Wabash (WNC)

Wabash is in for a bumpy ride. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Wabash Will Underperform

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

- Products and services are facing end-market challenges during this cycle, as seen in its flat sales over the last five years

- Earnings per share have dipped by 39.2% annually over the past five years, which is concerning because stock prices follow EPS over the long term

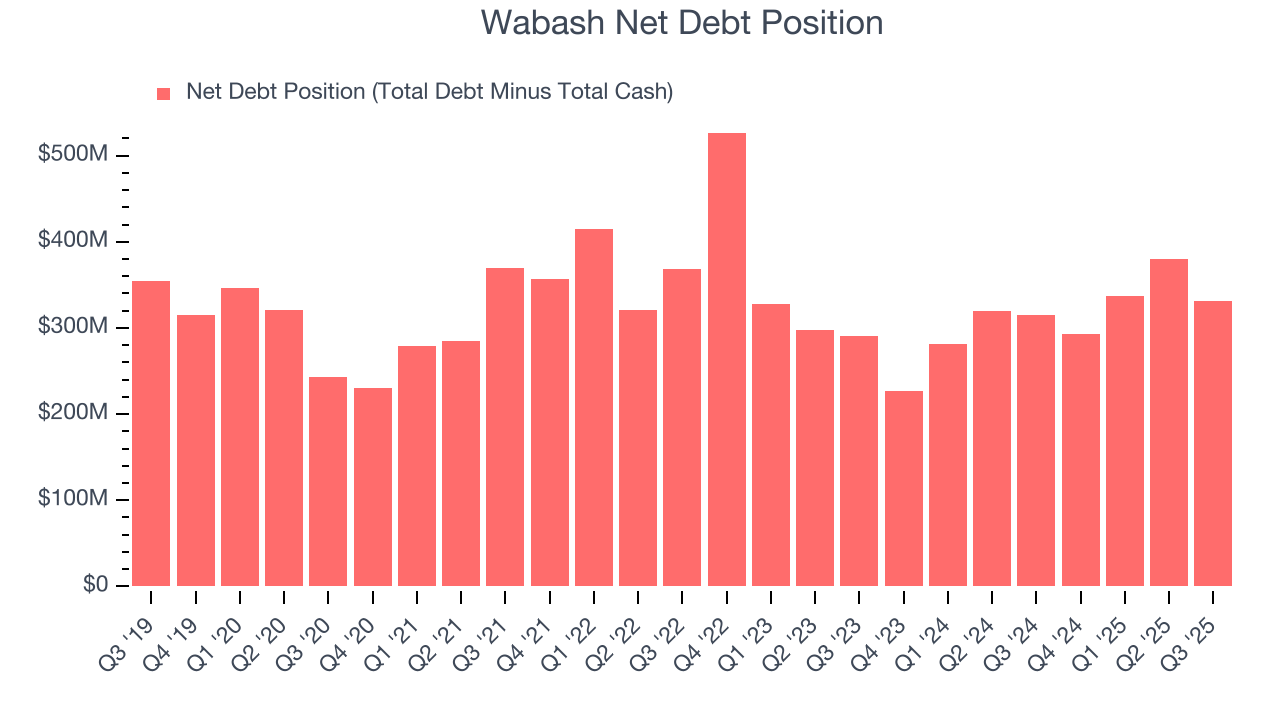

- High net-debt-to-EBITDA ratio of 37× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Wabash doesn’t pass our quality test. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Wabash

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Wabash

At $10.18 per share, Wabash trades at 12.8x forward EV-to-EBITDA. Wabash’s multiple may seem like a great deal among industrials peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Wabash (WNC) Research Report: Q3 CY2025 Update

Semi trailers and liquid transportation container manufacturer Wabash (NYSE:WNC) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 17.8% year on year to $381.6 million. On the other hand, the company’s full-year revenue guidance of $1.5 billion at the midpoint came in 5.1% below analysts’ estimates. Its non-GAAP loss of $0.51 per share was 31.5% below analysts’ consensus estimates.

