Paymentus (PAY)

Not many stocks excite us like Paymentus. Its superb revenue growth indicates its market share is increasing.― StockStory Analyst Team

1. News

2. Summary

Why We Like Paymentus

Founded in 2004 to simplify the complex world of bill payments, Paymentus (NYSE:PAY) provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

- Market share has increased this cycle as its 31.6% annual revenue growth over the last five years was exceptional

- Earnings per share grew by 80.7% annually over the last four years and trumped its peers

- The stock is expensive, but we’d argue it’s often wise to hold onto high-quality businesses for the long term

Paymentus is at the top of our list. There’s a lot to like here.

Is Now The Time To Buy Paymentus?

High Quality

Investable

Underperform

Is Now The Time To Buy Paymentus?

Paymentus’s stock price of $29.44 implies a valuation ratio of 42x forward P/E. The lofty multiple means expectations are high for this company over the next six to twelve months.

Do you admire this business? If so, a small position seems prudent as the long-term outlook seems solid. Be aware that its valuation could result in short-term volatility based on both macro and company-specific factors.

3. Paymentus (PAY) Research Report: Q3 CY2025 Update

Digital payment platform Paymentus (NYSE:PAY) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 34.2% year on year to $310.7 million. On top of that, next quarter’s revenue guidance ($309.5 million at the midpoint) was surprisingly good and 5.8% above what analysts were expecting. Its non-GAAP profit of $0.17 per share was 14.6% above analysts’ consensus estimates.

Paymentus (PAY) Q3 CY2025 Highlights:

Company Overview

Founded in 2004 to simplify the complex world of bill payments, Paymentus (NYSE:PAY) provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

Paymentus operates at the intersection of financial technology and customer experience, offering a digital platform that simplifies how organizations collect payments and how consumers pay their bills. The company's technology enables clients to accept multiple payment types—including credit cards, debit cards, bank transfers, and electronic checks—through various channels such as websites, mobile apps, interactive voice response systems, and text messaging.

The platform serves a diverse client base primarily consisting of essential service providers. For example, a municipal water utility might use Paymentus to allow residents to view their water usage, receive electronic bills, set up automatic payments, and pay their monthly bills through a branded payment portal. This eliminates paper-based processes while providing consumers with convenient payment options.

Paymentus generates revenue through a combination of transaction fees, subscription fees, and service charges. When a consumer pays their electric bill through a utility company's Paymentus-powered portal, Paymentus earns a fee for processing that transaction. The company's business model benefits from recurring revenue as consumers make regular payments for essential services.

Beyond basic payment processing, Paymentus offers additional features like payment reminders, electronic bill presentment, and customer engagement tools. These capabilities help service providers improve collection rates while reducing costs associated with paper billing and manual payment processing. The company maintains operations primarily in the United States, with additional presence in Canada and India, allowing it to serve clients across North America while leveraging global technology resources.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

Paymentus competes with other payment technology providers including ACI Worldwide (NASDAQ:ACIW), Fiserv (NASDAQ:FI), Jack Henry & Associates (NASDAQ:JKHY), and privately-held companies like Invoice Cloud and Aliaswire in the bill payment space.

