Sprout Social (SPT)

We aren’t fans of Sprout Social. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think Sprout Social Will Underperform

Born from the recognition that businesses needed a centralized way to handle their growing social media presence, Sprout Social (NASDAQ:SPT) provides a comprehensive software platform that helps businesses manage, analyze, and optimize their presence across various social media networks.

- Rapid expansion strategy came at the expense of operating margin profitability

- Estimated sales growth of 10.9% for the next 12 months implies demand will slow from its two-year trend

- On the bright side, its market share has increased as its 29.1% annual revenue growth over the last five years was exceptional

Sprout Social doesn’t live up to our standards. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Sprout Social

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Sprout Social

At $10.16 per share, Sprout Social trades at 1.2x forward price-to-sales. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Sprout Social (SPT) Research Report: Q3 CY2025 Update

Social media management platform Sprout Social (NASDAQ:SPT) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 12.6% year on year to $115.6 million. The company expects next quarter’s revenue to be around $118.6 million, close to analysts’ estimates. Its non-GAAP profit of $0.23 per share was 43.8% above analysts’ consensus estimates.

Sprout Social (SPT) Q3 CY2025 Highlights:

- Revenue: $115.6 million vs analyst estimates of $114.9 million (12.6% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.23 vs analyst estimates of $0.16 (43.8% beat)

- Adjusted Operating Income: $13.73 million vs analyst estimates of $9.87 million (11.9% margin, 39.1% beat)

- Revenue Guidance for Q4 CY2025 is $118.6 million at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $0.78 at the midpoint, a 6.8% increase

