United Rentals (URI)

United Rentals doesn’t excite us. Its decelerating growth and falling cash conversion suggest it’s struggling to scale down costs as demand fades.― StockStory Analyst Team

1. News

2. Summary

Why United Rentals Is Not Exciting

Owning the largest rental fleet in the world, United Rentals (NYSE:URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

- Estimated sales growth of 4.7% for the next 12 months implies demand will slow from its two-year trend

- Organic sales performance over the past two years indicates the company may need to make strategic adjustments or rely on M&A to catalyze faster growth

- On the bright side, its healthy operating margin shows it’s a well-run company with efficient processes, and its rise over the last five years was fueled by some leverage on its fixed costs

United Rentals is in the penalty box. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than United Rentals

High Quality

Investable

Underperform

Why There Are Better Opportunities Than United Rentals

United Rentals’s stock price of $917.77 implies a valuation ratio of 20.9x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. United Rentals (URI) Research Report: Q3 CY2025 Update

Equipment rental company United Rentals (NYSE:URI) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 5.9% year on year to $4.23 billion. The company expects the full year’s revenue to be around $16.1 billion, close to analysts’ estimates. Its non-GAAP profit of $11.70 per share was 4.9% below analysts’ consensus estimates.

United Rentals (URI) Q3 CY2025 Highlights:

- Revenue: $4.23 billion vs analyst estimates of $4.16 billion (5.9% year-on-year growth, 1.6% beat)

- Adjusted EPS: $11.70 vs analyst expectations of $12.30 (4.9% miss)

- Adjusted EBITDA: $1.95 billion vs analyst estimates of $1.96 billion (46% margin, 0.6% miss)

- The company slightly lifted its revenue guidance for the full year to $16.1 billion at the midpoint from $15.95 billion

- EBITDA guidance for the full year is $7.38 billion at the midpoint, in line with analyst expectations

- Operating Margin: 26.3%, down from 28.1% in the same quarter last year

- Free Cash Flow was -$6 million, down from $146 million in the same quarter last year

- Market Capitalization: $64.49 billion

Company Overview

Owning the largest rental fleet in the world, United Rentals (NYSE:URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

Founded in 1997, United Rentals was established to address the increasing demand for equipment rentals, which make economic sense for companies of all types. Renting enables businesses to manage their projects efficiently without the significant capital investment required for equipment ownership. In essence, renting heavy equipment instead of buying it means customers can incur predictable, smooth operating expenses rather than lumpy, capital expenditures. Additionally, obsolescence risk is much lower when renting.

A customer can rent earthmoving, material handling, and site preparation equipment from United Rentals. For instance, construction companies rely on United Rentals excavators, backhoes, and aerial work platforms, while industrial clients utilize their fleet of forklifts, generators, and compressors to maintain operations and ensure productivity.

The primary revenue sources for United Rentals come from equipment rental fees and related services. The company's business model focuses on providing well-maintained equipment through a network of rental locations and an easy-to-use online platform. Unlike companies that sell this equipment, United Rentals earns more predictable and recurring revenue due to long-term rental agreements with price escalators to account for inflation and with maintenance and repair as add-on services to help the company earn more on each unit.

4. Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Competitors in the equipment rental industry include Sunbelt Rentals (LSE:AHT), Herc Holdings (NYSE:HRI), and H&E Equipment Services (NASDAQ:HEES).

