QuidelOrtho (QDEL)

QuidelOrtho is in for a bumpy ride. Its falling revenue and negative returns on capital suggest it’s destroying value as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think QuidelOrtho Will Underperform

Born from the 2022 merger of Quidel and Ortho Clinical Diagnostics, QuidelOrtho (NASDAQ:QDEL) develops and manufactures diagnostic testing solutions for healthcare providers, from rapid point-of-care tests to complex laboratory instruments and systems.

- Sales over the last five years were less profitable as its earnings per share fell by 25.3% annually while its revenue was flat

- Negative returns on capital show management lost money while trying to expand the business, and its shrinking returns suggest its past profit sources are losing steam

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 6.8% annually over the last two years

QuidelOrtho doesn’t satisfy our quality benchmarks. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than QuidelOrtho

High Quality

Investable

Underperform

Why There Are Better Opportunities Than QuidelOrtho

QuidelOrtho is trading at $28.10 per share, or 14.6x forward P/E. QuidelOrtho’s valuation may seem like a bargain, especially when stacked up against other healthcare companies. We remind you that you often get what you pay for, though.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. QuidelOrtho (QDEL) Research Report: Q3 CY2025 Update

Healthcare diagnostics company QuidelOrtho (NASDAQ:QDEL) beat Wall Street’s revenue expectations in Q3 CY2025, but sales fell by 3.7% year on year to $699.9 million. The company expects the full year’s revenue to be around $2.71 billion, close to analysts’ estimates. Its non-GAAP profit of $0.80 per share was 71.6% above analysts’ consensus estimates.

QuidelOrtho (QDEL) Q3 CY2025 Highlights:

- Revenue: $699.9 million vs analyst estimates of $665.4 million (3.7% year-on-year decline, 5.2% beat)

- Adjusted EPS: $0.80 vs analyst estimates of $0.47 (71.6% beat)

- Adjusted EBITDA: $177.1 million vs analyst estimates of $139.5 million (25.3% margin, 27% beat)

- The company slightly lifted its revenue guidance for the full year to $2.71 billion at the midpoint from $2.71 billion

- Management lowered its full-year Adjusted EPS guidance to $2.08 at the midpoint, a 10.6% decrease

- EBITDA guidance for the full year is $595 million at the midpoint, in line with analyst expectations

