Frontdoor (FTDR)

We wouldn’t recommend Frontdoor. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Frontdoor Will Underperform

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ:FTDR) is a provider of home warranty and service plans.

- Muted 7.3% annual revenue growth over the last five years shows its demand lagged behind its consumer discretionary peers

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 15.7% for the last two years

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

Frontdoor fails to meet our quality criteria. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Frontdoor

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Frontdoor

Frontdoor is trading at $66.61 per share, or 15.2x forward P/E. Frontdoor’s multiple may seem like a great deal among consumer discretionary peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Frontdoor (FTDR) Research Report: Q4 CY2025 Update

Home warranty company Frontdoor (NASDAQ:FTDR) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 13.1% year on year to $433 million. On the other hand, next quarter’s revenue guidance of $442.5 million was less impressive, coming in 2% below analysts’ estimates. Its non-GAAP profit of $0.23 per share was 74.1% above analysts’ consensus estimates.

Frontdoor (FTDR) Q4 CY2025 Highlights:

- Revenue: $433 million vs analyst estimates of $421.8 million (13.1% year-on-year growth, 2.7% beat)

- Adjusted EPS: $0.23 vs analyst estimates of $0.13 (74.1% beat)

- Adjusted EBITDA: $59 million vs analyst estimates of $52.51 million (13.6% margin, 12.4% beat)

- Revenue Guidance for Q1 CY2026 is $442.5 million at the midpoint, below analyst estimates of $451.4 million

- EBITDA guidance for the upcoming financial year 2026 is $572.5 million at the midpoint, above analyst estimates of $553.5 million

- Operating Margin: 6.2%, up from 4.2% in the same quarter last year

- Free Cash Flow Margin: 21.7%, up from 13.3% in the same quarter last year

- Market Capitalization: $4.06 billion

Company Overview

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ:FTDR) is a provider of home warranty and service plans.

Frontdoor’s primary business revolves around providing homeowners with subscription-based service agreements that cover the repair or replacement of major home systems and appliances. The company operates through a network of pre-screened, licensed service contractors to address common household breakdowns, ranging from electrical systems and plumbing to HVAC and kitchen appliances. This service model helps homeowners avoid the unexpected costs and inconveniences of home system and appliance failures.

The company's flagship brands, including American Home Shield, HSA, Landmark, and OneGuard, have a long-standing reputation in the home warranty market. Each brand caters to specific regional needs and customer preferences, enabling Frontdoor to serve a diverse customer base across the United States.

A key aspect of Frontdoor's business model is its focus on customer service and satisfaction, which is reflected in its comprehensive service plans and transparent pricing policies.

4. Consumer Discretionary - Specialized Consumer Services

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Frontdoor's primary competitors include HomeServe (owned by Brookfield Infrastructure NYSE:BIP), The ServiceMaster (NYSE:SERV), Assurant (NYSE:AIZ), and private companies American Residential Warranty, Choice Home Warranty, and Cinch Home Services.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Frontdoor grew its sales at a weak 7.3% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Frontdoor’s annualized revenue growth of 8.5% over the last two years is above its five-year trend, which is encouraging.

This quarter, Frontdoor reported year-on-year revenue growth of 13.1%, and its $433 million of revenue exceeded Wall Street’s estimates by 2.7%. Company management is currently guiding for a 3.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

