Utz (UTZ)

Utz keeps us up at night. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Utz Will Underperform

Tracing its roots back to 1921 when Bill and Salie Utz began making potato chips in their kitchen, Utz Brands (NYSE:UTZ) offers salty snacks such as potato chips, tortilla chips, pretzels, cheese snacks, and ready-to-eat popcorn, among others.

- ROIC of 0.3% reflects management’s challenges in identifying attractive investment opportunities

- 2% annual revenue growth over the last three years was slower than its consumer staples peers

- Organic sales performance over the past two years indicates the company may need to make strategic adjustments or rely on M&A to catalyze faster growth

Utz doesn’t meet our quality standards. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Utz

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Utz

Utz is trading at $11.13 per share, or 12.8x forward P/E. This multiple is lower than most consumer staples companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Utz (UTZ) Research Report: Q4 CY2025 Update

Snack food company Utz Brands (NYSE:UTZ) met Wall Street’s revenue expectations in Q4 CY2025, but sales were flat year on year at $342.2 million. Its non-GAAP profit of $0.26 per share was in line with analysts’ consensus estimates.

Utz (UTZ) Q4 CY2025 Highlights:

- Revenue: $342.2 million vs analyst estimates of $342.6 million (flat year on year, in line)

- Adjusted EPS: $0.26 vs analyst estimates of $0.25 (in line)

- Adjusted EBITDA: $62.4 million vs analyst estimates of $63.17 million (18.2% margin, 1.2% miss)

- Operating Margin: 1.2%, in line with the same quarter last year

- Free Cash Flow Margin: 2.8%, down from 4.8% in the same quarter last year

- Organic Revenue was flat year on year (miss)

- Sales Volumes were flat year on year

- Market Capitalization: $974 million

Company Overview

Tracing its roots back to 1921 when Bill and Salie Utz began making potato chips in their kitchen, Utz Brands (NYSE:UTZ) offers salty snacks such as potato chips, tortilla chips, pretzels, cheese snacks, and ready-to-eat popcorn, among others.

In the century-plus after its founding, the company has grown through organic expansion of its portfolio as well as major acquisitions. Notable deals include the 2016 purchase of Golden Flake and the acquisition of Conagra Snacks in 2020.

Today, Utz goes to market with the Utz, Zapp’s, Golden Flake, Boulder Canyon, and other brand names. The company differentiates itself from other snack manufacturers by committing to use real ingredients and avoiding artificial preservatives.

It’s hard to pinpoint the core Utz customer because its product portfolio is so broad. If you don’t like chips, maybe you like pretzels. If pretzels aren’t your thing, there’s popcorn or cheese snacks. Suffice to say, though, that the core customer is likely someone who does the grocery shopping for his or her household and values proven brands.

The company’s products add convenience to everyday life, and they are also convenient to find. Ubiquitous retailers such as supermarkets, mass merchants, drug stores, and specialty stores sell Utz products.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors in salty snacks include PepsiCo (NASDAQ:PEP), Nestle (SWX:NESN), and Mondelez (NASDAQ:MDLZ).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