- Operating Margin: -101%, down from 2.1% in the same quarter last year

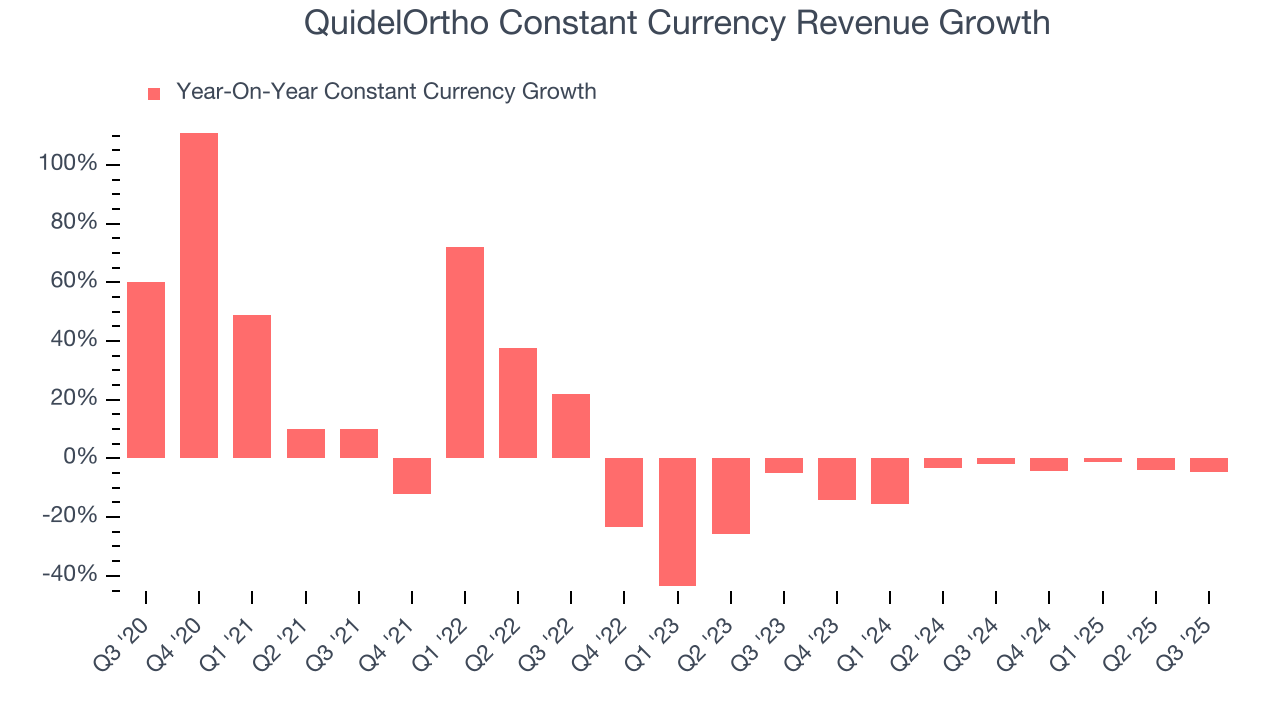

- Constant Currency Revenue fell 4.6% year on year (-1.8% in the same quarter last year)

- Market Capitalization: $1.84 billion

Company Overview

Born from the 2022 merger of Quidel and Ortho Clinical Diagnostics, QuidelOrtho (NASDAQ:QDEL) develops and manufactures diagnostic testing solutions for healthcare providers, from rapid point-of-care tests to complex laboratory instruments and systems.

QuidelOrtho operates across the entire diagnostic testing spectrum through four main business units: Labs, Molecular Diagnostics, Point of Care, and Transfusion Medicine. The company's products range from clinical chemistry analyzers that measure chemicals in bodily fluids to immunoassay systems that detect proteins related to disease, and from rapid tests that provide results in minutes to sophisticated molecular diagnostic platforms.

The company's customers include hospitals, clinical laboratories, physician offices, urgent care clinics, universities, retail clinics, pharmacies, and blood banks across more than 130 countries. During the COVID-19 pandemic, QuidelOrtho expanded its reach directly to consumers with at-home tests, while also serving school districts and health departments.

A physician might use QuidelOrtho's Sofia rapid test to diagnose a patient with influenza in minutes, allowing for immediate treatment decisions. Meanwhile, a hospital laboratory might run hundreds of patient samples daily on the company's Vitros systems to measure everything from cholesterol levels to thyroid function.

QuidelOrtho employs a "razor/razor blade" business model for much of its revenue, placing instruments with customers under long-term contracts that require the ongoing purchase of proprietary reagents and consumables. This creates a recurring revenue stream, as the instruments are closed systems that only work with QuidelOrtho's supplies.

The company maintains manufacturing facilities in the United States and United Kingdom, with a global network of sales centers, administrative offices, and warehouses. QuidelOrtho complements its product offerings with comprehensive services, including remote monitoring, technical support, and consulting services that help laboratories improve workflow and productivity.

QuidelOrtho's business is subject to seasonal fluctuations, particularly for its respiratory products, which see higher demand during fall and winter cold and flu seasons. The company must navigate complex regulatory requirements across global markets, including FDA clearances in the US and various international approvals.

4. Medical Devices & Supplies - Imaging, Diagnostics

The medical devices and supplies industry, particularly those specializing in imaging and diagnostics, operates with a comparatively stable yet capital-intensive business model. Companies in this space benefit from consistent demand driven by the essential nature of diagnostic tools in patient care, as well as recurring revenue streams from consumables, service contracts, and equipment maintenance. However, the industry faces challenges such as significant upfront development costs, stringent regulatory requirements, and pricing pressures from hospitals and healthcare systems, which are increasingly focused on cost containment. Looking ahead, the industry should enjoy tailwinds from advancements in technology, including the integration of artificial intelligence to enhance diagnostic accuracy and workflow efficiency, as well as rising demand for imaging solutions driven by aging populations. On the other hand, headwinds could arise from a rethinking of healthcare costs potentially resulting in reimbursement cuts and slower capital equipment purchasing. Additionally, cybersecurity concerns surrounding connected medical devices could introduce new risks and complexities for manufacturers.

