Church & Dwight (CHD)

We aren’t fans of Church & Dwight. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Church & Dwight Is Not Exciting

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

- Organic revenue growth fell short of our benchmarks over the past two years and implies it may need to improve its products, pricing, or go-to-market strategy

- Estimated sales growth of 2.7% for the next 12 months implies demand will slow from its three-year trend

- A silver lining is that its strong free cash flow margin of 15.5% gives it the option to reinvest, repurchase shares, or pay dividends, and its improved cash conversion implies it’s becoming a less capital-intensive business

Church & Dwight doesn’t satisfy our quality benchmarks. Better stocks can be found in the market.

Why There Are Better Opportunities Than Church & Dwight

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Church & Dwight

Church & Dwight is trading at $90.26 per share, or 25x forward P/E. Not only does Church & Dwight trade at a premium to companies in the consumer staples space, but this multiple is also high for its top-line growth.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Church & Dwight (CHD) Research Report: Q3 CY2025 Update

Household products company Church & Dwight (NYSE:CHD) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 5% year on year to $1.59 billion. The company expects next quarter’s revenue to be around $1.64 billion, close to analysts’ estimates. Its non-GAAP profit of $0.81 per share was 10.1% above analysts’ consensus estimates.

Church & Dwight (CHD) Q3 CY2025 Highlights:

- Revenue: $1.59 billion vs analyst estimates of $1.53 billion (5% year-on-year growth, 3.3% beat)

- Adjusted EPS: $0.81 vs analyst estimates of $0.74 (10.1% beat)

- Revenue Guidance for Q4 CY2025 is $1.64 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the full year is $3.49 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 51.2%, up from -6.1% in the same quarter last year

- Organic Revenue rose 3.4% year on year vs analyst estimates of 1.5% growth (185.4 basis point beat)

- Market Capitalization: $19.93 billion

Company Overview

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

The company traces its history back to 1846, when the brother-in-law founders, John Dwight and Austin Church, started a small business in a New York City tenement. From humble beginnings selling bicarbonate of soda (baking soda), Church & Dwight has grown into a diversified powerhouse with brands such as OxiClean (laundry detergent), Spinbrush (toothbrushes), Nair (hair removal), Trojan (condoms), Vitafusion (vitamins), and many others. As mentioned, Arm & Hammer is highly recognized and versatile, used for baking, cleaning, and deodorizing.

Church & Dwight primarily targets middle-income consumers. These customers are looking for trusted brands since the products will be used on themselves, their family members, and in their own homes. They also want cost-effective products, although many are willing to pay a reasonable premium to buy established brands rather than lesser-known or private-label brands.

It’s not hard to find Church & Dwight’s products in stores. Traditional brick-and-mortar retailers such as supermarkets, mass merchants, drug stores, and specialty stores are the most common sellers of the company’s products. Given Church & Dwight’s scale and traffic-driving brands, the company often has prominent or advantaged placement on retailer shelves.

4. Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Competitors that offer a wide range of household and personal care products include Proctor & Gamble (NYSE:PG), Unilever (LSE:ULVR), and Colgate-Palmolive (NYSE:CL).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

