Corpay (CPAY)

We’d invest in Corpay. Its stellar 31.1% ROE illustrates management’s exceptional investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why We Like Corpay

Formerly known as FLEETCOR until its 2024 rebrand, Corpay (NYSE:CPAY) provides specialized payment solutions for businesses to manage vehicle expenses, corporate payments, and lodging costs with enhanced control and reporting capabilities.

- Stellar return on equity showcases management’s ability to surface highly profitable business ventures

- Solid 13.6% annual revenue growth over the last five years indicates its offering’s solve complex business issues

- Earnings per share have outperformed the peer group average over the last five years, increasing by 14% annually

We’re optimistic about Corpay. The valuation seems reasonable when considering its quality, so this might be a good time to invest in some shares.

Why Is Now The Time To Buy Corpay?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Corpay?

At $347.38 per share, Corpay trades at 13.5x forward P/E. This multiple is lower than most financials companies, and we think the stock is a deal when considering its quality characteristics.

By definition, where you buy a stock impacts returns. Compared to entry price, business quality matters much more for long-term market outperformance. Buying in at a great price helps, nevertheless.

3. Corpay (CPAY) Research Report: Q4 CY2025 Update

Business payments company Corpay (NYSE:CPAY) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 20.7% year on year to $1.25 billion. The company’s full-year revenue guidance of $5.27 billion at the midpoint came in 0.6% above analysts’ estimates. Its non-GAAP profit of $6.04 per share was 1.7% above analysts’ consensus estimates.

Corpay (CPAY) Q4 CY2025 Highlights:

- Revenue: $1.25 billion vs analyst estimates of $1.24 billion (20.7% year-on-year growth, 0.7% beat)

- Pre-tax Profit: $399.4 million (32% margin)

- Adjusted EPS: $6.04 vs analyst estimates of $5.94 (1.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $26 at the midpoint, beating analyst estimates by 5.2%

- Market Capitalization: $20.44 billion

Company Overview

Formerly known as FLEETCOR until its 2024 rebrand, Corpay (NYSE:CPAY) provides specialized payment solutions for businesses to manage vehicle expenses, corporate payments, and lodging costs with enhanced control and reporting capabilities.

Corpay's business is organized into three main segments. The Vehicle Payments segment offers solutions for fuel purchases (regardless of fuel type, including electric charging), tolls, parking, and fleet maintenance. These solutions provide customers with control capabilities like customizable user-level restrictions, programmable alerts, and detailed reporting to help combat fraud and streamline expense management.

The Corporate Payments segment focuses on streamlining back-office vendor payment operations. Its accounts payable automation solutions can handle everything from simple small business needs to complex enterprise requirements, initiating and managing payments through various methods including ACH, wire, check, or payment cards. The company's Virtual Card solution provides single-use card numbers for specific amounts within defined timeframes, while its Cross-Border solutions help customers pay international vendors and manage currency exchange risks.

The Lodging Payments segment helps businesses control accommodation costs through three primary verticals: workforce, airlines, and insurance. For workforce clients, Corpay provides comprehensive travel booking and management. For airlines, it offers crew layover management and disruption handling for stranded passengers. For insurance carriers, it provides temporary housing solutions for displaced policyholders.

Corpay leverages its scale to negotiate discounted rates with merchants, particularly in lodging, passing these savings to customers. The company employs multiple distribution channels, including digital platforms, direct sales forces, and strategic partnerships. Its proprietary networks and technology platforms enable it to capture rich transaction data, providing customers with insights to better manage their spending while generating recurring revenue streams for Corpay.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

In Vehicle Payments, Corpay competes with WEX, U.S. Bank Voyager Fleet Systems, Edenred, and DKV. Its Corporate Payments solutions face competition from financial institutions like American Express, as well as specialized providers such as Coupa, AvidXchange, and Bill.com. In Lodging Payments, competitors include traditional travel management companies like American Express Global Business Travel.

