UniFirst (UNF)

We’re wary of UniFirst. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think UniFirst Will Underperform

With a fleet of trucks making weekly deliveries to over 300,000 customer locations, UniFirst (NYSE:UNF) provides, rents, cleans, and maintains workplace uniforms and protective clothing for businesses across various industries.

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 2.3% annually

- Estimated sales growth of 2.2% for the next 12 months implies demand will slow from its two-year trend

- One positive is that its products and services resonate with customers, evidenced by its respectable 6.2% annualized sales growth over the last five years

UniFirst’s quality is not up to our standards. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than UniFirst

High Quality

Investable

Underperform

Why There Are Better Opportunities Than UniFirst

UniFirst is trading at $205.50 per share, or 28.3x forward P/E. Not only is UniFirst’s multiple richer than most business services peers, but it’s also expensive for its fundamentals.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. UniFirst (UNF) Research Report: Q4 CY2025 Update

Workplace uniform provider UniFirst (NYSE:UNF) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 2.7% year on year to $621.3 million. The company expects the full year’s revenue to be around $2.49 billion, close to analysts’ estimates. Its GAAP profit of $1.89 per share was 5.1% below analysts’ consensus estimates.

UniFirst (UNF) Q4 CY2025 Highlights:

- Revenue: $621.3 million vs analyst estimates of $615.3 million (2.7% year-on-year growth, 1% beat)

- EPS (GAAP): $1.89 vs analyst expectations of $1.99 (5.1% miss)

- Adjusted EBITDA: $82.81 million vs analyst estimates of $88.45 million (13.3% margin, 6.4% miss)

- The company reconfirmed its revenue guidance for the full year of $2.49 billion at the midpoint

- EPS (GAAP) guidance for the full year is $6.78 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 7.3%, down from 9.2% in the same quarter last year

- Free Cash Flow was -$24.03 million, down from $24.56 million in the same quarter last year

- Market Capitalization: $3.67 billion

Company Overview

With a fleet of trucks making weekly deliveries to over 300,000 customer locations, UniFirst (NYSE:UNF) provides, rents, cleans, and maintains workplace uniforms and protective clothing for businesses across various industries.

UniFirst operates on a service model where it not only supplies uniforms but also handles the entire lifecycle of workplace apparel. The company picks up soiled garments from customers on a regular schedule (typically weekly), cleans and processes them at their facilities, and delivers fresh replacements—all managed through service contracts that generally run three to five years.

The company manufactures approximately 60% of the garments it places into service, with production facilities in Mexico and Nicaragua. This vertical integration allows UniFirst to offer customized uniform programs for larger clients and maintain quality control over its products.

Beyond standard uniforms like shirts, pants, and jackets, UniFirst provides specialized protective wear including flame-resistant and high-visibility garments. For certain industries, the company offers decontamination services for clothes exposed to radioactive materials and cleanroom garment processing.

UniFirst's customer base spans businesses of all sizes across most industry sectors. Auto service centers, food retailers, healthcare providers, manufacturers, restaurants, and transportation companies all rely on UniFirst to outfit their employees with appropriate workplace attire that serves functional needs while maintaining consistent branding.

The company has expanded beyond just garments to offer complementary workplace products including industrial wiping materials, floor mats, mops, restroom supplies, and safety equipment. This diversification allows UniFirst to be a more comprehensive workplace solutions provider for its customers.

UniFirst generates revenue through several service models: full-service rental programs where the company handles all cleaning and maintenance, lease programs where employees maintain the garments themselves, and direct purchase programs for customers who prefer to buy rather than rent.