Wabash (WNC) Q3 CY2025 Highlights:

- Revenue: $381.6 million vs analyst estimates of $381.5 million (17.8% year-on-year decline, in line)

- Adjusted EPS: -$0.51 vs analyst expectations of -$0.39 (31.5% miss)

- Adjusted EBITDA: -$5.48 million vs analyst estimates of -$3 million (-1.4% margin, 82.5% miss)

- The company dropped its revenue guidance for the full year to $1.5 billion at the midpoint from $1.6 billion, a 6.3% decrease

- Management lowered its full-year Adjusted EPS guidance to -$2 at the midpoint, a 73.9% decrease

- Operating Margin: 15.1%, up from -93.3% in the same quarter last year

- Free Cash Flow Margin: 15.9%, up from 5.8% in the same quarter last year

- Backlog: $829 million at quarter end, down 17.1% year on year

- Market Capitalization: $340.2 million

Company Overview

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash was founded in 1985 by the former president of a trailer manufacturer. The company initially only offered trailers but expanded by making acquisitions, specifically, targeting small companies to enhance specific capabilities and larger companies to broaden its market reach with new offerings.

Specifically, the acquisitions of Walker in 2012 and Supreme Industries in 2017 were pivotal. The acquisition of Supreme Industries, known for truck bodies and specialty vehicles, enabled it to offer more new transportation containers particularly for delivery and service vehicles. On the other hand, acquiring Walker strengthened its expertise in manufacturing lightweight trailers, particularly in refrigerated transport.

The company started with making detachable trailers to hold cargo for trucks but now also offers truck bodies (enclosed spaces on the back of trucks), refrigerated trailers (which keeps food cold), fluid containers, and equipment for moving goods between trucks and trains which are used to transport items. Its equipment for moving goods are specifically designed to reduce the need to unload and reload goods, save time, and reduce costs. For example, it offers chassis to transport containers to and from rail yards and ports. The company also offers specialized configurations for different industries and operational requirements.

Wabash engages in direct sales and contracts with dealers and fleet operators to sell its products. These contracts often involve long-term agreements (typically three to five years) that ensure supply and service support.

4. Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Competitors offering similar products include Trinity (NYSE:TRN), Great Dane (private), and Utility Trailer Manufacturing (private).

