PVH (PVH)

We wouldn’t recommend PVH. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think PVH Will Underperform

Founded in 1881 by a husband and wife duo, PVH (NYSE:PVH) is a global fashion conglomerate with iconic brands like Calvin Klein and Tommy Hilfiger.

- Sales trends were unexciting over the last five years as its 2.9% annual growth was below the typical consumer discretionary company

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 6.6% for the last two years

PVH is in the doghouse. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than PVH

High Quality

Investable

Underperform

Why There Are Better Opportunities Than PVH

PVH’s stock price of $65.58 implies a valuation ratio of 5.6x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. PVH (PVH) Research Report: Q3 CY2025 Update

Fashion conglomerate PVH (NYSE:PVH) met Wall Streets revenue expectations in Q3 CY2025, with sales up 1.7% year on year to $2.29 billion. Its non-GAAP profit of $2.83 per share was 11.4% above analysts’ consensus estimates.

PVH (PVH) Q3 CY2025 Highlights:

- Revenue: $2.29 billion vs analyst estimates of $2.28 billion (1.7% year-on-year growth, in line)

- Adjusted EPS: $2.83 vs analyst estimates of $2.54 (11.4% beat)

- Adjusted EBITDA: $250.2 million vs analyst estimates of $252.3 million (10.9% margin, 0.8% miss)

- Management slightly raised its full-year Adjusted EPS guidance to $10.93 at the midpoint

- Operating Margin: 7.9%, in line with the same quarter last year

- Constant Currency Revenue was flat year on year (-5.9% in the same quarter last year)

- Market Capitalization: $4.08 billion

Company Overview

Founded in 1881 by a husband and wife duo, PVH (NYSE:PVH) is a global fashion conglomerate with iconic brands like Calvin Klein and Tommy Hilfiger.

PVH is headquartered in New York City and has transformed into one of the largest apparel companies in the world. Its portfolio also includes Van Heusen, IZOD, ARROW, and Warner’s; each holds a unique position in its respective market, catering to diverse consumer tastes and preferences.

Calvin Klein and Tommy Hilfiger, the flagship brands under PVH's umbrella, embody the classic American style and have a significant global presence. Calvin Klein is known for its modern, sophisticated styles, while Tommy Hilfiger is popular for its stylish American designs. These brands have become cultural icons.

The company operates through a mix of direct-to-consumer channels, including branded retail stores and e-commerce platforms, and wholesale distribution through department stores and specialty retailers. This omnichannel approach enables PVH to reach a broad customer base.

PVH's global presence is marked by its operations in over 40 countries, allowing it to tap into various international markets. The company’s international strategy focuses on localizing products and marketing efforts to cater to regional tastes.

4. Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

PVH’s primary competitors include LVMH Moët Hennessy Louis Vuitton (Euronext:MC), Kering (Euronext:KER), Ralph Lauren Corporation (NYSE: RL), VF Corp (NYSE: VFC), and Hanesbrands Inc. (NYSE:HBI).

