WEX (WEX)

We aren’t fans of WEX. It’s recently struggled to grow its revenue, a worrying sign for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think WEX Will Underperform

Originally founded in 1983 as Wright Express to serve the fleet card market, WEX (NYSE:WEX) provides payment processing and business solutions across fleet management, employee benefits, and corporate payments sectors.

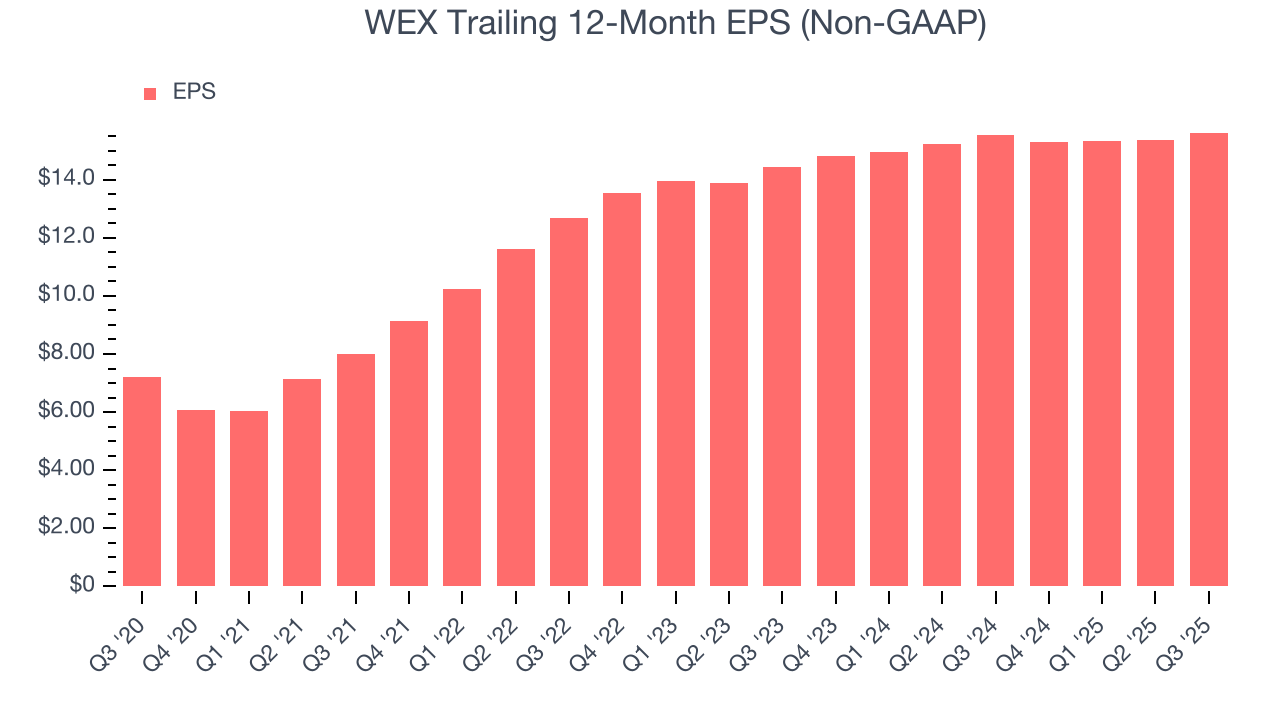

- One positive is that its performance over the past five years shows its incremental sales were more profitable, as its annual earnings per share growth of 16.7% outpaced its revenue gains

WEX doesn’t measure up to our expectations. There are more promising alternatives.

Why There Are Better Opportunities Than WEX

High Quality

Investable

Underperform

Why There Are Better Opportunities Than WEX

At $160.33 per share, WEX trades at 9.4x forward P/E. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. WEX (WEX) Research Report: Q3 CY2025 Update

Payment solutions provider WEX (NYSE:WEX) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 4% year on year to $691.8 million. The company expects the full year’s revenue to be around $2.64 billion, close to analysts’ estimates. Its non-GAAP profit of $4.59 per share was 3.1% above analysts’ consensus estimates.

