Vestis (VSTS)

Vestis is up against the odds. Its weak sales growth shows demand is soft and its low margins are a cause for concern.― StockStory Analyst Team

1. News

2. Summary

Why We Think Vestis Will Underperform

Operating a network of more than 350 facilities with 3,300 delivery routes serving customers weekly, Vestis (NYSE:VSTS) provides uniform rentals, workplace supplies, and facility services to over 300,000 business locations across the United States and Canada.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 2% annually over the last two years

- Earnings per share have contracted by 33% annually over the last three years, a headwind for returns as stock prices often echo long-term EPS performance

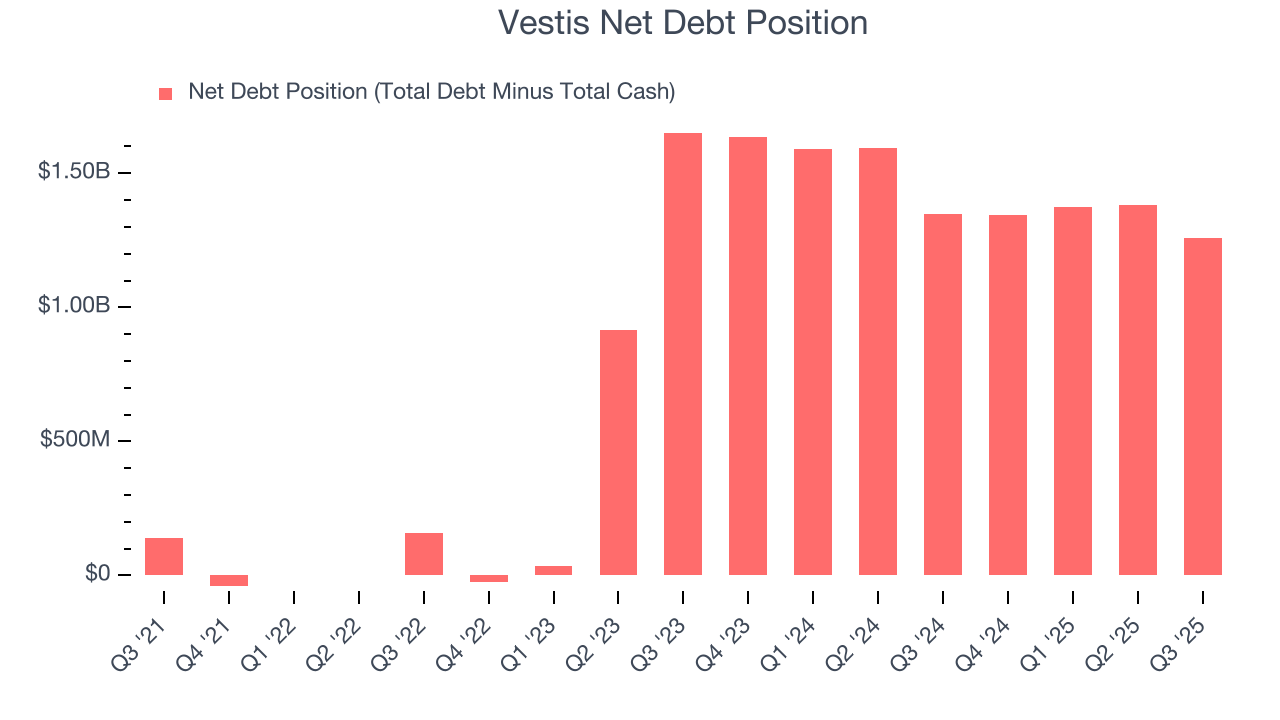

- 5× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

Vestis is in the penalty box. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Vestis

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Vestis

Vestis is trading at $6.57 per share, or 20.3x forward P/E. This multiple is quite expensive for the quality you get.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Vestis (VSTS) Research Report: Q3 CY2025 Update

Uniform rental provider Vestis Corporation (NYSE:VSTS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 4.1% year on year to $712 million. Its GAAP loss of $0.10 per share was significantly below analysts’ consensus estimates.

