Twilio (TWLO)

We’re skeptical of Twilio. Its decelerating growth shows demand is falling and its weak gross margin indicates it has bad unit economics.― StockStory Analyst Team

1. News

2. Summary

Why Twilio Is Not Exciting

Known for the clever "Twilio Magic" demo that had developers creating functioning communications apps in minutes, Twilio (NYSE:TWLO) provides a platform that enables businesses to communicate with their customers through voice, messaging, email, and other digital channels.

- Sky-high servicing costs result in an inferior gross margin of 48.9% that must be offset through increased usage

- Operating profits increased over the last year as the company gained some leverage on its fixed costs and became more efficient

- The good news is that its user-friendly software enables clients to ramp up spending quickly, leading to the speedy recovery of customer acquisition costs

Twilio’s quality is lacking. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Twilio

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Twilio

Twilio is trading at $110.95 per share, or 3x forward price-to-sales. Twilio’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Twilio (TWLO) Research Report: Q4 CY2025 Update

Customer engagement platform Twilio (NYSE:TWLO) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 14.3% year on year to $1.37 billion. On top of that, next quarter’s revenue guidance ($1.34 billion at the midpoint) was surprisingly good and 3.9% above what analysts were expecting. Its non-GAAP profit of $1.33 per share was 8.2% above analysts’ consensus estimates.

Twilio (TWLO) Q4 CY2025 Highlights:

- Revenue: $1.37 billion vs analyst estimates of $1.32 billion (14.3% year-on-year growth, 3.6% beat)

- Adjusted EPS: $1.33 vs analyst estimates of $1.23 (8.2% beat)

- Revenue Guidance for Q1 CY2026 is $1.34 billion at the midpoint, above analyst estimates of $1.29 billion

- Adjusted EPS guidance for Q1 CY2026 is $1.23 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 4.2%, up from 1.1% in the same quarter last year

- Free Cash Flow Margin: 18.7%, similar to the previous quarter

- Net Revenue Retention Rate: 108%, down from 109% in the previous quarter

- Market Capitalization: $16.74 billion

Company Overview

Known for the clever "Twilio Magic" demo that had developers creating functioning communications apps in minutes, Twilio (NYSE:TWLO) provides a platform that enables businesses to communicate with their customers through voice, messaging, email, and other digital channels.

Twilio's platform consists of two main business units: Communications and Data & Applications. The Communications unit offers highly customizable APIs that developers can integrate into their applications to enable various communication channels. These include Programmable Messaging for sending SMS and MMS messages, Programmable Voice for making and receiving calls, Email services, and Account Security features like two-factor authentication.

The Data & Applications unit helps businesses personalize customer interactions using first-party data. Its Segment product acts as a customer data platform that unifies information from various touchpoints into comprehensive customer profiles. Twilio Engage enables marketers to create personalized campaigns across multiple channels, while Twilio Flex offers a programmable virtual contact center solution that businesses can customize to their specific needs.

Twilio's "Super Network" underpins these offerings by connecting to communications networks worldwide, optimizing quality and cost of transmissions. A retail company might use Twilio to send order confirmations via SMS, alert customers about delivery updates via email, and enable customer service representatives to communicate with shoppers through a custom contact center interface—all while using customer data to personalize these interactions.

The company primarily generates revenue through usage-based pricing for its Communications products and subscription-based pricing for its Data & Applications solutions.

4. Communications Platform

The first shift towards voice communication over the internet (VOIP), rather than traditional phone networks, happened when the enterprises started replacing business phones with the cheaper VOIP technology. Today, the rise of the consumer internet has increased the need for two way audio and video functionality in applications, driving demand for software tools and platforms that enable this utility.

Twilio competes with cloud communications providers like Vonage (owned by Ericsson), Bandwidth (NASDAQ:BAND), and Sinch, as well as customer data platform competitors including Salesforce (NYSE:CRM), Adobe (NASDAQ:ADBE), and Microsoft Dynamics (NASDAQ:MSFT). In the contact center space, it faces competition from Five9 (NASDAQ:FIVN), NICE (NASDAQ:NICE), and Genesys.