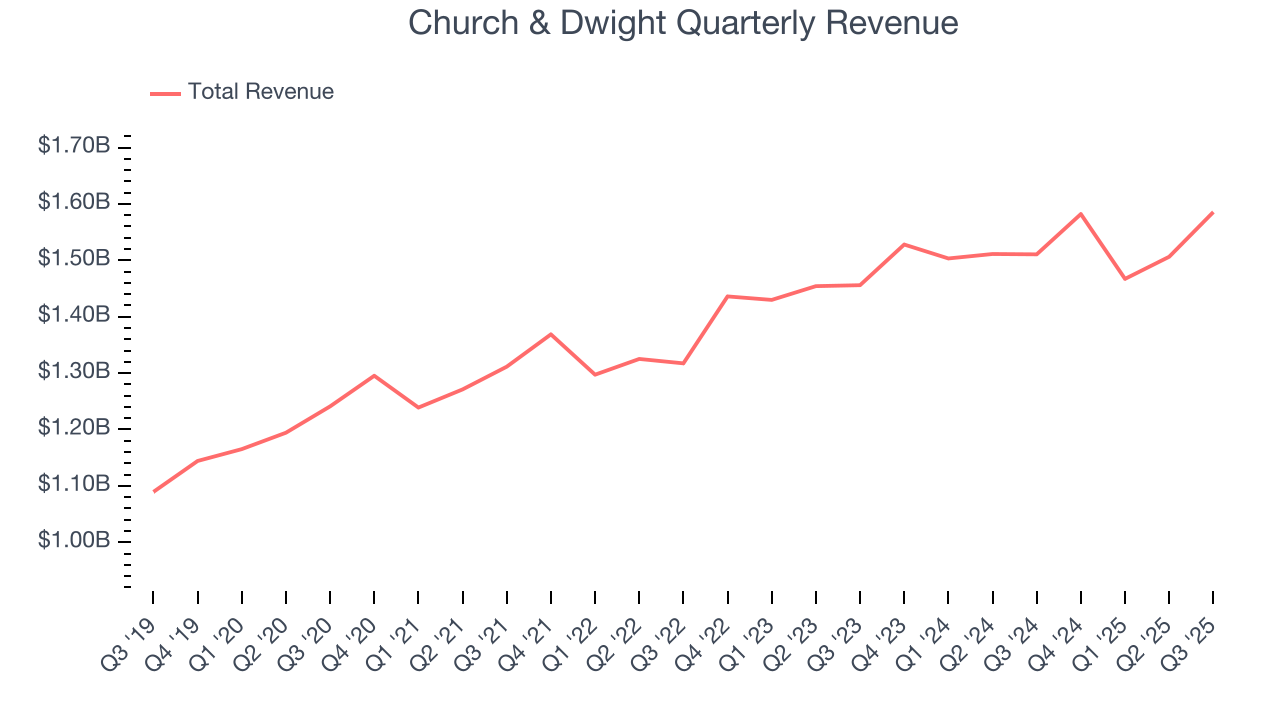

With $6.14 billion in revenue over the past 12 months, Church & Dwight carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, Church & Dwight grew its sales at a tepid 5% compounded annual growth rate over the last three years, but to its credit, consumers bought more of its products.

This quarter, Church & Dwight reported modest year-on-year revenue growth of 5% but beat Wall Street’s estimates by 3.3%. Company management is currently guiding for a 3.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.9% over the next 12 months, a slight deceleration versus the last three years. This projection doesn't excite us and indicates its products will face some demand challenges.

