Cintas (CTAS)

We’re firm believers in Cintas. Its marriage of growth and profitability makes it a financial powerhouse with attractive upside.― StockStory Analyst Team

1. News

2. Summary

Why We Like Cintas

Starting as a family business collecting and cleaning shop rags in Cincinnati, Cintas (NASDAQ:CTAS) provides corporate identity uniforms, facility services, and safety products to over one million businesses across North America.

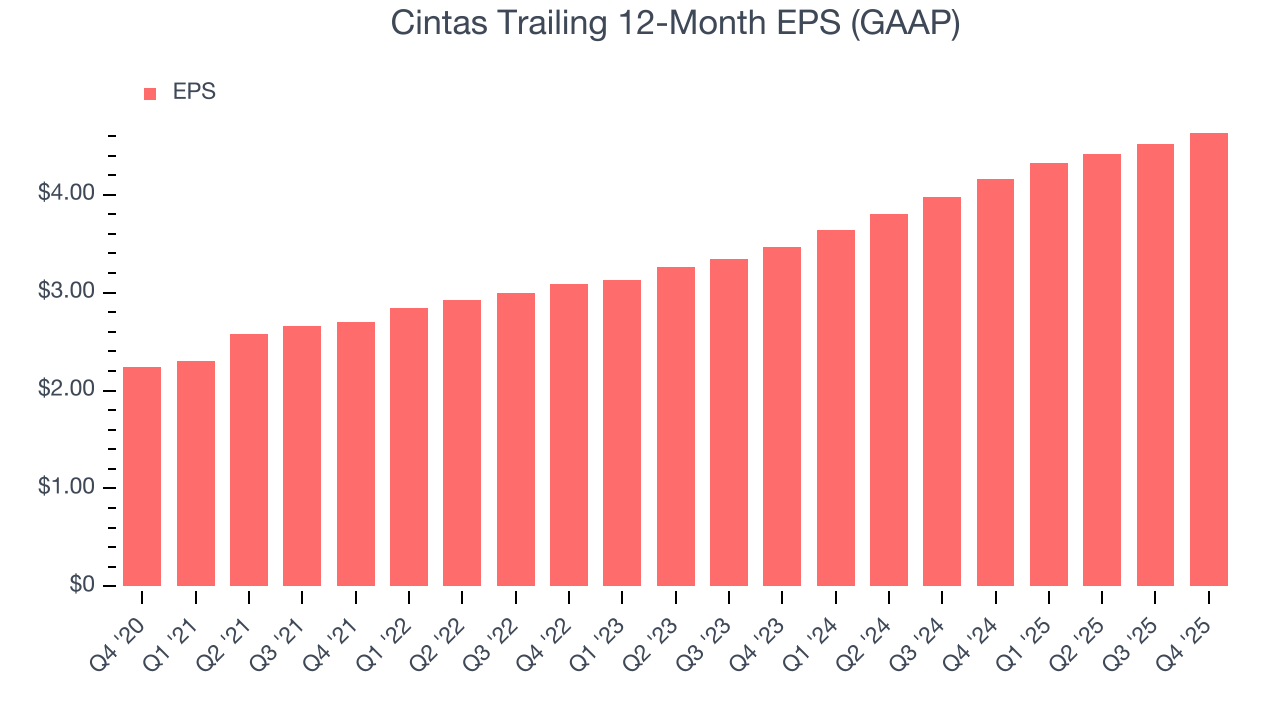

- Earnings growth has trumped its peers over the last five years as its EPS has compounded at 15.6% annually

- Successful business model is illustrated by its impressive adjusted operating margin

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders

We expect great things from Cintas. This is one of the best business services stocks in our coverage.

Is Now The Time To Buy Cintas?

High Quality

Investable

Underperform

Is Now The Time To Buy Cintas?

Cintas is trading at $192.33 per share, or 36.9x forward P/E. There are high expectations given this pricey multiple; we can’t deny that.

