Zoetis (ZTS)

We see potential in Zoetis. Its high free cash flow margin and returns on capital show it can produce cash and invest it wisely.― StockStory Analyst Team

1. News

2. Summary

Why Zoetis Is Interesting

Originally spun off from Pfizer in 2013 as the world's largest pure-play animal health company, Zoetis (NYSE:ZTS) discovers, develops, and sells medicines, vaccines, diagnostic products, and services for pets and livestock animals worldwide.

- Excellent adjusted operating margin highlights the strength of its business model

- ROIC punches in at 29.2%, illustrating management’s expertise in identifying profitable investments

- On the other hand, its estimated sales growth of 4.3% for the next 12 months implies demand will slow from its two-year trend

Zoetis has the potential to be a high-quality business. If you believe in the company, the price seems reasonable.

Why Is Now The Time To Buy Zoetis?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Zoetis?

Zoetis’s stock price of $128.53 implies a valuation ratio of 19.3x forward P/E. Scanning companies across the healthcare space, we think that Zoetis’s valuation is appropriate for the business quality.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Zoetis (ZTS) Research Report: Q4 CY2025 Update

Animal health company Zoetis (NYSE:ZTS) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 3% year on year to $2.39 billion. The company expects the full year’s revenue to be around $9.93 billion, close to analysts’ estimates. Its non-GAAP profit of $1.48 per share was 5.5% above analysts’ consensus estimates.

Zoetis (ZTS) Q4 CY2025 Highlights:

- Revenue: $2.39 billion vs analyst estimates of $2.37 billion (3% year-on-year growth, 0.8% beat)

- Adjusted EPS: $1.48 vs analyst estimates of $1.40 (5.5% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.05 at the midpoint, beating analyst estimates by 3.3%

- Operating Margin: 31.9%, down from 32.9% in the same quarter last year

- Market Capitalization: $56.7 billion

Company Overview

Originally spun off from Pfizer in 2013 as the world's largest pure-play animal health company, Zoetis (NYSE:ZTS) discovers, develops, and sells medicines, vaccines, diagnostic products, and services for pets and livestock animals worldwide.

Zoetis operates across two main segments: companion animals (dogs, cats, and horses) and livestock (cattle, swine, poultry, fish, and sheep). The company's product portfolio spans seven major categories including parasiticides, vaccines, dermatology treatments, anti-infectives, pain medications, diagnostics, and other pharmaceuticals.

The companion animal business, representing about 68% of revenue, focuses on products that extend and improve pets' quality of life while making treatment more convenient for owners and veterinarians. Flagship products include Apoquel and Cytopoint for treating itching and allergic skin conditions in dogs, Simparica for flea and tick control, and Librela and Solensia, innovative monoclonal antibody therapies for osteoarthritis pain in dogs and cats respectively.

For livestock, which accounts for approximately 31% of revenue, Zoetis develops solutions that help farmers and veterinarians predict, prevent, detect, and treat diseases efficiently, supporting sustainable production of safe animal protein. The Fostera vaccine line for swine and Protivity vaccine for cattle are examples of key livestock products.

Zoetis maintains a strong focus on innovation, both through developing first-in-class products and through product lifecycle management—expanding existing products into new species, formulations, or geographies. The company's research approach includes a "first to know and fast to market" philosophy for emerging infectious diseases, exemplified by its development of the first SARS-CoV-2 vaccine for zoo animals.

The company markets its products directly in about 45 countries and through distributors in over 100 countries worldwide. Its sales approach combines traditional veterinary sales representatives with technical specialists who provide scientific consulting on disease management. While most products are sold through veterinarians by prescription, Zoetis also reaches pet owners through retail channels and direct-to-consumer marketing in certain markets.

Beyond pharmaceuticals, Zoetis has expanded into veterinary diagnostics through its acquisition of Abaxis and its VetScan portfolio of diagnostic instruments, and has further enhanced these capabilities with AI-powered platforms like Vetscan Imagyst for rapid diagnostic testing.