6. Organic Revenue Growth

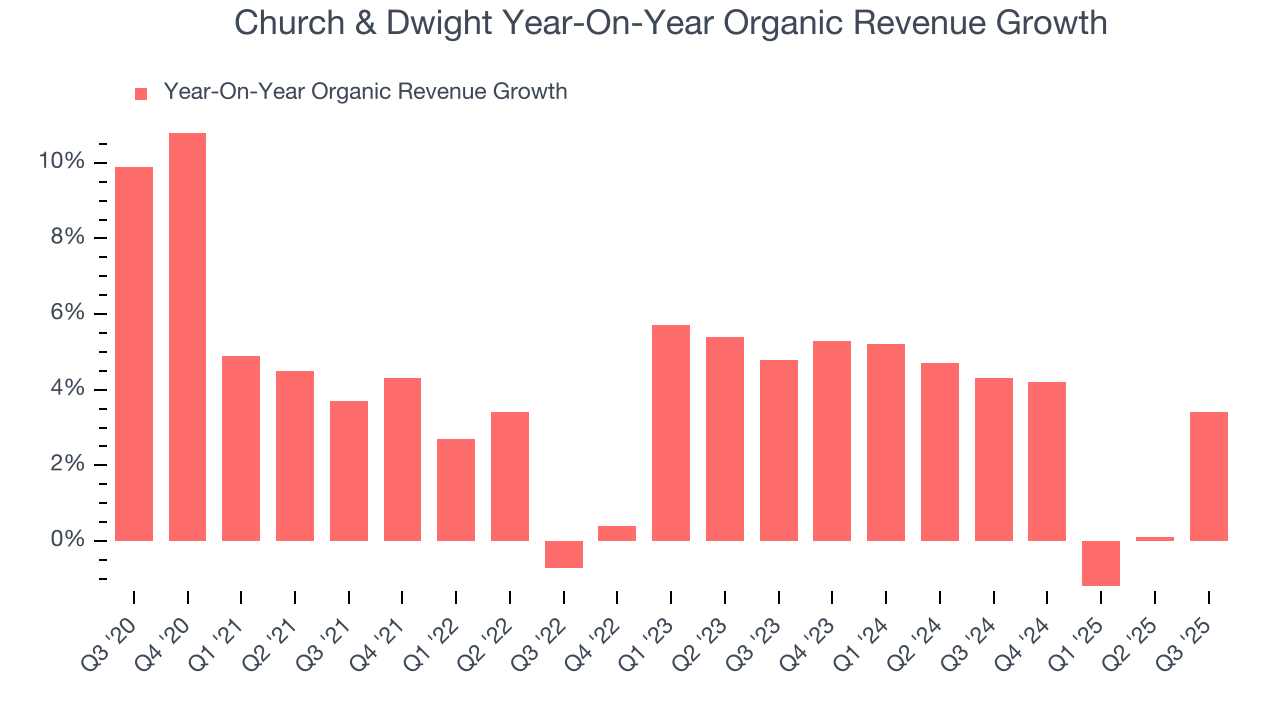

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Church & Dwight’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 3.3% year on year.

In the latest quarter, Church & Dwight’s organic sales rose by 3.4% year on year. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

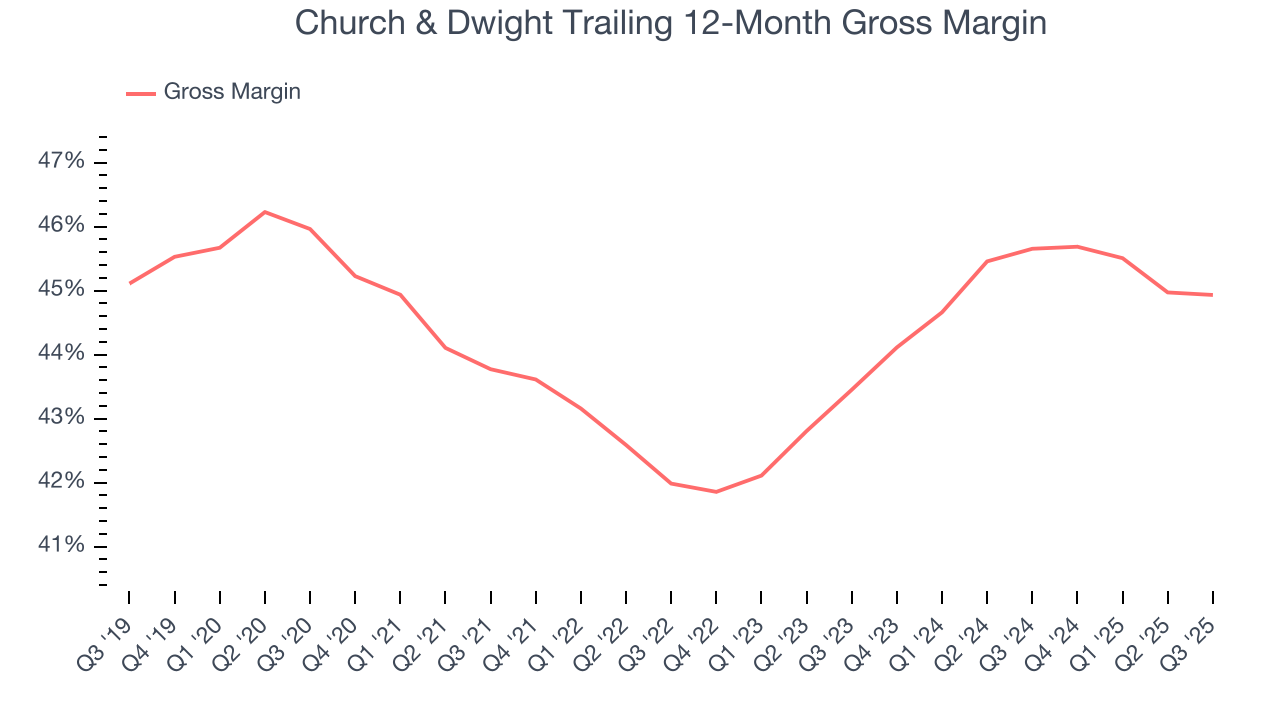

Church & Dwight has great unit economics for a consumer staples company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an excellent 45.3% gross margin over the last two years. That means Church & Dwight only paid its suppliers $54.71 for every $100 in revenue.

