Sixth Street Specialty Lending (TSLX)

We wouldn’t recommend Sixth Street Specialty Lending. Its decelerating revenue growth and even worse EPS performance give us little confidence it can beat the market.― StockStory Analyst Team

1. News

2. Summary

Why We Think Sixth Street Specialty Lending Will Underperform

Originally launched as TPG Specialty Lending before rebranding in 2020, Sixth Street Specialty Lending (NYSE:TSLX) is a business development company that provides customized financing solutions to middle-market companies across various industries.

- Flat earnings per share over the last two years lagged its peers

- Annual revenue growth of 1.2% over the last two years was below our standards for the financials sector

- On the bright side, its management team has demonstrated it can invest in profitable ventures through its 13% five-year return on equity

Sixth Street Specialty Lending’s quality doesn’t meet our expectations. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Sixth Street Specialty Lending

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Sixth Street Specialty Lending

At $20.10 per share, Sixth Street Specialty Lending trades at 10.1x forward P/E. Yes, this valuation multiple is lower than that of other financials peers, but we’ll remind you that you often get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Sixth Street Specialty Lending (TSLX) Research Report: Q4 CY2025 Update

Business development company Sixth Street Specialty Lending (NYSE:TSLX) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 12.5% year on year to $108.2 million. Its non-GAAP profit of $0.30 per share was 40.4% below analysts’ consensus estimates.

Sixth Street Specialty Lending (TSLX) Q4 CY2025 Highlights:

- Revenue: $108.2 million vs analyst estimates of $106.1 million (12.5% year-on-year decline, 2% beat)

- Adjusted EPS: $0.30 vs analyst expectations of $0.50 (40.4% miss)

- Market Capitalization: $1.9 billion

Company Overview

Originally launched as TPG Specialty Lending before rebranding in 2020, Sixth Street Specialty Lending (NYSE:TSLX) is a business development company that provides customized financing solutions to middle-market companies across various industries.

As a business development company (BDC), Sixth Street Specialty Lending operates under regulations that require it to distribute at least 90% of its taxable income to shareholders. The company focuses on providing direct loans to middle-market businesses—typically companies with annual EBITDA between $10 million and $250 million—that often find themselves too large for traditional bank lending but too small to access public debt markets efficiently.

The firm's investment strategy centers on first-lien senior secured loans, which provide priority claim on borrowers' assets in case of default, though it also selectively invests in second-lien and mezzanine debt. A typical transaction might involve Sixth Street providing $50-200 million in financing to a software company seeking capital for an acquisition or to a healthcare services provider funding expansion.

Sixth Street differentiates itself through its affiliation with Sixth Street Partners, a global investment firm with significant resources and expertise across multiple sectors. This relationship gives the BDC access to deal flow, industry insights, and due diligence capabilities that enhance its investment process. The company's investment professionals conduct thorough analysis of potential borrowers, examining factors like competitive positioning, cash flow stability, and management quality.

Revenue comes primarily from interest income on its debt investments, with rates typically including a variable component tied to benchmarks like SOFR plus a fixed spread. The company also sometimes receives equity components like warrants or preferred shares as part of its investment arrangements, providing potential upside beyond interest income.

4. Specialty Finance

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

Sixth Street Specialty Lending competes with other publicly traded BDCs including Ares Capital Corporation (NASDAQ:ARCC), FS KKR Capital Corp. (NYSE:FSK), and Blue Owl Capital Corporation (NYSE:OBDC), as well as private credit funds managed by firms like Blackstone, Apollo, and KKR.

