3D Systems (DDD)

We wouldn’t recommend 3D Systems. Its falling revenue and negative returns on capital suggest it’s destroying value as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think 3D Systems Will Underperform

Founded by the inventor of stereolithography, 3D Systems (NYSE:DDD) engineers, manufactures, and sells 3D printers and other related products to the aerospace, automotive, healthcare, and consumer goods industries.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 6.7% annually over the last five years

- Sales were less profitable over the last five years as its earnings per share fell by 29.7% annually, worse than its revenue declines

- Limited cash reserves may force the company to seek unfavorable financing terms that could dilute shareholders

3D Systems doesn’t live up to our standards. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than 3D Systems

High Quality

Investable

Underperform

Why There Are Better Opportunities Than 3D Systems

3D Systems is trading at $2.06 per share, or 0.6x forward price-to-sales. The market typically values companies like 3D Systems based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

We’d rather invest in companies with elite fundamentals than questionable ones with open questions and big downside risks. The durable earnings power of high-quality businesses helps us sleep well at night.

3. 3D Systems (DDD) Research Report: Q3 CY2025 Update

3D printing company 3D Systems (NYSE:DDD) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 19.2% year on year to $91.25 million. Next quarter’s revenue guidance of $99.46 million underwhelmed, coming in 0.8% below analysts’ estimates. Its non-GAAP loss of $0.08 per share was in line with analysts’ consensus estimates.

3D Systems (DDD) Q3 CY2025 Highlights:

- Revenue: $91.25 million vs analyst estimates of $93.61 million (19.2% year-on-year decline, 2.5% miss)

- Adjusted EPS: -$0.08 vs analyst estimates of -$0.09 (in line)

- Adjusted EBITDA: -$10.8 million vs analyst estimates of -$8.17 million (-11.8% margin, 32.2% miss)

- Revenue Guidance for Q4 CY2025 is $99.46 million at the midpoint, below analyst estimates of $100.2 million

- Operating Margin: -23.4%, up from -160% in the same quarter last year

- Free Cash Flow was -$15.75 million compared to -$4.45 million in the same quarter last year

- Market Capitalization: $354 million

Company Overview

Founded by the inventor of stereolithography, 3D Systems (NYSE:DDD) engineers, manufactures, and sells 3D printers and other related products to the aerospace, automotive, healthcare, and consumer goods industries.

3D Systems was established in 1986 by Chuck Hull, who is credited with inventing stereolithography, a process that enabled the creation of a three-dimensional object from a digital model. This breakthrough led to the development of the first commercial 3D printer.

The company quickly became a leader in the 3D printing industry, contributing significantly to the evolution of rapid prototyping and additive manufacturing technologies. Over the years, 3D Systems has expanded its technology portfolio to include various 3D printing methods, materials, software, and healthcare solutions.

Today, the company's suite of 3D printers is critical in manufacturing sectors including aerospace, automotive, and industrial goods, enabling rapid prototyping, tooling, and direct production of complex parts. These capabilities significantly reduce lead times and costs while improving product performance and customization.

In the healthcare sector, 3D Systems leverages its technology to revolutionize medical practices by producing patient-specific implants, prosthetics, and surgical planning tools. The precision and adaptability of 3D printing meet the needs of medical professionals, improving patient outcomes and surgical efficiencies.

Additionally, the company supports the manufacturing industry and the medical community with software for design and simulation. The company’s software services provide a source of recurring revenue through ongoing updates and licenses. By partnering with companies and institutions, 3D Systems leverages its expertise to co-create solutions.

The company engages in contracts with customers ranging from small businesses to large enterprises, often involving pricing agreements, volume commitments, and ongoing support contracts, which enhance financial stability and predictability.

4. Custom Parts Manufacturing

Onshoring and inventory management–themes that grew in focus after COVID wreaked havoc on global supply chains–are tailwinds for companies that combine economies of scale with reliable service. Many in the space have adopted 3D printing to efficiently address the need for bespoke parts and components, but all companies are still at the whim of economic cycles. For example, consumer spending and interest rates can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Stratasys (NASDAQ:SSYS), EOS (private), HP (NYSE:HPQ), and Desktop Metal (NYSE:DM).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. 3D Systems’s demand was weak over the last five years as its sales fell at a 6.7% annual rate. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. 3D Systems’s recent performance shows its demand remained suppressed as its revenue has declined by 12% annually over the last two years.

