Nutanix (NTNX)

Nutanix piques our interest. It’s not only a customer acquisition machine but also sports robust unit economics, a deadly combo.― StockStory Analyst Team

1. News

2. Summary

Why Nutanix Is Interesting

Originally pioneering hyperconverged infrastructure to break down traditional data center silos, Nutanix (NASDAQ:NTNX) provides a unified software platform that enables organizations to run applications and manage data across private, public, and hybrid cloud environments.

- Software is difficult to replicate at scale and results in a best-in-class gross margin of 87%

- Well-designed software integrates seamlessly with other workflows, enabling swift payback periods on marketing expenses and customer growth at scale

- On the other hand, its operating margin expanded by 5.6 percentage points over the last year as it scaled and became more efficient

Nutanix is close to becoming a high-quality business. If you like the story, the price looks fair.

Why Is Now The Time To Buy Nutanix?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Nutanix?

Nutanix’s stock price of $51.69 implies a valuation ratio of 5.2x forward price-to-sales. The current valuation is below that of most software companies, but this isn’t a bargain. Instead, the price is appropriate for the quality you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Nutanix (NTNX) Research Report: Q3 CY2025 Update

Hybrid multicloud computing company Nutanix (NASDAQ:NTNX) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 13.5% year on year to $670.6 million. Next quarter’s revenue guidance of $710 million underwhelmed, coming in 5.1% below analysts’ estimates. Its non-GAAP profit of $0.41 per share was in line with analysts’ consensus estimates.

Nutanix (NTNX) Q3 CY2025 Highlights:

- Revenue: $670.6 million vs analyst estimates of $676.7 million (13.5% year-on-year growth, 0.9% miss)

- Adjusted EPS: $0.41 vs analyst estimates of $0.41 (in line)

- Adjusted Operating Income: $131.8 million vs analyst estimates of $136.3 million (19.7% margin, 3.3% miss)

- Revenue Guidance for the full year is $2.84 billion at the midpoint, below analyst estimates of $2.93 billion

- Operating Margin: 7.4%, up from 4.6% in the same quarter last year

- Free Cash Flow Margin: 26%, down from 31.8% in the previous quarter

- Annual Recurring Revenue: $2.28 billion vs analyst estimates of $2.27 billion (17.6% year-on-year growth, 0.7% beat)

- Billings: $708.1 million at quarter end, up 19.7% year on year

- Market Capitalization: $13.98 billion

Company Overview

Originally pioneering hyperconverged infrastructure to break down traditional data center silos, Nutanix (NASDAQ:NTNX) provides a unified software platform that enables organizations to run applications and manage data across private, public, and hybrid cloud environments.

The Nutanix Cloud Platform serves as the foundation for an organization's hybrid multicloud strategy, allowing IT teams to create a consistent operating environment regardless of where workloads are deployed. This flexibility enables customers to run diverse workloads—from business-critical applications to modern containerized services and enterprise AI—on their infrastructure of choice, whether in data centers, edge locations, or public clouds like AWS, Azure, and Google Cloud.

The company's software combines compute, storage, networking, and virtualization capabilities into a single platform, eliminating the complexity of managing separate technology stacks. Nutanix's native hypervisor, AHV, provides virtualization for both traditional and cloud-native applications, while additional services like Nutanix Files, Objects, and Database Service deliver specialized data management capabilities. For enterprise AI initiatives, Nutanix offers GPT-in-a-Box, a full-stack solution designed for secure, on-premises AI deployment.

Revenue comes primarily through subscription-based licensing, typically spanning one to five years. Nutanix relies heavily on a network of channel partners and OEMs including Dell, HPE, Lenovo, and Cisco to reach customers. These partners not only resell Nutanix solutions but also integrate them with their hardware offerings, providing customers with multiple deployment options. This partner ecosystem extends to cloud providers, enabling Nutanix workloads to run seamlessly across public cloud environments.