5. Revenue Growth

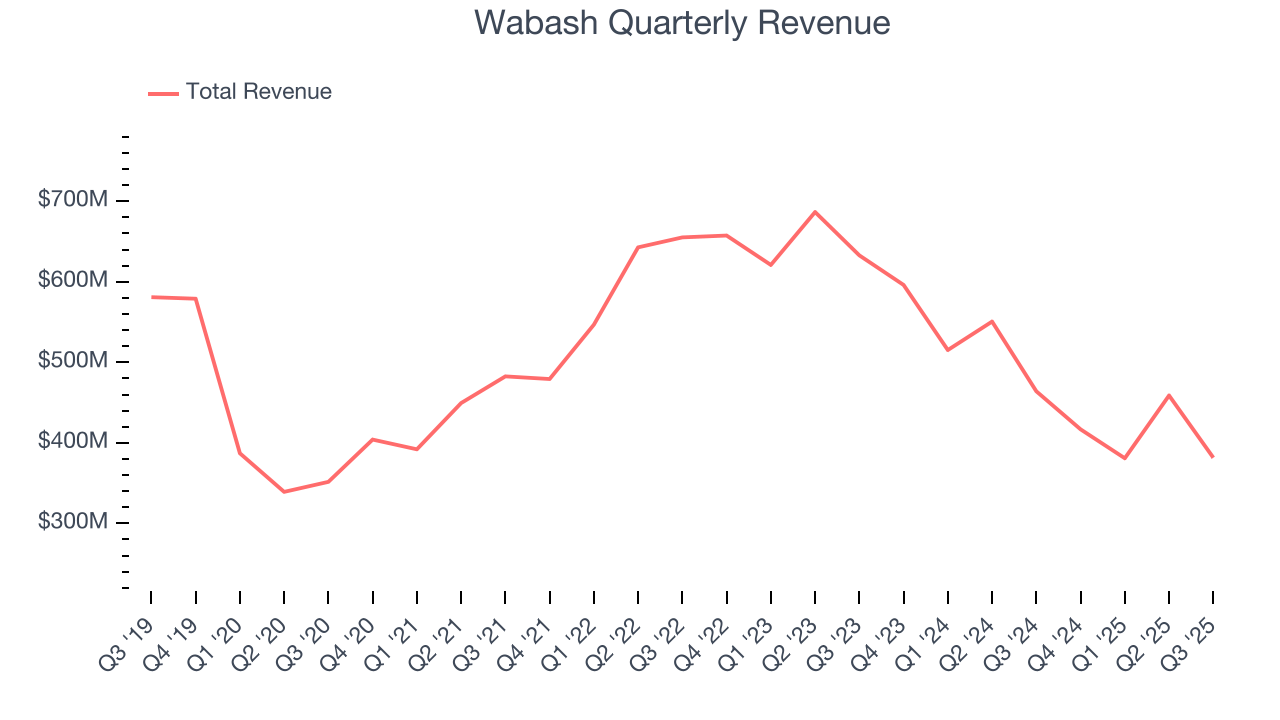

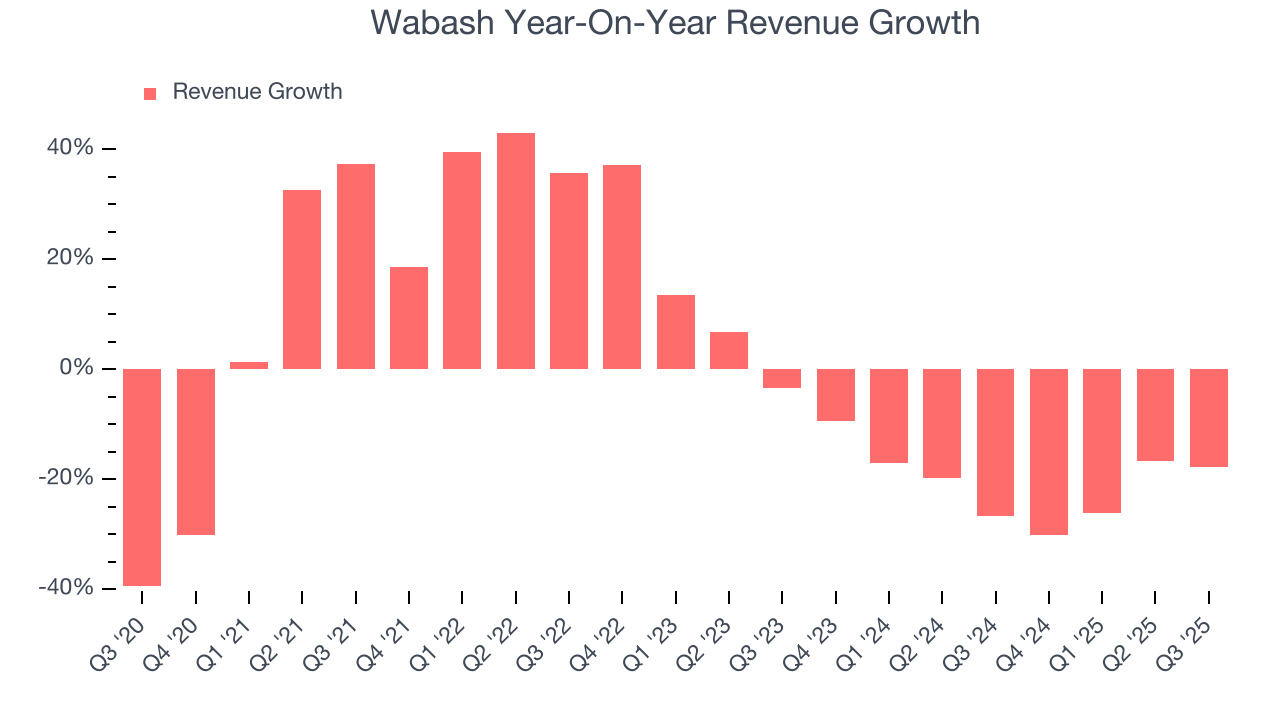

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Wabash struggled to consistently increase demand as its $1.64 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Wabash’s recent performance shows its demand remained suppressed as its revenue has declined by 20.6% annually over the last two years. Wabash isn’t alone in its struggles as the Heavy Transportation Equipment industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