5. Revenue Growth

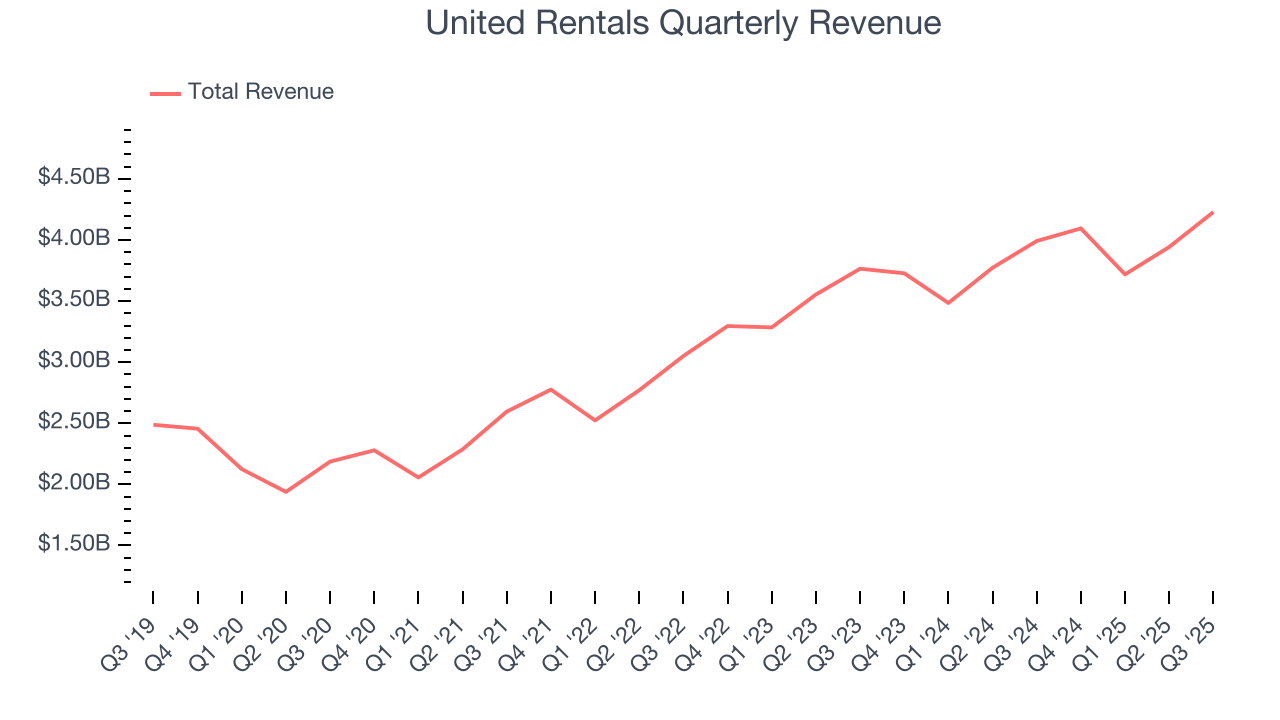

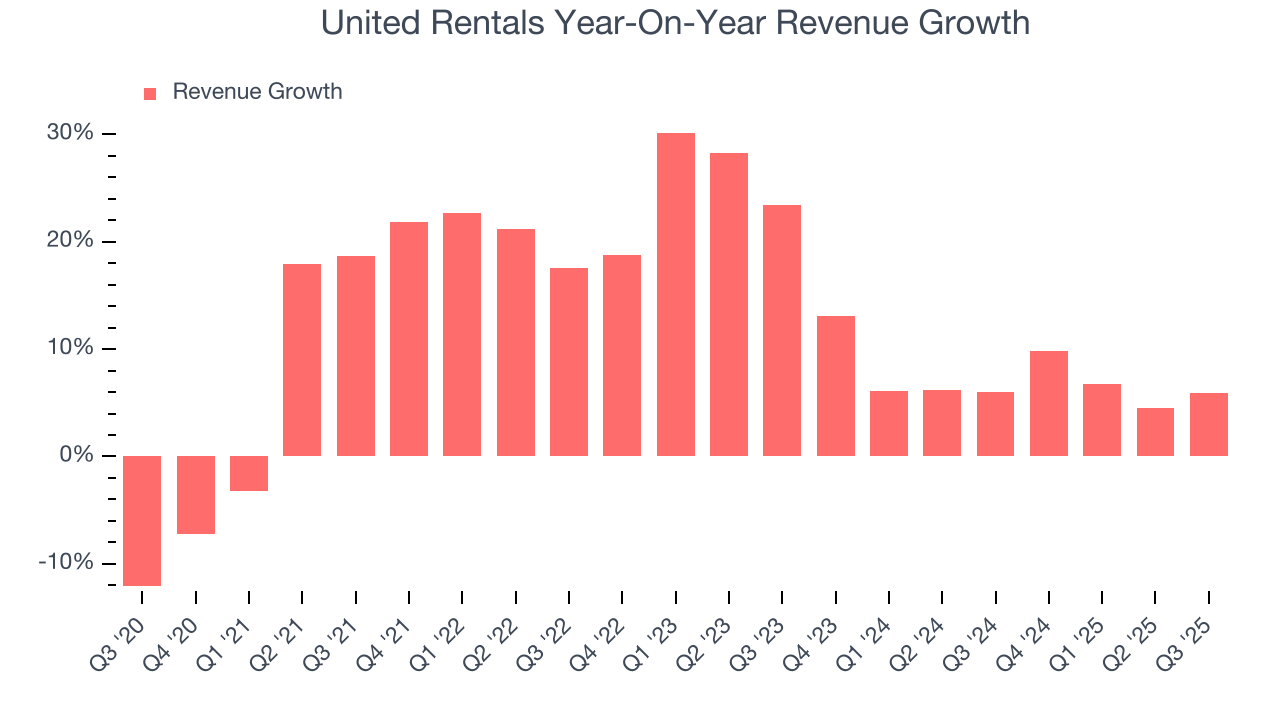

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, United Rentals’s sales grew at an excellent 12.9% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. United Rentals’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 7.2% over the last two years was well below its five-year trend.

