ADT (ADT)

We wouldn’t recommend ADT. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think ADT Will Underperform

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE:ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

- Sales were flat over the last five years, indicating it’s failed to expand its business

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 14.5% for the last two years

- ROIC of 6.7% reflects management’s challenges in identifying attractive investment opportunities

ADT doesn’t check our boxes. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than ADT

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ADT

At $6.90 per share, ADT trades at 7.6x forward P/E. ADT’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. ADT (ADT) Research Report: Q4 CY2025 Update

Security technology and services company ADT (NYSE:ADT) missed Wall Street’s revenue expectations in Q4 CY2025 as sales only rose 1.3% year on year to $1.28 billion. Its non-GAAP profit of $0.23 per share was in line with analysts’ consensus estimates.

ADT (ADT) Q4 CY2025 Highlights:

- Revenue: $1.28 billion vs analyst estimates of $1.29 billion (1.3% year-on-year growth, 1.2% miss)

- Adjusted EPS: $0.23 vs analyst estimates of $0.22 (in line)

- Adjusted EBITDA: $670 million vs analyst estimates of $682.4 million (52.5% margin, 1.8% miss)

- Operating Margin: 26.1%, up from 24.2% in the same quarter last year

- Free Cash Flow Margin: 25.4%, up from 16.3% in the same quarter last year

- Market Capitalization: $6.52 billion

Company Overview

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE:ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

ADT has evolved into a prominent security company since its early days, offering a comprehensive range of products and services designed to protect homes, businesses, and individuals from security and safety threats.

ADT's extensive product lineup includes burglar alarms, fire and smoke detectors, carbon monoxide alarms, video surveillance systems, and smart home automation technology. The company's solutions extend beyond traditional security systems, integrating software to provide smart, interconnected solutions for modern living. This includes remote monitoring and control capabilities, allowing customers to manage their security systems, lights, thermostats, and cameras using smartphones and other devices.

A cornerstone of ADT's operations is its vast network of monitoring centers, which provide 24/7 monitoring services to ensure rapid response to emergencies and alerts. This around-the-clock protection is a cornerstone of ADT's value proposition, offering peace of mind to millions of customers across the United States and Canada.

4. Consumer Discretionary - Specialized Consumer Services

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

ADT's primary competitors include Ring (owned by Amazon NASDAQ:AMZN), Honeywell (NYSE:HON), Nest Secure (owned by Google NASDAQ:GOOGL), Xfinity Home Security (owned by Comcast NASDAQ:CMCSA), and private companies Vivint Smart Home, SimpliSafe, Brinks Home Security, and Frontpoint.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, ADT struggled to consistently increase demand as its $5.13 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. ADT’s annualized revenue growth of 3.4% over the last two years is above its five-year trend, which is encouraging.

This quarter, ADT’s revenue grew by 1.3% year on year to $1.28 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet.

