Euronet Worldwide (EEFT)

We’d invest in Euronet Worldwide. Its eye-popping 28% annualized EPS growth over the last five years has significantly outpaced its peers.― StockStory Analyst Team

1. News

2. Summary

Why We Like Euronet Worldwide

Operating a global network of over 47,000 ATMs and 821,000 point-of-sale terminals across more than 60 countries, Euronet Worldwide (NASDAQ:EEFT) provides electronic payment solutions including ATM services, prepaid product processing, and international money transfer services.

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 28% outpaced its revenue gains

- Market-beating return on equity illustrates that management has a knack for investing in profitable ventures

- Annual revenue growth of 11.3% over the last five years beat the sector average and underscores the unique value of its offerings

Euronet Worldwide is a market leader. The price looks fair relative to its quality, so this might be a prudent time to buy some shares.

Why Is Now The Time To Buy Euronet Worldwide?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Euronet Worldwide?

At $67.72 per share, Euronet Worldwide trades at 6.5x forward P/E. This multiple is cheap, and we think the stock is a bargain considering its quality characteristics.

A powerful double-play is a business that can both grow earnings and achieve a loftier multiple over time. Elite companies trading at meaningful discounts are good ways to set up this play.

3. Euronet Worldwide (EEFT) Research Report: Q4 CY2025 Update

Financial technology provider Euronet Worldwide (NASDAQ:EEFT) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 5.9% year on year to $1.11 billion. Its non-GAAP profit of $2.39 per share was 3% below analysts’ consensus estimates.

Euronet Worldwide (EEFT) Q4 CY2025 Highlights:

- Revenue: $1.11 billion vs analyst estimates of $1.11 billion (5.9% year-on-year growth, in line)

- Pre-tax Profit: $91.2 million (8.2% margin)

- Adjusted EPS: $2.39 vs analyst expectations of $2.46 (3% miss)

- Market Capitalization: $2.95 billion

Company Overview

Operating a global network of over 47,000 ATMs and 821,000 point-of-sale terminals across more than 60 countries, Euronet Worldwide (NASDAQ:EEFT) provides electronic payment solutions including ATM services, prepaid product processing, and international money transfer services.

Euronet's business is organized into three complementary segments. The Electronic Funds Transfer (EFT) segment manages ATM networks and provides transaction processing services. The company both operates its own ATMs and manages networks for financial institutions, earning revenue through transaction fees, management fees, and dynamic currency conversion services that allow travelers to withdraw cash in their home currency while abroad.

The epay segment distributes digital content and processes payments through a network of approximately 821,000 point-of-sale terminals across 352,000 retailer locations worldwide. While initially focused on mobile airtime top-up services, epay has diversified to include digital media content, gift cards, and other prepaid products. The segment generates revenue through commissions and processing fees, with digital media products now representing the majority of its business.

The Money Transfer segment operates primarily under the brands Ria, Xe, and Dandelion. Ria provides consumer-to-consumer money transfers through a network of over 580,000 locations in 175 countries. Xe offers account-to-account international payments and foreign currency information services through its website and app. Dandelion is a cross-border payment platform that powers transactions for both Euronet's own brands and third-party financial institutions and technology companies.

Euronet's technology infrastructure includes proprietary transaction switching software and processing centers located across multiple countries. The company has developed value-added services beyond basic transactions, including fraud management, bill payment, and advertising at ATMs. For financial institutions, Euronet offers the Ren payments platform, which can be deployed on-premise or accessed as a cloud-based service to process various payment types.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

In the money transfer segment, Euronet competes primarily with Western Union and MoneyGram International. In the EFT processing space, competitors include traditional payment processors and financial technology companies. The epay segment faces competition from direct carrier billing systems and other digital content distributors.

