Petco (WOOF)

Petco keeps us up at night. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Petco Will Underperform

Historically known for its window displays of pets for sale or adoption, Petco (NASDAQ:WOOF) is a specialty retailer of pet food and supplies as well as a provider of services such as wellness checks and grooming.

- Push for growth has led to negative returns on capital, signaling value destruction, and its falling returns suggest its earlier profit pools are drying up

- Falling earnings per share over the last three years has some investors worried as stock prices ultimately follow EPS over the long term

- High net-debt-to-EBITDA ratio of 7× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Petco falls short of our quality standards. Better stocks can be found in the market.

Why There Are Better Opportunities Than Petco

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Petco

Petco’s stock price of $2.40 implies a valuation ratio of 10.8x forward P/E. This multiple expensive for its subpar fundamentals.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Petco (WOOF) Research Report: Q3 CY2025 Update

Pet-focused retailer Petco (NASDAQ:WOOF) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 3.1% year on year to $1.46 billion. Its GAAP profit of $0.03 per share was significantly above analysts’ consensus estimates.

Petco (WOOF) Q3 CY2025 Highlights:

- Revenue: $1.46 billion vs analyst estimates of $1.47 billion (3.1% year-on-year decline, in line)

- EPS (GAAP): $0.03 vs analyst estimates of -$0.01 (significant beat)

- Adjusted EBITDA: $98.56 million vs analyst estimates of $94.81 million (6.7% margin, 4% beat)

- EBITDA guidance for the full year is $396 million at the midpoint, in line with analyst expectations

- Operating Margin: 2%, up from 0.3% in the same quarter last year

- Free Cash Flow was $60.65 million, up from -$10.29 million in the same quarter last year

- Same-Store Sales fell 2.2% year on year (1.8% in the same quarter last year)

- Market Capitalization: $781.9 million

Company Overview

Historically known for its window displays of pets for sale or adoption, Petco (NASDAQ:WOOF) is a specialty retailer of pet food and supplies as well as a provider of services such as wellness checks and grooming.

Since its 1965 founding, the company has evolved from largely a place where consumers could buy or adopt pets such as dogs and fish to a one-stop shop for current and potential pet owners. A cat owner can buy Merrick cat food made from natural ingredients, a dog owner can buy Frontline flea and tick collars, and an aquarium owner can buy Tetra water filters. Additionally, services are available at Petco. Cats can be groomed, dogs can undergo parasite treatments, and small pets such as rabbits can undergo diagnostic tests.

Petco store sizes can vary, but most are 10,000 to 20,000 square feet. They tend to be located in shopping centers and retail plazas that get regular foot traffic. Most stores tend to dedicate the largest percentage of floor space to pet food and supplies such as toys and grooming products, separated by type of animal. There are then special aquatic sections with fish tanks and service areas for pets to be groomed and treated for minor ailments. Most Petco stores partner with local animal shelters or rescue organizations to facilitate adoptions of various animal types.

4. Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Competitors that offer pet products and services include Chewy (NYSE:CHWY), Tractor Supply Company (NASDAQ:TSCO), and Academy Sports and Outdoors (NASDAQ:ASO) as well as private companies such as PetSmart.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $6 billion in revenue over the past 12 months, Petco is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Petco struggled to increase demand as its $6 billion of sales for the trailing 12 months was close to its revenue three years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it closed stores.

This quarter, Petco reported a rather uninspiring 3.1% year-on-year revenue decline to $1.46 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and suggests its newer products will not accelerate its top-line performance yet.