5. Revenue Growth

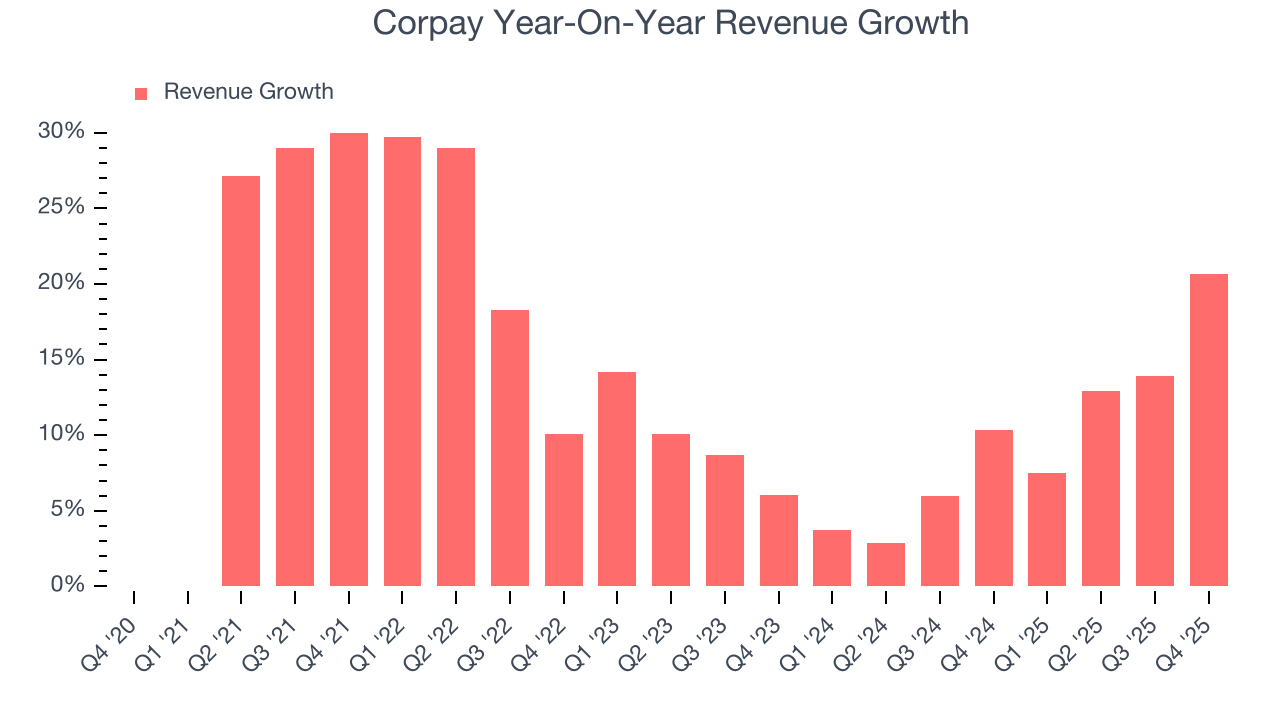

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Corpay’s revenue grew at a solid 13.6% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Corpay’s annualized revenue growth of 9.8% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Corpay reported robust year-on-year revenue growth of 20.7%, and its $1.25 billion of revenue topped Wall Street estimates by 0.7%.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

