Royalty Pharma (RPRX)

We’re not sold on Royalty Pharma. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why Royalty Pharma Is Not Exciting

Pioneering a unique business model in the pharmaceutical industry since 1996, Royalty Pharma (NASDAQ:RPRX) acquires rights to receive portions of sales from successful biopharmaceutical products, providing funding to drug developers without conducting research itself.

- Sales trends were unexciting over the last five years as its 3.2% annual growth was below the typical healthcare company

- Smaller revenue base of $2.35 billion means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

- A positive is that its excellent adjusted operating margin highlights the strength of its business model

Royalty Pharma is in the doghouse. You should search for better opportunities.

Why There Are Better Opportunities Than Royalty Pharma

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Royalty Pharma

Royalty Pharma is trading at $40.41 per share, or 7.9x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Royalty Pharma (RPRX) Research Report: Q3 CY2025 Update

Healthcare royalties company Royalty Pharma (NASDAQ:RPRX) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 7.8% year on year to $609 million. Its GAAP profit of $0.67 per share was 11.8% below analysts’ consensus estimates.

Royalty Pharma (RPRX) Q3 CY2025 Highlights:

- Revenue: $609 million vs analyst estimates of $625.3 million (7.8% year-on-year growth, 2.6% miss)

- EPS (GAAP): $0.67 vs analyst expectations of $0.76 (11.8% miss)

- Adjusted EBITDA: $779 million vs analyst estimates of $720 million (128% margin, 8.2% beat)

- Operating Margin: 70.1%, down from 130% in the same quarter last year

- Free Cash Flow was $703 million, up from -$491 million in the same quarter last year

- Market Capitalization: $16.36 billion

Company Overview

Pioneering a unique business model in the pharmaceutical industry since 1996, Royalty Pharma (NASDAQ:RPRX) acquires rights to receive portions of sales from successful biopharmaceutical products, providing funding to drug developers without conducting research itself.

Royalty Pharma operates at the intersection of finance and pharmaceuticals, creating a win-win arrangement for both drug developers and investors. The company purchases royalty interests in medications, which entitles it to receive a percentage of a drug's sales revenue over time. This model allows Royalty Pharma to benefit from pharmaceutical innovation without bearing the direct risks of drug development and clinical trials.

The company's portfolio spans more than 35 commercial products treating various conditions including cystic fibrosis, multiple sclerosis, cancer, and rare diseases. When a pharmaceutical company or research institution needs capital—whether to fund late-stage clinical trials, launch a new drug, or monetize an existing royalty stream—Royalty Pharma can step in with financing in exchange for future royalty rights.

For example, a university that developed a promising cancer treatment might sell its royalty rights to Royalty Pharma for an upfront payment, allowing the institution to immediately fund new research while Royalty Pharma collects the ongoing royalties as the drug generates sales. Similarly, a biotech company might partner with Royalty Pharma to fund a Phase 3 clinical trial in exchange for a percentage of future sales.

Royalty Pharma maintains a therapeutic-agnostic approach, focusing instead on products with strong clinical data or proven commercial success. The company employs scientific and financial experts who analyze potential acquisitions, tracking development programs across the industry to identify promising opportunities.

The company generates revenue entirely through the royalty payments it receives based on the sales performance of drugs in its portfolio. These royalties typically continue until patent expiration or for a contractually specified period. Royalty Pharma's largest revenue source comes from Vertex Pharmaceuticals' cystic fibrosis treatments, including Trikafta, which has patent protection extending to 2037.

4. Branded Pharmaceuticals

Looking ahead, the branded pharmaceutical industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Royalty Pharma's competitors include other healthcare royalty investors such as HealthCare Royalty Partners, Oberland Capital, and OrbiMed Advisors, as well as specialized investment firms like Drug Royalty Corporation and Ligand Pharmaceuticals (NASDAQ:LGND).