6. Store Performance

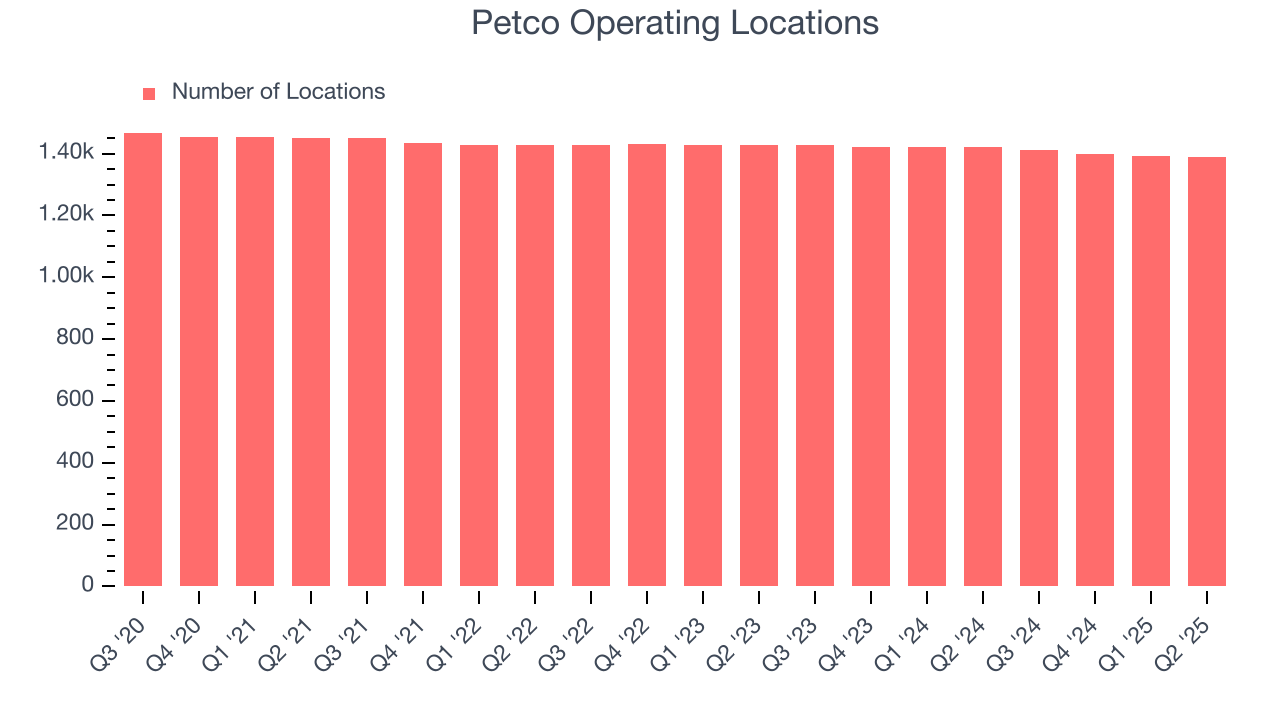

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Petco has generally closed its stores over the last two years, averaging 1.2% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Note that Petco reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Petco’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Petco is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Petco’s same-store sales fell by 2.2% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

7. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Petco’s gross margin is slightly below the average retailer, giving it less room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged a 38% gross margin over the last two years. Said differently, Petco had to pay a chunky $61.96 to its suppliers for every $100 in revenue.

Petco’s gross profit margin came in at 38.9% this quarter, in line with the same quarter last year. On a wider time horizon, Petco’s full-year margin has been trending up over the past 12 months, increasing by 1 percentage points. If this move continues, it could suggest the company has less pressure to discount products and is realizing better unit economics due to stable or shrinking input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Petco was roughly breakeven when averaging the last two years of quarterly operating profits, inadequate for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Petco’s operating margin rose by 1.9 percentage points over the last year.