- Operating Margin: -7.9%, up from -16.4% in the same quarter last year

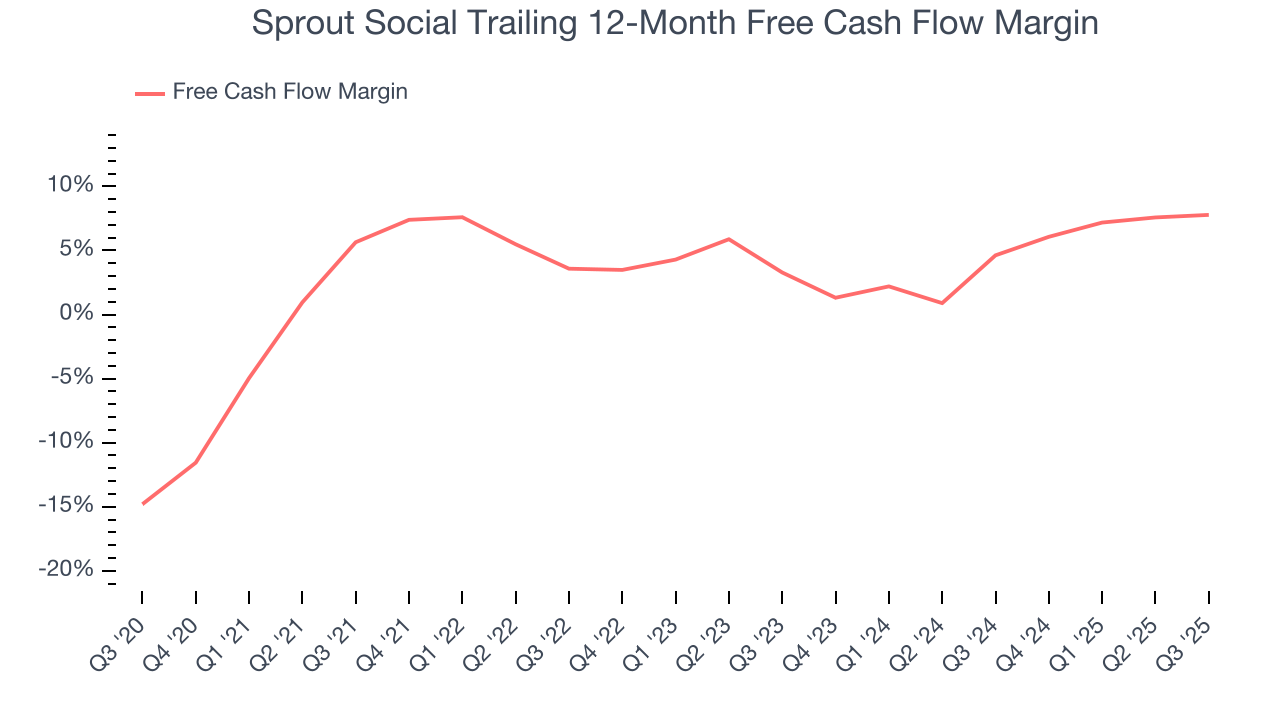

- Free Cash Flow Margin: 8.9%, up from 3.7% in the previous quarter

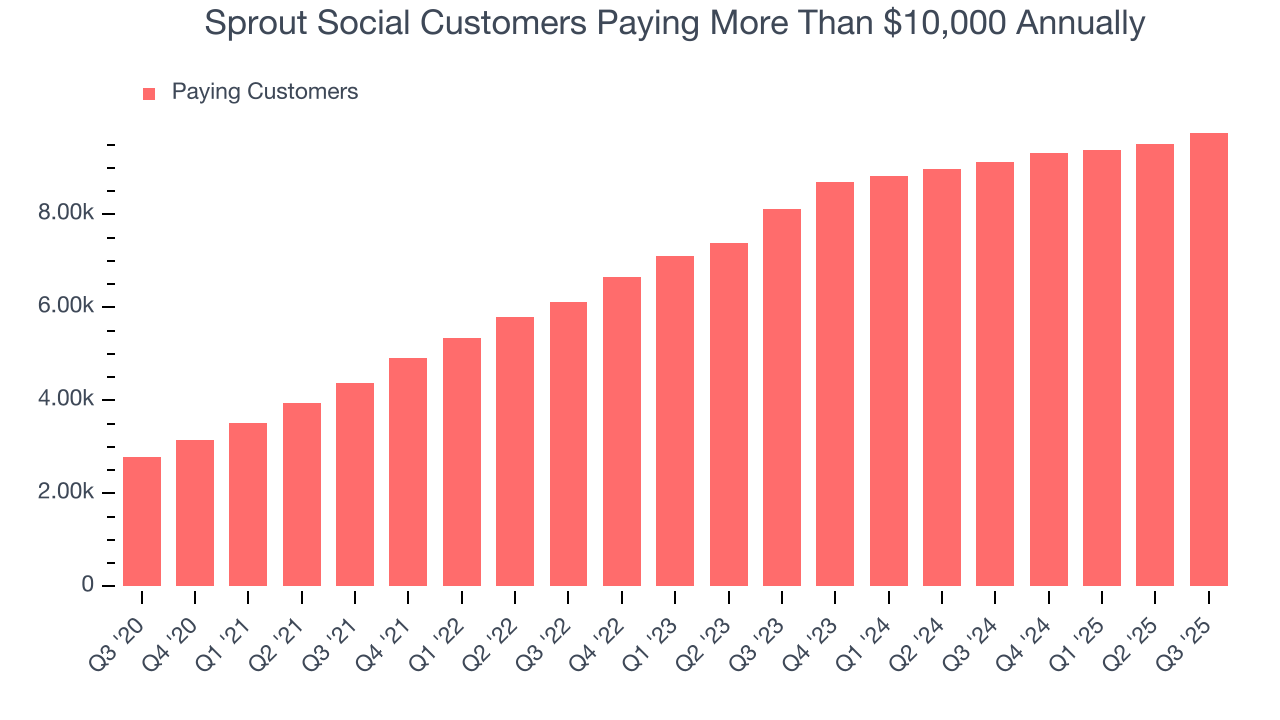

- Customers: 9,756 customers paying more than $10,000 annually

- Billings: $114.1 million at quarter end, up 10.1% year on year

- Market Capitalization: $600.5 million

Company Overview

Born from the recognition that businesses needed a centralized way to handle their growing social media presence, Sprout Social (NASDAQ:SPT) provides a comprehensive software platform that helps businesses manage, analyze, and optimize their presence across various social media networks.