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $2.35 billion in revenue over the past 12 months, Royalty Pharma lacks scale in an industry where it matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

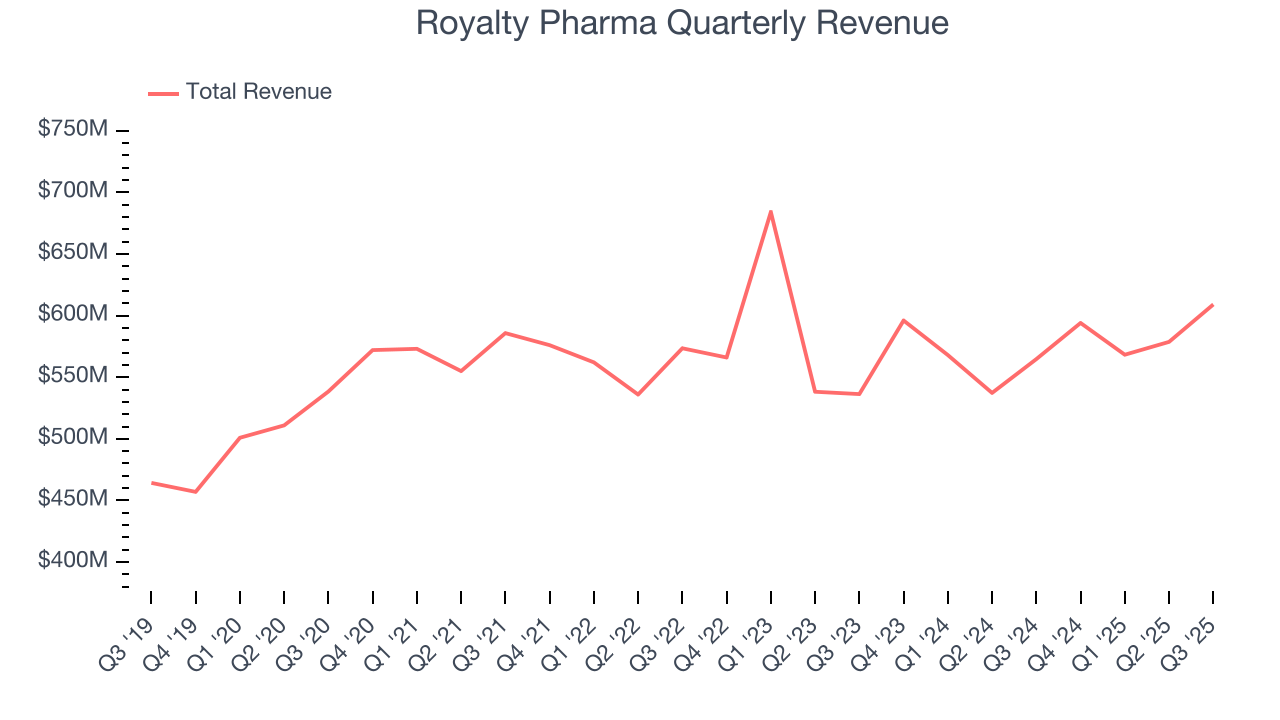

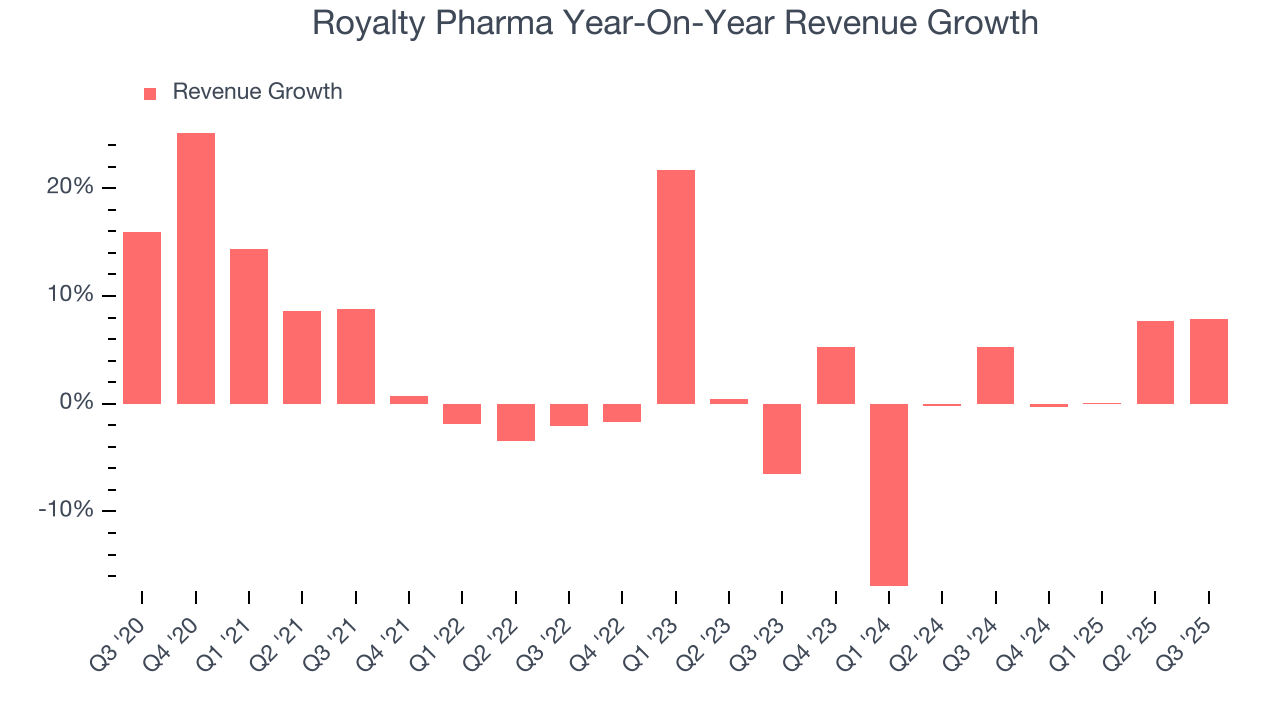

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Royalty Pharma’s sales grew at a tepid 3.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the healthcare sector and is a rough starting point for our analysis.

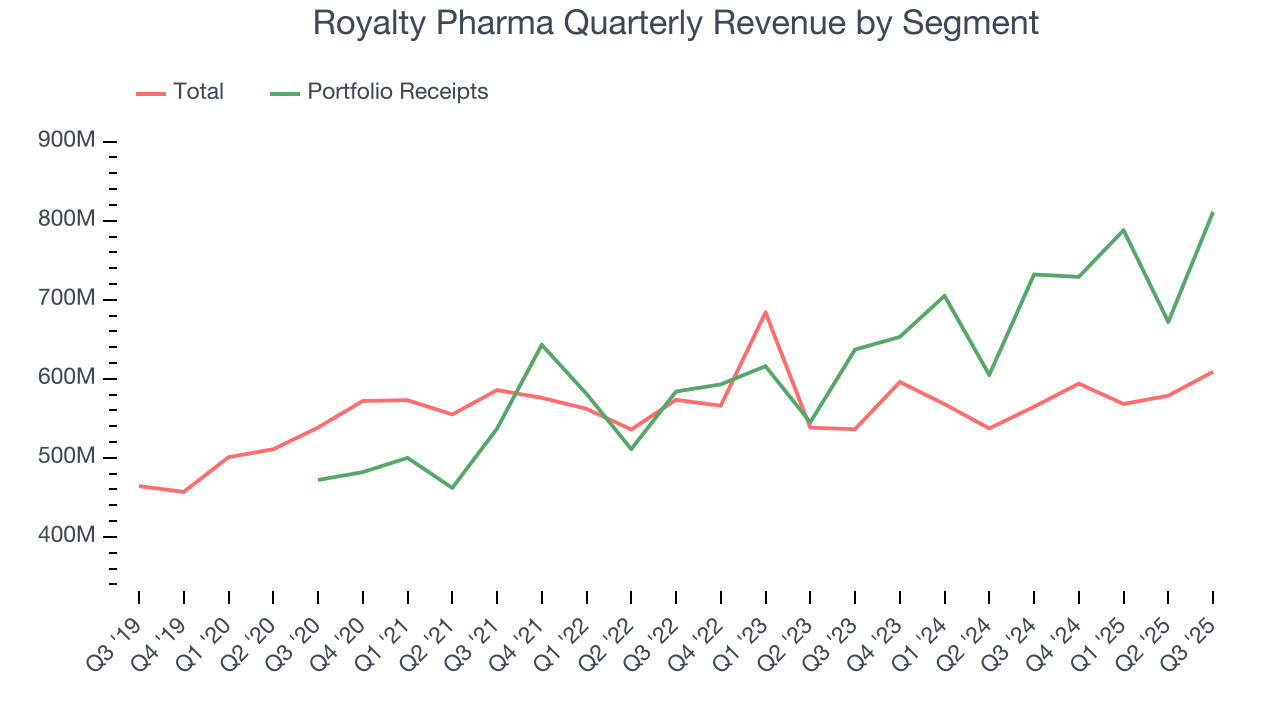

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Royalty Pharma’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Portfolio Receipts. Over the last two years, Royalty Pharma’s Portfolio Receipts revenue averaged 12% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Royalty Pharma’s revenue grew by 7.8% year on year to $609 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.8% over the next 12 months, an improvement versus the last two years. This projection is commendable and indicates its newer products and services will catalyze better top-line performance.

