Corcept (CORT)

Corcept has some tolerable aspects, but overall it’s lacking. We believe there are much better stocks in the market.― StockStory Analyst Team

1. News

2. Summary

Why We Think Corcept Will Underperform

Focusing on the powerful stress hormone that affects everything from metabolism to immune function, Corcept Therapeutics (NASDAQ:CORT) develops and markets medications that modulate cortisol to treat endocrine disorders, cancer, and neurological diseases.

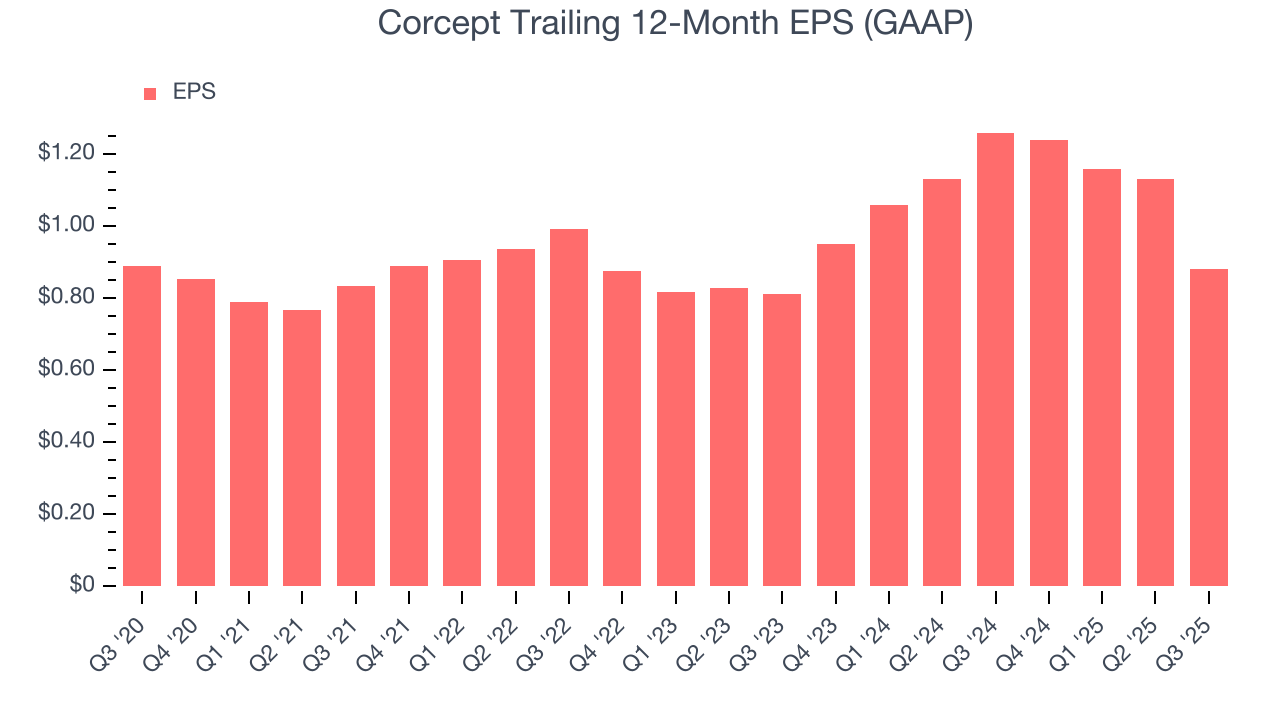

- Earnings per share fell by 6.5% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

- Subscale operations are evident in its revenue base of $741.2 million, meaning it has fewer distribution channels than its larger rivals