5. Revenue Growth

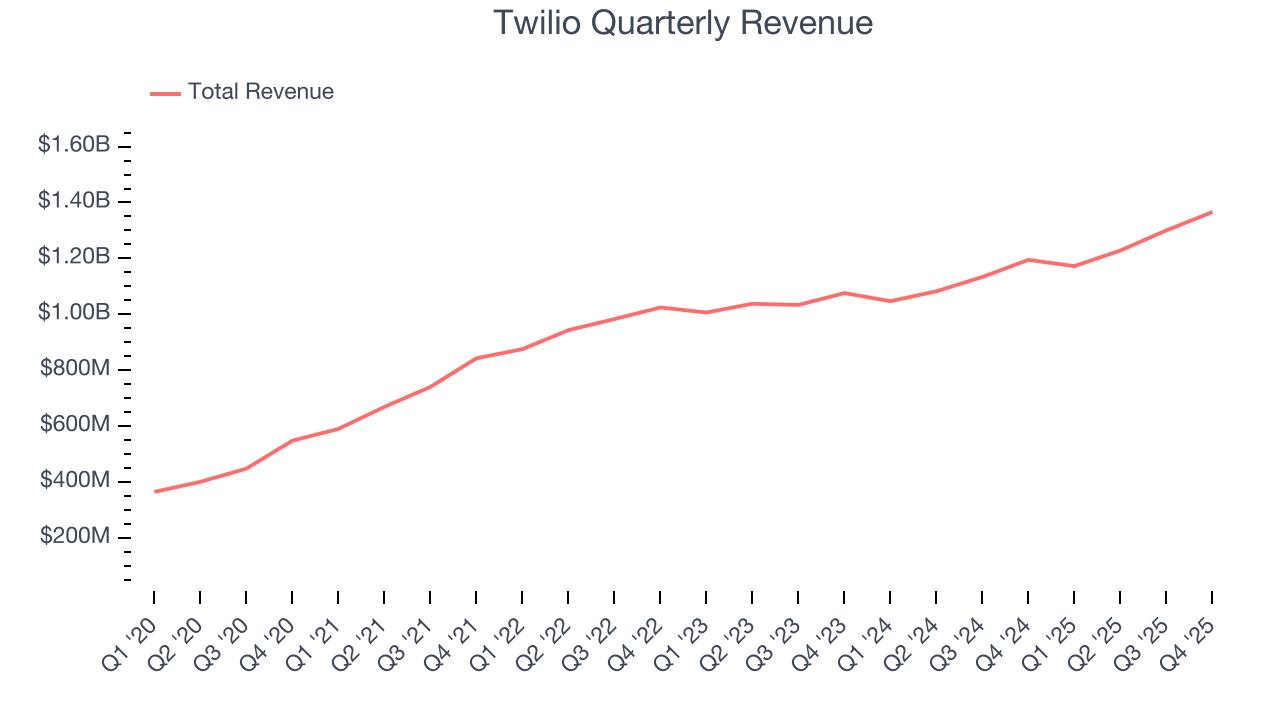

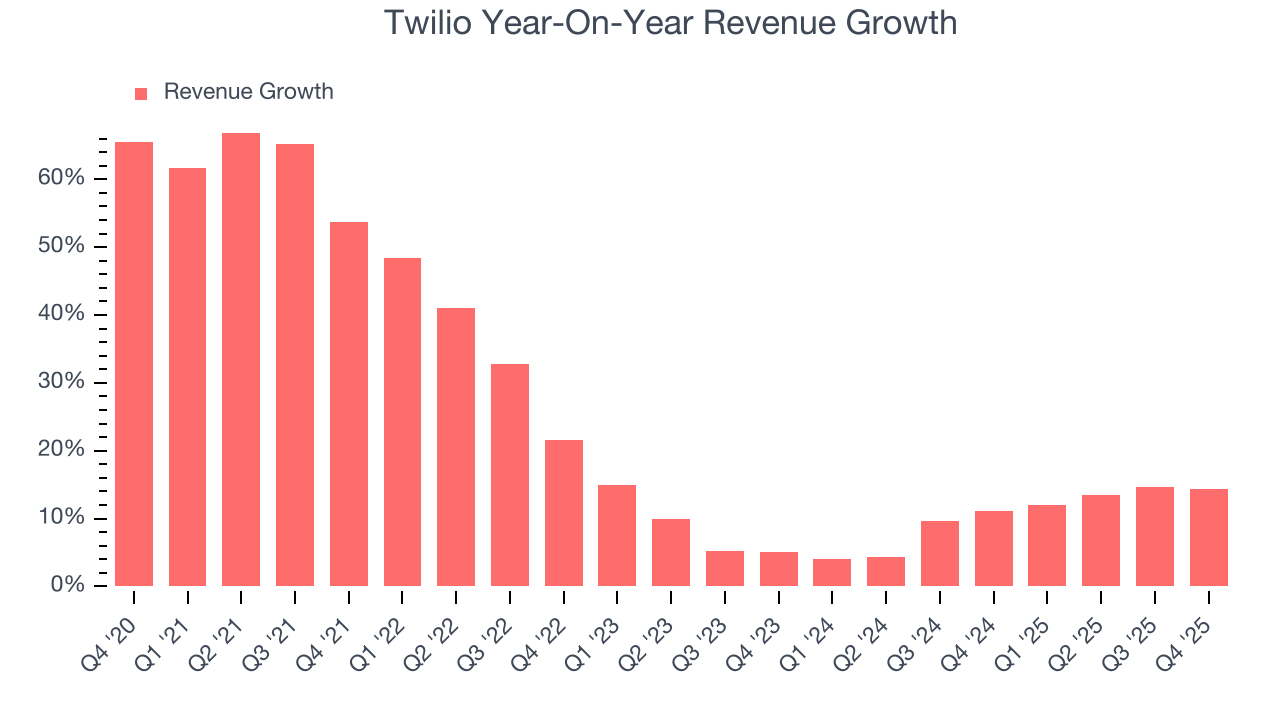

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Twilio’s 23.5% annualized revenue growth over the last five years was solid. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Twilio’s recent performance shows its demand has slowed as its annualized revenue growth of 10.4% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Twilio reported year-on-year revenue growth of 14.3%, and its $1.37 billion of revenue exceeded Wall Street’s estimates by 3.6%. Company management is currently guiding for a 14.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

