TJX (TJX)

TJX piques our interest. It consistently invests in attractive growth opportunities, generating substantial cash flows and returns.― StockStory Analyst Team

1. News

2. Summary

Why TJX Is Interesting

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE:TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

- Unparalleled revenue scale of $58.98 billion offsets its poor gross margin and gives it advantageous pricing and terms with suppliers

- Industry-leading 27.9% return on capital demonstrates management’s skill in finding high-return investments, and its rising returns show it’s making even more lucrative bets

- On the other hand, its commoditized inventory, bad unit economics, and high competition are reflected in its low gross margin of 30.6%

TJX is solid, but not perfect. We’d wait until its quality rises or its price falls.

Why Should You Watch TJX

Why Should You Watch TJX

At $150.31 per share, TJX trades at 30.6x forward P/E. This valuation multiple hovers around the sector average.

We’re adding this to our watchlist for the time being. It has potential, but we’re not buyers here and now. We prefer to invest in higher-quality companies that trade at comparable valuation multiples.

3. TJX (TJX) Research Report: Q3 CY2025 Update

Off-price retail company TJX (NYSE:TJX) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 7.5% year on year to $15.12 billion. On the other hand, next quarter’s revenue guidance of $17.2 billion was less impressive. Its GAAP profit of $1.28 per share was 5% above analysts’ consensus estimates.

Correction note: A previous version of this article had the incorrect estimates for operating margin and Q4 CY2025 revenue guidance. We have updated this article to reflect the accurate figures.

TJX (TJX) Q3 CY2025 Highlights:

- Revenue: $15.12 billion vs analyst estimates of $14.9 billion (7.5% year-on-year growth, 1.5% beat)

- EPS (GAAP): $1.28 vs analyst estimates of $1.22 (5% beat)

- Revenue Guidance for Q4 CY2025 is $17.2 billion at the midpoint

- EPS (GAAP) guidance for the full year is $4.65 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 12.7%

- Free Cash Flow Margin: 6.6%, up from 4.4% in the same quarter last year

- Locations: 5,191 at quarter end, up from 5,057 in the same quarter last year

- Same-Store Sales rose 5% year on year (3% in the same quarter last year)

- Market Capitalization: $162 billion

Company Overview

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE:TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

For example, if department store Macy’s is left with a huge supply of winter coats because of an unusually warm winter, Macy’s may sell those in bulk to TJX at pennies on the dollar rather than discount the items and try to sell them individually. This is often done to clear floor space for a new season.

Because of TJX’s unique buying approach, shopping there is often a treasure hunt–what the consumer loses in reliable selection is made up for with low prices. TJX prices can be up to 50% lower than those of department stores. While the company was built on buying excessive or defective inventory, TJX is now large enough to buy directly from manufacturers. This had led to more consistent selection from brands such as Polo, KitchenAid, and Estee Lauder to name a few.

TJX operates under the brand names of T.J. Maxx, Marshalls, HomeGoods, Homesense, and Winners. The core customer is the value-conscious shopper who enjoys the thrill of the hunt. This is typically a middle-aged, middle-income woman willing to sift through racks in person to find deals because while TJX has an online presence, it is limited.

4. Discount Retailer

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

Off-price and discount retail competitors include Ross Stores (NASDAQ:ROST), Burlington Stores (NYSE:BURL), and Ollie’s Bargain Outlet (NASDAQ:OLLI)

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $58.98 billion in revenue over the past 12 months, TJX is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To expand meaningfully, TJX likely needs to tweak its prices or enter new markets.

