Watts Water Technologies (WTS)

We’re firm believers in Watts Water Technologies. Its robust cash flows and returns on capital showcase its management team’s strong investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why We Like Watts Water Technologies

Founded in 1874, Watts Water (NYSE:WTS) specializes in manufacturing water products and systems for residential, commercial, and industrial applications globally.

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 21.8% over the last five years outstripped its revenue performance

- Superior product capabilities and pricing power result in a best-in-class gross margin of 45.9%

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures

We see a bright future for Watts Water Technologies. The price looks fair based on its quality, so this could be a favorable time to buy some shares.

Why Is Now The Time To Buy Watts Water Technologies?

Why Is Now The Time To Buy Watts Water Technologies?

At $297.29 per share, Watts Water Technologies trades at 26.8x forward P/E. Looking at the industrials space, we think the valuation is fair - potentially even too low - for the business quality.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Entry price matters less, but if you can get a good one, all the better.

3. Watts Water Technologies (WTS) Research Report: Q3 CY2025 Update

Water management manufacturer Watts Water (NYSE:WTS) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 12.5% year on year to $611.7 million. Its non-GAAP profit of $2.50 per share was 10.5% above analysts’ consensus estimates.

Watts Water Technologies (WTS) Q3 CY2025 Highlights:

- Revenue: $611.7 million vs analyst estimates of $576.2 million (12.5% year-on-year growth, 6.2% beat)

- Adjusted EPS: $2.50 vs analyst estimates of $2.26 (10.5% beat)

- Operating Margin: 18.2%, up from 17.1% in the same quarter last year

- Free Cash Flow Margin: 18.1%, up from 15.5% in the same quarter last year

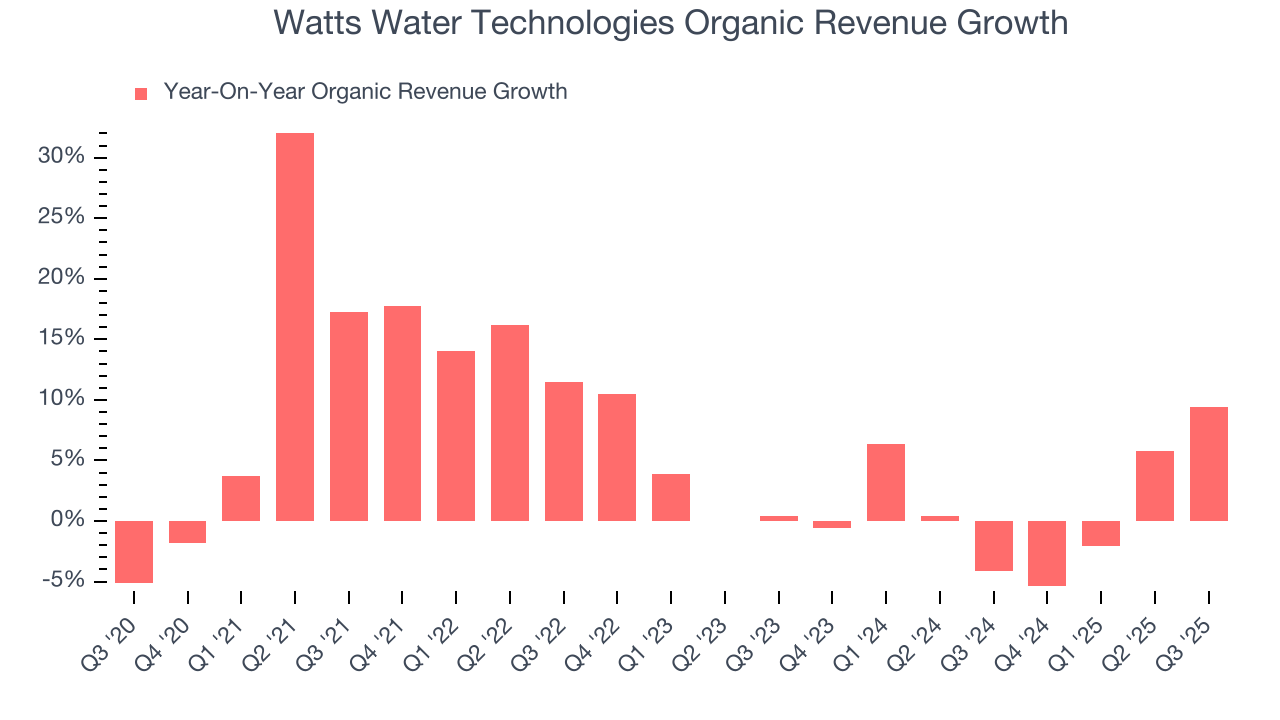

- Organic Revenue rose 9.4% year on year vs analyst estimates of 3.7% growth (567.3 basis point beat)

- Market Capitalization: $9.16 billion

Company Overview

Founded in 1874, Watts Water (NYSE:WTS) specializes in manufacturing water products and systems for residential, commercial, and industrial applications globally.