6. Billings

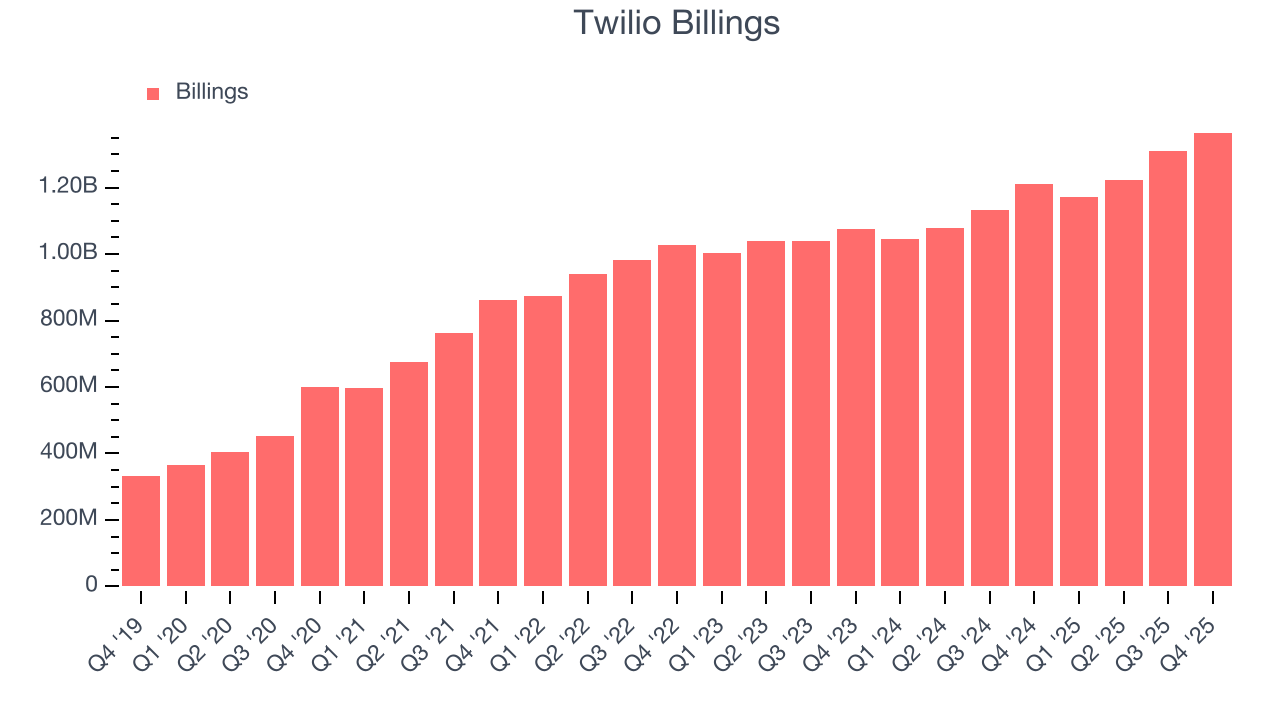

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Twilio’s billings came in at $1.37 billion in Q4, and over the last four quarters, its growth slightly lagged the sector as it averaged 13.4% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Twilio is extremely efficient at acquiring new customers, and its CAC payback period checked in at 1.1 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