QuidelOrtho competes with several major players in the diagnostic testing market, including Abbott Laboratories (NYSE:ABT), Roche (OTC:RHHBY), Thermo Fisher Scientific (NYSE:TMO), Danaher (NYSE:DHR), and Siemens Healthineers (OTC:SMMNY).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $2.71 billion in revenue over the past 12 months, QuidelOrtho has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

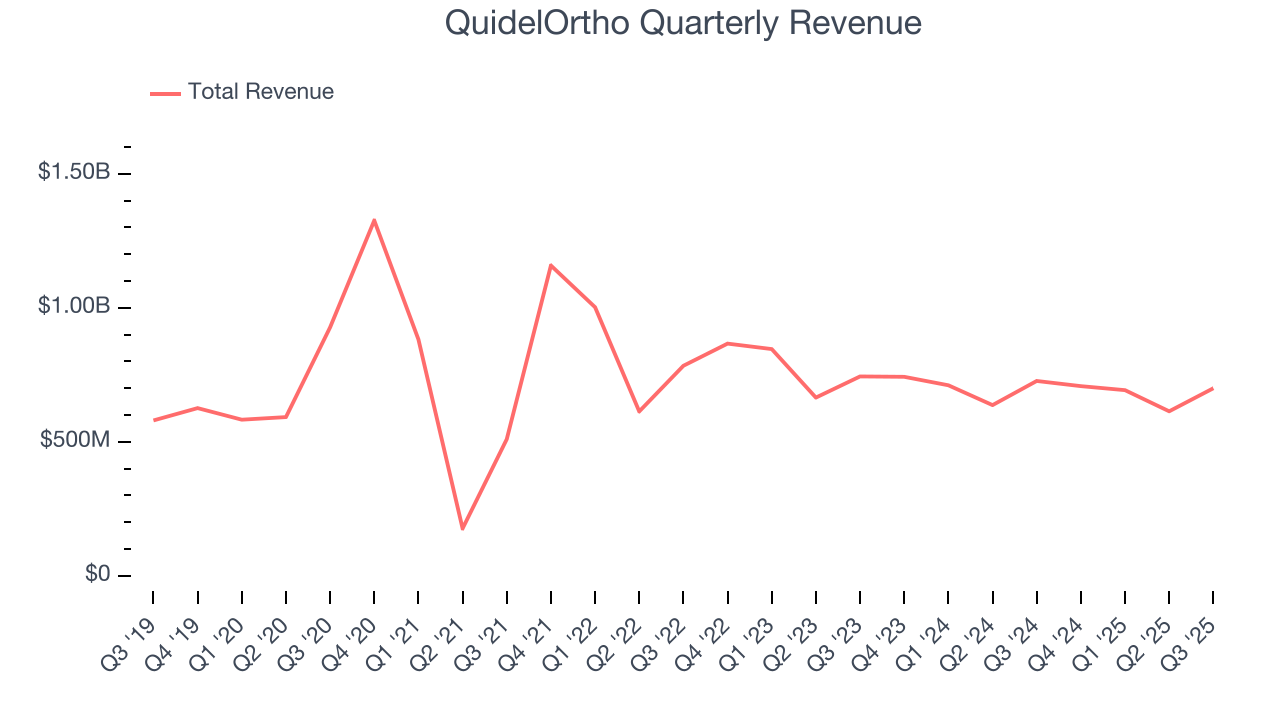

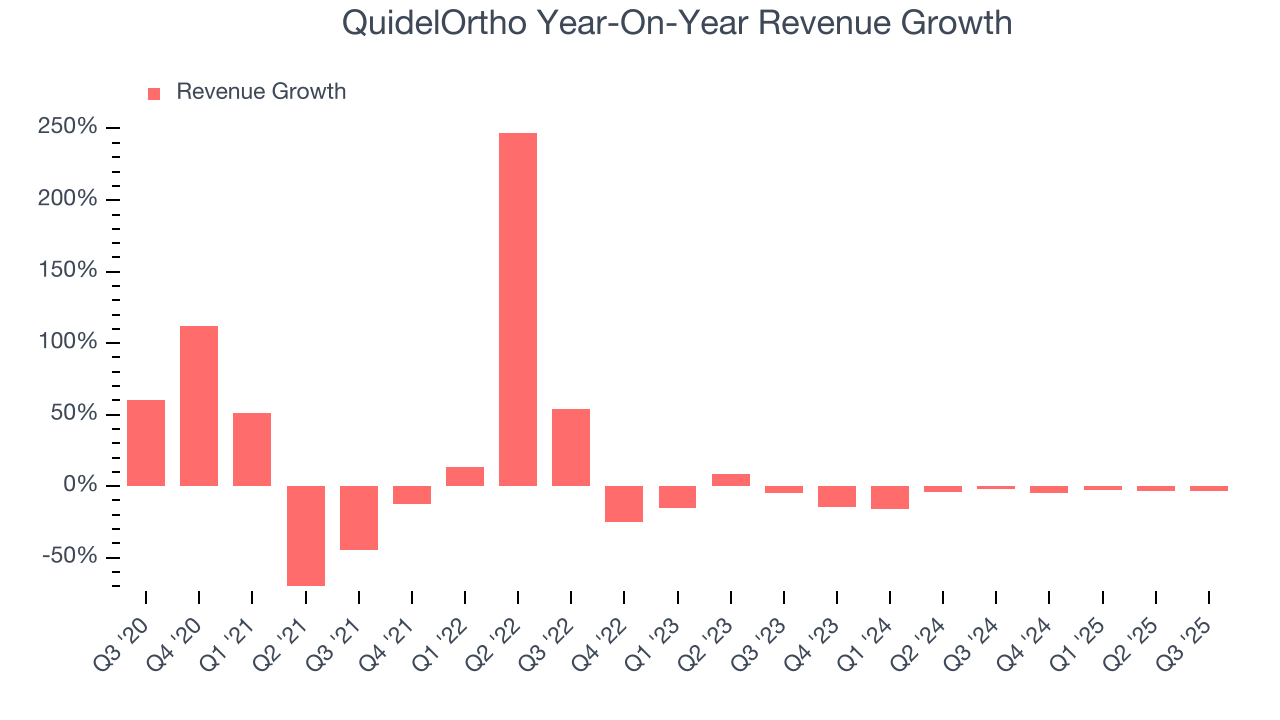

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, QuidelOrtho struggled to consistently increase demand as its $2.71 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. QuidelOrtho’s recent performance shows its demand remained suppressed as its revenue has declined by 6.8% annually over the last two years.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 6.1% year-on-year declines. Because this number aligns with its normal revenue growth, we can see that QuidelOrtho has properly hedged its foreign currency exposure.

This quarter, QuidelOrtho’s revenue fell by 3.7% year on year to $699.9 million but beat Wall Street’s estimates by 5.2%.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