Do you like the business model and believe in the company’s future? If so, you can own a smaller position, as our work shows that high-quality companies outperform the market over a multi-year period regardless of valuation at entry.

3. Cintas (CTAS) Research Report: Q4 CY2025 Update

Uniform and facility services provider Cintas (NASDAQ:CTAS) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 9.3% year on year to $2.8 billion. The company expects the full year’s revenue to be around $11.19 billion, close to analysts’ estimates. Its GAAP profit of $1.21 per share was 1.3% above analysts’ consensus estimates.

Cintas (CTAS) Q4 CY2025 Highlights:

- Revenue: $2.8 billion vs analyst estimates of $2.76 billion (9.3% year-on-year growth, 1.4% beat)

- EPS (GAAP): $1.21 vs analyst estimates of $1.19 (1.3% beat)

- The company slightly lifted its revenue guidance for the full year to $11.19 billion at the midpoint from $11.12 billion

- EPS (GAAP) guidance for the full year is $4.85 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 23.4%, in line with the same quarter last year

- Free Cash Flow Margin: 15.2%, up from 13.3% in the same quarter last year

- Market Capitalization: $75.3 billion

Company Overview

Starting as a family business collecting and cleaning shop rags in Cincinnati, Cintas (NASDAQ:CTAS) provides corporate identity uniforms, facility services, and safety products to over one million businesses across North America.

Cintas operates through two main business segments: Uniform Rental and Facility Services, and First Aid and Safety Services. The company's core uniform business involves not just providing standardized workwear but creating complete corporate identity programs through the rental, cleaning, and maintenance of professional attire. This service allows businesses to maintain consistent professional appearances without managing laundry operations or investing in uniform inventory.

Beyond uniforms, Cintas offers comprehensive facility services including floor mats, mops, shop towels, and restroom cleaning services and supplies. These services help businesses maintain clean, safe environments for both employees and customers. For example, a restaurant chain might rely on Cintas for chef uniforms, kitchen floor mats, and restroom supplies—all delivered and serviced on a regular schedule by the same route driver.

The First Aid and Safety Services segment provides workplace safety products and training. This includes stocking and maintaining first aid cabinets, providing automated external defibrillators (AEDs), and conducting safety training programs. Cintas also offers fire protection services, including the sale and servicing of fire extinguishers and sprinkler systems, helping businesses meet safety regulations.

Cintas generates revenue primarily through service contracts, with route-based delivery drivers visiting customer locations on regular schedules to deliver clean uniforms and supplies while picking up soiled items. This recurring revenue model creates stable, long-term customer relationships.

The company operates a network of processing facilities and local branches throughout North America, with approximately 11,700 local delivery routes serving customers ranging from small service businesses to major corporations with thousands of employees. While primarily focused on the U.S. market, Cintas also serves customers in Canada and Latin America.

4. Industrial & Environmental Services

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

Cintas competes with Aramark (NYSE:ARMK), UniFirst (NYSE:UNF), and G&K Services in the uniform rental space, while facing competition from Grainger (NYSE:GWW) and MSC Industrial (NYSE:MSM) in safety supplies, and Johnson Controls (NYSE:JCI) in fire protection services.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $10.79 billion in revenue over the past 12 months, Cintas is larger than most business services companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. This also gives it the flexibility to offer lower prices.