WEX (WEX) Q3 CY2025 Highlights:

- Revenue: $691.8 million vs analyst estimates of $681.9 million (4% year-on-year growth, 1.5% beat)

- Pre-tax Profit: $116.4 million (16.8% margin, 17.5% year-on-year decline)

- Adjusted EPS: $4.59 vs analyst estimates of $4.45 (3.1% beat)

- Adjusted EPS guidance for the full year is $15.86 at the midpoint, beating analyst estimates by 0.9%

- Market Capitalization: $5.44 billion

Company Overview

Originally founded in 1983 as Wright Express to serve the fleet card market, WEX (NYSE:WEX) provides payment processing and business solutions across fleet management, employee benefits, and corporate payments sectors.

WEX operates through three distinct business segments that leverage its payment technology expertise. In its Mobility segment, WEX manages over 19 million vehicles worldwide through its proprietary closed-loop payment network, capturing detailed transaction data that helps fleet managers control spending and prevent fraud. The company's payment cards enable purchases at fuel stations and maintenance providers while delivering analytics that optimize fleet operations.

The Benefits segment simplifies the administration of employee health plans through SaaS platforms with embedded payment capabilities. WEX's technology manages various account types including Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and COBRA administration. As an IRS-designated non-bank custodian, WEX earns revenue from monthly subscription fees, interest on HSA deposits, and interchange fees when participants use their benefit cards.

In the Corporate Payments segment, WEX focuses on complex B2B transactions through two main offerings: Embedded Payments and Accounts Payable Automation. The company's virtual card technology assigns unique card numbers with customized spending limits and controls for each transaction. This technology is particularly valuable in industries like travel, insurance, and media payments where reconciliation, fraud protection, and global currency capabilities are essential.

WEX Bank, a wholly-owned subsidiary, provides funding for many of the company's operations and gives WEX a competitive advantage through access to low-cost capital. The bank enables WEX to design funding solutions that complement its technology offerings while maintaining regulatory compliance across multiple jurisdictions worldwide.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

In the Mobility segment, WEX competes with Fleetcor (NYSE:FLT), U.S. Bank Voyager, and international players like Radius Payment Solutions and Edenred. The Benefits segment faces competition from HealthEquity (NASDAQ:HQY), Alegeus Technologies, and Alight Technologies (NYSE:ALIT). In Corporate Payments, WEX competes with specialized fintech firms like Global Payments (NYSE:GPN), Marqeta (NASDAQ:MQ), and Stripe.