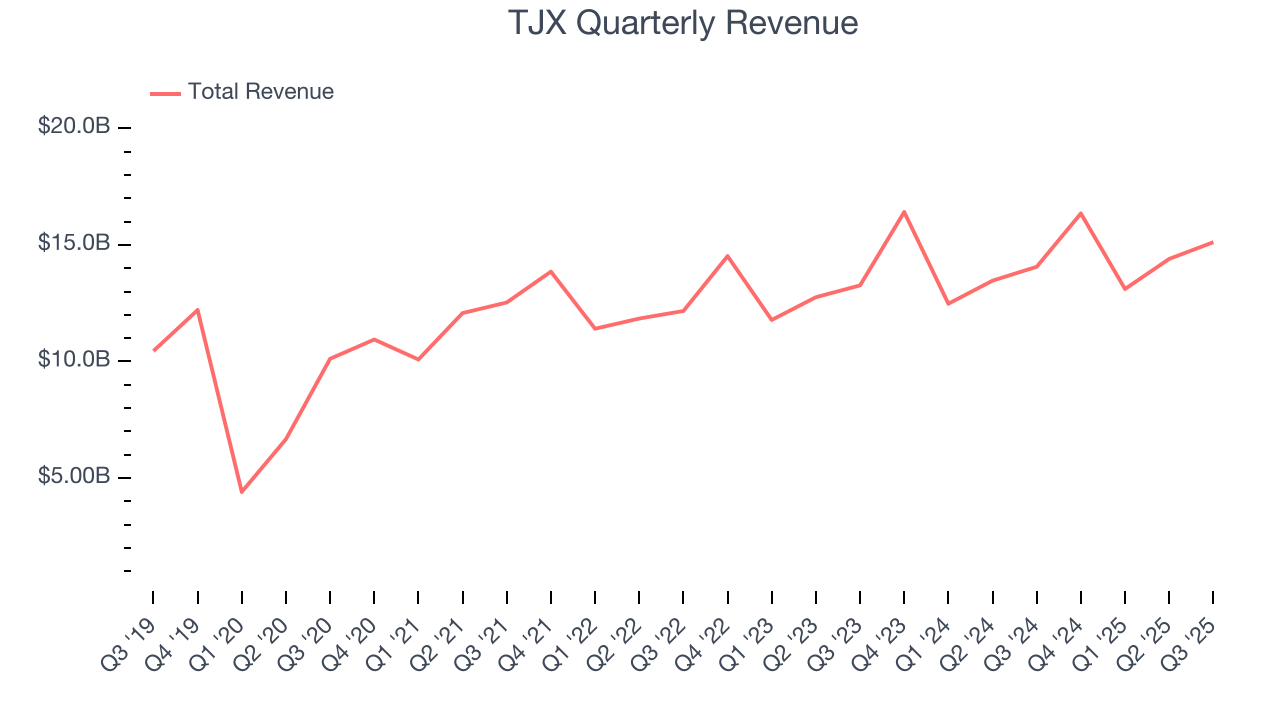

As you can see below, TJX’s sales grew at a tepid 6.4% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, TJX reported year-on-year revenue growth of 7.5%, and its $15.12 billion of revenue exceeded Wall Street’s estimates by 1.5%. Company management is currently guiding for a 2.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months, similar to its six-year rate. We still think its growth trajectory is attractive given its scale and implies the market sees success for its products.

