Tetra Tech (TTEK)

Tetra Tech catches our eye. Its rapid revenue growth gives it operating leverage, making it more profitable as it expands.― StockStory Analyst Team

1. News

2. Summary

Why Tetra Tech Is Interesting

With a 50-year legacy of "Leading with Science" and operations on all seven continents, Tetra Tech (NASDAQ:TTEK) provides high-end consulting and engineering services focused on water management, environmental solutions, and sustainable infrastructure for government and commercial clients worldwide.

- Earnings growth has trumped its peers over the last five years as its EPS has compounded at 15.3% annually

- Annual revenue growth of 13.8% over the last five years was superb and indicates its market share increased during this cycle

- One risk is its forecasted revenue decline of 5.2% for the upcoming 12 months implies demand will fall off a cliff

Tetra Tech almost passes our quality test. If you like the company, the valuation seems fair.

Why Is Now The Time To Buy Tetra Tech?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Tetra Tech?

At $37.85 per share, Tetra Tech trades at 24.5x forward P/E. While this multiple is higher than most business services companies, we think the valuation is deserved for the revenue growth you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Tetra Tech (TTEK) Research Report: Q4 CY2025 Update

Environmental engineering firm Tetra Tech (NASDAQ:TTEK) reported revenue ahead of Wall Streets expectations in Q4 CY2025, but sales fell by 13.4% year on year to $1.04 billion. Guidance for next quarter’s revenue was better than expected at $1 billion at the midpoint, 1% above analysts’ estimates. Its GAAP profit of $0.40 per share was 26% above analysts’ consensus estimates.

Tetra Tech (TTEK) Q4 CY2025 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $974.9 million (13.4% year-on-year decline, 6.4% beat)

- EPS (GAAP): $0.40 vs analyst estimates of $0.32 (26% beat)

- Adjusted Operating Income: $133.5 million vs analyst estimates of $120.8 million (12.9% margin, 10.6% beat)

- The company lifted its revenue guidance for the full year to $4.23 billion at the midpoint from $4.15 billion, a 1.8% increase

- EPS (GAAP) guidance for Q1 CY2026 is $0.32 at the midpoint, missing analyst estimates by 5.5%

- Operating Margin: 13.6%, up from 1.9% in the same quarter last year

- Market Capitalization: $9.75 billion

Company Overview

With a 50-year legacy of "Leading with Science" and operations on all seven continents, Tetra Tech (NASDAQ:TTEK) provides high-end consulting and engineering services focused on water management, environmental solutions, and sustainable infrastructure for government and commercial clients worldwide.

Tetra Tech's business is organized into two main segments: Government Services Group (GSG) and Commercial/International Services Group (CIG). The GSG primarily serves U.S. government clients (federal, state, and local) and international development agencies, while CIG focuses on commercial clients globally and international government clients.

The company's expertise spans critical environmental and infrastructure challenges. For water resources, Tetra Tech designs systems for water supply management, wastewater treatment, flood protection, and coastal resilience. Their environmental services include contaminated site cleanup, waste management, and environmental monitoring. In sustainable infrastructure, they provide engineering for resilient facilities, transportation systems, and renewable energy projects.

A typical Tetra Tech project might involve helping a coastal city develop a climate adaptation plan that includes redesigning stormwater systems to handle increased flooding, implementing nature-based shoreline protection, and creating digital monitoring systems to track performance during extreme weather events.

What distinguishes Tetra Tech is its integration of advanced technologies—collectively called "Tetra Tech Delta"—into its consulting work. These proprietary tools include AI-enabled software for asset management, digital twins for infrastructure monitoring, and advanced analytics platforms. For instance, a municipal water utility might use Tetra Tech's digital twin technology to create a virtual replica of their treatment plant, allowing them to simulate different scenarios and optimize operations in real-time.

The company generates revenue through three contract types: fixed-price, time-and-materials, and cost-plus arrangements. With approximately 30,000 employees working on over 100,000 projects annually across more than 100 countries, Tetra Tech has built a global footprint that allows it to address complex environmental challenges at virtually any scale or location.