This quarter, United Rentals reported year-on-year revenue growth of 5.9%, and its $4.23 billion of revenue exceeded Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

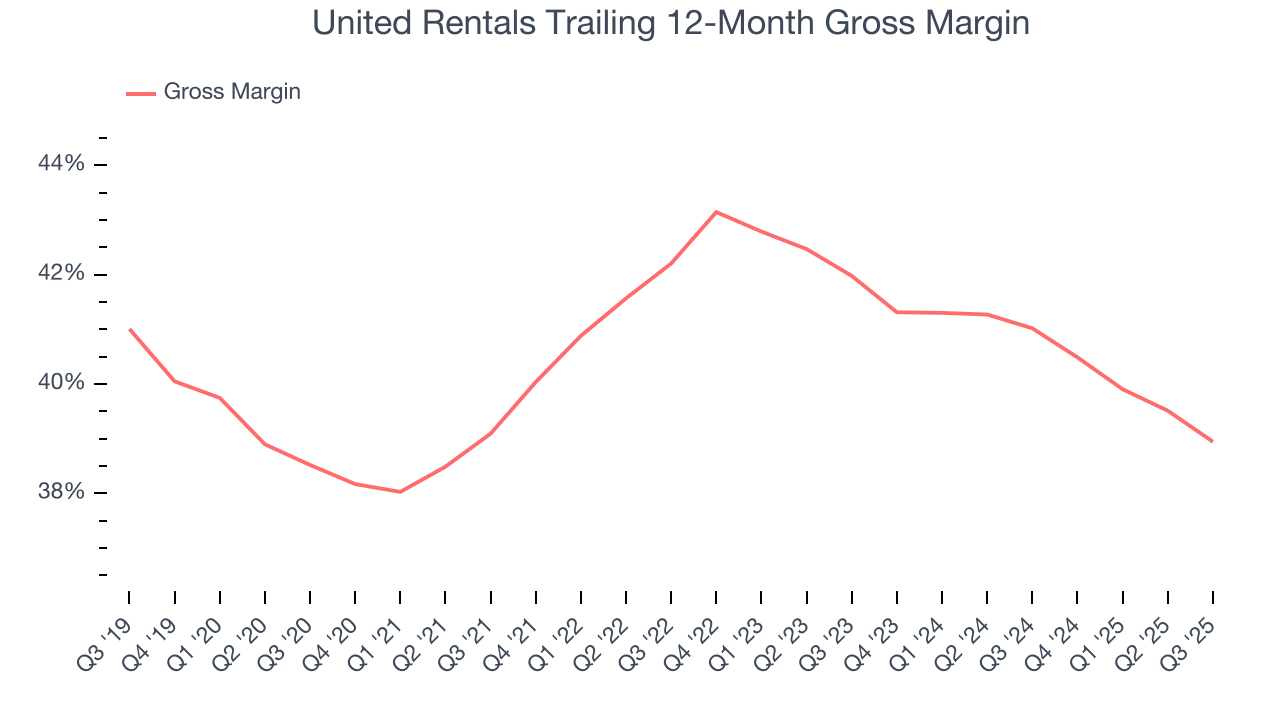

United Rentals’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 40.6% gross margin over the last five years. Said differently, roughly $40.65 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