5. Revenue Growth

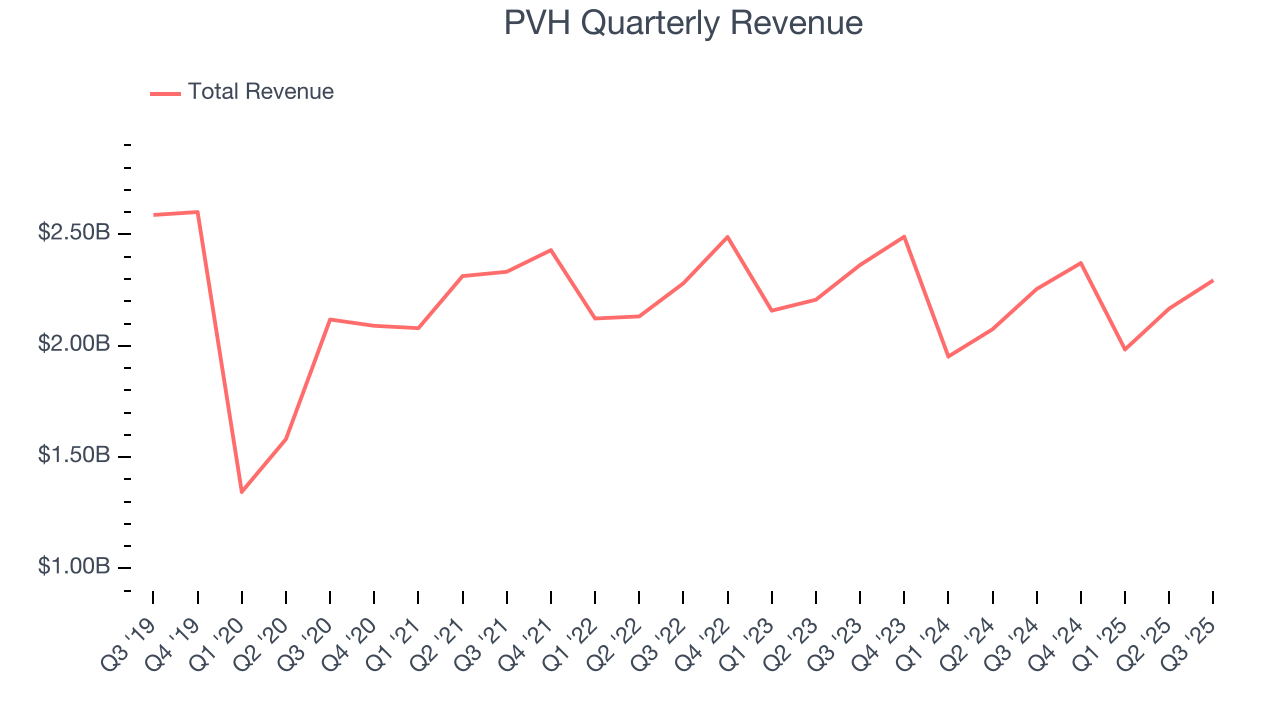

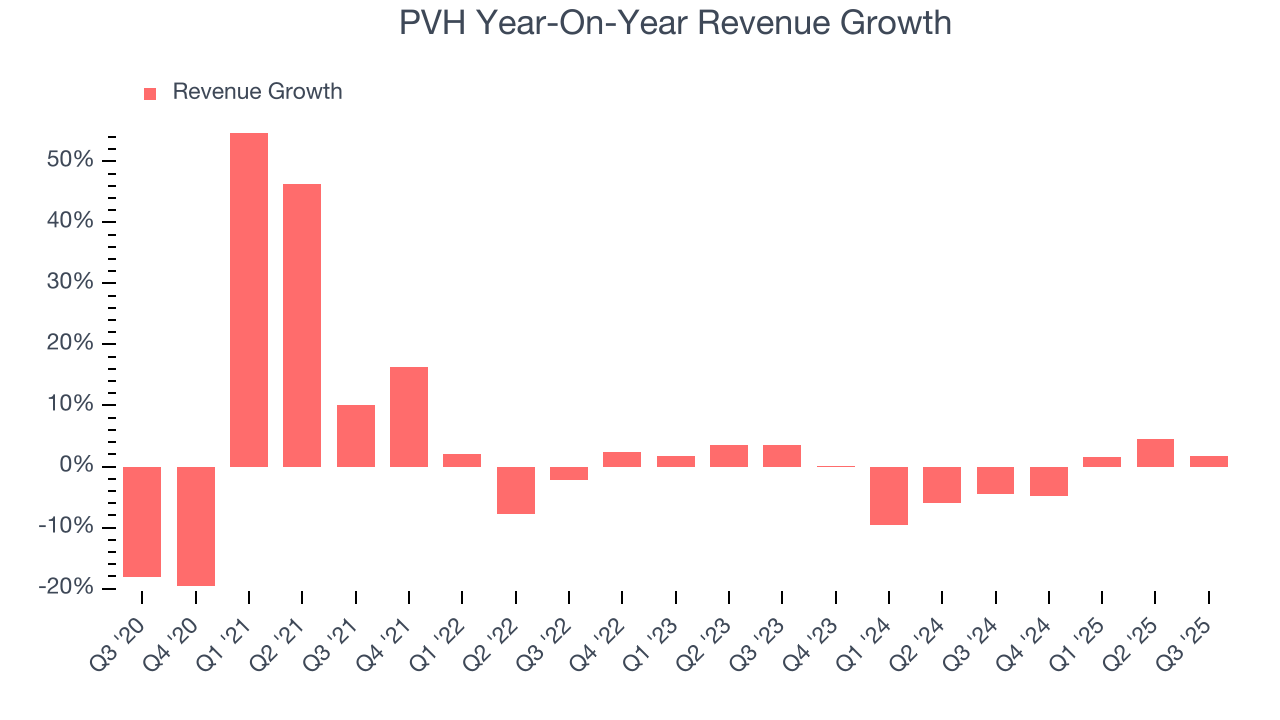

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, PVH’s 2.9% annualized revenue growth over the last five years was weak. This fell short of our benchmarks and is a tough starting point for our analysis.

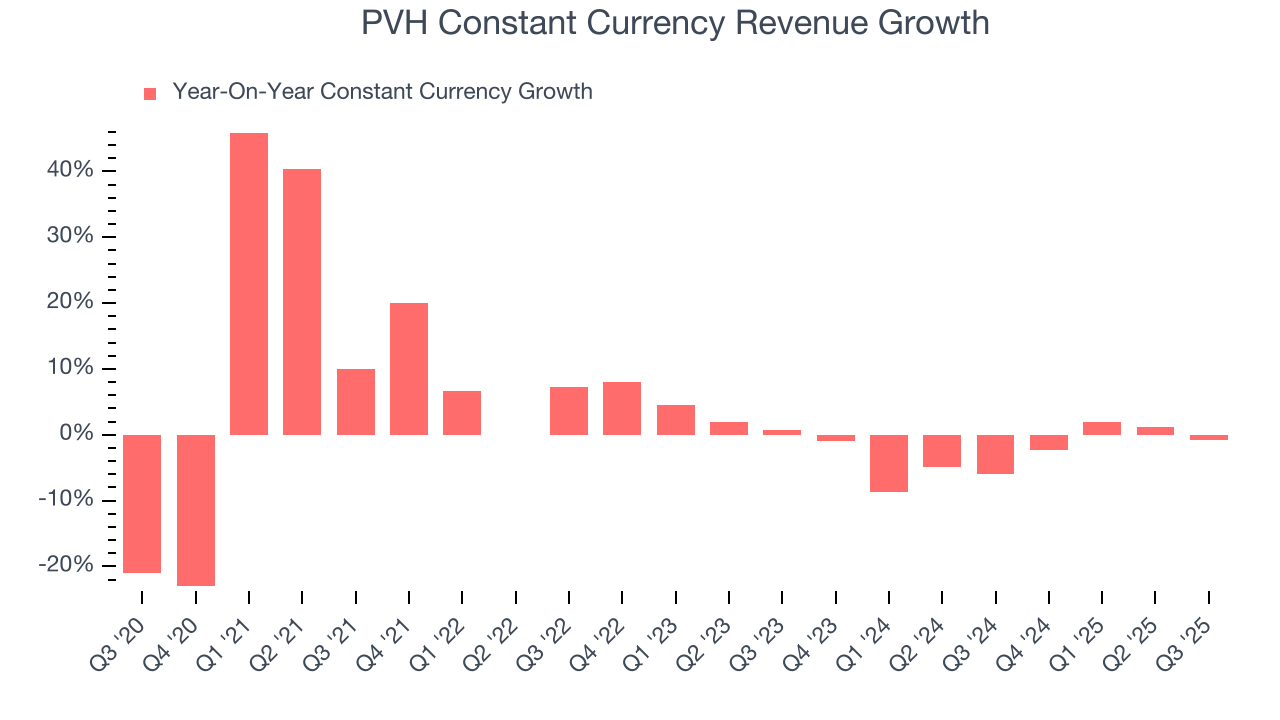

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. PVH’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.2% annually.

PVH also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 2.6% year-on-year declines. Because this number aligns with its normal revenue growth, we can see that PVH has properly hedged its foreign currency exposure.