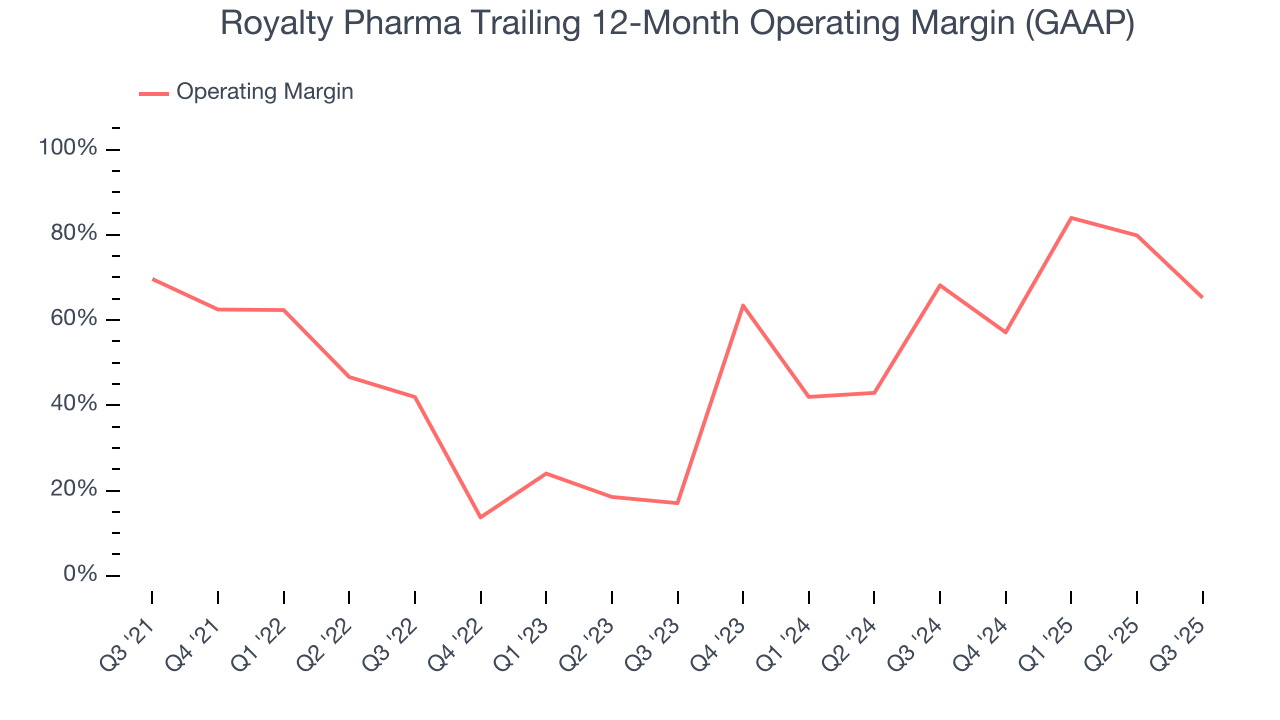

7. Operating Margin

Royalty Pharma has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average operating margin of 52.4%.

Looking at the trend in its profitability, Royalty Pharma’s operating margin decreased by 4.4 percentage points over the last five years, but it rose by 48.2 percentage points on a two-year basis. Still, shareholders will want to see Royalty Pharma become more profitable in the future.