4. Cloud Monitoring

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

Nutanix competes with virtualization and cloud infrastructure providers like VMware (owned by Broadcom), Microsoft, and Red Hat, public cloud platforms including AWS, Google Cloud, and Microsoft Azure, and traditional IT vendors such as Dell, HPE, NetApp, and Pure Storage that offer integrated systems and standalone storage products.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Nutanix grew its sales at a 14.9% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Nutanix.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Nutanix’s annualized revenue growth of 16.1% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Nutanix’s revenue grew by 13.5% year on year to $670.6 million but fell short of Wall Street’s estimates. Company management is currently guiding for a 8.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

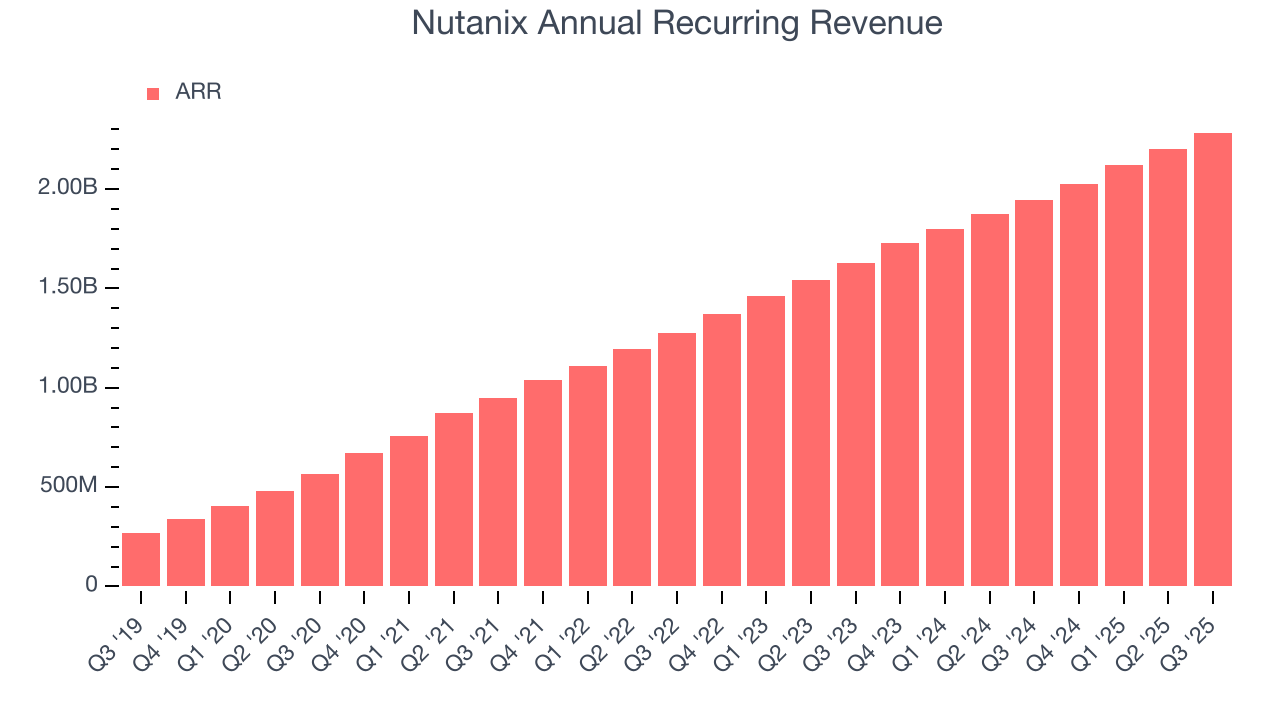

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Nutanix’s ARR punched in at $2.28 billion in Q3, and over the last four quarters, its growth was solid as it averaged 17.6% year-on-year increases. This performance aligned with its total sales growth, reflecting the company’s ability to maintain strong customer relationships and secure longer-term commitments. Its growth also contributes positively to Nutanix’s predictability and valuation, as investors typically prefer businesses with recurring revenue.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Nutanix is extremely efficient at acquiring new customers, and its CAC payback period checked in at 18.8 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Nutanix more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

