Utz (UTZ)

Utz is in for a bumpy ride. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Utz Will Underperform

Tracing its roots back to 1921 when Bill and Salie Utz began making potato chips in their kitchen, Utz Brands (NYSE:UTZ) offers salty snacks such as potato chips, tortilla chips, pretzels, cheese snacks, and ready-to-eat popcorn, among others.

- Low returns on capital reflect management’s struggle to allocate funds effectively

- 2% annual revenue growth over the last three years was slower than its consumer staples peers

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

Utz’s quality doesn’t meet our hurdle. There are more promising alternatives.

Why There Are Better Opportunities Than Utz

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Utz

At $10.51 per share, Utz trades at 11.9x forward P/E. This multiple is cheaper than most consumer staples peers, but we think this is justified.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Utz (UTZ) Research Report: Q3 CY2025 Update

Snack food company Utz Brands (NYSE:UTZ) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 3.4% year on year to $377.8 million. Its non-GAAP profit of $0.23 per share was in line with analysts’ consensus estimates.

Utz (UTZ) Q3 CY2025 Highlights:

- Revenue: $377.8 million vs analyst estimates of $375 million (3.4% year-on-year growth, 0.7% beat)

- Adjusted EPS: $0.23 vs analyst estimates of $0.23 (in line)

- Operating Margin: 0.9%, down from 5.3% in the same quarter last year

- Free Cash Flow Margin: 18.4%, up from 7.9% in the same quarter last year

- Organic Revenue rose 3.4% year on year vs analyst estimates of 2.6% growth (78.2 basis point beat)

- Sales Volumes rose 4.5% year on year (2.4% in the same quarter last year)

- Market Capitalization: $1.03 billion

Company Overview

Tracing its roots back to 1921 when Bill and Salie Utz began making potato chips in their kitchen, Utz Brands (NYSE:UTZ) offers salty snacks such as potato chips, tortilla chips, pretzels, cheese snacks, and ready-to-eat popcorn, among others.

In the century-plus after its founding, the company has grown through organic expansion of its portfolio as well as major acquisitions. Notable deals include the 2016 purchase of Golden Flake and the acquisition of Conagra Snacks in 2020.

Today, Utz goes to market with the Utz, Zapp’s, Golden Flake, Boulder Canyon, and other brand names. The company differentiates itself from other snack manufacturers by committing to use real ingredients and avoiding artificial preservatives.

It’s hard to pinpoint the core Utz customer because its product portfolio is so broad. If you don’t like chips, maybe you like pretzels. If pretzels aren’t your thing, there’s popcorn or cheese snacks. Suffice to say, though, that the core customer is likely someone who does the grocery shopping for his or her household and values proven brands.

The company’s products add convenience to everyday life, and they are also convenient to find. Ubiquitous retailers such as supermarkets, mass merchants, drug stores, and specialty stores sell Utz products.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors in salty snacks include PepsiCo (NASDAQ:PEP), Nestle (SWX:NESN), and Mondelez (NASDAQ:MDLZ).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