4. Branded Pharmaceuticals

Looking ahead, the branded pharmaceutical industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Zoetis competes primarily with other major animal health companies including Boehringer Ingelheim Animal Health, Merck Animal Health (a division of Merck & Co.), Elanco Animal Health (NYSE:ELAN), and IDEXX Laboratories (NASDAQ:IDXX) in the diagnostics space.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $9.47 billion in revenue over the past 12 months, Zoetis has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

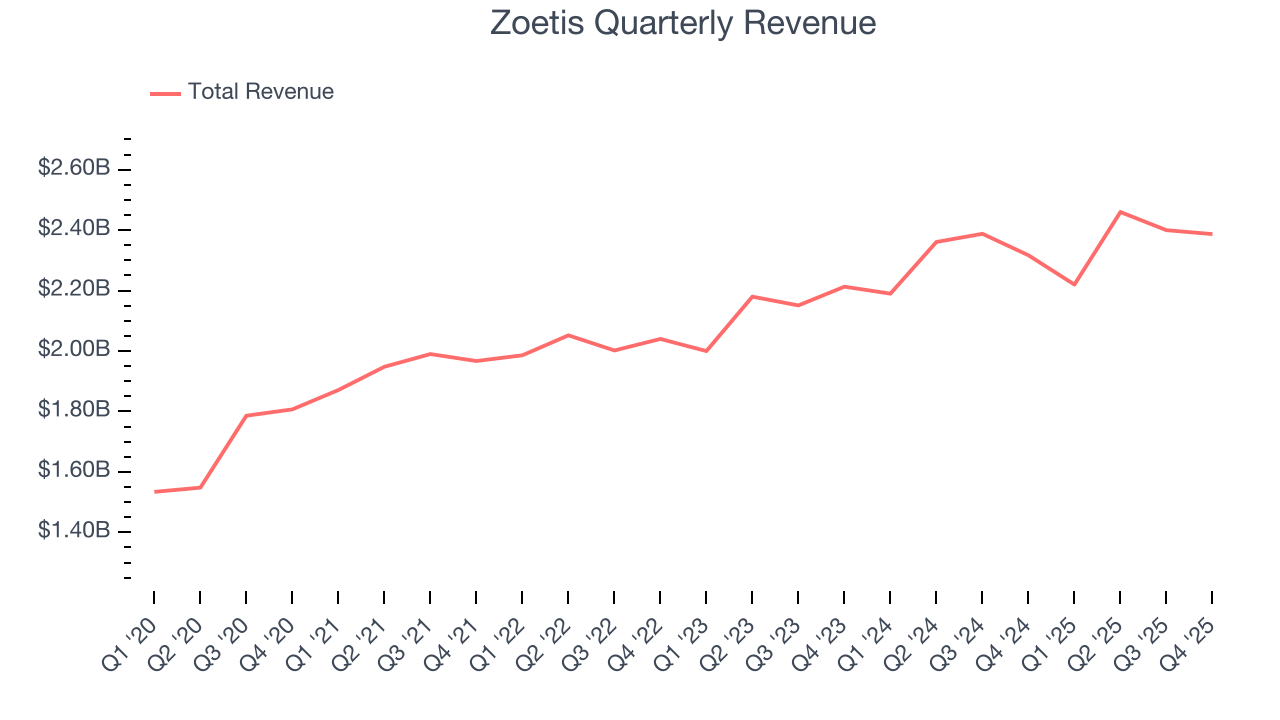

