Wabash (WNC)

Wabash faces an uphill battle. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Wabash Will Underperform

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

- Sales stagnated over the last five years and signal the need for new growth strategies

- Earnings per share have contracted by 39.2% annually over the last five years, a headwind for returns as stock prices often echo long-term EPS performance

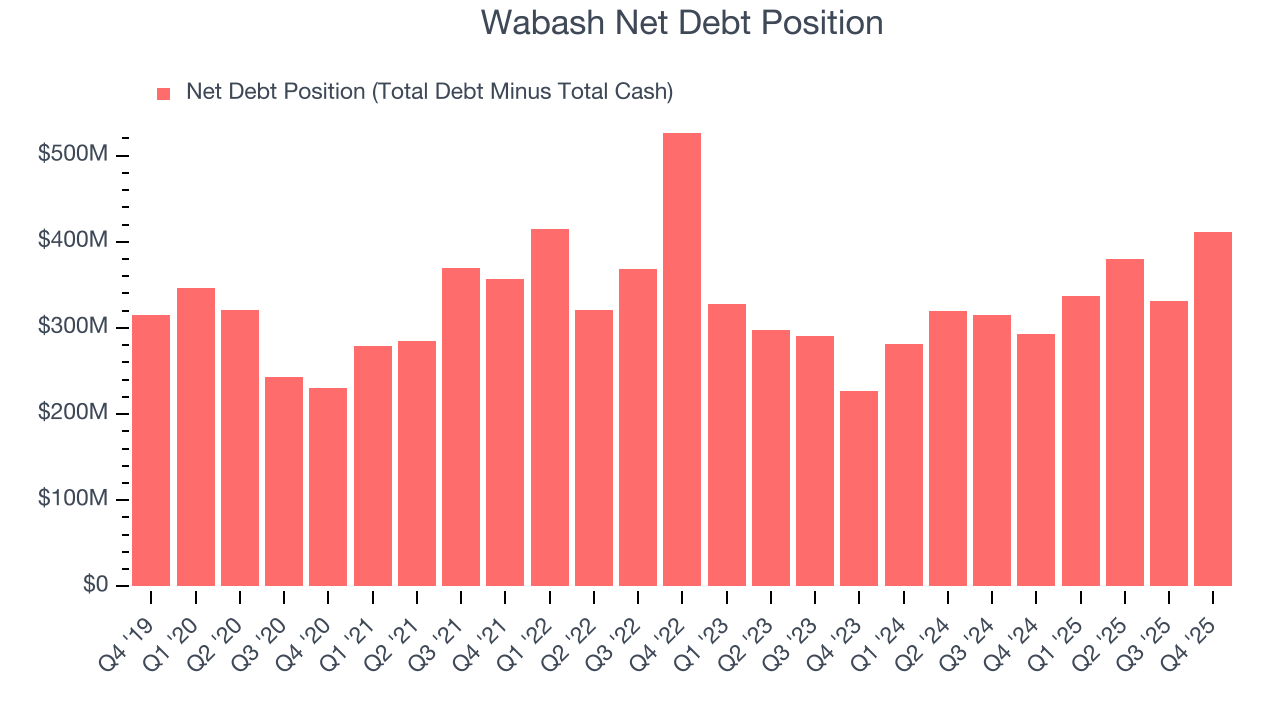

- High net-debt-to-EBITDA ratio of 37× increases the risk of forced asset sales or dilutive financing if operational performance weakens

Wabash is skating on thin ice. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Wabash

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Wabash

Wabash’s stock price of $11.25 implies a valuation ratio of 13.2x forward EV-to-EBITDA. Wabash’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Wabash (WNC) Research Report: Q4 CY2025 Update

Semi trailers and liquid transportation container manufacturer Wabash (NYSE:WNC) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 22.9% year on year to $321.5 million. On the other hand, next quarter’s revenue guidance of $320 million was less impressive, coming in 22% below analysts’ estimates. Its non-GAAP loss of $0.93 per share was 21.6% below analysts’ consensus estimates.

