Donnelley Financial Solutions (DFIN)

We’re not sold on Donnelley Financial Solutions. Its declining sales show demand has evaporated, a red flag for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Donnelley Financial Solutions Is Not Exciting

Born from the need to navigate increasingly complex financial regulations in the digital age, Donnelley Financial Solutions (NYSE:DFIN) provides software and technology-enabled services that help companies comply with SEC regulations and manage financial transactions and reporting requirements.

- Annual sales declines of 3% for the past five years show its products and services struggled to connect with the market during this cycle

- A consolation is that its market-beating return on equity illustrates that management has a knack for investing in profitable ventures

Donnelley Financial Solutions’s quality is lacking. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Donnelley Financial Solutions

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Donnelley Financial Solutions

Donnelley Financial Solutions’s stock price of $39.12 implies a valuation ratio of 9.2x forward P/E. Donnelley Financial Solutions’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Donnelley Financial Solutions (DFIN) Research Report: Q4 CY2025 Update

Financial regulatory software provider Donnelley Financial Solutions (NYSE:DFIN) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 10.4% year on year to $172.5 million. On the other hand, next quarter’s revenue guidance of $205 million was less impressive, coming in 1.1% below analysts’ estimates. Its non-GAAP profit of $0.70 per share was 70.7% above analysts’ consensus estimates.

Donnelley Financial Solutions (DFIN) Q4 CY2025 Highlights:

- Revenue: $172.5 million vs analyst estimates of $155.3 million (10.4% year-on-year growth, 11.1% beat)

- Pre-tax Profit: $10.1 million (5.9% margin)

- Adjusted EPS: $0.70 vs analyst estimates of $0.41 (70.7% beat)

- Revenue Guidance for Q1 CY2026 is $205 million at the midpoint, below analyst estimates of $207.2 million

- Market Capitalization: $1.04 billion

Company Overview

Born from the need to navigate increasingly complex financial regulations in the digital age, Donnelley Financial Solutions (NYSE:DFIN) provides software and technology-enabled services that help companies comply with SEC regulations and manage financial transactions and reporting requirements.

DFIN operates at the intersection of finance, regulation, and technology, offering solutions that span the entire lifecycle of regulatory compliance needs. The company's software portfolio includes ActiveDisclosure for SEC filing preparation, Venue for secure virtual data rooms during transactions, and the Arc Suite platform for investment companies' regulatory filings.

These tools allow clients to create, manage, file, and distribute regulatory documents while ensuring compliance with complex SEC requirements, including proper XBRL tagging formats. For capital markets clients, DFIN supports critical transactions like IPOs, secondary offerings, mergers and acquisitions, and debt offerings, helping companies navigate the documentation and filing requirements throughout these processes.

For investment companies such as mutual funds and alternative investment firms, DFIN provides specialized compliance solutions that address the unique regulatory requirements of the Investment Company Act. A financial advisor might use DFIN's Arc Suite to efficiently prepare and file a mutual fund's semi-annual report with the SEC, ensuring all disclosures meet regulatory standards.

DFIN generates revenue through software subscriptions, transaction-based fees, and tech-enabled services. The company has been strategically shifting its business model toward higher-margin software solutions while maintaining its expertise in traditional compliance services. DFIN serves clients globally, with operations primarily in the United States but also extending to Canada, Ireland, the United Kingdom, France, and Luxembourg.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

DFIN competes with financial compliance software providers like Workiva (NYSE:WK), Toppan Merrill, and SS&C Technologies (NASDAQ:SSNC), as well as specialized providers in the virtual data room space such as Datasite and Intralinks.