Vestis (VSTS) Q3 CY2025 Highlights:

- Revenue: $712 million vs analyst estimates of $685.5 million (4.1% year-on-year growth, 3.9% beat)

- EPS (GAAP): -$0.10 vs analyst estimates of -$0.02 (significant miss)

- Adjusted EBITDA: $64.66 million vs analyst estimates of $67.4 million (9.1% margin, 4.1% miss)

- Operating Margin: 2.5%, down from 4.4% in the same quarter last year

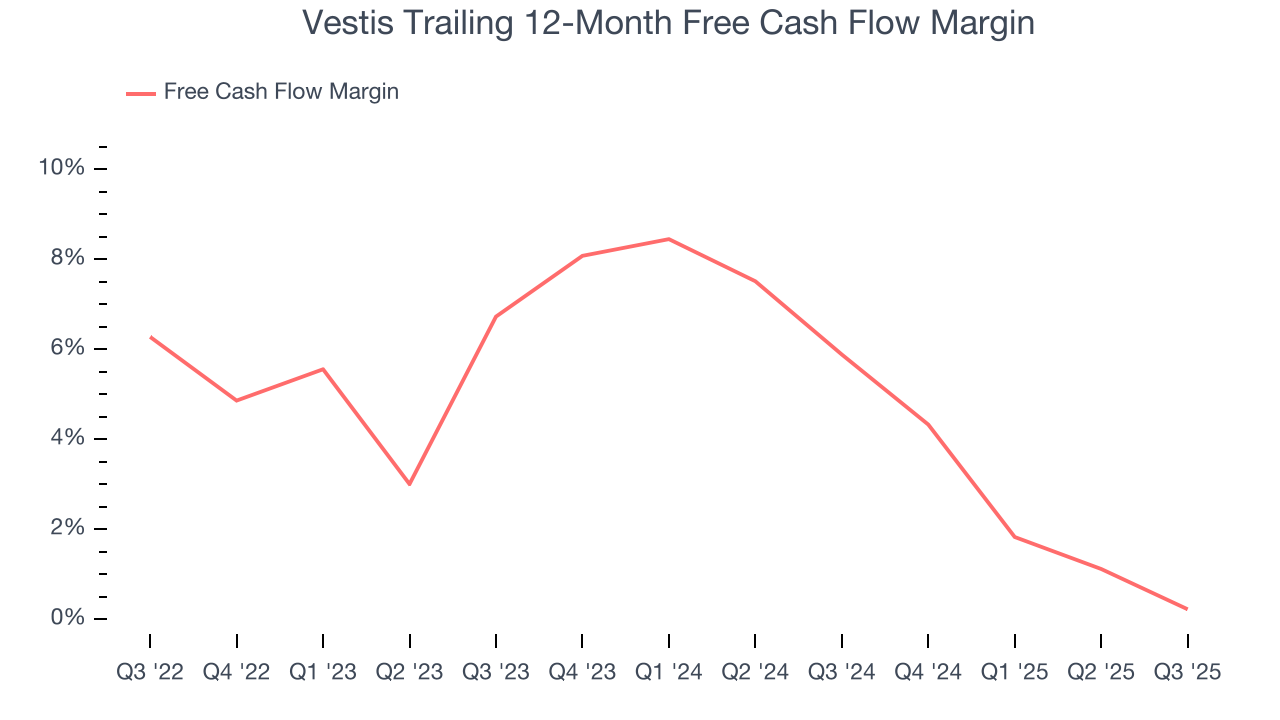

- Free Cash Flow Margin: 2.2%, down from 5.8% in the same quarter last year

- Market Capitalization: $854.3 million

Company Overview

Operating a network of more than 350 facilities with 3,300 delivery routes serving customers weekly, Vestis (NYSE:VSTS) provides uniform rentals, workplace supplies, and facility services to over 300,000 business locations across the United States and Canada.