Watts Water Technologies, started as a small machine shop supplying parts to textile mills in Lawrence, Massachusetts. Initially focused on steam regulators to control the pressure and efficiency of steam boilers, the company quickly became recognized for its products in the burgeoning industrial landscape. Over the decades, Watts expanded its offerings to include a variety of water control products. This growth was propelled by strategic acquisitions that broadened its product lines and extended its market reach. Today, Watts Water Technologies is known for its comprehensive range of products aimed at managing water efficiency and safety in residential, commercial, and industrial settings.

Watts Water specializes in products for managing water flow, temperature, and safety across residential and commercial settings. Its offerings include flow control devices like backflow preventers and water pressure regulators, along with safety equipment such as thermostatic mixing valves and leak detection systems. These products are increasingly integrated with smart technology, enabling remote monitoring and management via building management systems or personal devices to prevent water waste and damage.

In the HVAC and gas sector, Watts provides solutions like high-efficiency boilers, water heaters, and various heating systems, including those for under-floor radiant heating and commercial food service applications. Additionally, Watts ventures into water sustainability with its drainage and water re-use segment, offering products like engineered rainwater harvesting systems and drainage products including connected roof drain setups.

Watts Water generates revenue primarily by selling its products through various distribution channels. These include plumbing, heating, and mechanical wholesale distributors and dealers, as well as original equipment manufacturers (OEMs), specialty product distributors, and major DIY and retail chains. The company’s end markets are diverse, encompassing residential and commercial building services, industrial applications, and specialty areas like high-efficiency boilers, water heaters, and food service products.

4. Water Infrastructure

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Mueller Water Products (NYSE:MWA), A.O. Smith (NYSE:AOS), and Pentair (NYSE:PNR).