6. Store Performance

Number of Stores

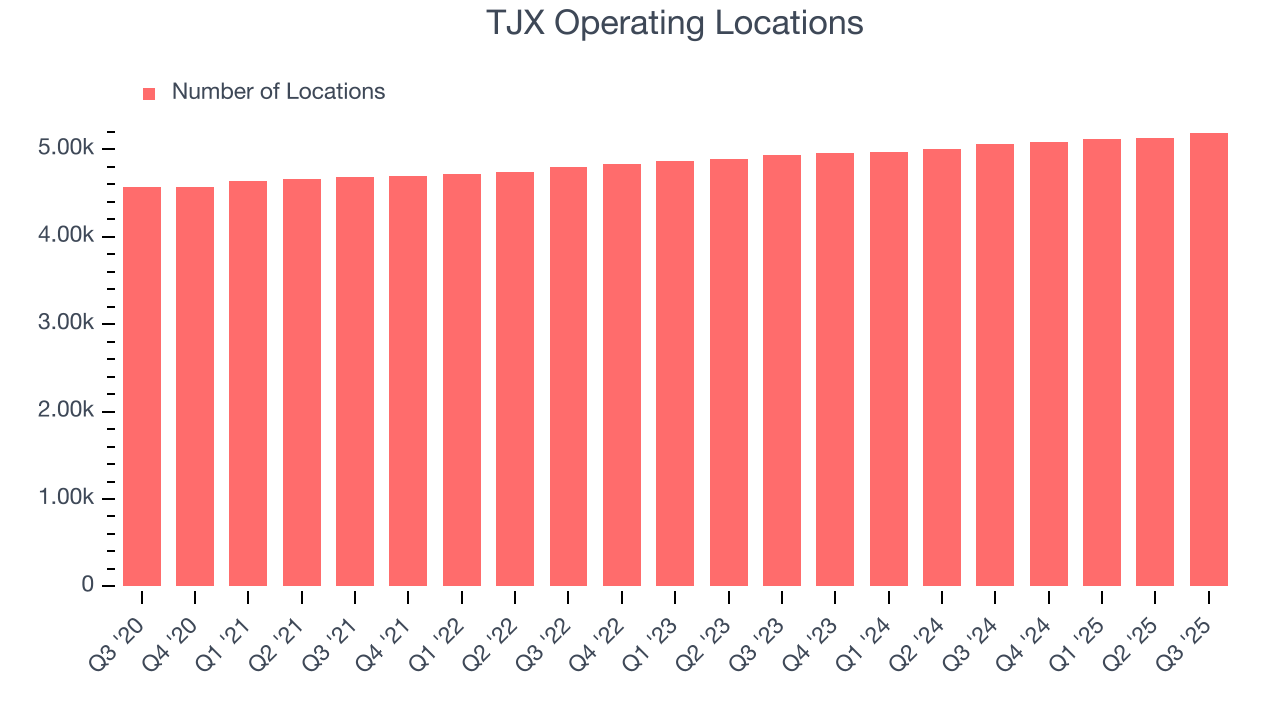

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

TJX operated 5,191 locations in the latest quarter. It has opened new stores quickly over the last two years, averaging 2.6% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

