IAC (IAC)

IAC is up against the odds. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think IAC Will Underperform

Originally known as InterActiveCorp and built through Barry Diller's strategic acquisitions since the 1990s, IAC (NASDAQ:IAC) operates a portfolio of category-leading digital businesses including Dotdash Meredith, Angi, and Care.com, focusing on digital publishing, home services, and caregiving platforms.

- Sales tumbled by 15% annually over the last two years, showing market trends are working against its favor during this cycle

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Forecasted revenue decline of 5.9% for the upcoming 12 months implies demand will fall even further

IAC’s quality is inadequate. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than IAC

Why There Are Better Opportunities Than IAC

IAC’s stock price of $37.02 implies a valuation ratio of 25.7x forward P/E. This multiple is higher than that of business services peers; it’s also rich for the top-line growth of the company. Not a great combination.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. IAC (IAC) Research Report: Q4 CY2025 Update

Digital media conglomerate IAC (NASDAQGS:IAC) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 10.5% year on year to $646 million. Its GAAP loss of $0.99 per share was significantly below analysts’ consensus estimates.

IAC (IAC) Q4 CY2025 Highlights:

- Revenue: $646 million vs analyst estimates of $641 million (10.5% year-on-year decline, 0.8% beat)

- EPS (GAAP): -$0.99 vs analyst estimates of $0.71 (significant miss)

- Adjusted EBITDA: $141.6 million vs analyst estimates of $137.5 million (21.9% margin, 3% beat)

- EBITDA guidance for the upcoming financial year 2026 is $297.5 million at the midpoint, below analyst estimates of $319 million