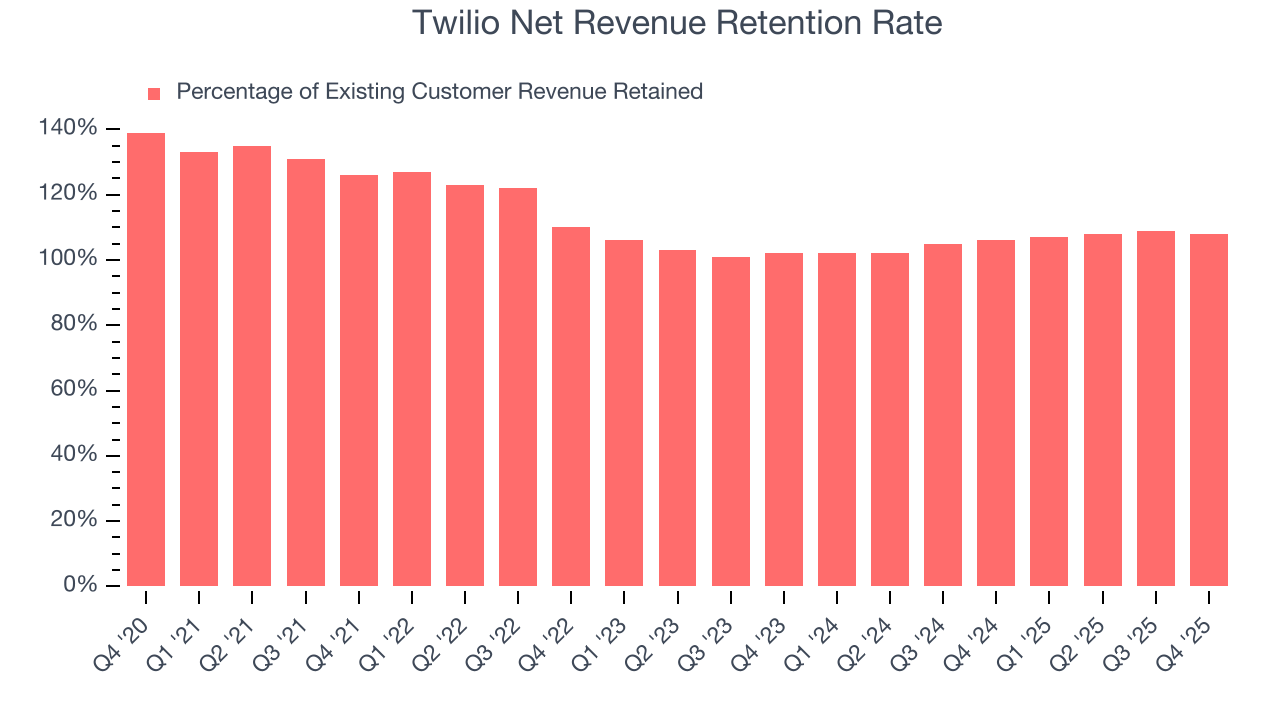

Twilio’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 108% in Q4. This means Twilio would’ve grown its revenue by 8% even if it didn’t win any new customers over the last 12 months.

Twilio has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

9. Gross Margin & Pricing Power

For software companies like Twilio, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Twilio’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 48.9% gross margin over the last year. Said differently, Twilio had to pay a chunky $51.06 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Twilio has seen