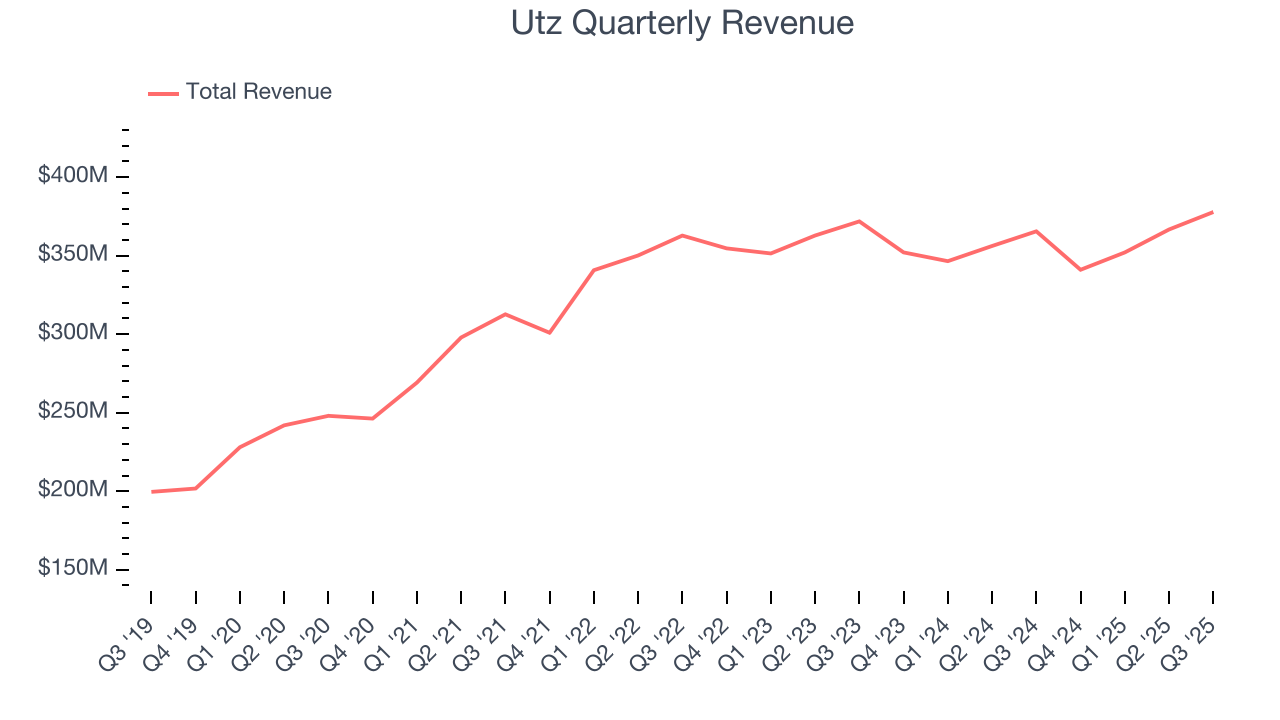

With $1.44 billion in revenue over the past 12 months, Utz is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, Utz’s 2% annualized revenue growth over the last three years was sluggish, but to its credit, consumers bought more of its products.

This quarter, Utz reported modest year-on-year revenue growth of 3.4% but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months, similar to its three-year rate. This projection is underwhelming and suggests its newer products will not catalyze better top-line performance yet.