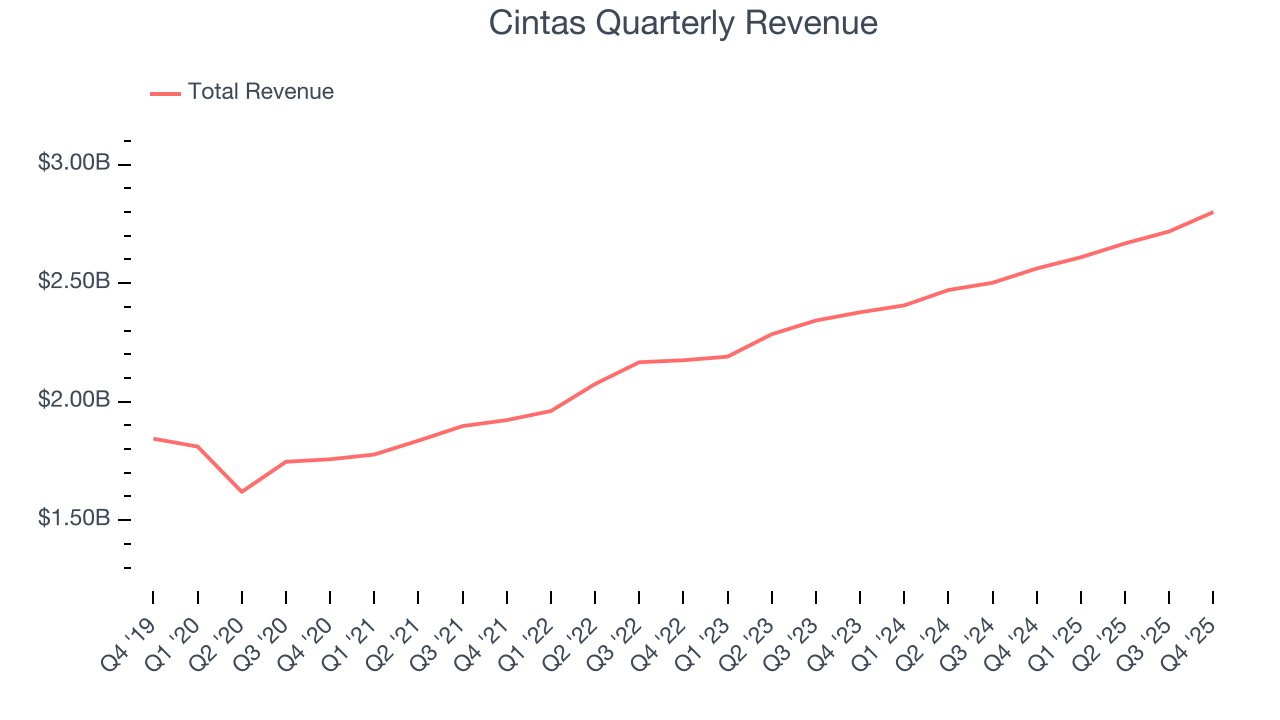

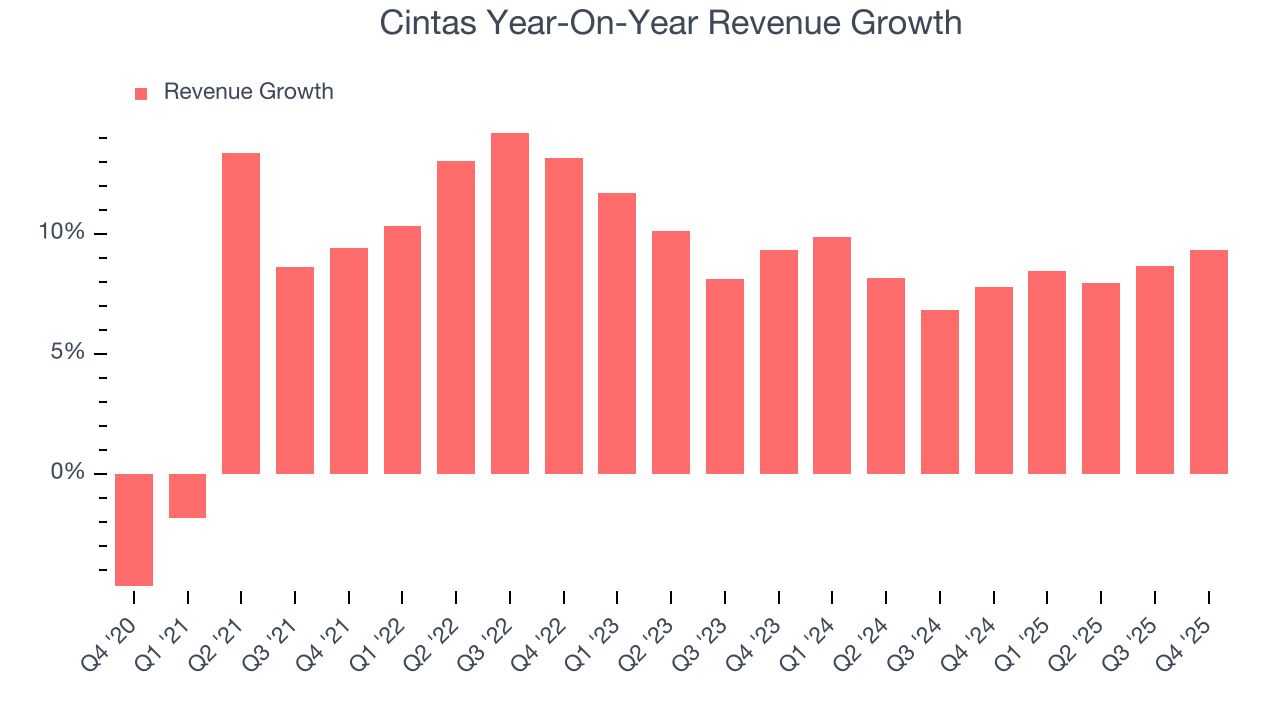

As you can see below, Cintas’s sales grew at an impressive 9.3% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Cintas’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Cintas’s annualized revenue growth of 8.4% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Cintas reported year-on-year revenue growth of 9.3%, and its $2.8 billion of revenue exceeded Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, a slight deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and indicates the market is forecasting success for its products and services.