This quarter, PVH grew its revenue by 1.7% year on year, and its $2.29 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

6. Operating Margin

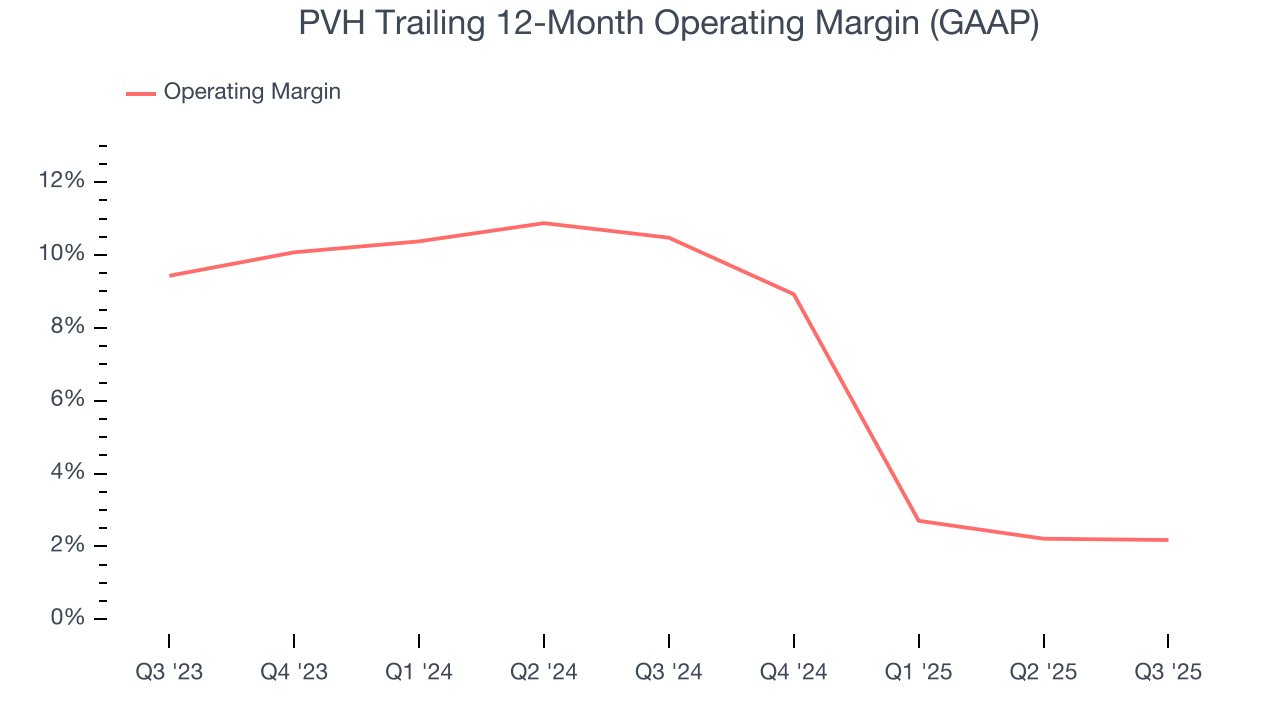

PVH’s operating margin has shrunk over the last 12 months and averaged 6.3% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q3, PVH generated an operating margin profit margin of 7.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