United Rentals’s gross profit margin came in at 39.4% this quarter, marking a 2.3 percentage point decrease from 41.6% in the same quarter last year. United Rentals’s full-year margin has also been trending down over the past 12 months, decreasing by 2.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

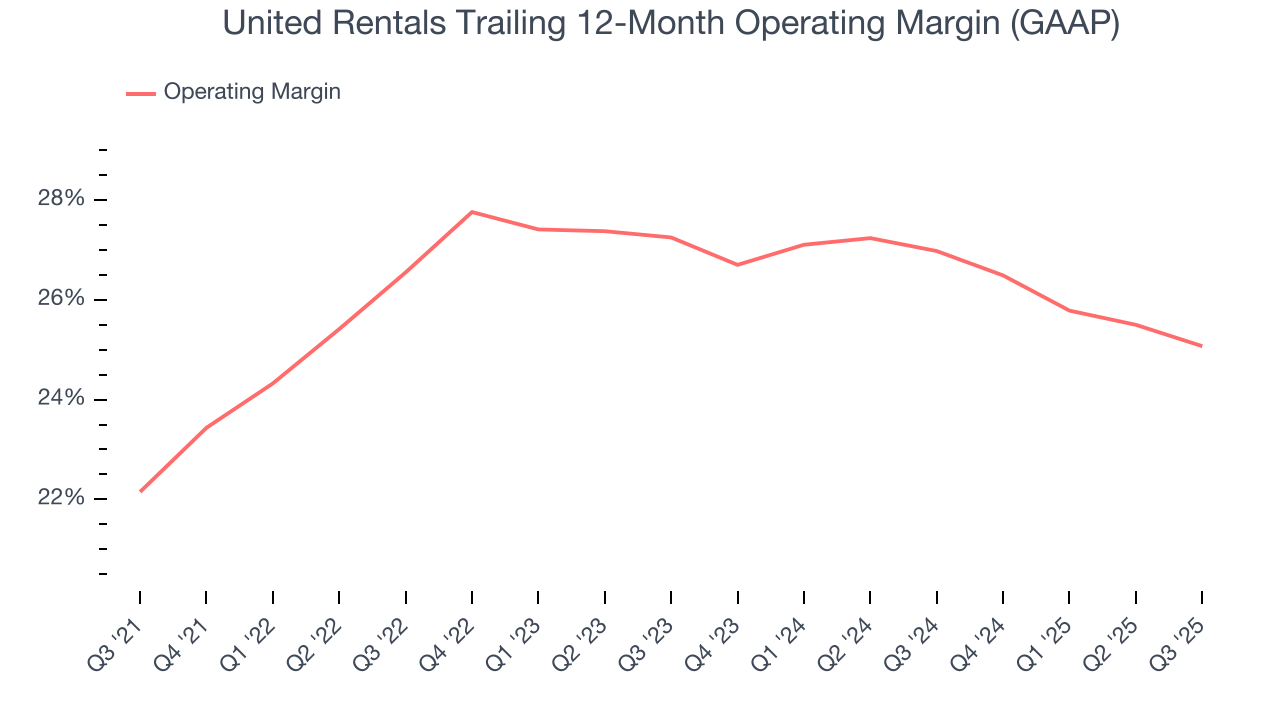

United Rentals has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 25.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, United Rentals’s operating margin rose by 2.9 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, United Rentals generated an operating margin profit margin of 26.3%, down 1.8 percentage points year on year. Since United Rentals’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