4. Industrial & Environmental Services

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

UniFirst's main competitors in the uniform rental and workplace solutions industry include Cintas Corporation (NASDAQ:CTAS), Alsco (privately held), and Vestis Corporation (NYSE:VSTS), all of which offer similar uniform rental and facility services programs.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $2.45 billion in revenue over the past 12 months, UniFirst is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

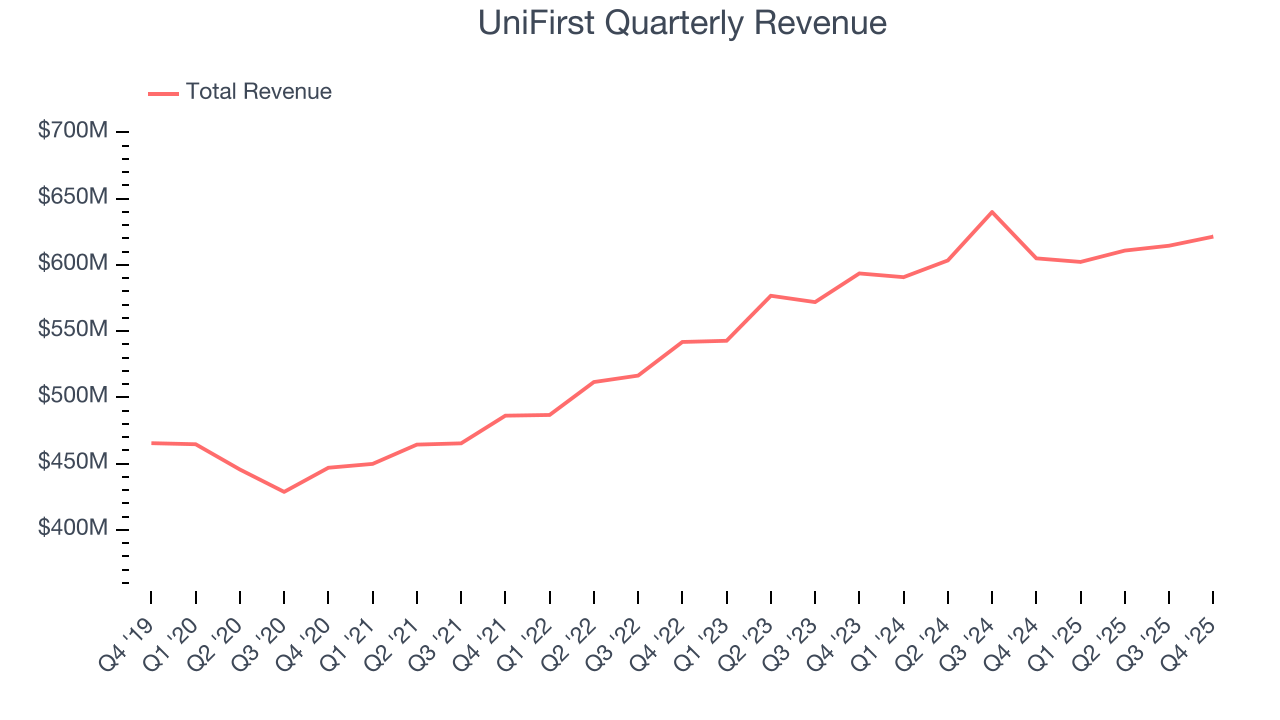

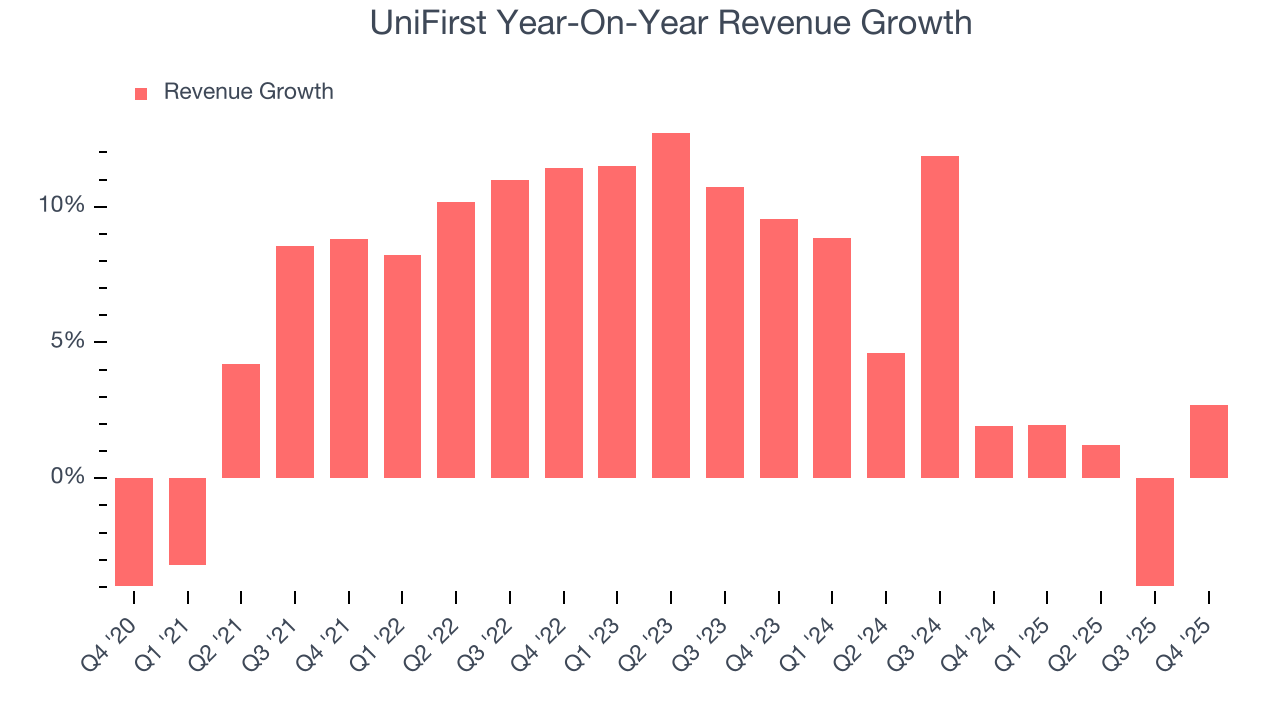

As you can see below, UniFirst grew its sales at a decent 6.5% compounded annual growth rate over the last five years. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. UniFirst’s recent performance shows its demand has slowed as its annualized revenue growth of 3.5% over the last two years was below its five-year trend.

This quarter, UniFirst reported modest year-on-year revenue growth of 2.7% but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its products and services will see some demand headwinds.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

