SiteOne (SITE)

SiteOne doesn’t excite us. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think SiteOne Will Underperform

Known for distributing John Deere tractors and LESCO turf care products, SiteOne Landscape Supply (NYSE:SITE) provides landscaping products and services to professionals, including irrigation, lighting, and nursery supplies.

- Organic revenue growth fell short of our benchmarks over the past two years and implies it may need to improve its products, pricing, or go-to-market strategy

- Anticipated sales growth of 4% for the next year implies demand will be shaky

- The good news is that its impressive 12.7% annual revenue growth over the last five years indicates it’s winning market share this cycle

SiteOne’s quality is inadequate. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than SiteOne

High Quality

Investable

Underperform

Why There Are Better Opportunities Than SiteOne

At $147.27 per share, SiteOne trades at 34.1x forward P/E. This multiple is higher than most industrials companies, and we think it’s quite expensive for the quality you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. SiteOne (SITE) Research Report: Q3 CY2025 Update

Agriculture products company SiteOne Landscape Supply (NYSE:SITE) met Wall Streets revenue expectations in Q3 CY2025, with sales up 4.1% year on year to $1.26 billion. Its GAAP profit of $1.31 per share was 6% above analysts’ consensus estimates.

SiteOne (SITE) Q3 CY2025 Highlights:

- Revenue: $1.26 billion vs analyst estimates of $1.26 billion (4.1% year-on-year growth, in line)

- EPS (GAAP): $1.31 vs analyst estimates of $1.24 (6% beat)

- Adjusted EBITDA: $127.5 million vs analyst estimates of $124 million (10.1% margin, 2.8% beat)

- EBITDA guidance for the full year is $410 million at the midpoint, below analyst estimates of $414.7 million

- Operating Margin: 6.8%, in line with the same quarter last year

- Free Cash Flow Margin: 9.4%, similar to the same quarter last year

- Organic Revenue rose 3% year on year vs analyst estimates of 1.1% growth (194.6 basis point beat)

- Market Capitalization: $5.50 billion

Company Overview

Known for distributing John Deere tractors and LESCO turf care products, SiteOne Landscape Supply (NYSE:SITE) provides landscaping products and services to professionals, including irrigation, lighting, and nursery supplies.

The company was formed in 2001 through the combination of John Deere Landscapes and other landscape supply companies. This gave the new combined company a national footprint rather than smaller regional ones. 2007 marked another milestone, with SiteOne acquiring LESCO, a leading supplier of lawn care, landscape, golf course and pest control products that boasted nearly 350 locations and doubles SiteOne’s distribution footprint.

Today SiteOne offers everything from synthetic turf to sprinkler systems to path lights. It aims to be a one-stop shop for landscape contractors, architects, and other industry professionals. For these customers, time is money, and the last thing they want to do is shop around, encounter out-of-stock positions, or wait for deliveries of product. SiteOne therefore promises broad inventory as well the ability to get these sometimes hard-to-transport products to project sites.

The primary revenue sources for SiteOne come from the sale of landscaping products and equipment. The company's business model focuses on direct sales through its network of branches and online platforms, providing accessibility for customers. While a smaller portion of revenue, SiteOne also offers services such as irrigation consultation to enhance water efficiency and facilitate optimal plant growth, for example.

4. Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Competitors in the landscape and industrial products industry include Ferguson (NYSE:FERG), Fastenal (NASDAQ:FAST), and Lowe's (NYSE:LOW).