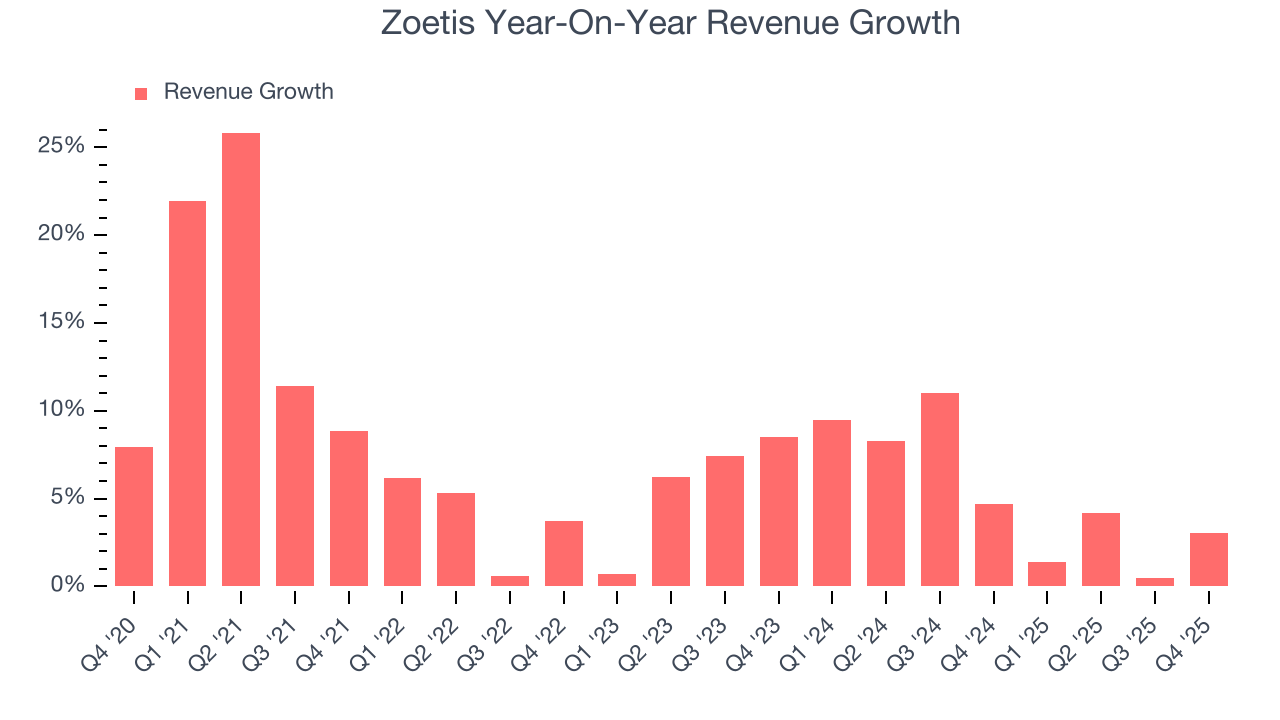

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Zoetis’s 7.2% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the healthcare sector, but there are still things to like about Zoetis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Zoetis’s recent performance shows its demand has slowed as its annualized revenue growth of 5.3% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Zoetis reported modest year-on-year revenue growth of 3% but beat Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet. At least the company is tracking well in other measures of financial health.