In Q3, Church & Dwight produced a 45.1% gross profit margin, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

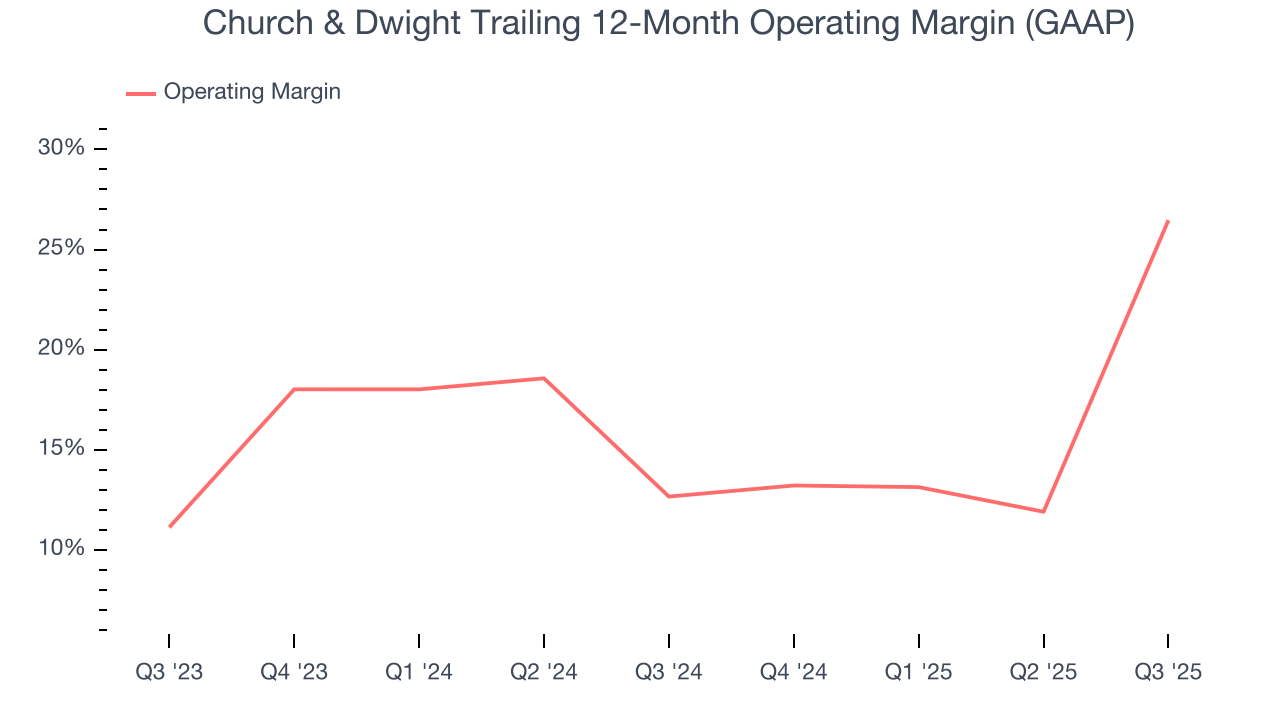

8. Operating Margin

Church & Dwight has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 19.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Church & Dwight’s operating margin rose by 13.8 percentage points over the last year, as its sales growth gave it operating leverage.

This quarter, Church & Dwight generated an operating margin profit margin of 51.2%, up 57.2 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