5. Revenue Growth

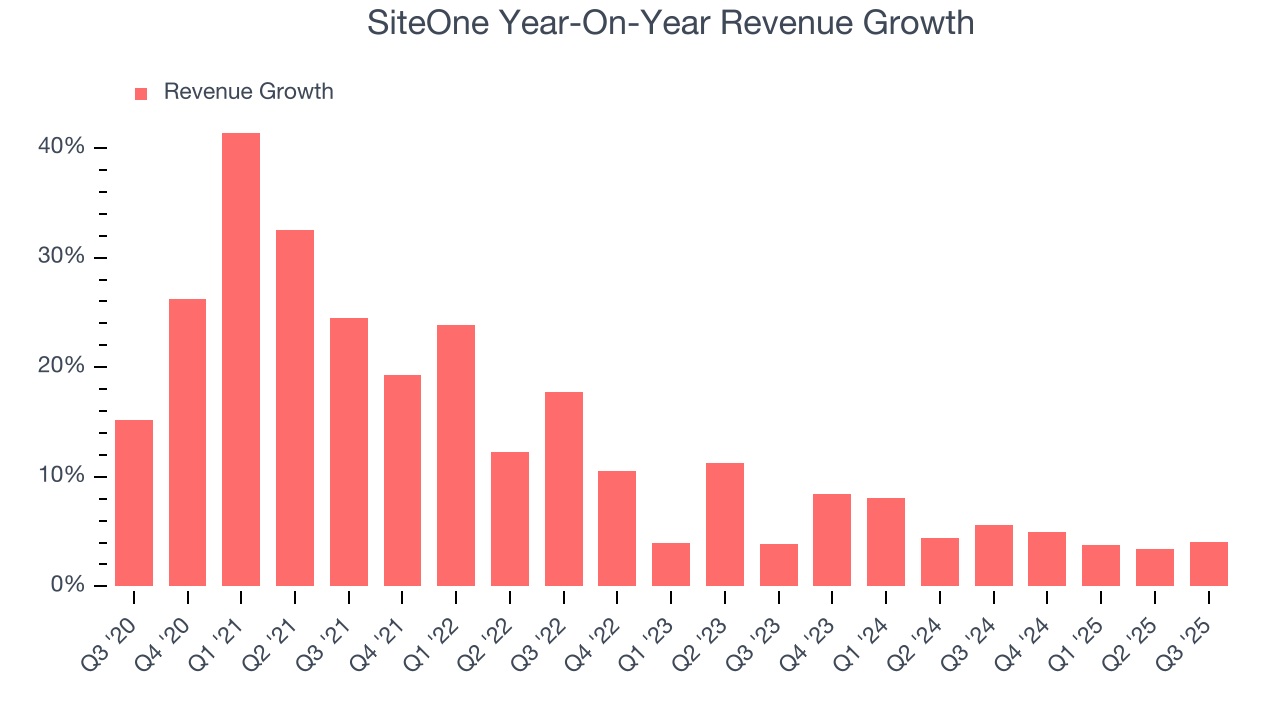

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, SiteOne grew its sales at an excellent 12.7% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. SiteOne’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 5.1% over the last two years was well below its five-year trend.