Wabash (WNC) Q4 CY2025 Highlights:

- Revenue: $321.5 million vs analyst estimates of $318.3 million (22.9% year-on-year decline, 1% beat)

- Adjusted EPS: -$0.93 vs analyst expectations of -$0.76 (21.6% miss)

- Adjusted EBITDA: -$26.2 million (-8.1% margin, 230% year-on-year decline)

- Revenue Guidance for Q1 CY2026 is $320 million at the midpoint, below analyst estimates of $410.4 million

- Adjusted EPS guidance for Q1 CY2026 is -$1 at the midpoint, below analyst estimates of -$0.09

- Adjusted EBITDA Margin: -8.1%, down from 4.8% in the same quarter last year

- Free Cash Flow was -$69.29 million, down from $54.03 million in the same quarter last year

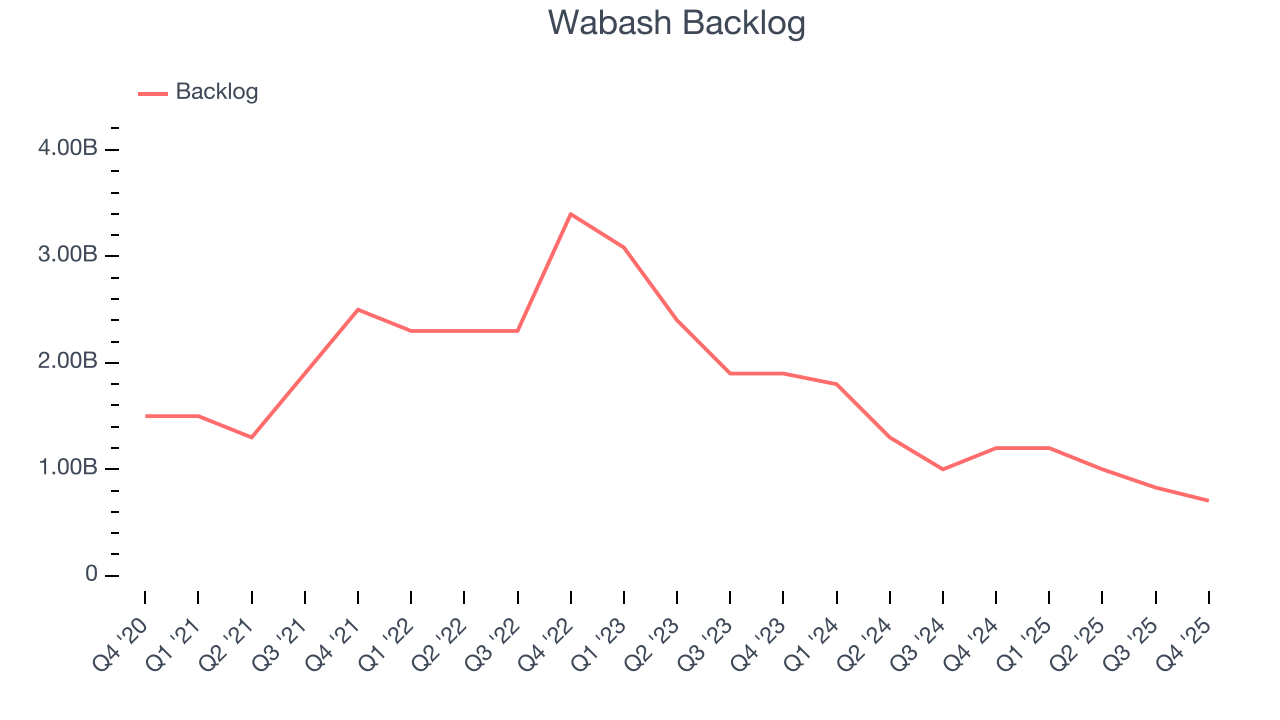

- Backlog: $705 million at quarter end, down 41.3% year on year

- Market Capitalization: $455.4 million

Company Overview

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash was founded in 1985 by the former president of a trailer manufacturer. The company initially only offered trailers but expanded by making acquisitions, specifically, targeting small companies to enhance specific capabilities and larger companies to broaden its market reach with new offerings.