6. Volume Growth

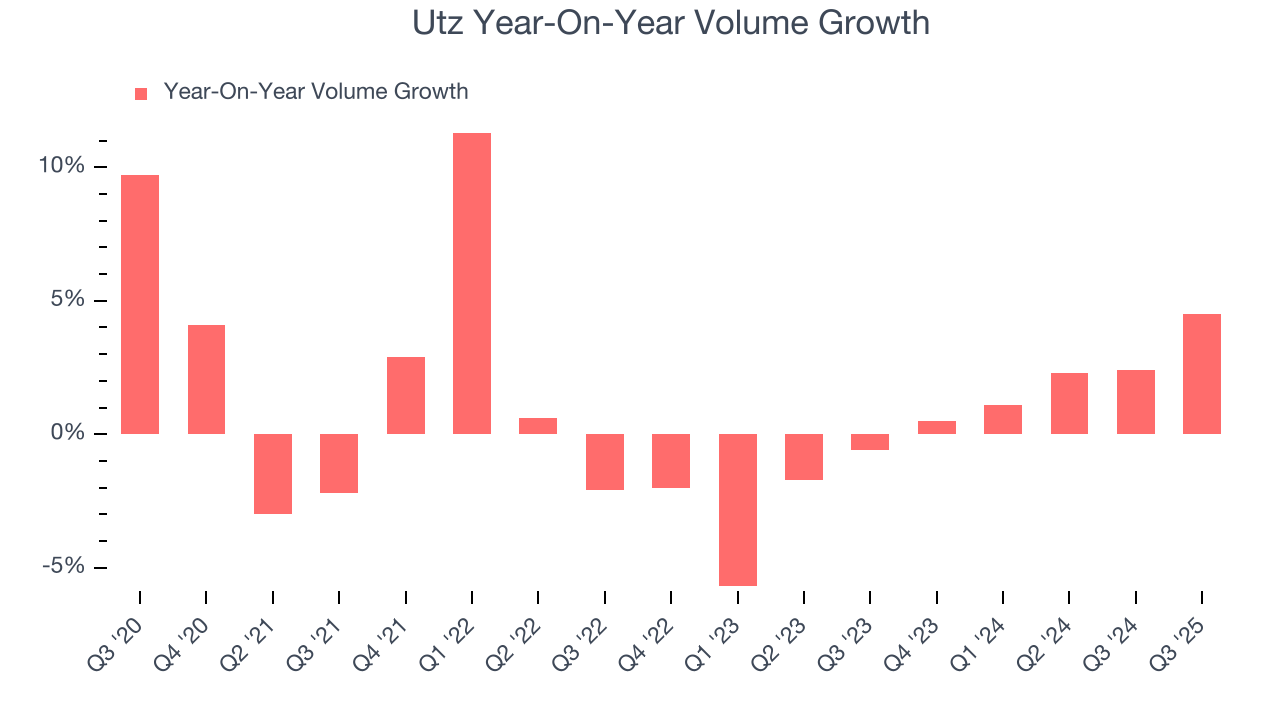

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Utz’s average quarterly volume growth was a healthy 2.2% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In Utz’s Q3 2025, sales volumes jumped 4.5% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

7. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

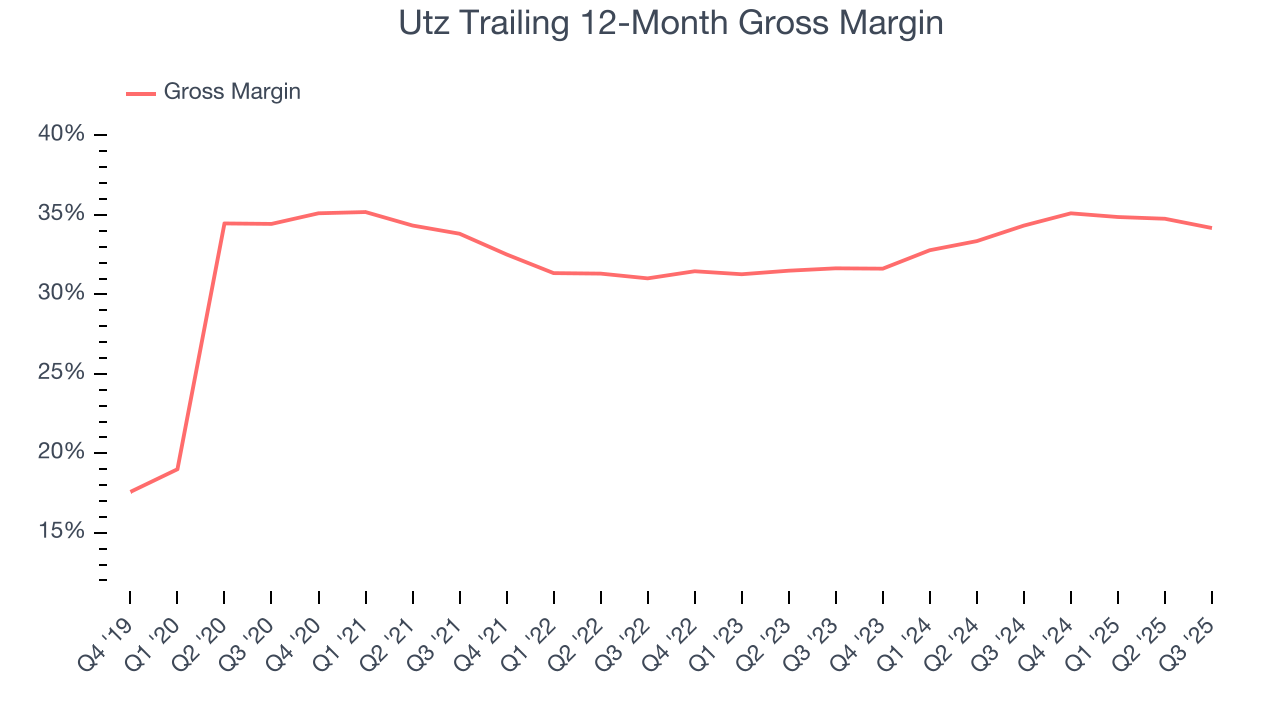

Utz’s unit economics are higher than the typical consumer staples company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 34.3% gross margin over the last two years. That means for every $100 in revenue, $65.75 went towards paying for raw materials, production of goods, transportation, and distribution.