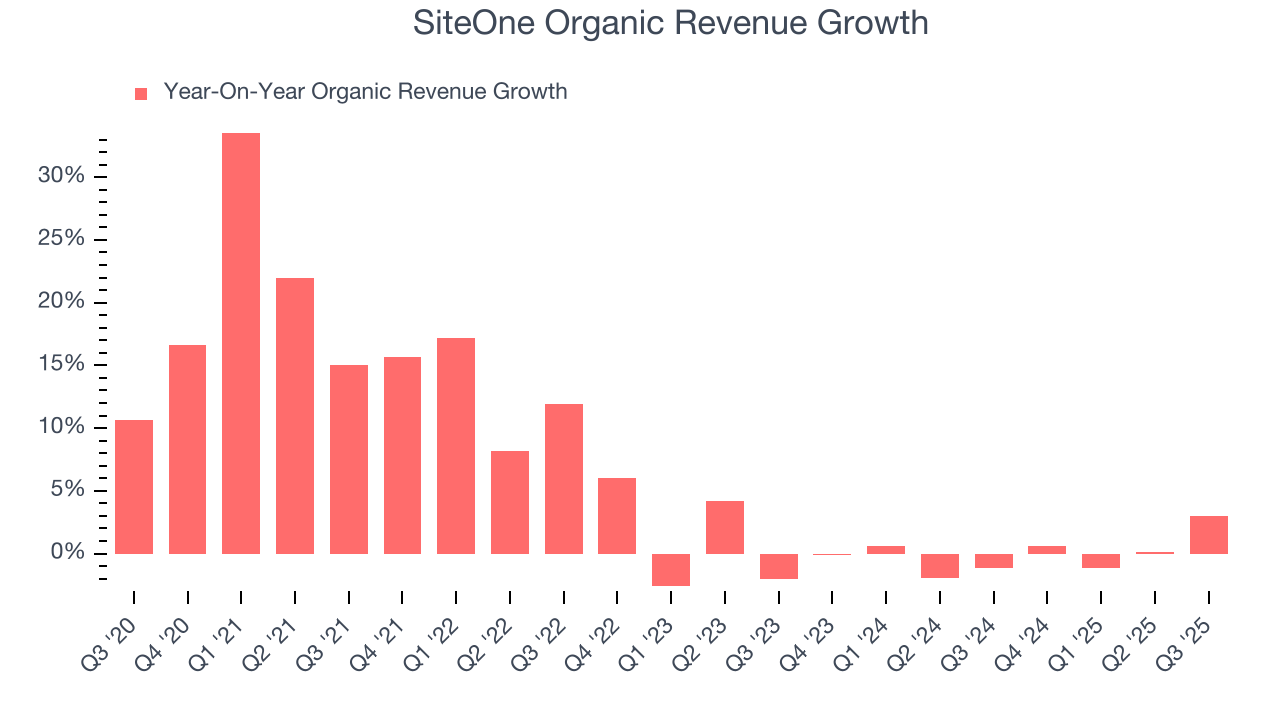

SiteOne also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, SiteOne’s organic revenue was flat. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, SiteOne grew its revenue by 4.1% year on year, and its $1.26 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

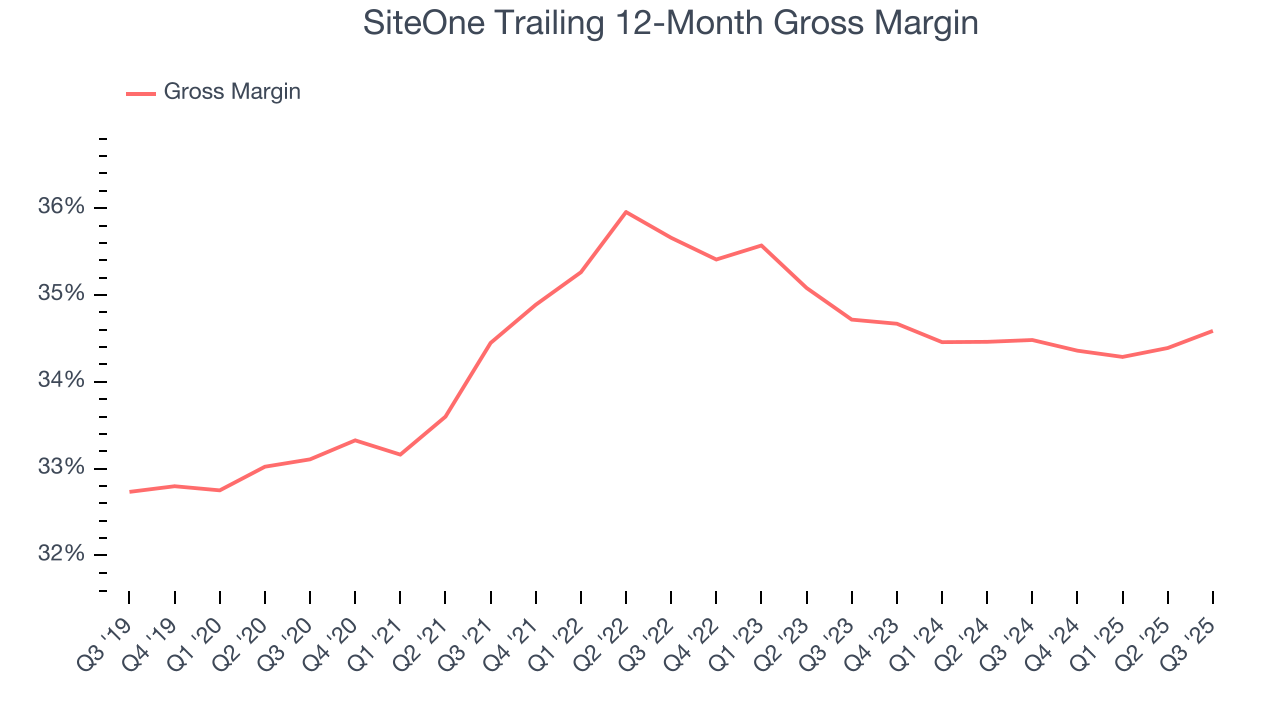

SiteOne’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 34.8% gross margin over the last five years. Said differently, SiteOne paid its suppliers $65.23 for every $100 in revenue.