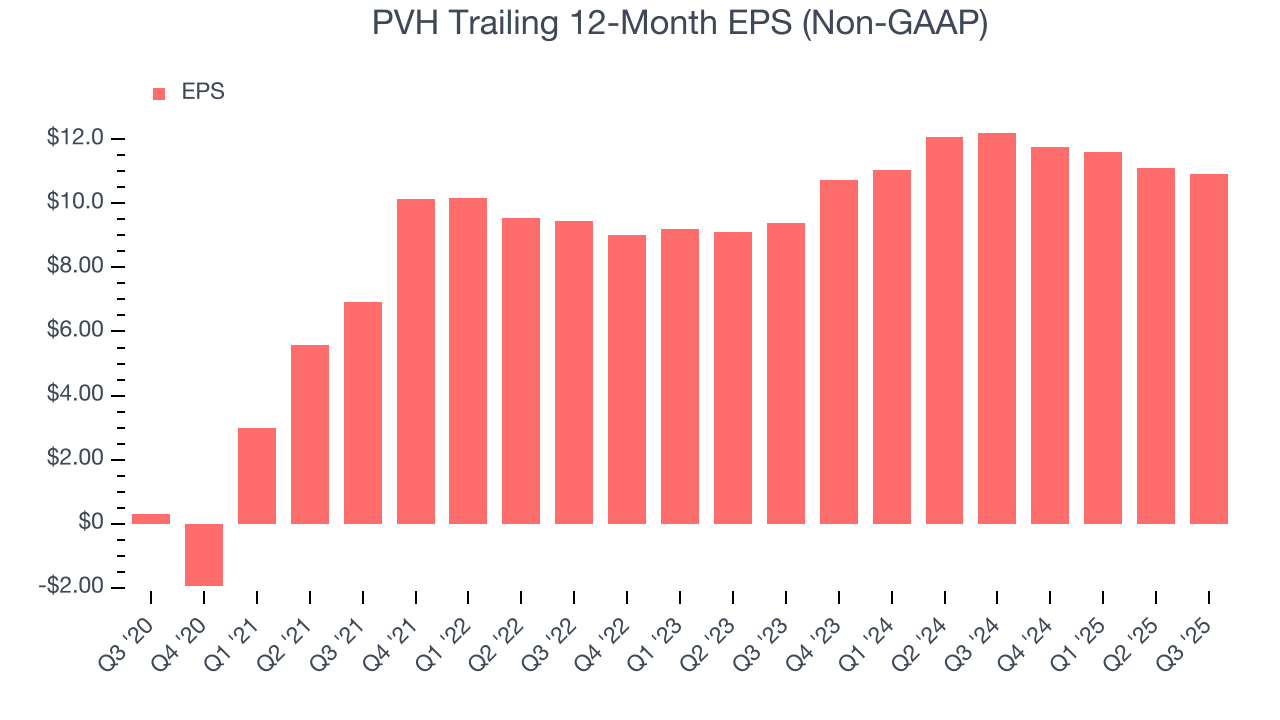

PVH’s EPS grew at an astounding 105% compounded annual growth rate over the last five years, higher than its 2.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, PVH reported adjusted EPS of $2.83, down from $3.03 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects PVH’s full-year EPS of $10.92 to grow 7.7%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