5. Revenue Growth

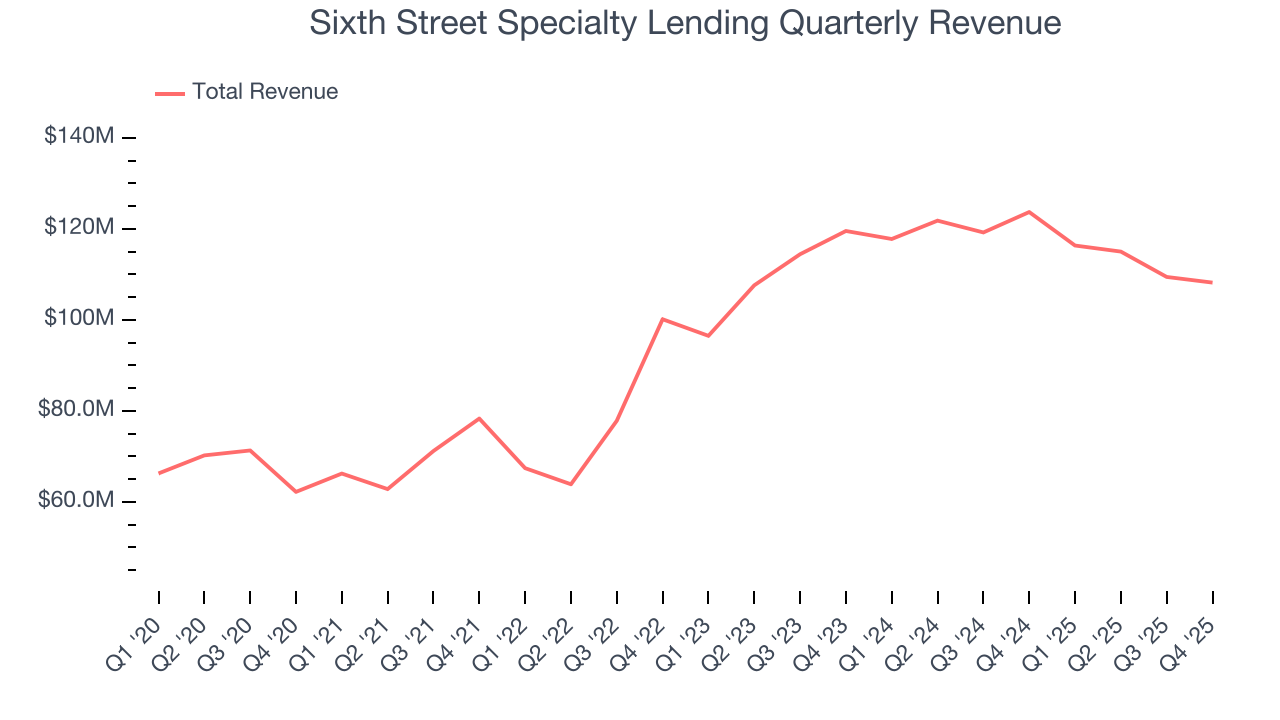

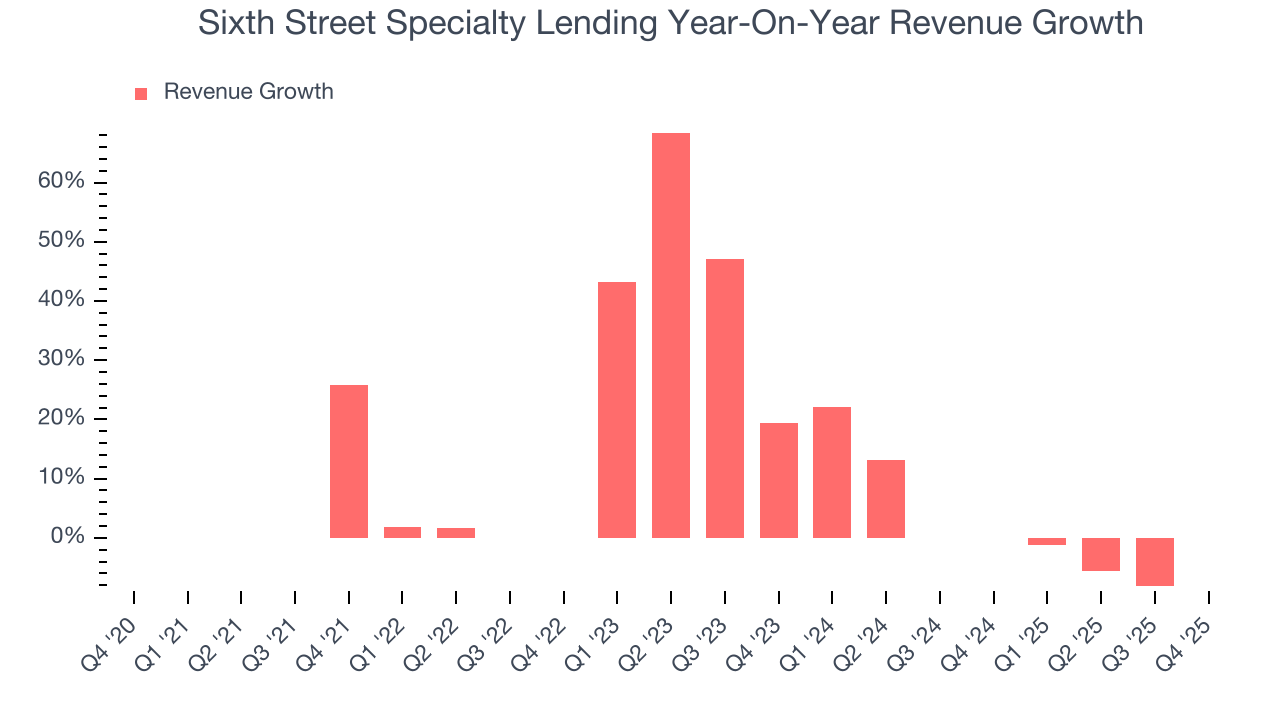

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Sixth Street Specialty Lending’s revenue grew at a decent 10.7% compounded annual growth rate over the last five years. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Sixth Street Specialty Lending’s recent performance shows its demand has slowed as its annualized revenue growth of 1.2% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Sixth Street Specialty Lending’s revenue fell by 12.5% year on year to $108.2 million but beat Wall Street’s estimates by 2%.

