Pediatrix Medical Group (MD)

Pediatrix Medical Group doesn’t excite us. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Pediatrix Medical Group Will Underperform

With a network of approximately 2,620 affiliated physicians caring for some of the most vulnerable patients, Pediatrix Medical Group (NYSE:MD) provides specialized physician services focused on neonatal, maternal-fetal, pediatric cardiology and other pediatric subspecialty care across 37 states.

- Annual revenue growth of 1.6% over the last five years was below our standards for the healthcare sector

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 1.1%

- On the plus side, its incremental sales over the last five years boosted profitability as its annual earnings per share growth of 12.5% outstripped its revenue performance

Pediatrix Medical Group’s quality is inadequate. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Pediatrix Medical Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Pediatrix Medical Group

Pediatrix Medical Group’s stock price of $21.54 implies a valuation ratio of 10.3x forward P/E. This multiple is cheaper than most healthcare peers, but we think this is justified.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Pediatrix Medical Group (MD) Research Report: Q3 CY2025 Update

Pediatric healthcare provider Pediatrix Medical Group (NYSE:MD) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 3.6% year on year to $492.9 million. Its non-GAAP profit of $0.67 per share was 43.9% above analysts’ consensus estimates.

Pediatrix Medical Group (MD) Q3 CY2025 Highlights:

- Revenue: $492.9 million vs analyst estimates of $477.7 million (3.6% year-on-year decline, 3.2% beat)

- Adjusted EPS: $0.67 vs analyst estimates of $0.47 (43.9% beat)

- Adjusted EBITDA: $87.32 million vs analyst estimates of $64.72 million (17.7% margin, 34.9% beat)

- EBITDA guidance for the full year is $280 million at the midpoint, above analyst estimates of $251.6 million