4. Industrial & Environmental Services

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

Tetra Tech competes with other environmental and engineering consulting firms including AECOM (NYSE: ACM), Jacobs Solutions (NYSE: J), WSP Global (TSX: WSP), and Stantec (NYSE: STN), as well as with specialized environmental and water management consultancies.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

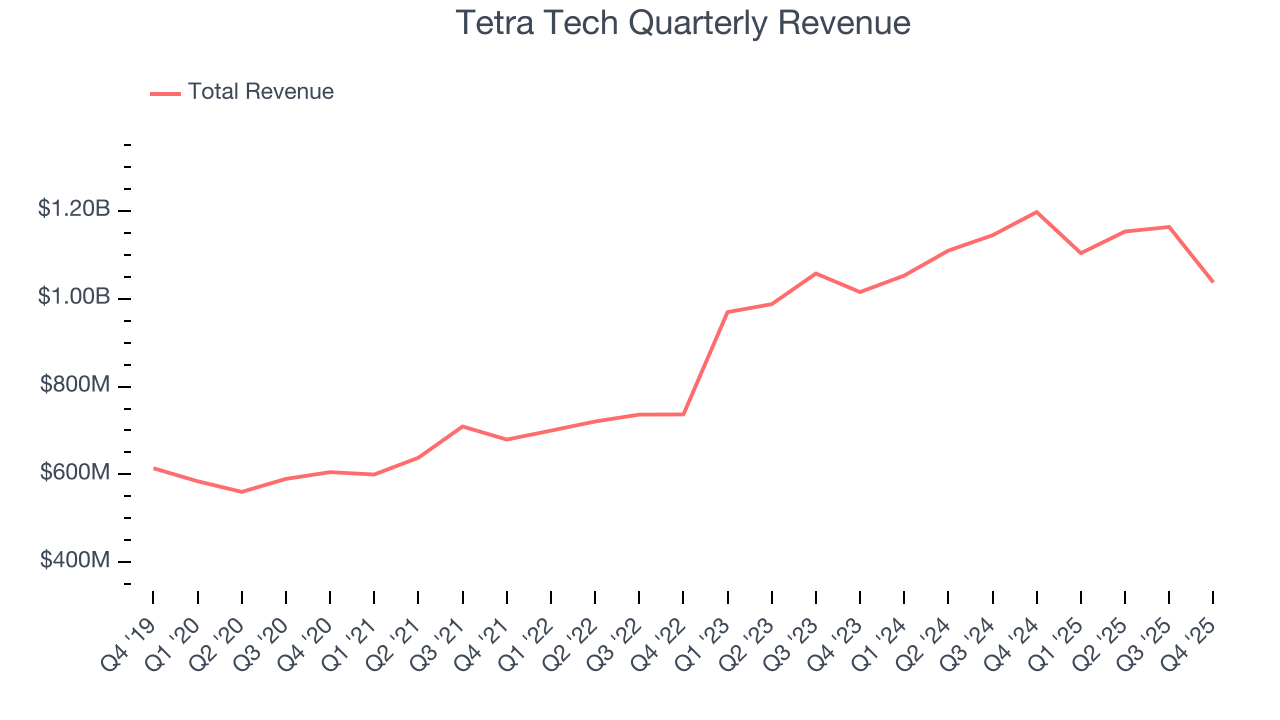

With $4.46 billion in revenue over the past 12 months, Tetra Tech is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

