Ocular Therapeutix (OCUL)

Ocular Therapeutix is in for a bumpy ride. Its sales have recently flopped and its historical cash burn means it has few resources to reignite growth.― StockStory Analyst Team

1. News

2. Summary

Why We Think Ocular Therapeutix Will Underperform

Pioneering a drug delivery platform that can eliminate the need for monthly eye injections, Ocular Therapeutix (NASDAQ:OCUL) develops sustained-release treatments for eye diseases using its proprietary ELUTYX bioresorbable hydrogel technology that gradually releases medication.

- Persistent adjusted operating margin losses suggest the business manages its expenses poorly

- Increased cash burn over the last five years raises questions about the return timeline for its investments

- Limited cash reserves may force the company to seek unfavorable financing terms that could dilute shareholders

Ocular Therapeutix doesn’t measure up to our expectations. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Ocular Therapeutix

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Ocular Therapeutix

Ocular Therapeutix’s stock price of $8.58 implies a valuation ratio of 26.4x forward price-to-sales. The market typically values companies like Ocular Therapeutix based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

It’s better to invest in high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Ocular Therapeutix (OCUL) Research Report: Q4 CY2025 Update

Ophthalmology biopharmaceutical company Ocular Therapeutix (NASDAQ:OCUL) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 22.4% year on year to $13.25 million. Its non-GAAP loss of $0.29 per share was 13.9% above analysts’ consensus estimates.

Ocular Therapeutix (OCUL) Q4 CY2025 Highlights:

- Revenue: $13.25 million vs analyst estimates of $14.89 million (22.4% year-on-year decline, 11% miss)

- Adjusted EPS: -$0.29 vs analyst estimates of -$0.34 (13.9% beat)

- Adjusted EBITDA: -$68.51 million (-517% margin, 38.1% year-on-year decline)

- Operating Margin: -526%, down from -296% in the same quarter last year

- Free Cash Flow was -$57.09 million compared to -$39.63 million in the same quarter last year

- Market Capitalization: $1.82 billion

Company Overview

Pioneering a drug delivery platform that can eliminate the need for monthly eye injections, Ocular Therapeutix (NASDAQ:OCUL) develops sustained-release treatments for eye diseases using its proprietary ELUTYX bioresorbable hydrogel technology that gradually releases medication.

The company's hydrogel technology works by incorporating therapeutic agents into a biodegradable polymer matrix that slowly dissolves in the eye's natural fluid, providing controlled drug release over extended periods. This approach addresses a critical challenge in ophthalmology: maintaining therapeutic drug levels in the eye while reducing the burden of frequent treatments.

Ocular Therapeutix's lead product candidate, AXPAXLI (axitinib intravitreal hydrogel), aims to treat wet age-related macular degeneration—a leading cause of vision loss among older adults. Currently in Phase 3 clinical trials, AXPAXLI could potentially offer a six-month treatment alternative to the monthly injections typically required with current therapies. The company is also developing PAXTRAVA for glaucoma and commercializing DEXTENZA, an FDA-approved insert that releases dexamethasone to treat post-surgical inflammation and ocular itching from allergic conjunctivitis.

For physicians, these technologies provide more predictable drug delivery and potentially better patient outcomes. For patients, particularly elderly ones who may struggle with travel or adherence to frequent treatment schedules, the extended-release formulations could significantly reduce treatment burden. The company generates revenue primarily through sales of DEXTENZA to ambulatory surgery centers and hospital outpatient departments, while advancing its pipeline of candidates that could address additional eye conditions including diabetic retinopathy.

