WEX (WEX)

We’re not sold on WEX. It’s recently struggled to grow its revenue, a worrying sign for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why WEX Is Not Exciting

Originally founded in 1983 as Wright Express to serve the fleet card market, WEX (NYSE:WEX) provides payment processing and business solutions across fleet management, employee benefits, and corporate payments sectors.

- A consolation is that its performance over the past five years shows its incremental sales were more profitable, as its annual earnings per share growth of 21.7% outpaced its revenue gains

WEX’s quality doesn’t meet our bar. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than WEX

High Quality

Investable

Underperform

Why There Are Better Opportunities Than WEX

WEX’s stock price of $154.77 implies a valuation ratio of 9.1x forward P/E. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. WEX (WEX) Research Report: Q4 CY2025 Update

Payment solutions provider WEX (NYSE:WEX) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 5.7% year on year to $672.9 million. On the other hand, the company’s full-year revenue guidance of $2.73 billion at the midpoint came in 1% below analysts’ estimates. Its non-GAAP profit of $4.11 per share was 4.7% above analysts’ consensus estimates.

WEX (WEX) Q4 CY2025 Highlights:

- Revenue: $672.9 million vs analyst estimates of $664.9 million (5.7% year-on-year growth, 1.2% beat)

- Pre-tax Profit: $110 million (16.3% margin)

- Adjusted EPS: $4.11 vs analyst estimates of $3.93 (4.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $17.55 at the midpoint, in line with analyst estimates

- Market Capitalization: $4.95 billion

Company Overview

Originally founded in 1983 as Wright Express to serve the fleet card market, WEX (NYSE:WEX) provides payment processing and business solutions across fleet management, employee benefits, and corporate payments sectors.

WEX operates through three distinct business segments that leverage its payment technology expertise. In its Mobility segment, WEX manages over 19 million vehicles worldwide through its proprietary closed-loop payment network, capturing detailed transaction data that helps fleet managers control spending and prevent fraud. The company's payment cards enable purchases at fuel stations and maintenance providers while delivering analytics that optimize fleet operations.

The Benefits segment simplifies the administration of employee health plans through SaaS platforms with embedded payment capabilities. WEX's technology manages various account types including Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and COBRA administration. As an IRS-designated non-bank custodian, WEX earns revenue from monthly subscription fees, interest on HSA deposits, and interchange fees when participants use their benefit cards.

In the Corporate Payments segment, WEX focuses on complex B2B transactions through two main offerings: Embedded Payments and Accounts Payable Automation. The company's virtual card technology assigns unique card numbers with customized spending limits and controls for each transaction. This technology is particularly valuable in industries like travel, insurance, and media payments where reconciliation, fraud protection, and global currency capabilities are essential.

WEX Bank, a wholly-owned subsidiary, provides funding for many of the company's operations and gives WEX a competitive advantage through access to low-cost capital. The bank enables WEX to design funding solutions that complement its technology offerings while maintaining regulatory compliance across multiple jurisdictions worldwide.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

In the Mobility segment, WEX competes with Fleetcor (NYSE:FLT), U.S. Bank Voyager, and international players like Radius Payment Solutions and Edenred. The Benefits segment faces competition from HealthEquity (NASDAQ:HQY), Alegeus Technologies, and Alight Technologies (NYSE:ALIT). In Corporate Payments, WEX competes with specialized fintech firms like Global Payments (NYSE:GPN), Marqeta (NASDAQ:MQ), and Stripe.