Specifically, the acquisitions of Walker in 2012 and Supreme Industries in 2017 were pivotal. The acquisition of Supreme Industries, known for truck bodies and specialty vehicles, enabled it to offer more new transportation containers particularly for delivery and service vehicles. On the other hand, acquiring Walker strengthened its expertise in manufacturing lightweight trailers, particularly in refrigerated transport.

The company started with making detachable trailers to hold cargo for trucks but now also offers truck bodies (enclosed spaces on the back of trucks), refrigerated trailers (which keeps food cold), fluid containers, and equipment for moving goods between trucks and trains which are used to transport items. Its equipment for moving goods are specifically designed to reduce the need to unload and reload goods, save time, and reduce costs. For example, it offers chassis to transport containers to and from rail yards and ports. The company also offers specialized configurations for different industries and operational requirements.

Wabash engages in direct sales and contracts with dealers and fleet operators to sell its products. These contracts often involve long-term agreements (typically three to five years) that ensure supply and service support.

4. Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Competitors offering similar products include Trinity (NYSE:TRN), Great Dane (private), and Utility Trailer Manufacturing (private).

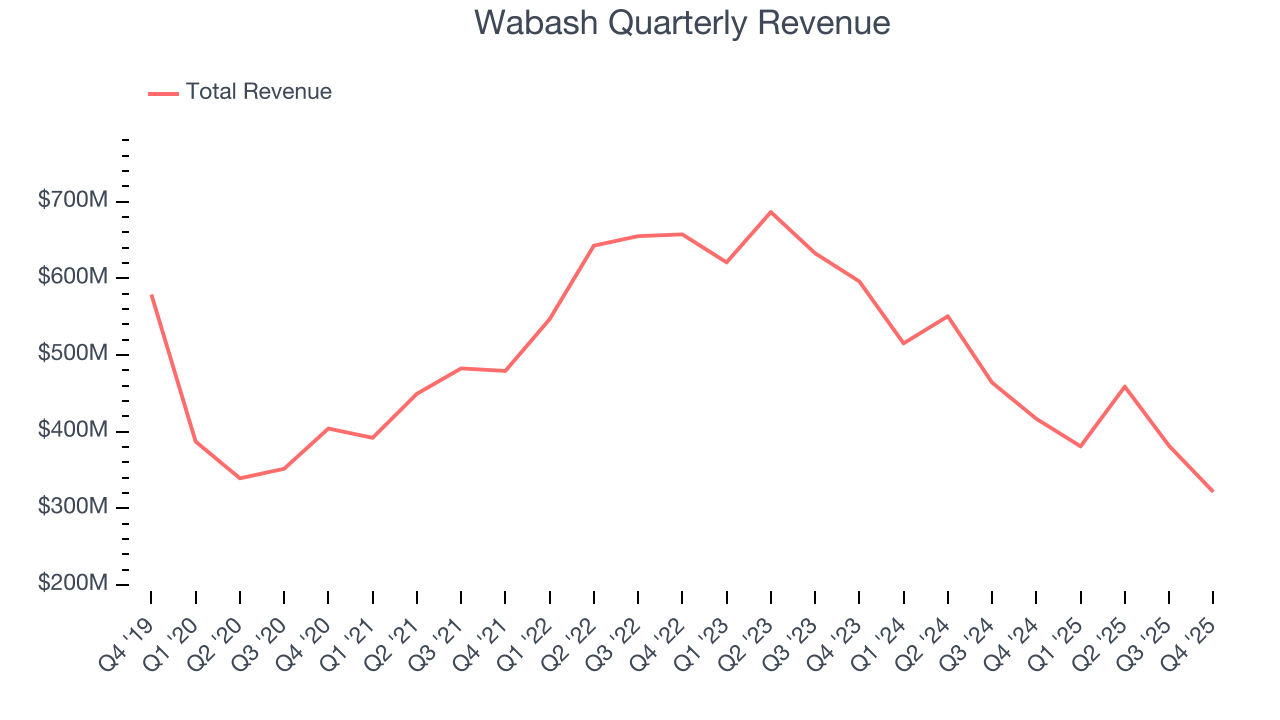

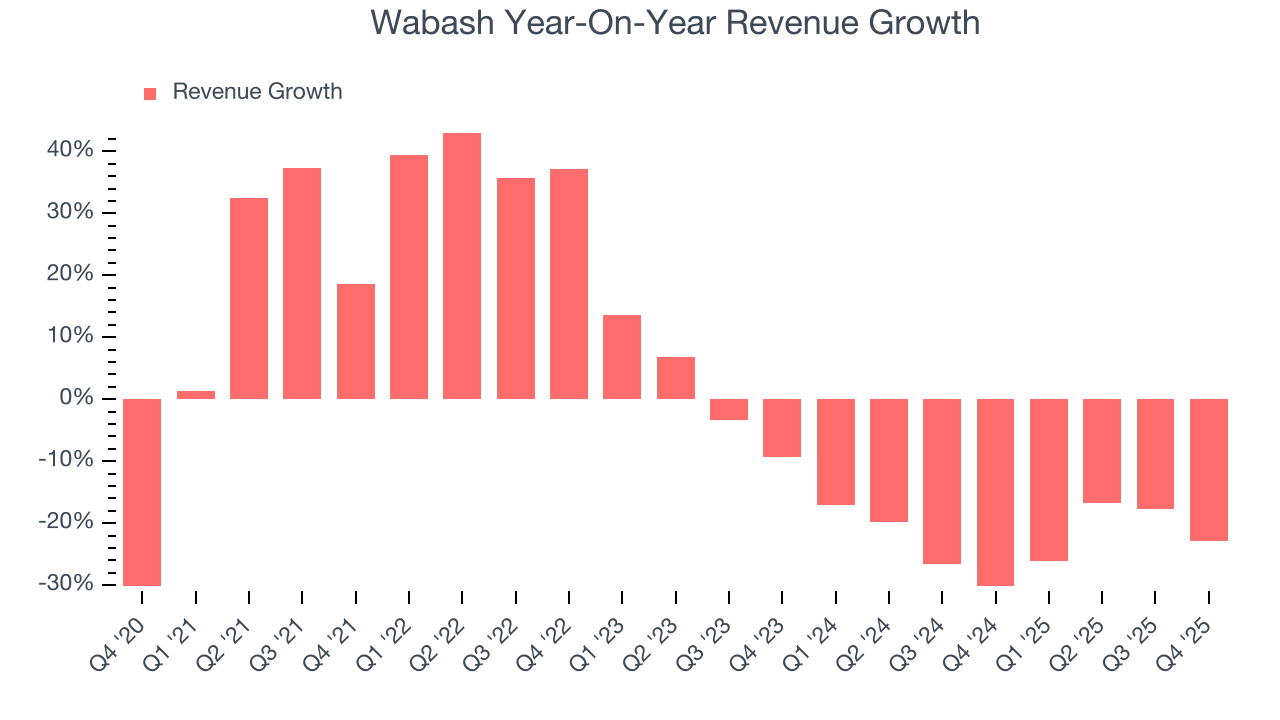

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Wabash struggled to consistently increase demand as its $1.54 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Wabash’s recent performance shows its demand remained suppressed as its revenue has declined by 22% annually over the last two years. Wabash isn’t alone in its struggles as the Heavy Transportation Equipment industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Wabash’s backlog reached $705 million in the latest quarter and averaged 35.8% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Wabash’s revenue fell by 22.9% year on year to $321.5 million but beat Wall Street’s estimates by 1%. Company management is currently guiding for a 16% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.2% over the next 12 months, an improvement versus the last two years. This projection is healthy and suggests its newer products and services will fuel better top-line performance.