6. Operating Margin

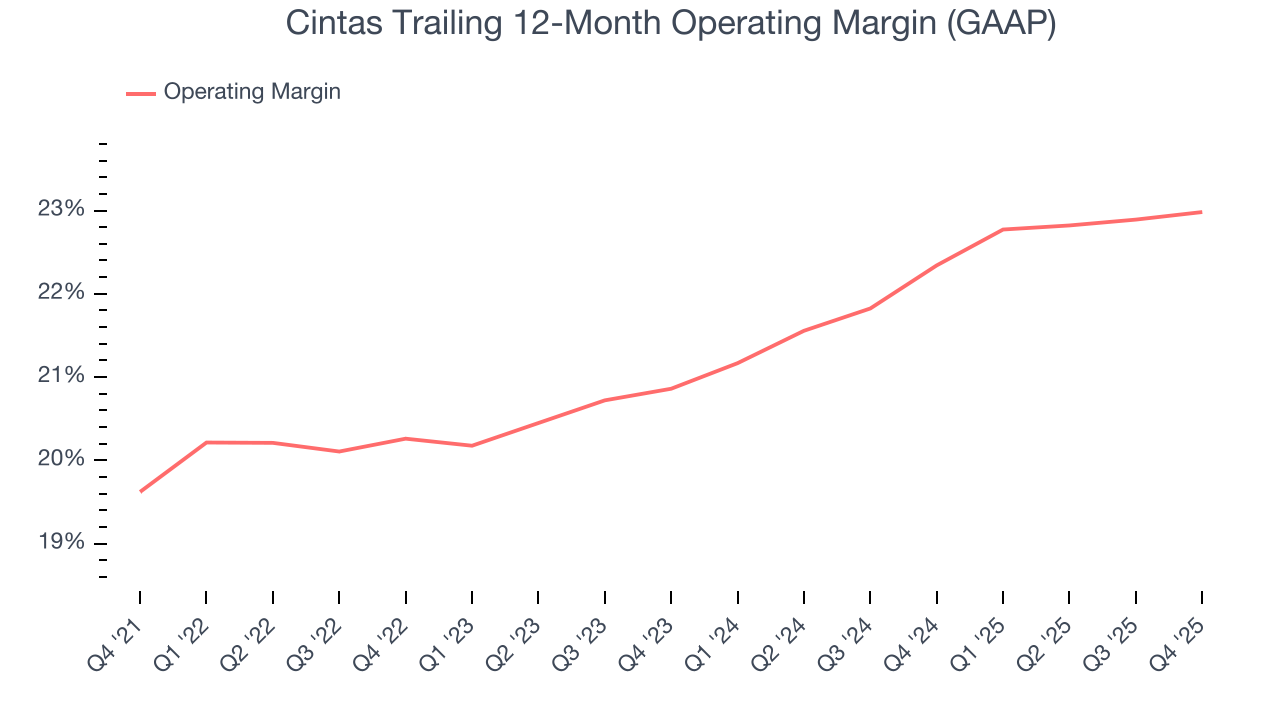

Cintas has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 21.4%.

Analyzing the trend in its profitability, Cintas’s operating margin rose by 3.4 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Cintas generated an operating margin profit margin of 23.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Cintas’s EPS grew at an astounding 15.6% compounded annual growth rate over the last five years, higher than its 9.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