This quarter, Petco generated an operating margin profit margin of 2%, up 1.7 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

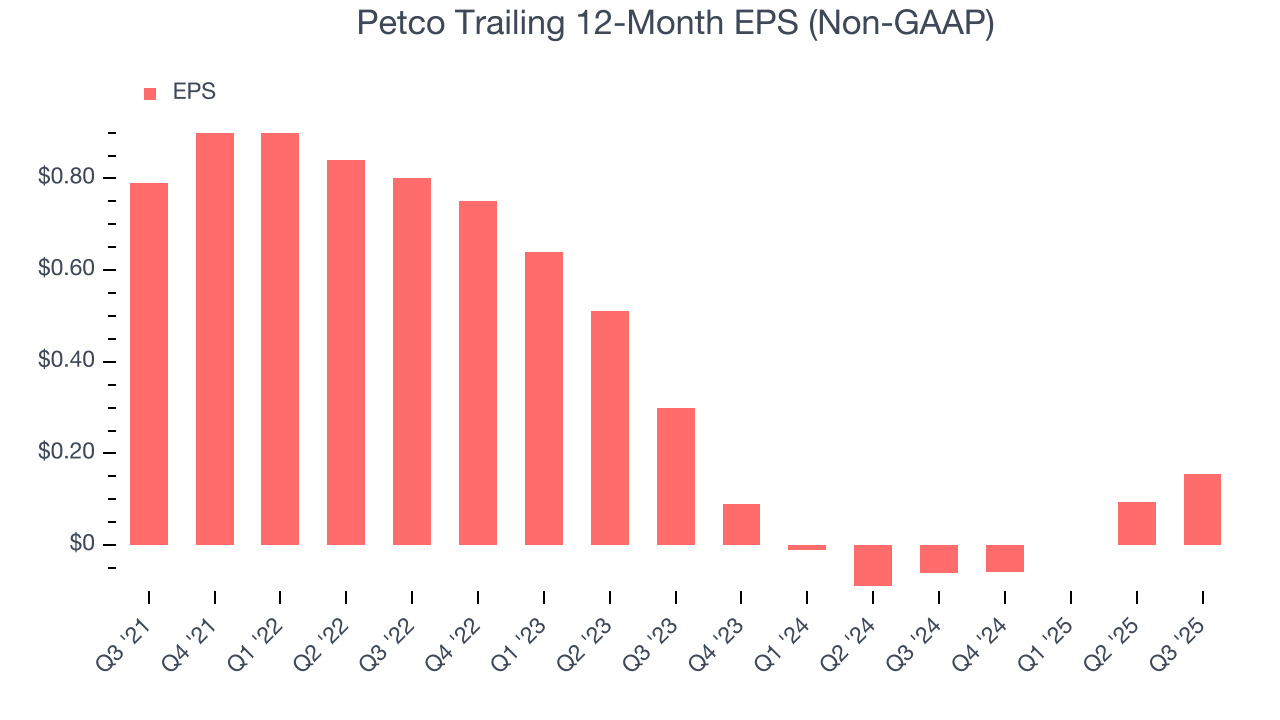

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Petco, its EPS declined by 42% annually over the last three years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q3, Petco reported adjusted EPS of $0.04, up from negative $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Petco’s full-year EPS of $0.16 to grow 33.2%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Petco broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Petco’s margin expanded by 2.3 percentage points over the last year. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Petco’s free cash flow clocked in at $60.65 million in Q3, equivalent to a 4.1% margin. This result was good as its margin was 4.8 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Petco’s five-year average ROIC was negative 2.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer retail sector.

12. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Petco’s $2.97 billion of debt exceeds the $237.4 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $398 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Petco could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Petco can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

13. Key Takeaways from Petco’s Q3 Results

It was good to see Petco beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Zooming out, we think this was a mixed quarter. The stock traded up 7.3% to $3.17 immediately after reporting.

14. Is Now The Time To Buy Petco?

Updated: March 6, 2026 at 9:51 PM EST

Before investing in or passing on Petco, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Petco doesn’t pass our quality test. For starters, its revenue growth was weak over the last three years, and analysts don’t see anything changing over the next 12 months. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Petco’s P/E ratio based on the next 12 months is 10.8x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $3.42 on the company (compared to the current share price of $2.40).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.