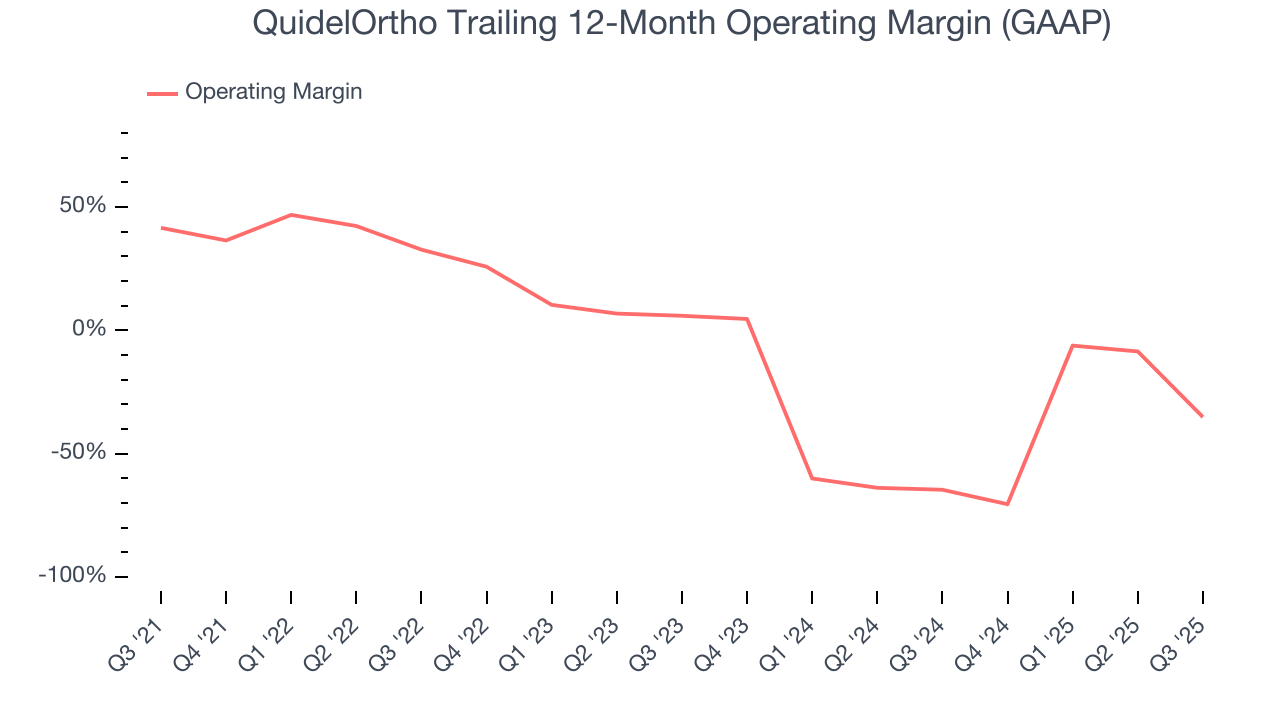

QuidelOrtho’s high expenses have contributed to an average operating margin of negative 1.5% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, QuidelOrtho’s operating margin decreased by 76.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 41.1 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

QuidelOrtho’s operating margin was negative 101% this quarter. The company's consistent lack of profits raise a flag.

8. Earnings Per Share

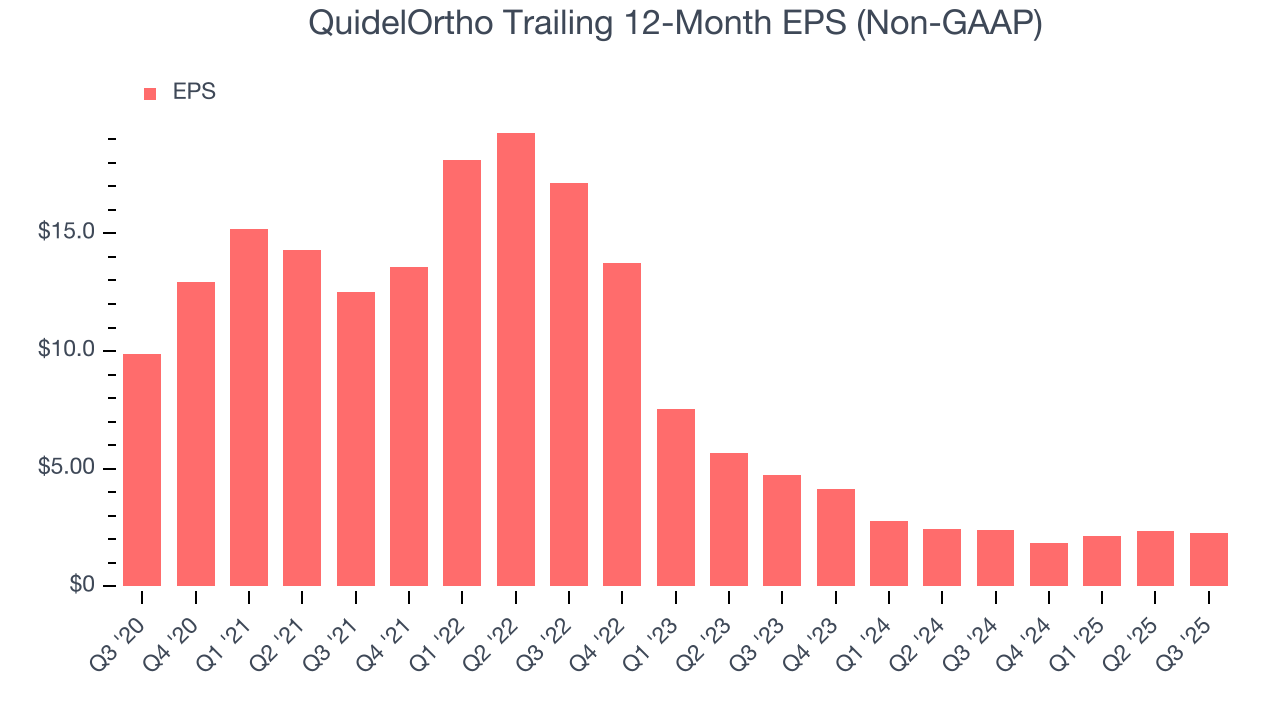

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for QuidelOrtho, its EPS declined by 25.3% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