- Operating Margin: 13.8%, up from 6.6% in the same quarter last year

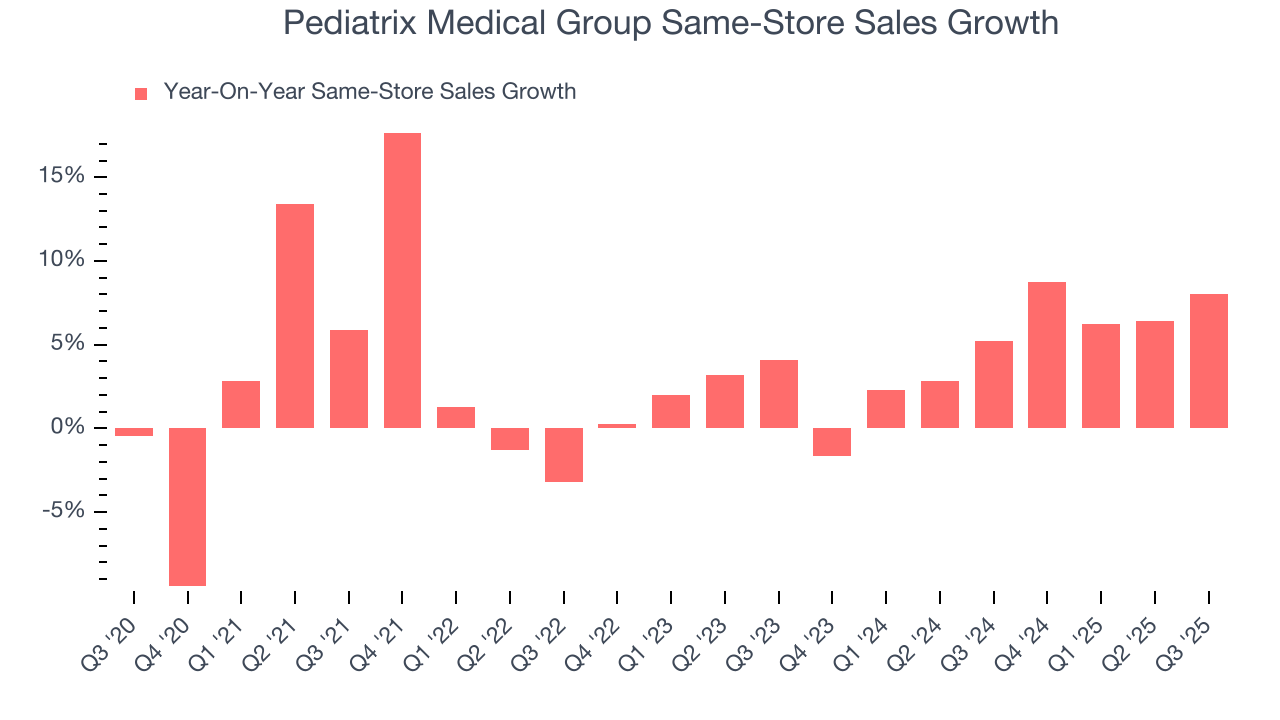

- Same-Store Sales rose 8% year on year (5.2% in the same quarter last year)

- Market Capitalization: $1.45 billion

Company Overview

With a network of approximately 2,620 affiliated physicians caring for some of the most vulnerable patients, Pediatrix Medical Group (NYSE:MD) provides specialized physician services focused on neonatal, maternal-fetal, pediatric cardiology and other pediatric subspecialty care across 37 states.

Pediatrix operates through a network of affiliated physicians who primarily work in hospital settings, with neonatal intensive care units (NICUs) forming the core of their practice. The company's neonatologists provide round-the-clock care for premature and medically complex newborns, while maternal-fetal medicine specialists manage high-risk pregnancies. This coordinated approach creates a continuum of care from pregnancy through delivery and newborn treatment.

The company's business model centers on staffing and managing clinical activities within specific hospital-based units. When a hospital partners with Pediatrix, the company typically assumes responsibility for physician staffing, scheduling, and clinical management of specialized units like NICUs. For example, a hospital might contract with Pediatrix to ensure 24/7 neonatologist coverage in its NICU, providing immediate specialized care for any premature infant born at that facility.

Beyond neonatal and maternal care, Pediatrix has expanded into multiple pediatric subspecialties including cardiology, intensive care, hospital medicine, surgery, urology, ENT, and ophthalmology. The company also operates pediatric urgent care clinics and provides newborn hearing screening services, having screened over 795,000 babies in 2023 alone.

Pediatrix generates revenue primarily through billing patients and insurance companies for physician services. The company also receives administrative fees from hospital partners for services like medical directorships, which accounted for approximately 14% of net revenue in 2023. Hospital contracts typically run for one to three years with automatic renewal provisions.

The company maintains extensive clinical data systems, including its proprietary BabySteps Cloud platform, which enables documentation of patient care and supports clinical research initiatives. This research focus has allowed Pediatrix to develop evidence-based protocols that aim to improve patient outcomes while reducing healthcare costs.

4. Specialized Medical & Nursing Services

The skilled nursing services industry provides specialized care for patients requiring medical or rehabilitative support after hospital stays or for chronic conditions. These companies benefit from stable demand driven by an aging population and recurring revenue from Medicare, Medicaid, and private insurance. However, the industry faces challenges such as thin margins due to high labor costs and stringent regulatory requirements. Looking ahead, the industry is supported by tailwinds from an aging population, which means higher chronic disease prevalence. Advances in medical technology, including using AI to better predict, diagnose, and treat illnesses, may reduce hospital readmissions and improve outcomes. However, headwinds such as labor shortages, wage inflation, and potential government reimbursement cuts pose challenges. Adapting to value-based care models may further squeeze margins by requiring investments in training, technology, and compliance.