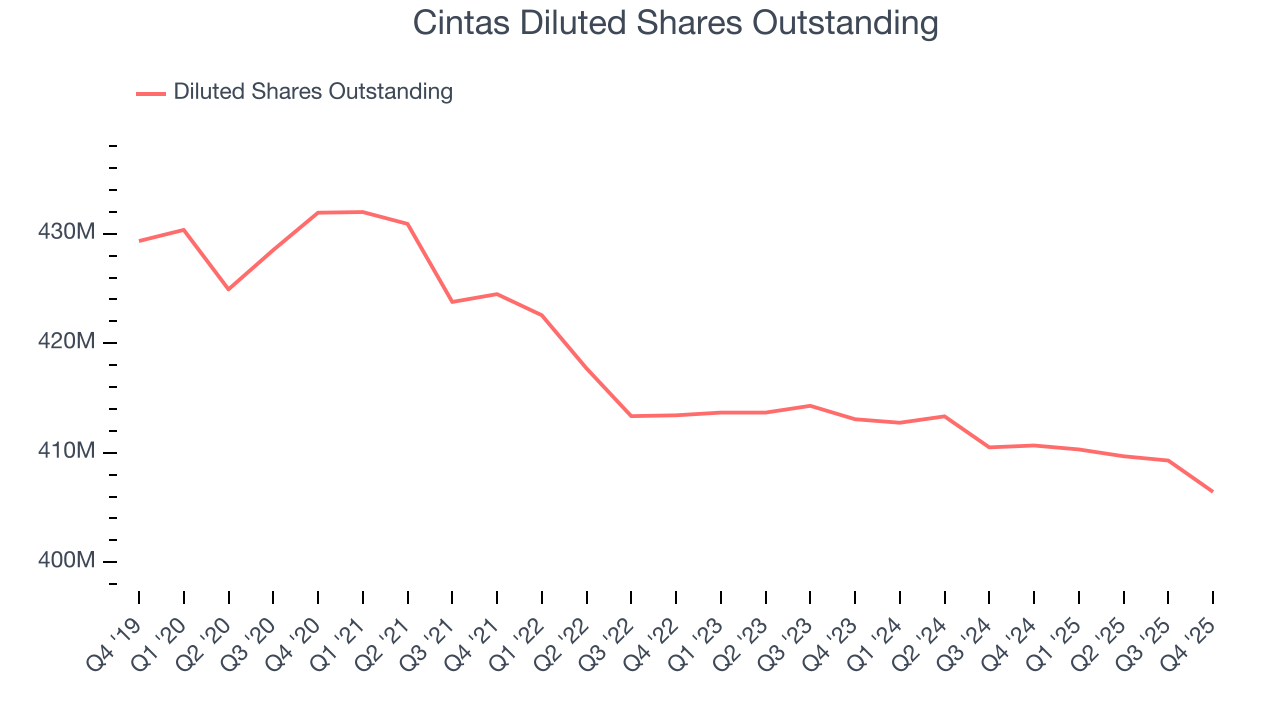

Diving into Cintas’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Cintas’s operating margin was flat this quarter but expanded by 3.4 percentage points over the last five years. On top of that, its share count shrank by 5.9%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Cintas, its two-year annual EPS growth of 15.7% is similar to its five-year trend, implying strong and stable earnings power.