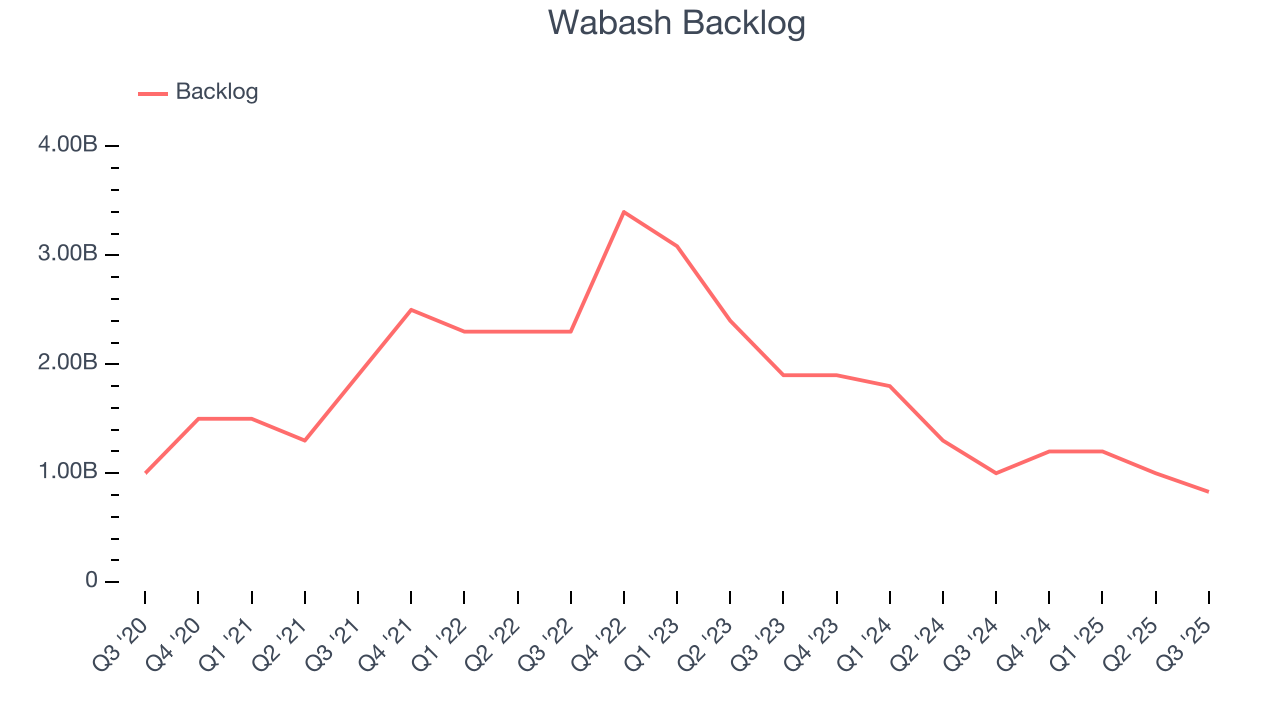

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Wabash’s backlog reached $829 million in the latest quarter and averaged 36.2% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Wabash reported a rather uninspiring 17.8% year-on-year revenue decline to $381.6 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