5. Revenue Growth

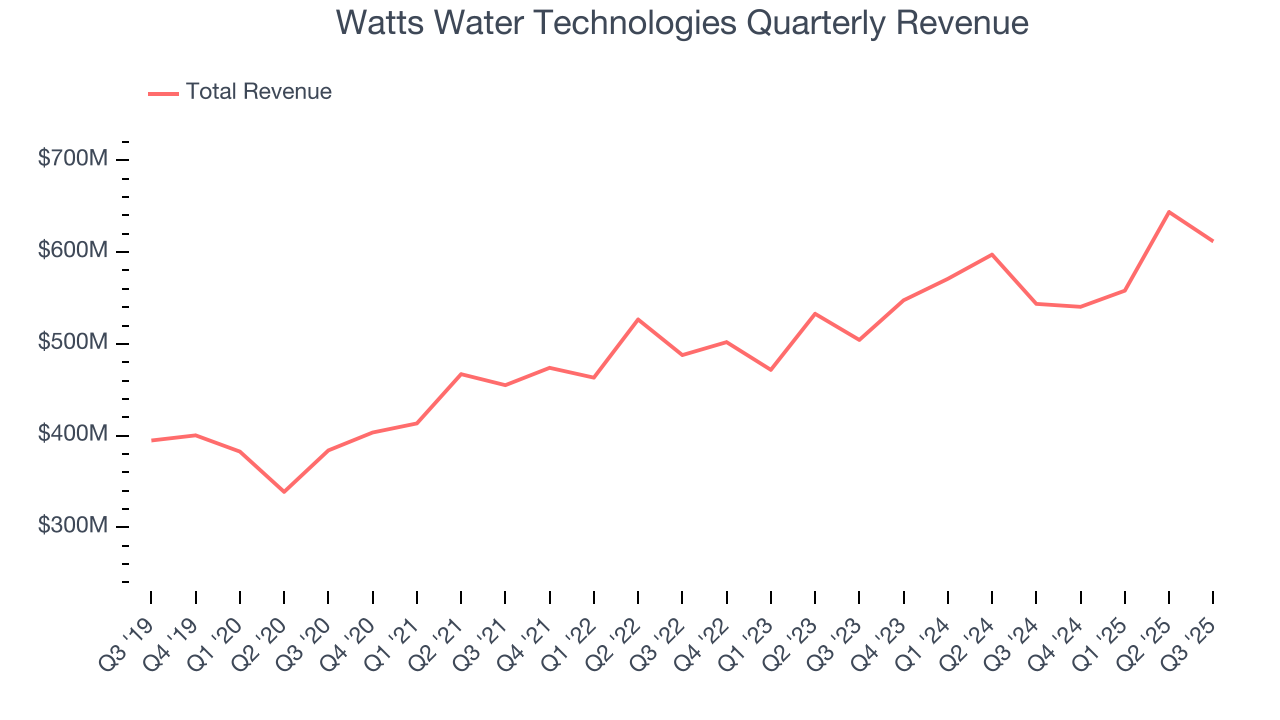

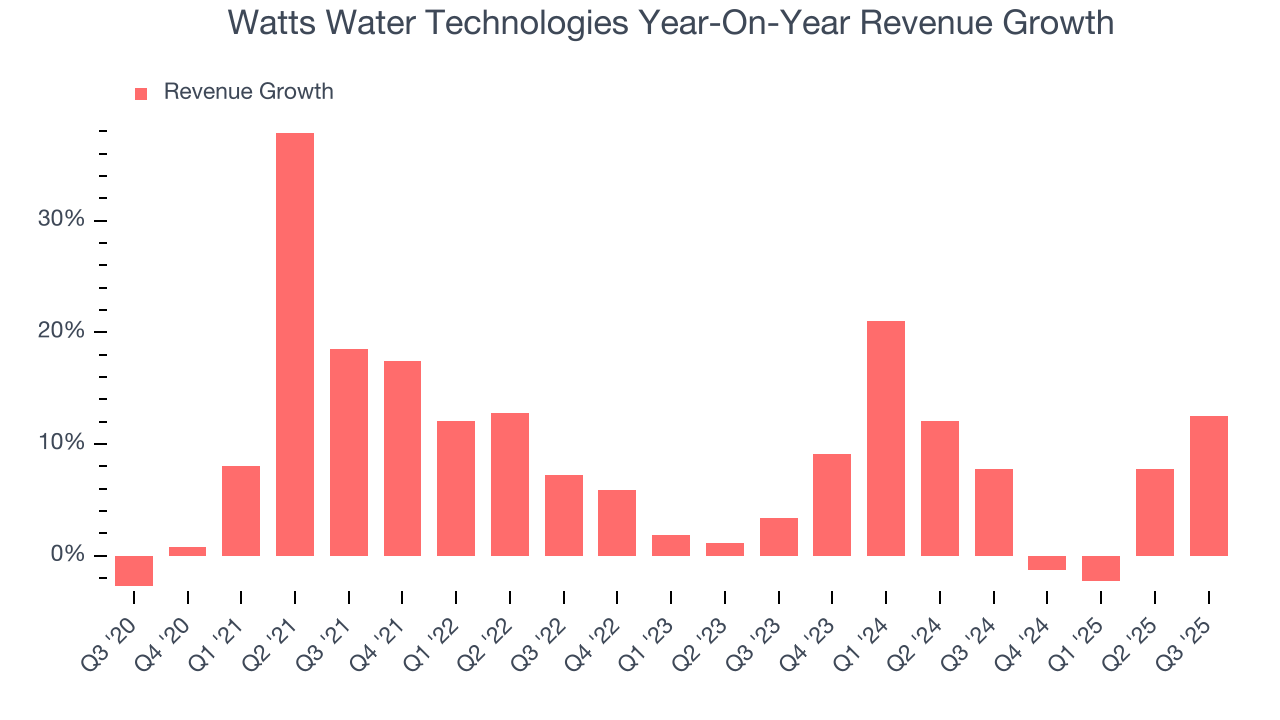

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Watts Water Technologies’s 9.3% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Watts Water Technologies’s annualized revenue growth of 8.2% over the last two years is below its five-year trend, but we still think the results were respectable.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Watts Water Technologies’s organic revenue averaged 1.2% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Watts Water Technologies reported year-on-year revenue growth of 12.5%, and its $611.7 million of revenue exceeded Wall Street’s estimates by 6.2%.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