5. Revenue Growth

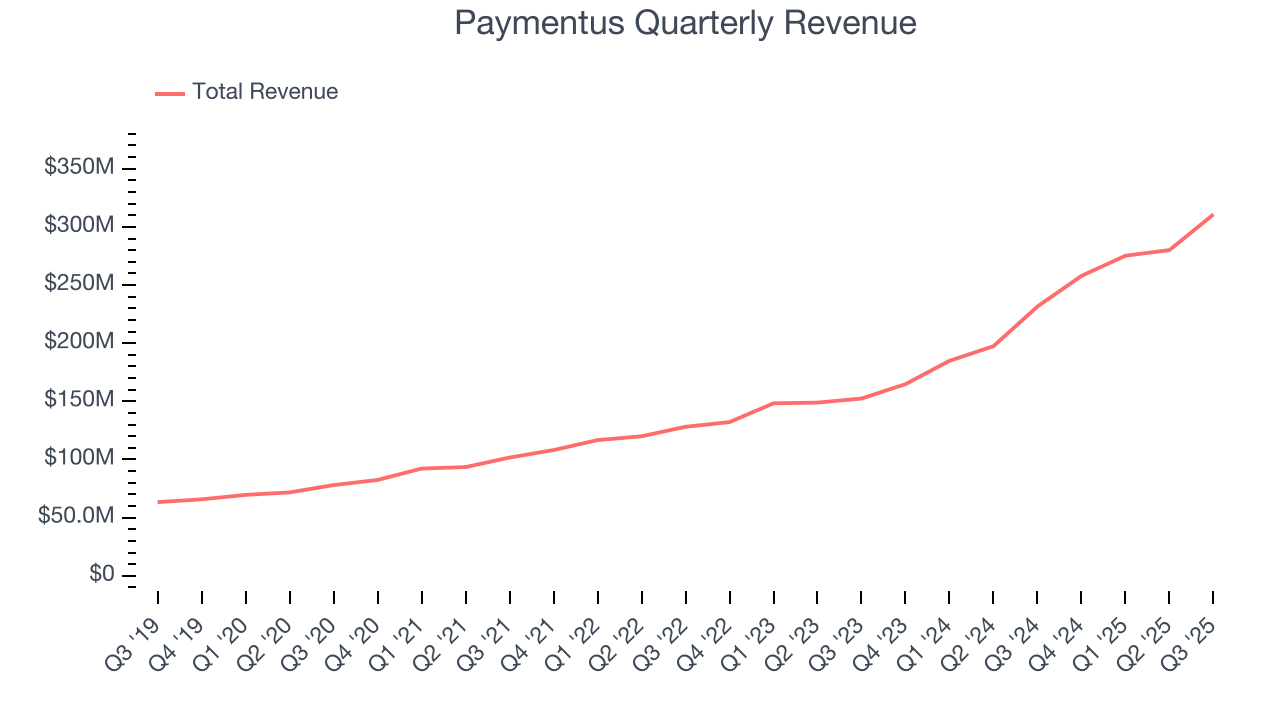

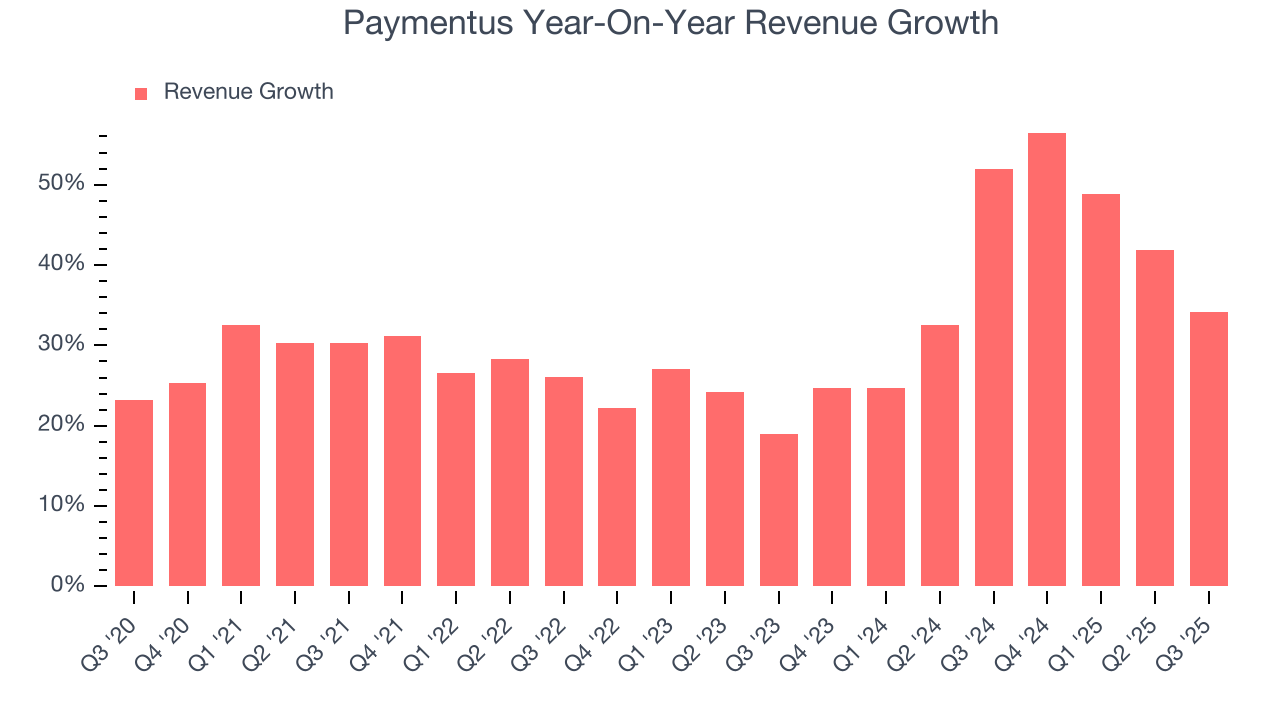

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Paymentus’s revenue grew at an incredible 31.6% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Paymentus’s annualized revenue growth of 39% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Paymentus reported wonderful year-on-year revenue growth of 34.2%, and its $310.7 million of revenue exceeded Wall Street’s estimates by 10.7%. Company management is currently guiding for a 20% year-on-year increase in sales next quarter.