- Operating Margin: -17.5%, down from 6.7% in the same quarter last year

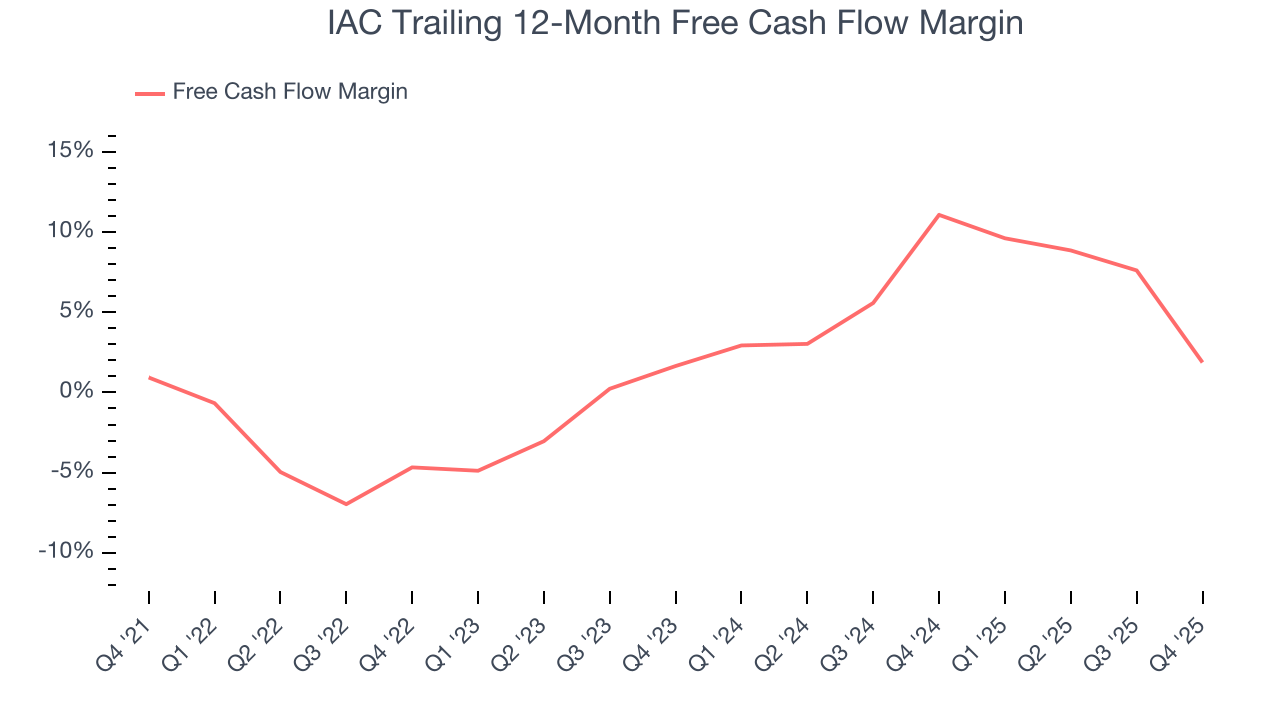

- Free Cash Flow Margin: 4.9%, down from 24.2% in the same quarter last year

- Market Capitalization: $2.87 billion

Company Overview

Originally known as InterActiveCorp and built through Barry Diller's strategic acquisitions since the 1990s, IAC (NASDAQ:IAC) operates a portfolio of category-leading digital businesses including Dotdash Meredith, Angi, and Care.com, focusing on digital publishing, home services, and caregiving platforms.

IAC's business model revolves around acquiring, developing, and sometimes spinning off digital businesses. The company's largest segment is Dotdash Meredith, formed when IAC's Dotdash acquired Meredith Corporation in 2021, creating one of America's largest digital and print publishers. This segment operates well-known brands like PEOPLE, Better Homes & Gardens, and Investopedia across entertainment, lifestyle, and health verticals, generating revenue through digital advertising, print subscriptions, and licensing.

Angi (formerly Angie's List), in which IAC holds a controlling stake, connects homeowners with service professionals across hundreds of categories. The platform offers multiple business models: an Ads and Leads segment where professionals pay for consumer connections, a Services segment where consumers pay directly through the platform for pre-priced offerings, and an International segment operating similar marketplaces in Europe and Canada.

Care.com, another key IAC business, facilitates connections between families and caregivers for children, seniors, pets, and homes. The platform offers consumer matching services, payment solutions for household employers, and enterprise solutions for companies providing care benefits to employees.

IAC's Search segment includes Ask Media Group, which operates websites like Ask.com and Reference.com that provide search services and content, generating revenue primarily through advertising. The company also maintains an Emerging & Other segment that includes businesses like Vivian Health (a healthcare professional job platform) and The Daily Beast (a news and opinion website).

Throughout its history, IAC has demonstrated a pattern of incubating businesses, growing them to scale, and then spinning them off as independent public companies when they reach maturity. Past spin-offs include Match Group (dating apps), Expedia (travel), and Vimeo (video software). This approach allows IAC to maintain a relatively asset-light structure while continuously evolving its portfolio of digital businesses.

4. Digital Media & Content Platforms

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

IAC's businesses face competition across multiple sectors: Dotdash Meredith competes with major digital publishers like Hearst, Condé Nast, and BuzzFeed; Angi faces competition from HomeAdvisor (which it now owns), Thumbtack, and Yelp in the home services market; while Care.com competes with UrbanSitter, Sittercity, and traditional caregiving agencies.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $2.39 billion in revenue over the past 12 months, IAC is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