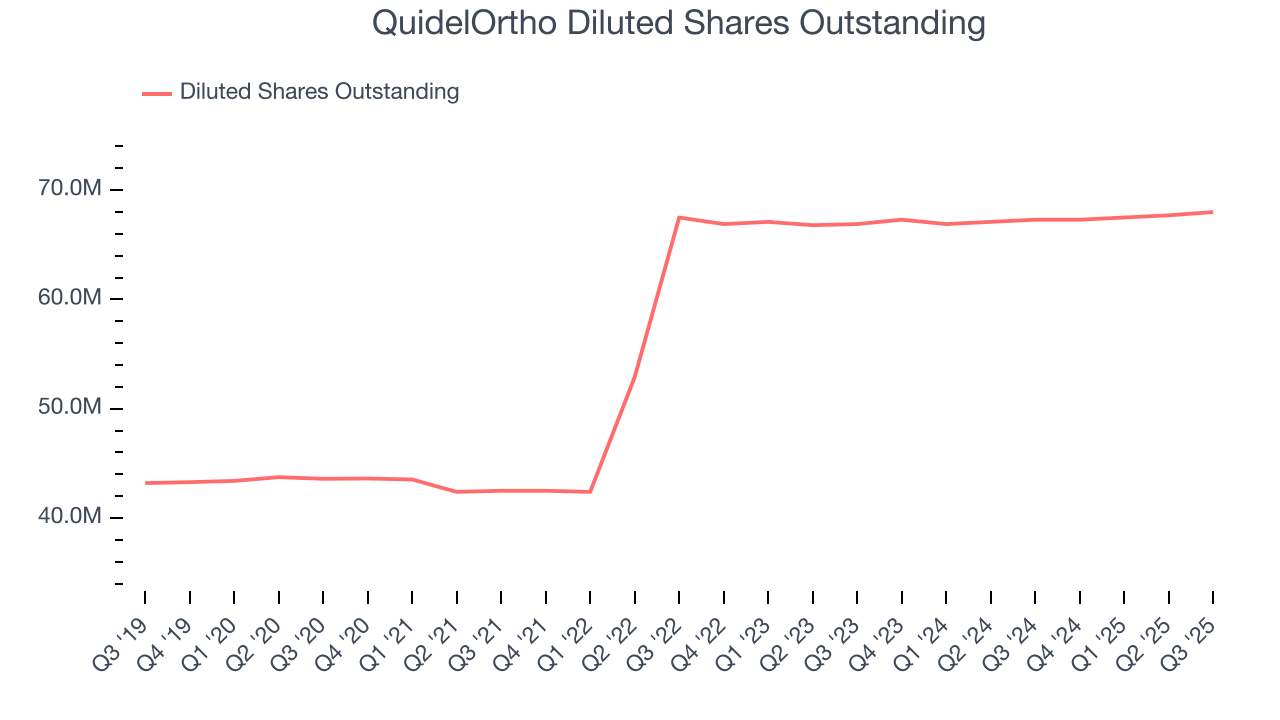

Diving into the nuances of QuidelOrtho’s earnings can give us a better understanding of its performance. As we mentioned earlier, QuidelOrtho’s operating margin declined by 76.7 percentage points over the last five years. Its share count also grew by 56%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, QuidelOrtho reported adjusted EPS of $0.80, down from $0.85 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects QuidelOrtho’s full-year EPS of $2.29 to grow 19.3%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