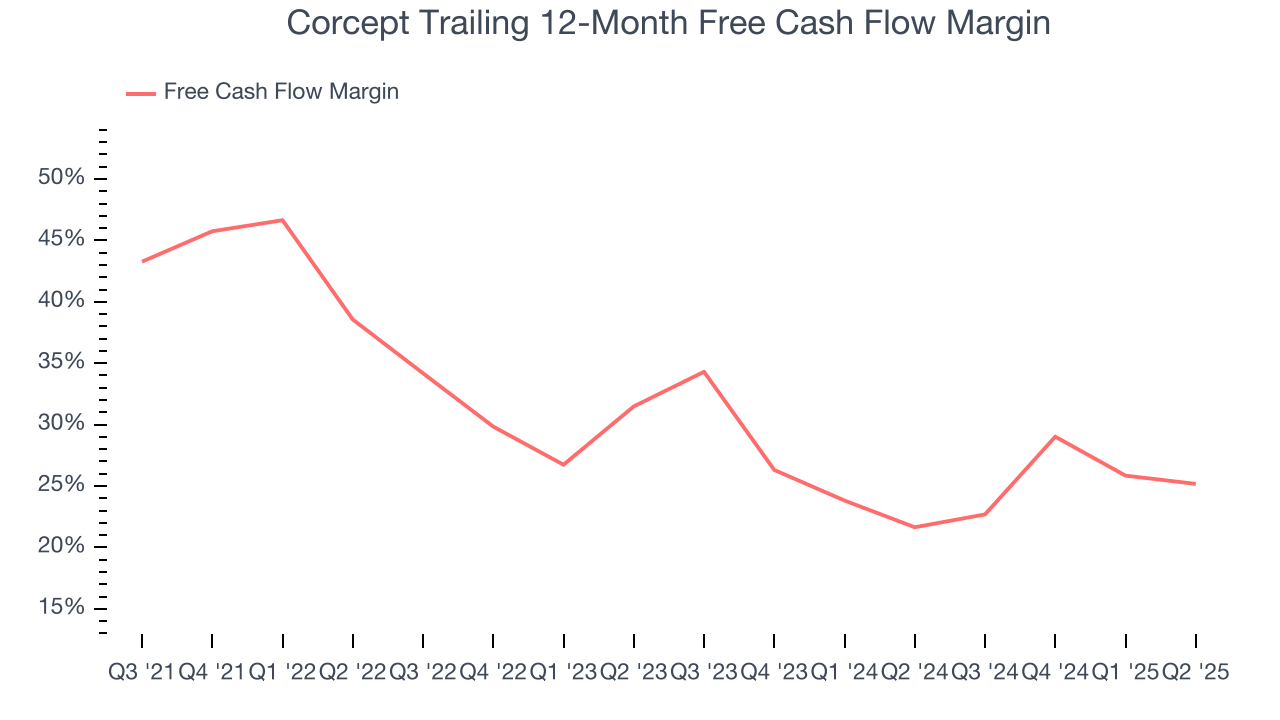

- A positive is that its strong free cash flow margin of 29.1% gives it the option to reinvest, repurchase shares, or pay dividends

Corcept fails to meet our quality criteria. There are more promising alternatives.

Why There Are Better Opportunities Than Corcept

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Corcept

Corcept is trading at $43.50 per share, or 66.1x forward P/E. This valuation multiple seems a bit much considering the quality you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Corcept (CORT) Research Report: Q3 CY2025 Update

Biopharma company Corcept Therapeutics (NASDAQ:CORT) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 13.7% year on year to $207.6 million. The company’s full-year revenue guidance of $825 million at the midpoint came in 3.3% below analysts’ estimates. Its GAAP profit of $0.16 per share was 18.4% above analysts’ consensus estimates.

Corcept (CORT) Q3 CY2025 Highlights:

- Revenue: $207.6 million vs analyst estimates of $218.5 million (13.7% year-on-year growth, 5% miss)

- EPS (GAAP): $0.16 vs analyst estimates of $0.14 (18.4% beat)

- The company dropped its revenue guidance for the full year to $825 million at the midpoint from $875 million, a 5.7% decrease

- Operating Margin: 4.9%, down from 25.5% in the same quarter last year

- Market Capitalization: $7.82 billion

Company Overview

Focusing on the powerful stress hormone that affects everything from metabolism to immune function, Corcept Therapeutics (NASDAQ:CORT) develops and markets medications that modulate cortisol to treat endocrine disorders, cancer, and neurological diseases.