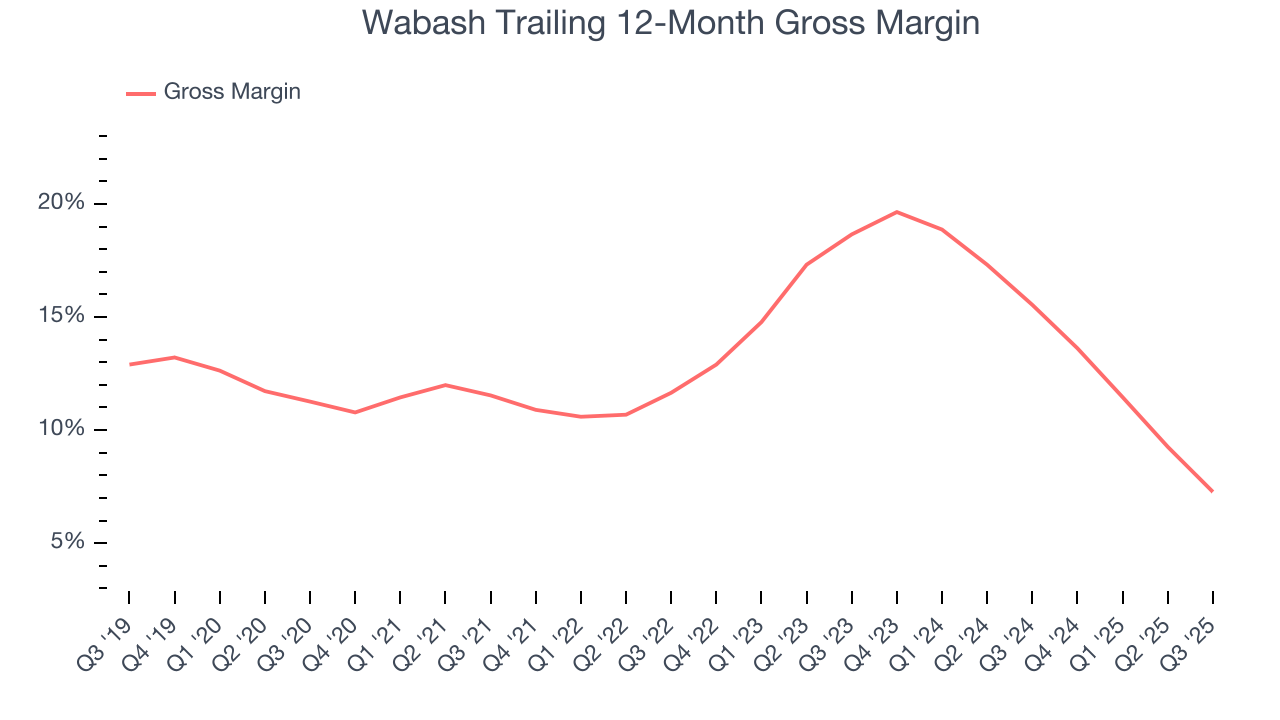

6. Gross Margin & Pricing Power

Wabash has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13.5% gross margin over the last five years. Said differently, Wabash had to pay a chunky $86.52 to its suppliers for every $100 in revenue.

Wabash’s gross profit margin came in at 4.1% this quarter, down 8 percentage points year on year. Wabash’s full-year margin has also been trending down over the past 12 months, decreasing by 8.3 percentage points. If this move continues, it could suggest deteriorating pricing power and higher input costs (such as raw materials and manufacturing expenses).