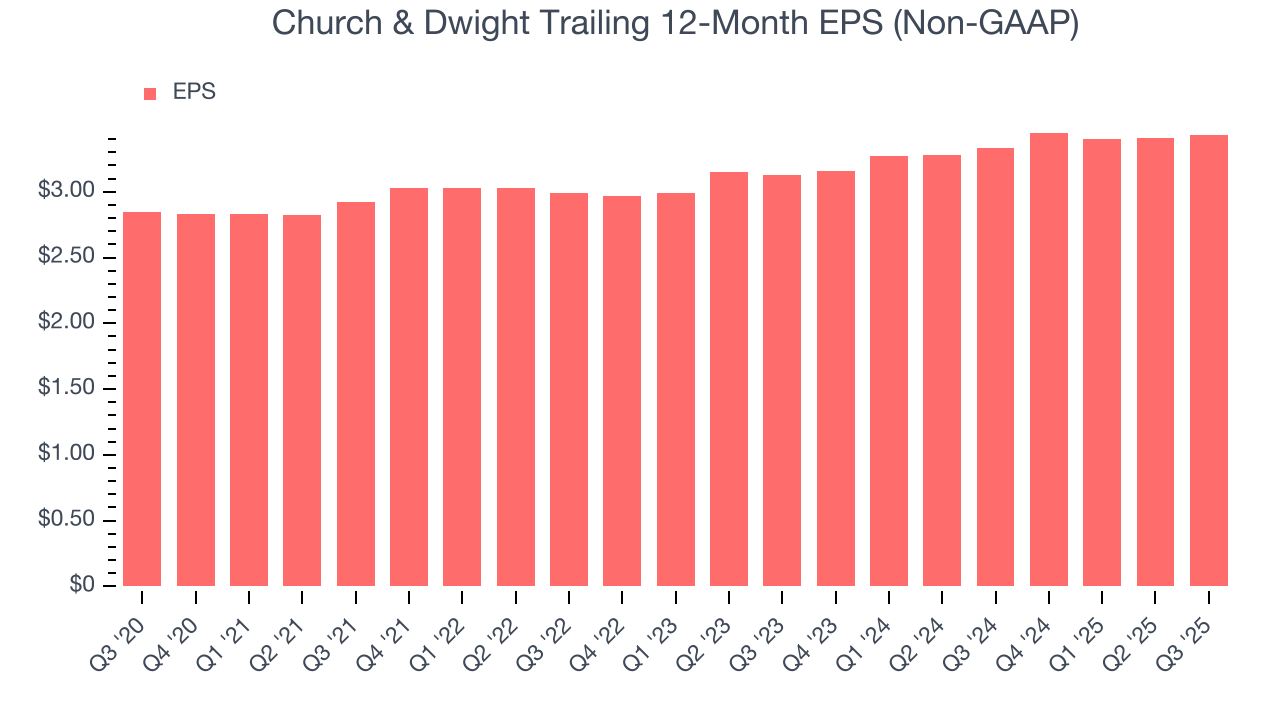

9. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Church & Dwight reported adjusted EPS of $0.81, up from $0.79 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Church & Dwight’s full-year EPS of $3.43 to grow 7%.