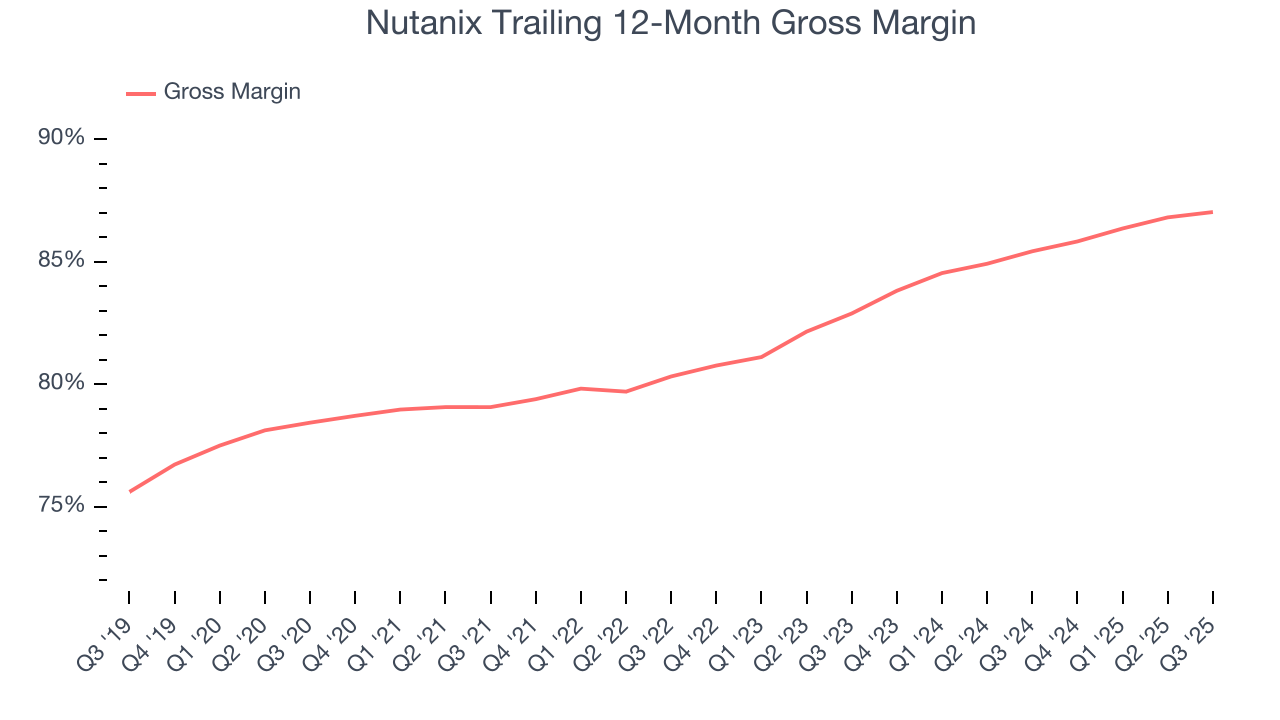

8. Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Nutanix’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 87% gross margin over the last year. That means Nutanix only paid its providers $12.97 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Nutanix has seen gross margins improve by 4.1 percentage points over the last 2 year, which is very good in the software space.

In Q3, Nutanix produced a 87% gross profit margin, in line with the same quarter last year. On a wider time horizon, Nutanix’s full-year margin has been trending up over the past 12 months, increasing by 1.6 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