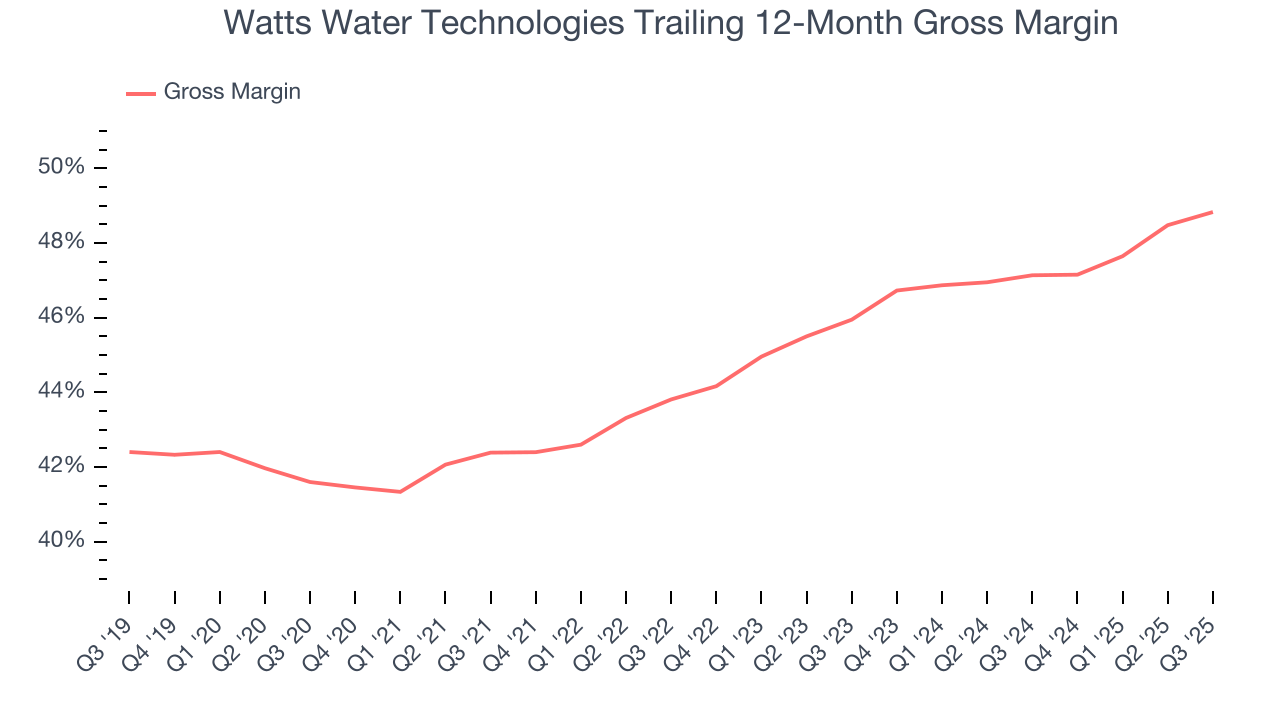

Watts Water Technologies has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 45.9% gross margin over the last five years. Said differently, roughly $45.86 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

In Q3, Watts Water Technologies produced a 48.8% gross profit margin, up 1.5 percentage points year on year. Watts Water Technologies’s full-year margin has also been trending up over the past 12 months, increasing by 1.7 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