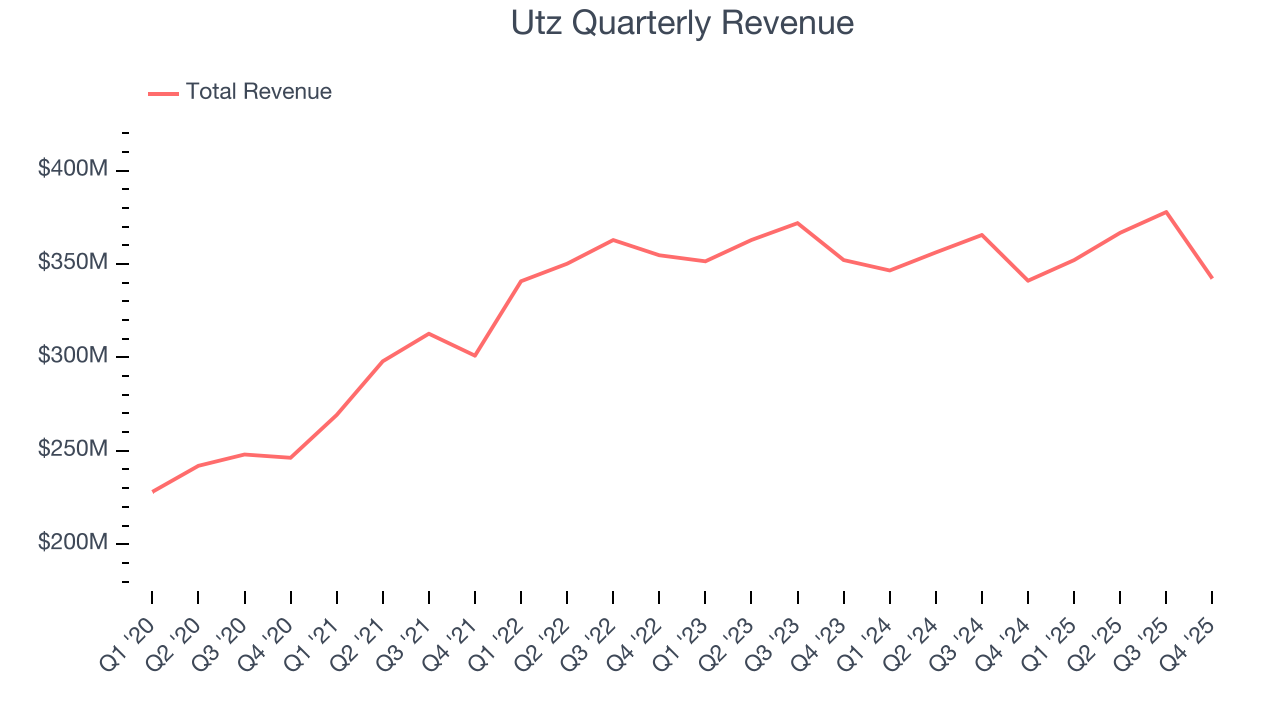

With $1.44 billion in revenue over the past 12 months, Utz is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, Utz struggled to increase demand as its $1.44 billion of sales for the trailing 12 months was close to its revenue three years ago. To its credit, however, consumers bought more of its products - we’ll explore what this means in the "Volume Growth" section.

This quarter, Utz’s $342.2 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months. While this projection indicates its newer products will fuel better top-line performance, it is still below the sector average.