Pediatrix Medical Group competes with other physician services organizations like TeamHealth, Envision Healthcare, and Sound Physicians, as well as hospital-employed physician groups and academic medical centers that directly employ specialists in neonatal, maternal-fetal, and pediatric subspecialty care.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.92 billion in revenue over the past 12 months, Pediatrix Medical Group is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

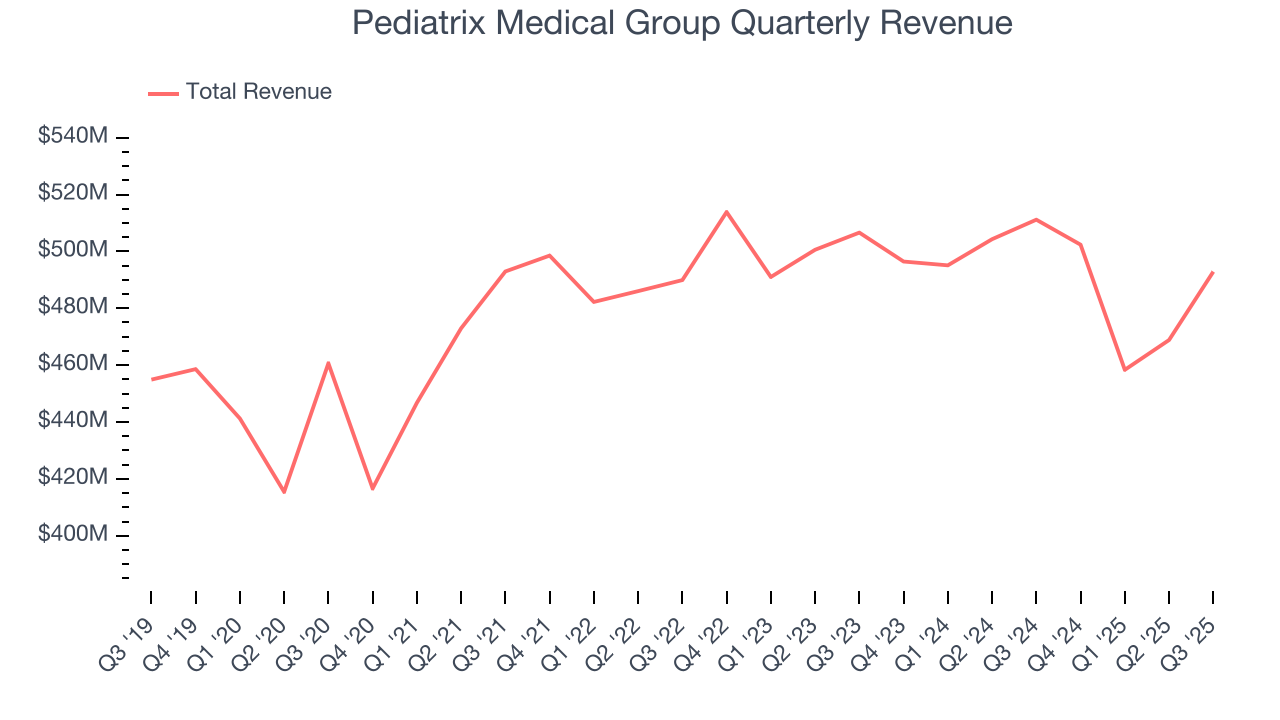

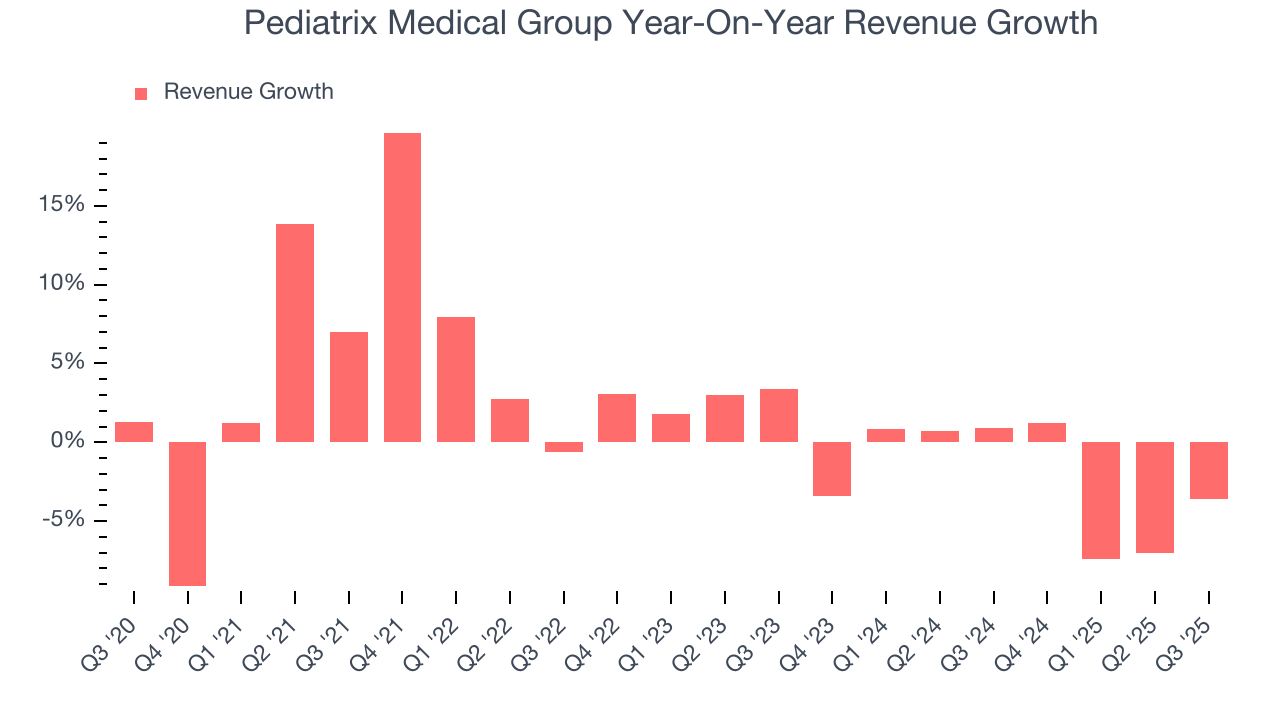

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Pediatrix Medical Group’s sales grew at a tepid 1.6% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Pediatrix Medical Group’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.3% annually.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Pediatrix Medical Group’s same-store sales averaged 4.8% year-on-year growth. Because this number is better than its revenue growth, we can see its sales from existing locations are performing better than its sales from new locations.

This quarter, Pediatrix Medical Group’s revenue fell by 3.6% year on year to $492.9 million but beat Wall Street’s estimates by 3.2%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