Corcept's flagship product is Korlym, approved for treating Cushing's syndrome, a rare condition where the body produces too much cortisol, leading to serious health problems including diabetes, hypertension, and muscle weakness. The company sells Korlym directly to patients in the United States through specialty pharmacies and distributors.

Beyond Korlym, Corcept has developed a portfolio of over 1,000 proprietary cortisol modulators that target the glucocorticoid receptor (GR) without the progesterone receptor-related side effects of Korlym. Their lead compound, relacorilant, is in Phase 3 trials for Cushing's syndrome and advanced ovarian cancer.

Corcept's drug development strategy extends across multiple therapeutic areas. For oncology, the company is investigating how cortisol modulation might enhance the effectiveness of other cancer treatments by reducing cortisol's immunosuppressive effects. In neurology, they're studying dazucorilant for amyotrophic lateral sclerosis (ALS), while in metabolic disease, they're testing miricorilant for non-alcoholic steatohepatitis (NASH), a serious liver condition.

The company collaborates with academic institutions like the University of Chicago and works with contract research organizations to conduct clinical trials. Corcept relies on third-party manufacturers to produce both its marketed drug and clinical candidates.

Corcept protects its innovations through an extensive patent portfolio covering both compositions and methods of use for its compounds across various disorders. These patents have varying expiration dates, with some extending to 2041, providing the company with potential long-term market exclusivity for its novel treatments.

4. Branded Pharmaceuticals

Looking ahead, the branded pharmaceutical industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Corcept's main competitors in the Cushing's syndrome market include Recordati S.p.A, which sells Signifor and Isturisa, and Xeris Biopharma Holdings, which markets Recorlev. In its broader therapeutic areas, Corcept competes with various pharmaceutical companies developing treatments for endocrine disorders, oncology, and neurological diseases.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $741.2 million in revenue over the past 12 months, Corcept is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