7. Operating Margin

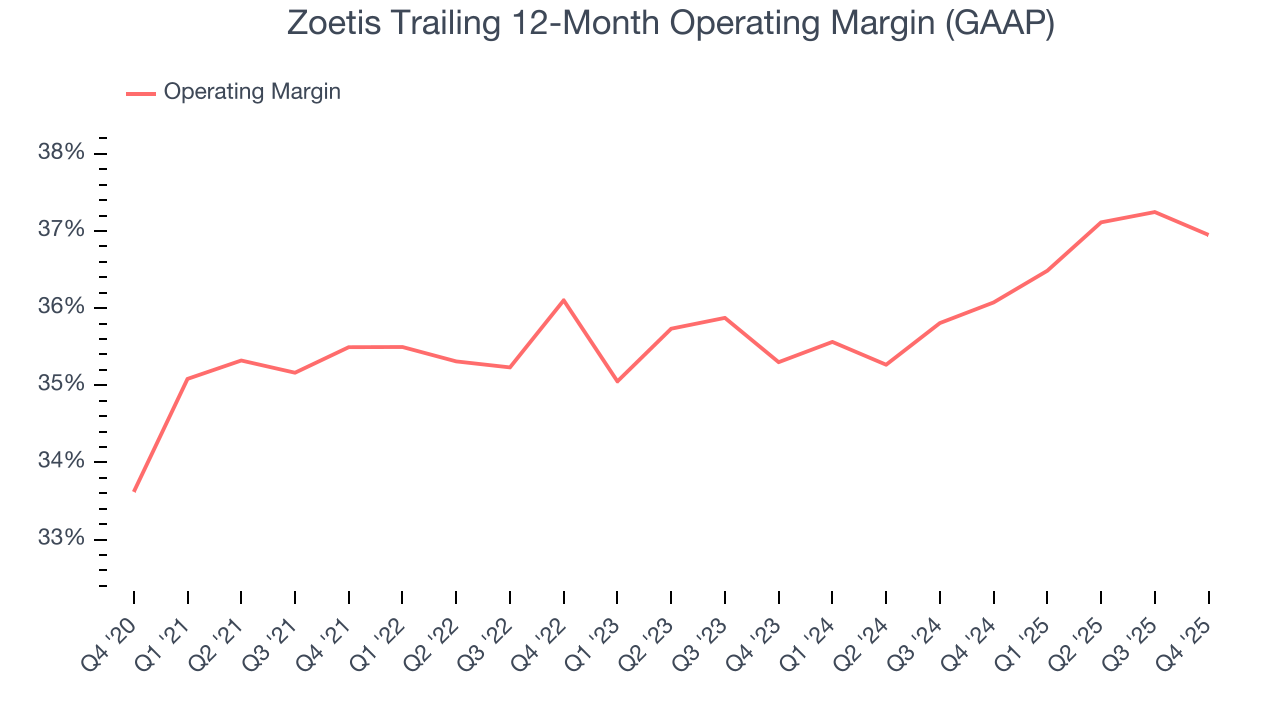

Zoetis has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average operating margin of 36%.

Looking at the trend in its profitability, Zoetis’s operating margin rose by 1.5 percentage points over the last five years, as its sales growth gave it operating leverage. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements.

In Q4, Zoetis generated an operating margin profit margin of 31.9%, down 1 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