7. Operating Margin

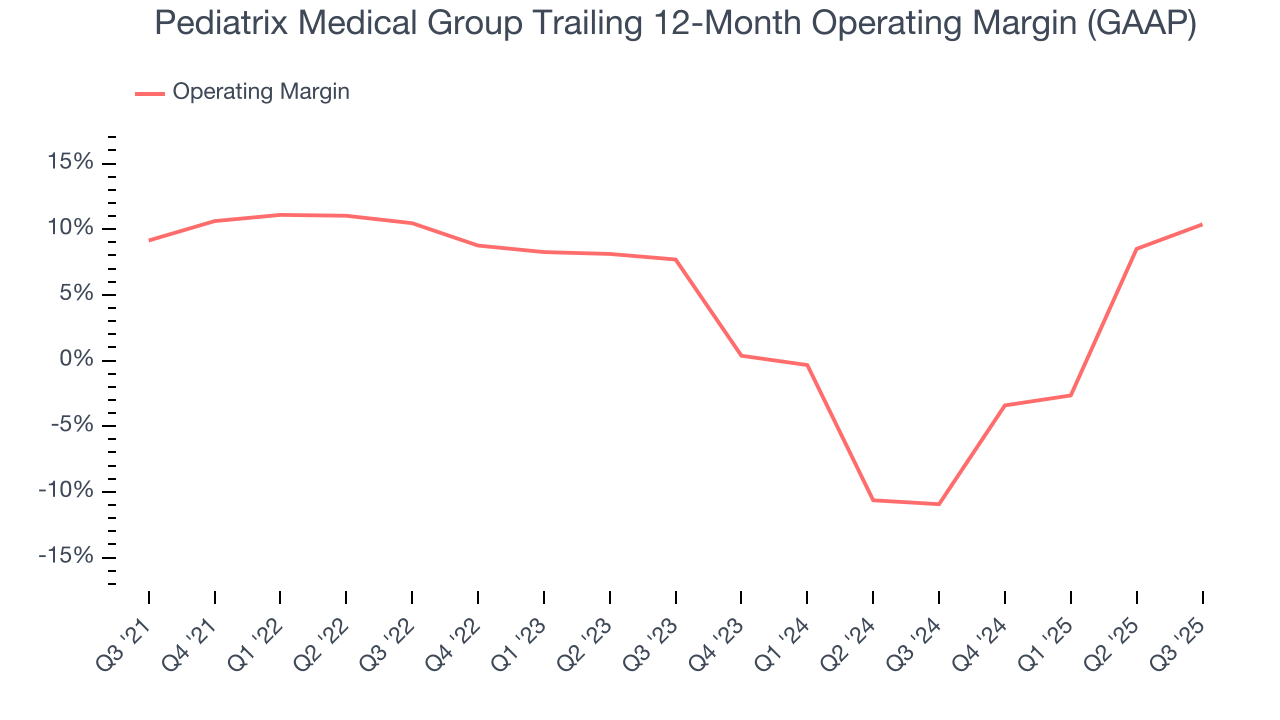

Pediatrix Medical Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.2% was weak for a healthcare business.

On the plus side, Pediatrix Medical Group’s operating margin rose by 1.2 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 2.7 percentage points on a two-year basis.

This quarter, Pediatrix Medical Group generated an operating margin profit margin of 13.8%, up 7.2 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