Vestis offers a comprehensive suite of services centered around its core uniform rental business. The company handles the entire uniform lifecycle - from design and manufacturing to customization, delivery, laundering, sanitization, repair, and replacement. Its uniform options range from basic shirts and pants to specialized garments like flame-resistant clothing, high-visibility wear, and particulate-free garments for cleanroom environments.

Beyond uniforms, Vestis provides complementary workplace essentials including floor mats, towels, linens, restroom supplies, first-aid kits, and safety products. These services are typically delivered on a recurring weekly schedule through multi-year contracts, creating predictable revenue streams.

For a manufacturing client, Vestis might supply flame-resistant uniforms that meet safety regulations, deliver them weekly, handle all cleaning and repairs, and simultaneously restock first-aid stations and replace soiled floor mats - allowing the client to focus on production rather than facility management.

The company operates its own manufacturing facilities in Mexico, producing approximately 60% of its uniforms and linens. This vertical integration helps control quality and costs. Vestis maintains a network of laundry plants, satellite facilities, distribution centers, and a fleet of delivery vehicles operated by route service representatives who both deliver clean items and collect soiled ones.

Vestis serves customers across diverse industries including manufacturing, hospitality, retail, food processing, pharmaceuticals, healthcare, and automotive. Its client base spans from small single-location businesses to large national corporations with multiple facilities. This industry diversification helps insulate the company from downturns in any single sector.

The company emphasizes sustainability in its operations, focusing on minimizing fuel usage in its delivery routes and reducing energy and water consumption in its laundry facilities. By repairing and reusing garments whenever possible, Vestis extends product lifecycles and supports circular economy principles.

4. Industrial & Environmental Services

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

Vestis competes with Cintas Corporation (NASDAQ:CTAS), Aramark (NYSE:ARMK), and UniFirst Corporation (NYSE:UNF) in the uniform rental and workplace supplies industry, along with numerous regional and local providers across North America.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