5. Revenue Growth

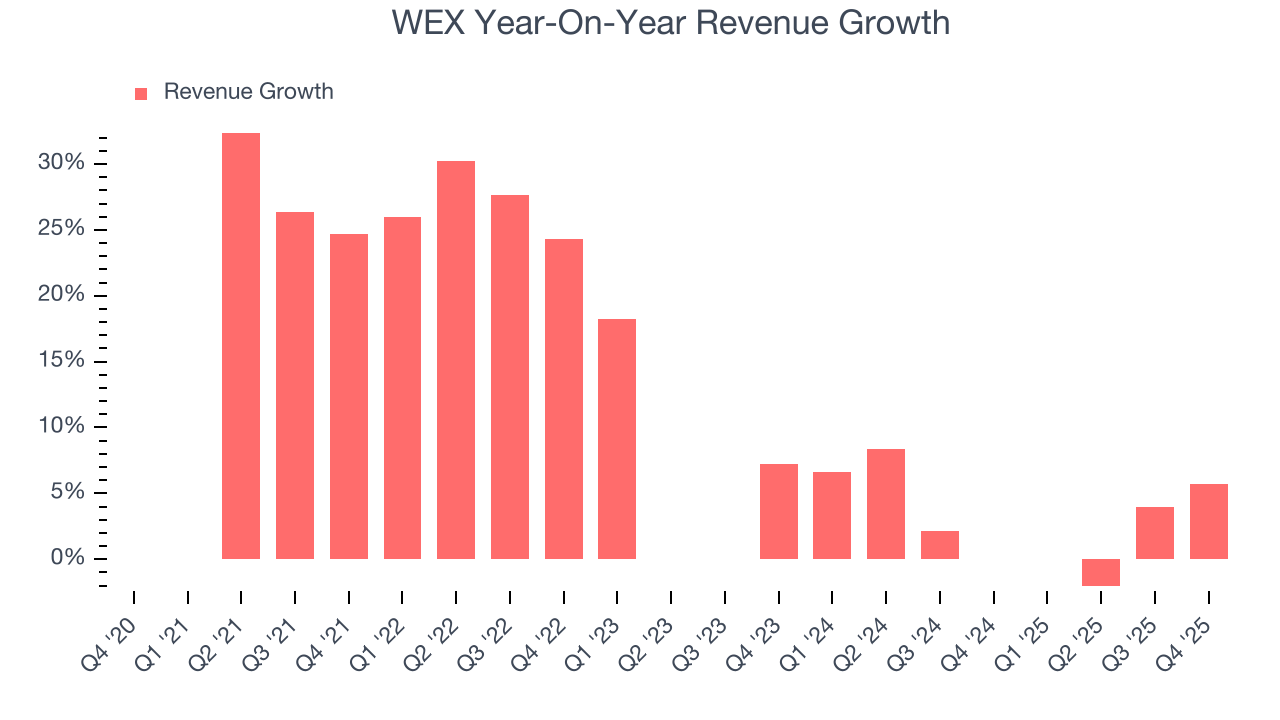

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, WEX’s 11.3% annualized revenue growth over the last five years was solid. Its growth beat the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. WEX’s recent performance shows its demand has slowed as its annualized revenue growth of 2.2% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, WEX reported year-on-year revenue growth of 5.7%, and its $672.9 million of revenue exceeded Wall Street’s estimates by 1.2%.