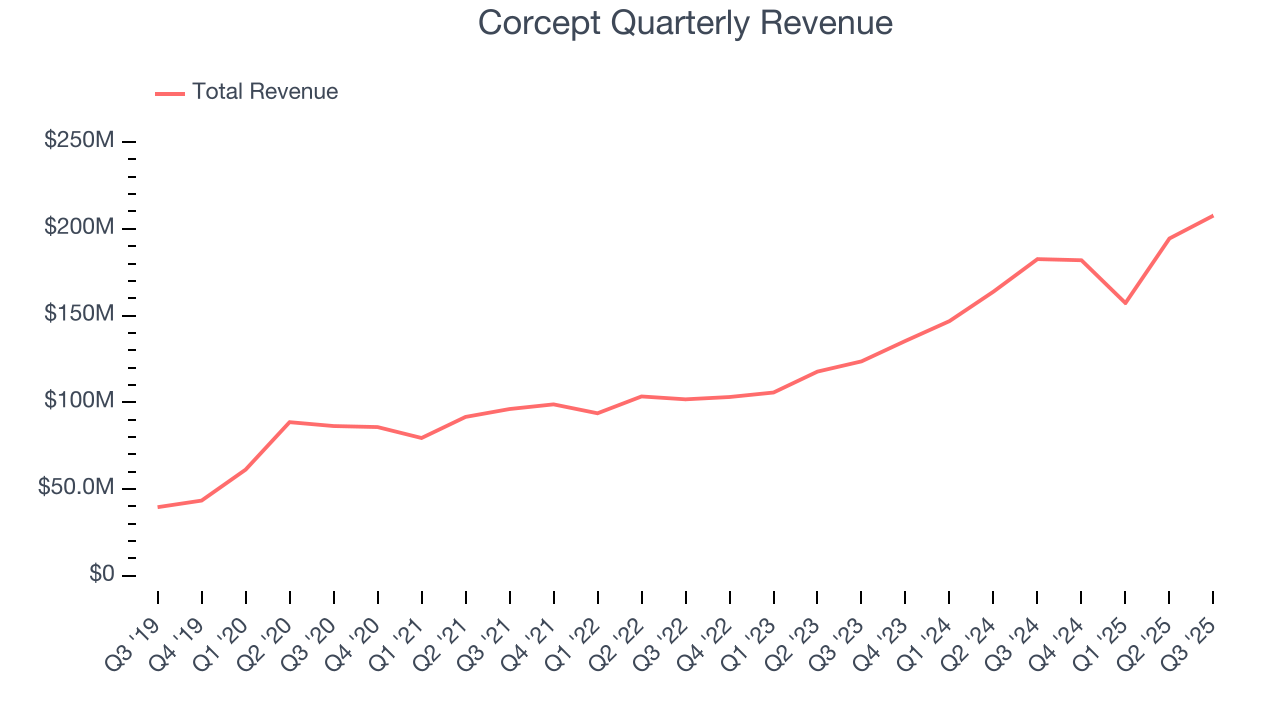

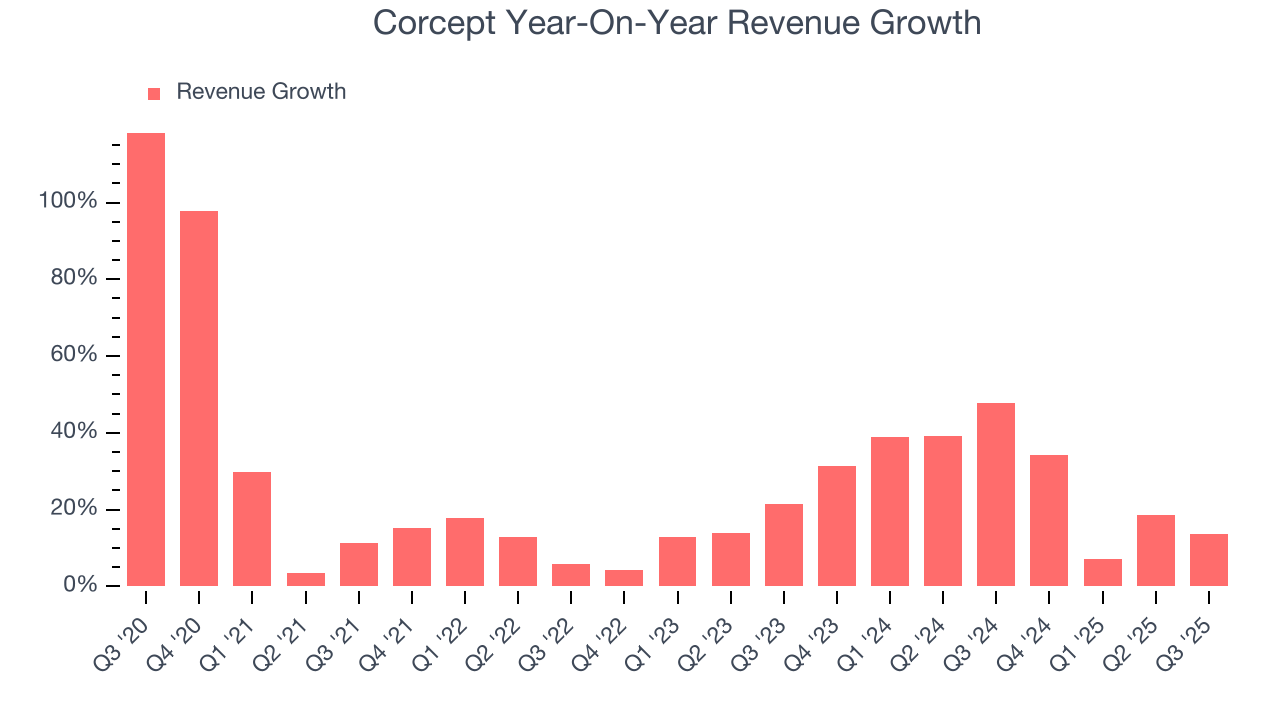

6. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Corcept’s sales grew at an excellent 21.5% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Corcept’s annualized revenue growth of 28.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Corcept’s revenue grew by 13.7% year on year to $207.6 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 43.2% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will spur better top-line performance.