In Q3, SiteOne produced a 34.7% gross profit margin, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

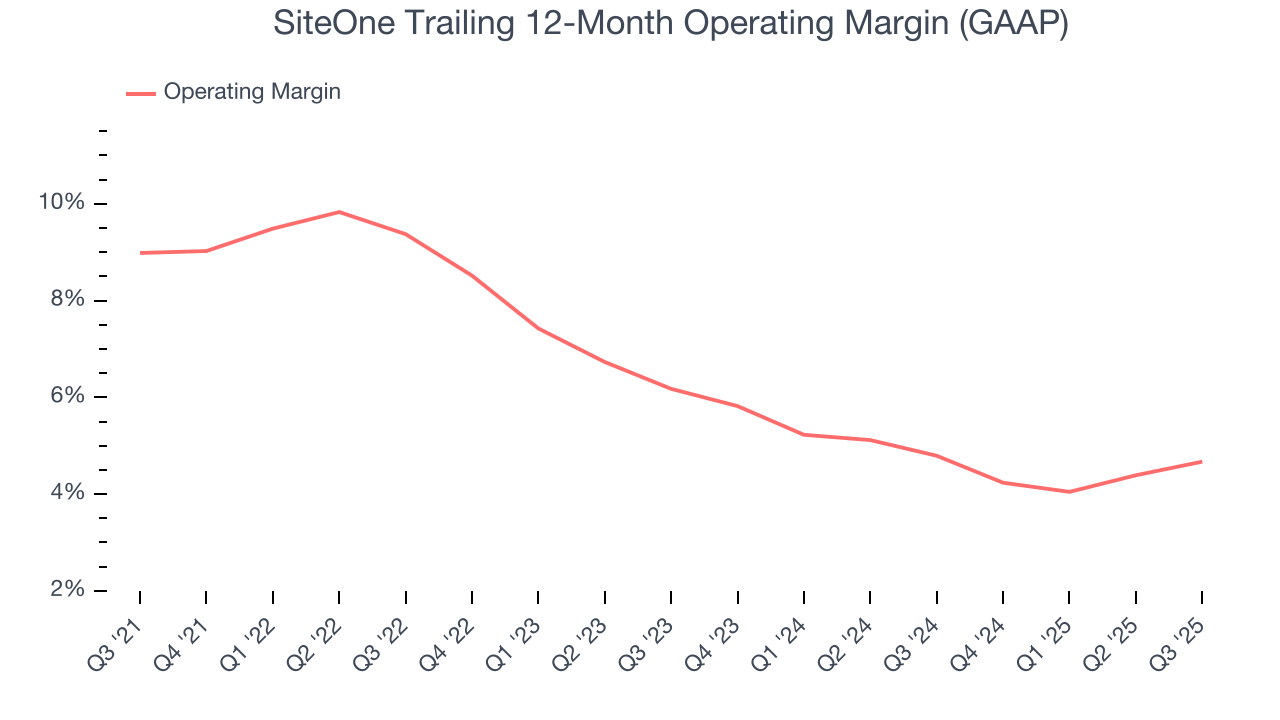

SiteOne was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.6% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, SiteOne’s operating margin decreased by 4.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. SiteOne’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, SiteOne generated an operating margin profit margin of 6.8%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