6. Pre-Tax Profit Margin

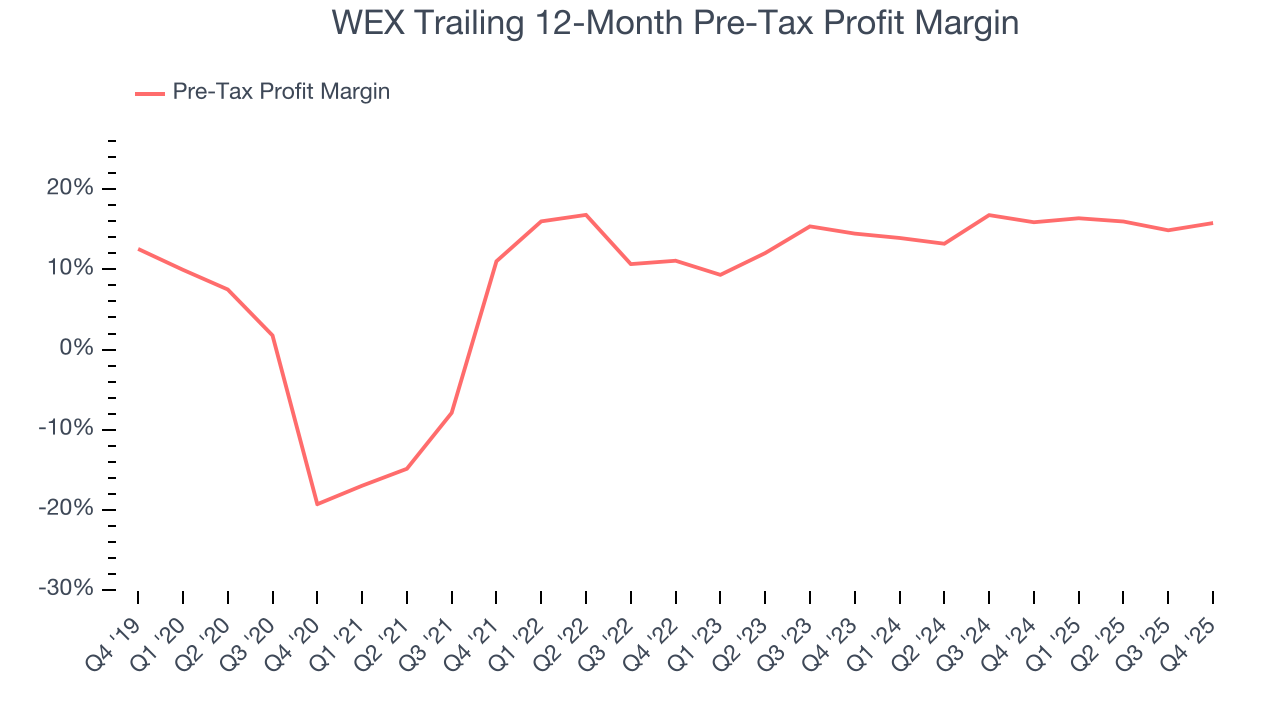

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last five years, WEX’s pre-tax profit margin has fallen by 35.1 percentage points, going from 11% to 15.8%. It has also expanded by 1.3 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

WEX’s pre-tax profit margin came in at 16.3% this quarter. This result was 3.7 percentage points better than the same quarter last year.

7. Earnings Per Share

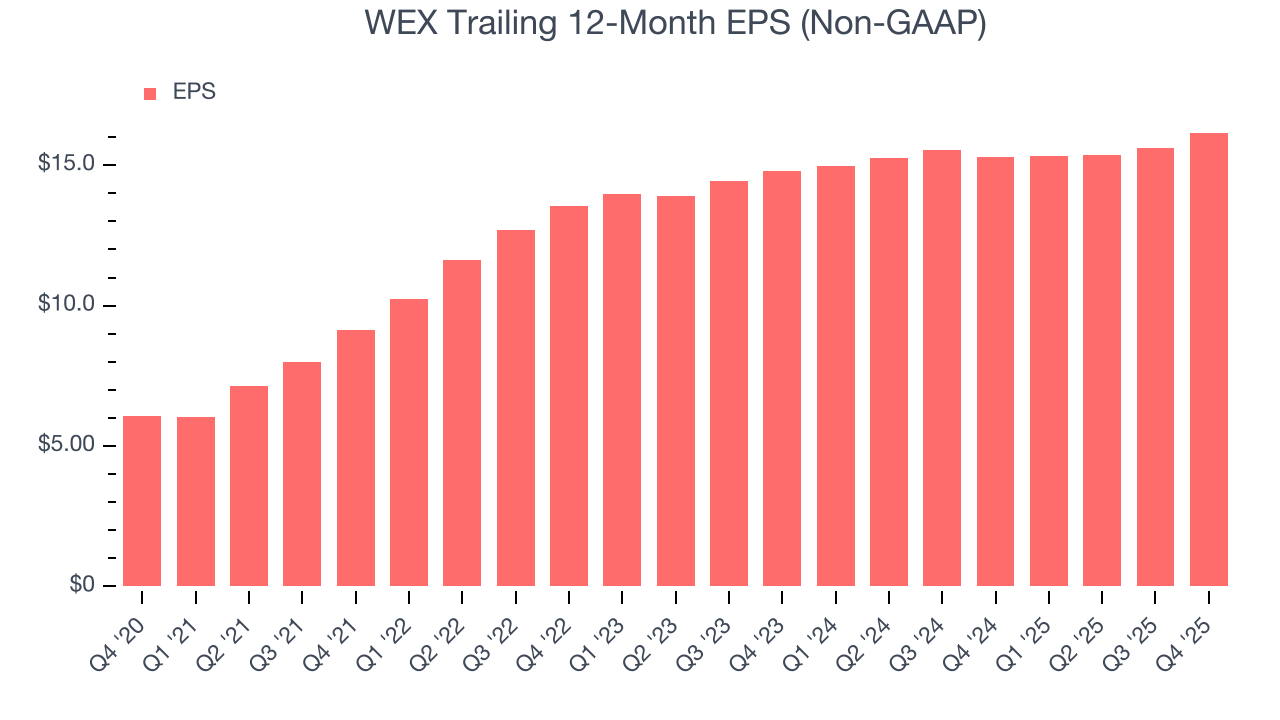

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

WEX’s EPS grew at a spectacular 21.7% compounded annual growth rate over the last five years, higher than its 11.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For WEX, its two-year annual EPS growth of 4.5% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, WEX reported adjusted EPS of $4.11, up from $3.57 in the same quarter last year. This print beat analysts’ estimates by 4.7%. Over the next 12 months, Wall Street expects WEX’s full-year EPS of $16.16 to grow 8.9%.

8. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, WEX has averaged an ROE of 14.9%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for WEX.

9. Balance Sheet Risk

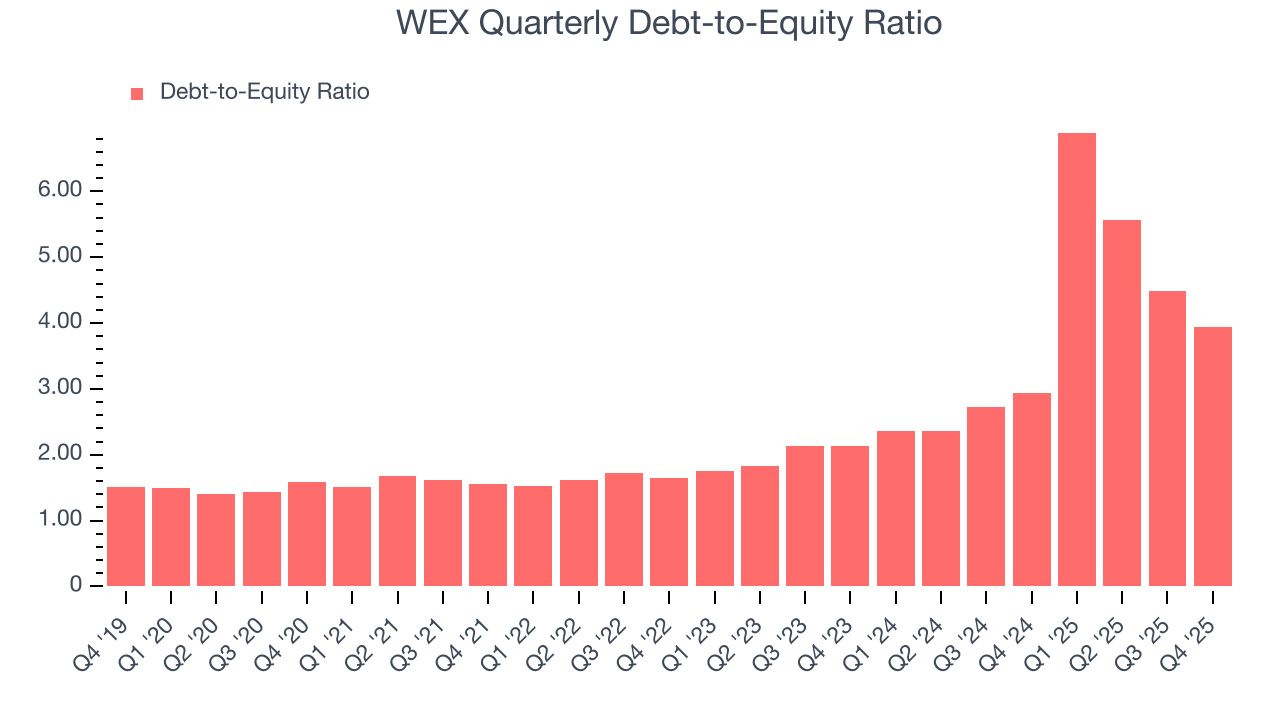

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

WEX currently has $4.86 billion of debt and $1.23 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 5.2×. We think this is dangerous - for a financials business, anything above 3.5× raises red flags.

10. Key Takeaways from WEX’s Q4 Results

It was good to see WEX beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $148.26 immediately after reporting.

11. Is Now The Time To Buy WEX?

Updated: February 19, 2026 at 11:10 PM EST

When considering an investment in WEX, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are some bright spots in WEX’s fundamentals, but its business quality ultimately falls short. To kick things off, its revenue growth was solid over the last five years. On top of that, WEX’s expanding pre-tax profit margin shows the business has become more efficient, and its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders.

WEX’s P/E ratio based on the next 12 months is 9.1x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $169.40 on the company (compared to the current share price of $154.77).