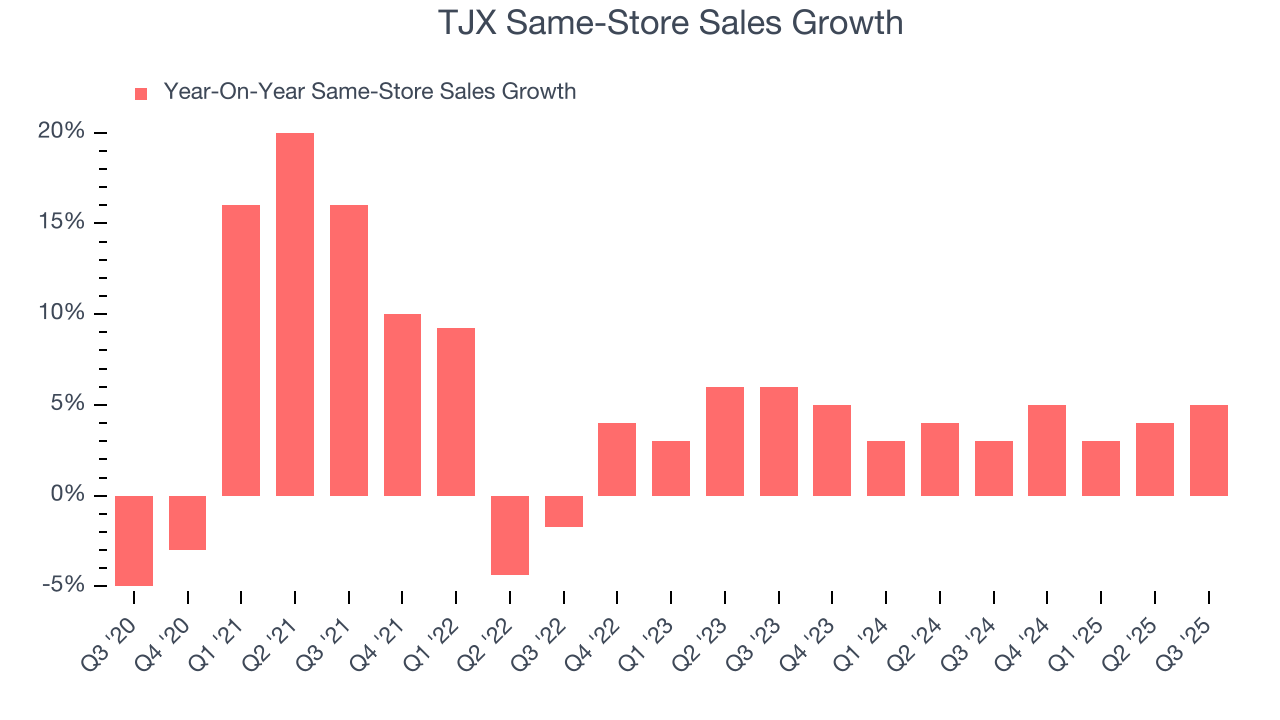

TJX’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 4% per year. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives TJX multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, TJX’s same-store sales rose 5% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