6. Organic Revenue Growth

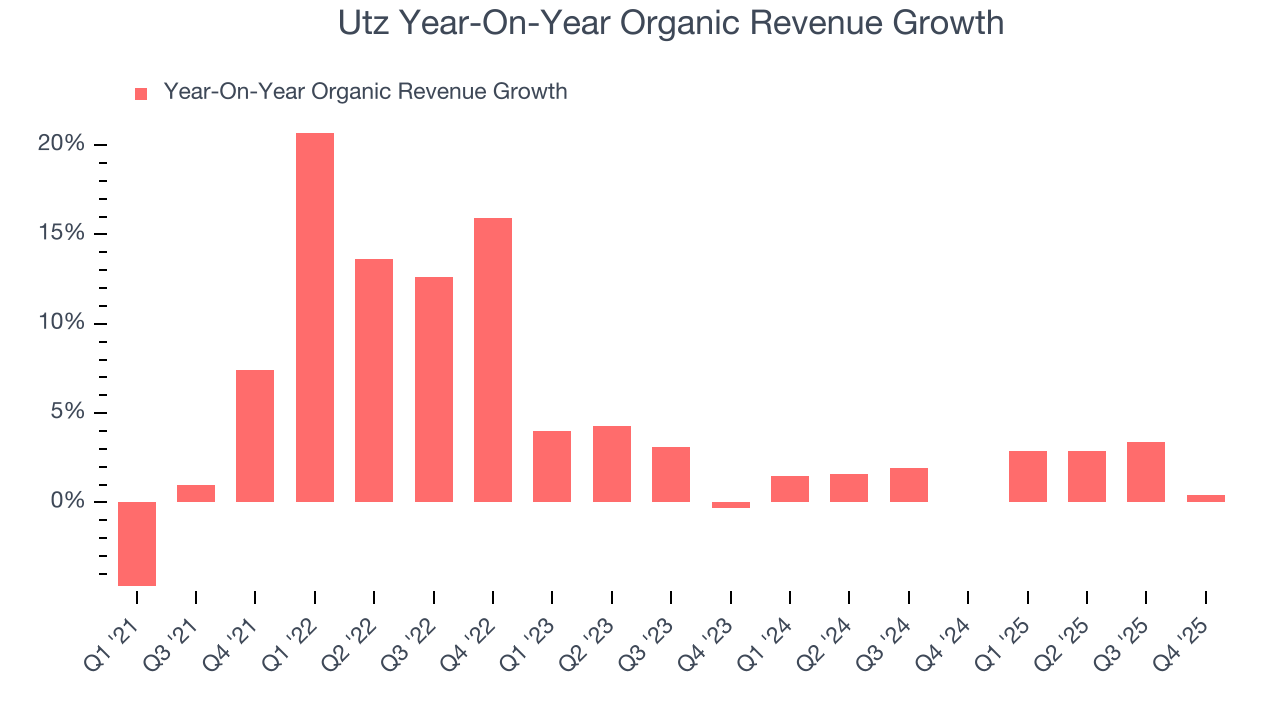

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Utz’s products has been stable over the last eight quarters but fell behind the broader sector. On average, the company has posted feeble year-on-year organic revenue growth of 1.8%.

In the latest quarter, Utz’s year on year organic sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Utz can reaccelerate growth.

7. Gross Margin & Pricing Power

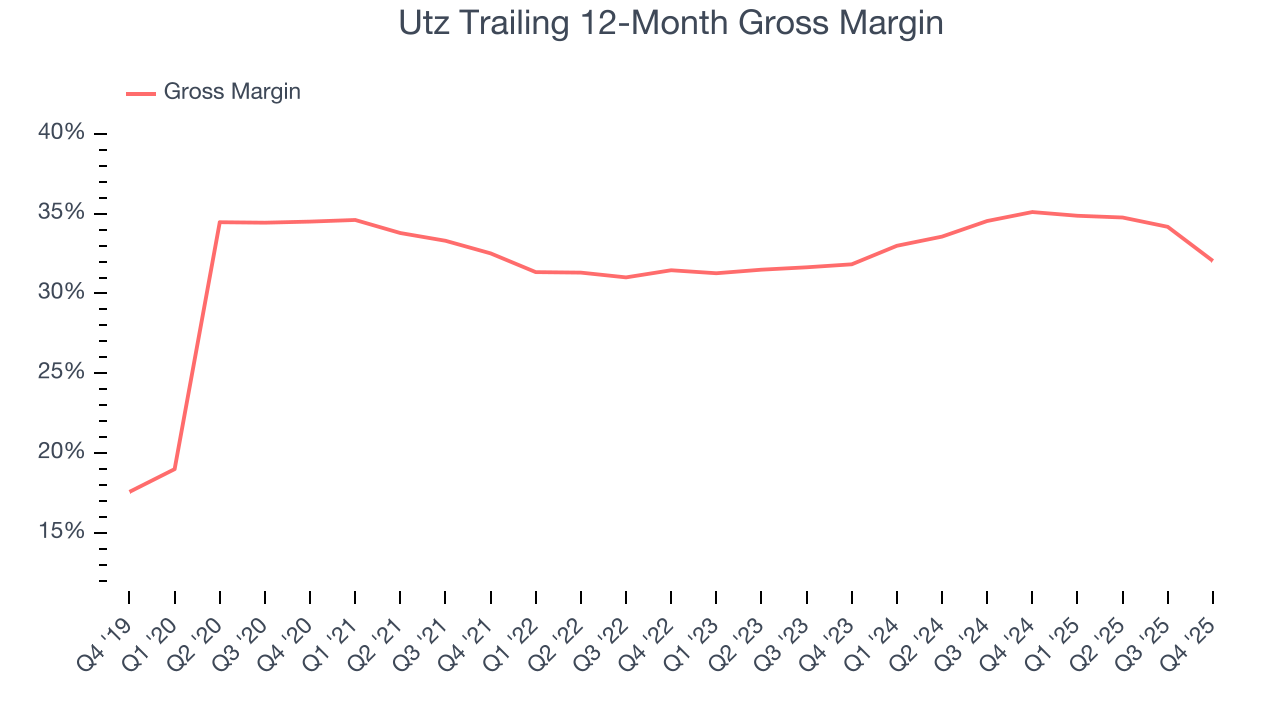

Utz’s unit economics are higher than the typical consumer staples company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 33.6% gross margin over the last two years. That means for every $100 in revenue, $66.44 went towards paying for raw materials, production of goods, transportation, and distribution.