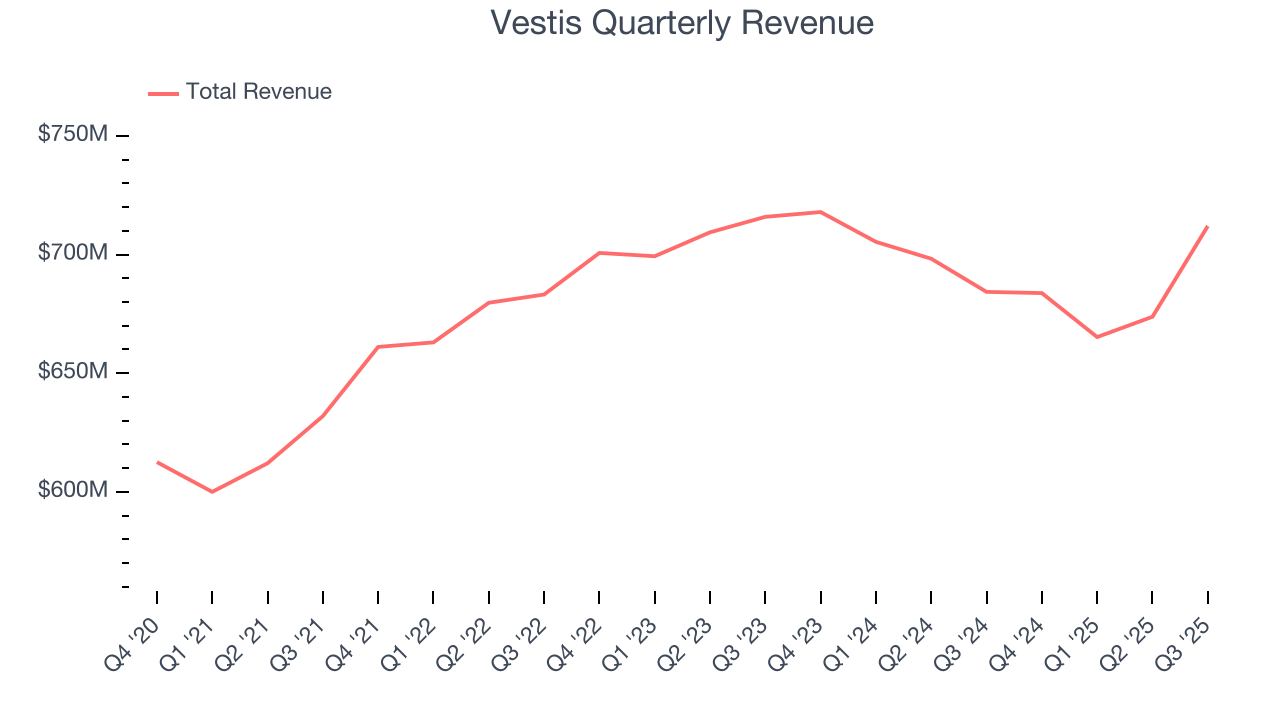

With $2.73 billion in revenue over the past 12 months, Vestis is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

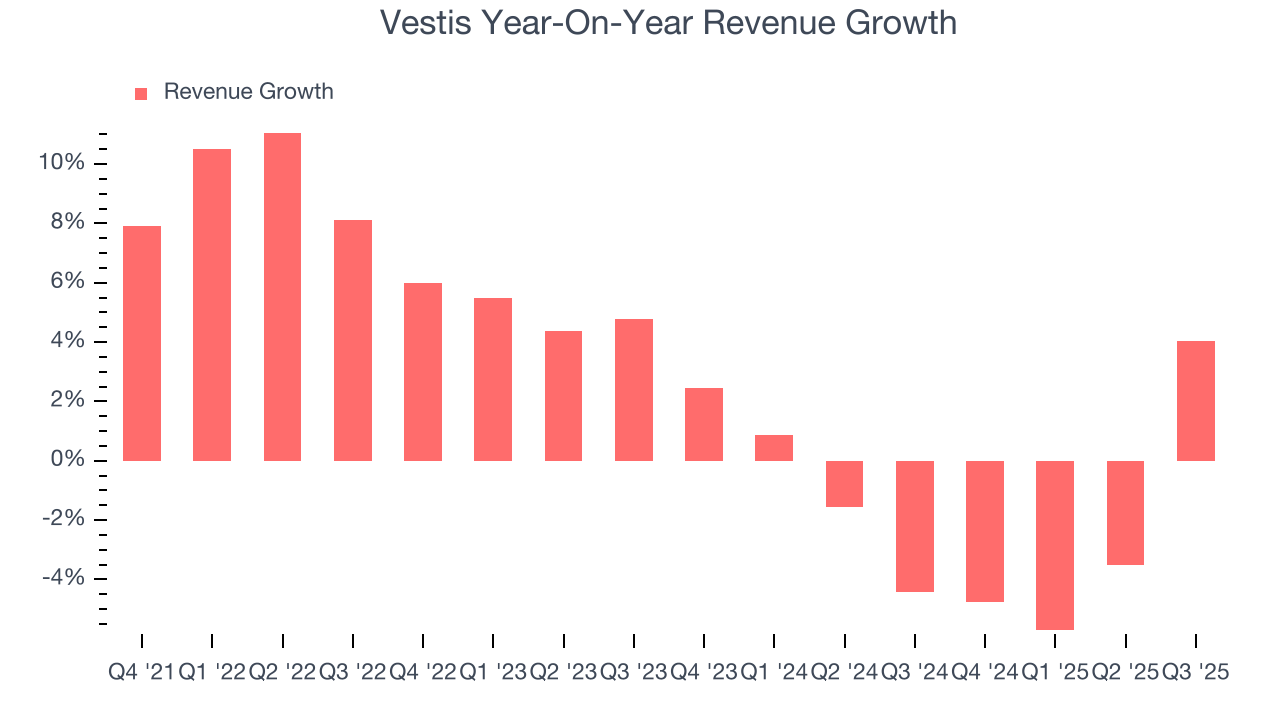

As you can see below, Vestis grew its sales at a sluggish 2.7% compounded annual growth rate over the last four years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. Vestis’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.6% annually.

