Donnelley Financial Solutions (DFIN)

Donnelley Financial Solutions doesn’t impress us. Its declining sales show demand has evaporated, a red flag for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Donnelley Financial Solutions Is Not Exciting

Born from the need to navigate increasingly complex financial regulations in the digital age, Donnelley Financial Solutions (NYSE:DFIN) provides software and technology-enabled services that help companies comply with SEC regulations and manage financial transactions and reporting requirements.

- Annual sales declines of 3% for the past five years show its products and services struggled to connect with the market during this cycle

- On the bright side, its stellar return on equity showcases management’s ability to surface highly profitable business ventures

Donnelley Financial Solutions’s quality is inadequate. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Donnelley Financial Solutions

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Donnelley Financial Solutions

At $47.48 per share, Donnelley Financial Solutions trades at 11.6x forward P/E. Donnelley Financial Solutions’s multiple may seem like a great deal among financials peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Donnelley Financial Solutions (DFIN) Research Report: Q3 CY2025 Update

Financial regulatory software provider Donnelley Financial Solutions (NYSE:DFIN) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 2.3% year on year to $175.3 million. On the other hand, next quarter’s revenue guidance of $155 million was less impressive, coming in 6.3% below analysts’ estimates. Its non-GAAP profit of $0.86 per share was 50% above analysts’ consensus estimates.

Donnelley Financial Solutions (DFIN) Q3 CY2025 Highlights:

- Revenue: $175.3 million vs analyst estimates of $169.7 million (2.3% year-on-year decline, 3.3% beat)

- Pre-tax Profit: -$57.9 million (-33% margin, 476% year-on-year decline)

- Adjusted EPS: $0.86 vs analyst estimates of $0.57 (50% beat)

- Revenue Guidance for Q4 CY2025 is $155 million at the midpoint, below analyst estimates of $165.4 million

- Market Capitalization: $1.42 billion

Company Overview

Born from the need to navigate increasingly complex financial regulations in the digital age, Donnelley Financial Solutions (NYSE:DFIN) provides software and technology-enabled services that help companies comply with SEC regulations and manage financial transactions and reporting requirements.

DFIN operates at the intersection of finance, regulation, and technology, offering solutions that span the entire lifecycle of regulatory compliance needs. The company's software portfolio includes ActiveDisclosure for SEC filing preparation, Venue for secure virtual data rooms during transactions, and the Arc Suite platform for investment companies' regulatory filings.

These tools allow clients to create, manage, file, and distribute regulatory documents while ensuring compliance with complex SEC requirements, including proper XBRL tagging formats. For capital markets clients, DFIN supports critical transactions like IPOs, secondary offerings, mergers and acquisitions, and debt offerings, helping companies navigate the documentation and filing requirements throughout these processes.

For investment companies such as mutual funds and alternative investment firms, DFIN provides specialized compliance solutions that address the unique regulatory requirements of the Investment Company Act. A financial advisor might use DFIN's Arc Suite to efficiently prepare and file a mutual fund's semi-annual report with the SEC, ensuring all disclosures meet regulatory standards.

DFIN generates revenue through software subscriptions, transaction-based fees, and tech-enabled services. The company has been strategically shifting its business model toward higher-margin software solutions while maintaining its expertise in traditional compliance services. DFIN serves clients globally, with operations primarily in the United States but also extending to Canada, Ireland, the United Kingdom, France, and Luxembourg.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

DFIN competes with financial compliance software providers like Workiva (NYSE:WK), Toppan Merrill, and SS&C Technologies (NASDAQ:SSNC), as well as specialized providers in the virtual data room space such as Datasite and Intralinks.