6. Operating Margin

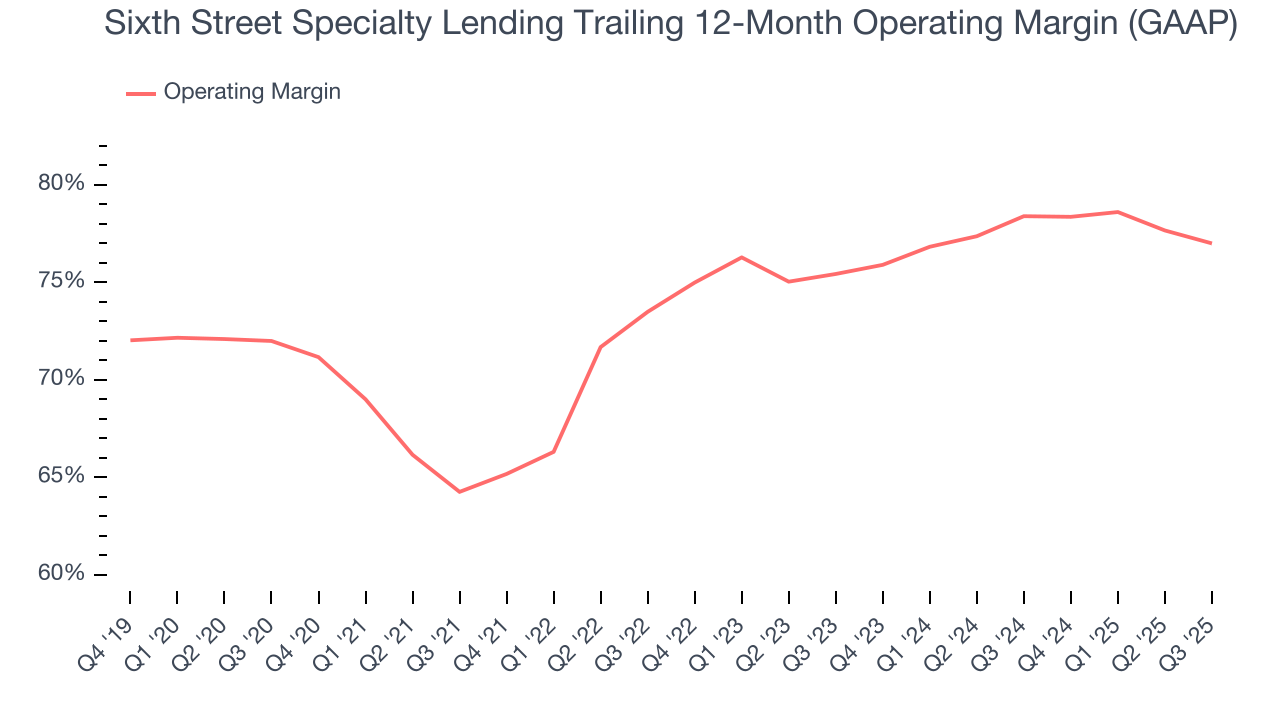

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Over the last five years, Sixth Street Specialty Lending’s operating margin has fallen by 13.9 percentage points. However, the company gave back some of its expense savings as its operating margin declined by 1.8 percentage points on a two-year basis.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Sixth Street Specialty Lending, its EPS declined by 1.7% annually over the last five years while its revenue grew by 10.7%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Sixth