7. Gross Margin & Pricing Power

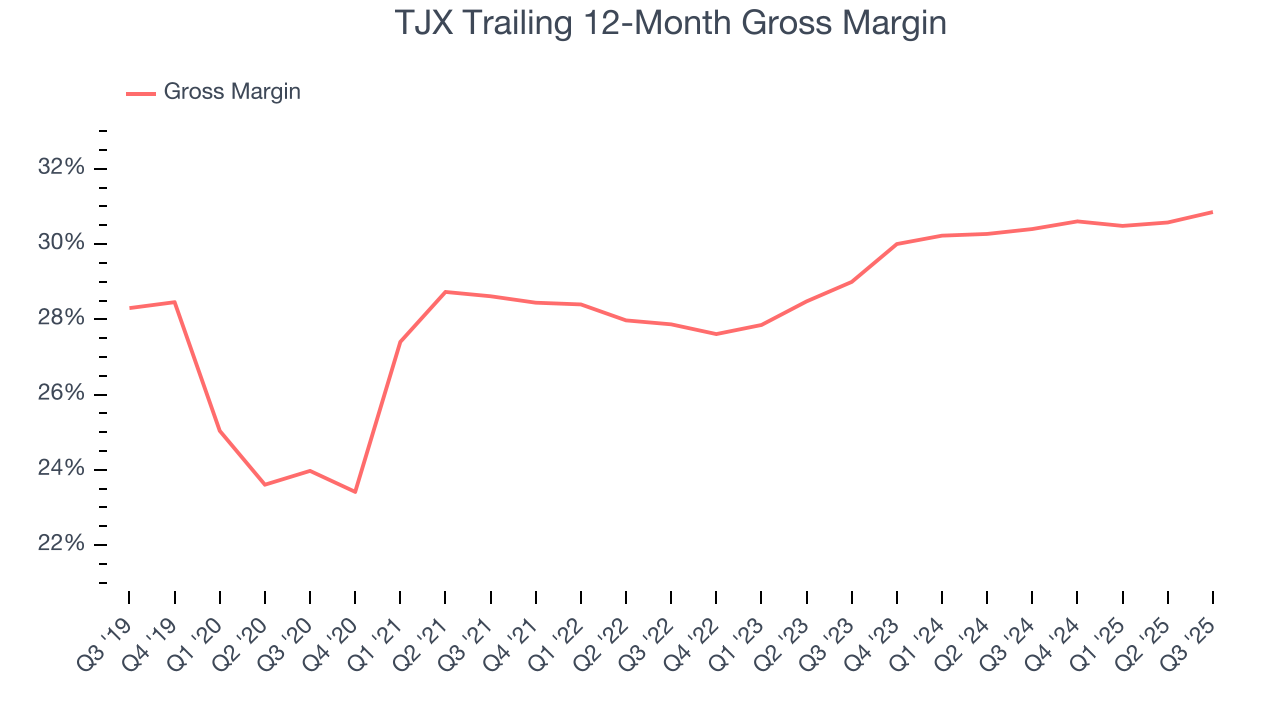

TJX has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 30.6% gross margin over the last two years. That means TJX paid its suppliers a lot of money ($69.37 for every $100 in revenue) to run its business.

This quarter, TJX’s gross profit margin was 32.6%, marking a 1 percentage point increase from 31.6% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

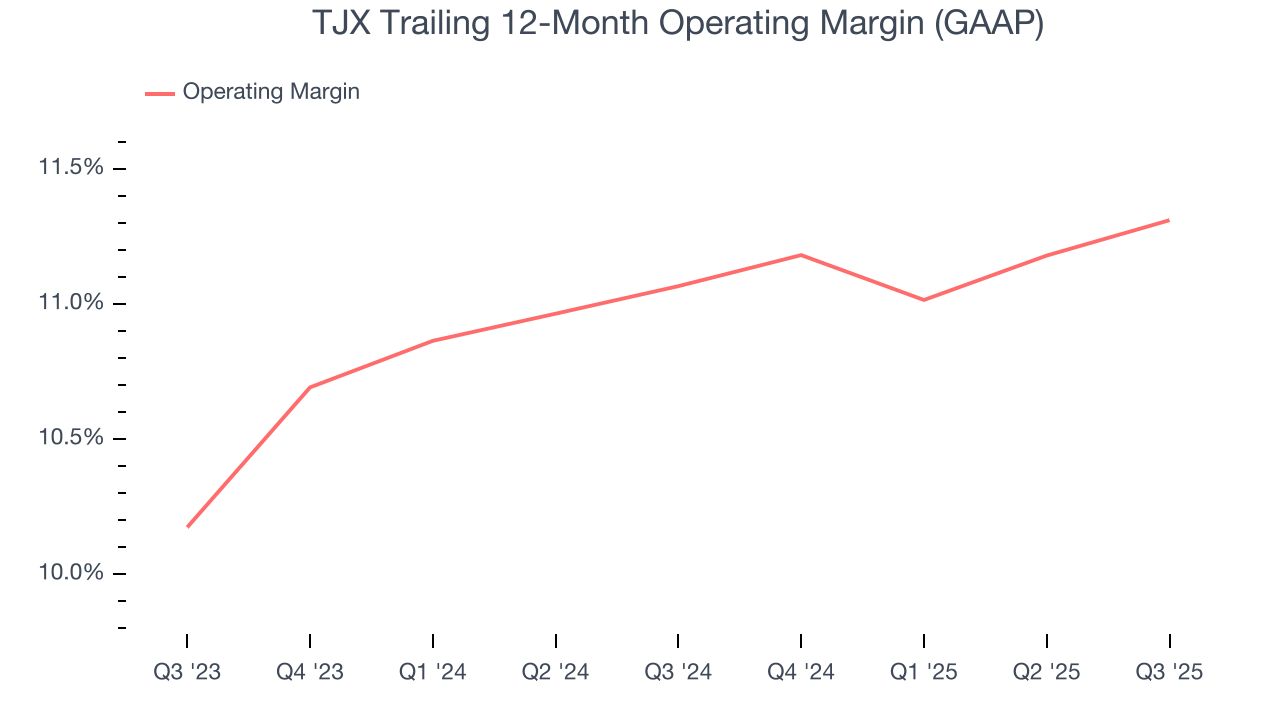

8. Operating Margin

TJX’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 11.2% over the last two years. This profitability was solid for a consumer retail business and shows it’s an efficient company that manages its expenses well. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, TJX’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, TJX generated an operating margin profit margin of 12.7%. This indicates the company’s cost structure has recently been stable.