5. Revenue Growth

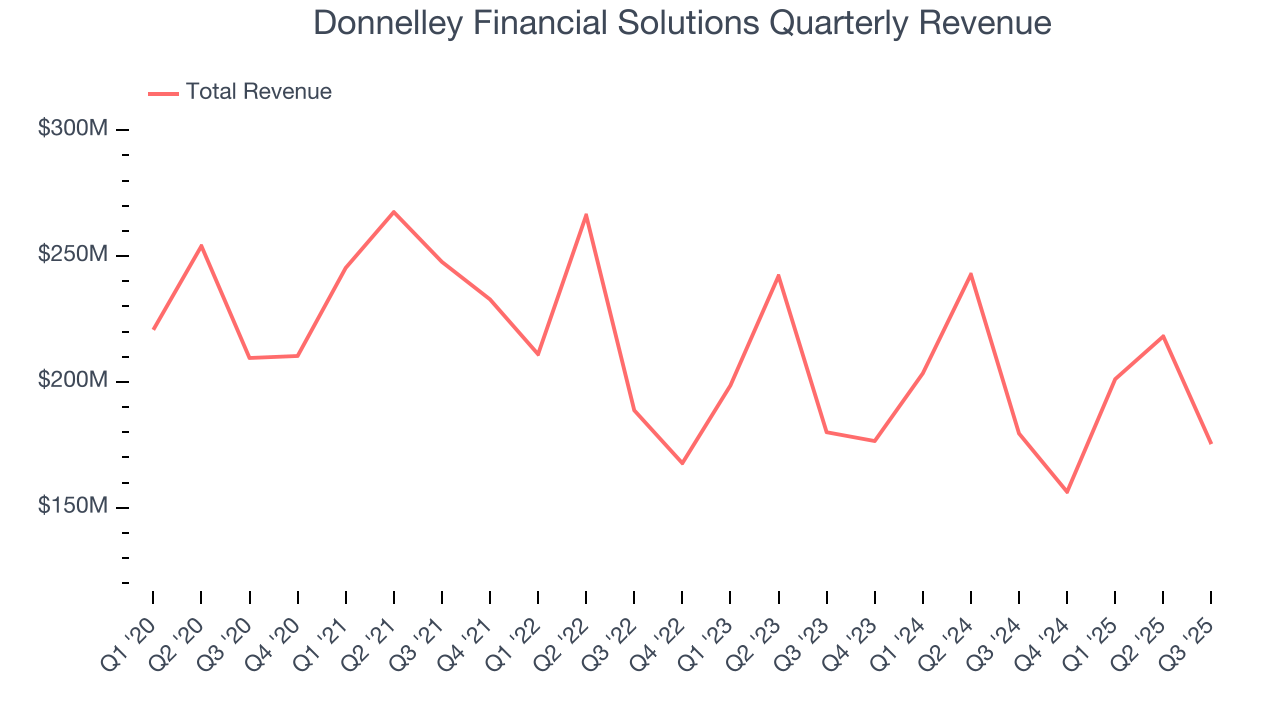

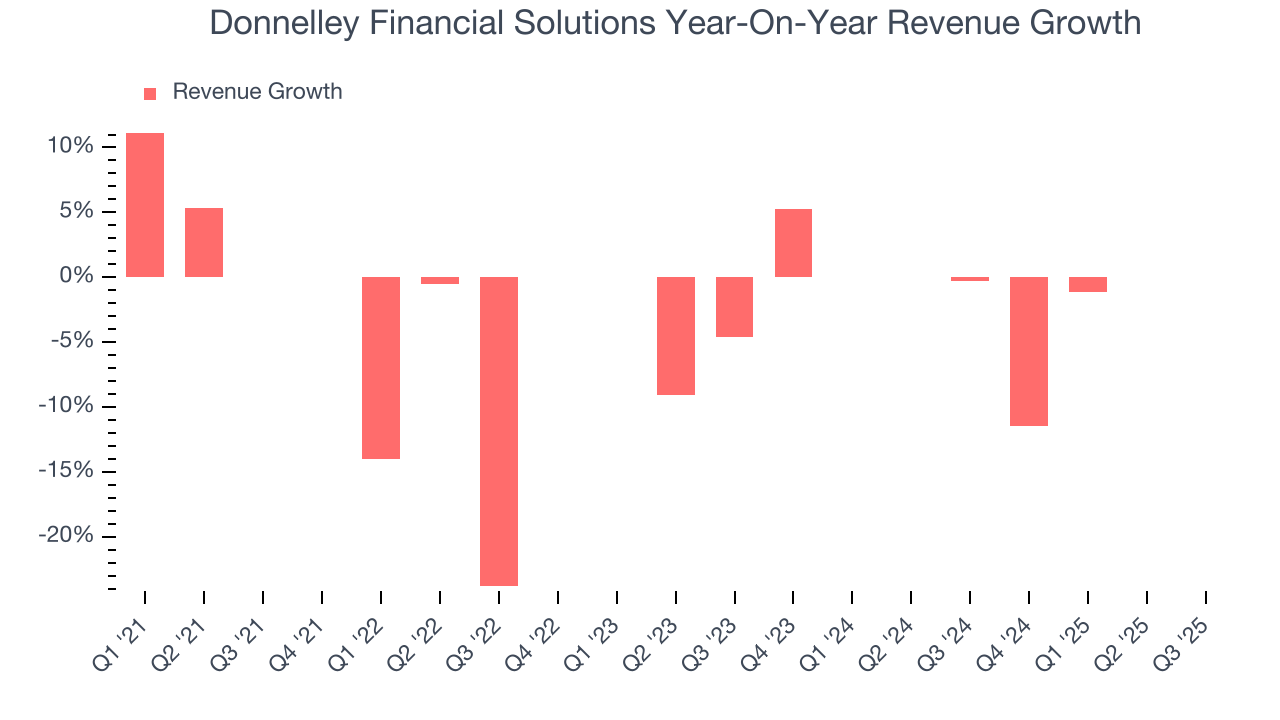

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Donnelley Financial Solutions struggled to consistently generate demand over the last five years as its revenue dropped at a 2.8% annual rate. This was below our standards and is a tough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Donnelley Financial Solutions’s annualized revenue declines of 2.4% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Donnelley Financial Solutions’s revenue fell by 2.3% year on year to $175.3 million but beat Wall Street’s estimates by 3.3%. Company management is currently guiding for flat sales next quarter.