This quarter, Utz’s gross profit margin was 26%, down 9 percentage points year on year. Utz’s full-year margin has also been trending down over the past 12 months, decreasing by 3.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

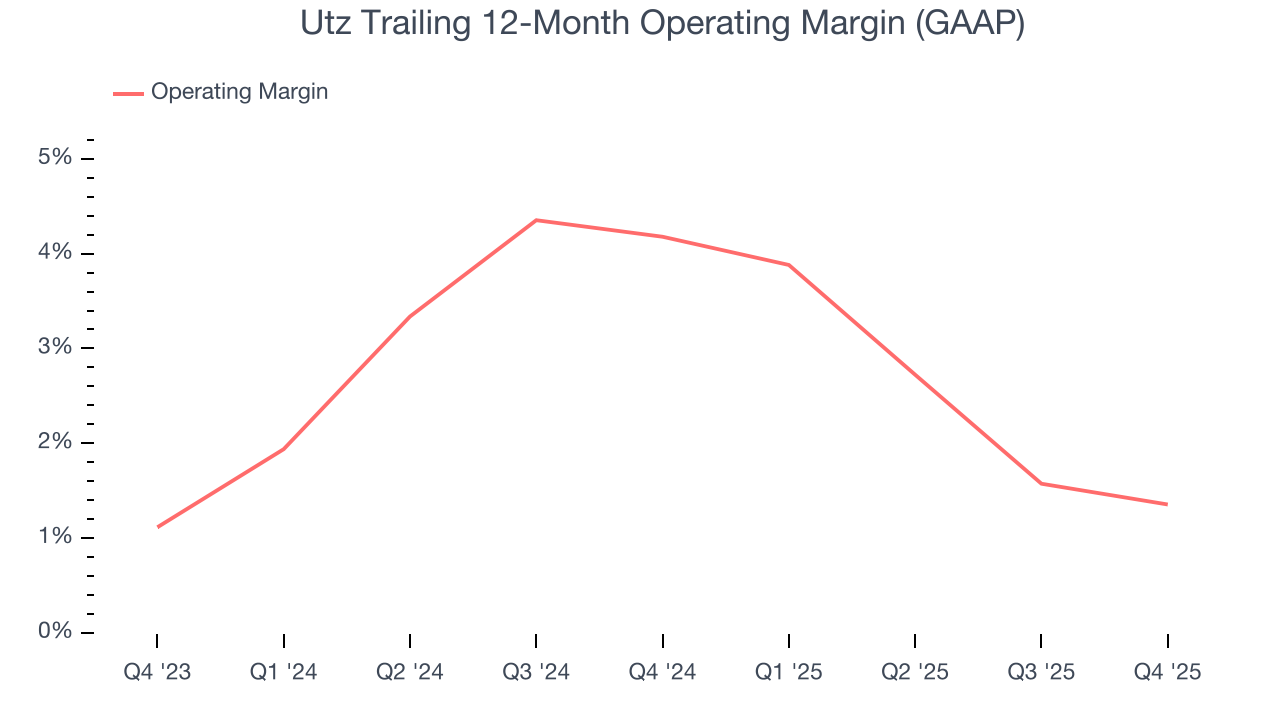

8. Operating Margin

Utz was profitable over the last two years but held back by its large cost base. Its average operating margin of 2.8% was weak for a consumer staples business.

Analyzing the trend in its profitability, Utz’s operating margin decreased by 2.8 percentage points over the last year. Utz’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Utz generated an operating margin profit margin of 1.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