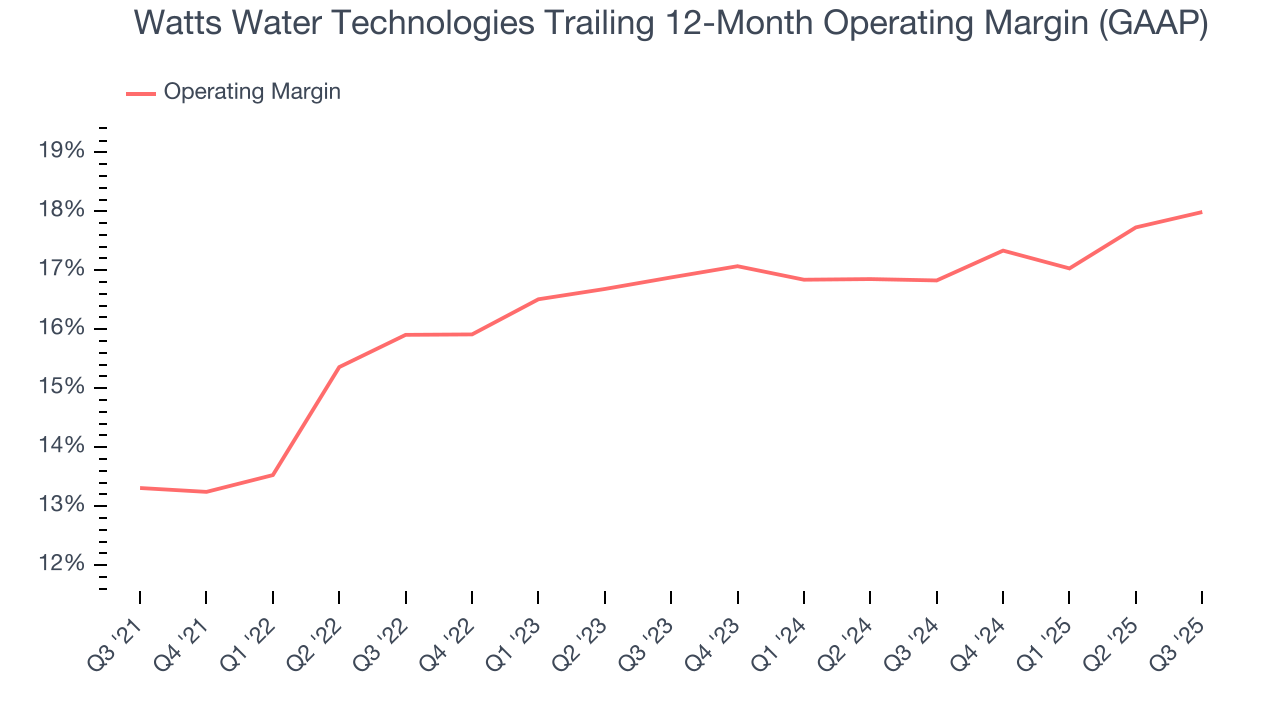

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Watts Water Technologies has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Watts Water Technologies’s operating margin rose by 4.7 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Watts Water Technologies generated an operating margin profit margin of 18.2%, up 1.1 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