In Q3, Royalty Pharma generated an operating margin profit margin of 70.1%, down 60.1 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

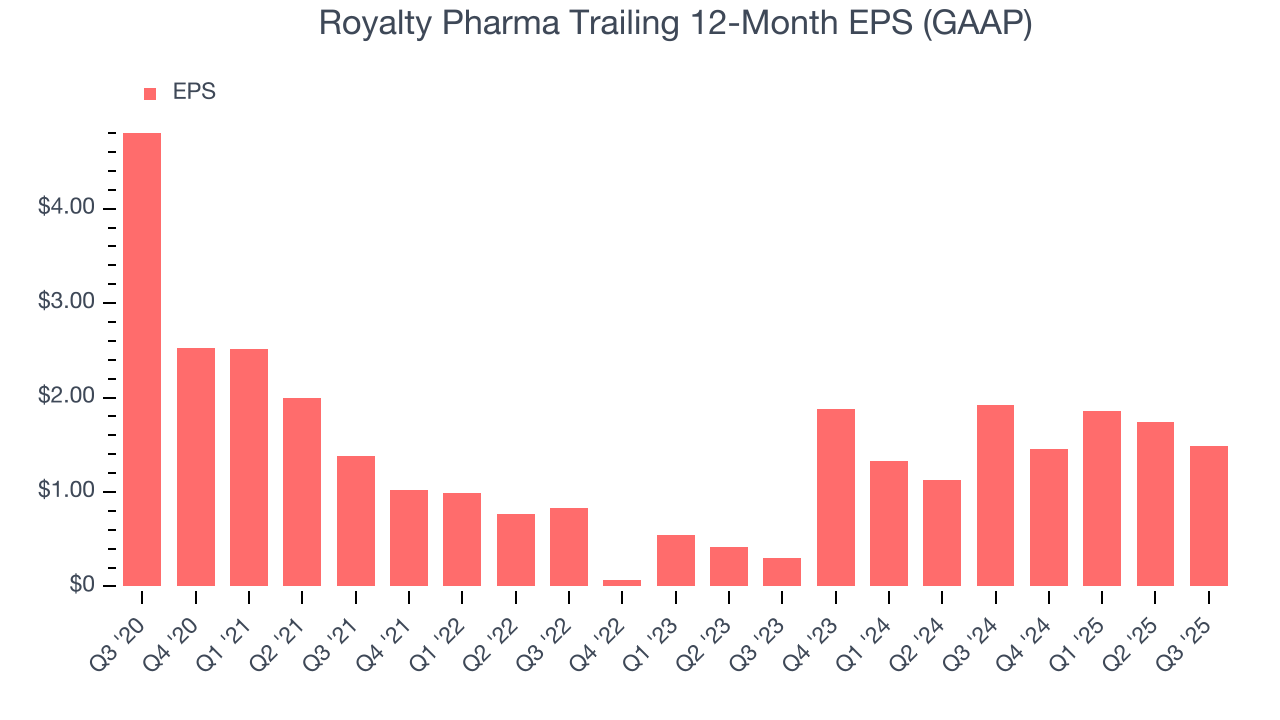

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

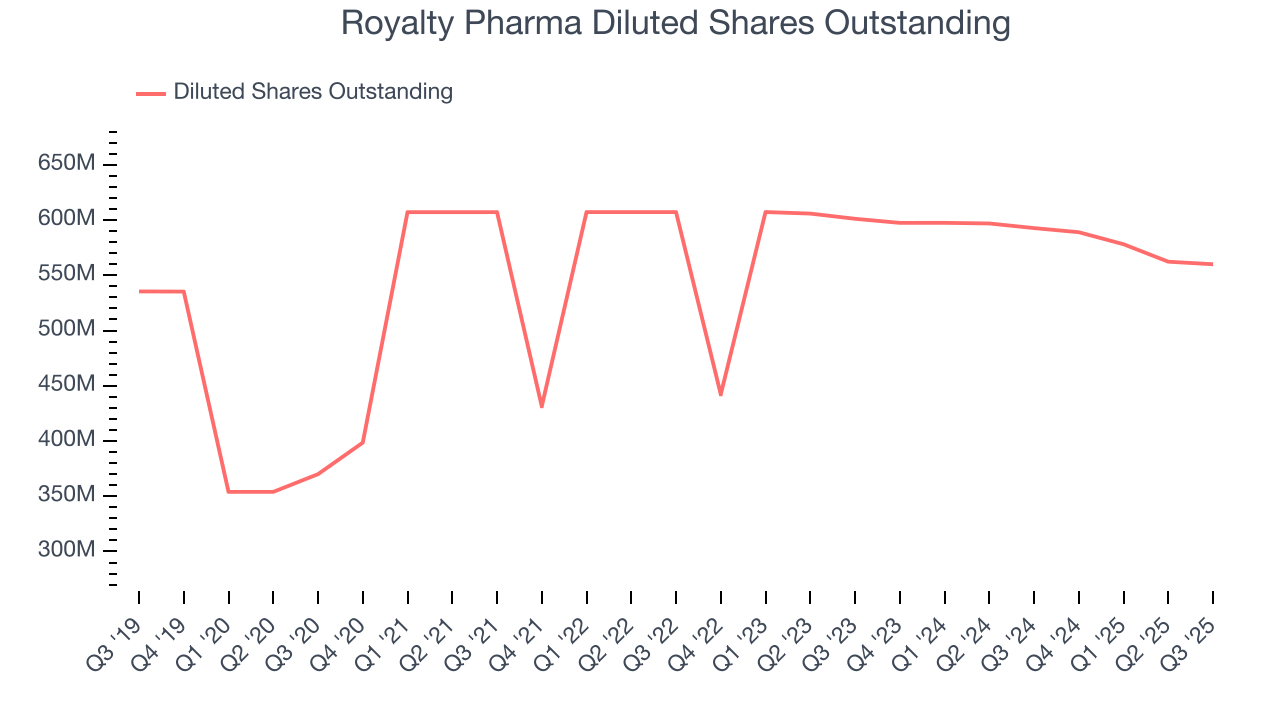

Sadly for Royalty Pharma, its EPS declined by 20.9% annually over the last five years while its revenue grew by 3.2%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Royalty Pharma’s earnings to better understand the drivers of its performance. As we mentioned earlier, Royalty Pharma’s operating margin declined by 4.4 percentage points over the last five years. Its share count also grew by 