Sprout Social's platform integrates with major social networks including X (formerly Twitter), Facebook, Instagram, TikTok, LinkedIn, and YouTube, creating a unified system for social media management. The cloud-based software consolidates multiple functions such as social engagement, publishing, analytics, listening, reputation management, and commerce into a single interface.

A marketing team might use Sprout Social to schedule posts across multiple platforms, monitor brand mentions, respond to customer inquiries, and analyze which content performs best—all from one dashboard. The platform also offers specialized tools for customer service teams to handle support requests coming through social channels.

The company serves over 31,000 customers across more than 100 countries, ranging from small businesses to large enterprises. While many users can self-onboard through free trials, Sprout Social also maintains sales teams for larger clients with more complex needs. The company generates revenue primarily through subscription-based pricing tiers, with additional revenue coming from professional services such as consulting and training.

Sprout Social's platform is designed to be accessible yet powerful, allowing organizations to coordinate social media efforts across departments, measure performance, gain market insights, and ultimately build stronger relationships with their audiences.

4. Marketing Software

Whether or not companies market their products through social media, all businesses need to meet customers where they are; and increasingly, that is social media. As more and more people use a greater number of social media platforms, social media management software become more valuable to their customers.

Sprout Social competes primarily with other social media management platforms including Hootsuite, Khoros, and Sprinklr, along with various point solutions that address specific aspects of social media management.