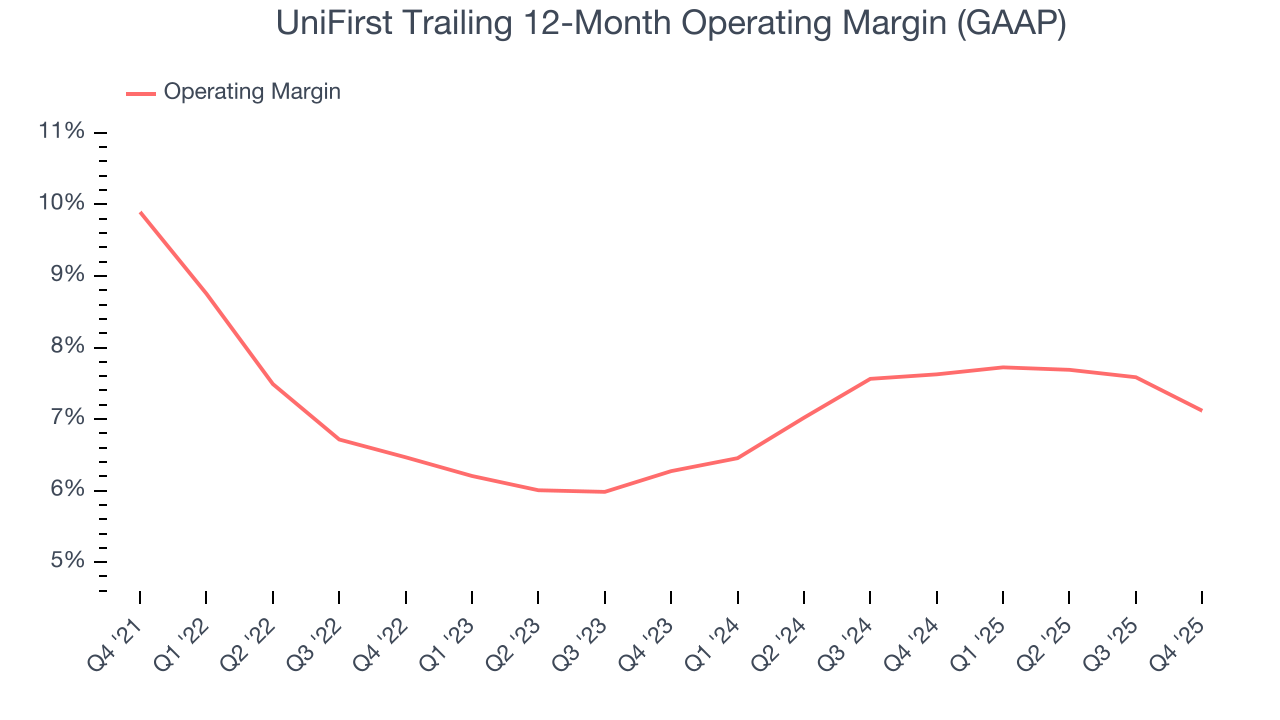

UniFirst was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.4% was weak for a business services business.

Looking at the trend in its profitability, UniFirst’s operating margin decreased by 2.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. UniFirst’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, UniFirst generated an operating margin profit margin of 7.3%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