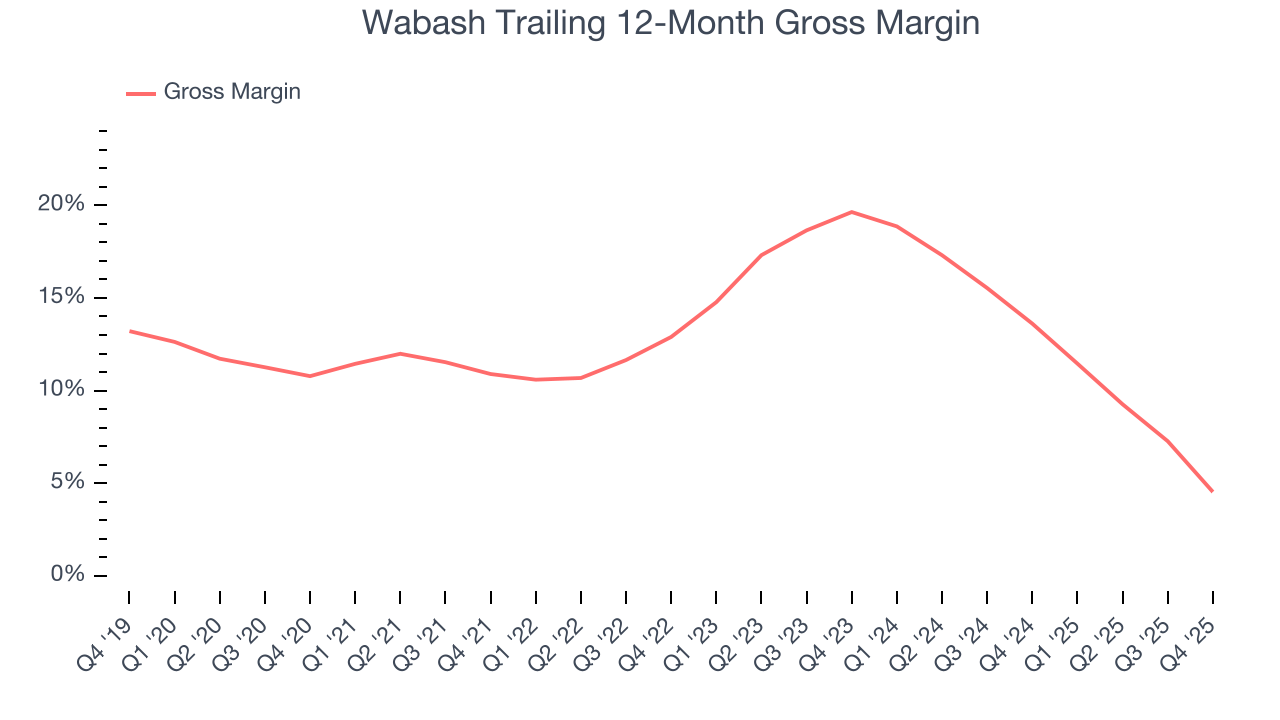

6. Gross Margin & Pricing Power

Wabash has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13.1% gross margin over the last five years. That means Wabash paid its suppliers a lot of money ($86.91 for every $100 in revenue) to run its business.

This quarter, Wabash’s gross profit margin was negative 1.9%. Wabash’s full-year margin has also been trending down over the past 12 months, decreasing by 9.1 percentage points. If this move continues, it could suggest deteriorating pricing power and higher input costs (such as raw materials and manufacturing expenses).