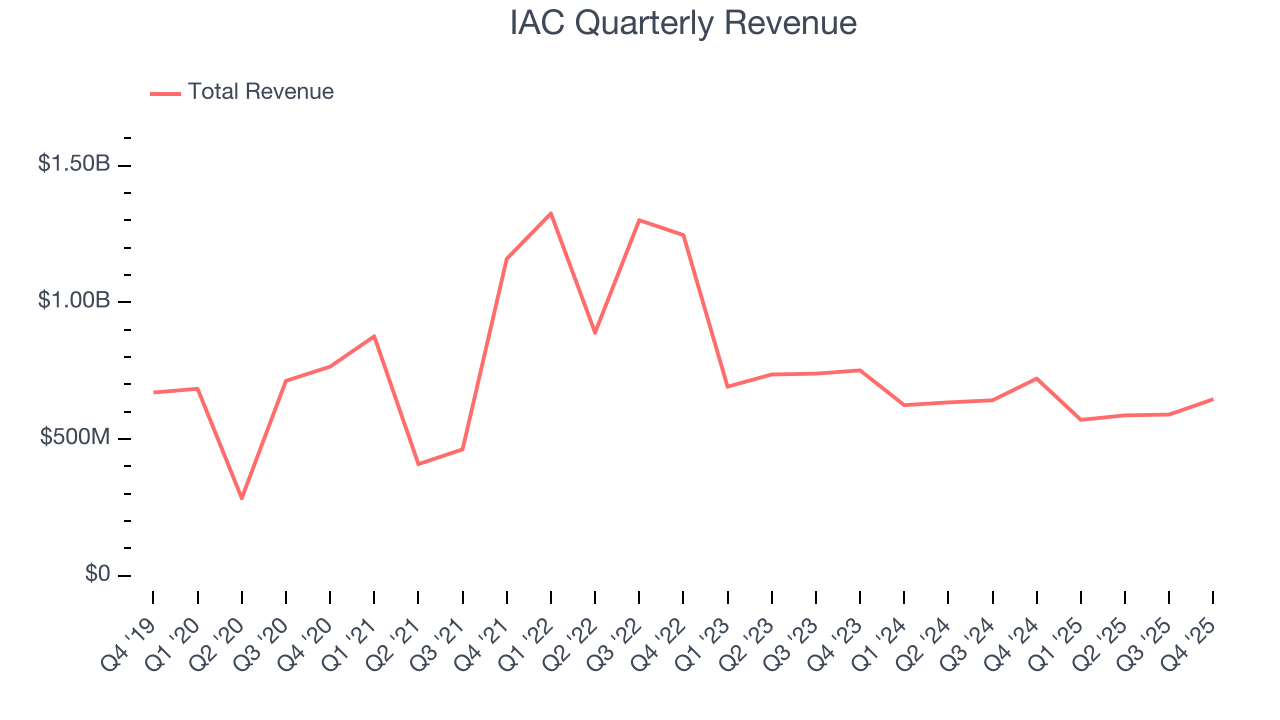

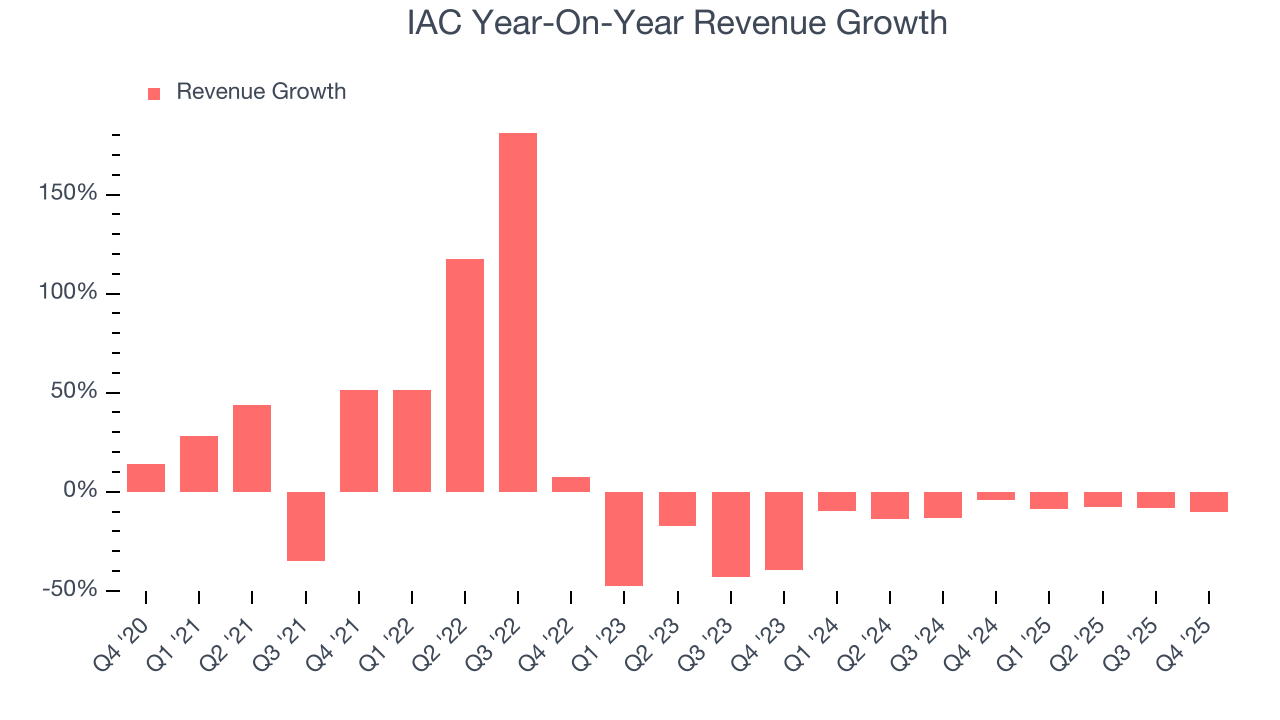

As you can see below, IAC struggled to increase demand as its $2.39 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a tough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. IAC’s recent performance shows its demand remained suppressed as its revenue has declined by 9.5% annually over the last two years.

This quarter, IAC’s revenue fell by 10.5% year on year to $646 million but beat Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to decline by 2.6% over the next 12 months. Although this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