51.4%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Royalty Pharma reported EPS of $0.67, down from $0.92 in the same quarter last year. This print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

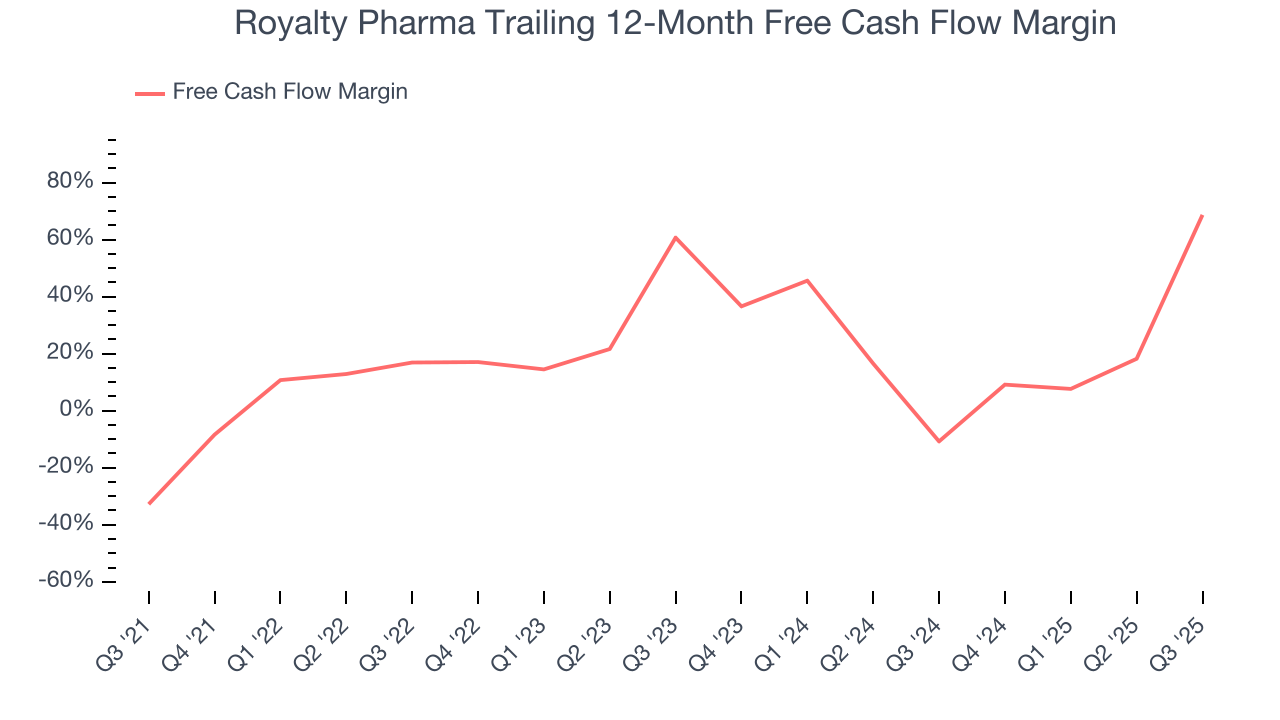

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Royalty Pharma has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 21% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Royalty Pharma’s margin expanded meaningfully during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Royalty Pharma’s free cash flow clocked in at $703 million in Q3, equivalent to a 115% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