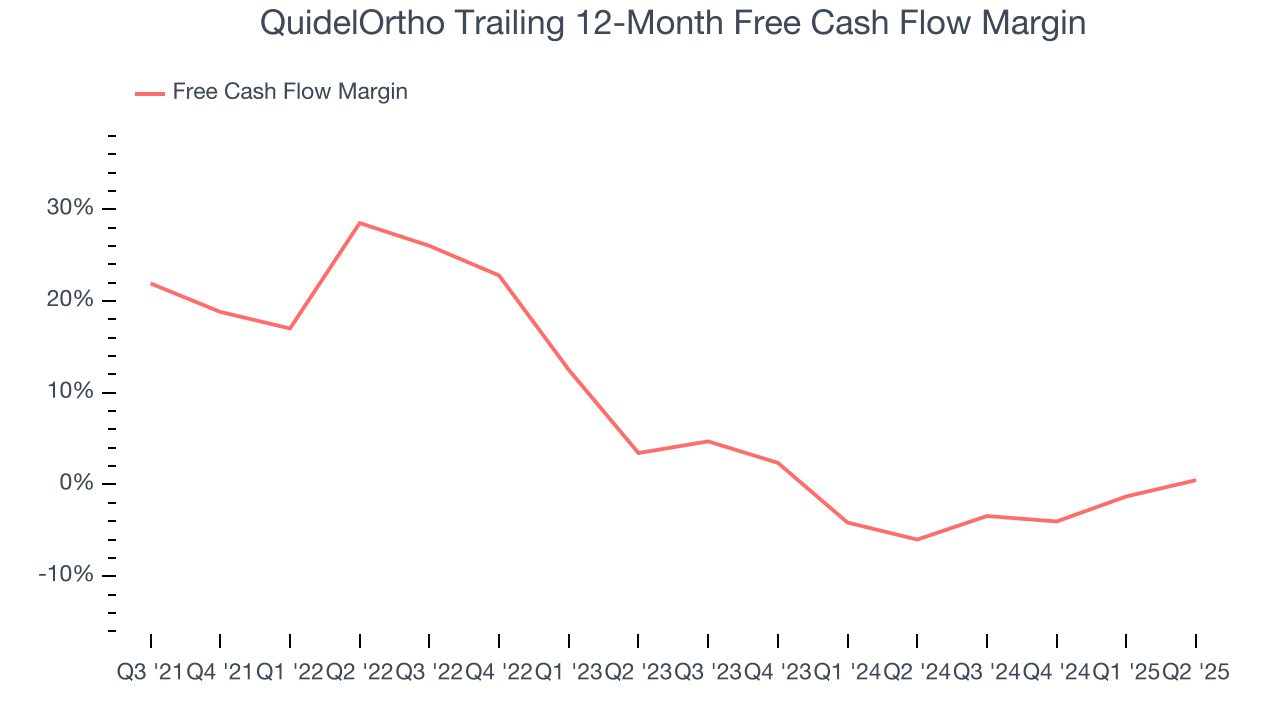

QuidelOrtho has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.8% over the last five years, better than the broader healthcare sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that QuidelOrtho’s margin dropped by 30.8 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

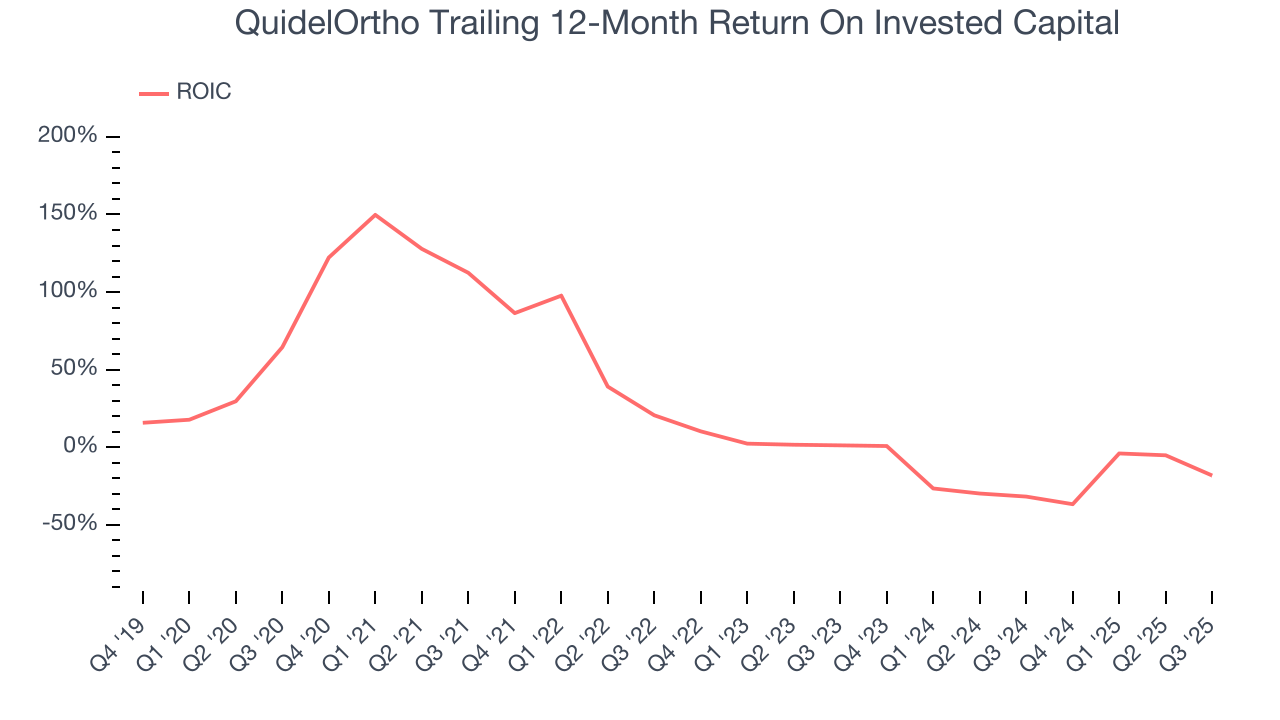

QuidelOrtho’s five-year average ROIC was negative 7%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, QuidelOrtho’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