6. Pre-Tax Profit Margin

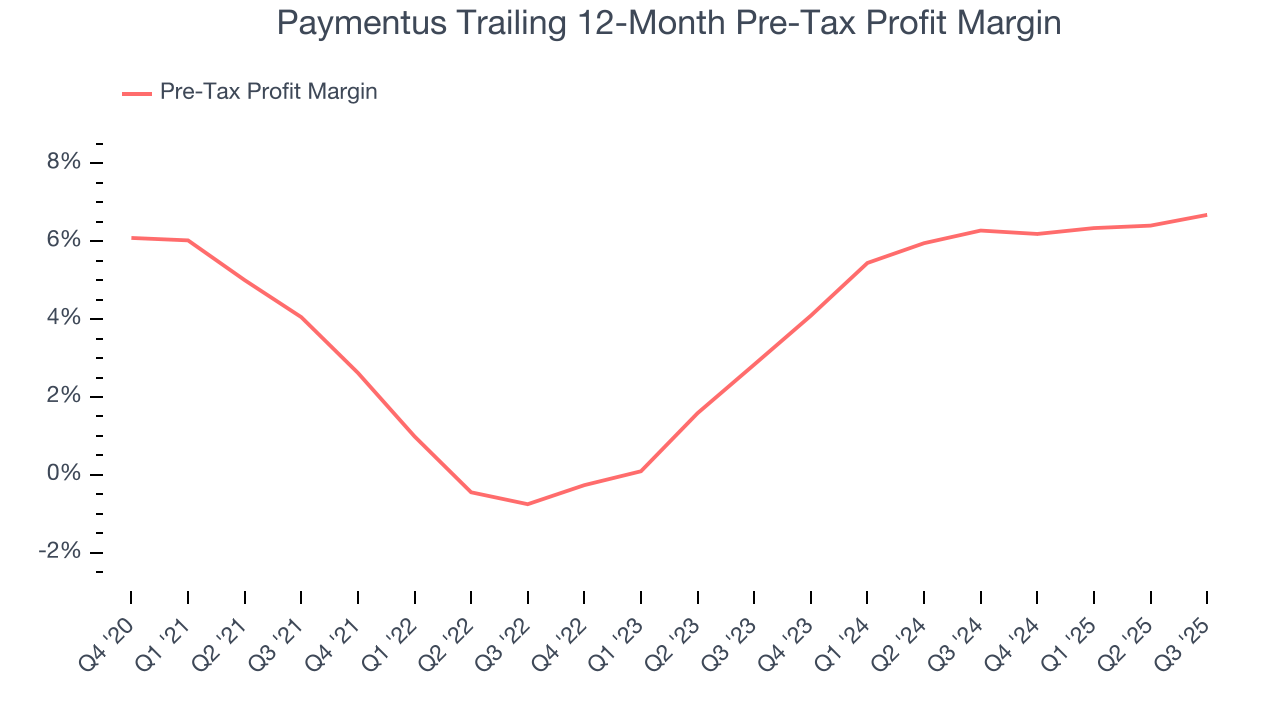

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last four years, Paymentus’s pre-tax profit margin has fallen by 2.6 percentage points, going from 4.1% to 6.7%. It has also expanded by 3.8 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

Paymentus’s pre-tax profit margin came in at 7.3% this quarter. This result was 1 percentage points better than the same quarter last year.