5. Revenue Growth

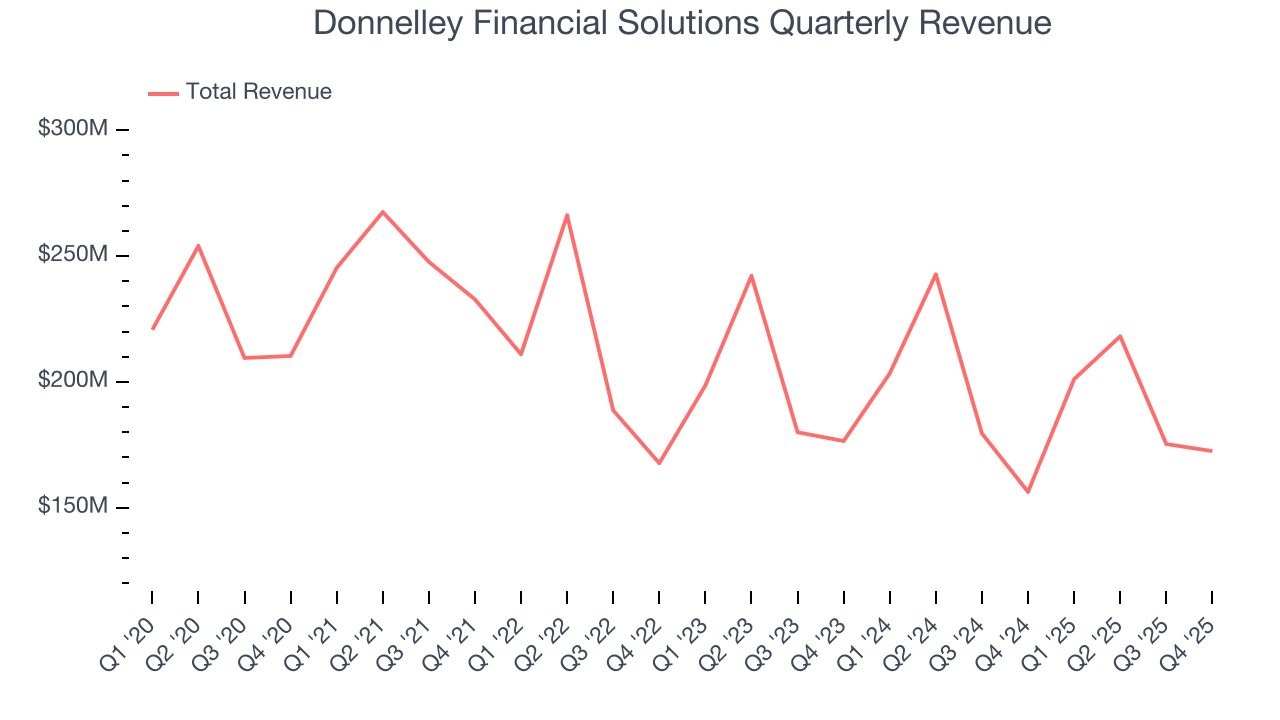

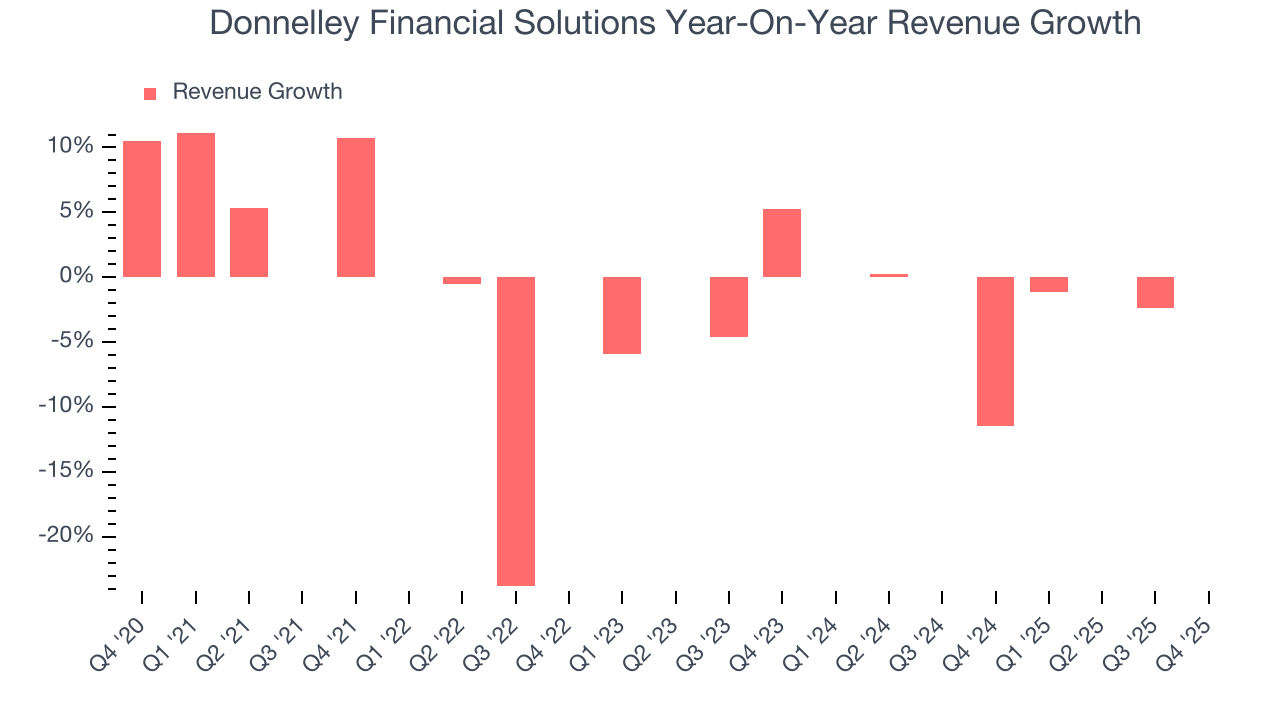

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Donnelley Financial Solutions struggled to consistently generate demand over the last five years as its revenue dropped at a 3% annual rate. This wasn’t a great result, but there are still things to like about Donnelley Financial Solutions.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Donnelley Financial Solutions’s annualized revenue declines of 1.9% over the last two years suggest its demand continued shrinking.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Donnelley Financial Solutions reported year-on-year revenue growth of 10.4%, and its $172.5 million of revenue exceeded Wall Street’s estimates by 11.1%. Company management is currently guiding for a 1.9% year-on-year increase in sales next quarter.