5. Revenue Growth

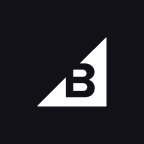

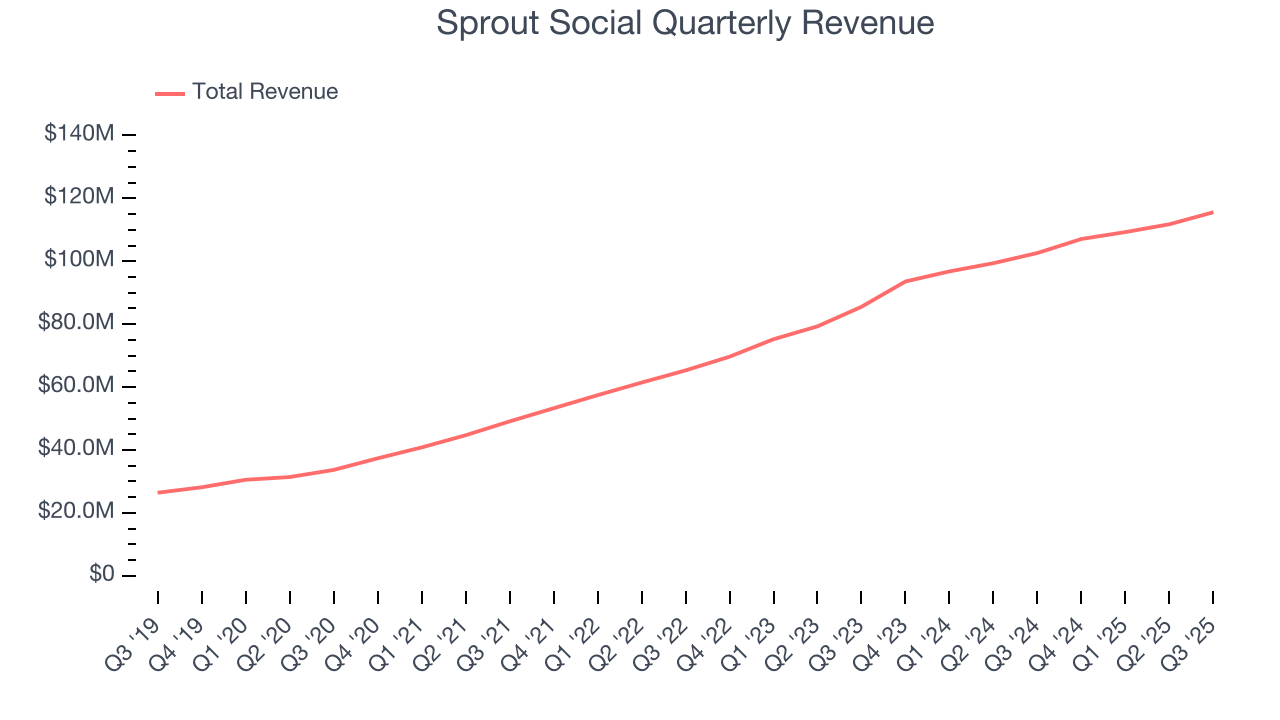

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Sprout Social grew its sales at an impressive 29.1% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Sprout Social’s annualized revenue growth of 19.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Sprout Social reported year-on-year revenue growth of 12.6%, and its $115.6 million of revenue exceeded Wall Street’s estimates by 0.6%. Company management is currently guiding for a 10.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

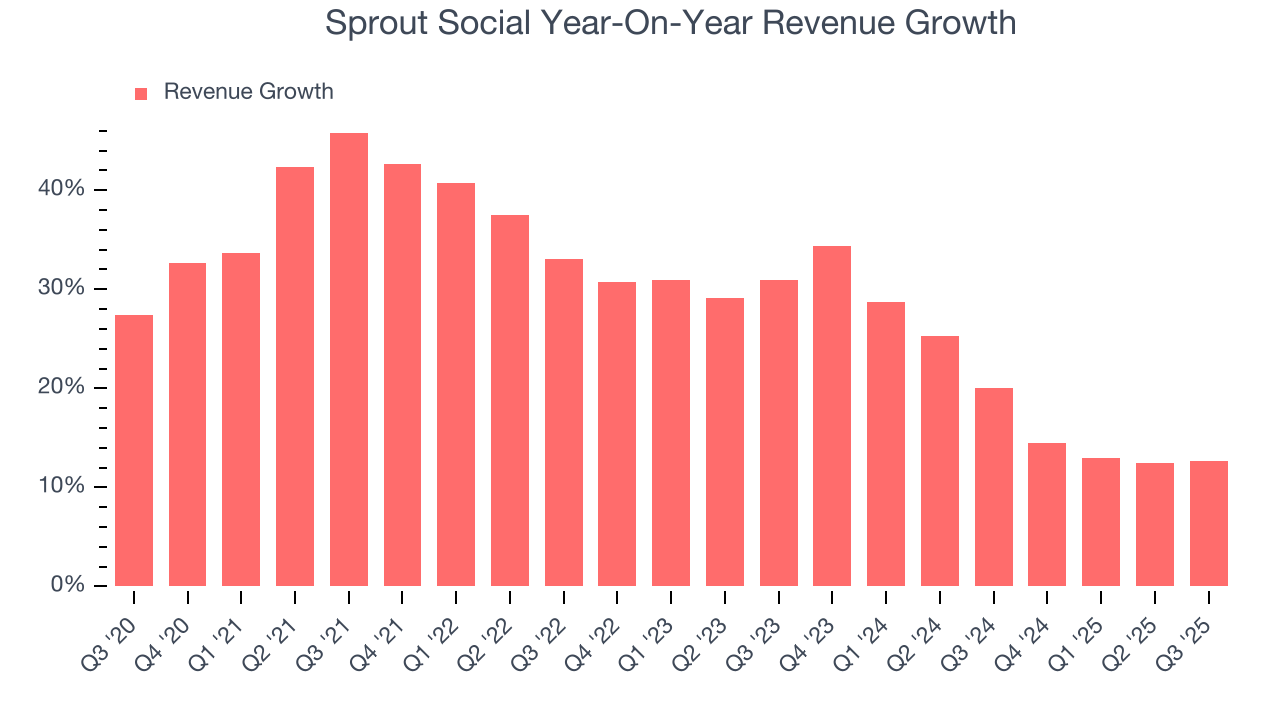

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Sprout Social’s billings came in at $114.1 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 10.4% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