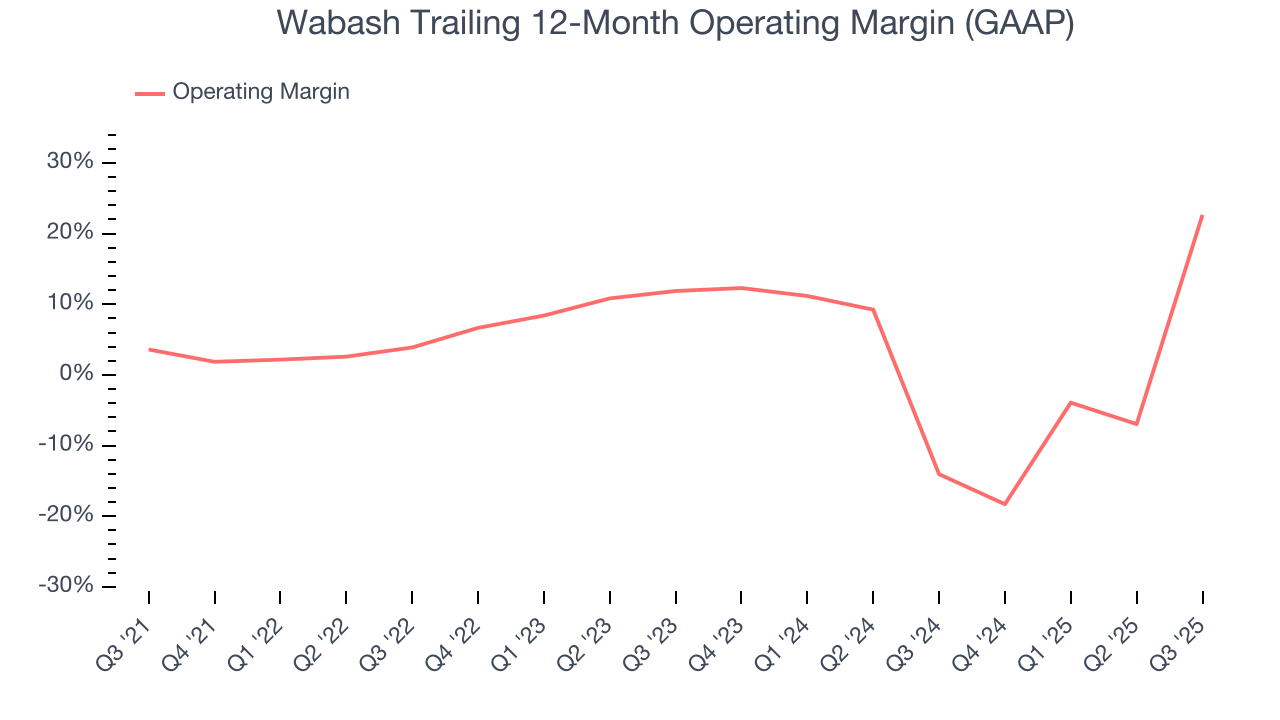

7. Operating Margin

Wabash was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.1% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Wabash’s operating margin rose by 19.1 percentage points over the last five years.

This quarter, Wabash generated an operating margin profit margin of 15.1%, up 108.4 percentage points year on year. The increase was solid, and because its revenue and gross margin actually decreased, we can assume it was more efficient because it trimmed its operating expenses like marketing, R&D, and administrative overhead.