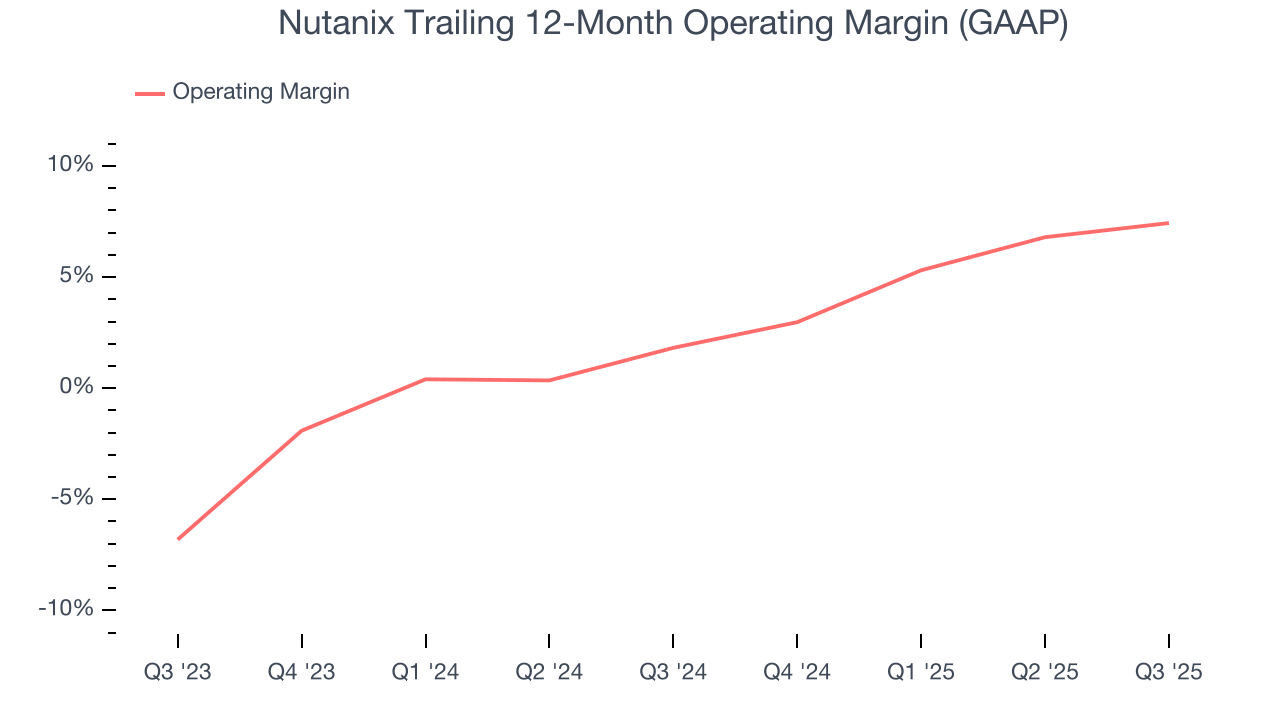

9. Operating Margin

Nutanix has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 7.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Nutanix’s operating margin rose by 5.6 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q3, Nutanix generated an operating margin profit margin of 7.4%, up 2.7 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

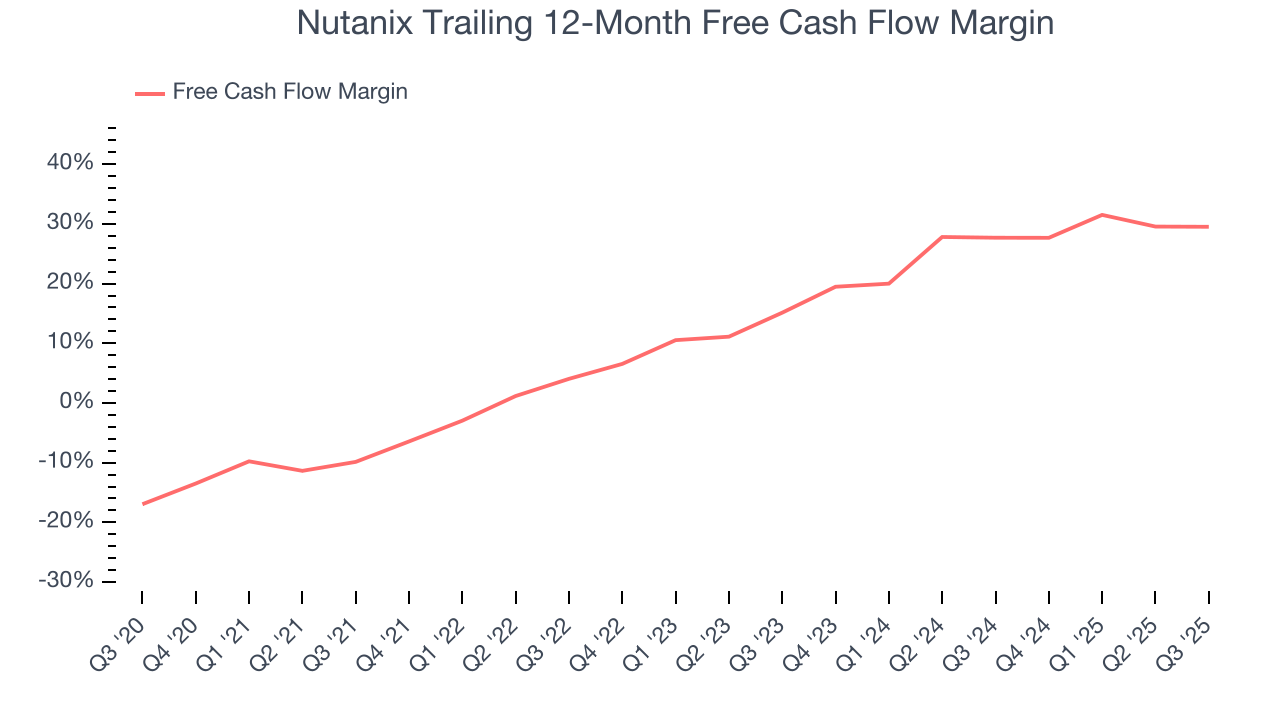

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Nutanix has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 29.5% over the last year, quite impressive for a software business.