3D Systems also breaks out the revenue for its most important segments, Industrial and Healthcare, which are 53.1% and 46.9% of revenue. Over the last two years, 3D Systems’s Industrial revenue (aerospace, defense, and transportation manufacturing) averaged 11.4% year-on-year declines while its Healthcare revenue (dental and medical devices) averaged 12.2% declines.

This quarter, 3D Systems missed Wall Street’s estimates and reported a rather uninspiring 19.2% year-on-year revenue decline, generating $91.25 million of revenue. Company management is currently guiding for a 10.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

3D Systems’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 39.9% gross margin over the last five years. That means 3D Systems only paid its suppliers $60.12 for every $100 in revenue.

3D Systems produced a 32.3% gross profit margin in Q3, down 5.1 percentage points year on year. 3D Systems’s full-year margin has also been trending down over the past 12 months, decreasing by 5.2 percentage points. If this move continues, it could suggest deteriorating pricing power and higher input costs (such as raw materials and manufacturing expenses).

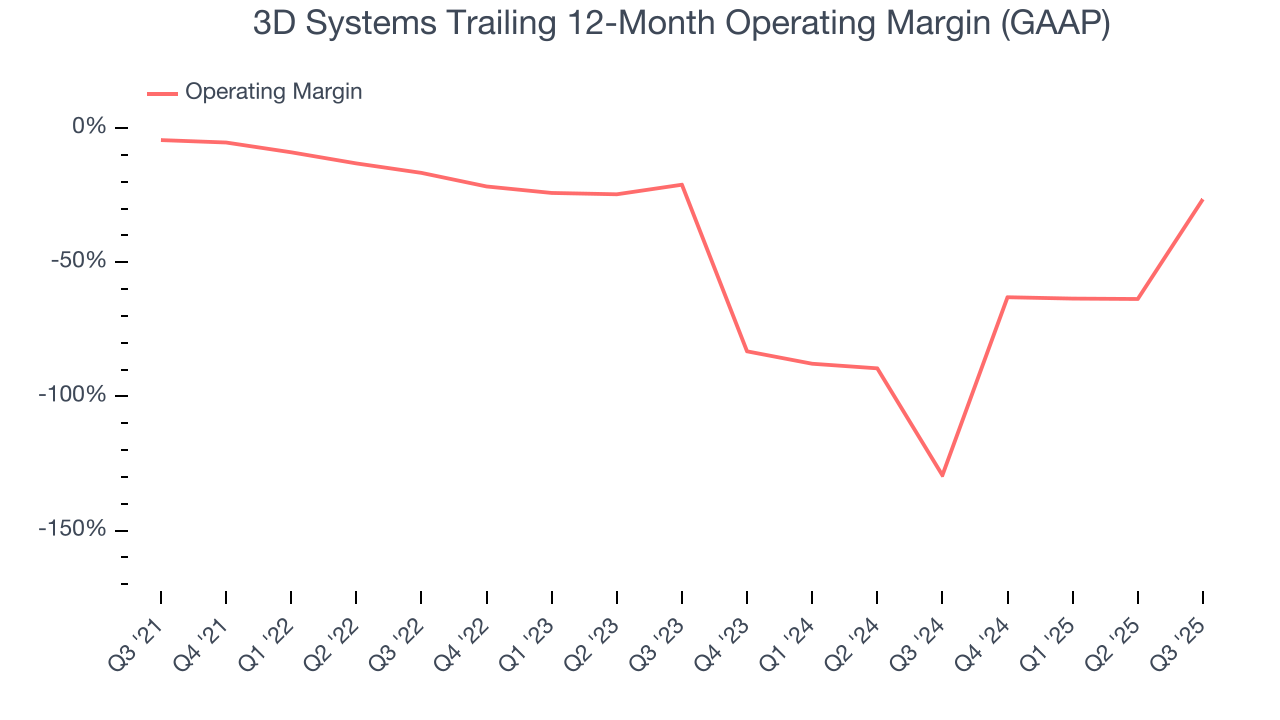

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

3D Systems’s high expenses have contributed to an average operating margin of negative 35.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, 3D Systems’s operating margin decreased by 22 percentage points over the last five years. 3D Systems’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

3D Systems’s operating margin was negative 23.4% this quarter. The company's consistent lack of profits raise a flag.