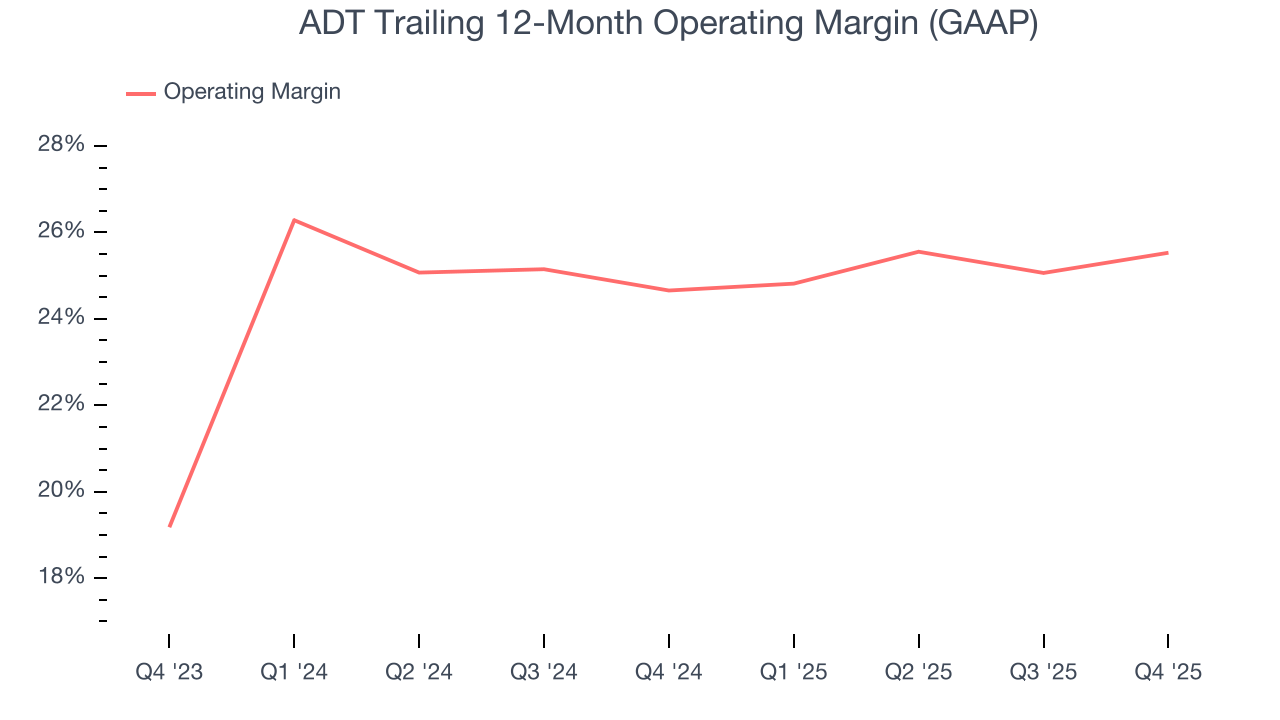

6. Operating Margin

ADT’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 25.1% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, ADT generated an operating margin profit margin of 26.1%, up 1.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

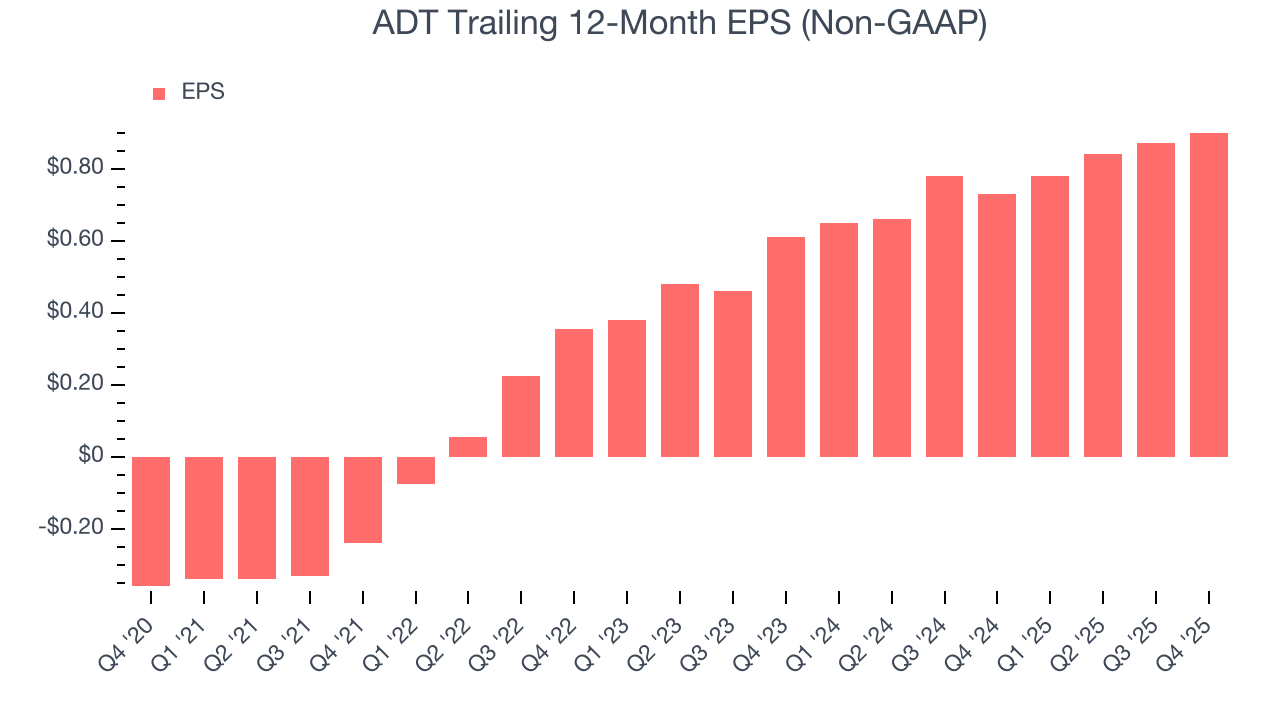

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

ADT’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, ADT reported adjusted EPS of $0.23, up from $0.20 in the same quarter last year. This print beat analysts’ estimates by 3.4%. Over the next 12 months, Wall Street expects ADT’s full-year EPS of $0.90 to grow 5.5%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

ADT has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 16.4%, lousy for a consumer discretionary business.