7. Earnings Per Share

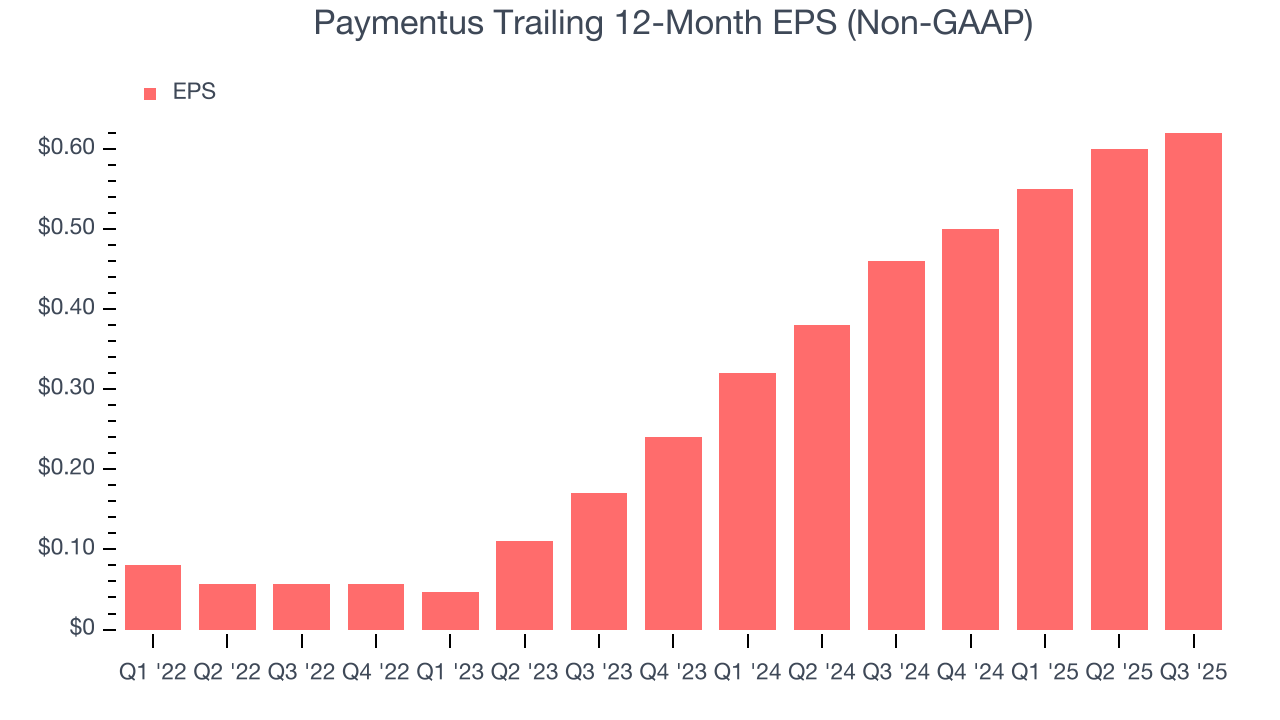

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Paymentus’s full-year EPS grew at an astounding 83.5% compounded annual growth rate over the last four years, better than the broader financials sector.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Paymentus’s EPS grew at an astounding 91% compounded annual growth rate over the last two years, higher than its 39% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Paymentus’s earnings can give us a better understanding of its performance. Paymentus’s pre-tax profit margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Paymentus reported adjusted EPS of $0.17, up from $0.15 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Paymentus’s full-year EPS of $0.62 to grow 11.7%.

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Paymentus has averaged an ROE of 5.9%, uninspiring for a company operating in a sector where the average shakes out around 10%. We’re optimistic Paymentus can turn the ship around given its success in other measures of financial health.