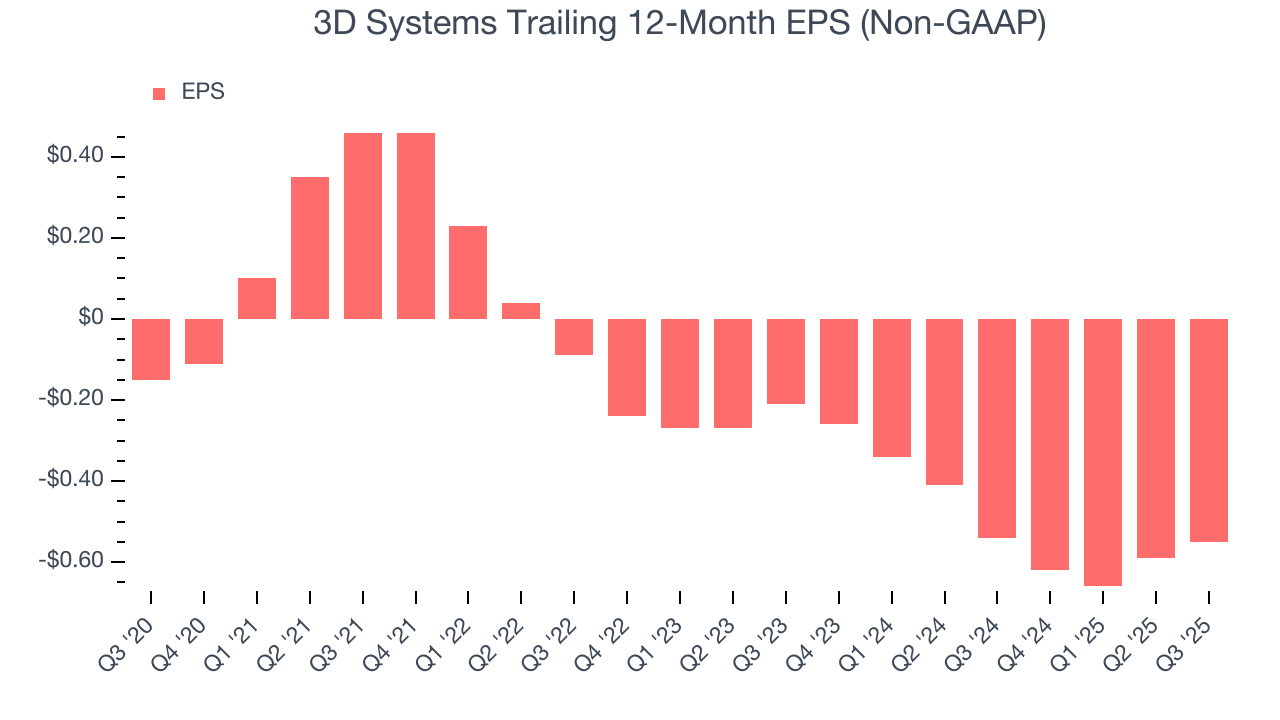

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

3D Systems’s earnings losses deepened over the last five years as its EPS dropped 29.7% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, 3D Systems’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For 3D Systems, its two-year annual EPS declines of 61.8% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, 3D Systems reported adjusted EPS of negative $0.08, up from negative $0.12 in the same quarter last year. This print beat analysts’ estimates by 5.9%. Over the next 12 months, Wall Street expects 3D Systems to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.55 will advance to negative $0.19.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

3D Systems’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 11.9%, meaning it lit $11.90 of cash on fire for every $100 in revenue.