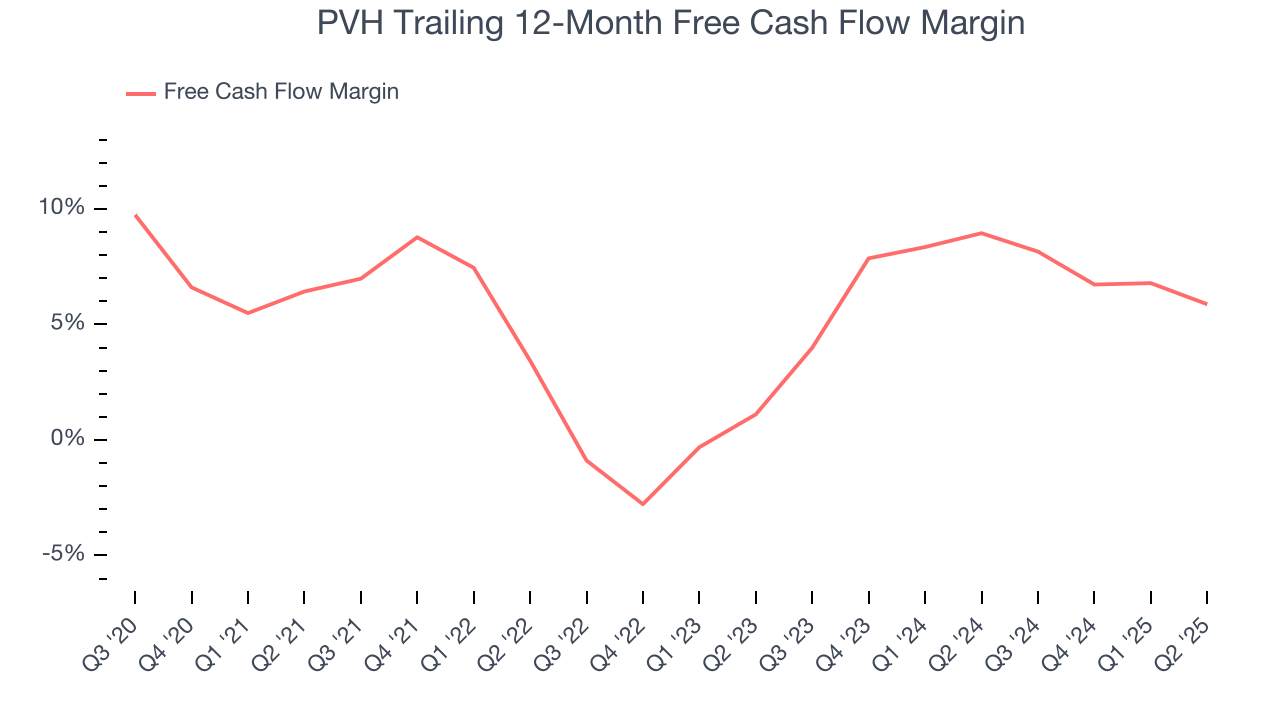

PVH has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.1%, lousy for a consumer discretionary business.

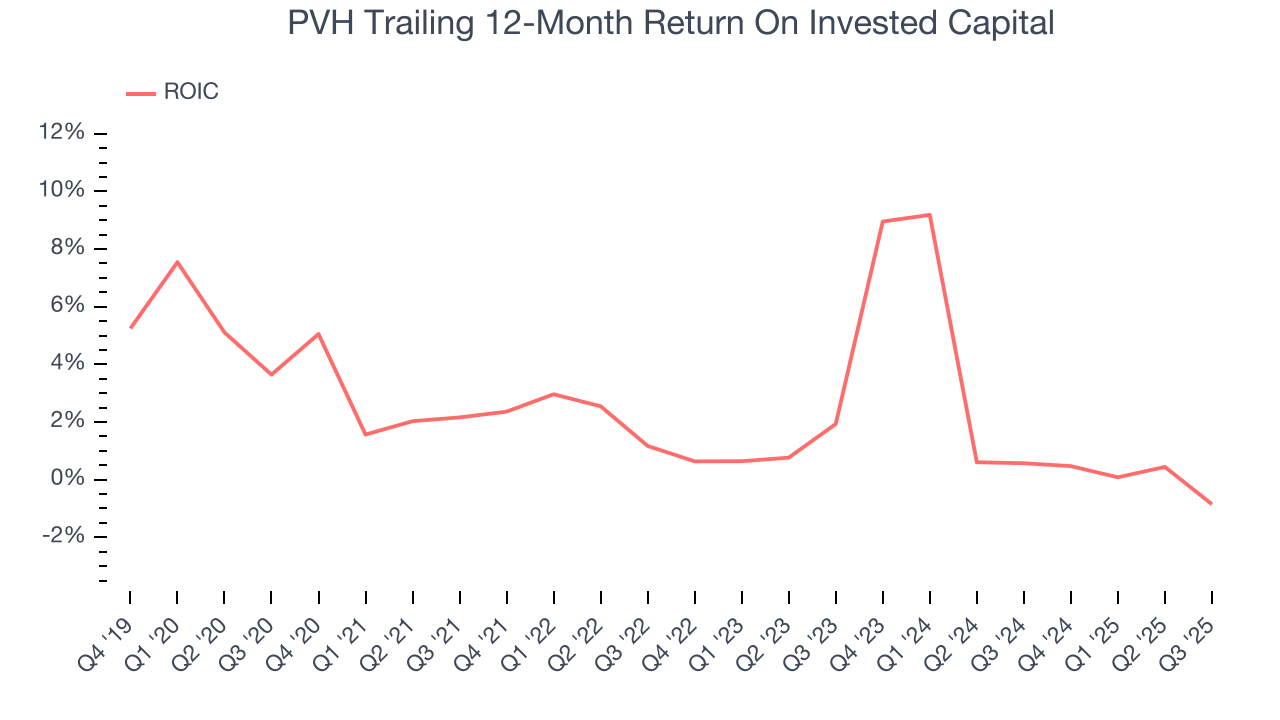

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

PVH historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, PVH’s ROIC averaged 1.8 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