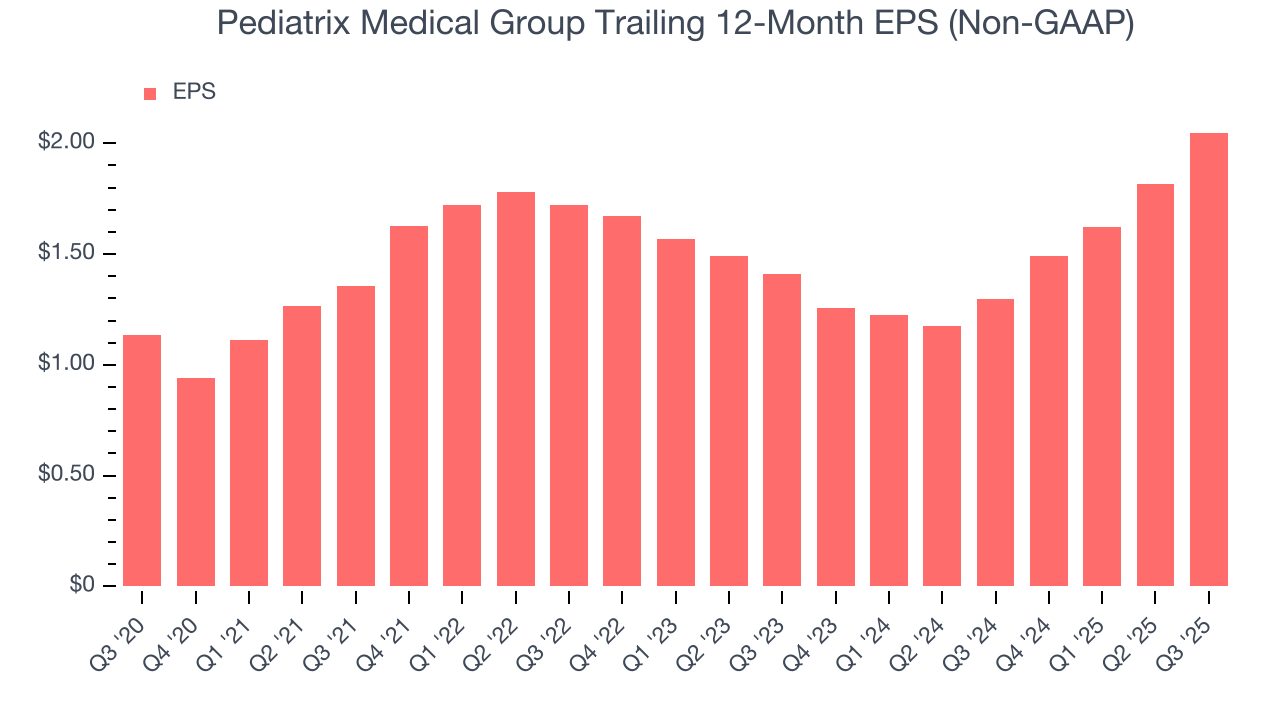

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Pediatrix Medical Group’s EPS grew at a spectacular 12.5% compounded annual growth rate over the last five years, higher than its 1.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Pediatrix Medical Group’s earnings to better understand the drivers of its performance. As we mentioned earlier, Pediatrix Medical Group’s operating margin expanded by 1.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Pediatrix Medical Group reported adjusted EPS of $0.67, up from $0.44 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Pediatrix Medical Group’s full-year EPS of $2.05 to shrink by 11.2%.