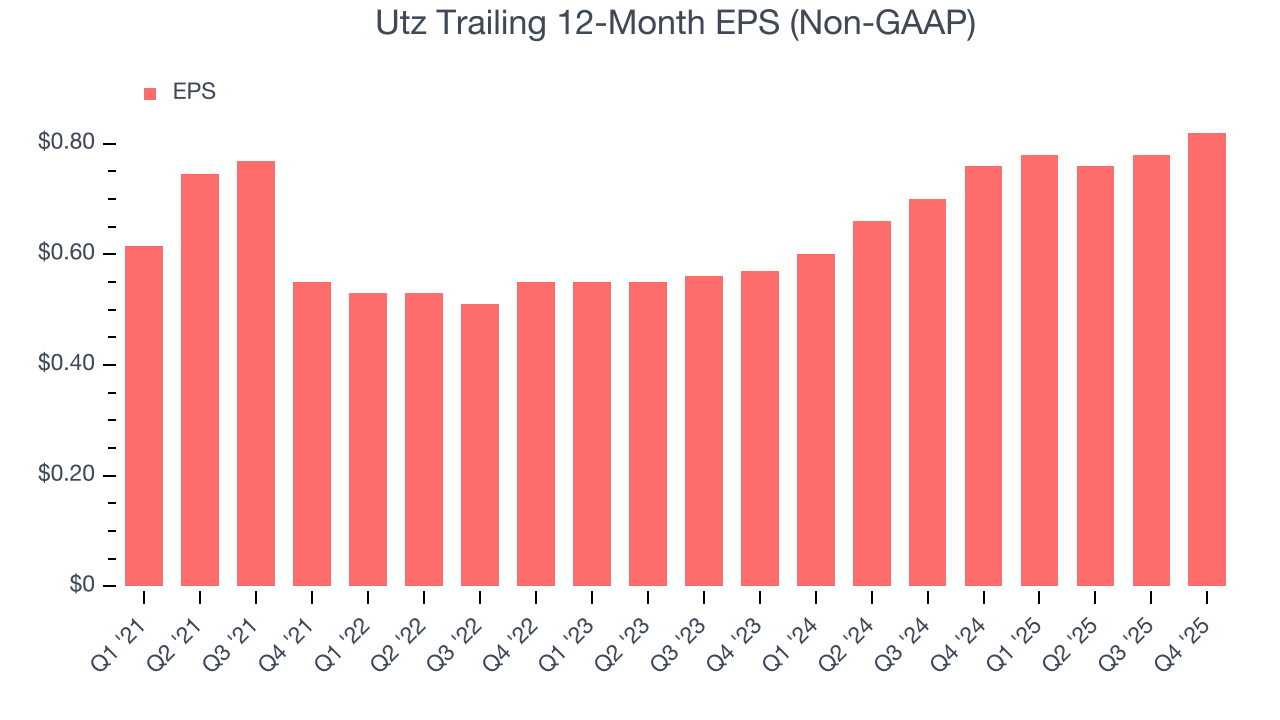

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Utz’s EPS grew at a remarkable 14.2% compounded annual growth rate over the last three years, higher than its flat revenue. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Utz reported adjusted EPS of $0.26, up from $0.22 in the same quarter last year. This print beat analysts’ estimates by 2%. Over the next 12 months, Wall Street expects Utz’s full-year EPS of $0.82 to grow 7.8%.