In Q3, Utz produced a 33.6% gross profit margin, down 2.3 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

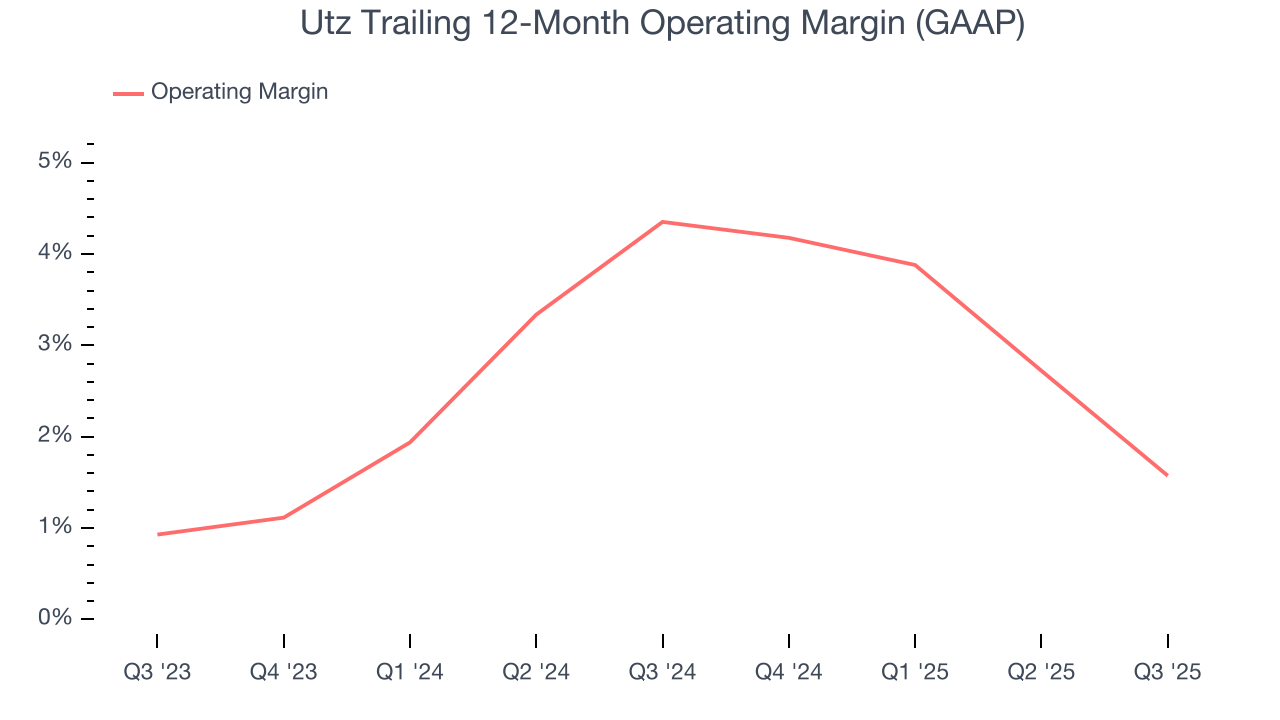

Utz was profitable over the last two years but held back by its large cost base. Its average operating margin of 3% was weak for a consumer staples business.

Analyzing the trend in its profitability, Utz’s operating margin decreased by 2.8 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Utz’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Utz’s breakeven margin was down 4.5 percentage points year on year. Since Utz’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

9. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

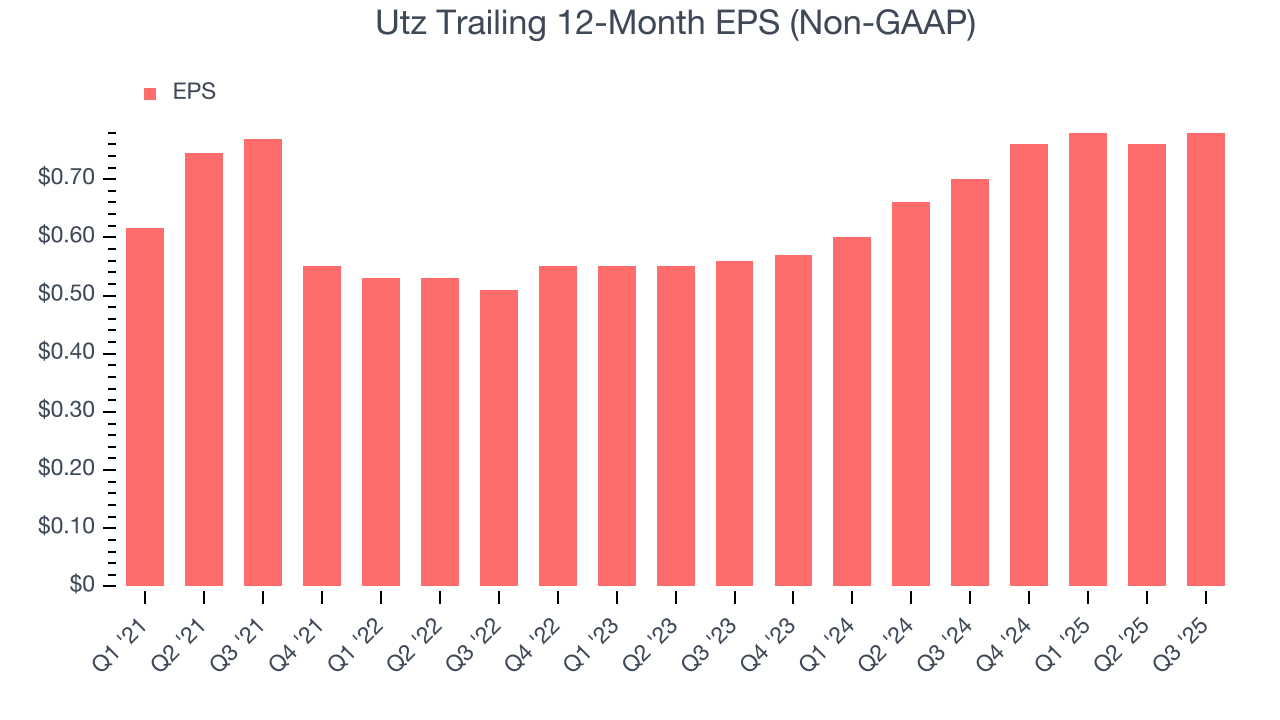

In Q3, Utz reported adjusted EPS of $0.23, up from $0.21 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Utz’s full-year EPS of $0.78 to grow 14.8%.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