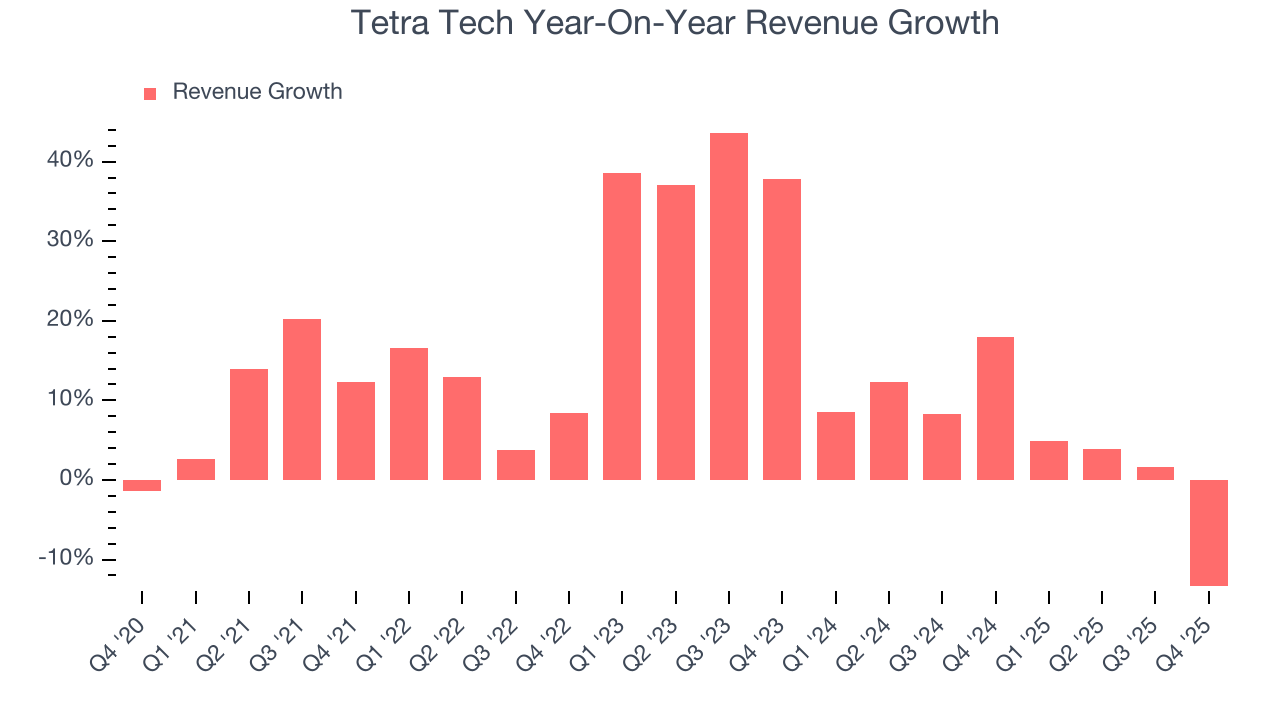

As you can see below, Tetra Tech’s 13.8% annualized revenue growth over the last five years was exceptional. This is an encouraging starting point for our analysis because it shows Tetra Tech’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Tetra Tech’s annualized revenue growth of 5.2% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Tetra Tech’s revenue fell by 13.4% year on year to $1.04 billion but beat Wall Street’s estimates by 6.4%. Company management is currently guiding for a 9.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 5.1% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