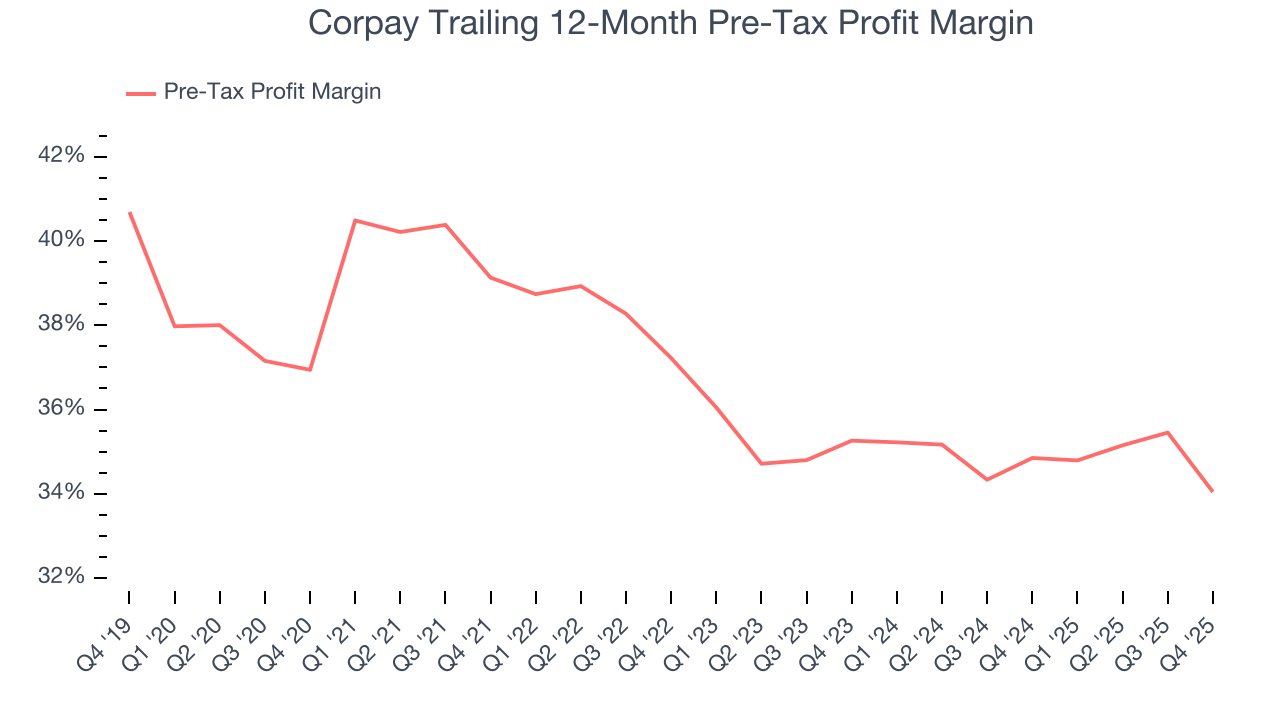

Over the last five years, Corpay’s pre-tax profit margin has risen by 2.9 percentage points, going from 39.1% to 34%. It has also declined by 1.2 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

In Q4, Corpay’s pre-tax profit margin was 32%. This result was 5.4 percentage points worse than the same quarter last year.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