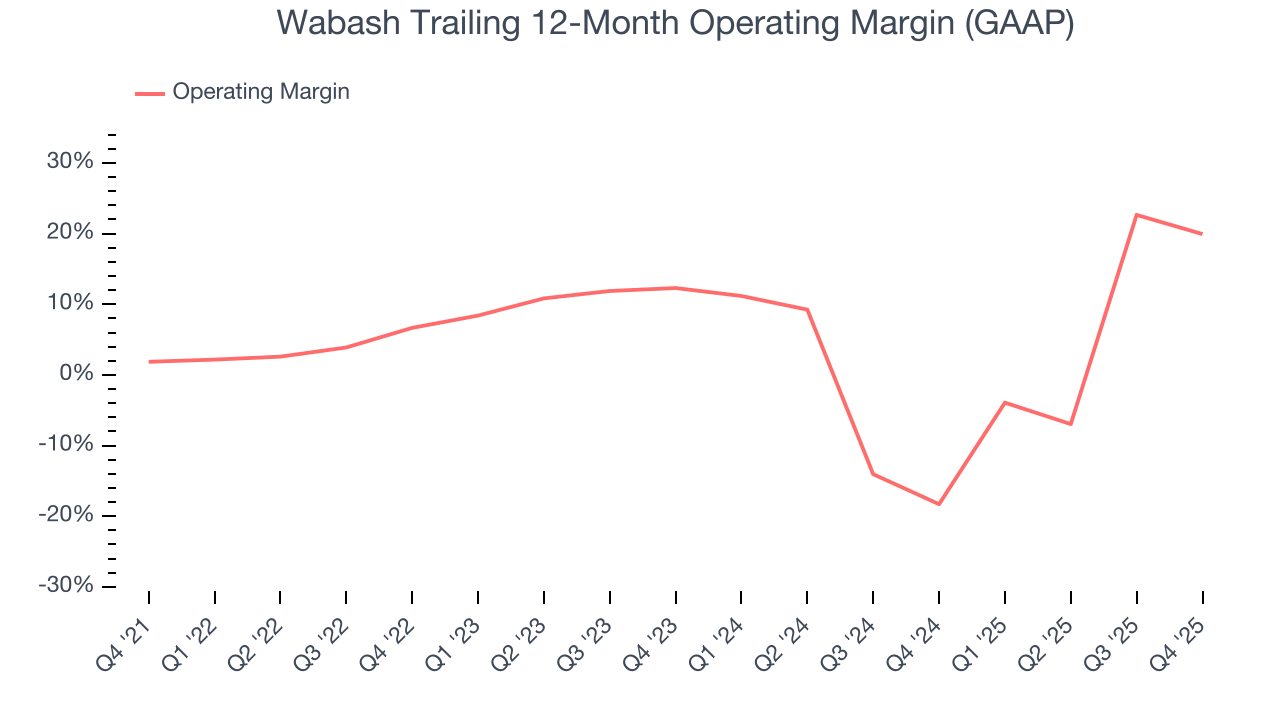

7. Operating Margin

Wabash was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Wabash’s operating margin rose by 18.1 percentage points over the last five years.

This quarter, Wabash generated an operating margin profit margin of negative 18.6%, down 19.5 percentage points year on year. Since Wabash’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