5. Revenue Growth

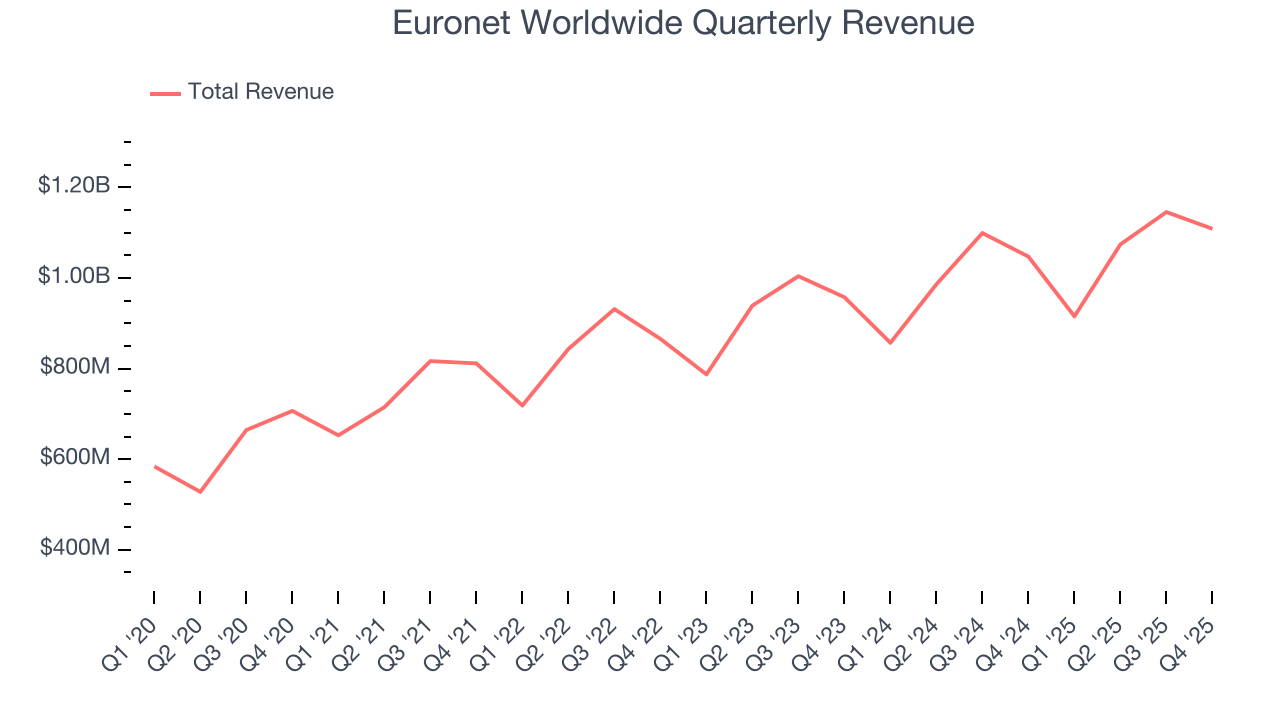

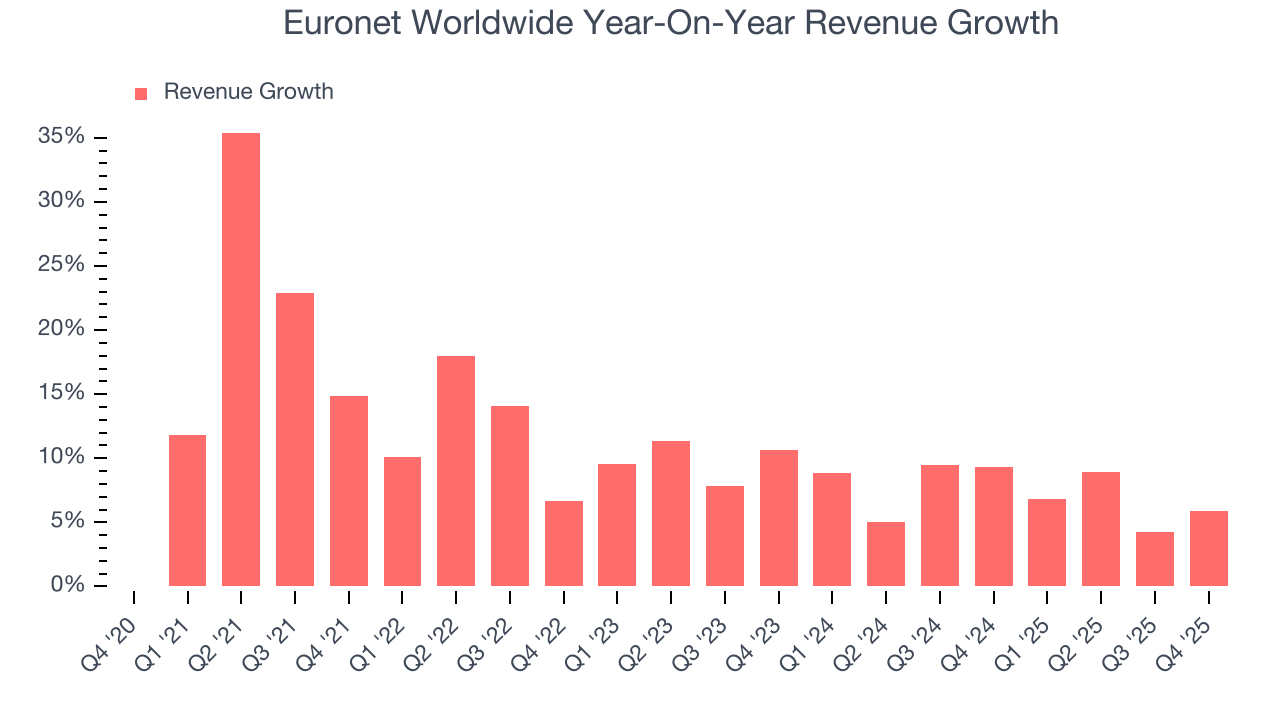

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Euronet Worldwide’s 11.3% annualized revenue growth over the last five years was solid. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Euronet Worldwide’s recent performance shows its demand has slowed as its annualized revenue growth of 7.3% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Euronet Worldwide grew its revenue by 5.9% year on year, and its $1.11 billion of revenue was in line with Wall Street’s estimates.