5. Revenue Growth

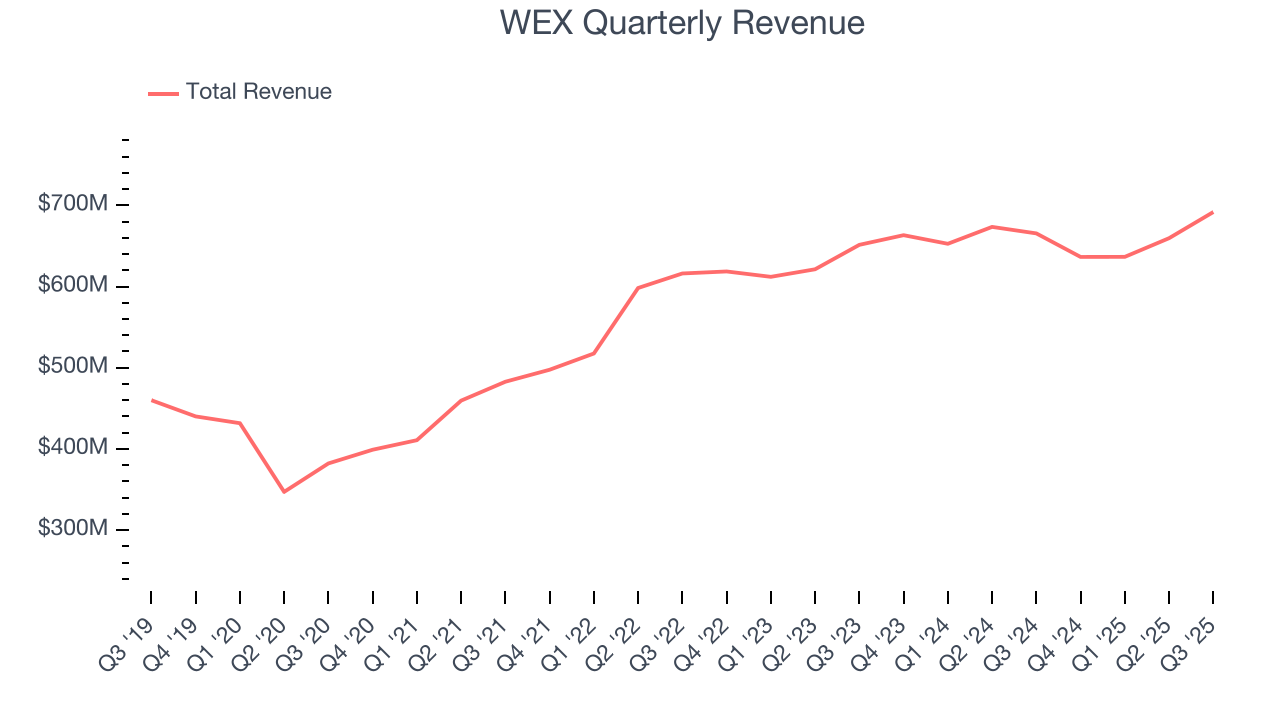

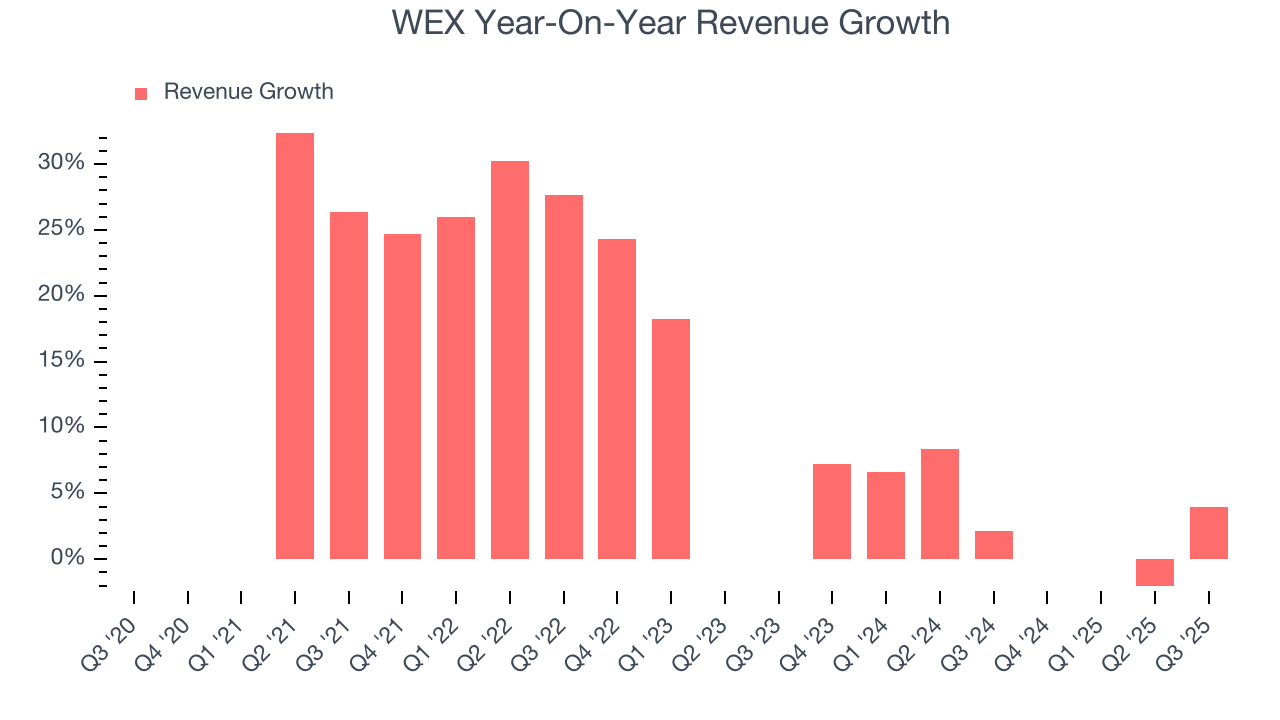

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, WEX grew its revenue at a decent 10.4% compounded annual growth rate. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. WEX’s recent performance shows its demand has slowed as its annualized revenue growth of 2.4% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, WEX reported modest year-on-year revenue growth of 4% but beat Wall Street’s estimates by 1.5%.