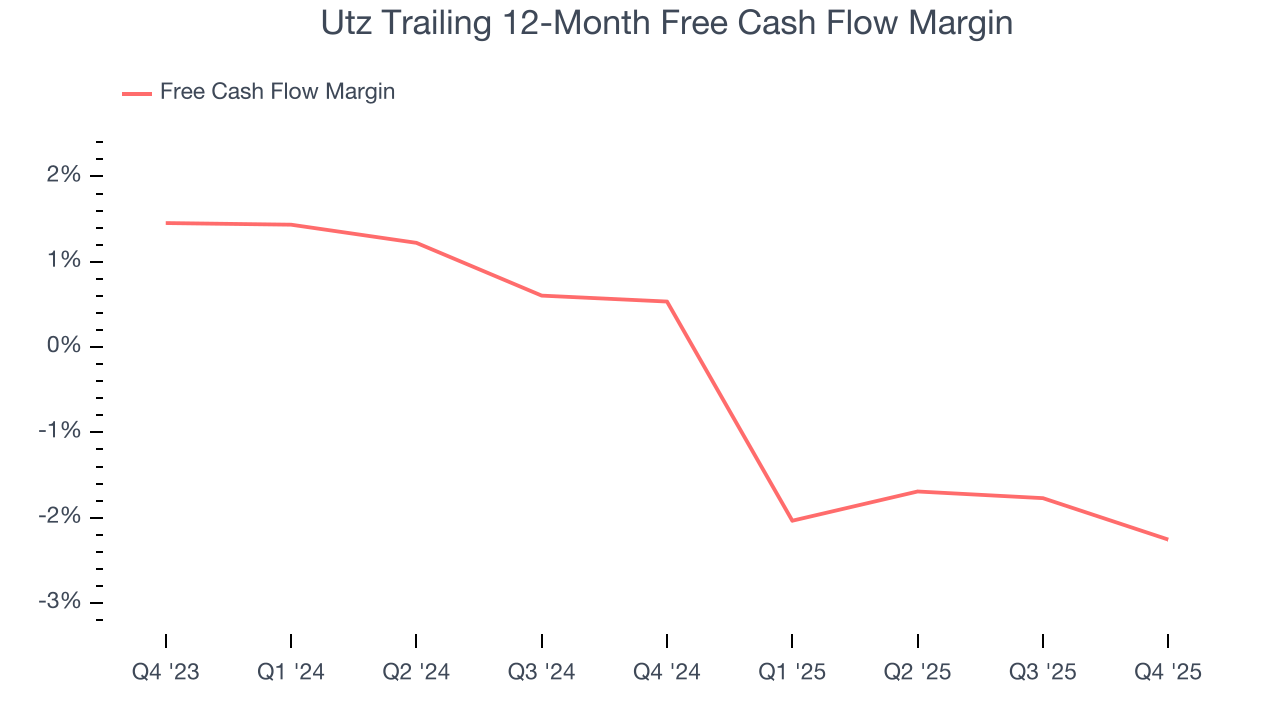

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Utz broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that Utz’s margin dropped by 2.8 percentage points over the last year. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s in the middle of an investment cycle.

Utz’s free cash flow clocked in at $9.44 million in Q4, equivalent to a 2.8% margin. The company’s cash profitability regressed as it was 2.1 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

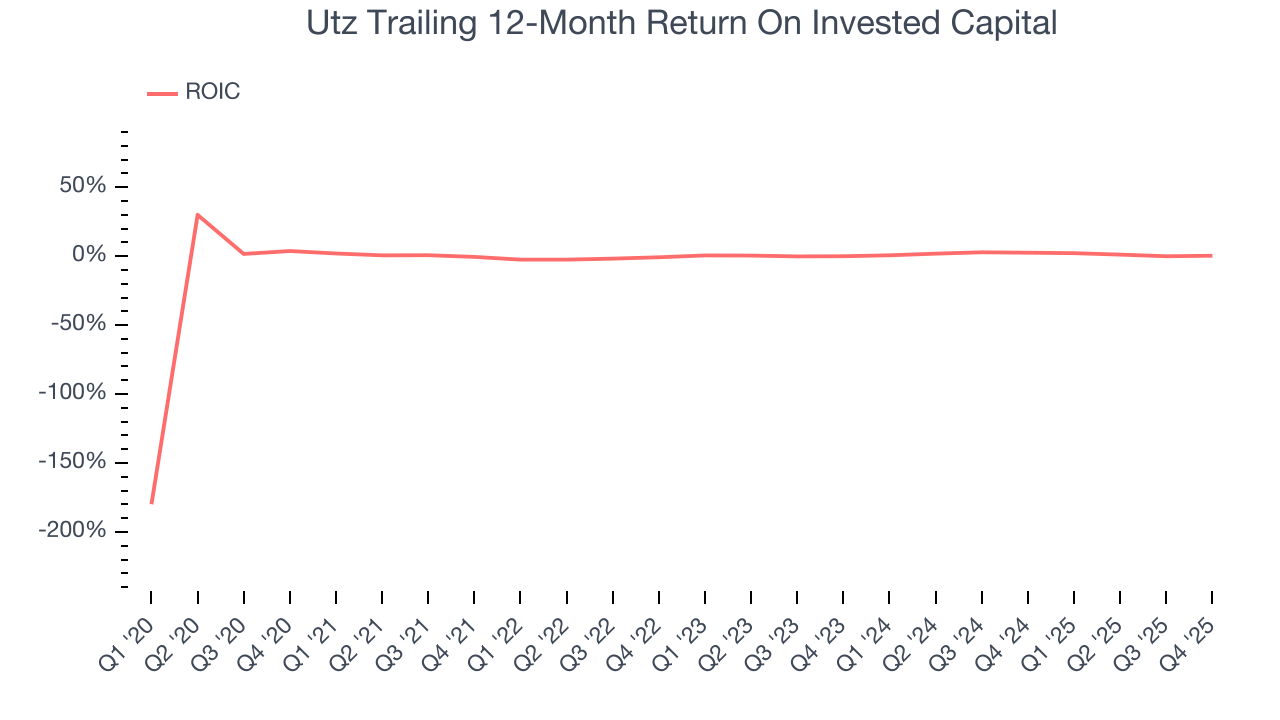

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Utz historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.3%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