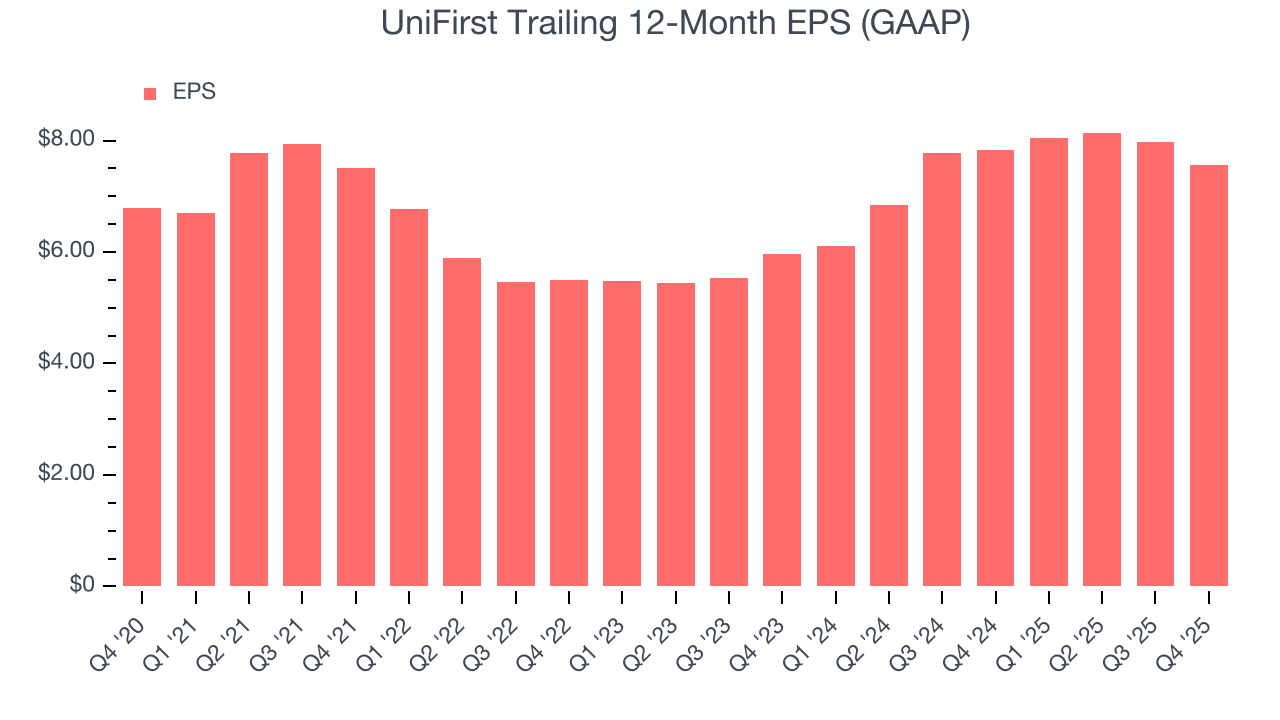

UniFirst’s EPS grew at a weak 2.1% compounded annual growth rate over the last five years, lower than its 6.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into UniFirst’s earnings to better understand the drivers of its performance. As we mentioned earlier, UniFirst’s operating margin declined by 2.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For UniFirst, its two-year annual EPS growth of 12.5% was higher than its five-year trend. This acceleration made it one of the faster-growing business services companies in recent history.

In Q4, UniFirst reported EPS of $1.89, down from $2.31 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects UniFirst’s full-year EPS of $7.56 to shrink by 5.1%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