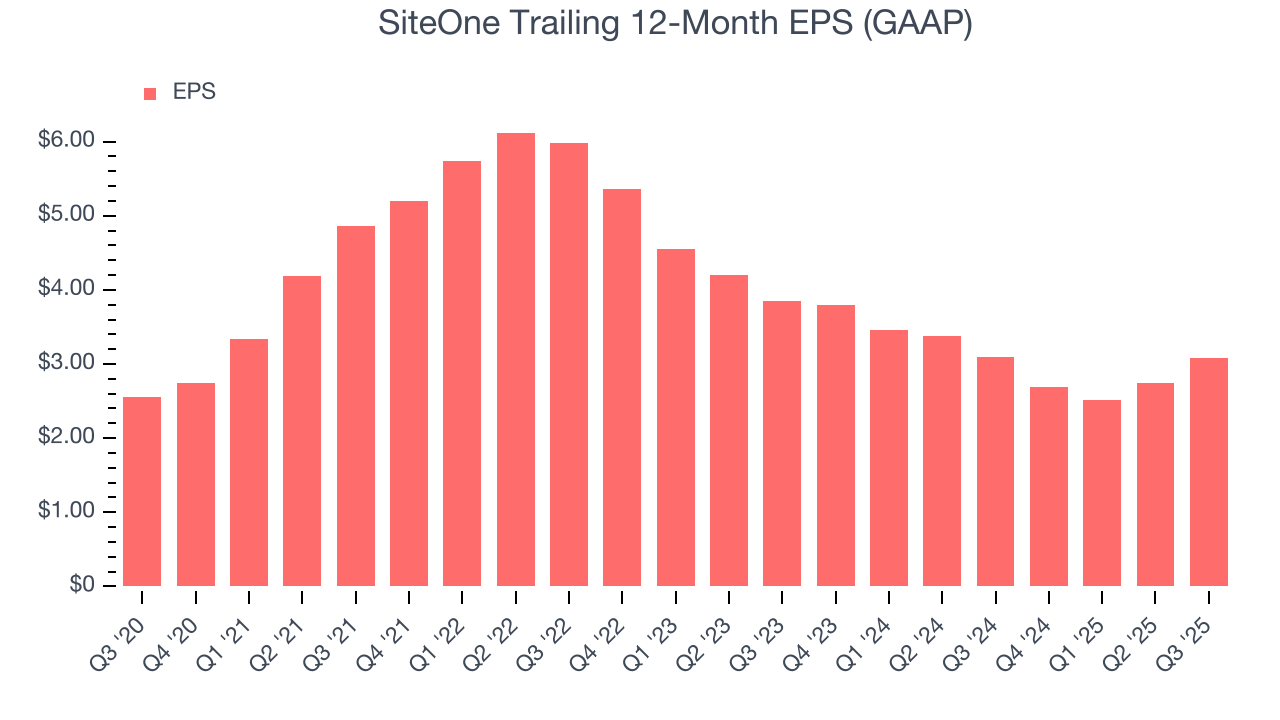

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

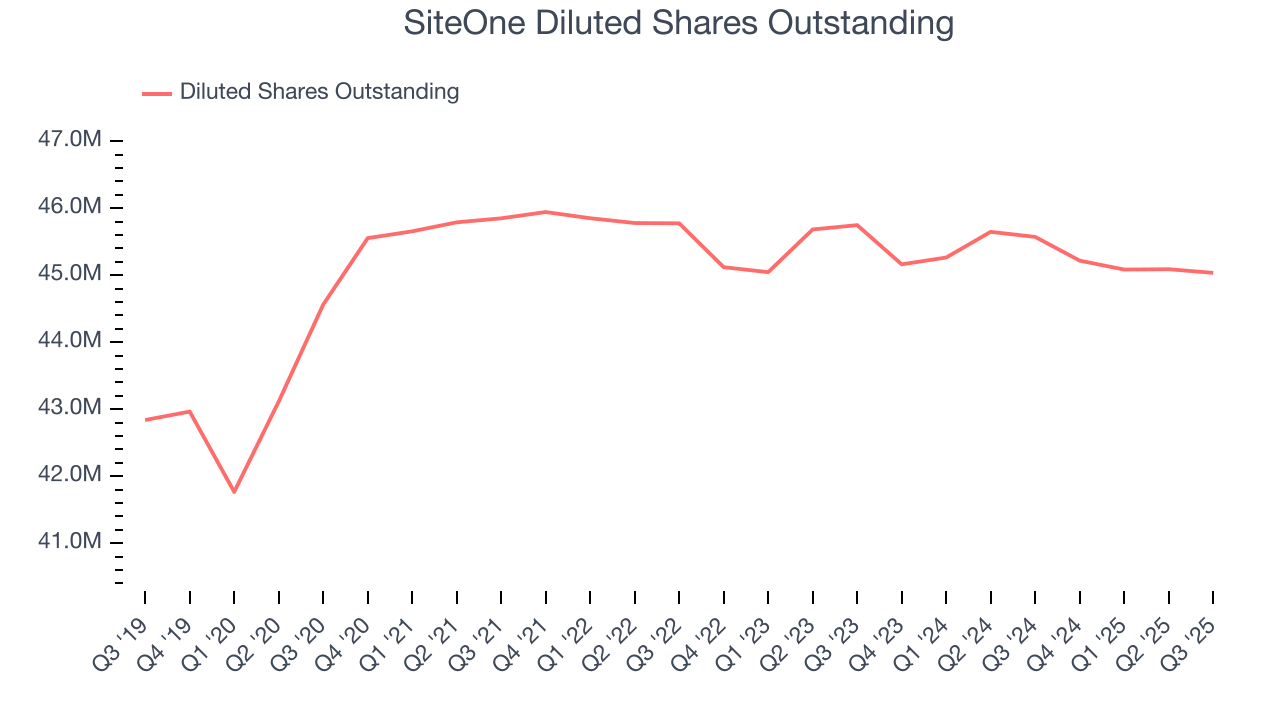

SiteOne’s EPS grew at a weak 3.8% compounded annual growth rate over the last five years, lower than its 12.7% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into SiteOne’s earnings to better understand the drivers of its performance. As we mentioned earlier, SiteOne’s operating margin was flat this quarter but declined by 4.3 percentage points over the last five years. Its share count also grew by 1.1%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For SiteOne, its two-year annual EPS declines of 10.5% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, SiteOne reported EPS of $1.31, up from $0.97 in the same quarter last year. This print beat analysts’ estimates by 6%. Over the next 12 months, Wall Street expects SiteOne’s full-year EPS of $3.08 to grow 30.9%.