12. Balance Sheet Assessment

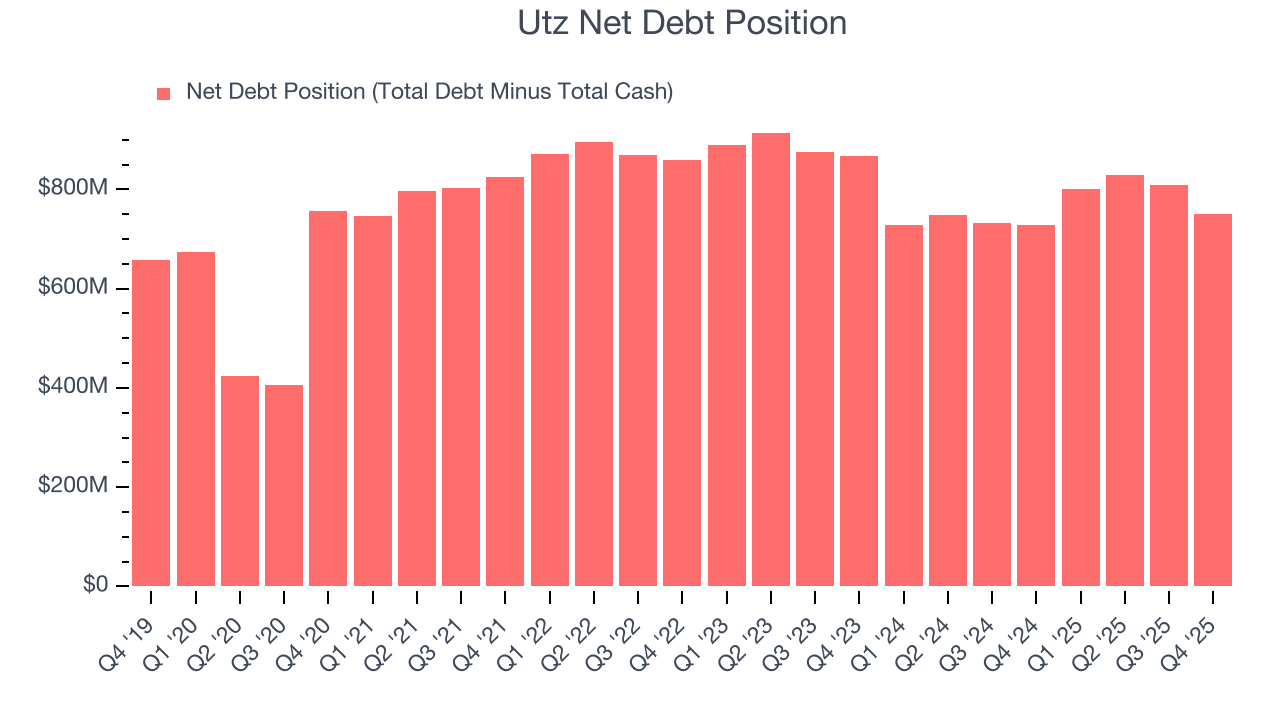

Utz reported $120.4 million of cash and $870.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $277.4 million of EBITDA over the last 12 months, we view Utz’s 2.7× net-debt-to-EBITDA ratio as safe. We also see its $22.97 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Utz’s Q4 Results

Revenue and EPS were in line with expectations. Overall, this quarter was without surprises, good or bad. The stock remained flat at $11.19 immediately following the results.

14. Is Now The Time To Buy Utz?

Updated: February 12, 2026 at 6:46 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies serving everyday consumers, but in the case of Utz, we’ll be cheering from the sidelines. First off, its revenue growth was weak over the last three years. While its EPS growth over the last three years has exceeded its peer group average, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its brand caters to a niche market.

Utz’s P/E ratio based on the next 12 months is 12.6x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $14 on the company (compared to the current share price of $11.19).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.