gross margins decline by 0.3 percentage points over the last 2 year, which is slightly worse than average for software.

Twilio produced a 48.5% gross profit margin in Q4 , marking a 1.8 percentage point decrease from 50.3% in the same quarter last year. Twilio’s full-year margin has also been trending down over the past 12 months, decreasing by 2.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

10. Operating Margin

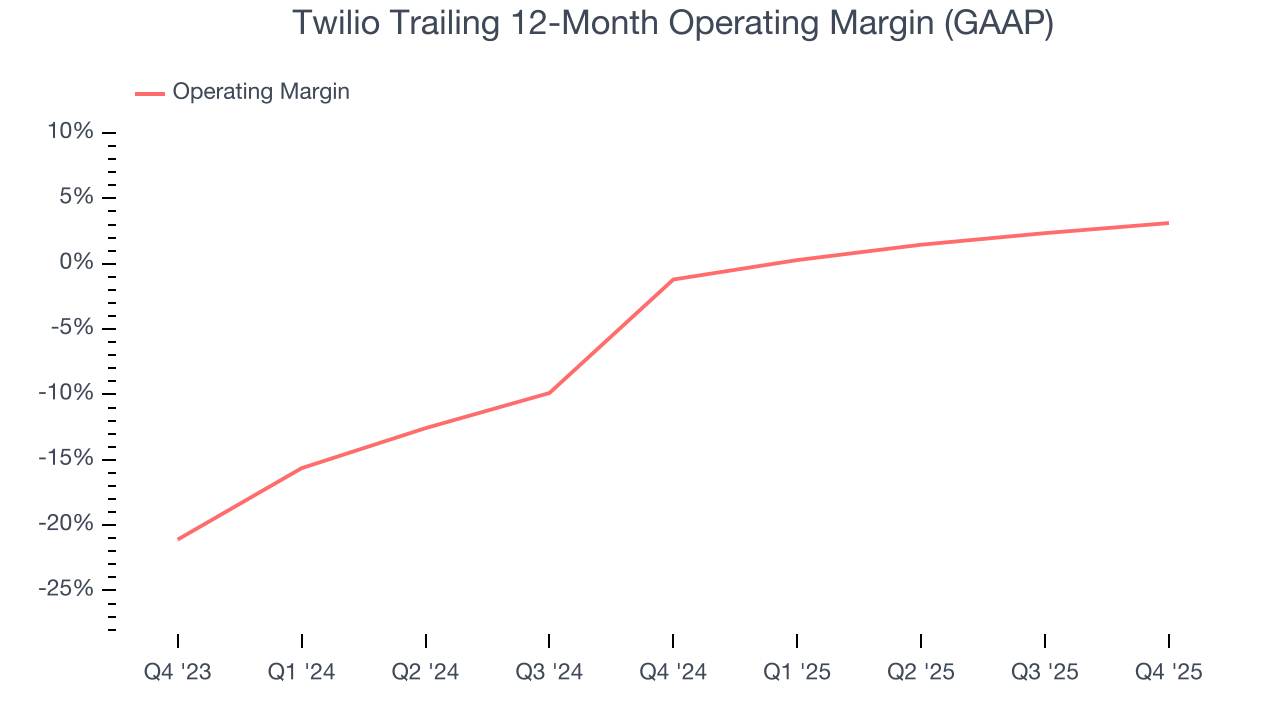

Twilio has done a decent job managing its cost base over the last year. The company has produced an average operating margin of 3.1%, higher than the broader software sector.