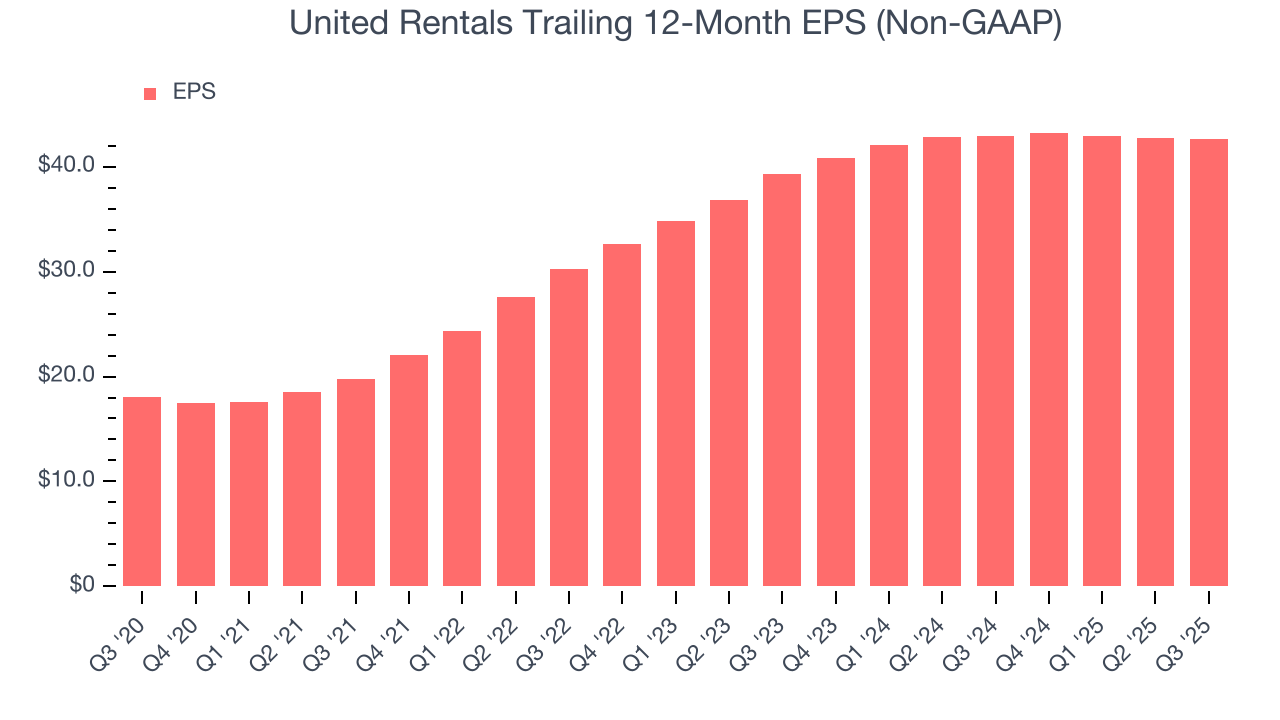

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

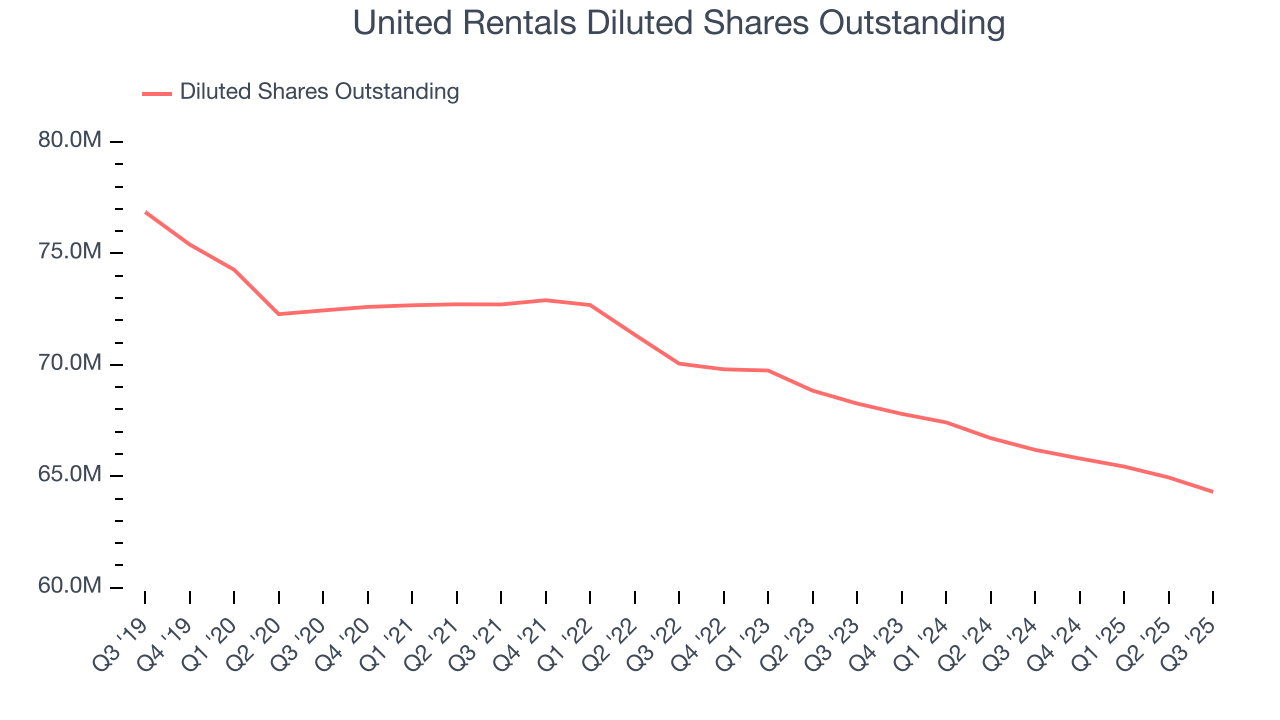

United Rentals’s EPS grew at an astounding 18.8% compounded annual growth rate over the last five years, higher than its 12.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into United Rentals’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, United Rentals’s operating margin declined this quarter but expanded by 2.9 percentage points over the last five years. Its share count also shrank by 11.2%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For United Rentals, its two-year annual EPS growth of 4.1% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q3, United Rentals reported adjusted EPS of $11.70, down from $11.80 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects United Rentals’s full-year EPS of $42.62 to grow 10%.