6. Pre-Tax Profit Margin

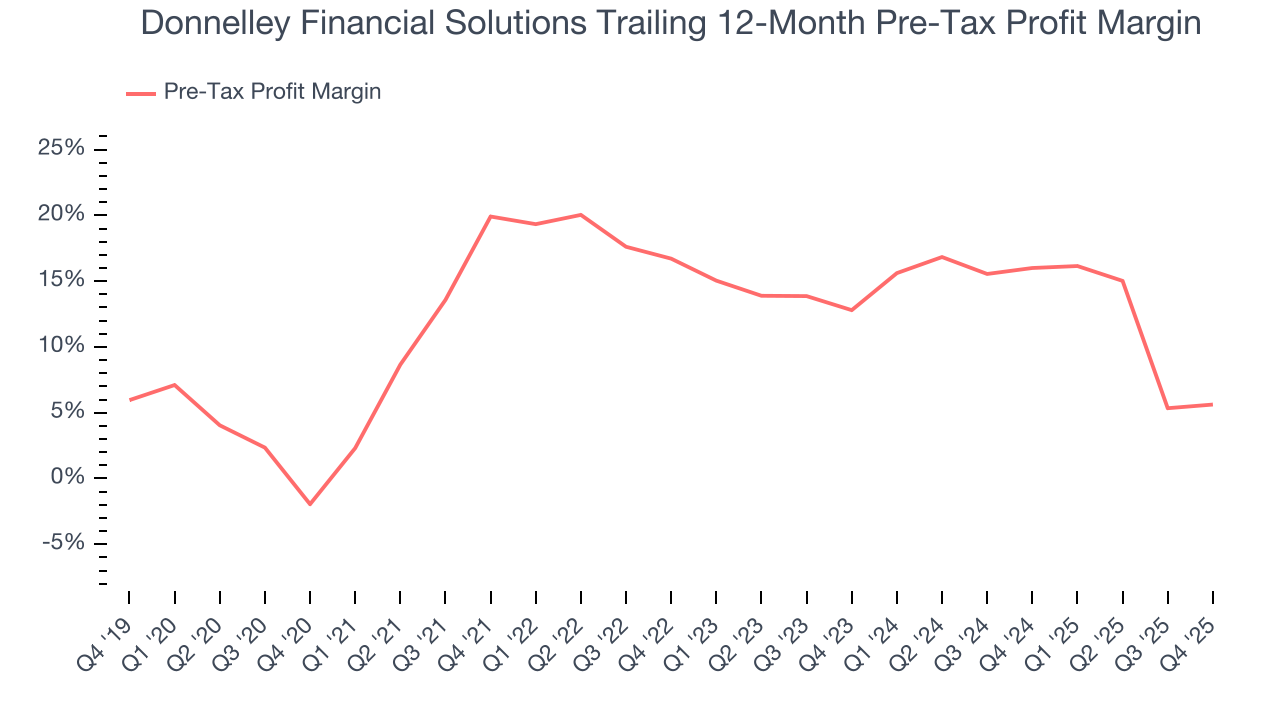

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Financials companies manage interest-bearing assets and liabilities, making the interest income and expenses included in pre-tax profit essential to their profit calculation. Taxes, being external factors beyond management control, are appropriately excluded from this alternative margin measure.

Over the last five years, Donnelley Financial Solutions’s pre-tax profit margin has fallen by 7.6 percentage points, going from 19.9% to 5.6%. However, the company gave back some of its expense savings as its pre-tax profit margin declined by 7.2 percentage points on a two-year basis.

