Ziff Davis (ZD)

Ziff Davis keeps us up at night. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Ziff Davis Will Underperform

Originally a pioneering technology publisher founded in 1927 that became famous for PC Magazine, Ziff Davis (NASDAQ:ZD) operates a portfolio of digital media brands and subscription services across technology, shopping, gaming, healthcare, and cybersecurity markets.

- Earnings per share fell by 4.1% annually over the last five years while its revenue was flat, showing each sale was less profitable

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

- Products and services are facing end-market challenges during this cycle, as seen in its flat sales over the last five years

Ziff Davis’s quality is lacking. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Ziff Davis

Why There Are Better Opportunities Than Ziff Davis

Ziff Davis is trading at $26.73 per share, or 4.1x forward P/E. Ziff Davis’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Ziff Davis (ZD) Research Report: Q4 CY2025 Update

Digital media company Ziff Davis (NASDAQ:ZD) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 1.5% year on year to $406.7 million. Its non-GAAP profit of $2.56 per share was 5.1% below analysts’ consensus estimates.

Ziff Davis (ZD) Q4 CY2025 Highlights:

- Revenue: $406.7 million vs analyst estimates of $414.8 million (1.5% year-on-year decline, 1.9% miss)

- Adjusted EPS: $2.56 vs analyst expectations of $2.70 (5.1% miss)

- Adjusted EBITDA: $163.2 million vs analyst estimates of $174.7 million (40.1% margin, 6.6% miss)

- Operating Margin: 21.2%, up from 19% in the same quarter last year

- Free Cash Flow Margin: 38.8%, up from 31.8% in the same quarter last year

- Market Capitalization: $1.17 billion

Company Overview

Originally a pioneering technology publisher founded in 1927 that became famous for PC Magazine, Ziff Davis (NASDAQ:ZD) operates a portfolio of digital media brands and subscription services across technology, shopping, gaming, healthcare, and cybersecurity markets.

Ziff Davis's business is organized into two main segments: Digital Media and Cybersecurity and Martech. The Digital Media segment includes well-known brands like PCMag, IGN, RetailMeNot, Mashable, Speedtest, and Everyday Health. These properties generate revenue primarily through advertising, subscriptions, and licensing arrangements.

The company's technology platform delivers product reviews and buying guides through PCMag, while its shopping properties like RetailMeNot connect consumers with discounts and promotional offers from thousands of retailers. In gaming, IGN reaches hundreds of millions of users across multiple platforms with video game and entertainment content, while Humble Bundle offers digital subscriptions for games, ebooks, and software.

The Connectivity division includes Ookla's Speedtest, which conducts millions of internet speed tests daily, providing valuable data on global internet performance. The Health and Wellness division operates properties like Everyday Health, BabyCenter, and What to Expect, offering tools and information for consumers managing health conditions, pregnancy, and parenting.

The Cybersecurity and Martech segment provides subscription-based software services under brands like VIPRE, IPVanish, and MOZ. These include endpoint security, virtual private networks, email marketing, and search engine optimization tools targeted at both consumers and businesses of all sizes.

Ziff Davis monetizes its audience through multiple revenue streams. Its advertising business sells display and video ads on its websites and in email campaigns. The subscription services generate recurring revenue from consumers and businesses paying for cybersecurity protection, marketing tools, and specialized content. The company also earns revenue through affiliate marketing, where it receives commissions when users click through to merchant sites and make purchases.

The company regularly acquires businesses to expand its portfolio, enter new markets, and enhance its technological capabilities. This acquisition strategy has transformed Ziff Davis from its publishing roots into a diversified digital media and internet company with global reach.

4. Digital Media & Content Platforms

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

Ziff Davis competes with diversified internet and digital media companies like IAC, Future PLC, Red Ventures, and Penske Media. In specific verticals, it faces competition from companies like RVO Health, TechTarget, and Doximity. Its cybersecurity and marketing technology businesses compete with providers such as Palo Alto Networks, CrowdStrike, SEMRush, and MailChimp.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.45 billion in revenue over the past 12 months, Ziff Davis is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Ziff Davis struggled to increase demand as its $1.45 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a tough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Ziff Davis’s annualized revenue growth of 3.1% over the last two years is above its five-year trend, which is encouraging.

This quarter, Ziff Davis missed Wall Street’s estimates and reported a rather uninspiring 1.5% year-on-year revenue decline, generating $406.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not lead to better top-line performance yet.

6. Operating Margin

Ziff Davis’s operating margin has been trending up over the last 12 months and averaged 11.4% over the last five years. Its profitability was higher than the broader business services sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Ziff Davis’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. Shareholders will want to see Ziff Davis grow its margin in the future.

