NerdWallet (NRDS)

NerdWallet is an exciting business. Its exceptional revenue growth indicates it’s winning market share.― StockStory Analyst Team

1. News

2. Summary

Why We Like NerdWallet

Born from founder Tim Chen's frustration with the lack of transparent credit card information when helping his sister in 2009, NerdWallet (NASDAQ:NRDS) is a digital platform that provides financial guidance to help consumers and small businesses make smarter decisions about credit cards, loans, insurance, and other financial products.

- Annual revenue growth of 27.8% over the past five years was outstanding, reflecting market share gains this cycle

- Earnings growth has massively outpaced its peers over the last three years as its EPS has compounded at 38% annually

- The stock is a timely buy because it’s trading at a reasonable price relative to its growth prospects

NerdWallet is a top-tier company. The price seems reasonable in light of its quality, so this might be a favorable time to buy some shares.

Why Is Now The Time To Buy NerdWallet?

High Quality

Investable

Underperform

Why Is Now The Time To Buy NerdWallet?

At $10.94 per share, NerdWallet trades at 8x forward P/E. This multiple is cheap, and we think the stock is a bargain considering its quality characteristics.

Our eyes light up when companies with elite fundamentals trade at bargain prices because shareholders can benefit from both earnings growth and a positive re-rating - a powerful one-two punch.

3. NerdWallet (NRDS) Research Report: Q4 CY2025 Update

Financial guidance platform NerdWallet (NASDAQ:NRDS) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 22.6% year on year to $225.4 million. Its GAAP profit of $0.19 per share was 8.9% above analysts’ consensus estimates.

NerdWallet (NRDS) Q4 CY2025 Highlights:

- Revenue: $225.4 million vs analyst estimates of $183.5 million (22.6% year-on-year growth, 22.9% beat)

- Pre-tax Profit: $19.9 million (8.8% margin)

- EPS (GAAP): $0.19 vs analyst estimates of $0.17 (8.9% beat)

- Market Capitalization: $695.1 million

Company Overview

Born from founder Tim Chen's frustration with the lack of transparent credit card information when helping his sister in 2009, NerdWallet (NASDAQ:NRDS) is a digital platform that provides financial guidance to help consumers and small businesses make smarter decisions about credit cards, loans, insurance, and other financial products.

NerdWallet operates across eight financial verticals: credit cards, mortgages, insurance, small business products, personal loans, banking, investing, and student loans. The company's platform is built around three core offerings: Learn, Shop, and Manage. Through its "Learn" section, NerdWallet's editorial team of financial experts (called "Nerds") creates educational content including articles, calculators, videos, and podcasts that break down complex financial topics into understandable guidance.

The "Shop" component allows users to compare financial products side-by-side, filter options based on their needs, and access personalized recommendations. For example, a consumer looking for a new credit card can filter by rewards type, annual fee, or credit score requirements to find the best match for their situation. The "Manage" feature enables registered users to track their finances in one place, view spending patterns across accounts, and receive personalized suggestions for financial improvement.

NerdWallet monetizes its platform primarily through partnerships with over 400 financial services providers. When consumers use NerdWallet to research and select financial products, the company typically earns referral fees from partners when users apply for or obtain those products. This business model allows NerdWallet to offer its guidance free to consumers while generating revenue from financial institutions seeking access to informed consumers ready to transact.

Originally focused on the U.S. market, NerdWallet has expanded internationally to the United Kingdom, Canada, and Australia, with plans for further global expansion. The company's platform serves both individuals managing personal finances and small to mid-sized businesses seeking financial products and guidance for their operations.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

NerdWallet competes with traditional financial advisors and media outlets, online financial marketplaces like Bankrate, Credit Karma, and LendingTree (NASDAQ:TREE), as well as search engines like Google (NASDAQ:GOOGL) that attract financial services advertising dollars.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, NerdWallet’s revenue grew at an incredible 27.8% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. NerdWallet’s annualized revenue growth of 18.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, NerdWallet reported robust year-on-year revenue growth of 22.6%, and its $225.4 million of revenue topped Wall Street estimates by 22.9%.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, NerdWallet’s pre-tax profit margin has fallen by 7.8 percentage points, going from negative 9.9% to 8.2%. It has also expanded by 7.1 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q4, NerdWallet’s pre-tax profit margin was 8.8%. This result was 8.4 percentage points better than the same quarter last year.