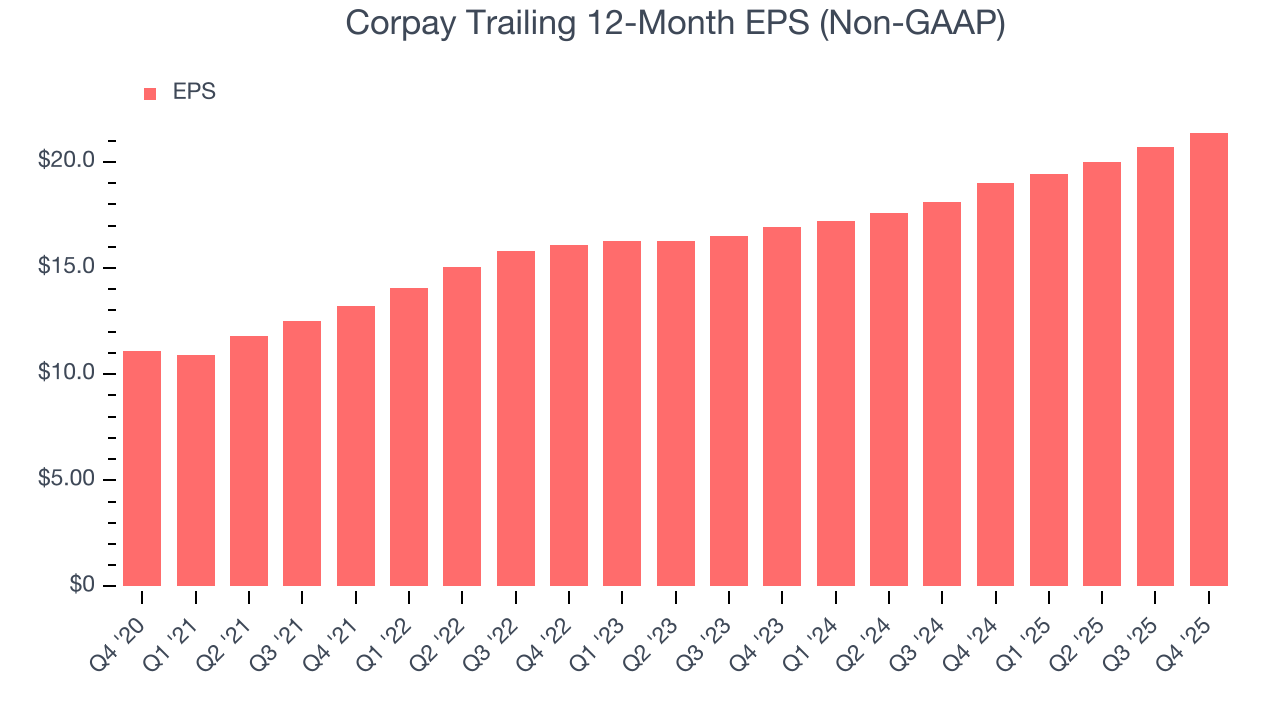

Corpay’s solid 14% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Corpay’s two-year annual EPS growth of 12.4% was decent and topped its 9.8% two-year revenue growth.

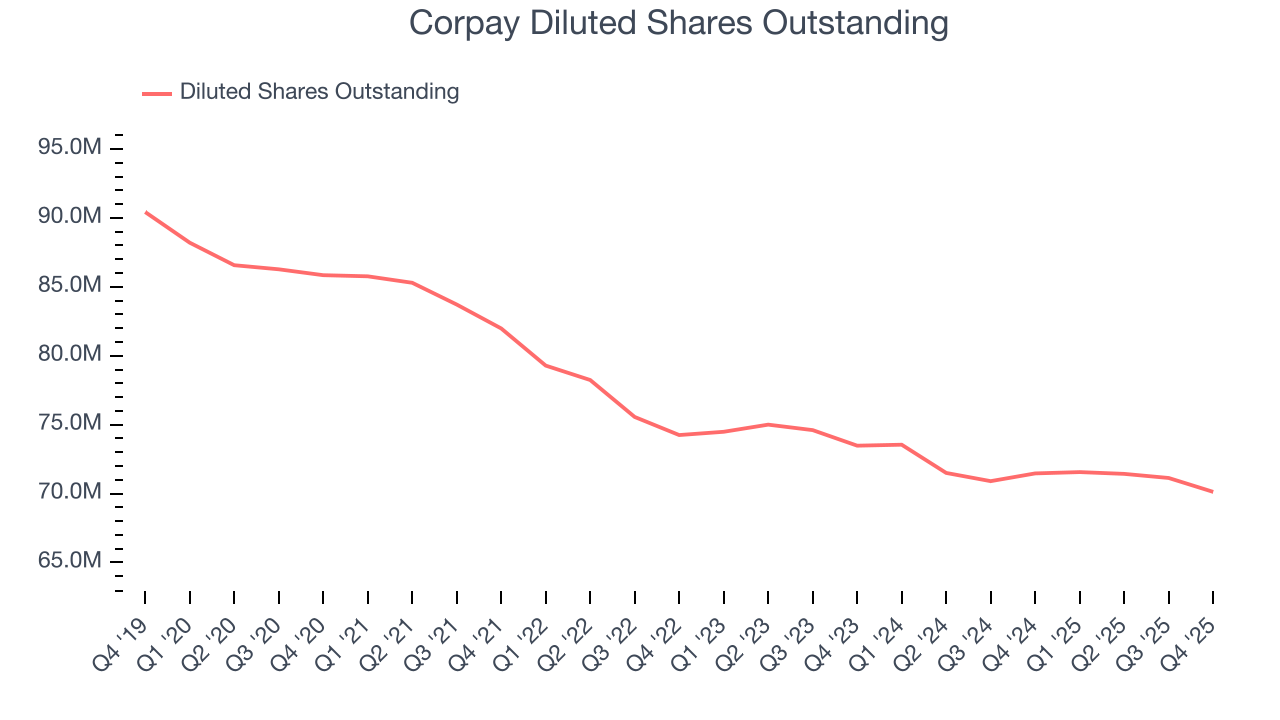

Diving into the nuances of Corpay’s earnings can give us a better understanding of its performance. A two-year view shows that Corpay has repurchased its stock, shrinking its share count by 4.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Corpay reported adjusted EPS of $6.04, up from $5.36 in the same quarter last year. This print beat analysts’ estimates by 1.7%. Over the next 12 months, Wall Street expects Corpay’s full-year EPS of $21.38 to grow 15.5%.