Analyzing the trend in its profitability, Twilio’s operating margin rose by 4.3 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Twilio generated an operating margin profit margin of 4.2%, up 3 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

11. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

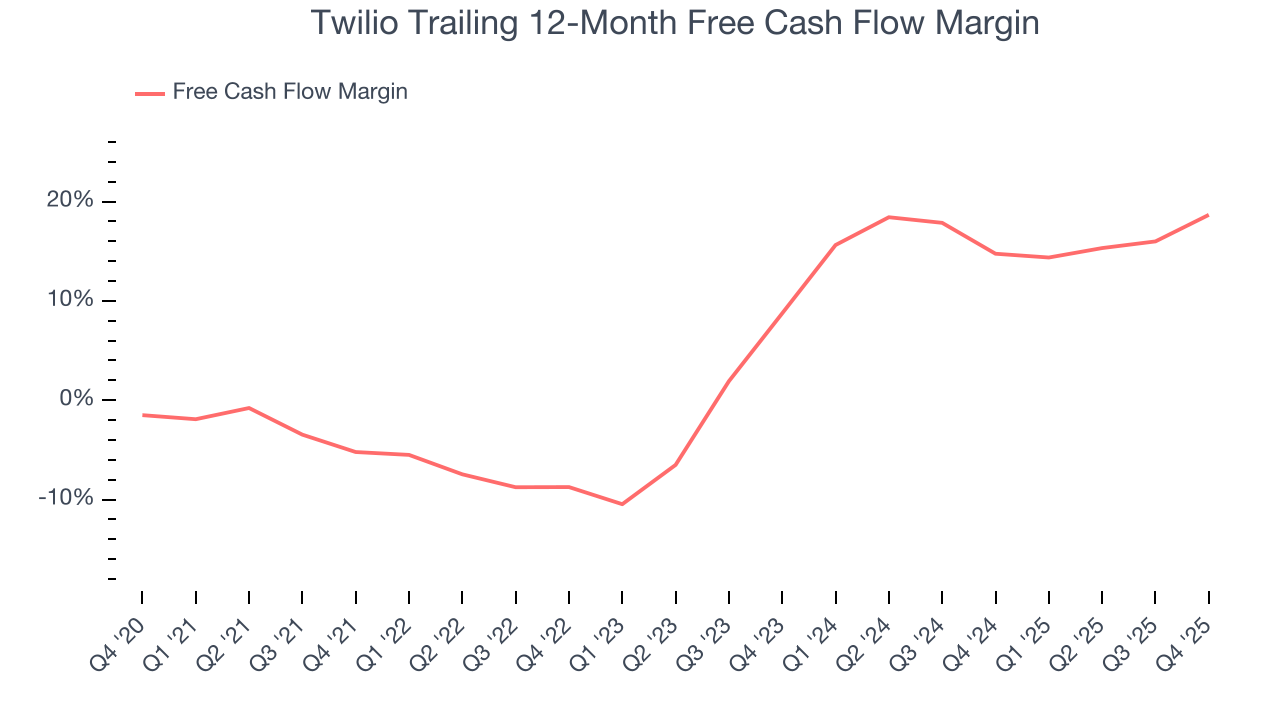

Twilio has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 18.7% over the last year, slightly better than the broader software sector.

Twilio’s free cash flow clocked in at $256.1 million in Q4, equivalent to a 18.7% margin. This result was good as its margin was 10.9 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

Over the next year, analysts’ consensus estimates show they’re expecting Twilio’s free cash flow margin of 18.7% for the last 12 months to remain the same.