In Q4, Cintas reported EPS of $1.21, up from $1.09 in the same quarter last year. This print beat analysts’ estimates by 1.3%. Over the next 12 months, Wall Street expects Cintas’s full-year EPS of $4.63 to grow 10.3%.

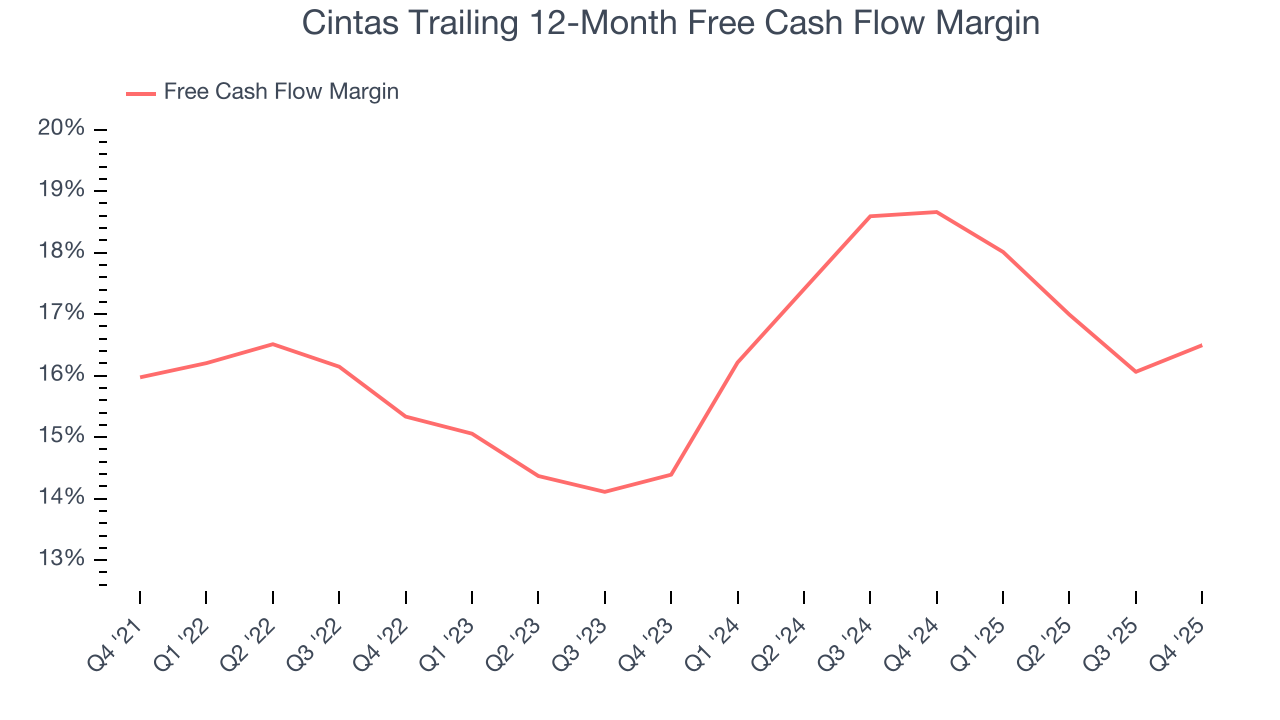

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Cintas has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 16.2% over the last five years.