6. Operating Margin

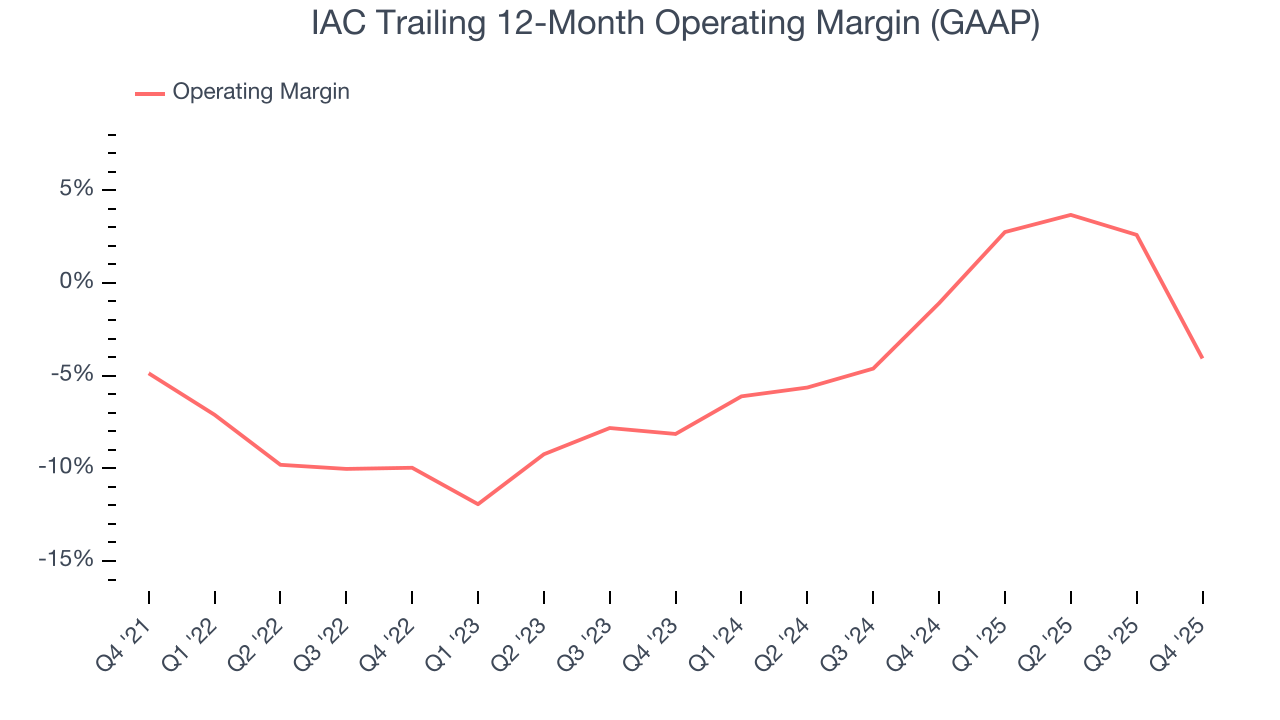

IAC’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging negative 6.3% over the last five years. Unprofitable business services companies that fail to improve their losses or grow sales rapidly deserve extra scrutiny. For the time being, it’s unclear if IAC’s business model is sustainable.

Looking at the trend in its profitability, IAC’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change.

This quarter, IAC generated a negative 17.5% operating margin. The company's consistent lack of profits raise a flag.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