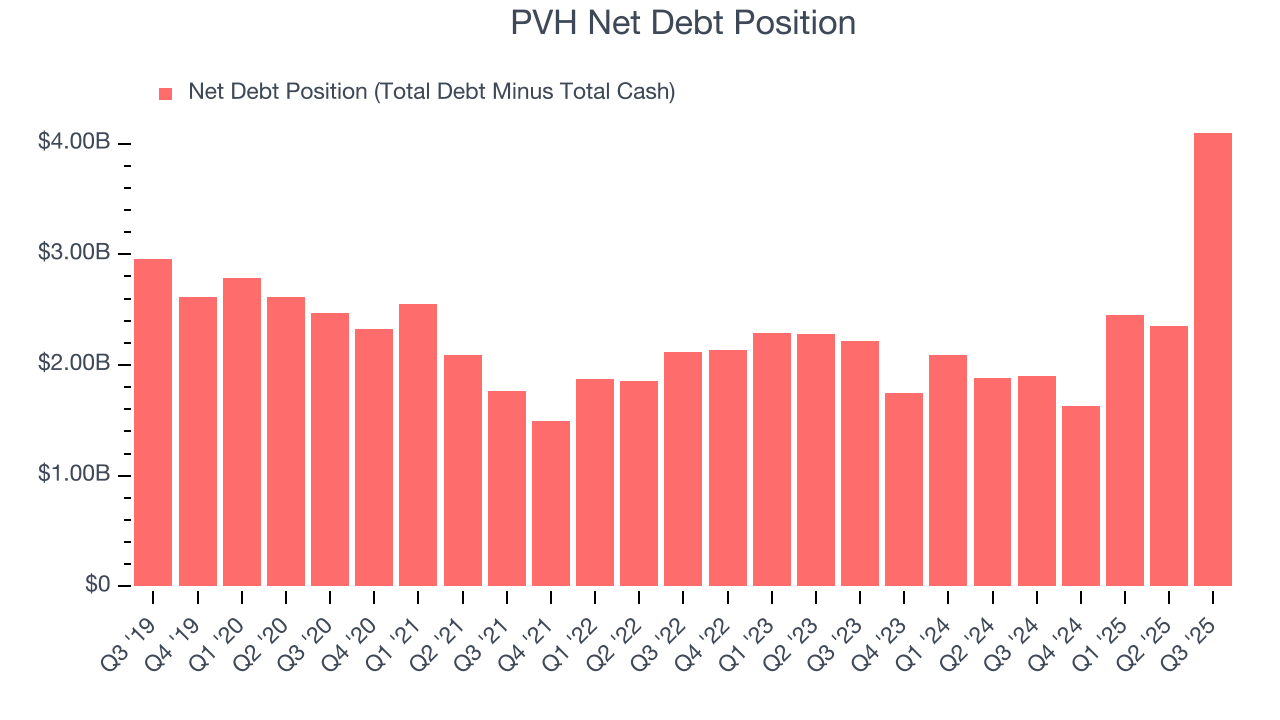

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

PVH’s $4.26 billion of debt exceeds the $158.2 million of cash on its balance sheet. Furthermore, its 9× net-debt-to-EBITDA ratio (based on its EBITDA of $468.4 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. PVH could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope PVH can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from PVH’s Q3 Results

It was good to see PVH beat analysts’ EPS expectations this quarter. On the other hand, its EPS guidance for next quarter missed and its constant currency revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.7% to $85.25 immediately after reporting.

12. Is Now The Time To Buy PVH?

Updated: January 14, 2026 at 9:49 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in PVH.

We see the value of companies helping consumers, but in the case of PVH, we’re out. First off, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. And while its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its constant currency sales performance has disappointed. On top of that, its projected EPS for the next year is lacking.

PVH’s P/E ratio based on the next 12 months is 5.6x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $97.83 on the company (compared to the current share price of $65.58).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.