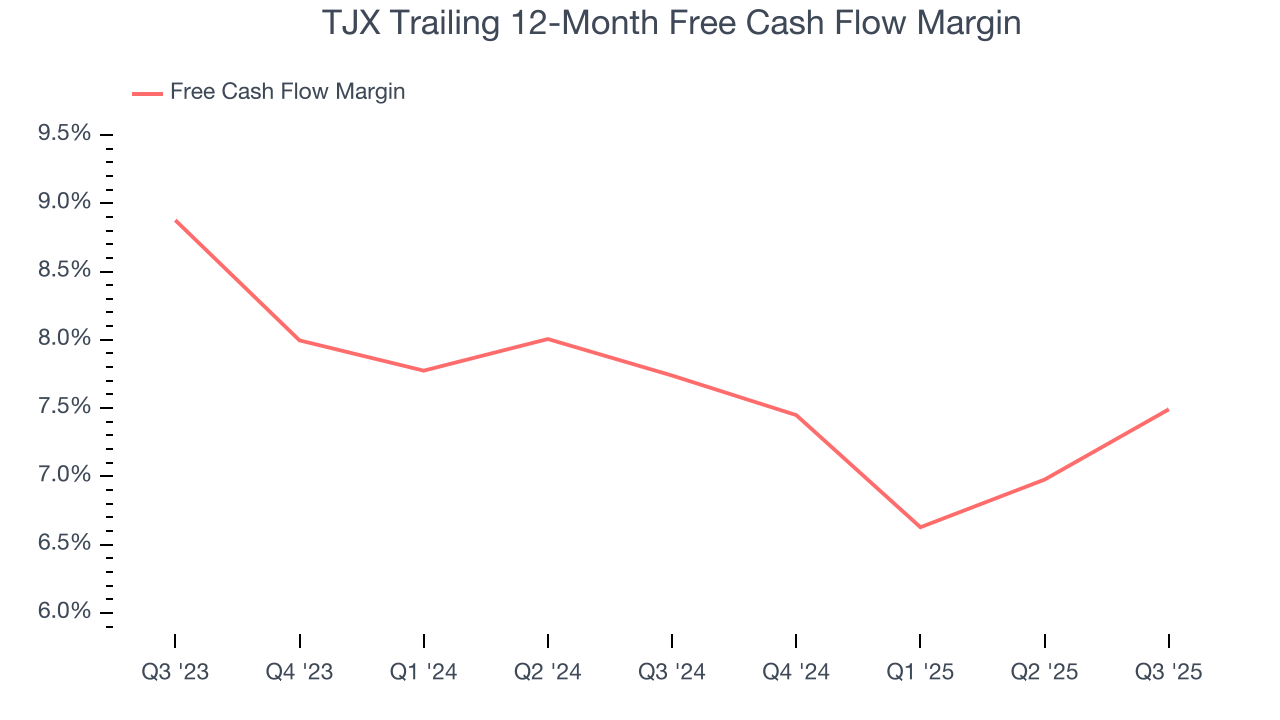

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

TJX has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.6% over the last two years, quite impressive for a consumer retail business.