4. Specialty Pharmaceuticals

The specialty pharmaceutical industry relies on a high-cost, high-reward business model, driven by substantial investments in research and development to create innovative, patent-protected drugs for niche diseases. Successful products can generate significant revenue streams over their patent life, and the larger a roster of niche drugs, the stronger a moat a company enjoys. However, the business model is inherently risky, with high failure rates during clinical trials, lengthy regulatory approval processes, and competition from generic and biosimilar manufacturers once patents expire. These challenges, combined with scrutiny over drug pricing, create a complex operating environment. Looking ahead, the industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Ocular Therapeutix competes with large ophthalmology companies like Regeneron (NASDAQ:REGN) and Roche (OTCQX:RHHBY), whose Eylea and Lucentis dominate the wet AMD market. In the glaucoma space, it faces competition from Allergan (now part of AbbVie, NYSE:ABBV) with Durysta, while its DEXTENZA product competes with corticosteroid eye drops from various pharmaceutical manufacturers.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

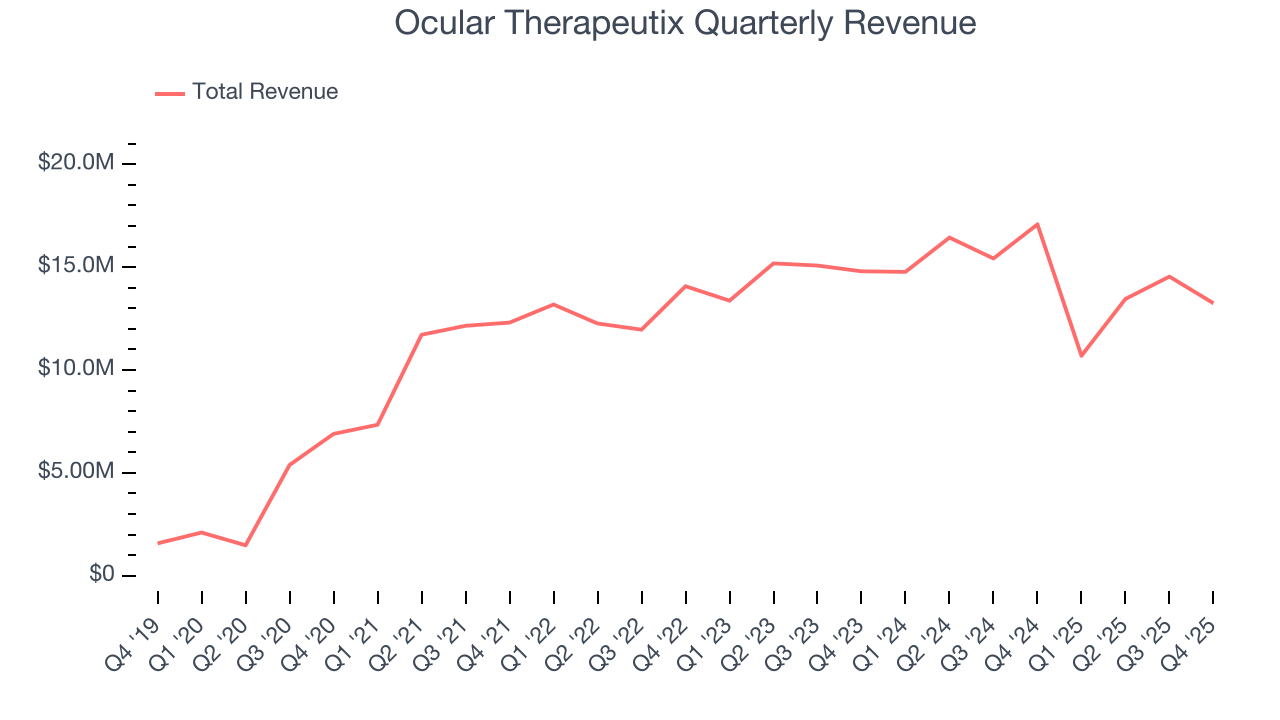

With just $51.95 million in revenue over the past 12 months, Ocular Therapeutix is a tiny company in an industry where scale matters. This makes it difficult to succeed because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Ocular Therapeutix’s 26.8% annualized revenue growth over the last five years was exceptional. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Ocular Therapeutix’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 5.7% over the last two years.