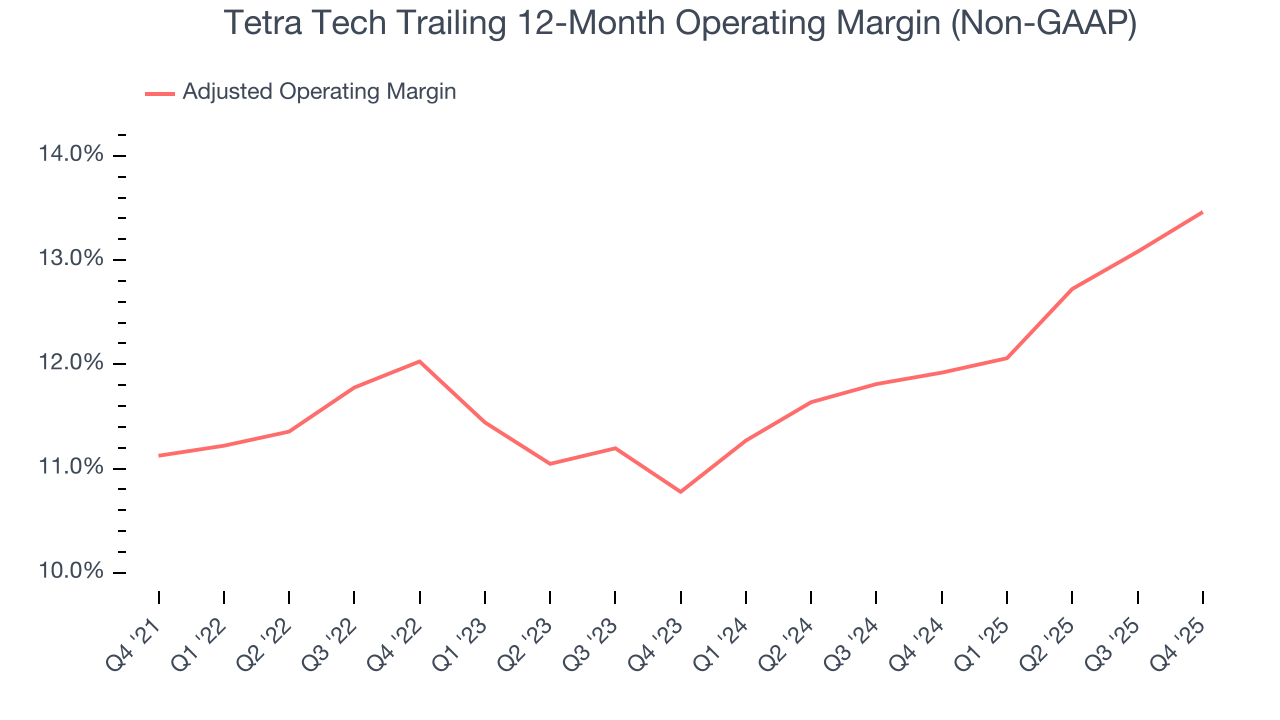

Tetra Tech has done a decent job managing its cost base over the last five years. The company has produced an average adjusted operating margin of 11.9%, higher than the broader business services sector.

Looking at the trend in its profitability, Tetra Tech’s adjusted operating margin rose by 2.3 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Tetra Tech generated an adjusted operating margin profit margin of 12.9%, up 1.4 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

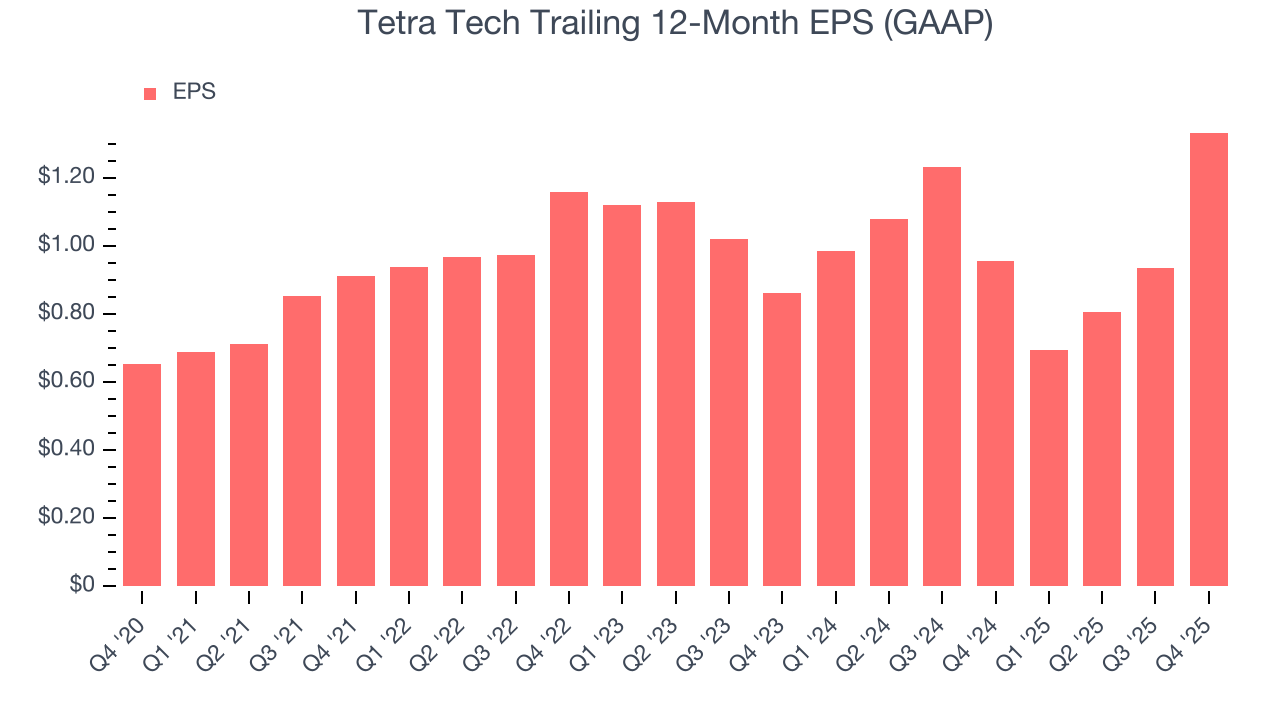

Tetra Tech’s astounding 15.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Tetra Tech’s two-year annual EPS growth of 24.3% was fantastic and topped its 5.2% two-year revenue growth.