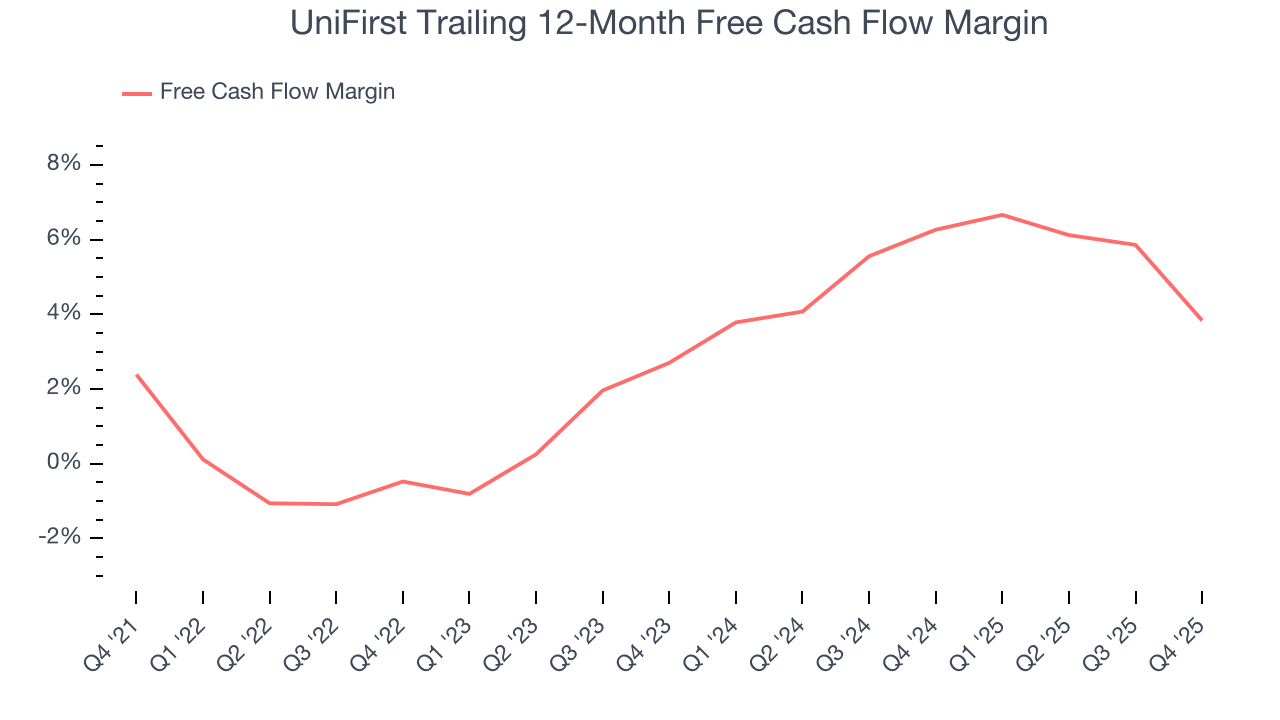

UniFirst has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.1%, subpar for a business services business.

Taking a step back, an encouraging sign is that UniFirst’s margin expanded by 1.4 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

UniFirst burned through $24.03 million of cash in Q4, equivalent to a negative 3.9% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

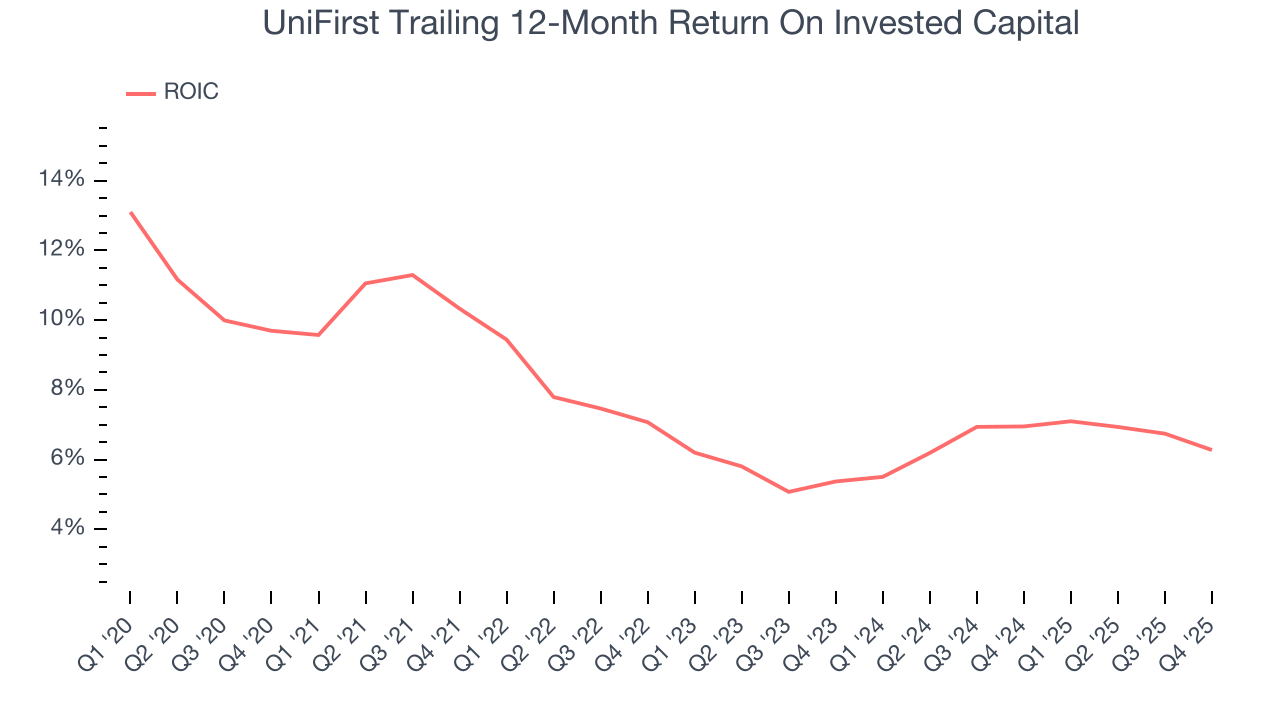

UniFirst historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.2%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, UniFirst’s ROIC averaged 2.1 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