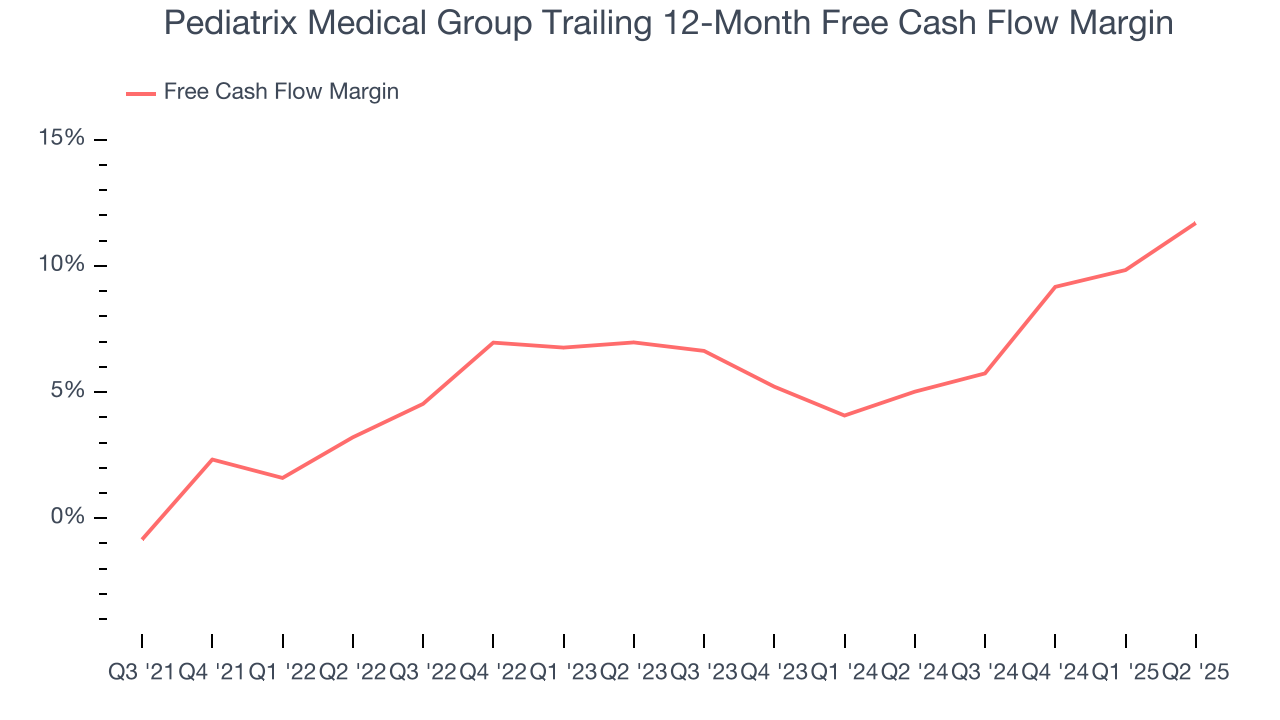

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Pediatrix Medical Group has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Pediatrix Medical Group’s margin expanded by 14.8 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

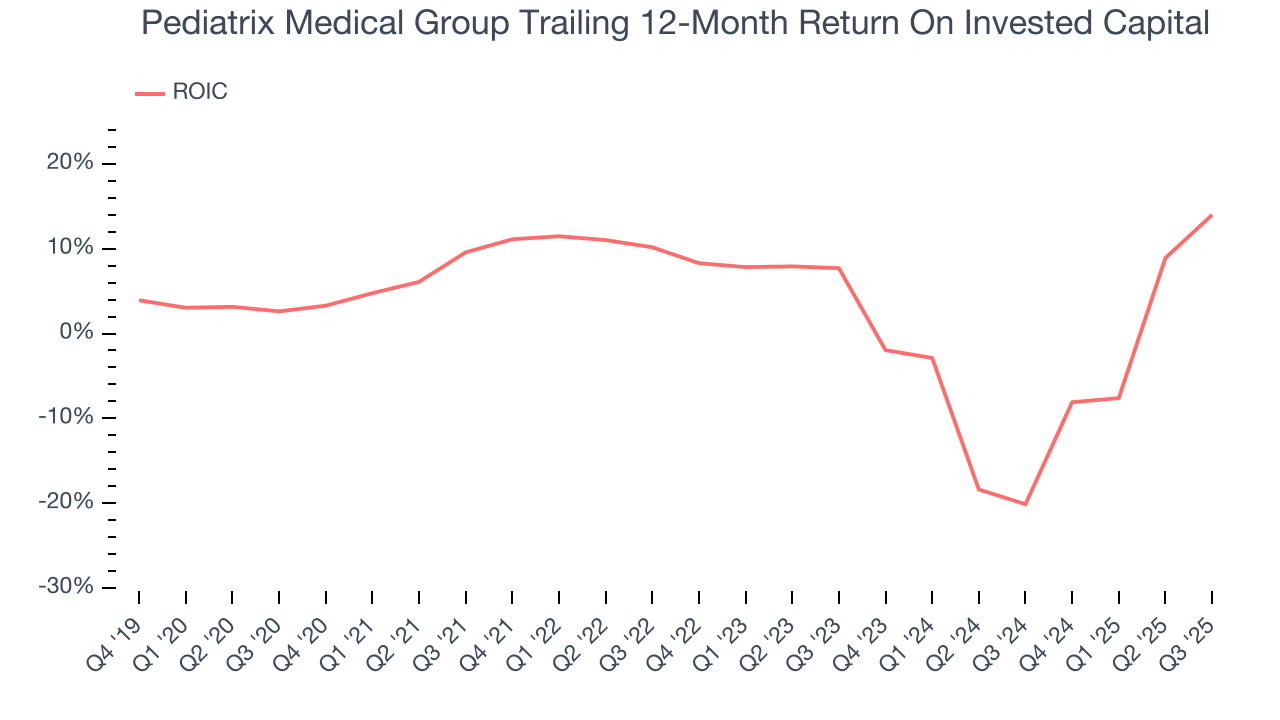

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Pediatrix Medical Group historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.3%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Pediatrix Medical Group’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