ADT’s free cash flow clocked in at $324 million in Q4, equivalent to a 25.4% margin. This result was good as its margin was 9.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict ADT’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 19.2% for the last 12 months will decrease to 17.8%.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

ADT historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, ADT’s ROIC has increased. This is a good sign, and we hope the company can continue improving.

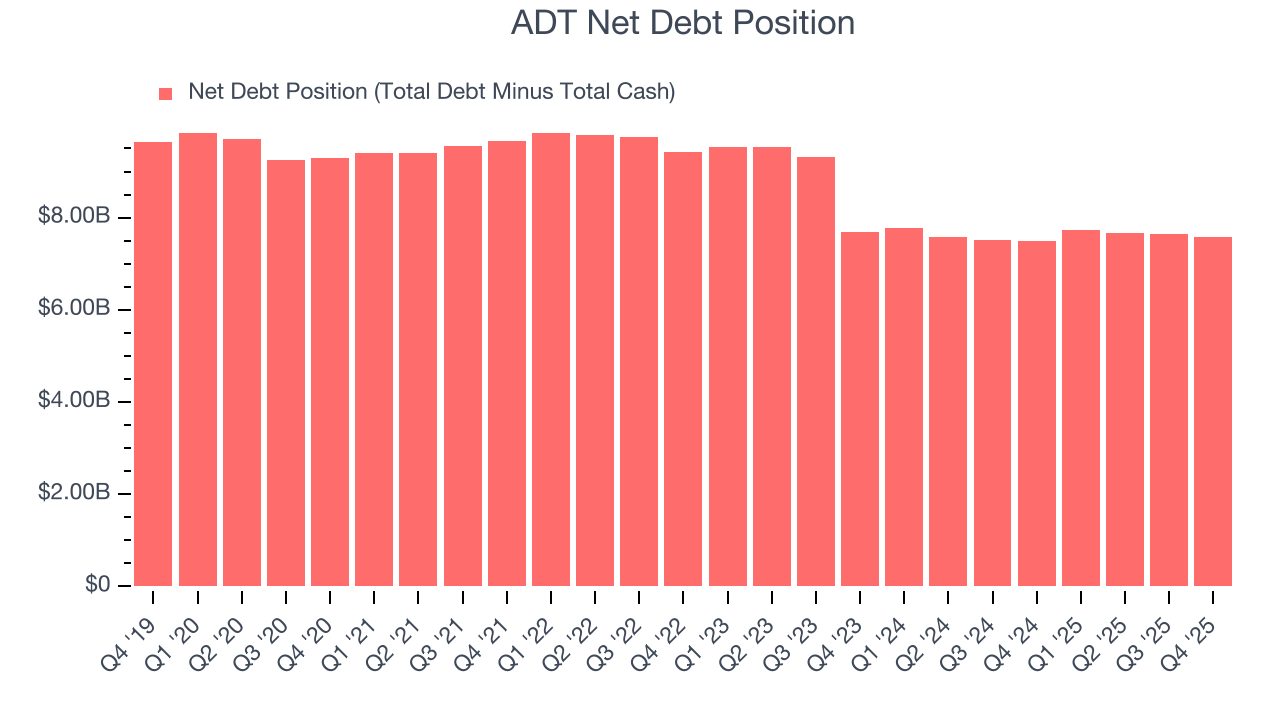

10. Balance Sheet Assessment

ADT reported $109 million of cash and $7.69 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.68 billion of EBITDA over the last 12 months, we view ADT’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $471 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from ADT’s Q4 Results

It was encouraging to see ADT meet analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Overall, this was a softer quarter. The stock traded down 1.7% to $7.89 immediately after reporting.

12. Is Now The Time To Buy ADT?

Updated: March 4, 2026 at 9:20 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in ADT.

ADT falls short of our quality standards. While its decent EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

ADT’s P/E ratio based on the next 12 months is 7.6x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $8.50 on the company (compared to the current share price of $6.90).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.