10. Balance Sheet Assessment

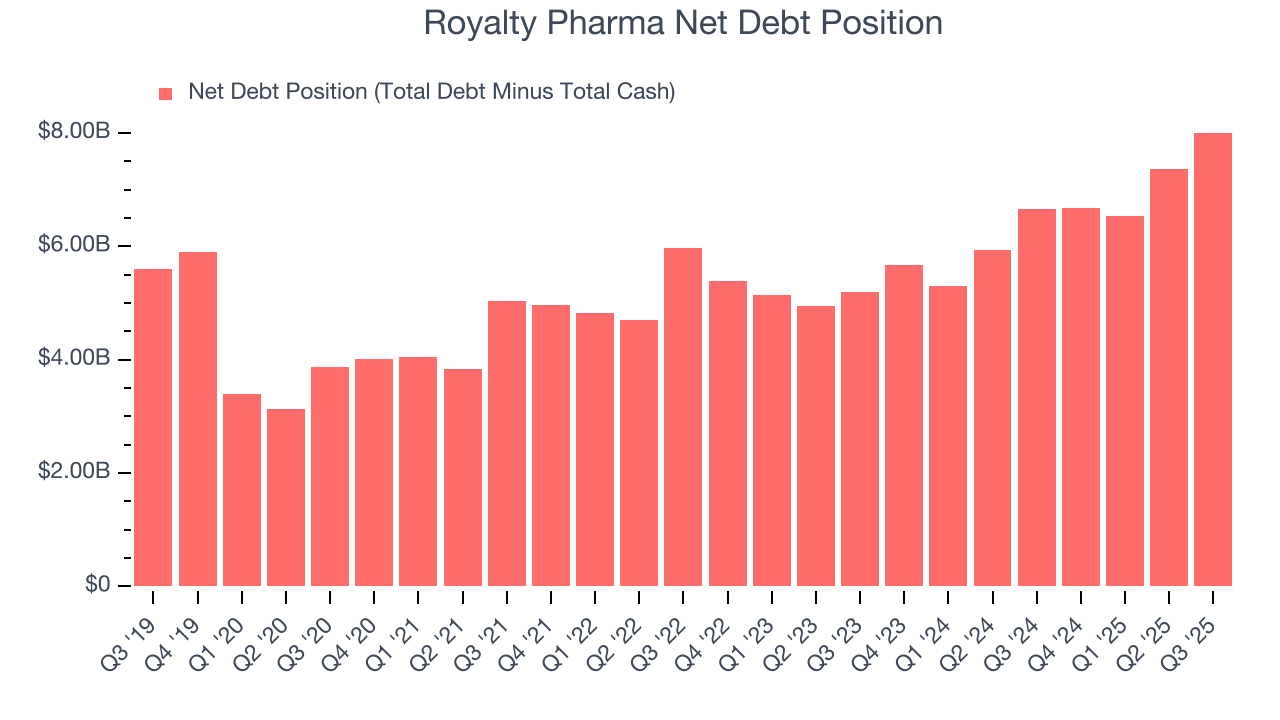

Royalty Pharma reported $939 million of cash and $8.95 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.82 billion of EBITDA over the last 12 months, we view Royalty Pharma’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $91.04 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Royalty Pharma’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded up 6.3% to $40.25 immediately following the results.

12. Is Now The Time To Buy Royalty Pharma?

Updated: January 21, 2026 at 11:04 PM EST

Before deciding whether to buy Royalty Pharma or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Royalty Pharma isn’t a bad business, but we have other favorites. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Royalty Pharma’s declining adjusted operating margin shows the business has become less efficient, its impressive operating margins show it has a highly efficient business model.

Royalty Pharma’s P/E ratio based on the next 12 months is 7.7x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $46.65 on the company (compared to the current share price of $39.78).