Street Specialty Lending, its two-year annual EPS declines of 6.5% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Sixth Street Specialty Lending reported adjusted EPS of $0.30, down from $0.62 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Sixth Street Specialty Lending’s full-year EPS of $2.01 to stay about the same.

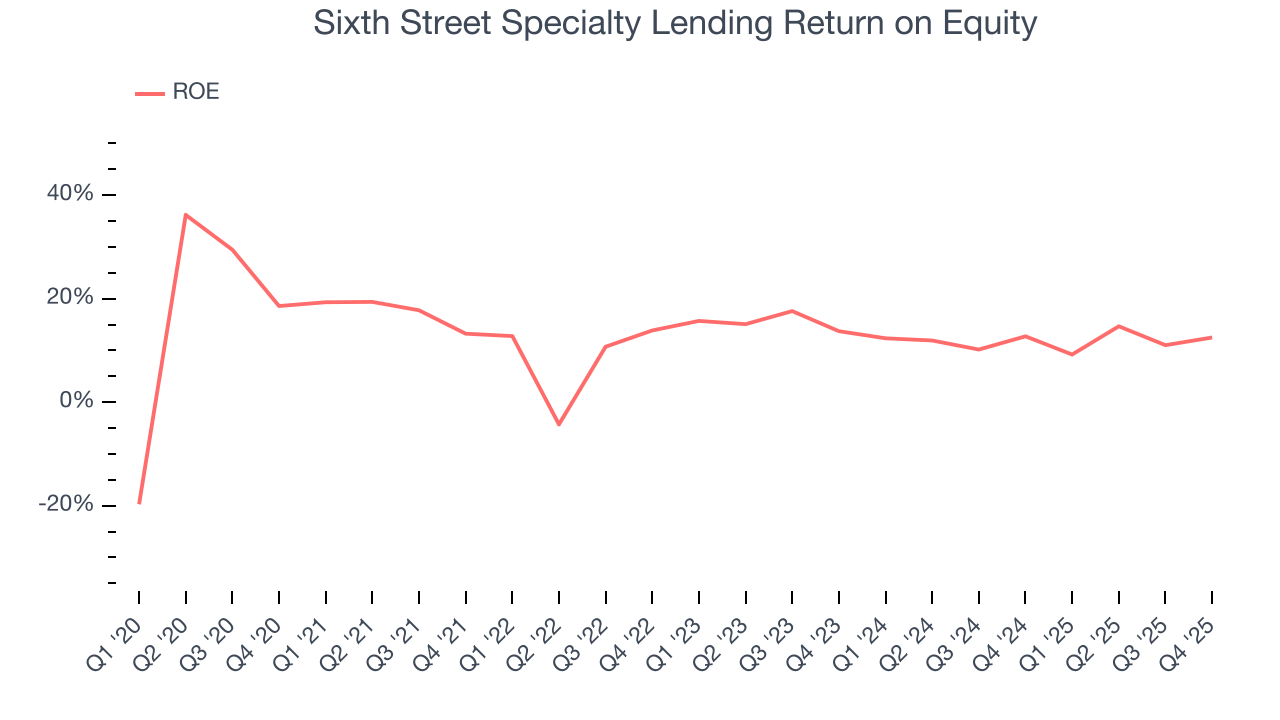

8. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Sixth Street Specialty Lending has averaged an ROE of 13%, respectable for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired.