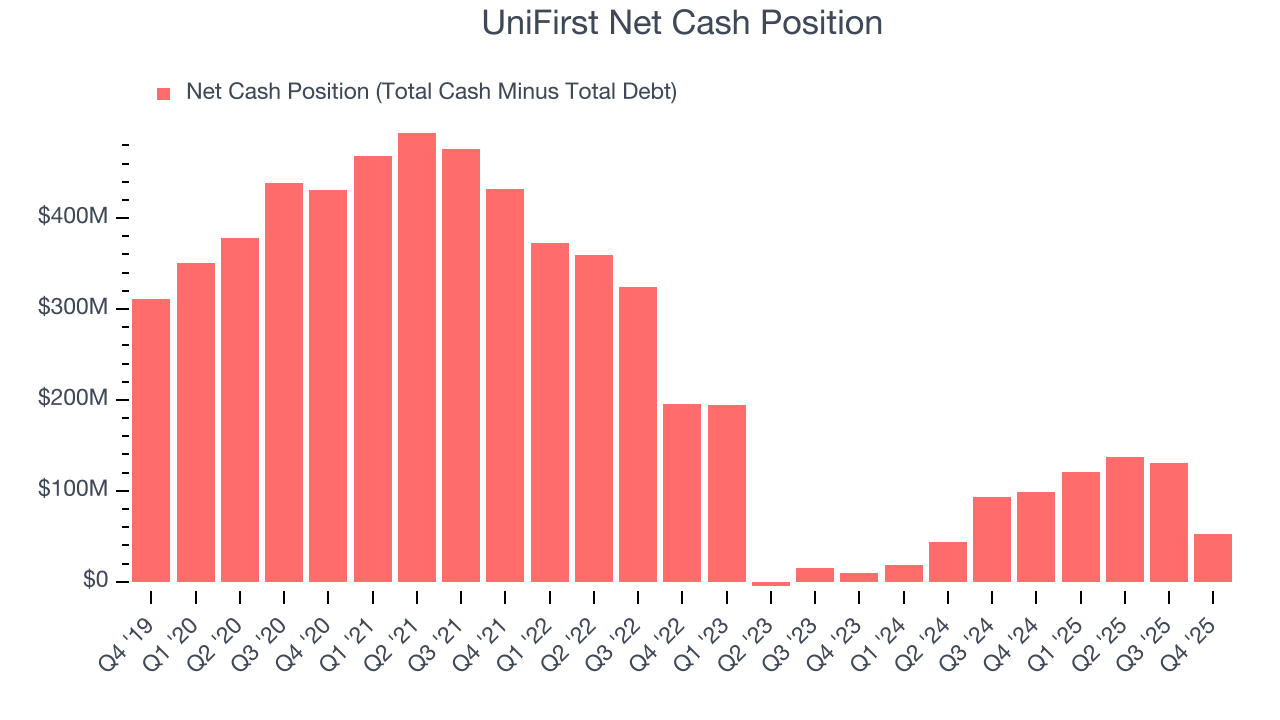

UniFirst is a profitable, well-capitalized company with $129.5 million of cash and $76.94 million of debt on its balance sheet. This $52.6 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from UniFirst’s Q4 Results

It was good to see UniFirst narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Looking ahead, full-year EPS guidance roughly met expectations. Overall, this was a mixed quarter. The stock traded down 2.4% to $198 immediately following the results.

12. Is Now The Time To Buy UniFirst?

Updated: January 7, 2026 at 8:12 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

UniFirst isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its projected EPS for the next year is lacking. And while the company’s rising cash profitability gives it more optionality, the downside is its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

UniFirst’s P/E ratio based on the next 12 months is 27.9x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $167.33 on the company (compared to the current share price of $198), implying they don’t see much short-term potential in UniFirst.