9. Cash Is King

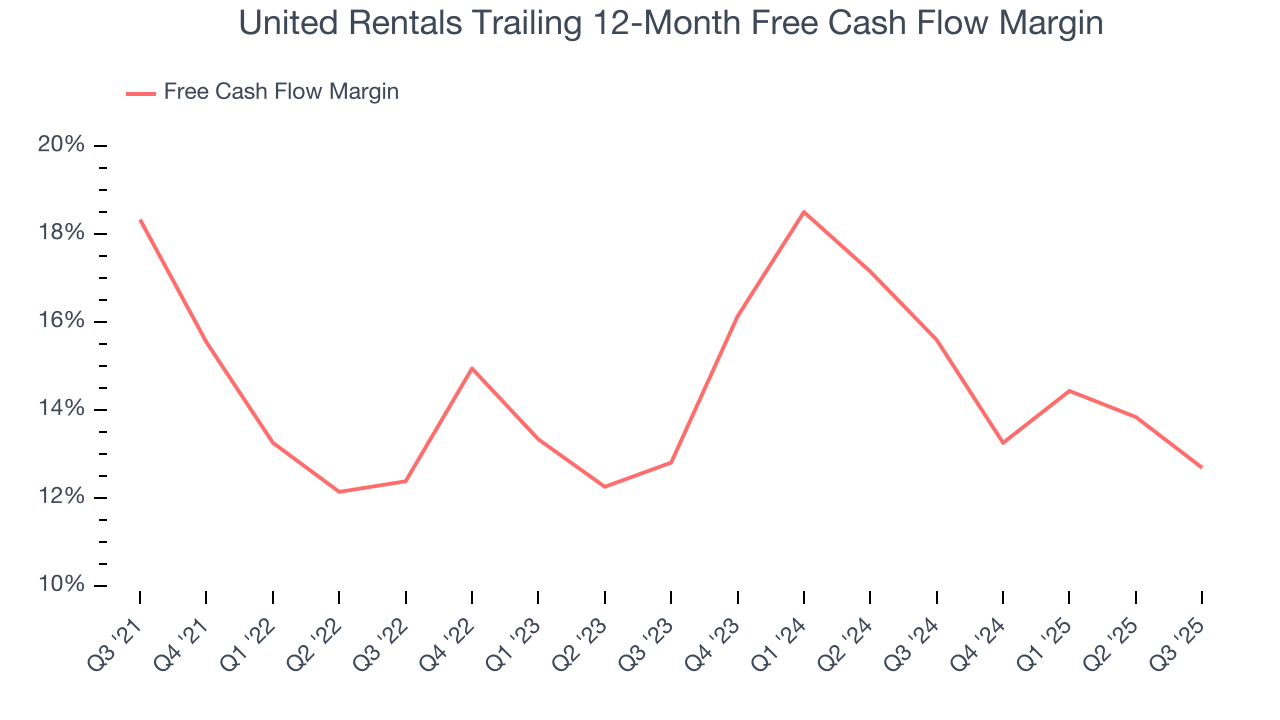

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

United Rentals has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 14.1% over the last five years.

Taking a step back, we can see that United Rentals’s margin dropped by 5.6 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

United Rentals broke even from a free cash flow perspective in Q3. The company’s cash profitability regressed as it was 3.8 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

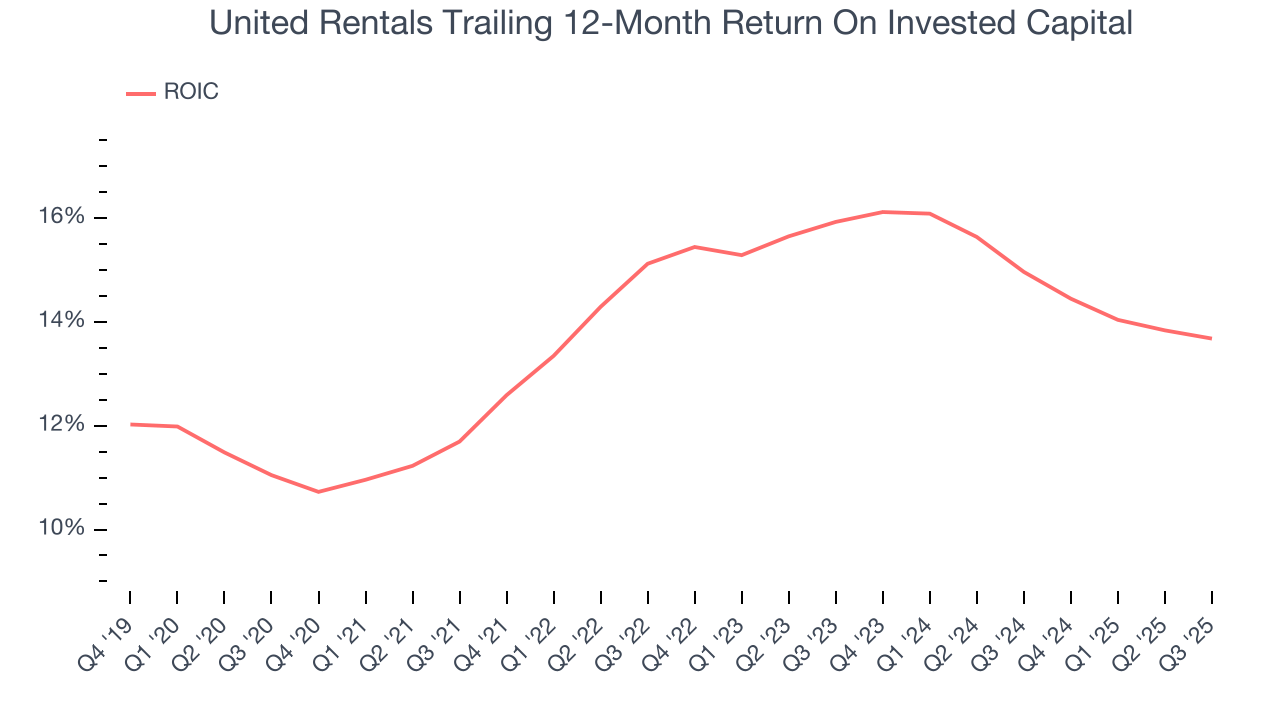

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

United Rentals’s five-year average ROIC was 14.3%, beating other industrials companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, United Rentals’s ROIC has stayed the same over the last few years. Rising returns would be ideal, but this is still a noteworthy feat since they're already high.