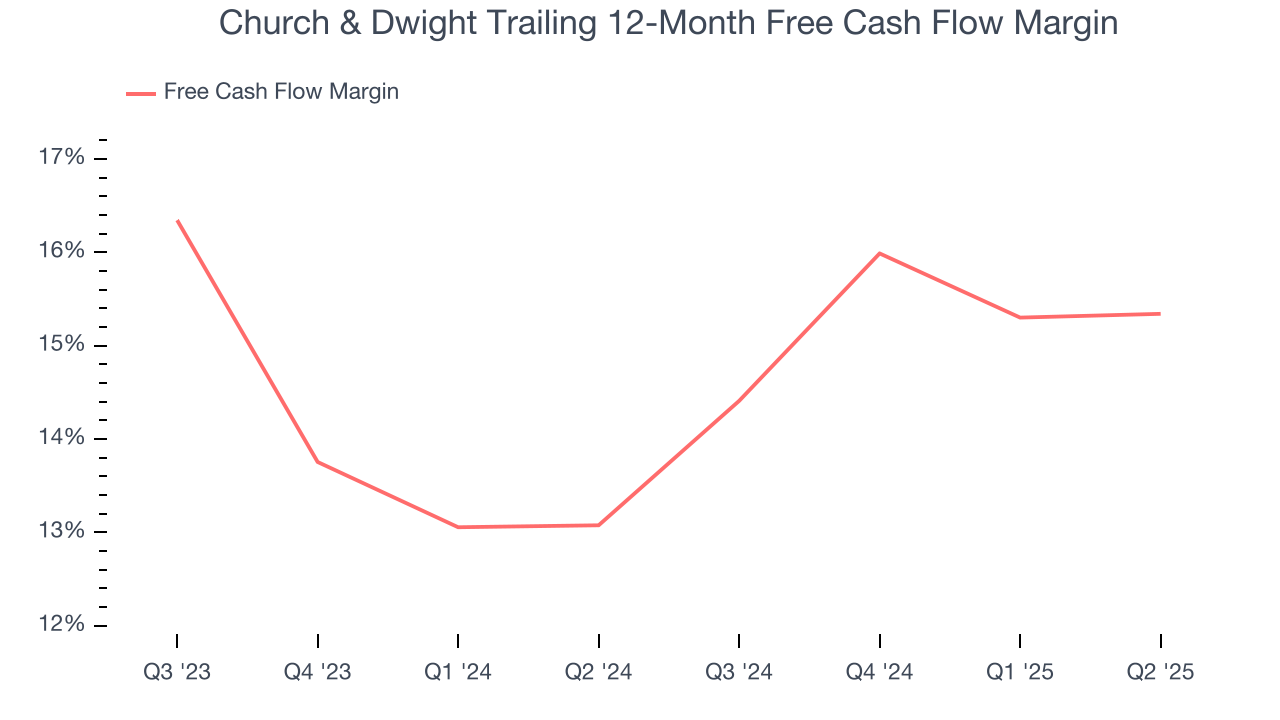

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Church & Dwight has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 14% over the last two years.

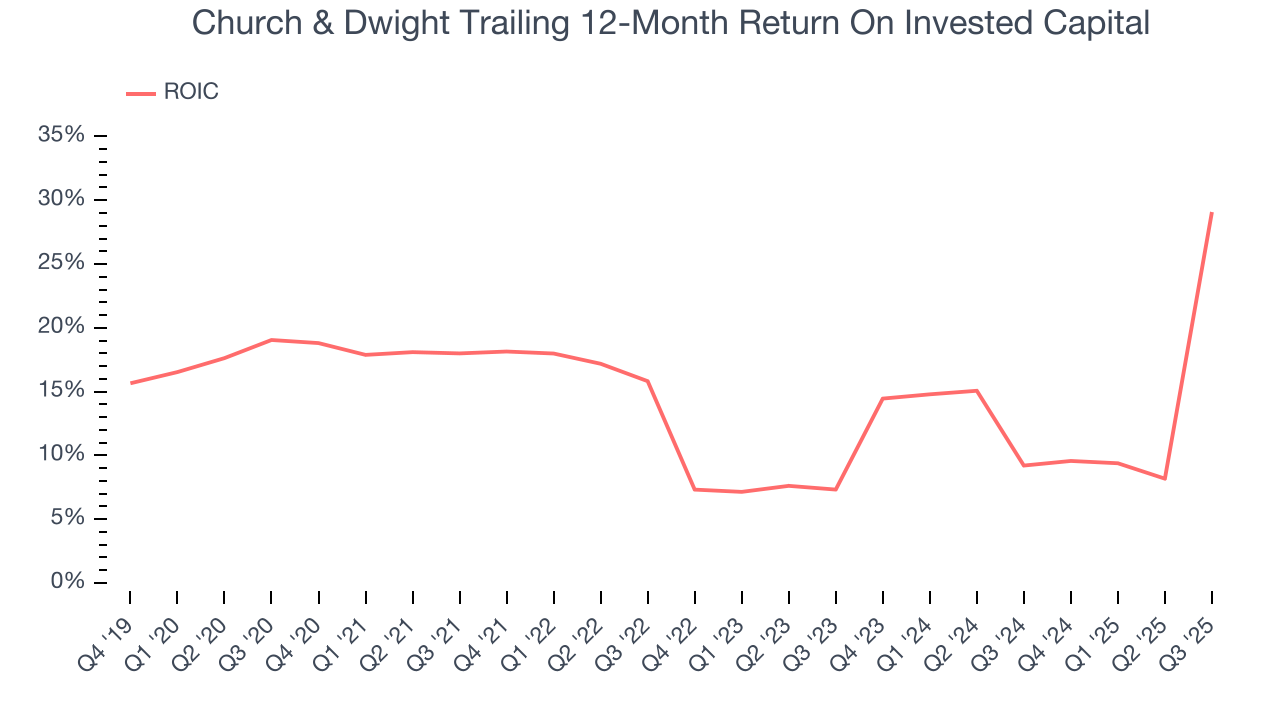

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Church & Dwight hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked. Its five-year average ROIC was 15.9%, higher than most consumer staples businesses.