7. Enterprise Customer Base

This quarter, Sprout Social reported 9,756 enterprise customers paying more than $10,000 annually, an increase of 239 from the previous quarter. That’s quite a bit more contract wins than last quarter but also quite a bit below what we’ve observed over the previous year. This indicates the company is optimizing its go-to-market strategy to reinvigorate growth.

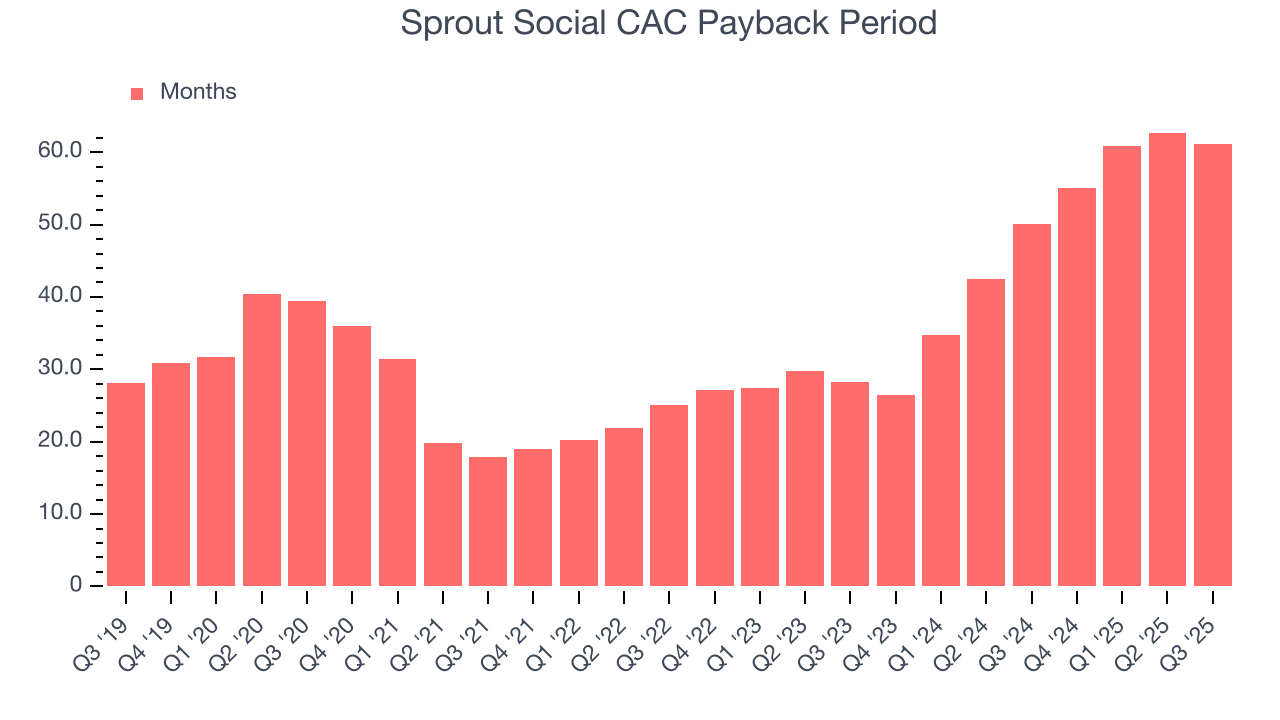

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Sprout Social to acquire new customers as its CAC payback period checked in at 61.1 months this quarter. The company’s drawn-out sales cycles partly stem from its focus on enterprise clients who require some degree of customization, resulting in long onboarding periods that delay delay returns and limit customer growth.