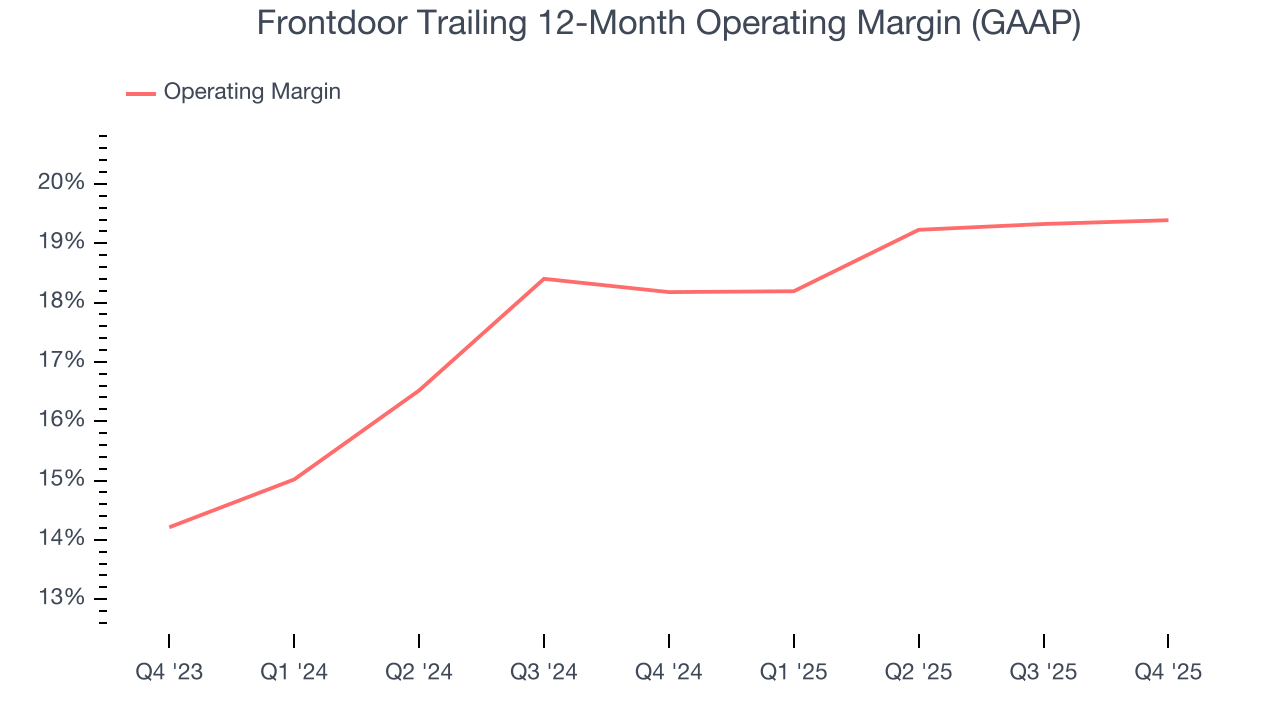

6. Operating Margin

Frontdoor’s operating margin has been trending up over the last 12 months and averaged 18.8% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, Frontdoor generated an operating margin profit margin of 6.2%, up 2.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Frontdoor’s EPS grew at a weak 21.5% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 7.3% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Frontdoor reported adjusted EPS of $0.23, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Frontdoor’s full-year EPS of $4.08 to grow 10.2%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Frontdoor has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 15.7%, lousy for a consumer discretionary business.

Frontdoor’s free cash flow clocked in at $94 million in Q4, equivalent to a 21.7% margin. This result was good as its margin was 8.4 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts predict Frontdoor’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 18.6% for the last 12 months will decrease to 16.6%.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Frontdoor’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 40.9%, slightly better than typical consumer discretionary business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Frontdoor’s ROIC increased by 2.8 percentage points annually each year over the last few years. This is a good sign, and we hope the company can keep improving.

10. Balance Sheet Assessment

Frontdoor reported $566 million of cash and $1.19 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $553 million of EBITDA over the last 12 months, we view Frontdoor’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $23 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Frontdoor’s Q4 Results

It was good to see Frontdoor beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this print was mixed. The stock remained flat at $56.30 immediately following the results.

12. Is Now The Time To Buy Frontdoor?

Updated: March 6, 2026 at 10:28 PM EST

Before deciding whether to buy Frontdoor or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Frontdoor falls short of our quality standards. On top of that, Frontdoor’s Forecasted free cash flow margin suggests the company will ramp up its investments next year, and its projected EPS for the next year is lacking.

Frontdoor’s P/E ratio based on the next 12 months is 15.2x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $71.75 on the company (compared to the current share price of $66.61).