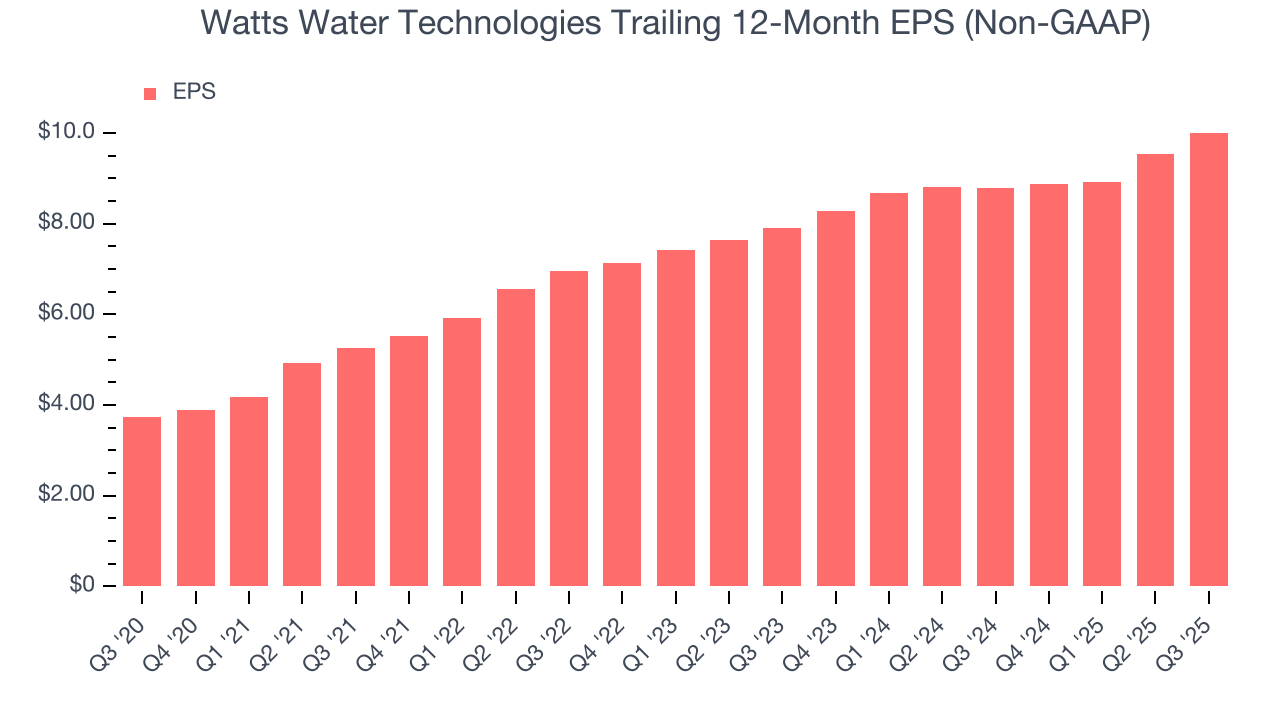

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

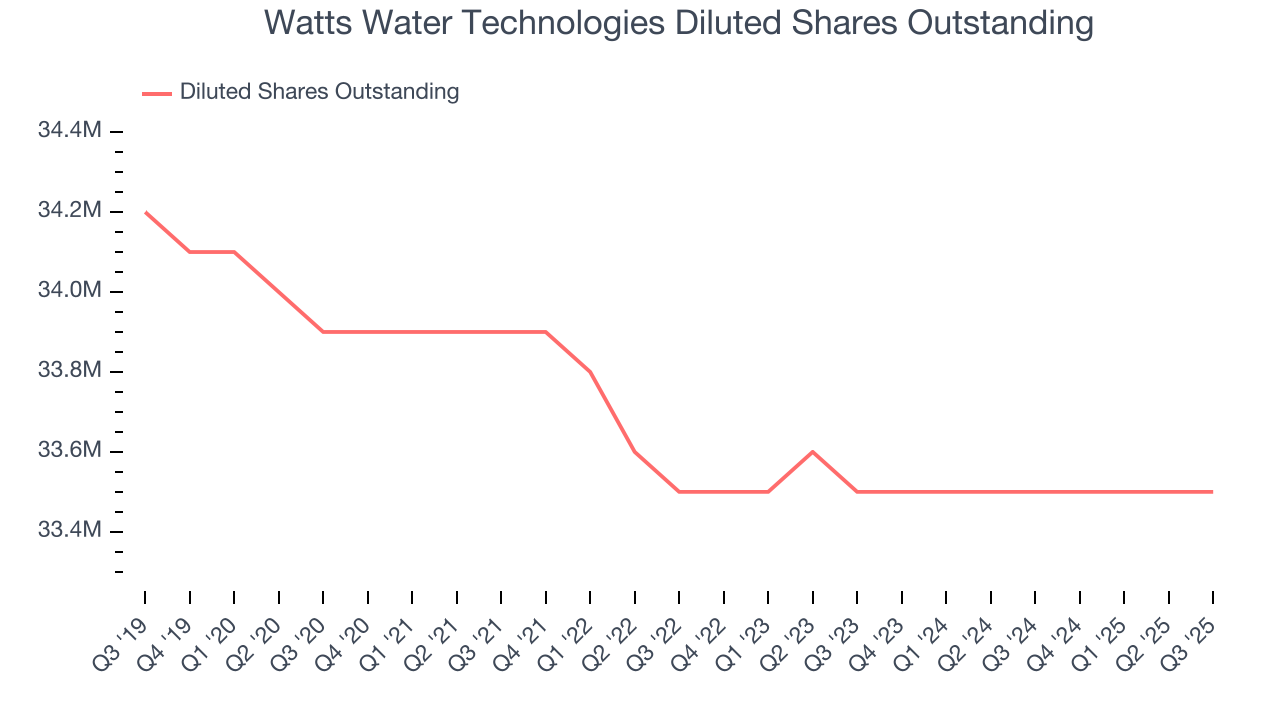

Watts Water Technologies’s EPS grew at an astounding 21.8% compounded annual growth rate over the last five years, higher than its 9.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Watts Water Technologies’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Watts Water Technologies’s operating margin expanded by 4.7 percentage points over the last five years. On top of that, its share count shrank by 1.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Watts Water Technologies, its two-year annual EPS growth of 12.6% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Watts Water Technologies reported adjusted EPS of $2.50, up from $2.03 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Watts Water Technologies’s full-year EPS of $10.01 to grow 3%.