This quarter, Ocular Therapeutix missed Wall Street’s estimates and reported a rather uninspiring 22.4% year-on-year revenue decline, generating $13.25 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

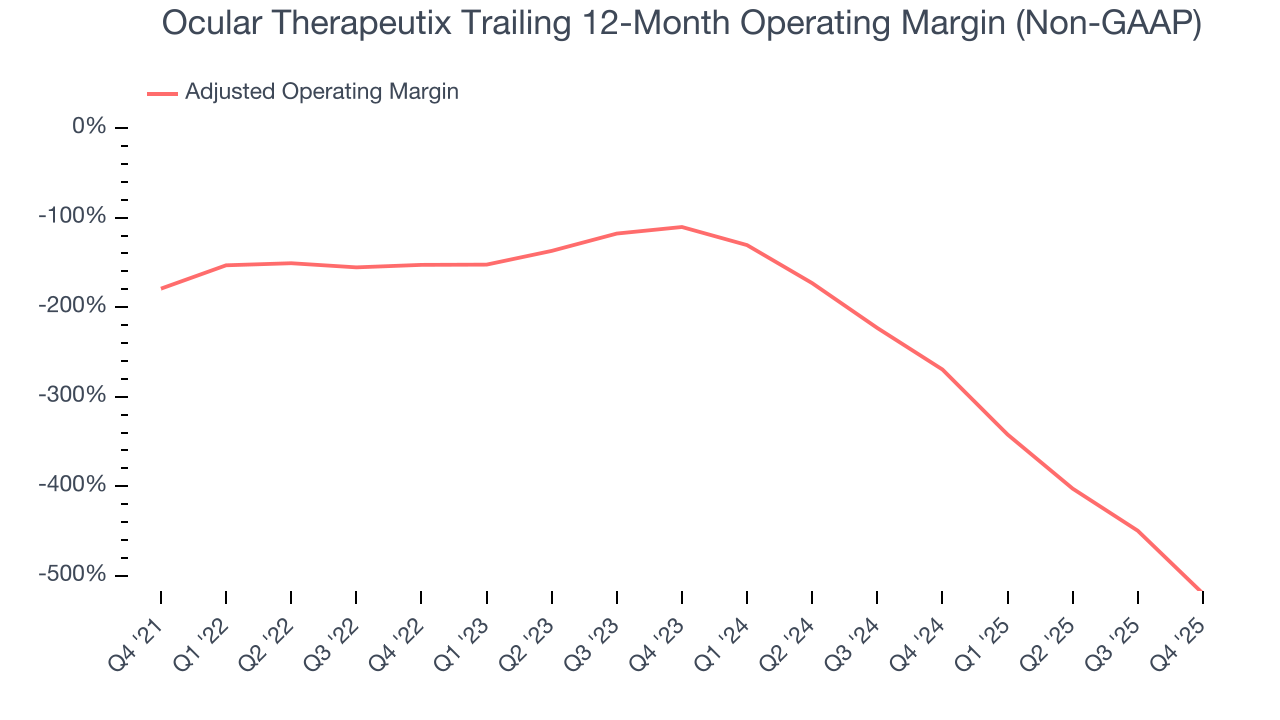

7. Adjusted Operating Margin

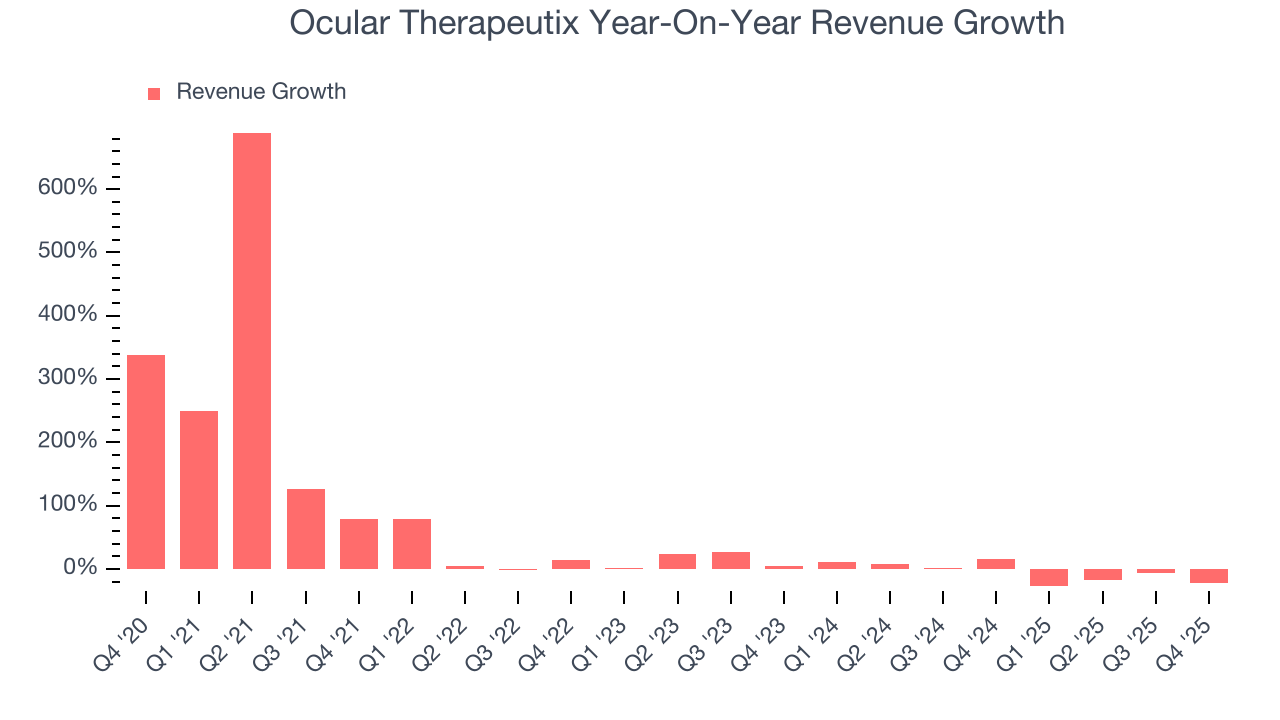

Ocular Therapeutix’s high expenses have contributed to an average adjusted operating margin of negative 246% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Ocular Therapeutix’s adjusted operating margin decreased significantly over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 409.3 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Ocular Therapeutix generated a negative 526% adjusted operating margin.