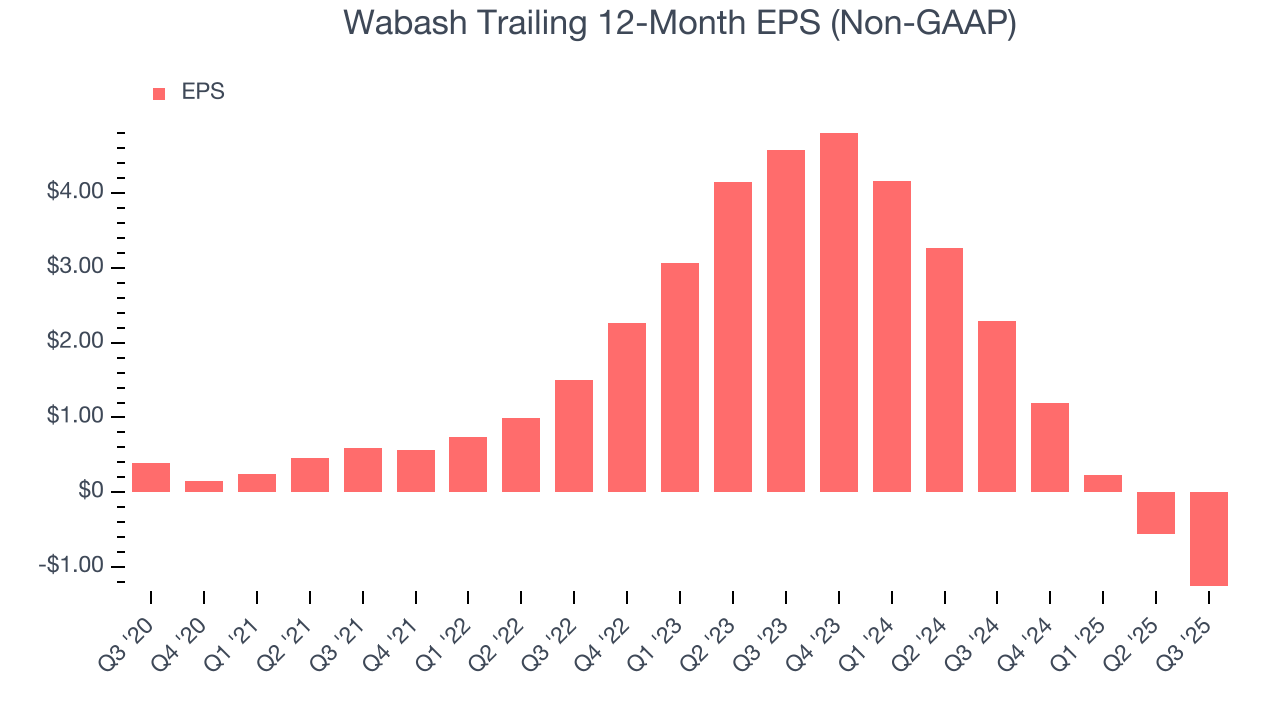

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Wabash, its EPS declined by 39.2% annually over the last five years while its revenue was flat. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Wabash, its two-year annual EPS declines of 50.8% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, Wabash reported adjusted EPS of negative $0.51, down from $0.19 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Wabash’s full-year EPS of negative $1.26 will flip to positive $0.17.

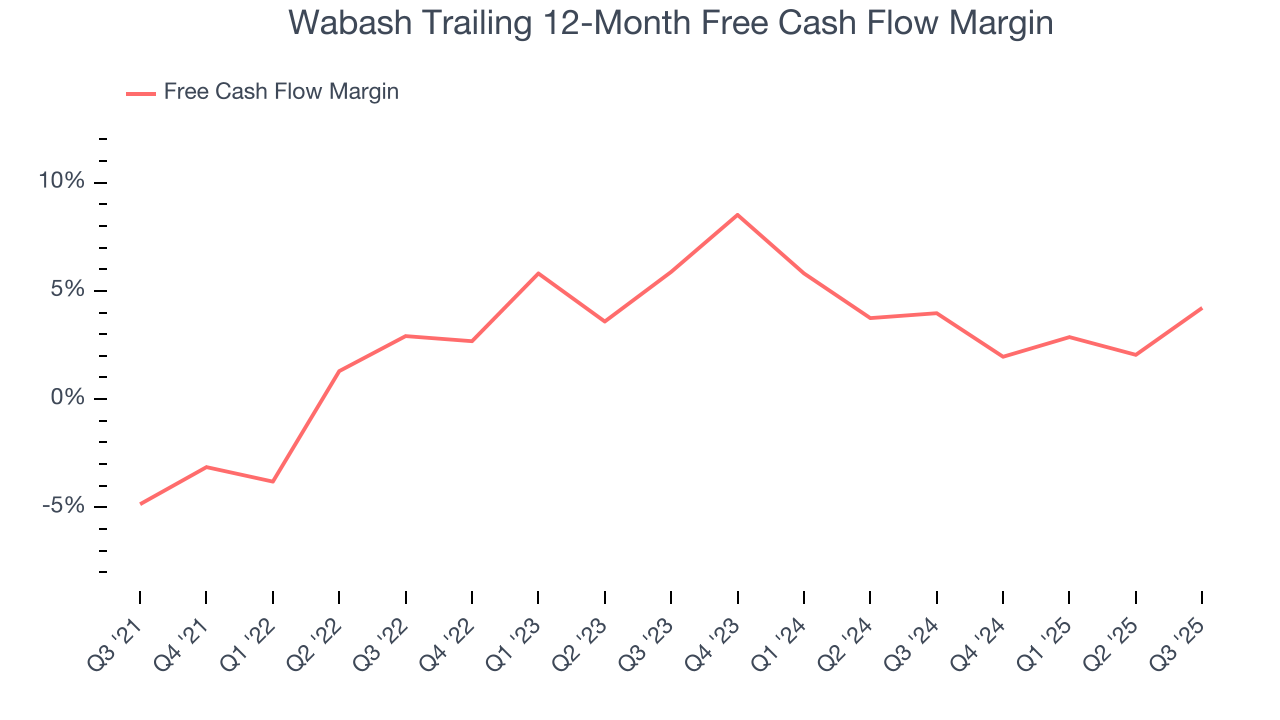

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Wabash has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.8%, lousy for an industrials business.