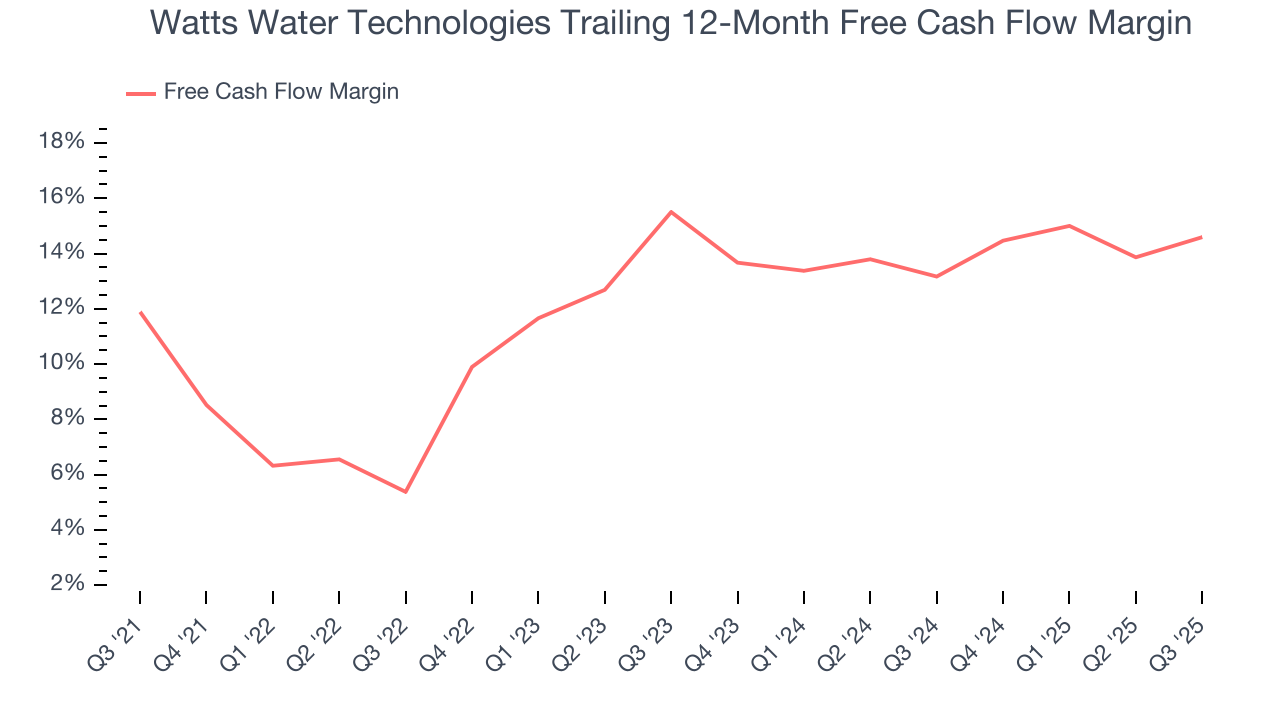

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Watts Water Technologies has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 12.3% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Watts Water Technologies’s margin expanded by 2.7 percentage points during that time. This is encouraging because it gives the company more optionality.

Watts Water Technologies’s free cash flow clocked in at $110.9 million in Q3, equivalent to a 18.1% margin. This result was good as its margin was 2.6 percentage points higher than in the same quarter last year, building on its favorable historical trend.

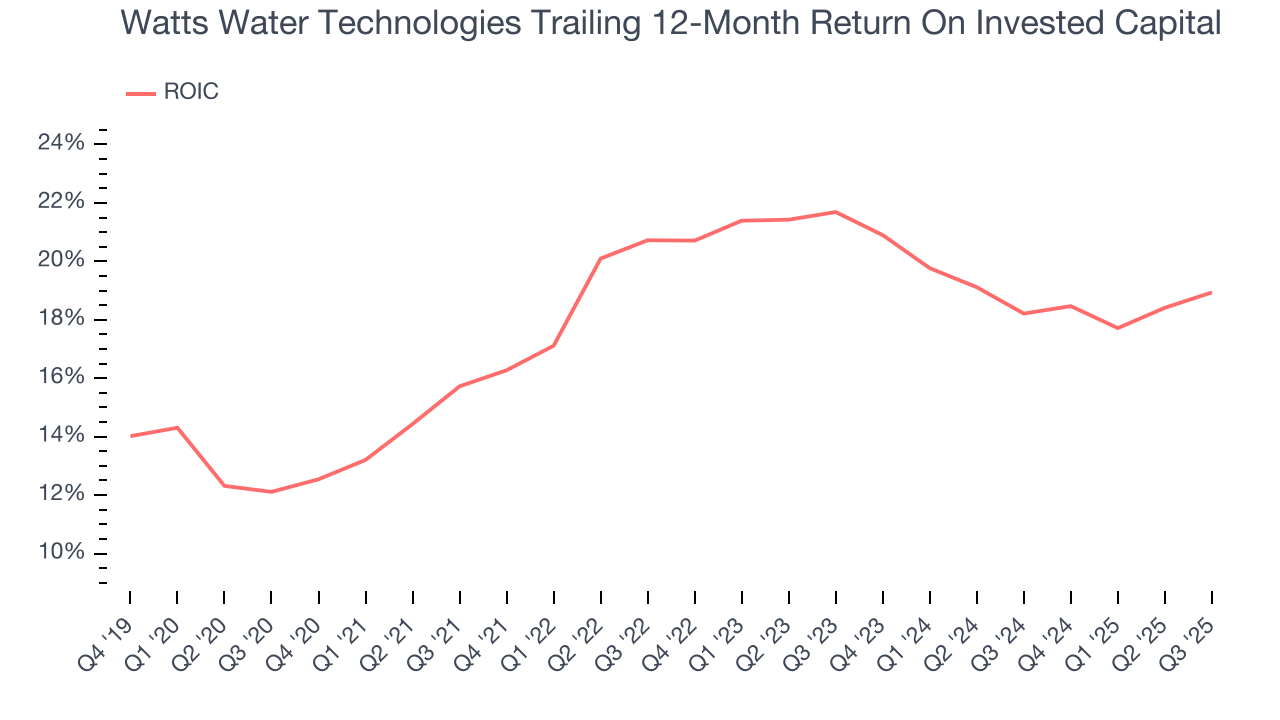

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Watts Water Technologies’s five-year average ROIC was 19.1%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Watts Water Technologies’s ROIC has stayed the same over the last few years. Rising returns would be ideal, but this is still a noteworthy feat since they're already high.