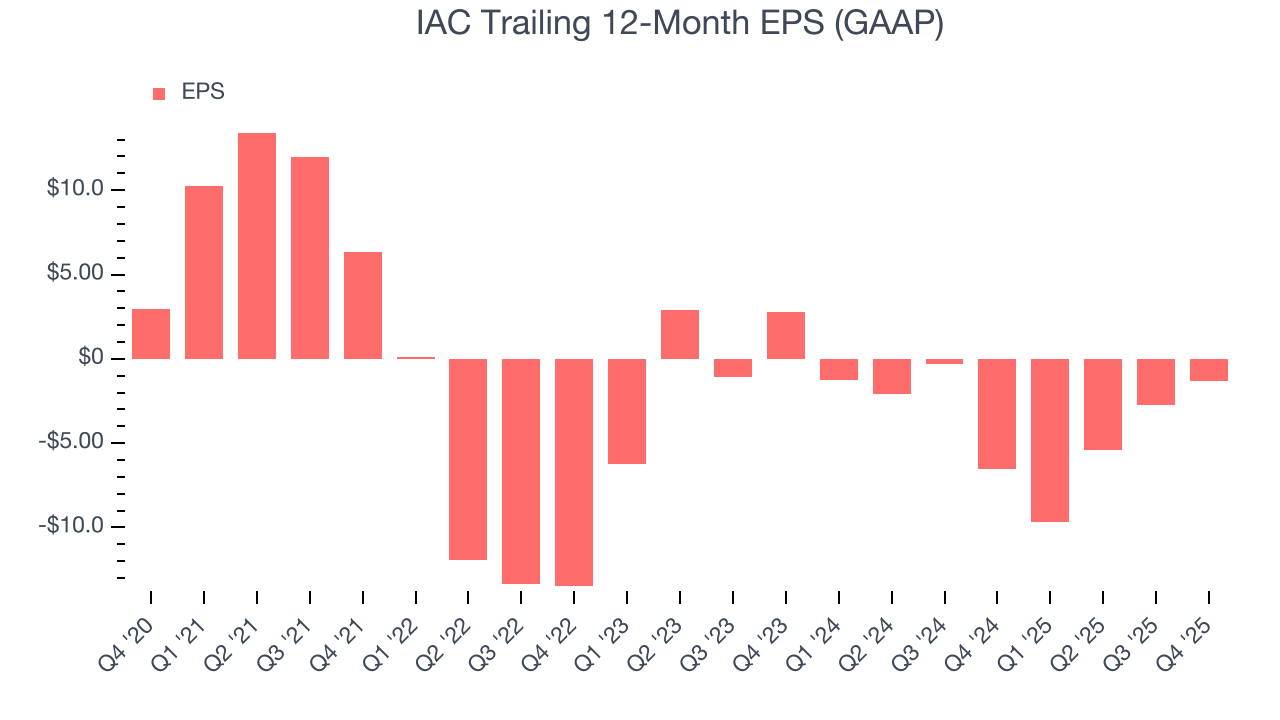

Sadly for IAC, its EPS declined by 19.6% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For IAC, its two-year annual EPS declines of 57.4% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, IAC reported EPS of negative $0.99, up from negative $2.39 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast IAC’s full-year EPS of negative $1.33 will flip to positive $0.59.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

IAC has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.2%, lousy for a business services business.