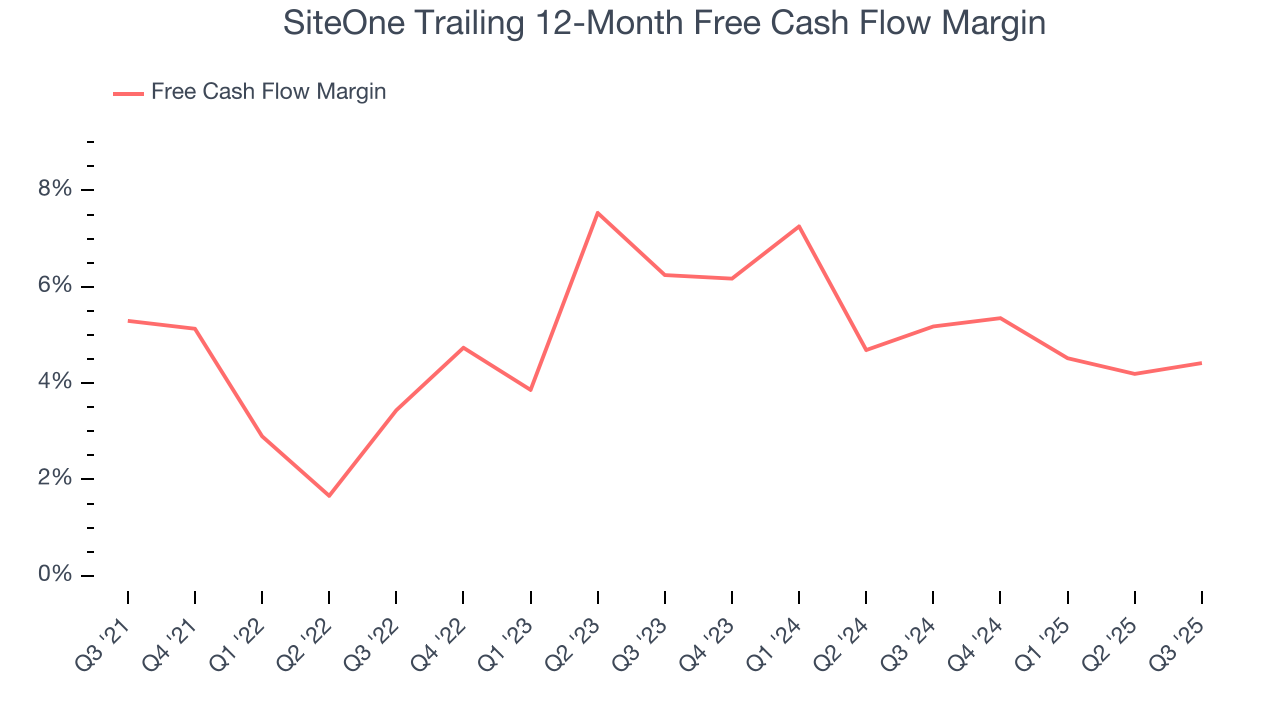

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

SiteOne has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.9%, subpar for an industrials business.

SiteOne’s free cash flow clocked in at $118.5 million in Q3, equivalent to a 9.4% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

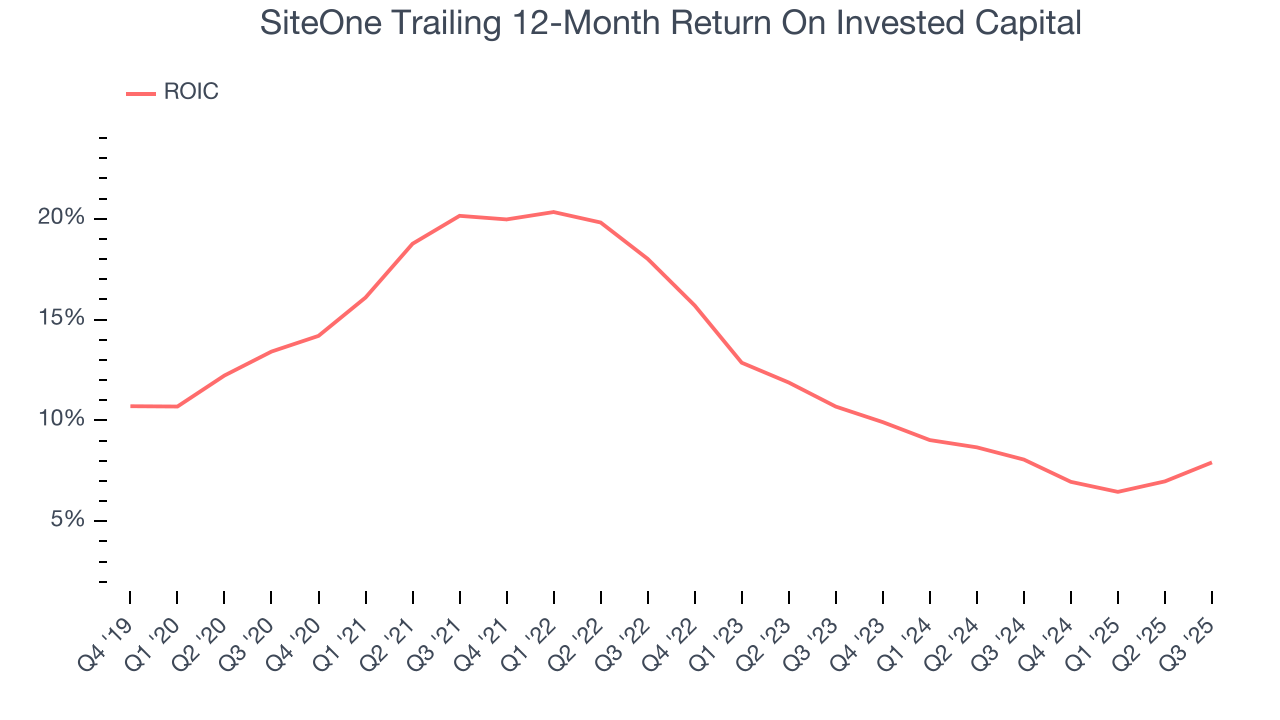

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although SiteOne hasn’t been the highest-quality company lately because of its poor bottom-line (EPS) performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 13%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, SiteOne’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