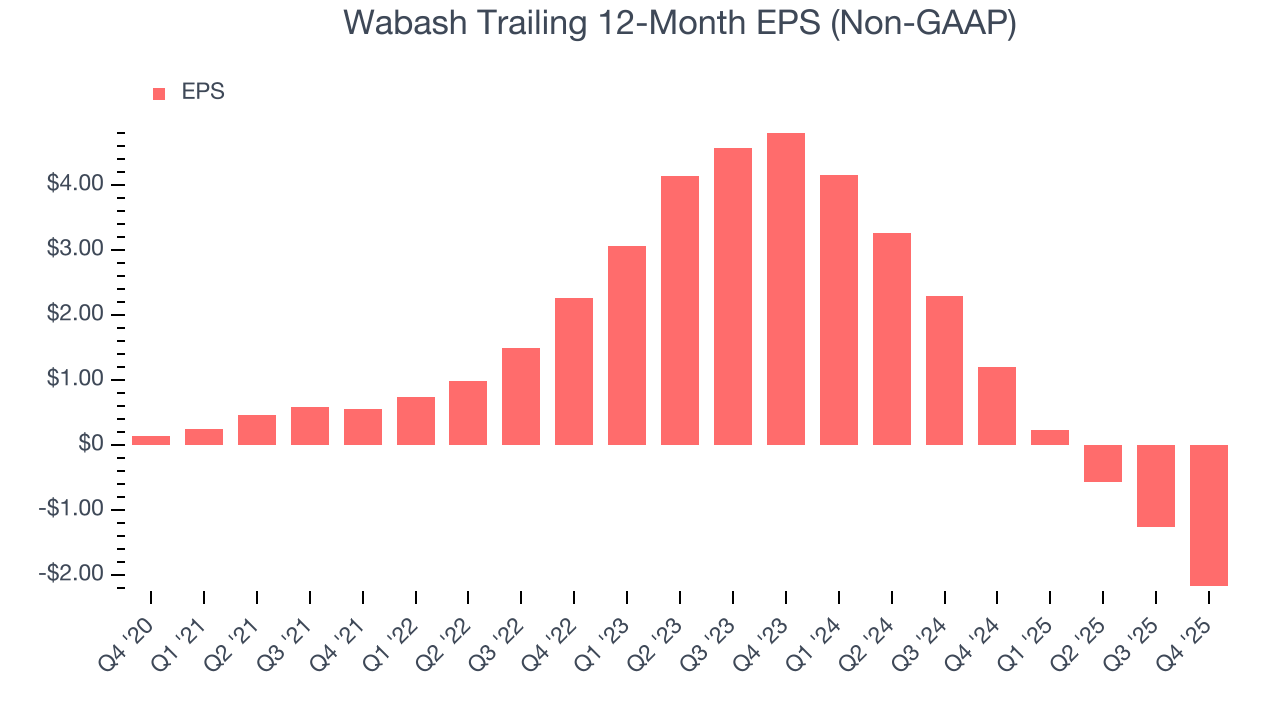

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Wabash, its EPS declined by 75.1% annually over the last five years while its revenue was flat. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Wabash, its two-year annual EPS declines of 56.6% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q4, Wabash reported adjusted EPS of negative $0.93, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Wabash’s full-year EPS of negative $2.17 will flip to positive $0.42.

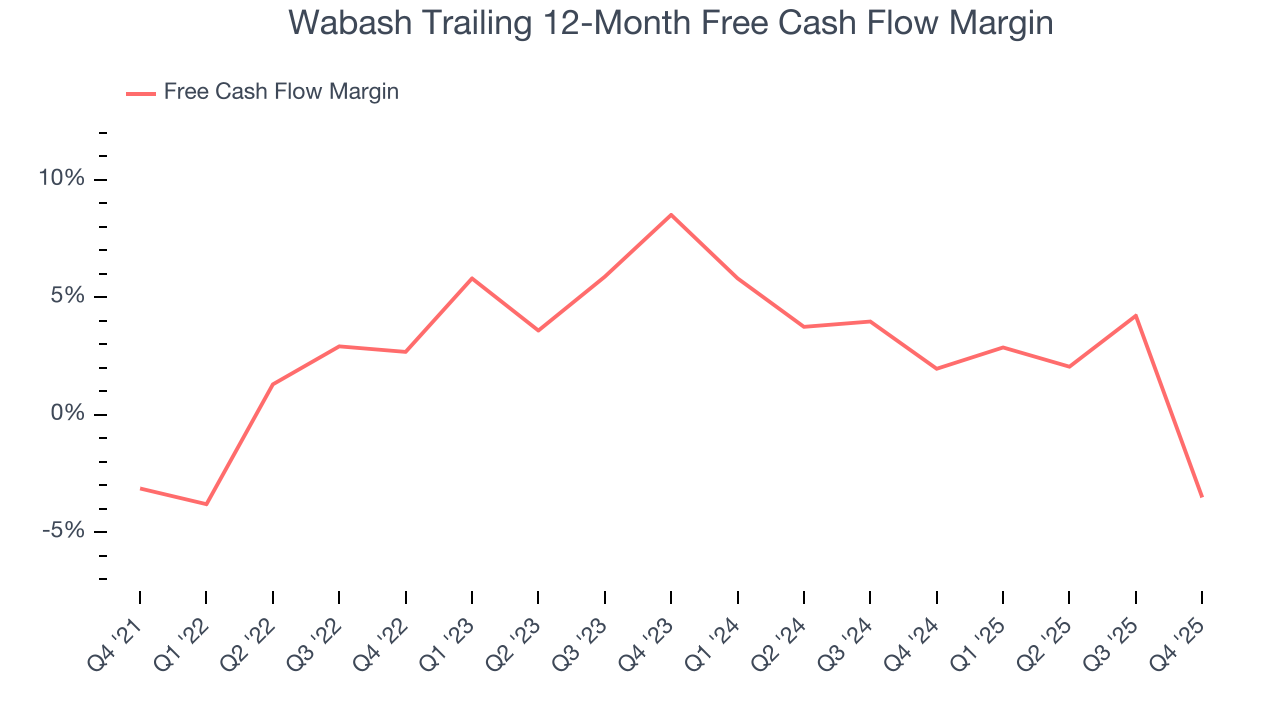

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Wabash has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2%, lousy for an industrials business.