This quarter, Ziff Davis generated an operating margin profit margin of 21.2%, up 2.1 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

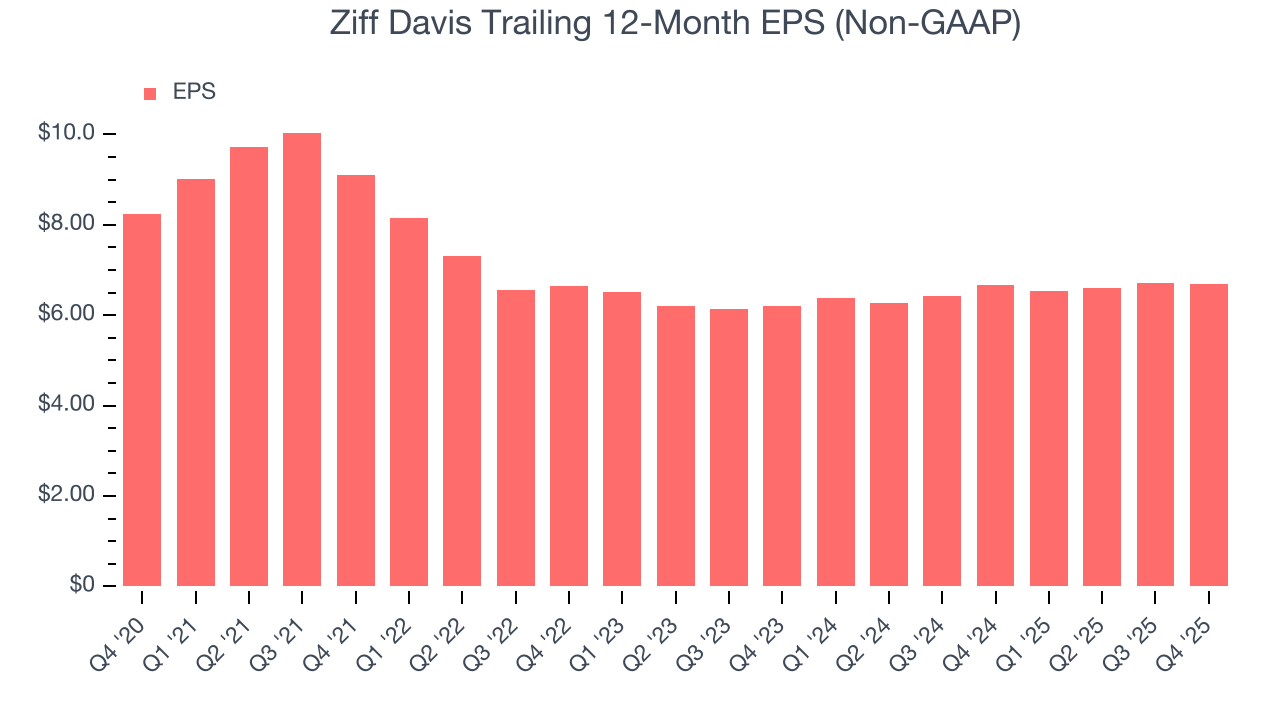

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Ziff Davis, its EPS declined by 4.1% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Ziff Davis, its two-year annual EPS growth of 4% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, Ziff Davis reported adjusted EPS of $2.56, down from $2.58 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Ziff Davis’s full-year EPS of $6.70 to grow 11.5%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Ziff Davis has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 20.2% over the last five years.

Taking a step back, we can see that Ziff Davis’s margin dropped by 9.3 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Ziff Davis’s free cash flow clocked in at $157.8 million in Q4, equivalent to a 38.8% margin. This result was good as its margin was 7 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Ziff Davis historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.2%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Ziff Davis’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

10. Balance Sheet Assessment

Ziff Davis reported $607 million of cash and $866.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $495.1 million of EBITDA over the last 12 months, we view Ziff Davis’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $25.91 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Ziff Davis’s Q4 Results

We struggled to find many positives in these results. Its EPS missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 12.6% to $25.83 immediately after reporting.

12. Is Now The Time To Buy Ziff Davis?

Updated: February 26, 2026 at 12:09 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Ziff Davis.

We see the value of companies helping their customers, but in the case of Ziff Davis, we’re out. First off, its revenue growth was weak over the last five years. While its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its declining adjusted operating margin shows the business has become less efficient.

Ziff Davis’s P/E ratio based on the next 12 months is 3.7x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $37 on the company (compared to the current share price of $27.03).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.