Movado (MOV)

Movado keeps us up at night. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Movado Will Underperform

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

- Sales trends were unexciting over the last five years as its 4.7% annual growth was below the typical consumer discretionary company

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

- Lacking free cash flow limits its freedom to invest in growth initiatives, execute share buybacks, or pay dividends

Movado falls short of our expectations. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Movado

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Movado

Movado is trading at $24.92 per share, or 15x forward P/E. Movado’s valuation may seem like a bargain, especially when stacked up against other consumer discretionary companies. We remind you that you often get what you pay for, though.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Movado (MOV) Research Report: Q3 CY2025 Update

Luxury watch company Movado (NYSE:MOV) met Wall Streets revenue expectations in Q3 CY2025, with sales up 1.9% year on year to $186.1 million. Its GAAP profit of $0.42 per share was 26.8% below analysts’ consensus estimates.

Movado (MOV) Q3 CY2025 Highlights:

- Revenue: $186.1 million vs analyst estimates of $185.9 million (1.9% year-on-year growth, in line)

- EPS (GAAP): $0.42 vs analyst expectations of $0.57 (26.8% miss)

- Adjusted EBITDA: $14.11 million (7.6% margin, 10% year-on-year growth)

- Operating Margin: 6.3%, up from 5.1% in the same quarter last year

- Free Cash Flow was $11.6 million, up from -$7.17 million in the same quarter last year

- Market Capitalization: $430.6 million

Company Overview

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado’s signature Museum Watch is characterized by a singular dot at 12 o'clock, symbolizing the sun at high noon. This iconic design has gained mainstream popularity and is displayed in the Museum of Modern Art’s permanent collection in New York.

Movado’s portfolio extends beyond its flagship brand with labels including Ebel, Concord, Olivia Burton, and MVMT. This multi-brand strategy allows Movado to offer a broad spectrum of watch designs, from classic and luxury timepieces to contemporary and fashion-forward styles. This product breadth captures a wide customer base, from watch enthusiasts to casual wearers. Additionally, the company designs and distributes jewelry, eyewear, and other accessories, broadening its category offerings.

Movado's growth is dependent on the development of new watch designs and its approach to sales and marketing. The brand leverages digital platforms and e-commerce to adapt to changing consumer purchasing behaviors and the evolving retail landscape.

4. Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Movado’s primary competitors include Omega (owned by Swatch SWX:UHR), Fossil Group (NASDAQ:FOSL), Citizen Watch (TYO:7762), TAG Heuer (owned by LVMH Moët Hennessy Louis Vuitton Euronext:MC), and private company Rolex.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Movado grew its sales at a weak 4.7% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Movado’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.4% annually.

This quarter, Movado grew its revenue by 1.9% year on year, and its $186.1 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Operating Margin