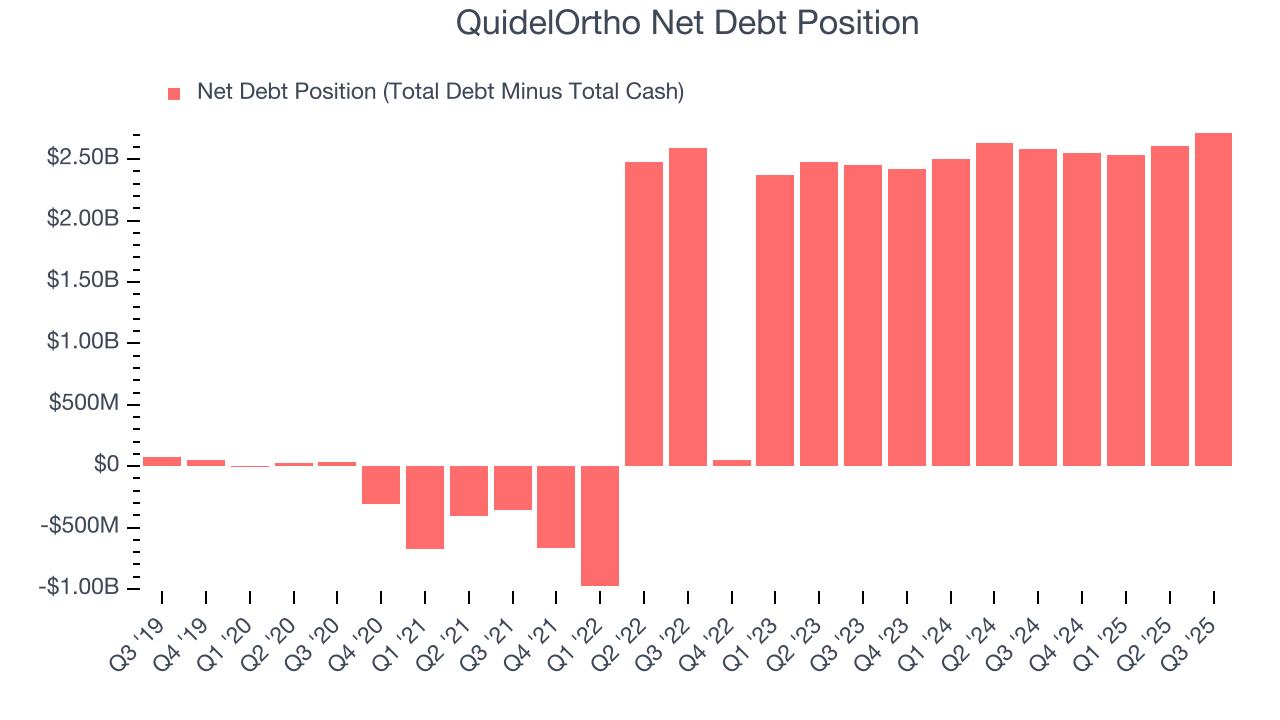

QuidelOrtho reported $98.1 million of cash and $2.81 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $594 million of EBITDA over the last 12 months, we view QuidelOrtho’s 4.6× net-debt-to-EBITDA ratio as safe. We also see its $84.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from QuidelOrtho’s Q3 Results

We were impressed by how significantly QuidelOrtho blew past analysts’ constant currency revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 4% to $28.49 immediately after reporting.

13. Is Now The Time To Buy QuidelOrtho?

Updated: January 23, 2026 at 10:55 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in QuidelOrtho.

QuidelOrtho falls short of our quality standards. To kick things off, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. And while its impressive operating margins show it has a highly efficient business model, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

QuidelOrtho’s P/E ratio based on the next 12 months is 14.6x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $38.33 on the company (compared to the current share price of $28.10).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.