Taking a step back, an encouraging sign is that Wabash’s margin expanded by 9.1 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Wabash’s free cash flow clocked in at $60.62 million in Q3, equivalent to a 15.9% margin. This result was good as its margin was 10.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

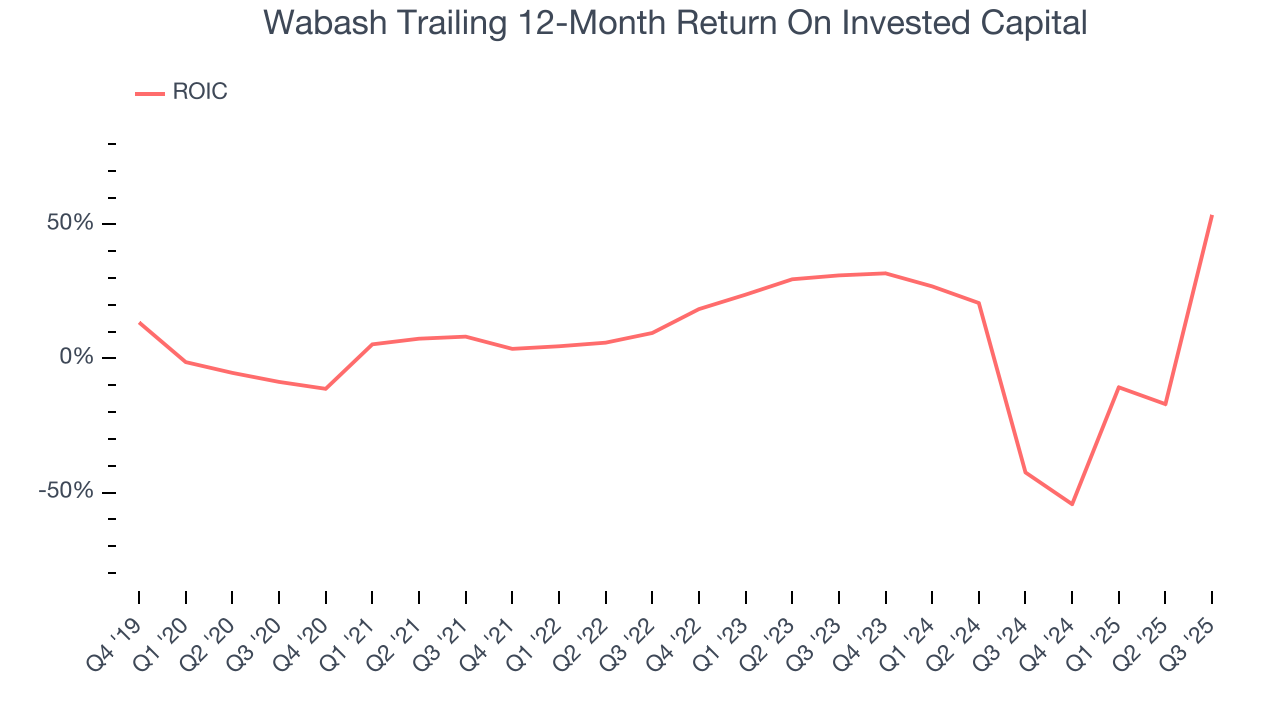

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Wabash’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 12%, slightly better than typical industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Wabash’s ROIC decreased by 3.3 percentage points annually over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Wabash’s $422.7 million of debt exceeds the $91.68 million of cash on its balance sheet. Furthermore, its 27× net-debt-to-EBITDA ratio (based on its EBITDA of $12.35 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Wabash could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Wabash can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from Wabash’s Q3 Results

We struggled to find many positives in these results. Wabash's EPS missed. Additionally, its full-year revenue guidance missed and its full-year EPS guidance fell short of Wall Street’s estimates after both were lowered. Overall, this was a weaker quarter. The stock traded down 7% to $7.72 immediately following the results.

13. Is Now The Time To Buy Wabash?

Updated: January 24, 2026 at 10:05 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Wabash.

Wabash falls short of our quality standards. First off, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. And while its rising cash profitability gives it more optionality, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its low gross margins indicate some combination of competitive pressures and high production costs.

Wabash’s EV-to-EBITDA ratio based on the next 12 months is 12.8x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $13.50 on the company (compared to the current share price of $10.18).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.