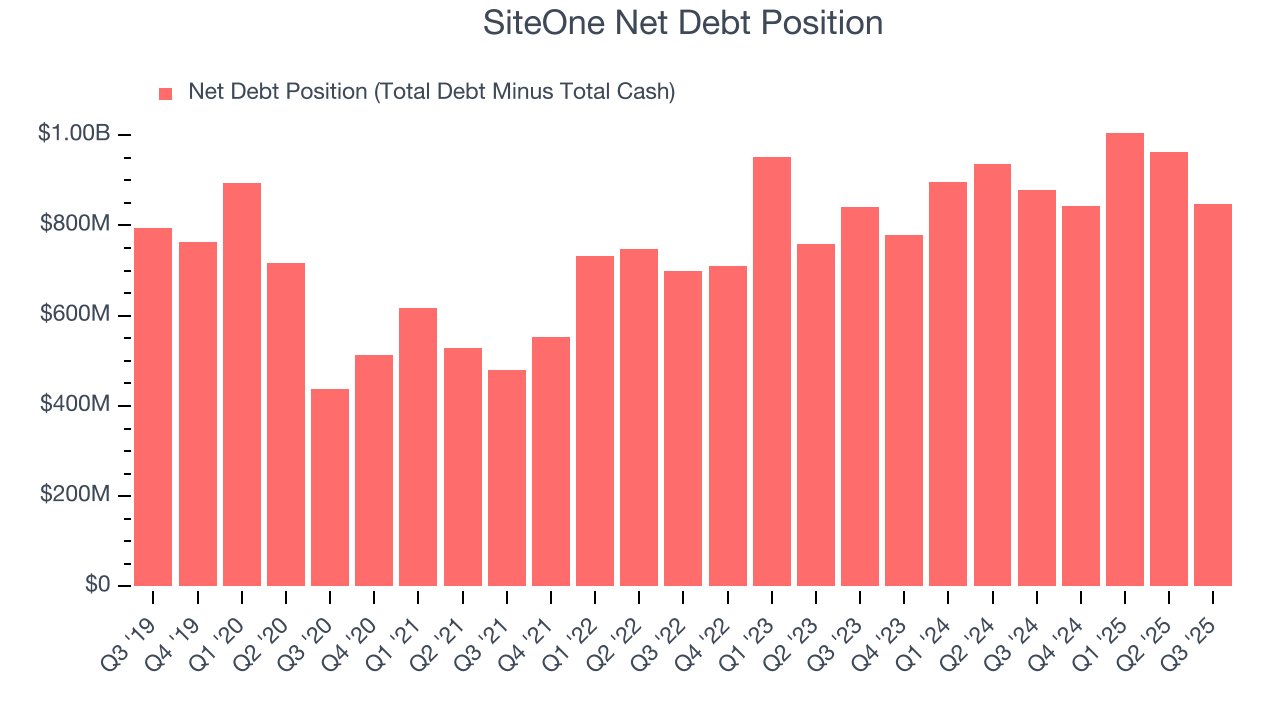

SiteOne reported $106.9 million of cash and $955.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $408.4 million of EBITDA over the last 12 months, we view SiteOne’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $15.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from SiteOne’s Q3 Results

We enjoyed seeing SiteOne beat analysts’ organic revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance slightly missed. Overall, this print was mixed. The stock remained flat at $123.99 immediately following the results.

13. Is Now The Time To Buy SiteOne?

Updated: January 23, 2026 at 10:17 PM EST

Before deciding whether to buy SiteOne or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

SiteOne isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its flat organic revenue disappointed.

SiteOne’s P/E ratio based on the next 12 months is 34.1x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $155 on the company (compared to the current share price of $147.27).