This quarter, Vestis reported modest year-on-year revenue growth of 4.1% but beat Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to decline by 1.4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not accelerate its top-line performance yet.

6. Operating Margin

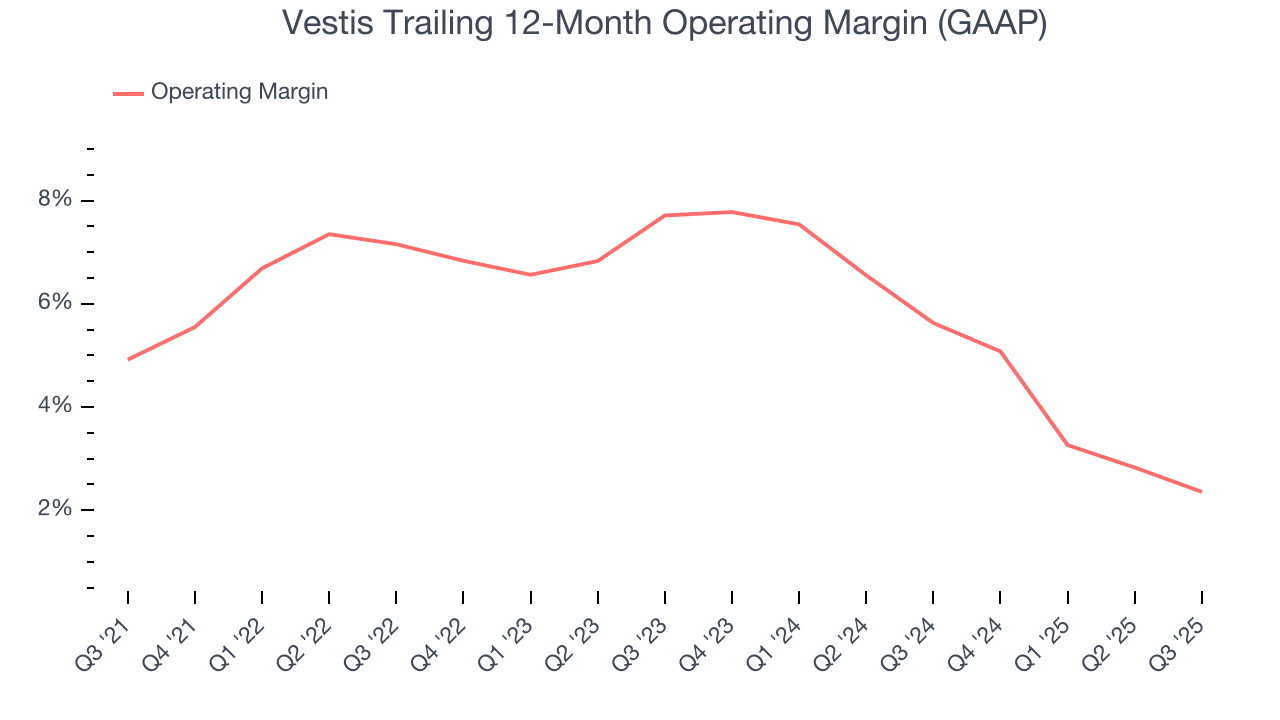

Vestis was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.6% was weak for a business services business.

Looking at the trend in its profitability, Vestis’s operating margin decreased by 2.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Vestis’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Vestis generated an operating margin profit margin of 2.5%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