IAC’s free cash flow clocked in at $31.37 million in Q4, equivalent to a 4.9% margin. The company’s cash profitability regressed as it was 19.3 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

9. Return on Invested Capital (ROIC)

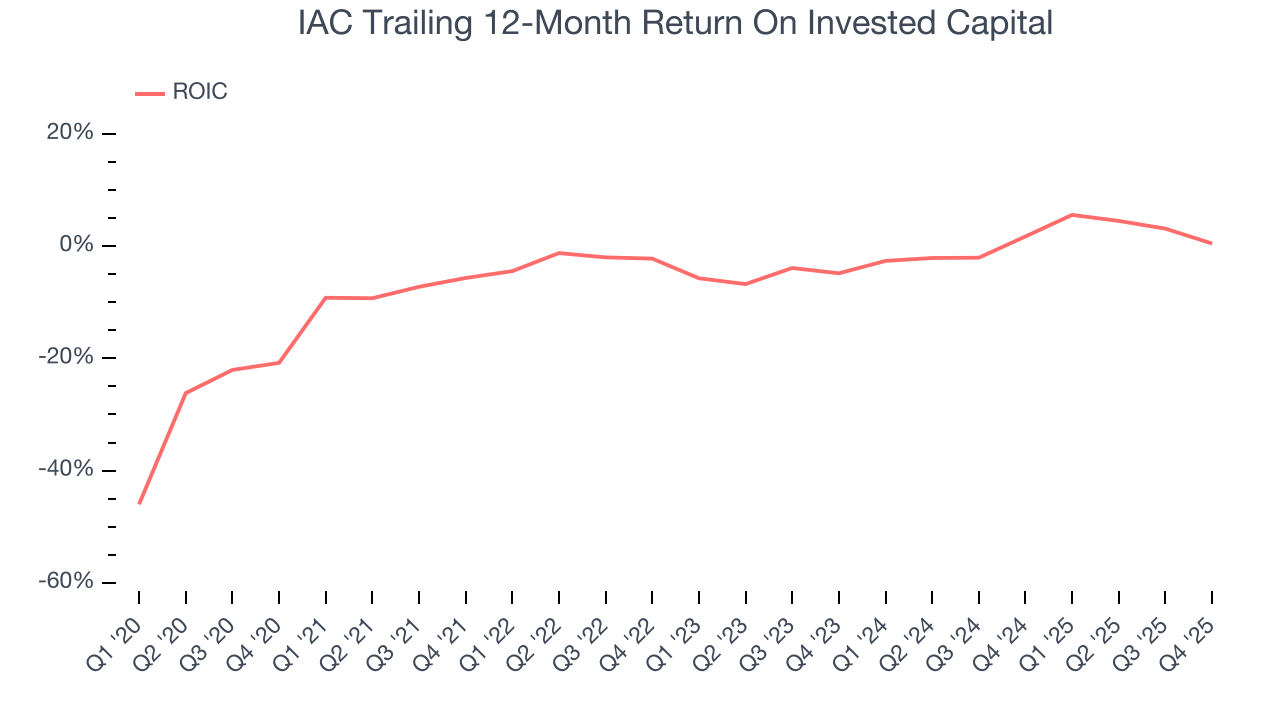

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

IAC’s five-year average ROIC was negative 2.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, IAC’s has increased over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