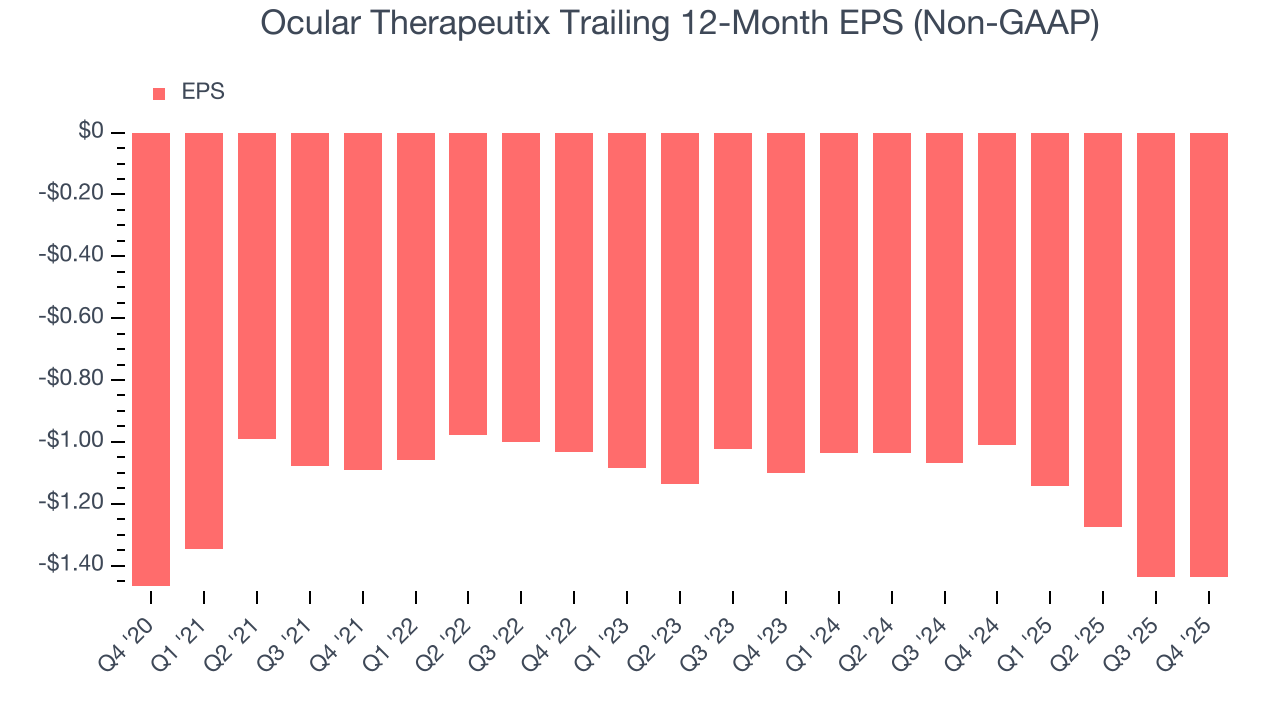

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Ocular Therapeutix’s full-year EPS was flat over the last five years. This performance was underwhelming across the board.

In Q4, Ocular Therapeutix reported adjusted EPS of negative $0.29, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Ocular Therapeutix to perform poorly. Analysts forecast its full-year EPS of negative $1.44 will tumble to negative $1.50.

9. Cash Is King

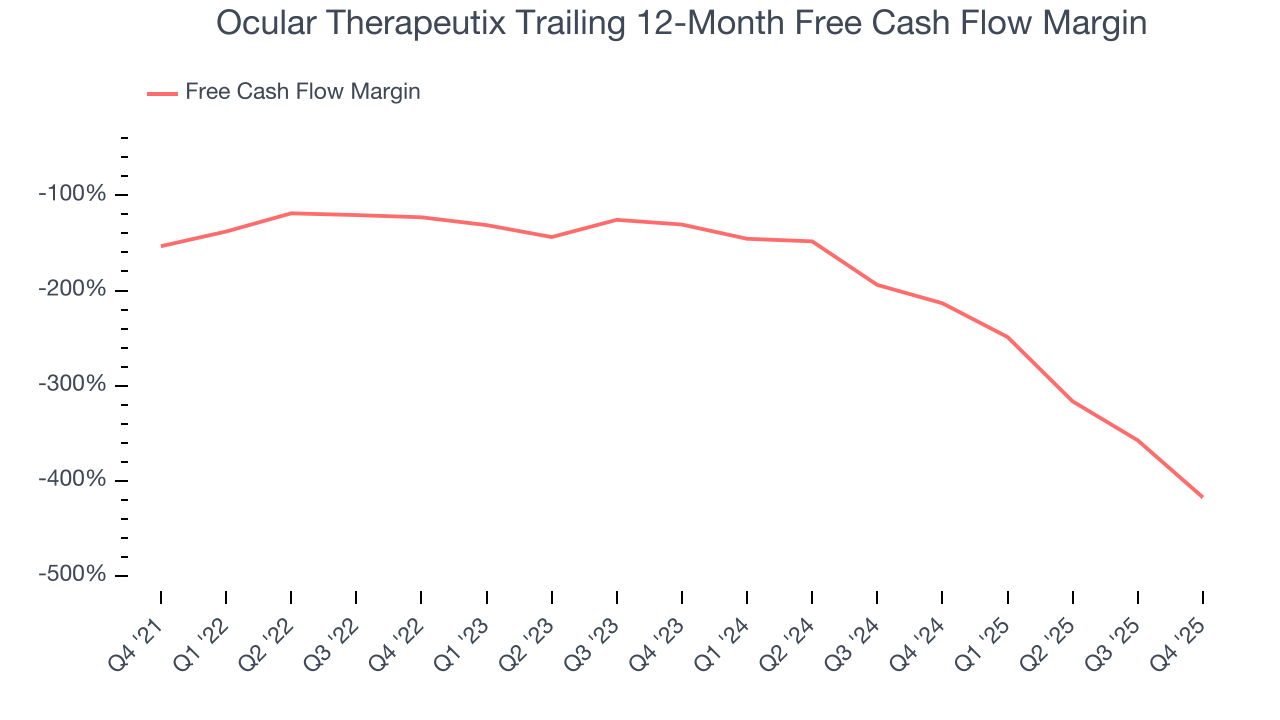

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Ocular Therapeutix’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 208%, meaning it lit $207.79 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Ocular Therapeutix’s margin dropped meaningfully during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Ocular Therapeutix burned through $57.09 million of cash in Q4, equivalent to a negative 431% margin. The company’s cash burn was similar to its $39.63 million of lost cash in the same quarter last year.