9. Gross Margin & Pricing Power

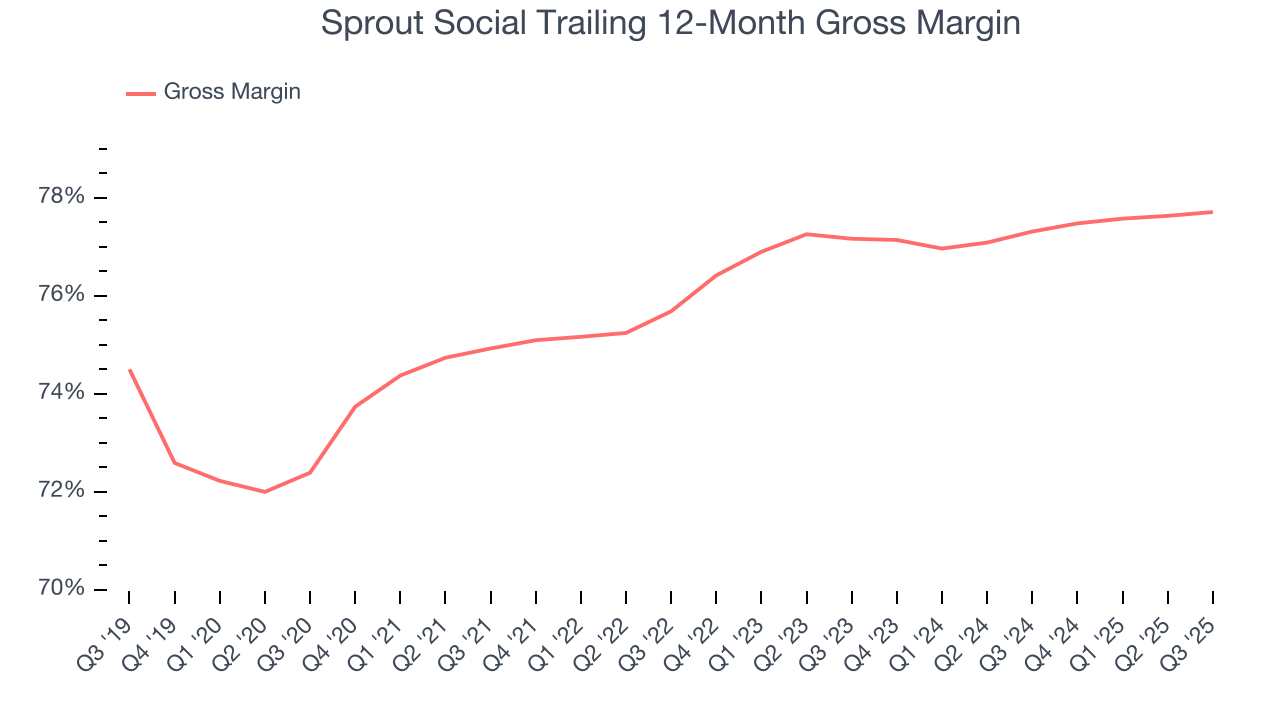

For software companies like Sprout Social, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Sprout Social’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an excellent 77.7% gross margin over the last year. Said differently, roughly $77.71 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Sprout Social has seen gross margins improve by 0.5 percentage points over the last 2 year, which is slightly better than average for software.