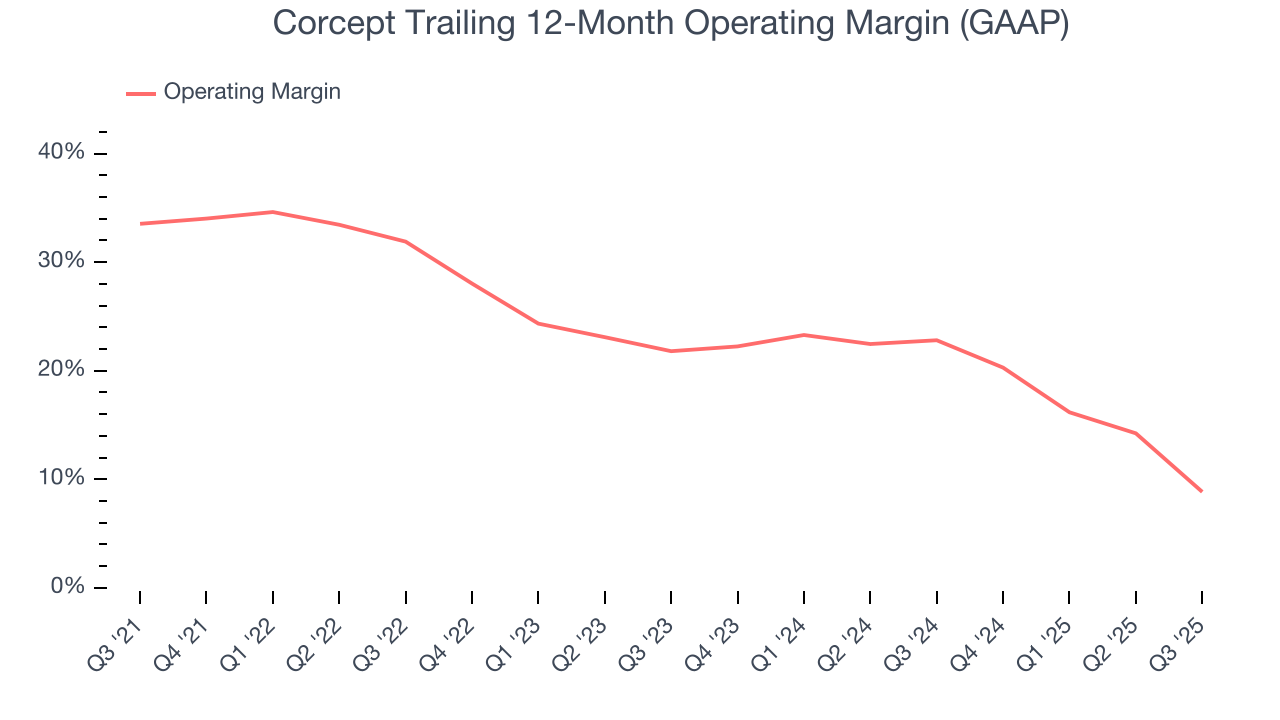

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Corcept has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 21.5%.

Looking at the trend in its profitability, Corcept’s operating margin decreased by 24.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 13 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Corcept generated an operating margin profit margin of 4.9%, down 20.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Corcept’s flat EPS over the last five years was below its 21.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Corcept’s earnings can give us a better understanding of its performance. As we mentioned earlier, Corcept’s operating margin declined by 24.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Corcept reported EPS of $0.16, down from $0.41 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Corcept’s full-year EPS of $0.88 to grow 59.4%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Corcept has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging 29.4% over the last five years.