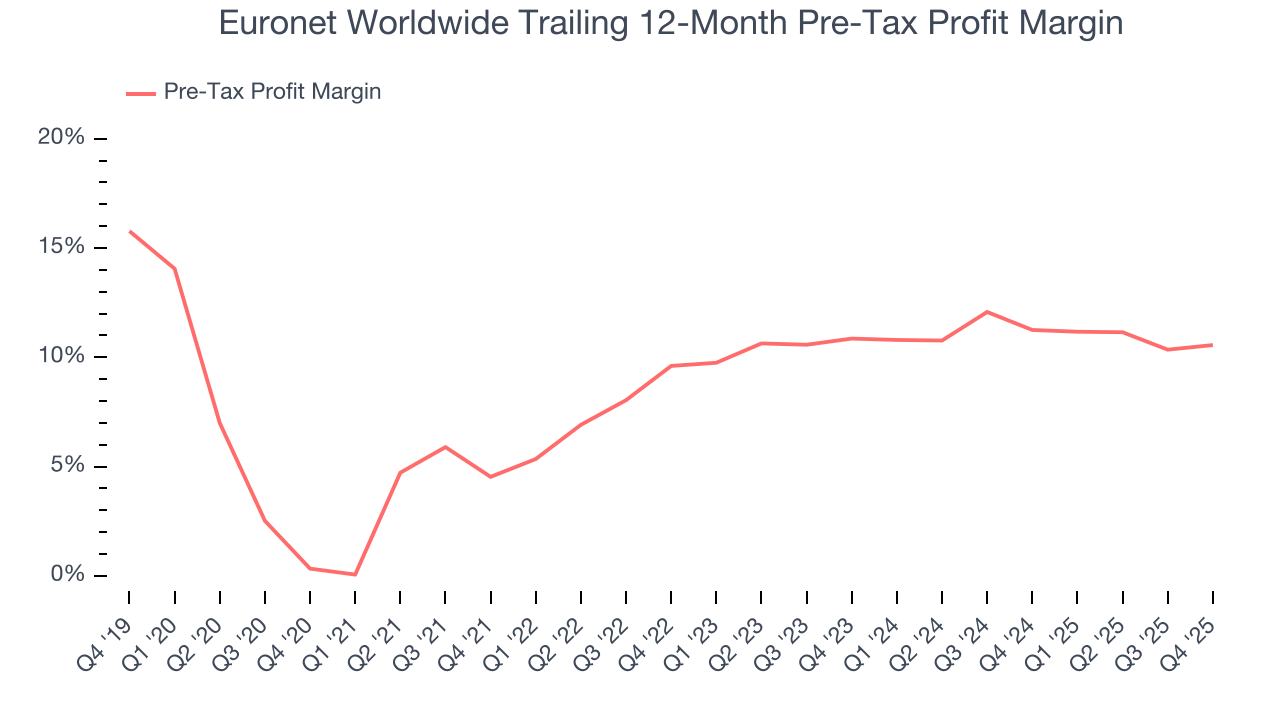

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Euronet Worldwide’s pre-tax profit margin has fallen by 10.2 percentage points, going from 4.5% to 10.6%. However, fixed cost leverage was muted more recently as the company’s pre-tax profit margin was flat on a two-year basis.

In Q4, Euronet Worldwide’s pre-tax profit margin was 8.2%. This result was in line with the same quarter last year.

7. Earnings Per Share

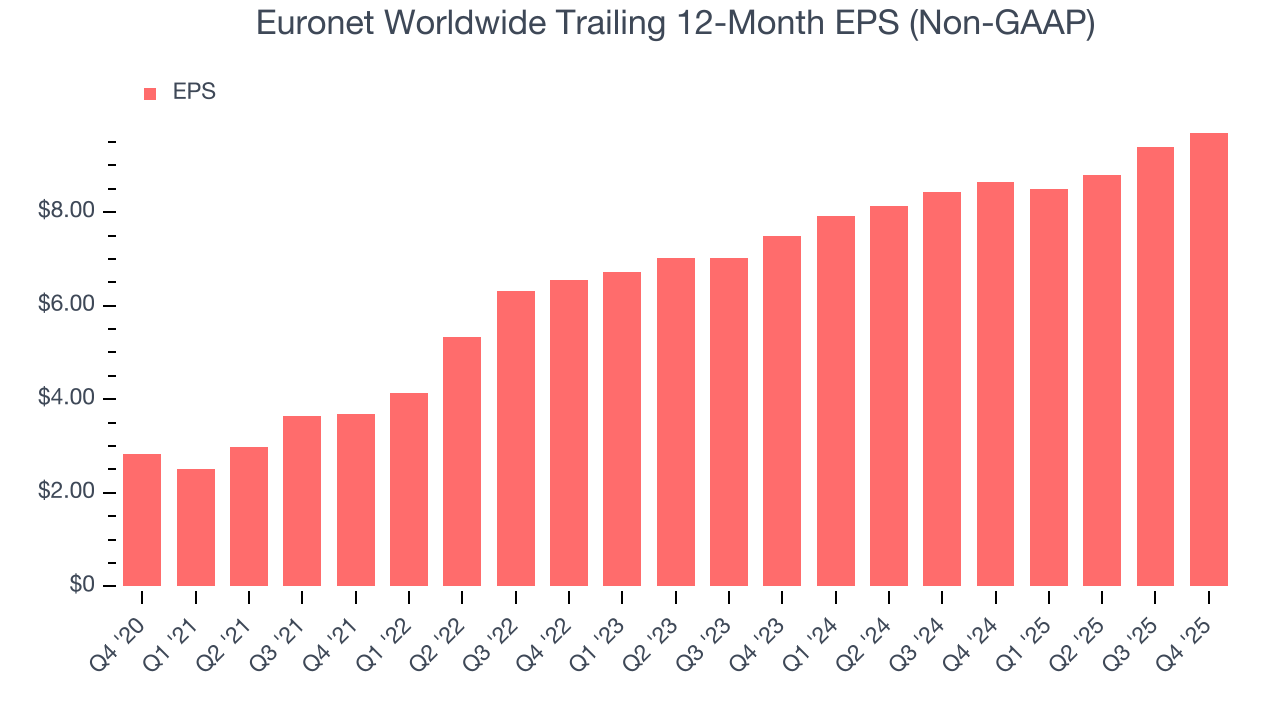

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Euronet Worldwide’s EPS grew at an astounding 28% compounded annual growth rate over the last five years, higher than its 11.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Euronet Worldwide, its two-year annual EPS growth of 13.7% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Euronet Worldwide reported adjusted EPS of $2.39, up from $2.08 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Euronet Worldwide’s full-year EPS of $9.70 to grow 13.8%.

8. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Euronet Worldwide has averaged an ROE of 19.4%, excellent for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Euronet Worldwide has a strong competitive moat.

9. Balance Sheet Assessment

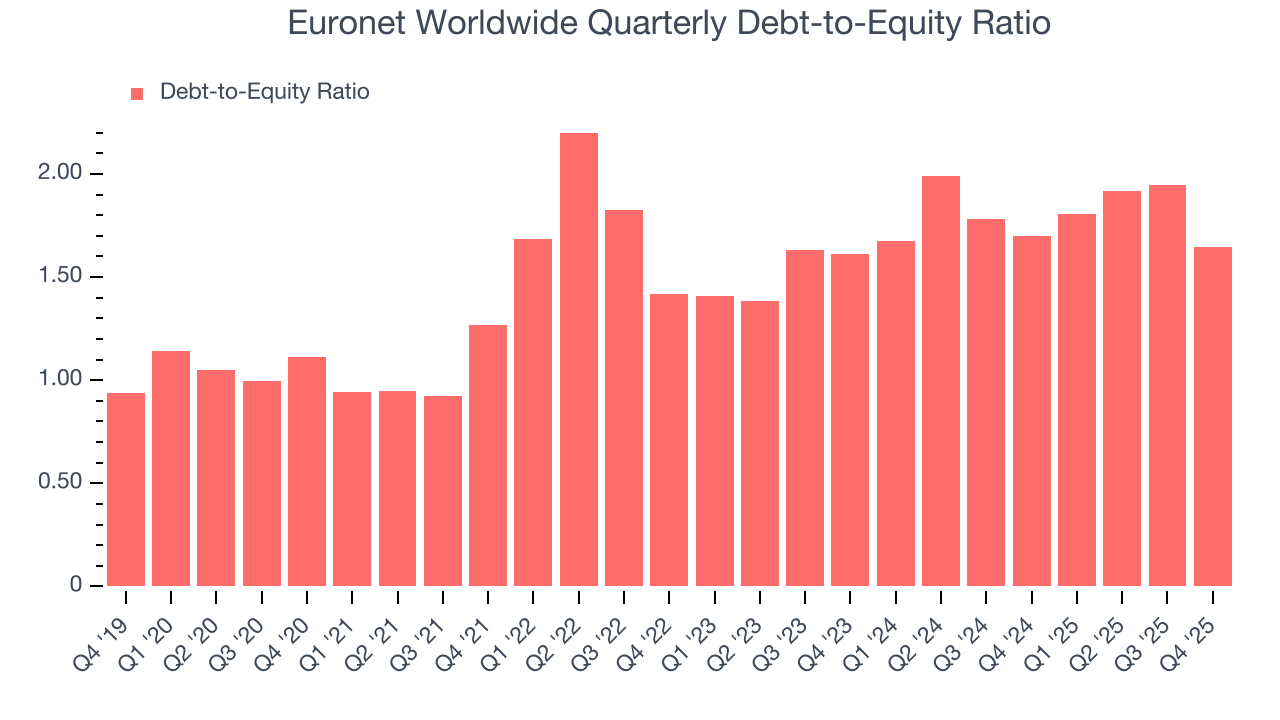

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Euronet Worldwide currently has $2.18 billion of debt and $1.32 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.8×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Euronet Worldwide’s Q4 Results

We struggled to find many positives in these results. Overall, this was a weaker quarter. The stock traded down 5.4% to $66.43 immediately after reporting.

11. Is Now The Time To Buy Euronet Worldwide?

Updated: February 12, 2026 at 11:51 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Euronet Worldwide.

There are multiple reasons why we think Euronet Worldwide is an amazing business. For starters, its revenue growth was solid over the last five years. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, and its expanding pre-tax profit margin shows the business has become more efficient.

Euronet Worldwide’s P/E ratio based on the next 12 months is 6.5x. Looking across the spectrum of financials businesses, Euronet Worldwide’s fundamentals shine bright. We like the stock at this bargain price.

Wall Street analysts have a consensus one-year price target of $92.14 on the company (compared to the current share price of $67.72), implying they see 36.1% upside in buying Euronet Worldwide in the short term.