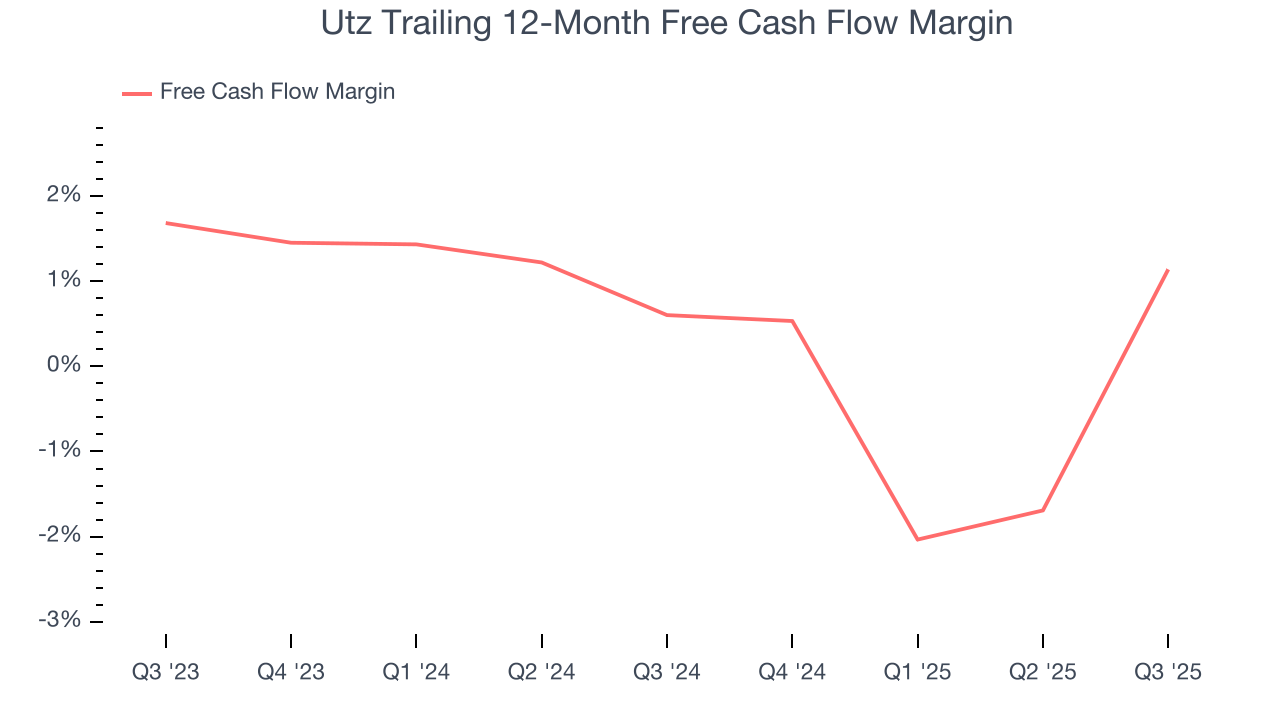

Utz broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Utz’s free cash flow clocked in at $69.56 million in Q3, equivalent to a 18.4% margin. This result was good as its margin was 10.5 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

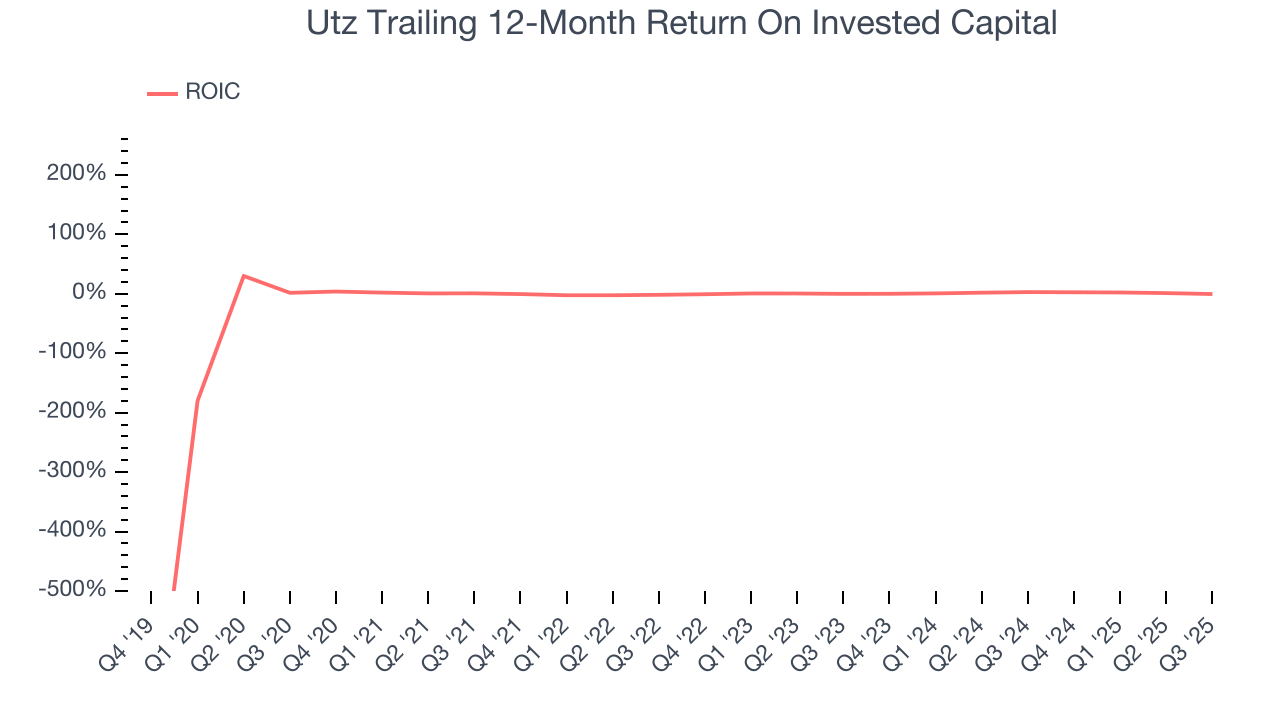

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Utz historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.2%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