11. Balance Sheet Assessment

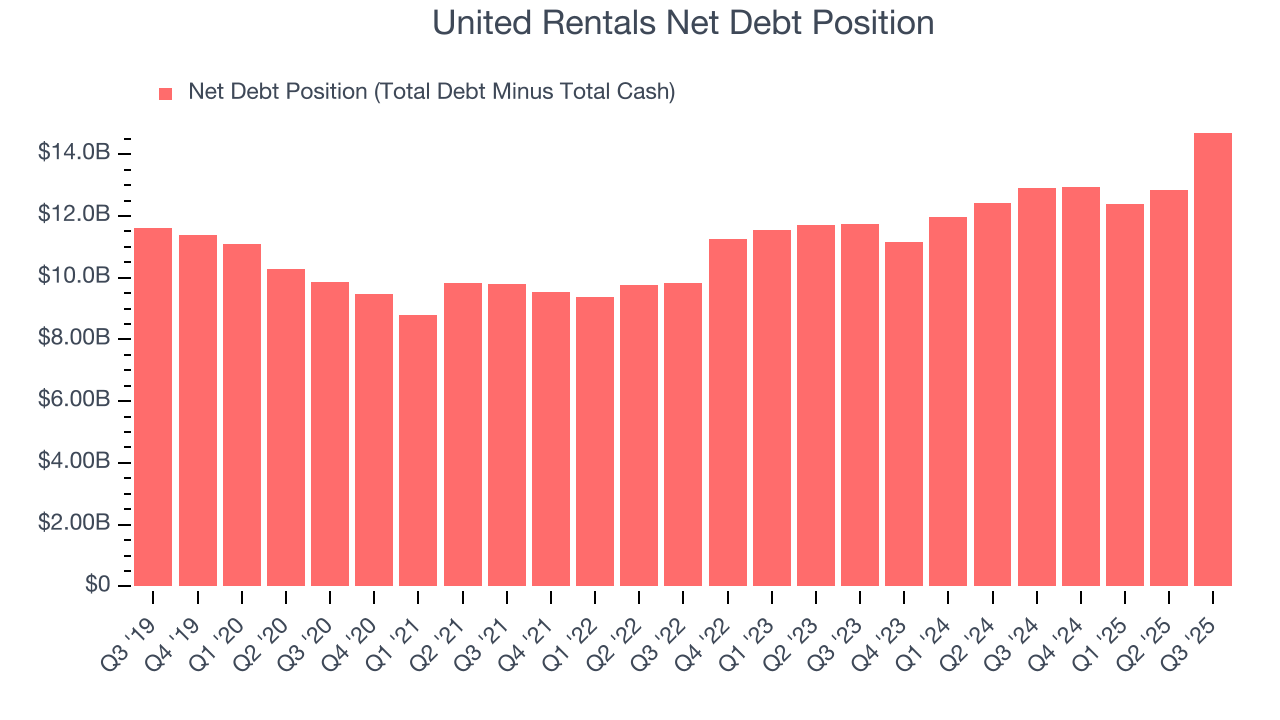

United Rentals reported $512 million of cash and $15.21 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $7.33 billion of EBITDA over the last 12 months, we view United Rentals’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $357 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from United Rentals’s Q3 Results

It was encouraging to see United Rentals beat analysts’ revenue expectations this quarter. We were also glad its full-year EBITDA guidance was in line with Wall Street’s estimates. On the other hand, its EPS missed and its EBITDA fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.8% to $954.01 immediately after reporting.

13. Is Now The Time To Buy United Rentals?

Updated: January 24, 2026 at 10:11 PM EST

Before making an investment decision, investors should account for United Rentals’s business fundamentals and valuation in addition to what happened in the latest quarter.

There are some bright spots in United Rentals’s fundamentals, but its business quality ultimately falls short. To kick things off, its revenue growth was impressive over the last five years. And while United Rentals’s cash profitability fell over the last five years, its impressive operating margins show it has a highly efficient business model.

United Rentals’s P/E ratio based on the next 12 months is 20.9x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $1,017 on the company (compared to the current share price of $917.77).