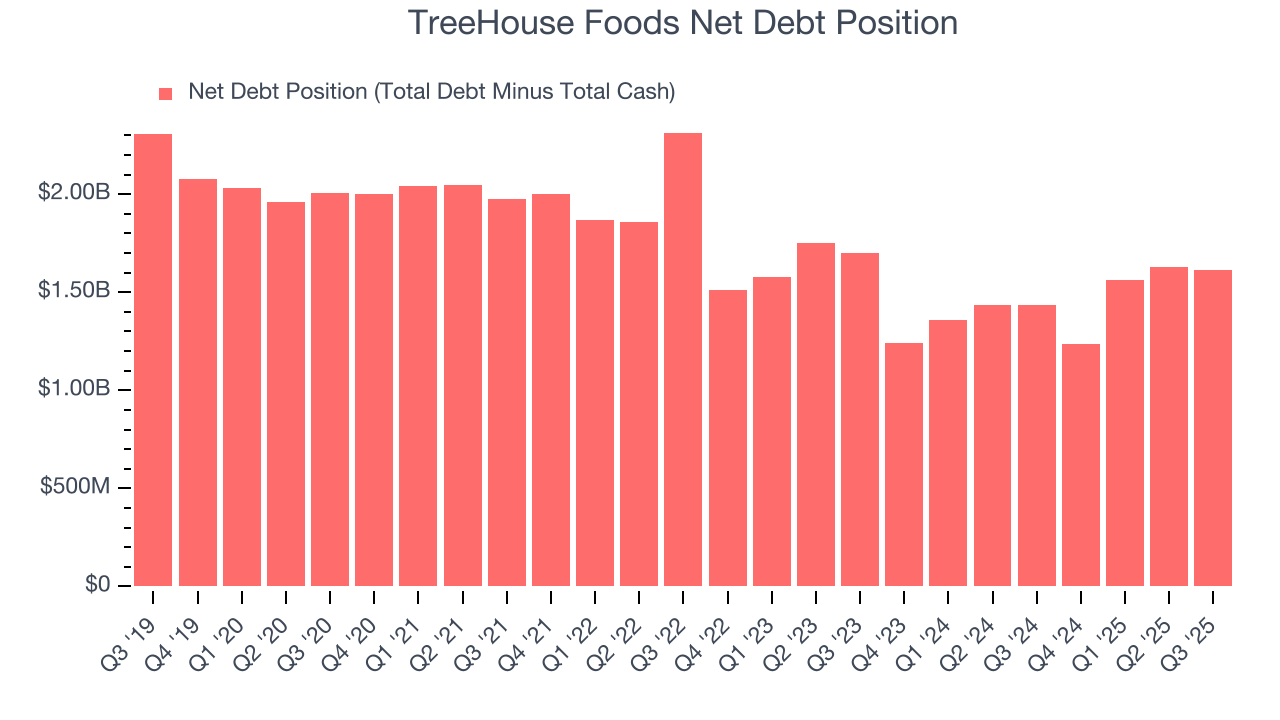

TreeHouse Foods’s $1.63 billion of debt exceeds the $21 million of cash on its balance sheet. Furthermore, its 34× net-debt-to-EBITDA ratio (based on its EBITDA of $47 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. TreeHouse Foods could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope TreeHouse Foods can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

13. Key Takeaways from TreeHouse Foods’s Q3 Results

The stock traded up 20.4% to $22.92 immediately following the results largely due to the announcement that TreeHouse Foods will be acquired by Investindustrial for a total of $2.9 billion.

14. Is Now The Time To Buy TreeHouse Foods?

Updated: January 20, 2026 at 9:53 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own TreeHouse Foods, you should also grasp the company’s longer-term business quality and valuation.

We cheer for all companies serving everyday consumers, but in the case of TreeHouse Foods, we’ll be cheering from the sidelines. To kick things off, its revenue growth was weak over the last three years, and analysts don’t see anything changing over the next 12 months. And while its EPS growth over the last three years has been fantastic, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its declining operating margin shows the business has become less efficient.

TreeHouse Foods’s P/E ratio based on the next 12 months is 13x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $21.92 on the company (compared to the current share price of $24.31).