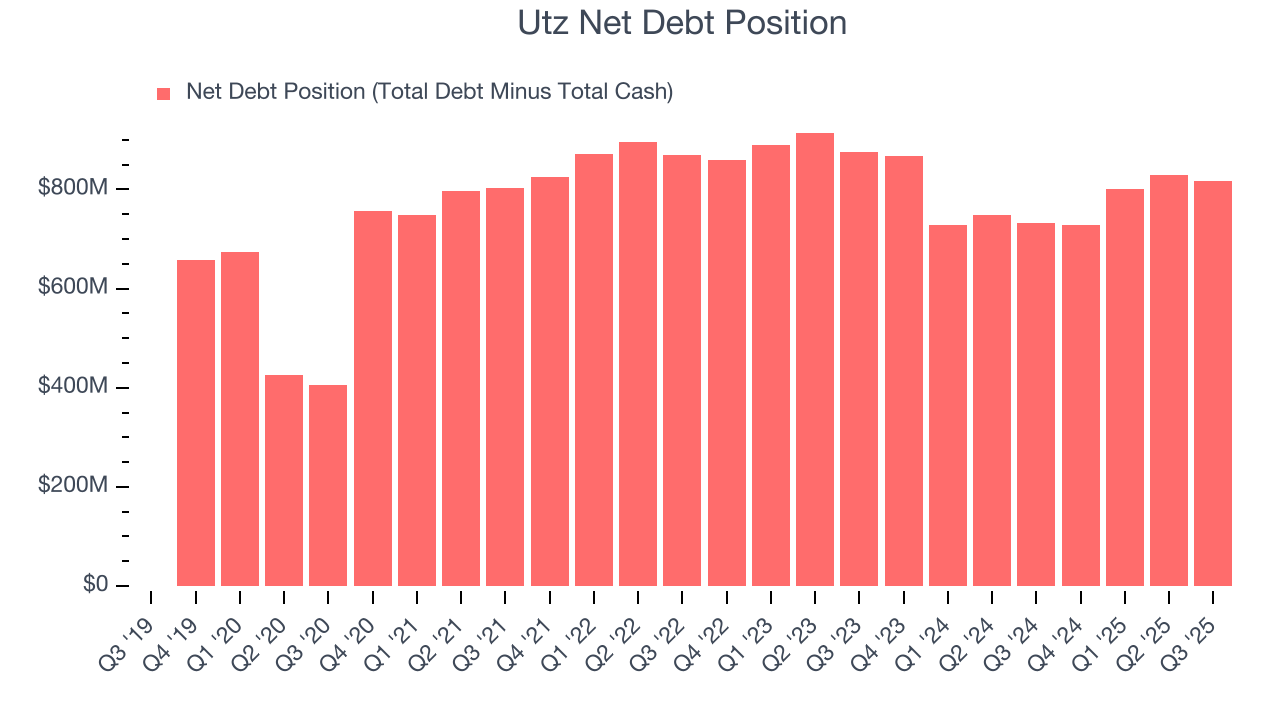

12. Balance Sheet Assessment

Utz reported $57.7 million of cash and $873.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $263.8 million of EBITDA over the last 12 months, we view Utz’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $20.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Utz’s Q3 Results

Revenue and EPS were roughly in line. We were also happy its organic revenue narrowly outperformed Wall Street’s estimates. On the other hand, its gross margin missed. Overall, this print had some key positives. The stock traded up 8.4% to $12.96 immediately after reporting.

14. Is Now The Time To Buy Utz?

Updated: December 18, 2025 at 10:00 PM EST

Before investing in or passing on Utz, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We see the value of companies helping consumers, but in the case of Utz, we’re out. For starters, its revenue growth was uninspiring over the last three years, and analysts don’t see anything changing over the next 12 months. And while its EPS growth over the last three years has been fantastic, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its brand caters to a niche market.

Utz’s forward price-to-sales ratio is 0.6x. The market typically values companies like Utz based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.