Cintas’s free cash flow clocked in at $425 million in Q4, equivalent to a 15.2% margin. This result was good as its margin was 1.9 percentage points higher than in the same quarter last year, but we note it was lower than its five-year cash profitability. Nevertheless, we wouldn’t read too much into a single quarter because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

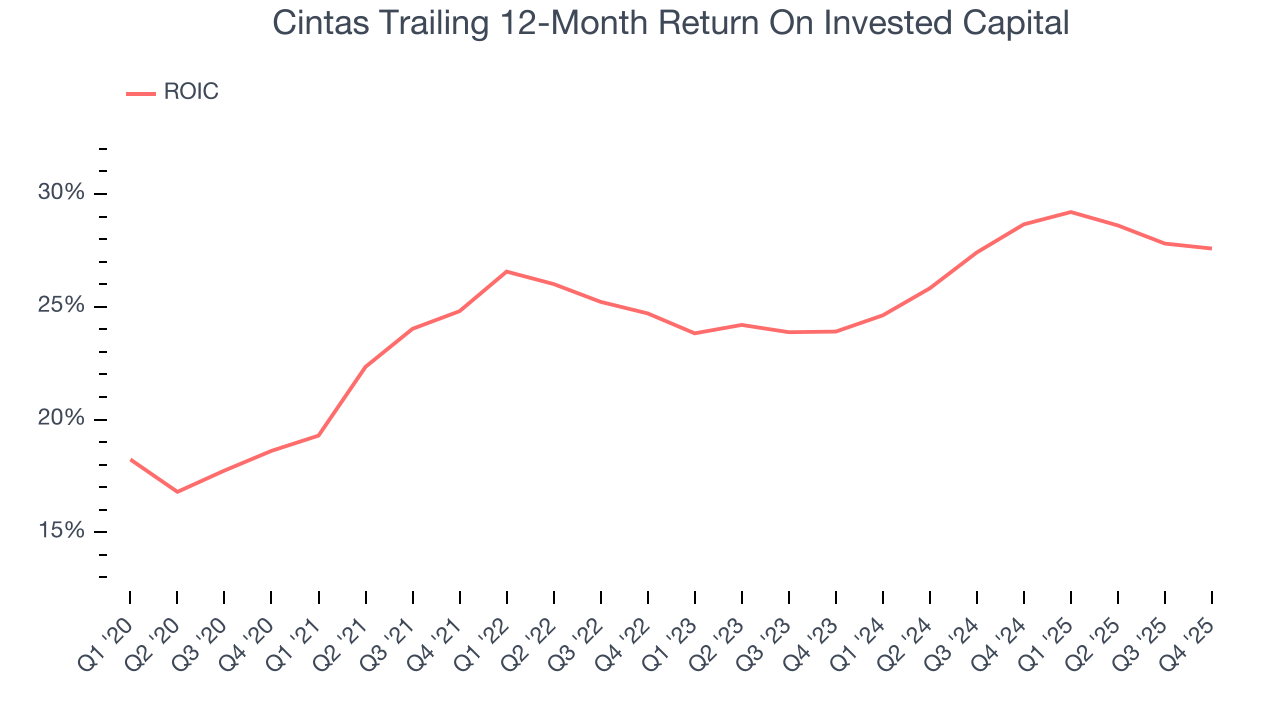

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Cintas’s five-year average ROIC was 25.9%, placing it among the best business services companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Cintas’s ROIC increased by 3.4 percentage points annually over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