9. Balance Sheet Assessment

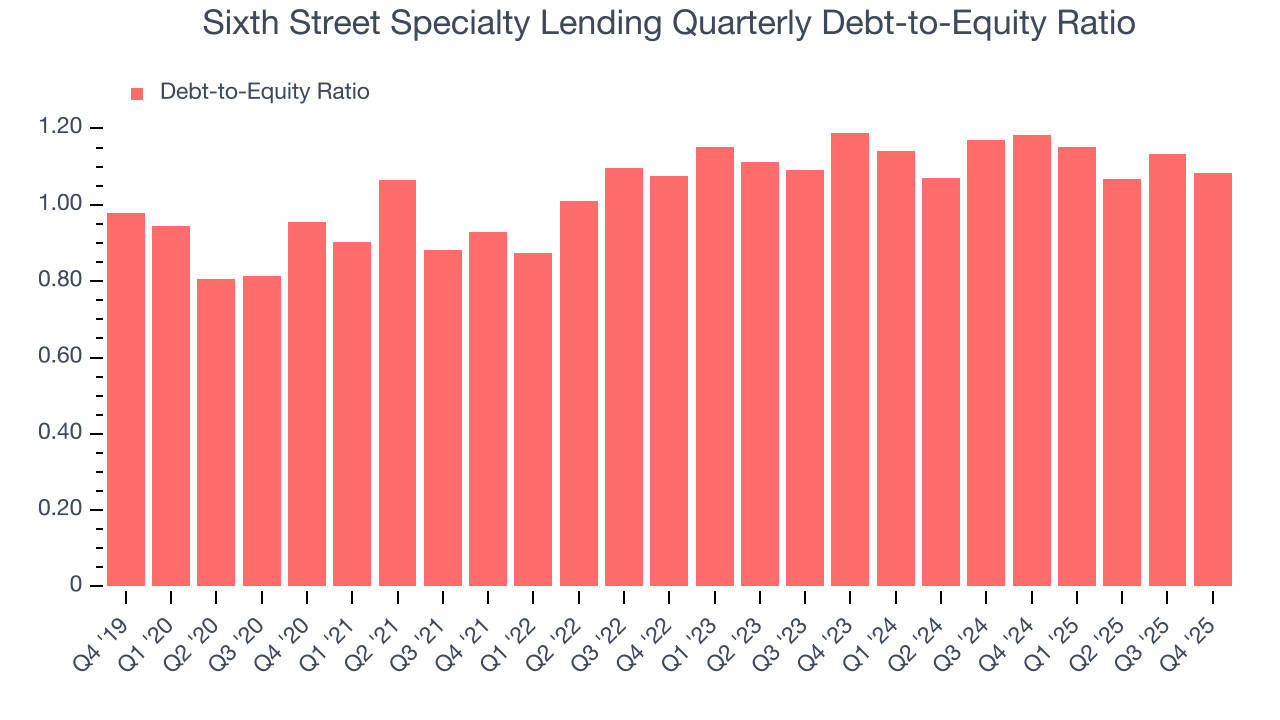

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Sixth Street Specialty Lending currently has $1.74 billion of debt and $1.61 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Sixth Street Specialty Lending’s Q4 Results

It was encouraging to see Sixth Street Specialty Lending beat analysts’ revenue expectations this quarter. The stock traded up 1.1% to $20.34 immediately following the results.

11. Is Now The Time To Buy Sixth Street Specialty Lending?

Updated: February 12, 2026 at 11:58 PM EST

Before deciding whether to buy Sixth Street Specialty Lending or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Sixth Street Specialty Lending doesn’t pass our quality test. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Sixth Street Specialty Lending’s P/E ratio based on the next 12 months is 10.1x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $23.65 on the company (compared to the current share price of $20.10).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.