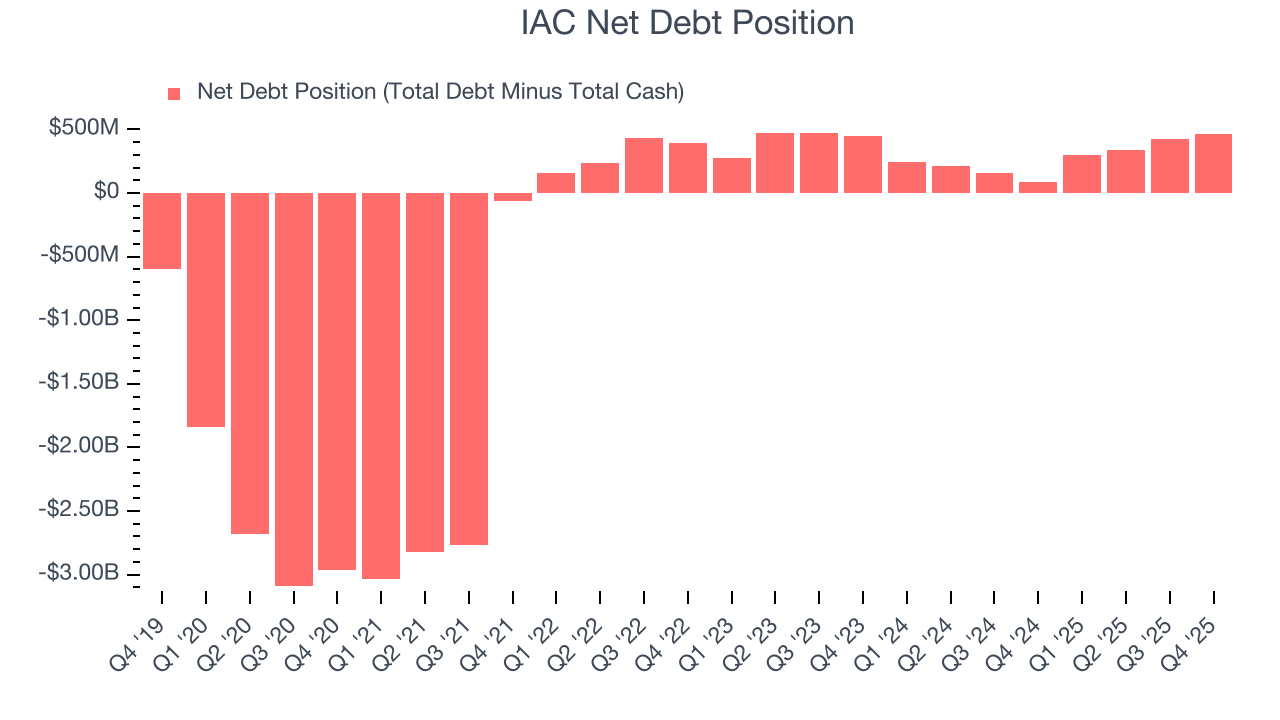

IAC reported $960.2 million of cash and $1.43 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $273 million of EBITDA over the last 12 months, we view IAC’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $29.05 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from IAC’s Q4 Results

It was good to see IAC narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a weaker quarter. The stock traded down 2.9% to $35.76 immediately following the results.

12. Is Now The Time To Buy IAC?

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in IAC.

IAC doesn’t pass our quality test. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

IAC’s P/E ratio based on the next 12 months is 23.6x. At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $46.25 on the company (compared to the current share price of $35.76).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.