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Corpay has averaged an ROE of 31.4%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Corpay has a strong competitive moat.

9. Balance Sheet Assessment

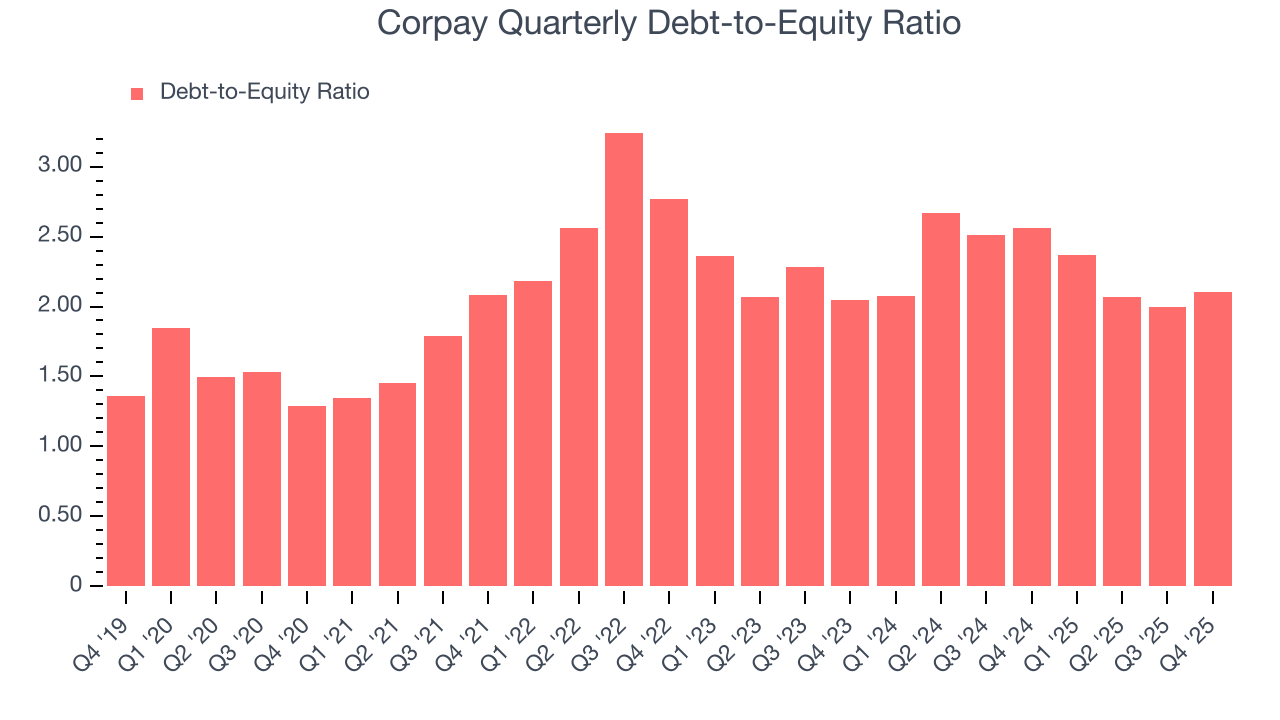

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Corpay currently has $8.18 billion of debt and $3.88 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 2.1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Corpay’s Q4 Results

Revenue and EPS in the quarter both beat, which is a good start. We were also impressed by Corpay’s optimistic full-year revenue and EPS guidance, both of which exceeded analysts’ expectations. Overall, we think this was a solid quarter with some key metrics above expectations. The stock traded up 10.2% to $330.92 immediately following the results.

11. Is Now The Time To Buy Corpay?

Updated: February 19, 2026 at 11:47 PM EST

When considering an investment in Corpay, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are several reasons why we think Corpay is a great business. To begin with, its revenue growth was solid over the last five years, and its growth over the next 12 months is expected to accelerate. And while its declining pre-tax profit margin shows the business has become less efficient, its stellar ROE suggests it has been a well-run company historically. Additionally, Corpay’s solid EPS growth over the last five years shows its profits are trickling down to shareholders.

Corpay’s P/E ratio based on the next 12 months is 13.5x. Looking across the spectrum of financials companies today, Corpay’s fundamentals shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $384.71 on the company (compared to the current share price of $347.38), implying they see 10.7% upside in buying Corpay in the short term.