TJX’s free cash flow clocked in at $1.00 billion in Q3, equivalent to a 6.6% margin. This result was good as its margin was 2.2 percentage points higher than in the same quarter last year. We hope the company can build on this trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

TJX’s five-year average ROIC was 27.9%, placing it among the best consumer retail companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

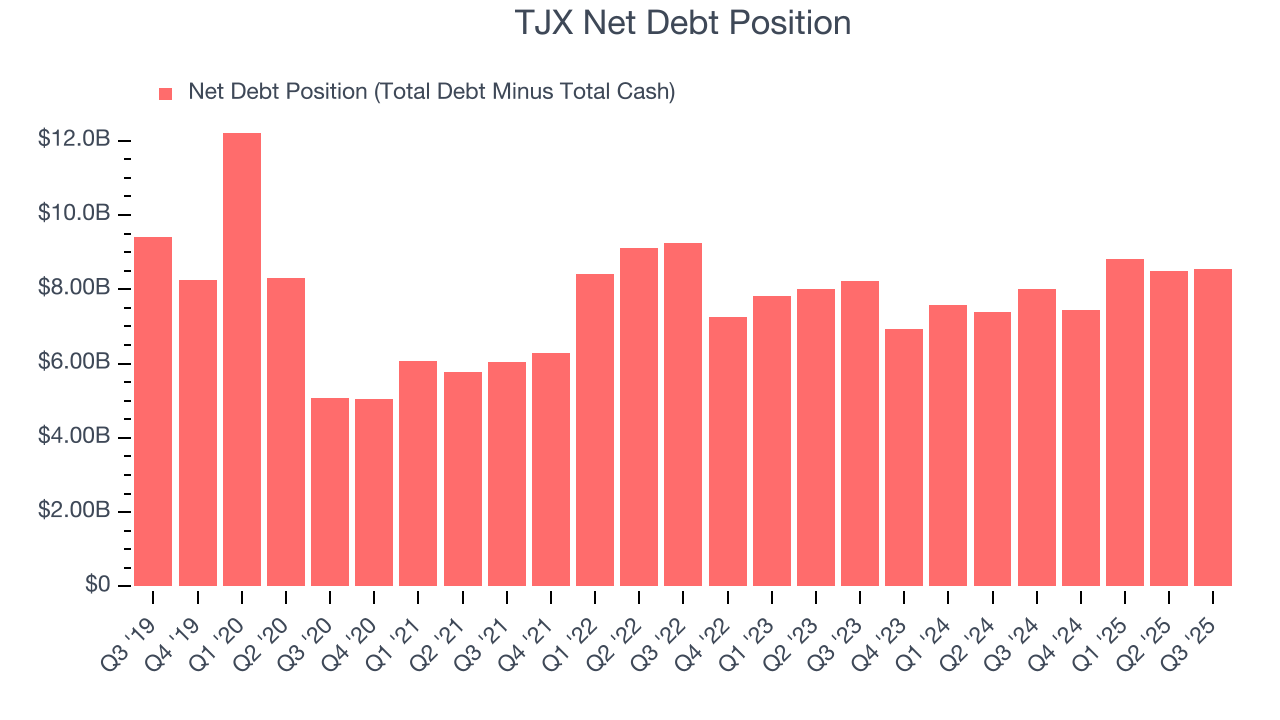

11. Balance Sheet Assessment

TJX reported $4.64 billion of cash and $13.19 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $8.03 billion of EBITDA over the last 12 months, we view TJX’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $71 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from TJX’s Q3 Results

We liked that TJX's revenue, gross margin, and EPS all outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 2.7% to $149.46 immediately after reporting.

13. Is Now The Time To Buy TJX?

Updated: January 26, 2026 at 9:35 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in TJX.

TJX is a fine business. Although its revenue growth was a little slower over the last three years, its coveted brand awareness makes it a household name consumers consistently turn to. And while its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses, its stellar ROIC suggests it has been a well-run company historically.

TJX’s P/E ratio based on the next 12 months is 30.6x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. This is a good one to add to your watchlist - there are better opportunities elsewhere at the moment.

Wall Street analysts have a consensus one-year price target of $164.83 on the company (compared to the current share price of $150.31).