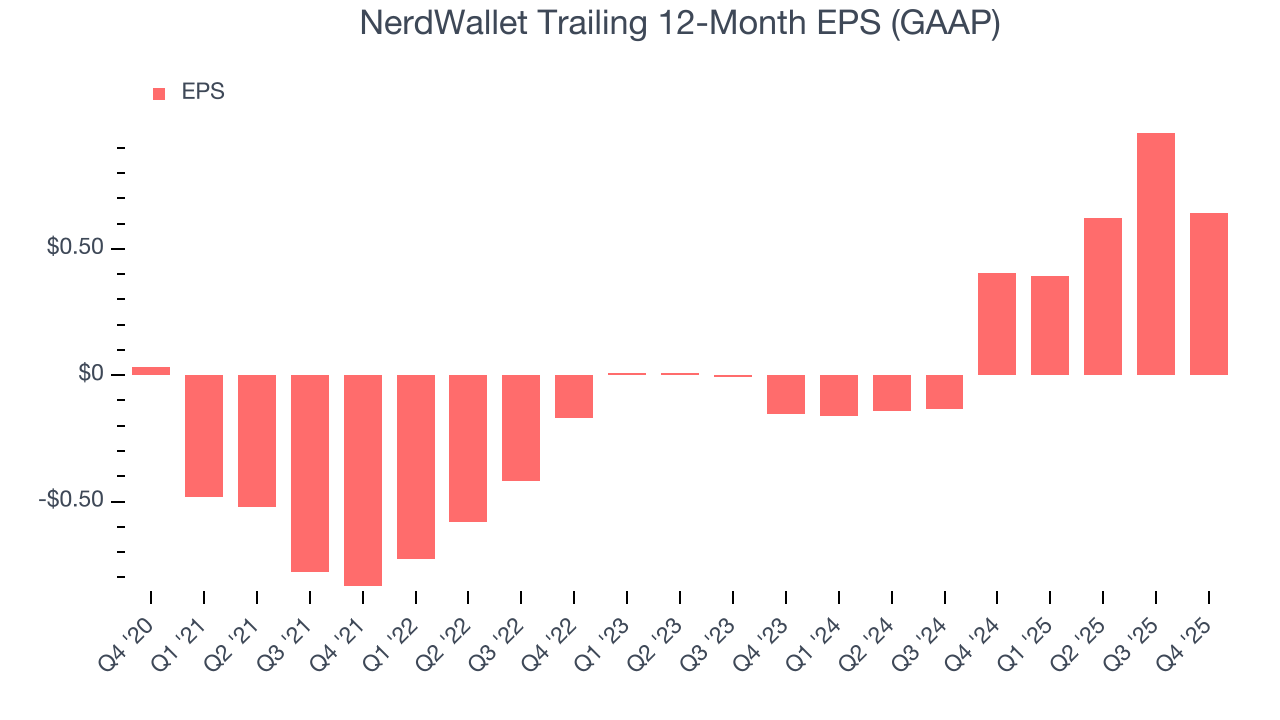

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

NerdWallet’s EPS grew at an astounding 82% compounded annual growth rate over the last five years, higher than its 27.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For NerdWallet, its two-year annual EPS growth of 148% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, NerdWallet reported EPS of $0.19, down from $0.51 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 8.9%. Over the next 12 months, Wall Street expects NerdWallet’s full-year EPS of $0.64 to grow 56.3%.

8. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, NerdWallet has averaged an ROE of negative 4.4%, a disappointing result relative to the majority of firms putting up 25%+. But we wouldn’t write off NerdWallet given its success in other measures of financial health.

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

NerdWallet has no debt, so leverage is not an issue here.

10. Key Takeaways from NerdWallet’s Q4 Results

We were impressed by how significantly NerdWallet blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The market seemed to be hoping for more, and the stock traded down 9.2% to $9.40 immediately following the results.

11. Is Now The Time To Buy NerdWallet?

Updated: March 9, 2026 at 12:45 AM EDT

Are you wondering whether to buy NerdWallet or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

NerdWallet is an amazing business ranking highly on our list. For starters, its revenue growth was exceptional over the last five years. And while its relatively low ROE suggests management has struggled to find compelling investment opportunities, its astounding EPS growth over the last three years shows its profits are trickling down to shareholders. On top of that, NerdWallet’s expanding pre-tax profit margin shows the business has become more efficient.

NerdWallet’s P/E ratio based on the next 12 months is 8.2x. Looking across the spectrum of financials businesses, NerdWallet’s fundamentals shine bright. We like the stock at this bargain price.

Wall Street analysts have a consensus one-year price target of $15.33 on the company (compared to the current share price of $11.10), implying they see 38.1% upside in buying NerdWallet in the short term.