Nutanix’s free cash flow clocked in at $174.5 million in Q3, equivalent to a 26% margin. This cash profitability was in line with the comparable period last year but below its one-year average. We wouldn’t read too much into it because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Nutanix’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 29.5% for the last 12 months will decrease to 28.9%.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

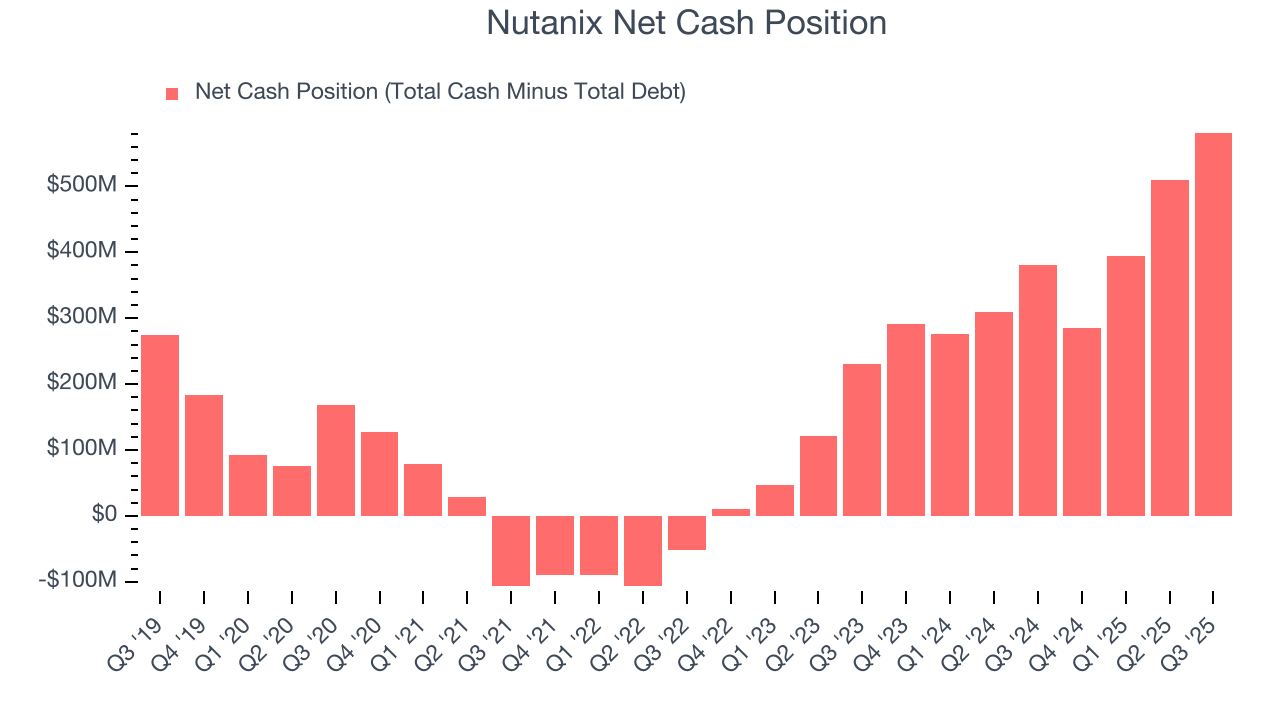

Nutanix is a profitable, well-capitalized company with $2.06 billion of cash and $1.48 billion of debt on its balance sheet. This $581.6 million net cash position is 4.2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Nutanix’s Q3 Results

It was good to see Nutanix narrowly top analysts’ annual recurring revenue expectations this quarter. On the other hand, its full-year revenue guidance missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $51.69 immediately after reporting.

13. Is Now The Time To Buy Nutanix?

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Nutanix, you should also grasp the company’s longer-term business quality and valuation.

We think Nutanix is a good business. Although its revenue growth was a little slower over the last five years and analysts expect growth to slow over the next 12 months, its admirable gross margin indicates excellent unit economics. And while its expanding operating margin shows it’s becoming more efficient at building and selling its software, its efficient sales strategy allows it to target and onboard new users at scale.

Nutanix’s price-to-sales ratio based on the next 12 months is 5.2x. When scanning the software space, Nutanix trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $70.70 on the company (compared to the current share price of $51.69), implying they see 36.8% upside in buying Nutanix in the short term.