6. Pre-Tax Profit Margin

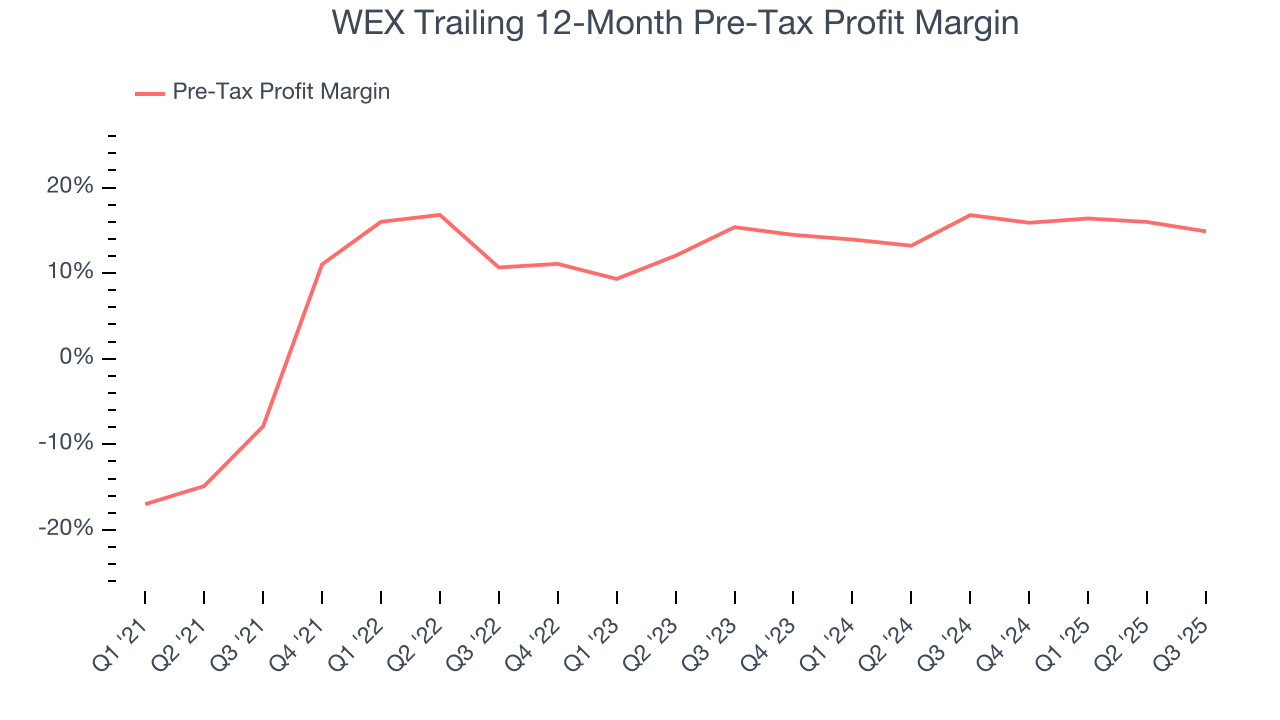

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last four years, WEX’s pre-tax profit margin has fallen by 22.8 percentage points, going from negative 7.9% to 14.9%. However, fixed cost leverage was muted more recently as the company’s pre-tax profit margin was flat on a two-year basis.

WEX’s pre-tax profit margin came in at 16.8% this quarter. This result was 4.4 percentage points worse than the same quarter last year.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

WEX’s EPS grew at a remarkable 16.7% compounded annual growth rate over the last five years, higher than its 10.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For WEX, its two-year annual EPS growth of 4% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, WEX reported adjusted EPS of $4.59, up from $4.35 in the same quarter last year. This print beat analysts’ estimates by 3.1%. Over the next 12 months, Wall Street expects WEX’s full-year EPS of $15.62 to grow 8.9%.

8. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, WEX has averaged an ROE of 11.1%, respectable for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired.

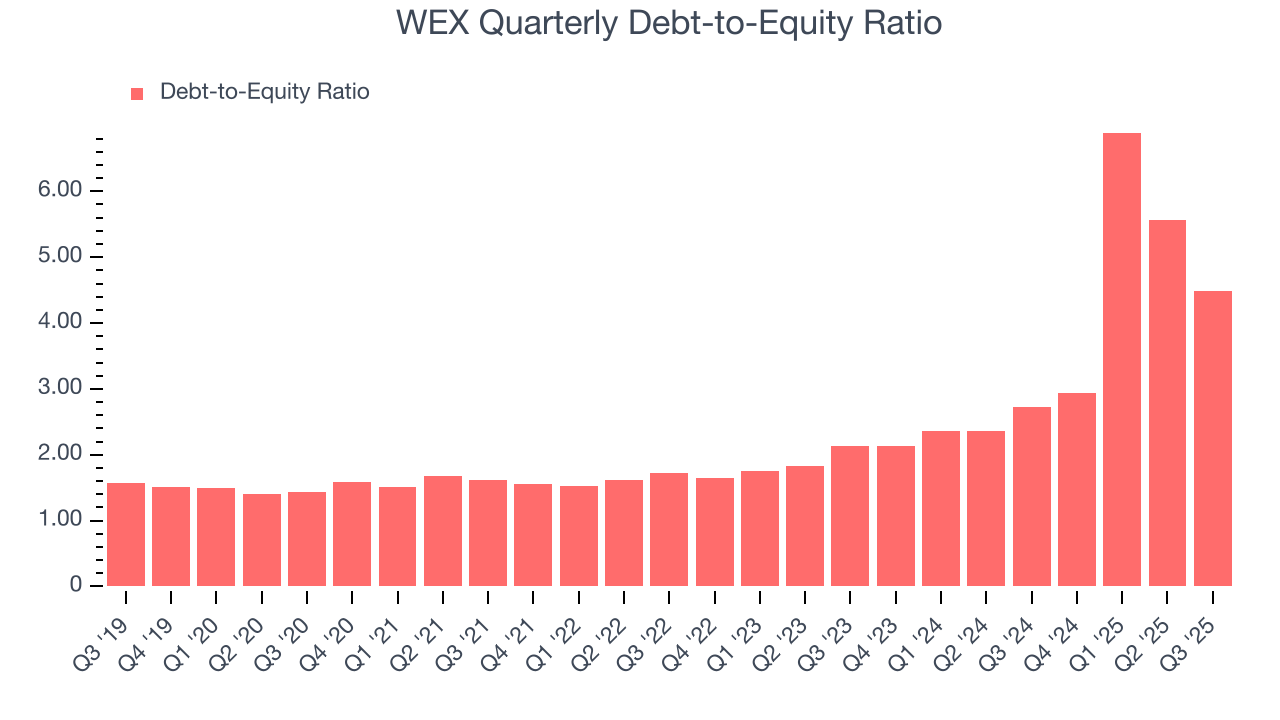

9. Balance Sheet Risk

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

WEX currently has $5.03 billion of debt and $1.12 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 5×. We think this is dangerous - for a financials business, anything above 3.5× raises red flags.

10. Key Takeaways from WEX’s Q3 Results

It was good to see WEX narrowly top analysts’ revenue expectations this quarter. We were also glad its full-year EPS guidance slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 3.8% to $159.90 immediately after reporting.

11. Is Now The Time To Buy WEX?

Updated: January 12, 2026 at 11:14 PM EST

Are you wondering whether to buy WEX or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

WEX’s business quality ultimately falls short of our standards. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its above-average ROE suggests its management team has made good investment decisions

WEX’s P/E ratio based on the next 12 months is 9.4x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $176.89 on the company (compared to the current share price of $160.33).