12. Balance Sheet Assessment

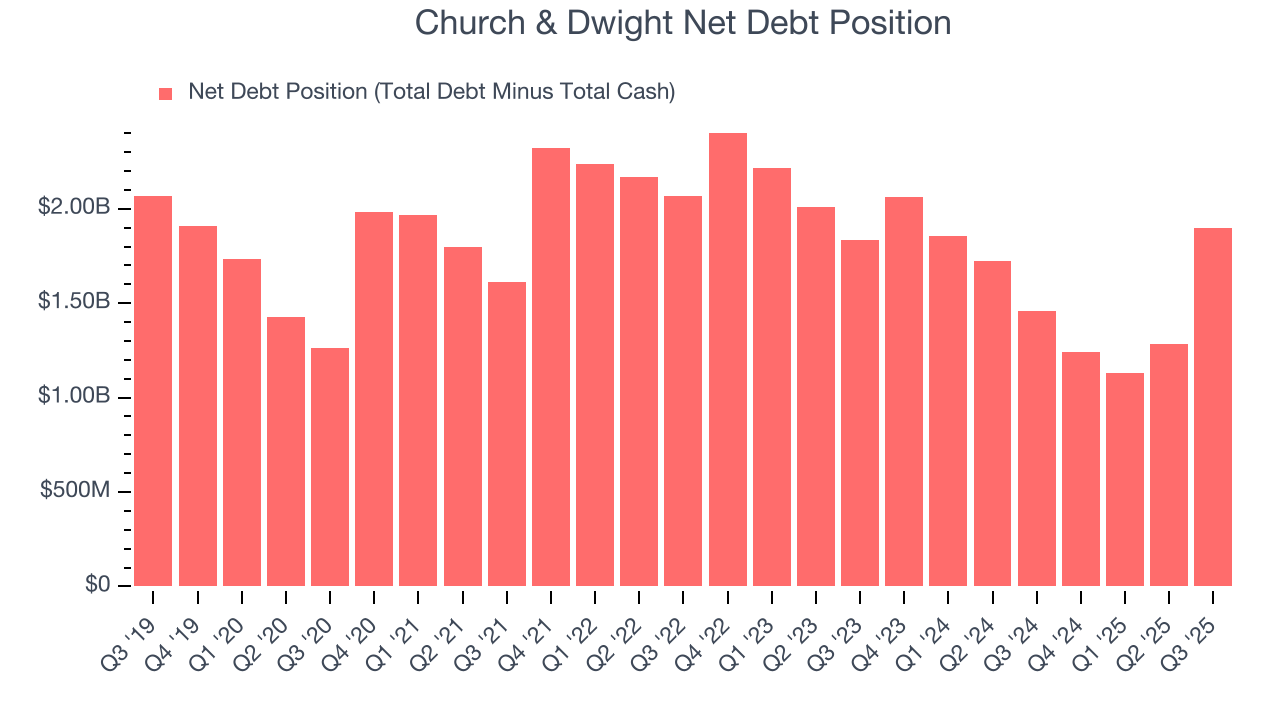

Church & Dwight reported $305.3 million of cash and $2.20 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.39 billion of EBITDA over the last 12 months, we view Church & Dwight’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $43.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Church & Dwight’s Q3 Results

We enjoyed seeing Church & Dwight beat analysts’ revenue expectations this quarter. We were also happy its organic revenue outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Overall, this print had some key positives. The stock traded up 3% to $84.20 immediately after reporting.

14. Is Now The Time To Buy Church & Dwight?

Updated: January 29, 2026 at 9:44 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Church & Dwight.

There are some bright spots in Church & Dwight’s fundamentals, but its business quality ultimately falls short. Although its revenue growth was a little slower over the last three years and analysts expect growth to slow over the next 12 months, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. Tread carefully with this one, however, as its projected EPS for the next year is lacking.

Church & Dwight’s P/E ratio based on the next 12 months is 25x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $96.05 on the company (compared to the current share price of $90.26).