12. Balance Sheet Assessment

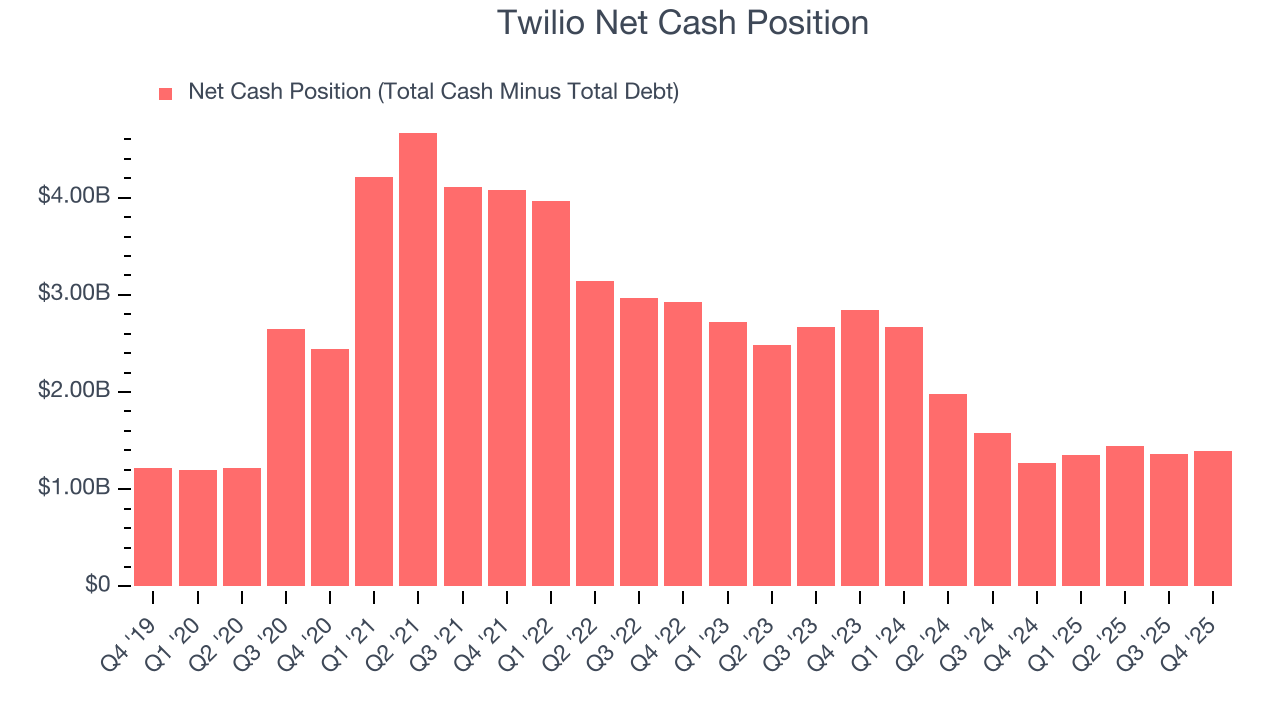

Companies with more cash than debt have lower bankruptcy risk.

Twilio is a profitable, well-capitalized company with $2.47 billion of cash and $1.08 billion of debt on its balance sheet. This $1.39 billion net cash position is 8.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Twilio’s Q4 Results

It was great to see Twilio’s revenue guidance for next quarter top analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 1.7% to $107.17 immediately following the results.

14. Is Now The Time To Buy Twilio?

Updated: February 19, 2026 at 9:13 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Twilio’s business quality ultimately falls short of our standards. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its gross margins show its business model is much less lucrative than other companies. And while the company’s efficient sales strategy allows it to target and onboard new users at scale, the downside is its expanding operating margin shows it’s becoming more efficient at building and selling its software.

Twilio’s price-to-sales ratio based on the next 12 months is 3x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $142.66 on the company (compared to the current share price of $110.95).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.