Taking a step back, we can see that Corcept’s margin dropped by 20.3 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

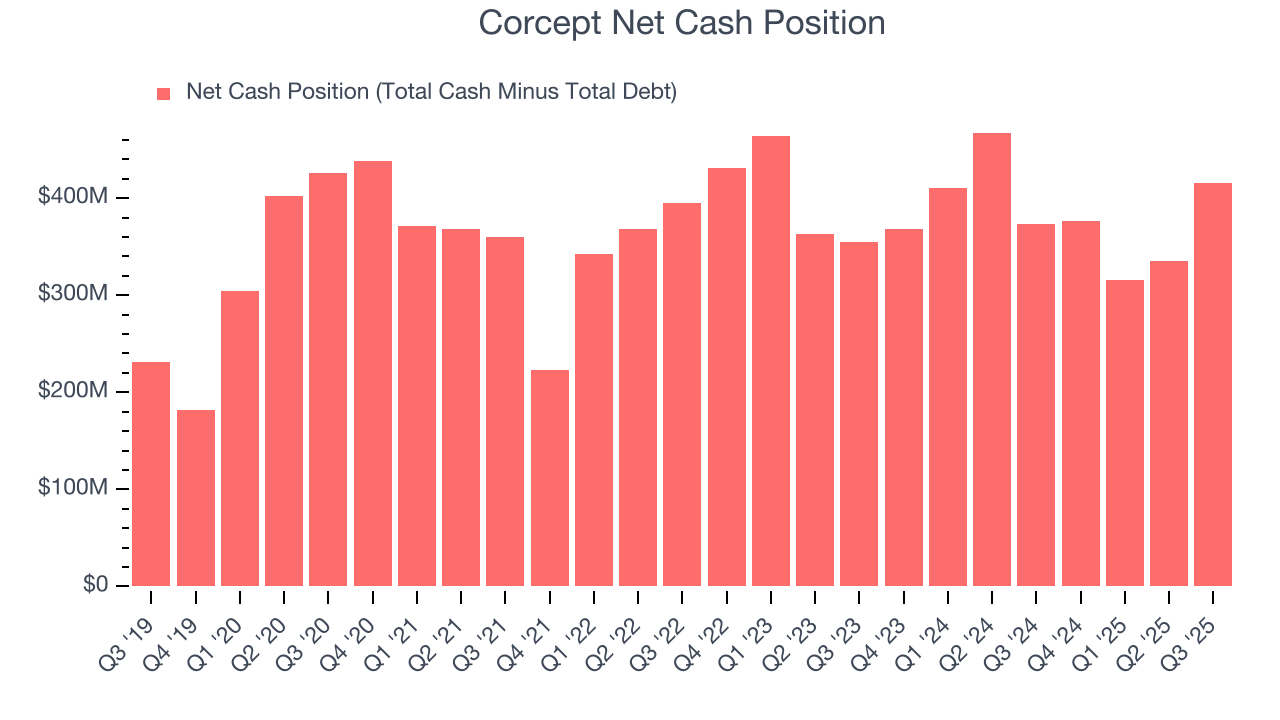

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Corcept is a profitable, well-capitalized company with $421.7 million of cash and $6.36 million of debt on its balance sheet. This $415.3 million net cash position is 5.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Corcept’s Q3 Results

It was good to see Corcept beat analysts’ EPS expectations this quarter. On the other hand, its full-year revenue guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.1% to $68.95 immediately following the results.

12. Is Now The Time To Buy Corcept?

Updated: January 21, 2026 at 11:10 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Corcept.

We see the value of companies making people healthier, but in the case of Corcept, we’re out. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its declining EPS over the last five years makes it a less attractive asset to the public markets. And while the company’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining adjusted operating margin shows the business has become less efficient.

Corcept’s P/E ratio based on the next 12 months is 50.5x. This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $91 on the company (compared to the current share price of $36.25).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.