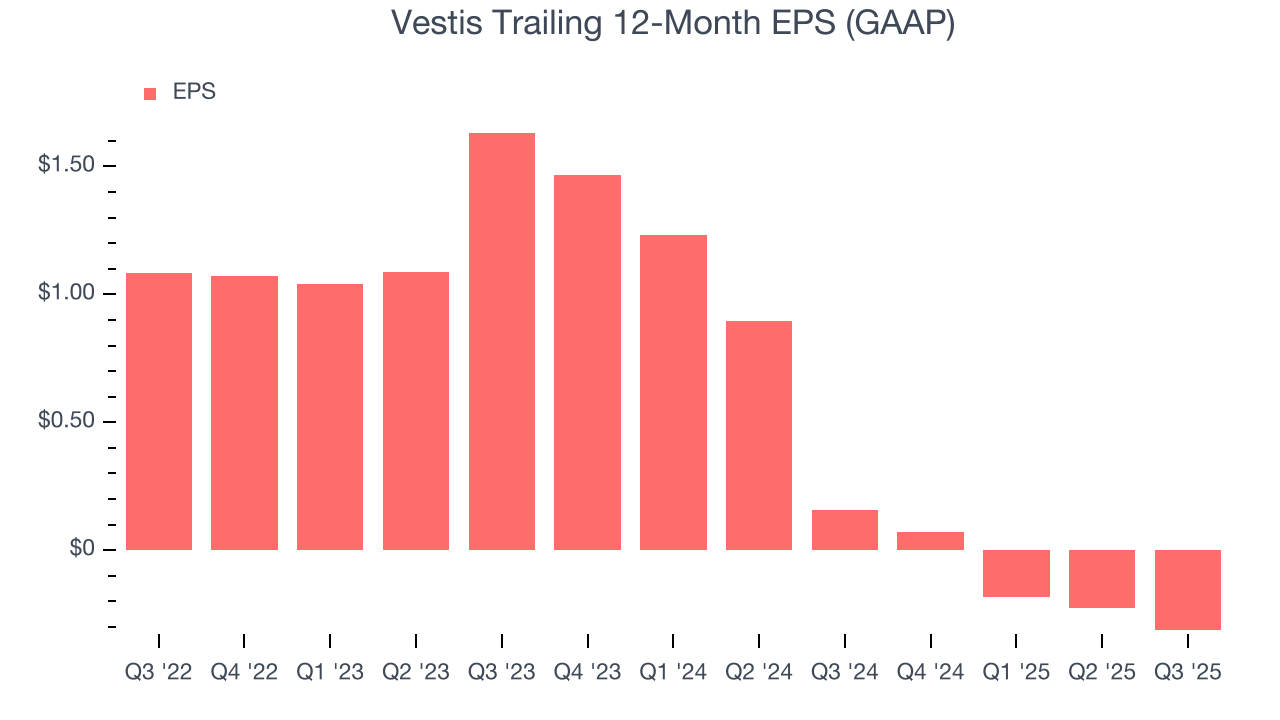

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Vestis, its EPS declined by more than its revenue over the last two years, dropping 48%. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into Vestis’s earnings to better understand the drivers of its performance. Vestis’s operating margin has declined over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Vestis reported EPS of negative $0.10, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Vestis’s full-year EPS of negative $0.31 will flip to positive $0.09.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Vestis has shown mediocre cash profitability over the last four years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.8%, subpar for a business services business.

Taking a step back, we can see that Vestis’s margin dropped by 6.1 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Vestis’s free cash flow clocked in at $15.57 million in Q3, equivalent to a 2.2% margin. The company’s cash profitability regressed as it was 3.6 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

9. Balance Sheet Assessment

Vestis reported $29.75 million of cash and $1.29 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $257.4 million of EBITDA over the last 12 months, we view Vestis’s 4.9× net-debt-to-EBITDA ratio as safe. We also see its $43.58 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Vestis’s Q3 Results

We enjoyed seeing Vestis beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock traded down 5.2% to $6.37 immediately following the results.

11. Is Now The Time To Buy Vestis?

Updated: January 20, 2026 at 10:21 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Vestis.

We see the value of companies helping their customers, but in the case of Vestis, we’re out. To kick things off, its revenue growth was weak over the last four years, and analysts expect its demand to deteriorate over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its cash profitability fell over the last four years.

Vestis’s P/E ratio based on the next 12 months is 20.3x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $6.13 on the company (compared to the current share price of $6.57), implying they don’t see much short-term potential in Vestis.