6. Pre-Tax Profit Margin

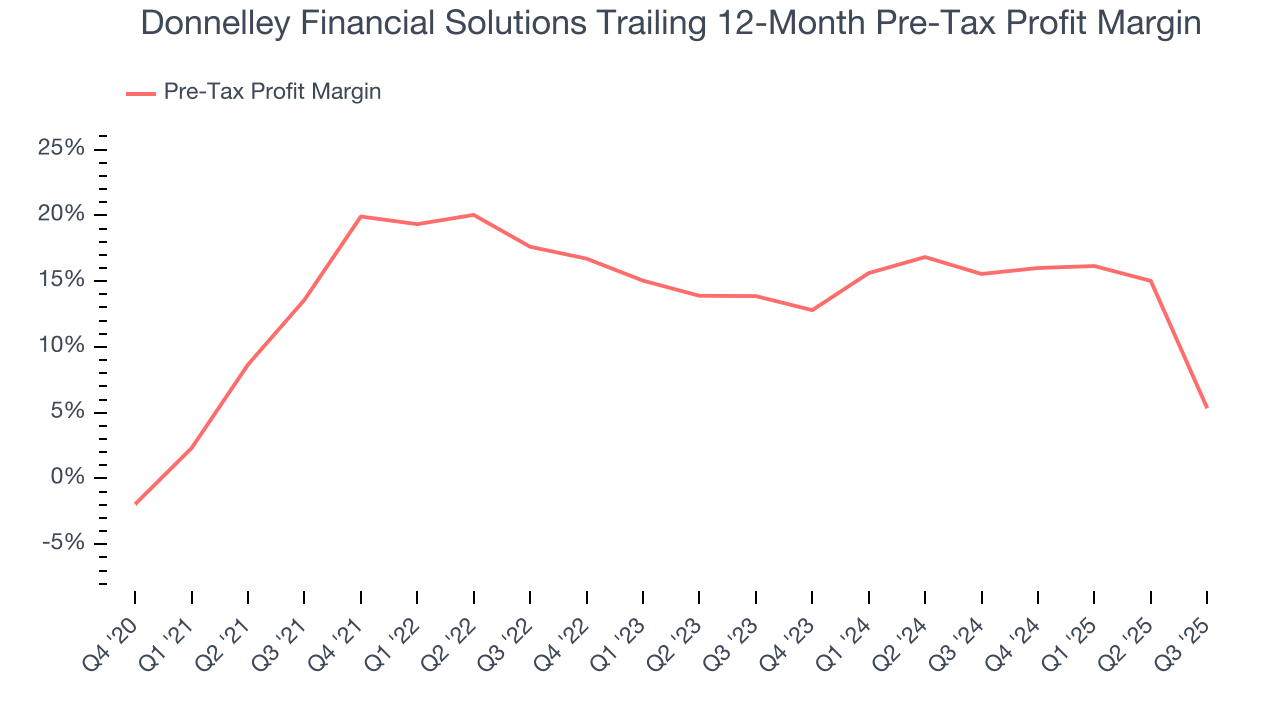

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last four years, Donnelley Financial Solutions’s pre-tax profit margin has risen by 8.2 percentage points, going from 13.6% to 5.3%. It has also declined by 8.5 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

In Q3, Donnelley Financial Solutions’s pre-tax profit margin was negative 33%. This result was 41.6 percentage points worse than the same quarter last year.

7. Earnings Per Share

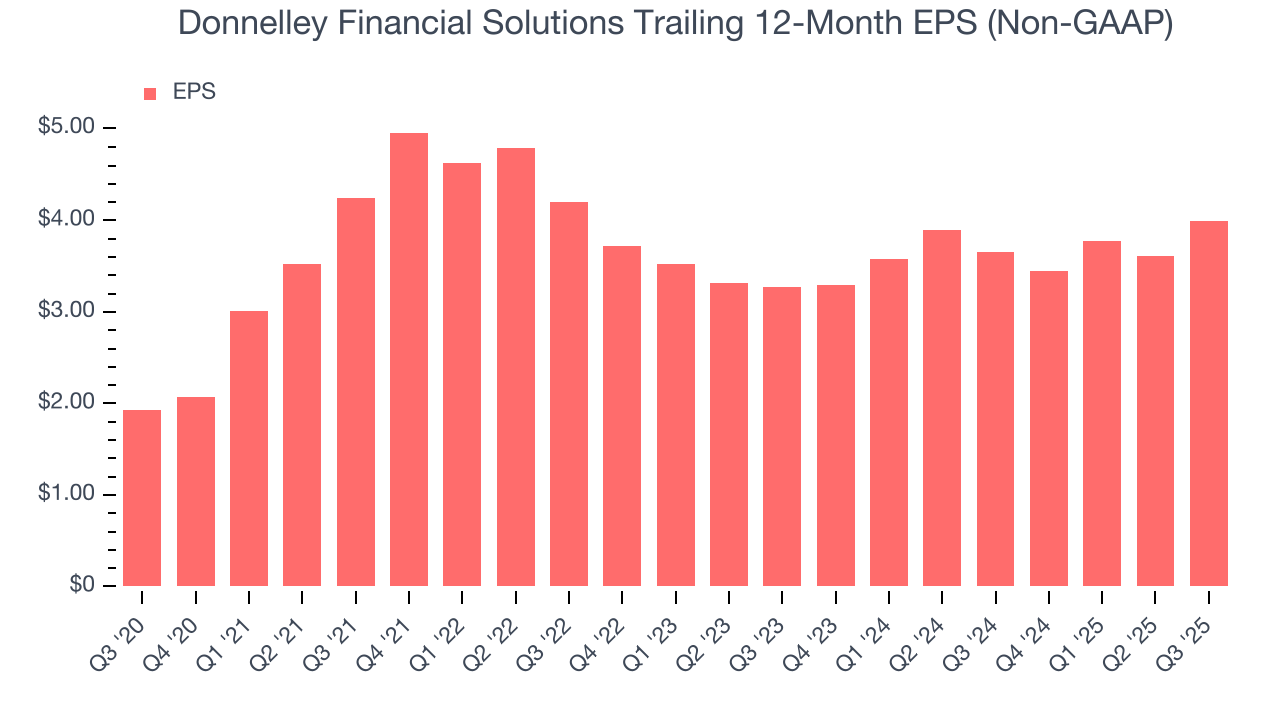

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Donnelley Financial Solutions’s EPS grew at a solid 15.6% compounded annual growth rate over the last five years, higher than its 2.8% annualized revenue declines. However, this alone doesn’t tell us much about its business quality because its pre-tax profit margin didn’t improve.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Donnelley Financial Solutions, its two-year annual EPS growth of 10.5% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Donnelley Financial Solutions reported adjusted EPS of $0.86, up from $0.48 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Donnelley Financial Solutions’s full-year EPS of $3.99 to grow 3.2%.

8. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Donnelley Financial Solutions has averaged an ROE of 26%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Donnelley Financial Solutions.

9. Balance Sheet Assessment

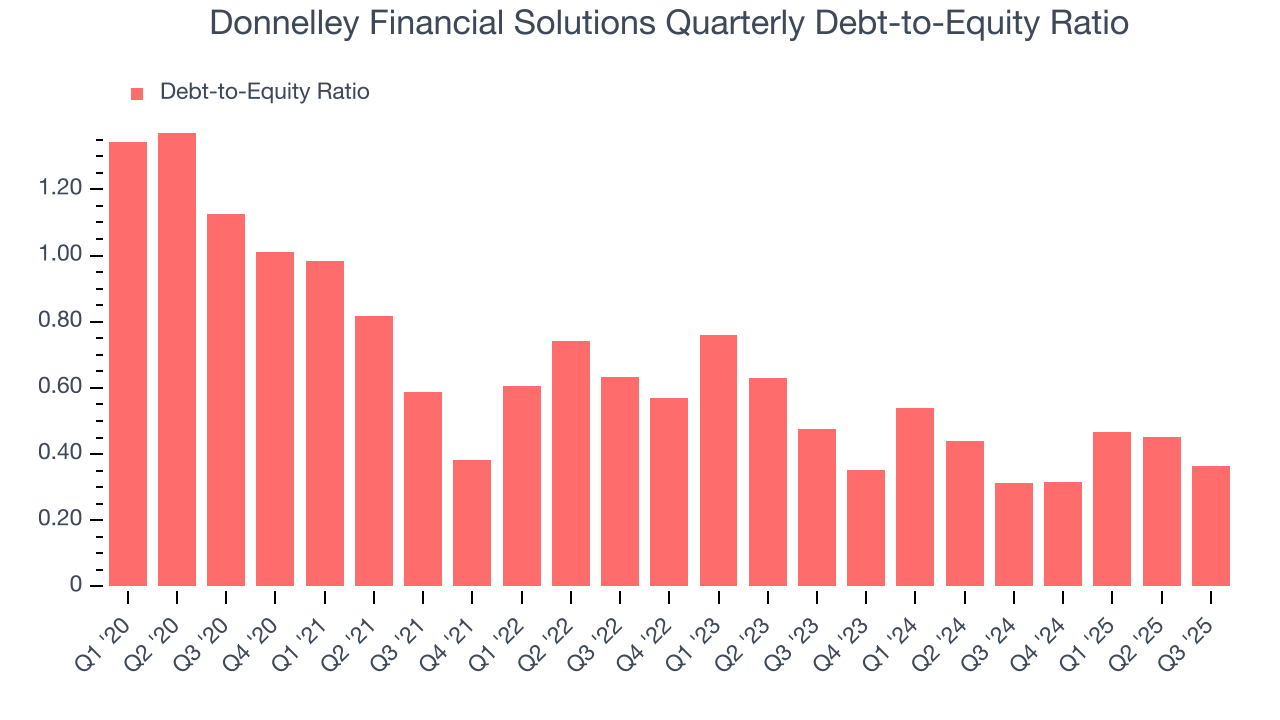

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Donnelley Financial Solutions currently has $154.3 million of debt and $423.1 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.4×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Donnelley Financial Solutions’s Q3 Results

It was good to see Donnelley Financial Solutions beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $51.70 immediately following the results.

11. Is Now The Time To Buy Donnelley Financial Solutions?

Updated: December 4, 2025 at 11:18 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Donnelley Financial Solutions.

Donnelley Financial Solutions has a few positive attributes, but it doesn’t top our wishlist. Although its revenue has declined over the last five years, its growth over the next 12 months is expected to be higher. Plus, Donnelley Financial Solutions’s stellar ROE suggests it has been a well-run company historically.

Donnelley Financial Solutions’s P/E ratio based on the next 12 months is 11.6x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $64.33 on the company (compared to the current share price of $47.48).