Wabash burned through $69.29 million of cash in Q4, equivalent to a negative 21.6% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

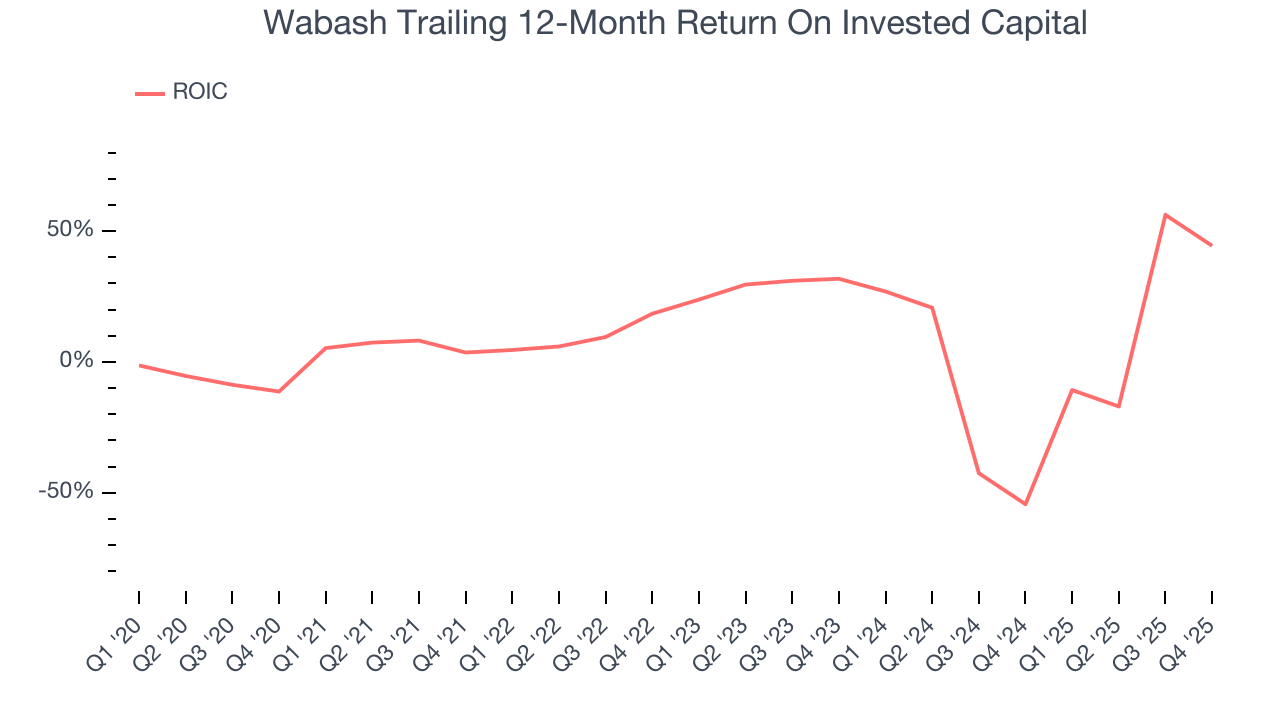

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Wabash historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.8%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Wabash’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Wabash burned through $54.26 million of cash over the last year, and its $442.9 million of debt exceeds the $31.92 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Wabash’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Wabash until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

12. Key Takeaways from Wabash’s Q4 Results

It was good to see Wabash narrowly top analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 7.5% to $10.40 immediately after reporting.

13. Is Now The Time To Buy Wabash?

Before deciding whether to buy Wabash or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We see the value of companies helping their customers, but in the case of Wabash, we’re out. To begin with, its revenue growth was weak over the last five years. And while its expanding operating margin shows the business has become more efficient, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Wabash’s P/E ratio based on the next 12 months is 26.8x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $13.50 on the company (compared to the current share price of $10.40).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.