We can take a deeper look into Tetra Tech’s earnings quality to better understand the drivers of its performance. Tetra Tech’s adjusted operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Tetra Tech reported EPS of $0.40, up from $0 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Tetra Tech’s full-year EPS of $1.33 to grow 13.7%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

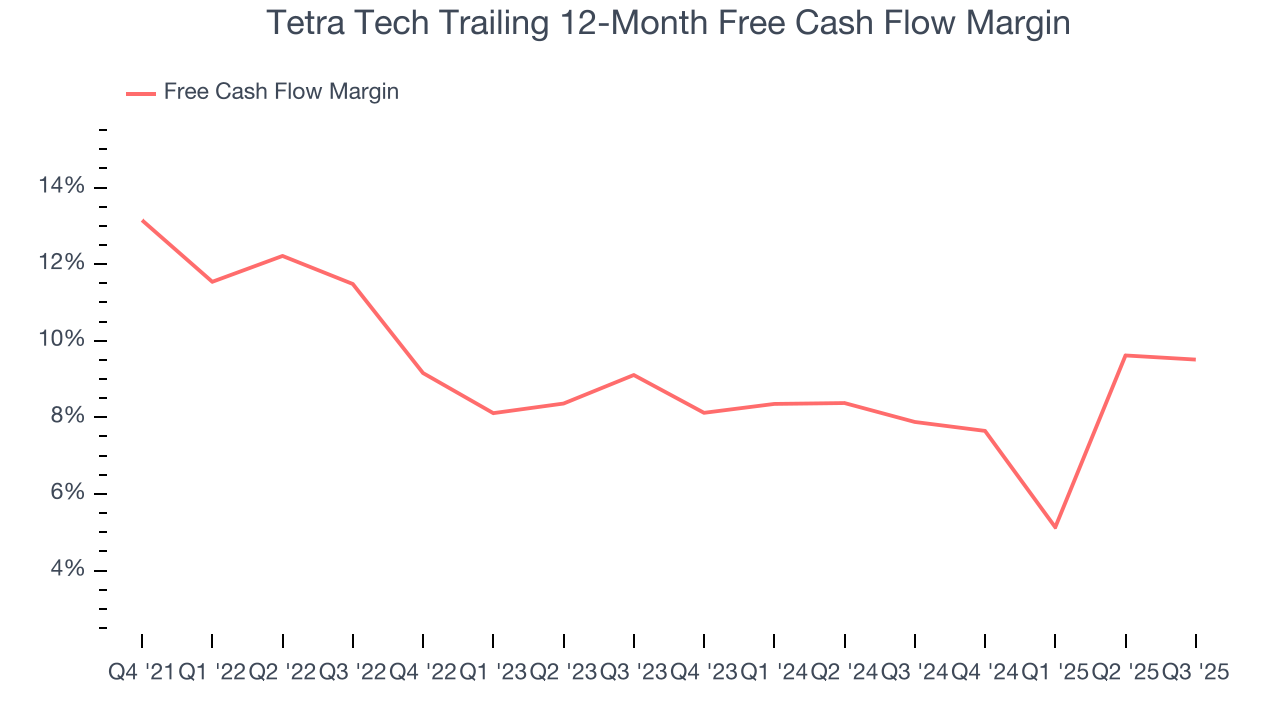

Tetra Tech has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.8% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that Tetra Tech’s margin dropped by 1 percentage points during that time. We’re willing to live with its performance for now but hope its cash conversion can rise soon. If its declines continue, it could signal increasing investment needs and capital intensity.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Tetra Tech’s five-year average ROIC was 13.4%, higher than most business services businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Tetra Tech’s ROIC averaged 4.6 percentage point decreases over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

10. Key Takeaways from Tetra Tech’s Q4 Results

It was good to see Tetra Tech beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS guidance for next quarter missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 2% to $37.80 immediately following the results.

11. Is Now The Time To Buy Tetra Tech?

Updated: January 28, 2026 at 9:56 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Tetra Tech.

There are definitely a lot of things to like about Tetra Tech. To kick things off, its revenue growth was exceptional over the last five years. And while its flat backlog disappointed, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, its projected EPS for the next year implies the company will continue generating shareholder value.

Tetra Tech’s P/E ratio based on the next 12 months is 24.5x. Looking at the business services space right now, Tetra Tech trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $42.50 on the company (compared to the current share price of $37.85), implying they see 12.3% upside in buying Tetra Tech in the short term.