In Q3, Sprout Social produced a 77.7% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

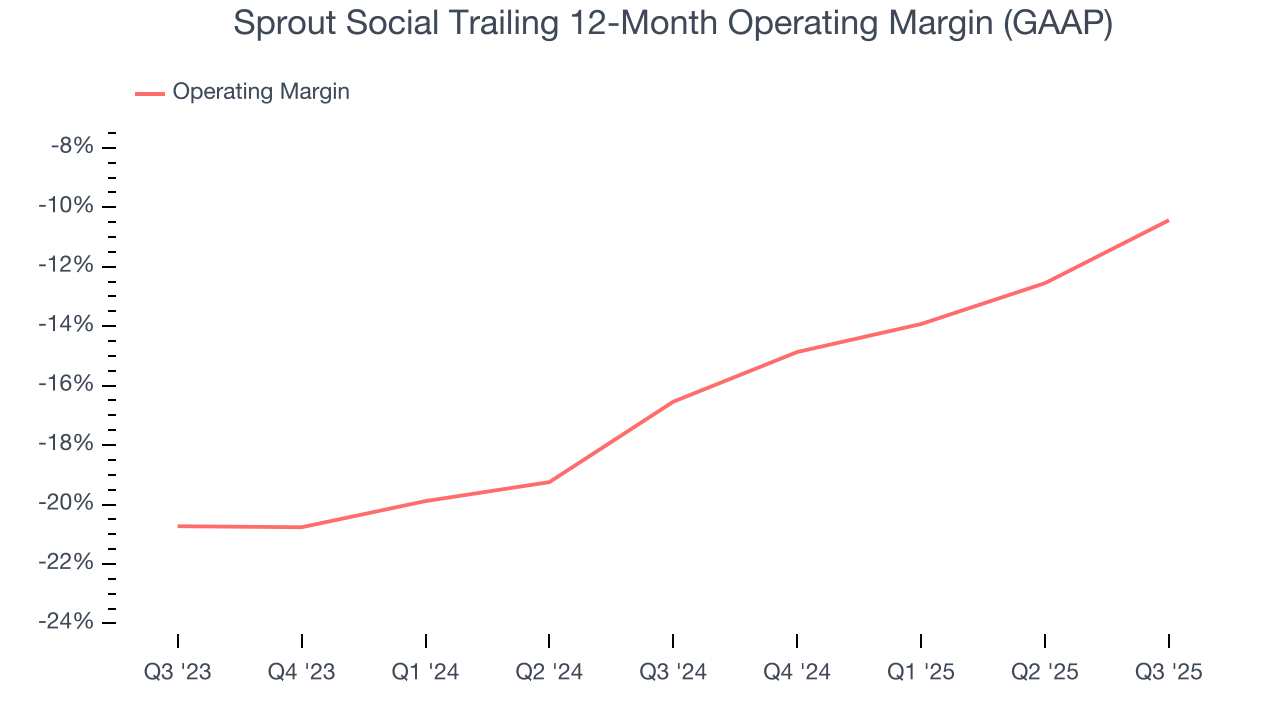

10. Operating Margin

Sprout Social’s expensive cost structure has contributed to an average operating margin of negative 10.4% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Sprout Social reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Over the last two years, Sprout Social’s expanding sales gave it operating leverage as its margin rose by 6.1 percentage points. Still, it will take much more for the company to reach long-term profitability.

This quarter, Sprout Social generated a negative 7.9% operating margin.

11. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Sprout Social has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.8%, subpar for a software business.

Sprout Social’s free cash flow clocked in at $10.34 million in Q3, equivalent to a 8.9% margin. This cash profitability was in line with the comparable period last year and above its one-year average.

Over the next year, analysts predict Sprout Social’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 7.8% for the last 12 months will increase to 11.4%, giving it more flexibility for investments, share buybacks, and dividends.