Taking a step back, we can see that 3D Systems’s margin dropped by 33.1 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

3D Systems burned through $15.75 million of cash in Q3, equivalent to a negative 17.3% margin. The company’s cash burn was similar to its $4.45 million of lost cash in the same quarter last year.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

3D Systems’s five-year average ROIC was negative 20.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, 3D Systems’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

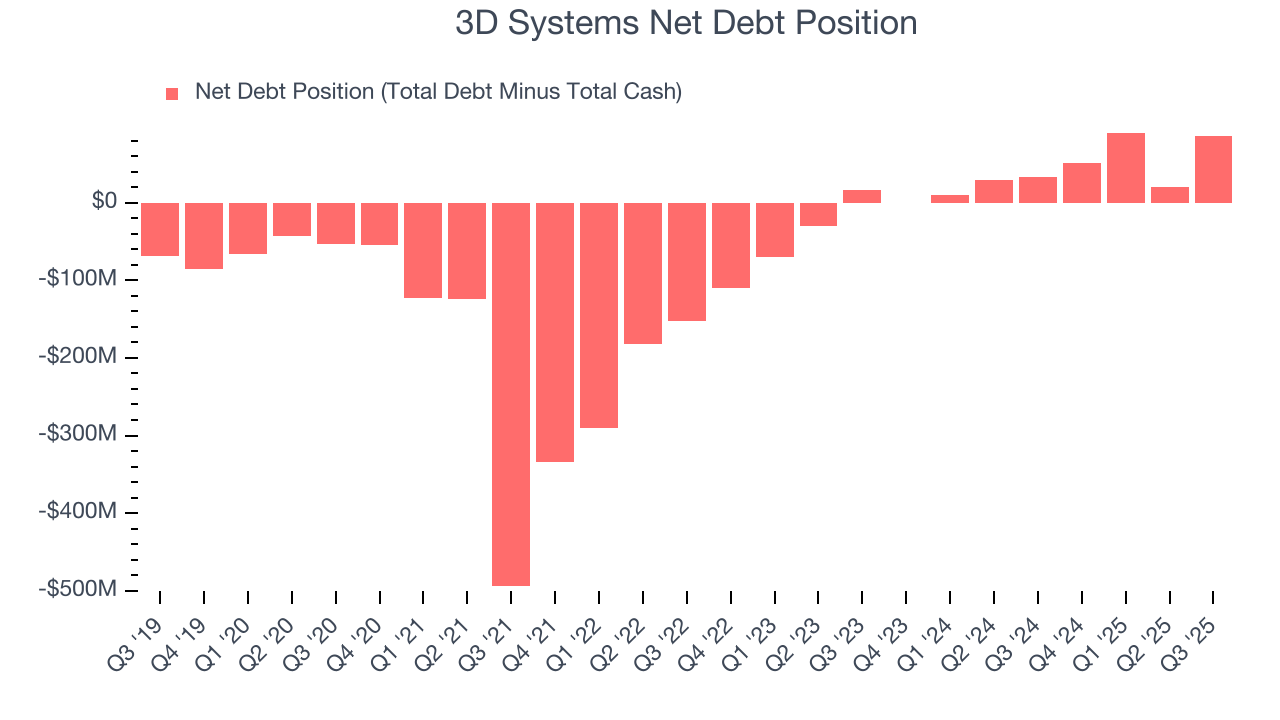

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

3D Systems burned through $94.23 million of cash over the last year, and its $181.8 million of debt exceeds the $95.54 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the 3D Systems’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of 3D Systems until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

12. Key Takeaways from 3D Systems’s Q3 Results

It was tough to see 3D Systems' revenue and EBITDA miss analysts’ expectations this quarter. Additionally, its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this print could have been better. The stock traded down 10.9% to $2.34 immediately following the results.

13. Is Now The Time To Buy 3D Systems?

Updated: March 2, 2026 at 10:45 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own 3D Systems, you should also grasp the company’s longer-term business quality and valuation.

3D Systems falls short of our quality standards. To begin with, its revenue has declined over the last five years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

3D Systems’s forward price-to-sales ratio is 0.6x. The market typically values companies like 3D Systems based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $3.63 on the company (compared to the current share price of $2.06).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.