In Q4, Donnelley Financial Solutions’s pre-tax profit margin was 5.9%. This result was 1.3 percentage points better than the same quarter last year.

7. Earnings Per Share

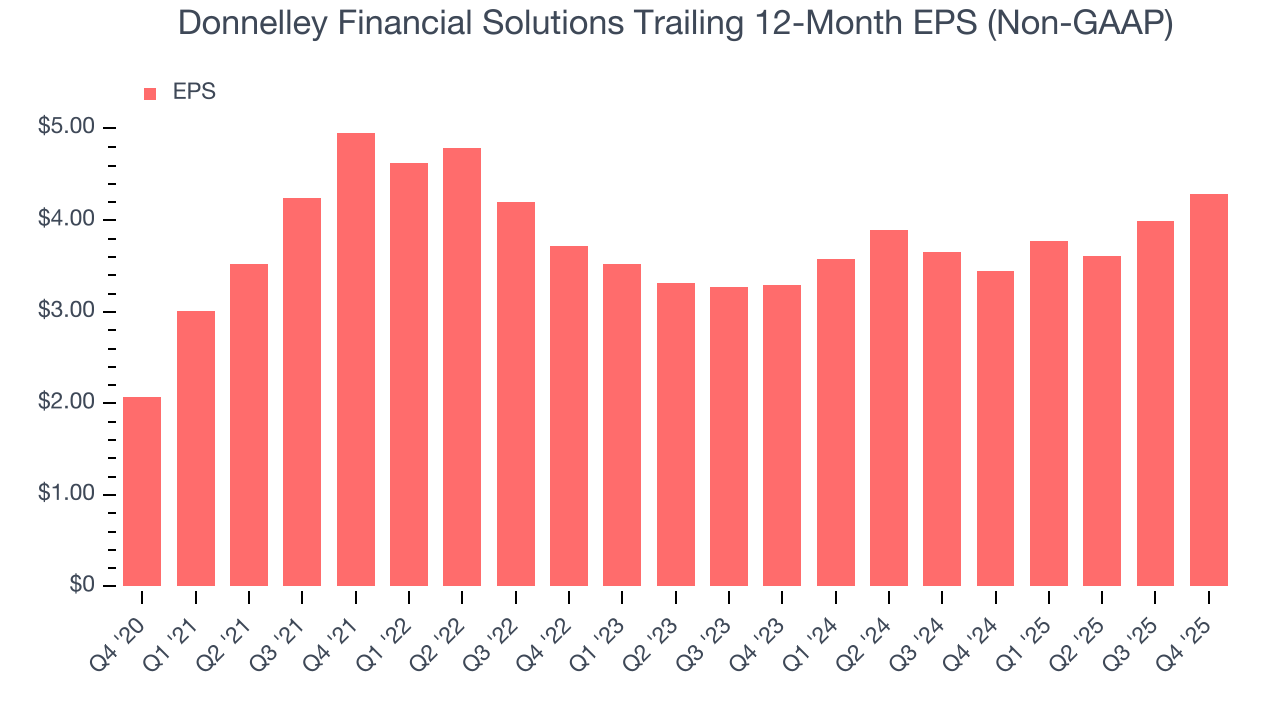

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Donnelley Financial Solutions’s EPS grew at a solid 15.7% compounded annual growth rate over the last five years, higher than its 3% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Donnelley Financial Solutions, its two-year annual EPS growth of 14.2% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Donnelley Financial Solutions reported adjusted EPS of $0.70, up from $0.40 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Donnelley Financial Solutions’s full-year EPS of $4.29 to grow 3.2%.

8. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Donnelley Financial Solutions has averaged an ROE of 26.9%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Donnelley Financial Solutions.

9. Balance Sheet Assessment

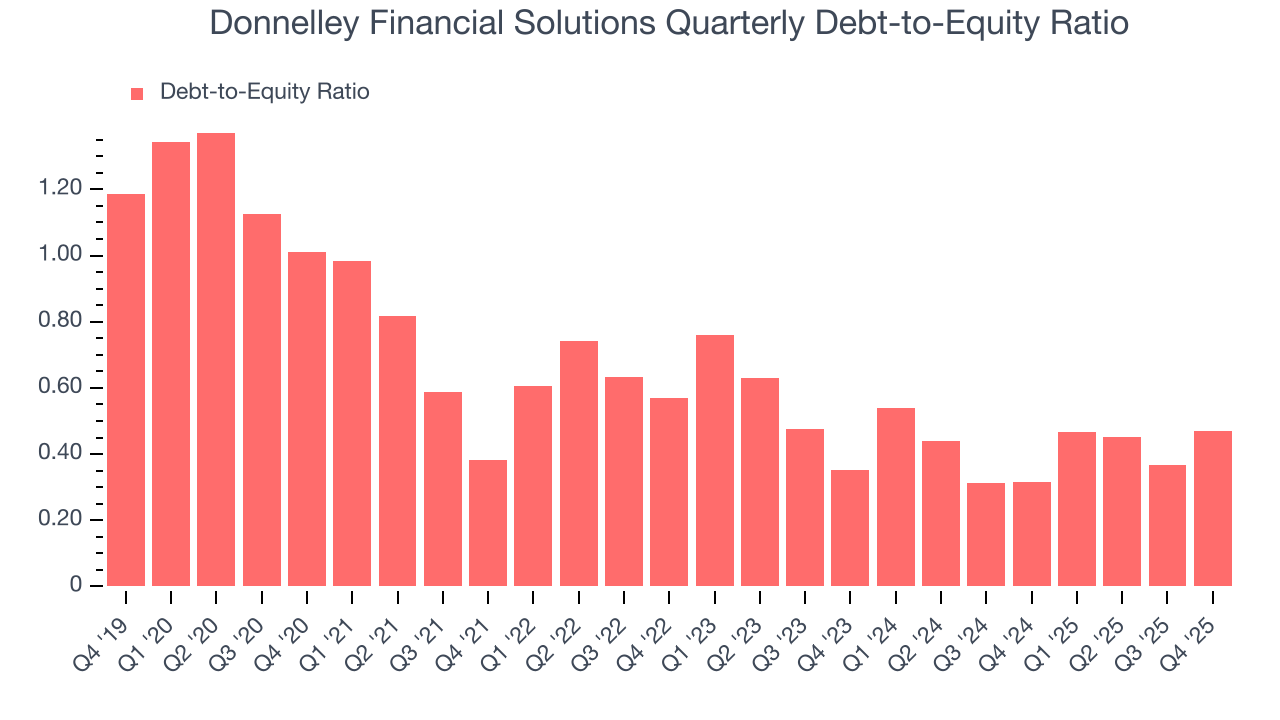

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Donnelley Financial Solutions currently has $178.5 million of debt and $379.2 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.4×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Donnelley Financial Solutions’s Q4 Results

It was good to see Donnelley Financial Solutions beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock remained flat at $39.12 immediately following the results.

11. Is Now The Time To Buy Donnelley Financial Solutions?

Updated: February 17, 2026 at 7:14 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Donnelley Financial Solutions has some positive attributes, but it isn’t one of our picks. Although its revenue has declined over the last five years, its growth over the next 12 months is expected to be higher. On top of that, Donnelley Financial Solutions’s stellar ROE suggests it has been a well-run company historically, and the company’s expanding pre-tax profit margin shows the business has become more efficient.

Donnelley Financial Solutions’s forward price-to-sales ratio is 0x. The market typically values companies like Donnelley Financial Solutions based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $64.33 on the company (compared to the current share price of $39.12).