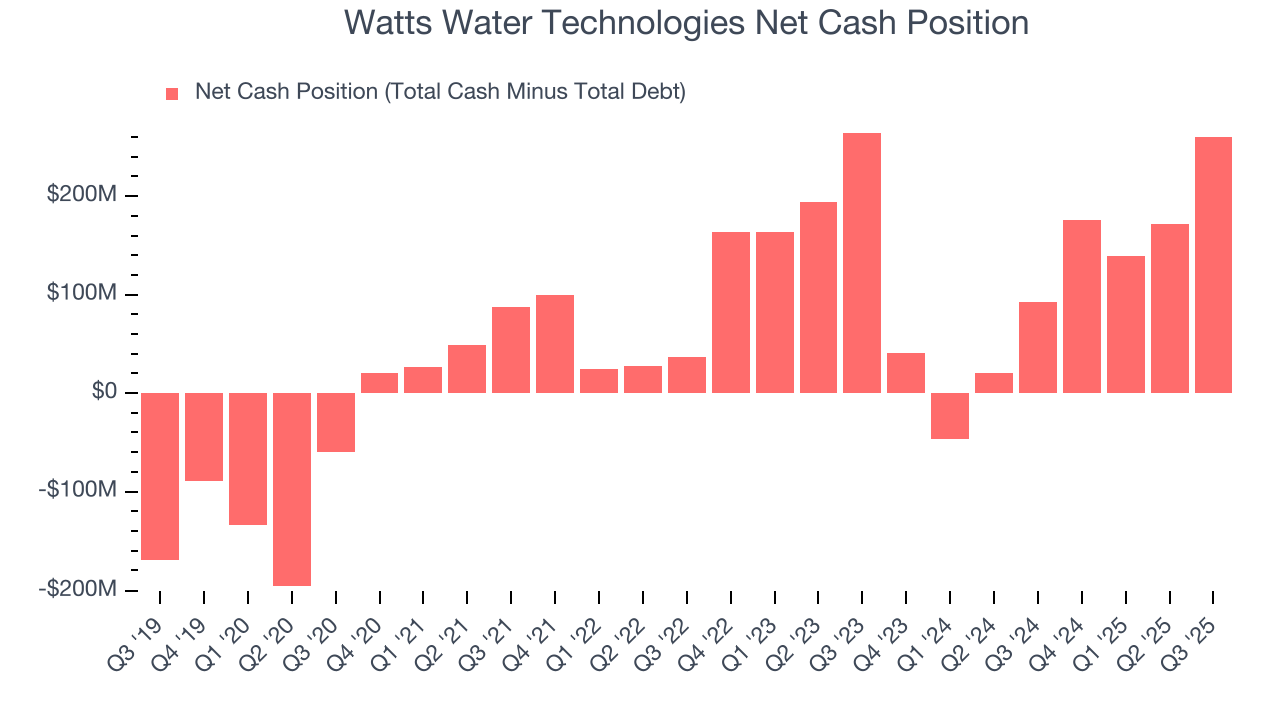

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Watts Water Technologies is a profitable, well-capitalized company with $457.7 million of cash and $197.5 million of debt on its balance sheet. This $260.2 million net cash position is 3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Watts Water Technologies’s Q3 Results

We were impressed by how significantly Watts Water Technologies blew past analysts’ organic revenue expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.2% to $285.70 immediately after reporting.

13. Is Now The Time To Buy Watts Water Technologies?

Updated: January 18, 2026 at 10:33 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Watts Water Technologies.

There is a lot to like about Watts Water Technologies. First, the company’s revenue growth was solid over the last five years, and analysts believe it can continue growing at these levels. And while its organic revenue growth has disappointed, its admirable gross margins indicate the mission-critical nature of its offerings. Additionally, Watts Water Technologies’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Watts Water Technologies’s P/E ratio based on the next 12 months is 26.8x. Analyzing the industrials landscape today, Watts Water Technologies’s positive attributes shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $296.75 on the company (compared to the current share price of $297.29).