9. Balance Sheet Assessment

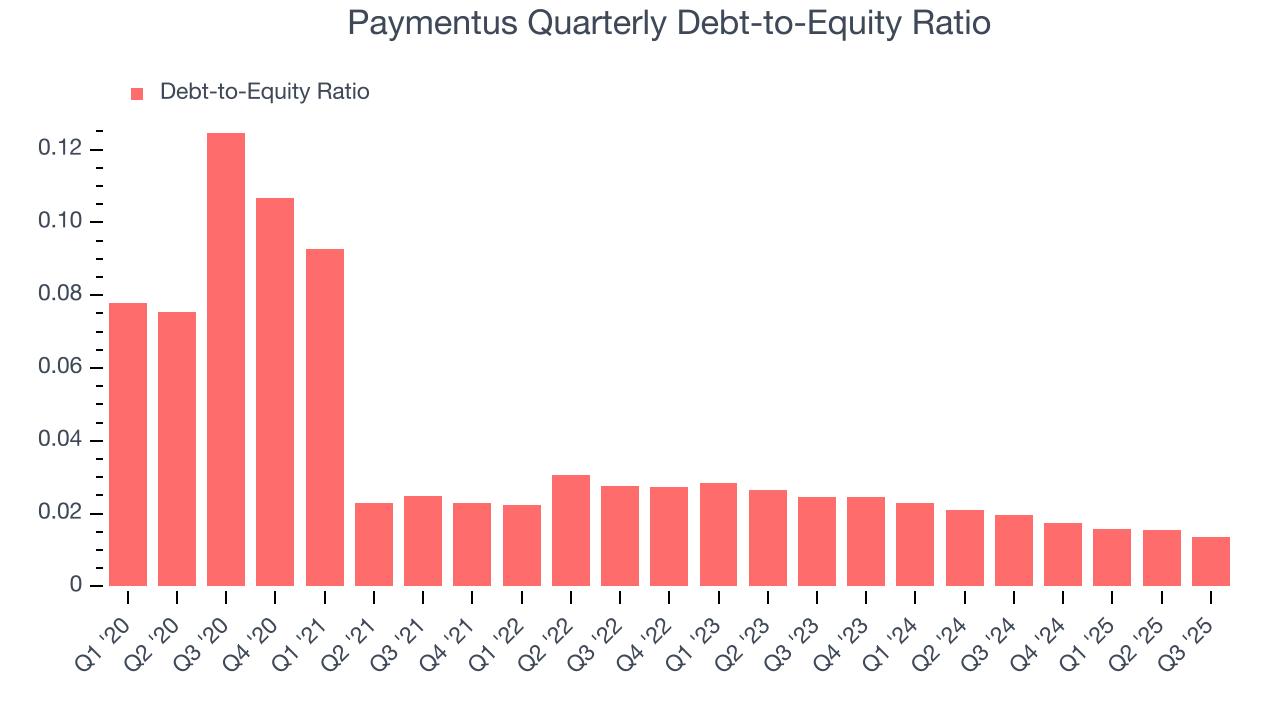

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Paymentus currently has $7.36 million of debt and $537.4 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Paymentus’s Q3 Results

We were impressed by how significantly Paymentus blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 11.3% to $31.79 immediately after reporting.

11. Is Now The Time To Buy Paymentus?

Updated: January 24, 2026 at 11:08 PM EST

Are you wondering whether to buy Paymentus or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There are multiple reasons why we think Paymentus is an elite financials company. First of all, the company’s revenue growth was exceptional over the last five years. And while its mediocre ROE lags the market and is a headwind for its stock price, its astounding EPS growth over the last four years shows its profits are trickling down to shareholders. On top of that, Paymentus’s expanding pre-tax profit margin shows the business has become more efficient.

Paymentus’s P/E ratio based on the next 12 months is 42x. A lot of good news is certainly baked in given its premium multiple, but we’ll happily own what we believe is one of the best businesses in our coverage. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with high valuations.

Wall Street analysts have a consensus one-year price target of $39.43 on the company (compared to the current share price of $29.44).