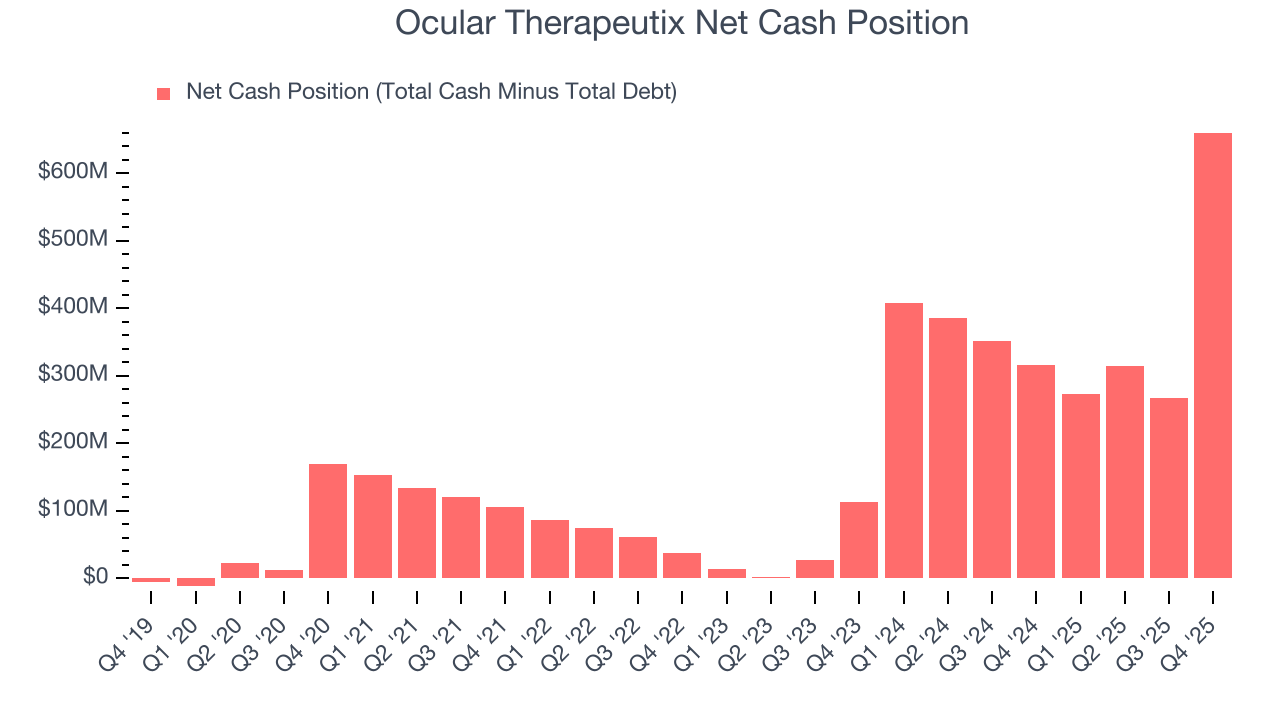

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Ocular Therapeutix is a well-capitalized company with $737.1 million of cash and $76.97 million of debt on its balance sheet. This $660.1 million net cash position is 36.2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Ocular Therapeutix’s Q4 Results

It was good to see Ocular Therapeutix beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed. Overall, this was a weaker quarter. The stock remained flat at $8.96 immediately after reporting.

12. Is Now The Time To Buy Ocular Therapeutix?

Updated: February 5, 2026 at 4:06 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We see the value of companies making people healthier, but in the case of Ocular Therapeutix, we’re out. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its declining adjusted operating margin shows the business has become less efficient. On top of that, the company’s cash profitability fell over the last five years.

Ocular Therapeutix’s forward price-to-sales ratio is 36.7x. The market typically values companies like Ocular Therapeutix based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $24.58 on the company (compared to the current share price of $8.96).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.