Rumble (RUM)

We see potential in Rumble, but its negative EBITDA and debt balance put it in a tough position.― StockStory Analyst Team

1. News

2. Summary

Why Rumble Is Not Exciting

Founded in 2013 as a champion for content creator rights and free expression, Rumble (NASDAQ:RUM) is a video sharing platform that positions itself as a free speech alternative to mainstream platforms, offering creators more favorable revenue-sharing opportunities.

- Subscale operations are evident in its revenue base of $100.6 million, meaning it has fewer distribution channels than its larger rivals (but more room for growth)

- Historical operating margin losses point to an inefficient cost structure

- EBITDA losses may force it to accept punitive lending terms or high-cost debt

Rumble has some noteworthy aspects, but we’d hold off on buying the stock until its EBITDA can comfortably support its debt.

Why There Are Better Opportunities Than Rumble

Why There Are Better Opportunities Than Rumble

At $4.89 per share, Rumble trades at 34.2x forward EV-to-EBITDA. This multiple is high given its weaker fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects.

3. Rumble (RUM) Research Report: Q4 CY2025 Update

Video sharing platform Rumble (NASDAQGM:RUM) met Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 10.5% year on year to $27.07 million. Its GAAP loss of $0.13 per share was 36.8% below analysts’ consensus estimates.

Rumble (RUM) Q4 CY2025 Highlights:

- Revenue: $27.07 million vs analyst estimates of $27.09 million (10.5% year-on-year decline, in line)

- EPS (GAAP): -$0.13 vs analyst expectations of -$0.10 (36.8% miss)

- Adjusted EBITDA: -$16.03 million (-59.2% margin, 19.8% year-on-year decline)

- Operating Margin: -131%, down from -80.1% in the same quarter last year

- Free Cash Flow was -$31.72 million compared to -$12.38 million in the same quarter last year

- Market Capitalization: $1.88 billion

Company Overview

Founded in 2013 as a champion for content creator rights and free expression, Rumble (NASDAQ:RUM) is a video sharing platform that positions itself as a free speech alternative to mainstream platforms, offering creators more favorable revenue-sharing opportunities.

Rumble operates as a content-sharing ecosystem where video creators can upload, distribute, and monetize their work. The platform emphasizes creator-friendly policies, including more generous revenue-sharing arrangements compared to traditional video platforms. This approach attracts content creators who may feel restricted by content moderation policies on other platforms or who seek better financial terms.

The platform serves diverse user groups, from independent content creators and influencers to media organizations looking for alternative distribution channels. A political commentator might use Rumble to share opinion videos that they believe might be demonetized elsewhere, while a musician could upload performances to reach fans while retaining a larger portion of advertising revenue.

Rumble generates revenue primarily through video advertising, displaying ads before, during, or alongside content. The company also offers subscription services through Rumble+, allowing users to access premium features and content without advertisements. Additionally, the platform facilitates partnerships between creators and brands for sponsored content opportunities.

The company has begun expanding beyond its core video platform into cloud services, potentially offering infrastructure solutions to content creators and other businesses. This diversification represents an effort to broaden revenue streams while leveraging existing technological capabilities.

Rumble's user interface provides creators with analytics tools to track performance metrics like views, engagement rates, and audience demographics. These insights help creators optimize their content strategies and maximize potential earnings on the platform.

While headquartered in the United States, Rumble serves a global audience with particular strength in North America. The company operates within a competitive digital media landscape where user attention is highly contested and platform loyalty can shift rapidly based on creator incentives and content policies.

4. Digital Media & Content Platforms

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

Rumble's primary competitors include major video sharing platforms like YouTube (owned by Alphabet, NASDAQ:GOOGL), TikTok (owned by ByteDance), and Vimeo (NASDAQ:VMEO), as well as alternative platforms like Odysee and BitChute that also position themselves as free speech havens.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $100.6 million in revenue over the past 12 months, Rumble is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

As you can see below, Rumble grew its sales at an incredible 75.6% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Rumble’s annualized revenue growth of 11.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Rumble reported a rather uninspiring 10.5% year-on-year revenue decline to $27.07 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 349% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will fuel better top-line performance.

6. Operating Margin

Rumble’s high expenses have contributed to an average operating margin of negative 133% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

Analyzing the trend in its profitability, Rumble’s operating margin decreased by 43.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Rumble’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Rumble generated a negative 131% operating margin.

7. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Rumble’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 97.9%, meaning it lit $97.92 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Rumble’s margin dropped by 3.8 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it’s in the middle of an investment cycle.

Rumble burned through $31.72 million of cash in Q4, equivalent to a negative 117% margin. The company’s cash burn was similar to its $12.38 million of lost cash in the same quarter last year.

8. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

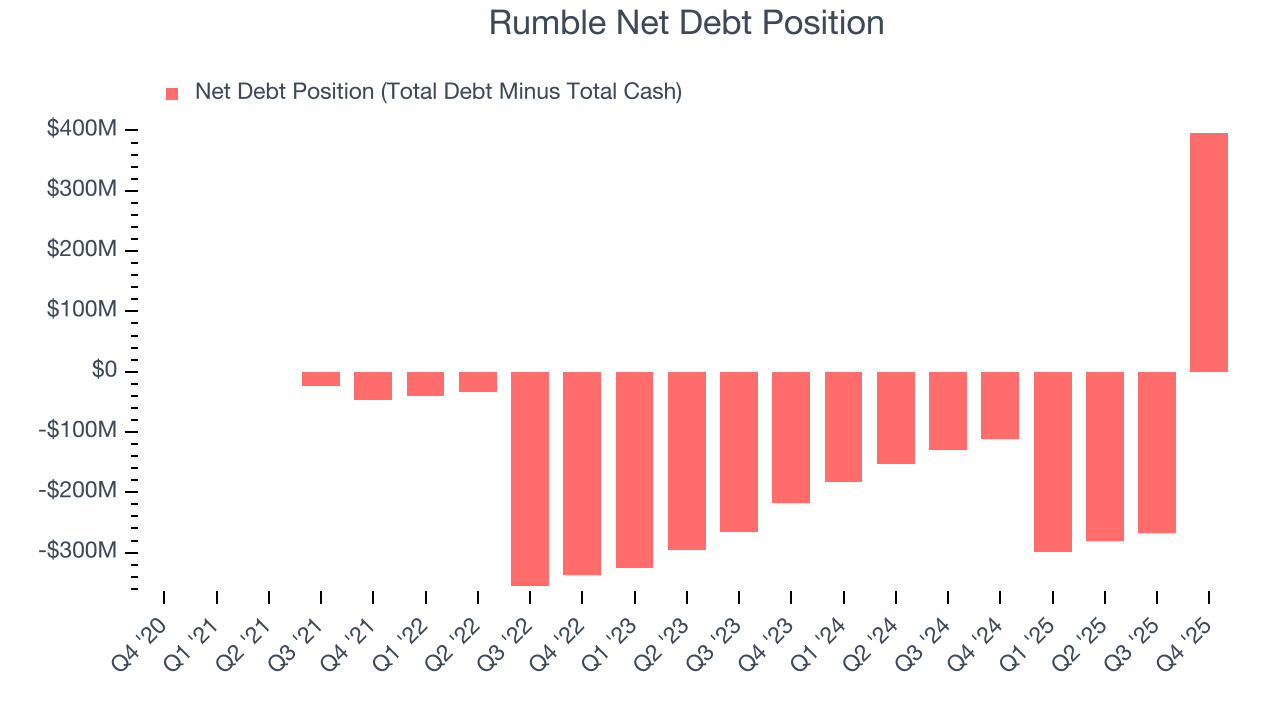

Rumble posted negative $74.3 million of EBITDA over the last 12 months, and its $634.4 million of debt exceeds the $237.9 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Rumble if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Rumble can improve its profitability and remain cautious until then.

9. Key Takeaways from Rumble’s Q4 Results

We struggled to find many positives in these results. Overall, this was a weaker quarter. The stock traded down 2.9% to $5.46 immediately following the results.

10. Is Now The Time To Buy Rumble?

Updated: March 7, 2026 at 11:42 PM EST

When considering an investment in Rumble, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Aside from its balance sheet, Rumble is a pretty decent company. First off, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. And while its projected EPS for the next year is lacking, its astounding EPS growth over the last two years shows its profits are trickling down to shareholders.

Rumble’s EV-to-EBITDA ratio based on the next 12 months is 34.2x. Certain aspects of its fundamentals are attractive, but we aren’t investing at the moment because its balance sheet makes us uneasy. Interested in this company and its prospects? We recommend you wait until it generates sufficient cash flows or raises money.

Wall Street analysts have a consensus one-year price target of $22 on the company (compared to the current share price of $4.89).