12. Balance Sheet Assessment

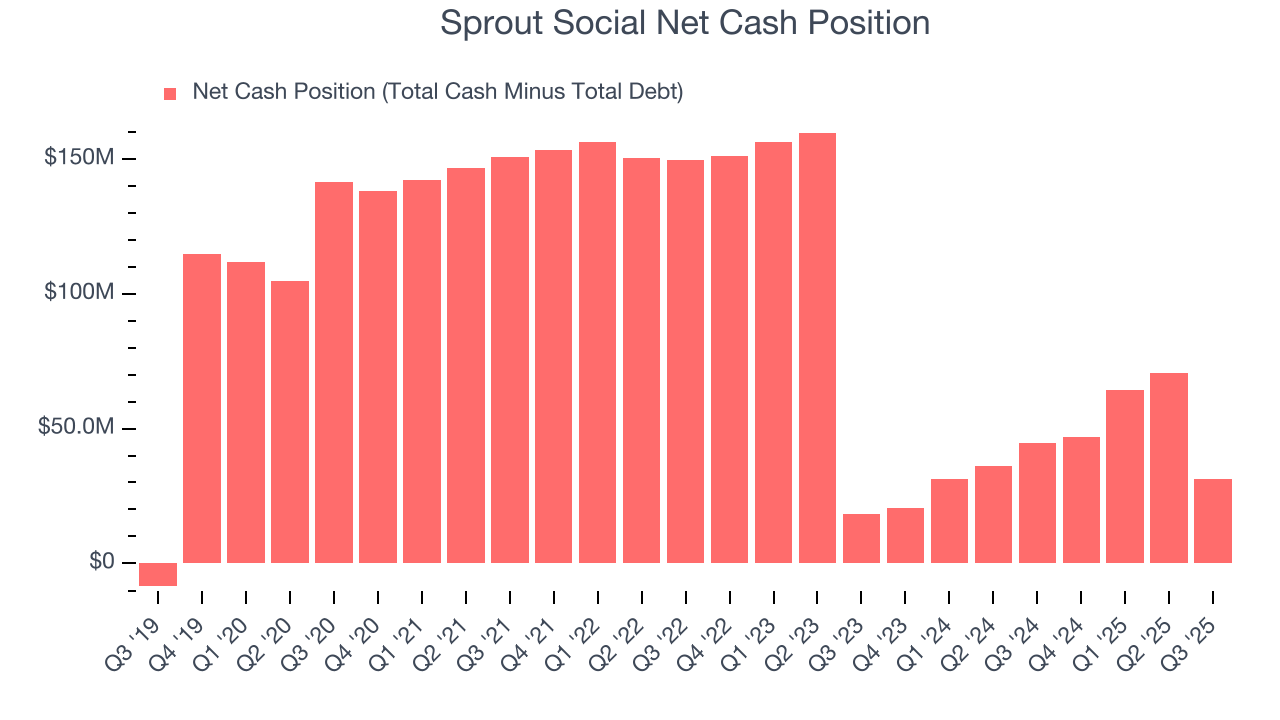

Companies with more cash than debt have lower bankruptcy risk.

Sprout Social is a well-capitalized company with $90.64 million of cash and $59.32 million of debt on its balance sheet. This $31.32 million net cash position is 5.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Sprout Social’s Q3 Results

We were impressed by Sprout Social’s optimistic full-year EPS guidance, which blew past analysts’ expectations. On the other hand, its EPS guidance for next quarter missed. Zooming out, we think this was a mixed quarter. The stock traded up 2.5% to $10.50 immediately after reporting.

14. Is Now The Time To Buy Sprout Social?

Updated: January 15, 2026 at 9:06 PM EST

Before investing in or passing on Sprout Social, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Sprout Social isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was strong over the last five years, it’s expected to deteriorate over the next 12 months and its operating margins reveal poor profitability compared to other software companies. And while the company’s gross margin suggests it can generate sustainable profits, the downside is its expanding operating margin shows it’s becoming more efficient at building and selling its software.

Sprout Social’s price-to-sales ratio based on the next 12 months is 1.2x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $15.60 on the company (compared to the current share price of $10.16).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.