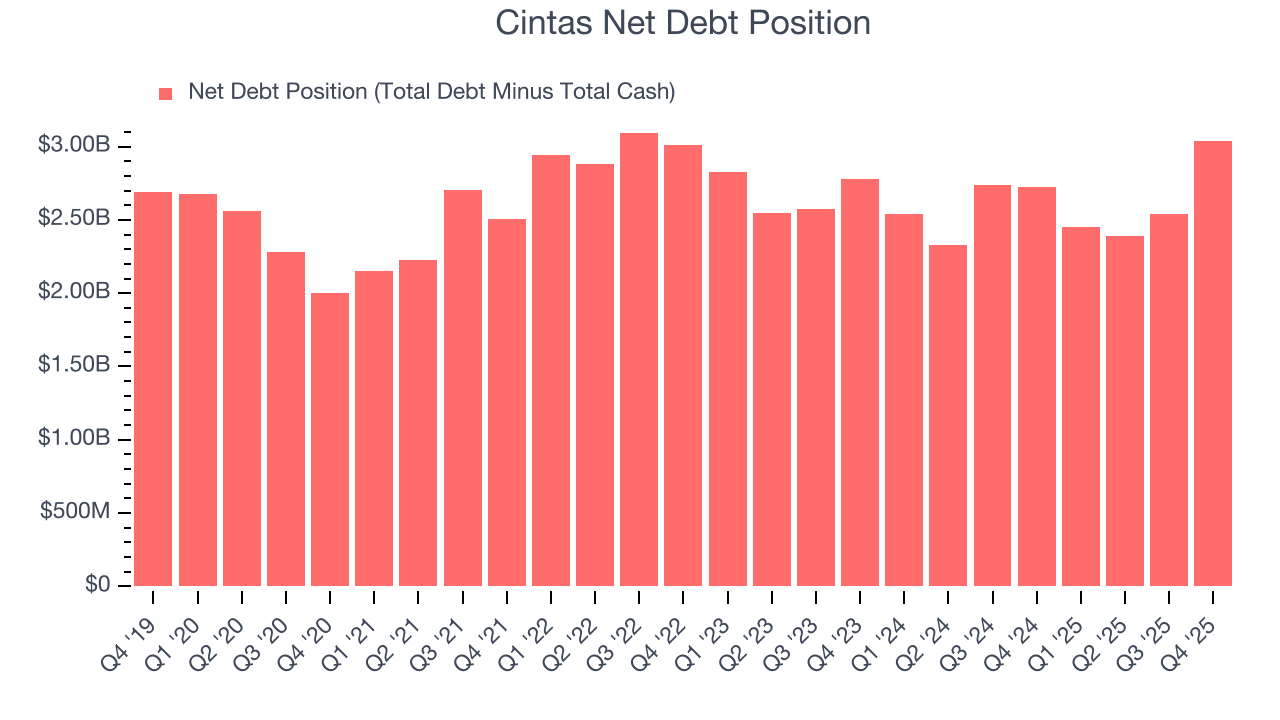

Cintas reported $200.8 million of cash and $3.24 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.97 billion of EBITDA over the last 12 months, we view Cintas’s 1.0× net-debt-to-EBITDA ratio as safe. We also see its $94.61 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Cintas’s Q4 Results

It was good to see Cintas narrowly top analysts’ revenue expectations this quarter. EPS also exceeded estimates. Overall, this print had some key positives. The stock remained flat at $188.42 immediately after reporting.

12. Is Now The Time To Buy Cintas?

Updated: January 31, 2026 at 11:19 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Cintas.

There is a lot to like about Cintas. First of all, the company’s revenue growth was impressive over the last five years. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its impressive operating margins show it has a highly efficient business model.

Cintas’s P/E ratio based on the next 12 months is 36.9x. There’s some optimism reflected in this multiple, but we don’t mind owning a high-quality business, even if it’s slightly expensive. It’s often wise to hold investments like this for at least three to five years, as the power of long-term compounding negates short-term price swings that can accompany relatively high valuations.

Wall Street analysts have a consensus one-year price target of $216.78 on the company (compared to the current share price of $192.33).