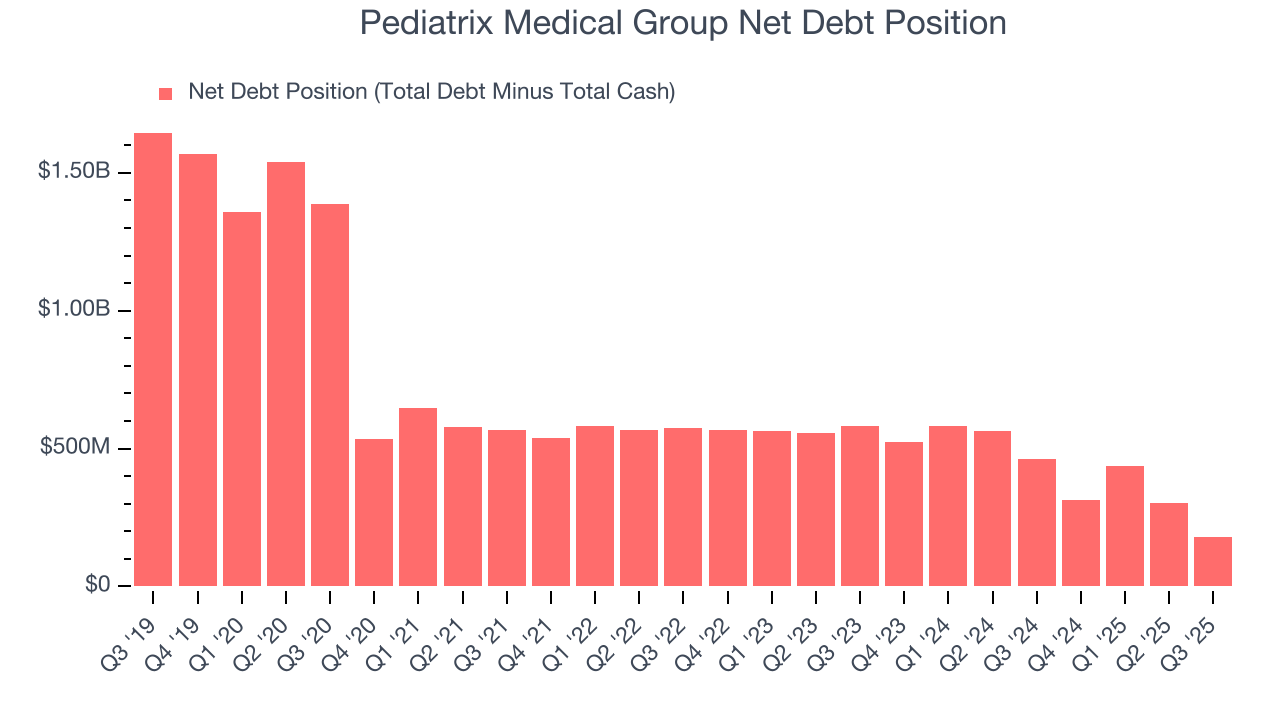

11. Balance Sheet Assessment

Pediatrix Medical Group reported $463.1 million of cash and $642.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $278.5 million of EBITDA over the last 12 months, we view Pediatrix Medical Group’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $7.76 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Pediatrix Medical Group’s Q3 Results

We were impressed by how significantly Pediatrix Medical Group blew past analysts’ same-store sales expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates on better proftability. Zooming out, we think this was a very solid print. The stock traded up 11.9% to $19 immediately after reporting.

13. Is Now The Time To Buy Pediatrix Medical Group?

Updated: January 23, 2026 at 10:59 PM EST

Are you wondering whether to buy Pediatrix Medical Group or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Pediatrix Medical Group isn’t a terrible business, but it doesn’t pass our bar. To kick things off, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. And while its rising cash profitability gives it more optionality, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its subscale operations give it fewer distribution channels than its larger rivals.

Pediatrix Medical Group’s P/E ratio based on the next 12 months is 10.3x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $22.67 on the company (compared to the current share price of $21.54).