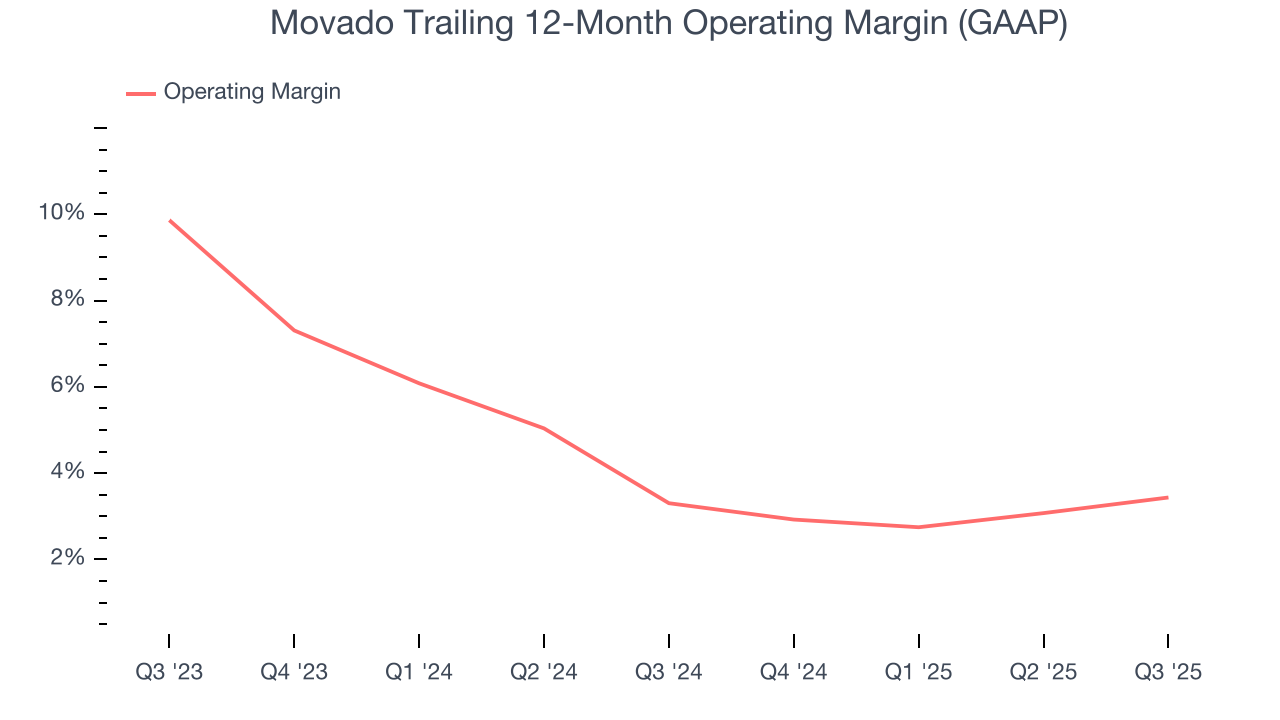

Movado’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 3.4% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Movado generated an operating margin profit margin of 6.3%, up 1.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Movado’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Movado reported EPS of $0.42, up from $0.22 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Movado’s full-year EPS of $0.97 to grow 111%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Movado has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.3%, lousy for a consumer discretionary business.

Movado’s free cash flow clocked in at $11.6 million in Q3, equivalent to a 6.2% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Movado historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 19.8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Movado’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

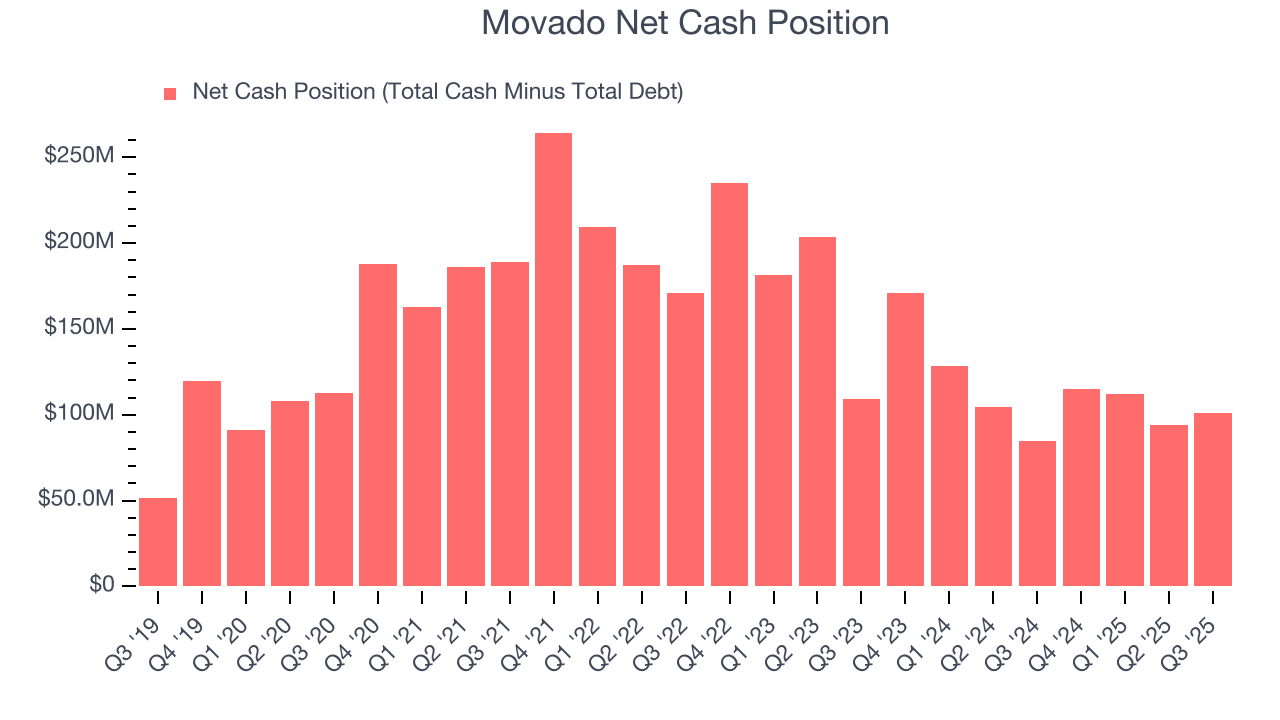

Movado is a profitable, well-capitalized company with $183.9 million of cash and $83.07 million of debt on its balance sheet. This $100.8 million net cash position is 23.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Movado’s Q3 Results

We struggled to find many resounding positives in these results. Revenue was just in line and EPS missed. Overall, this was a weaker quarter. The stock remained flat at $19.49 immediately after reporting.

12. Is Now The Time To Buy Movado?

Updated: February 19, 2026 at 9:49 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Movado.

We cheer for all companies serving everyday consumers, but in the case of Movado, we’ll be cheering from the sidelines. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its low free cash flow margins give it little breathing room.

Movado’s P/E ratio based on the next 12 months is 15x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $30.75 on the company (compared to the current share price of $24.92).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.