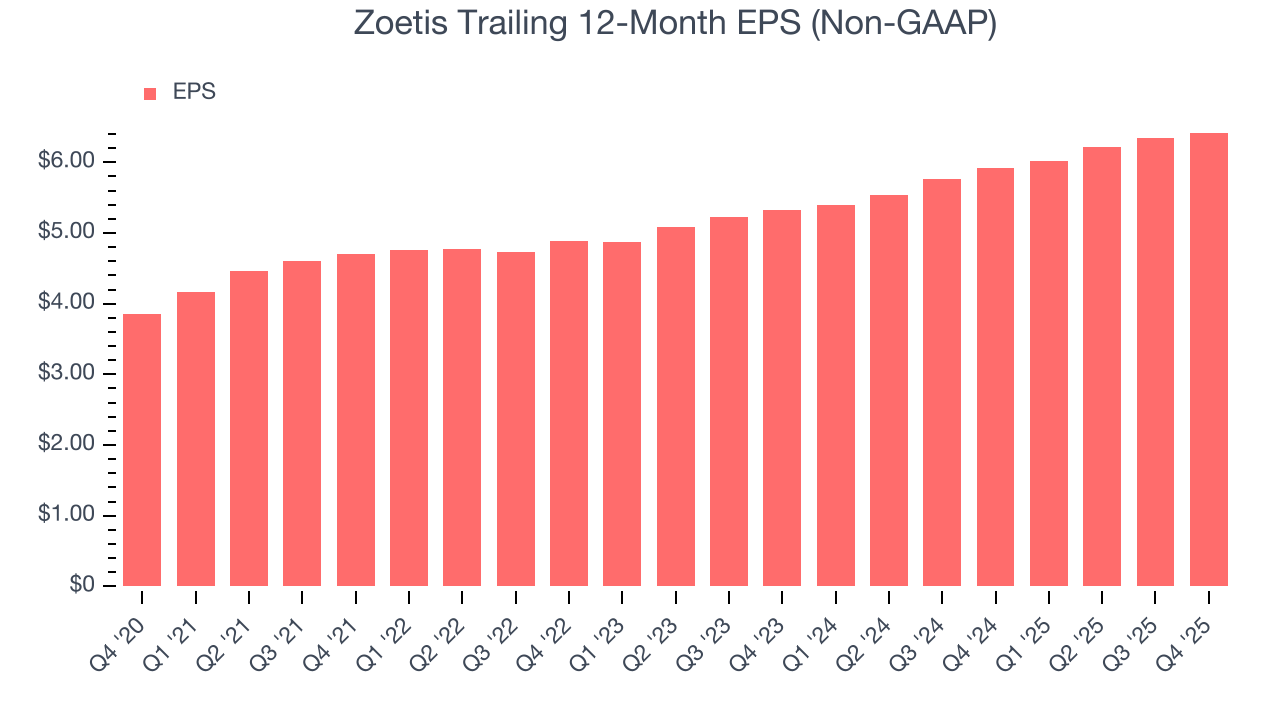

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Zoetis’s EPS grew at a remarkable 10.8% compounded annual growth rate over the last five years, higher than its 7.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

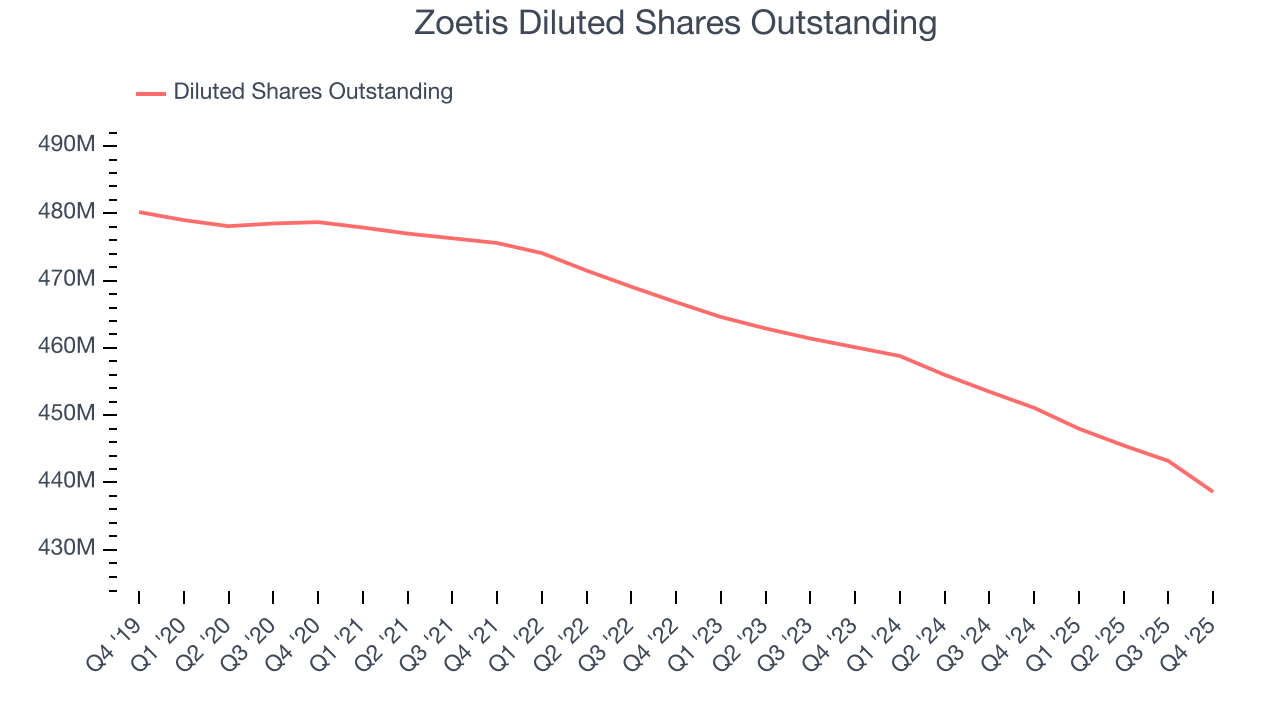

We can take a deeper look into Zoetis’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Zoetis’s operating margin declined this quarter but expanded by 1.5 percentage points over the last five years. Its share count also shrank by 8.4%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Zoetis reported adjusted EPS of $1.48, up from $1.40 in the same quarter last year. This print beat analysts’ estimates by 5.5%. Over the next 12 months, Wall Street expects Zoetis’s full-year EPS of $6.42 to grow 6%.

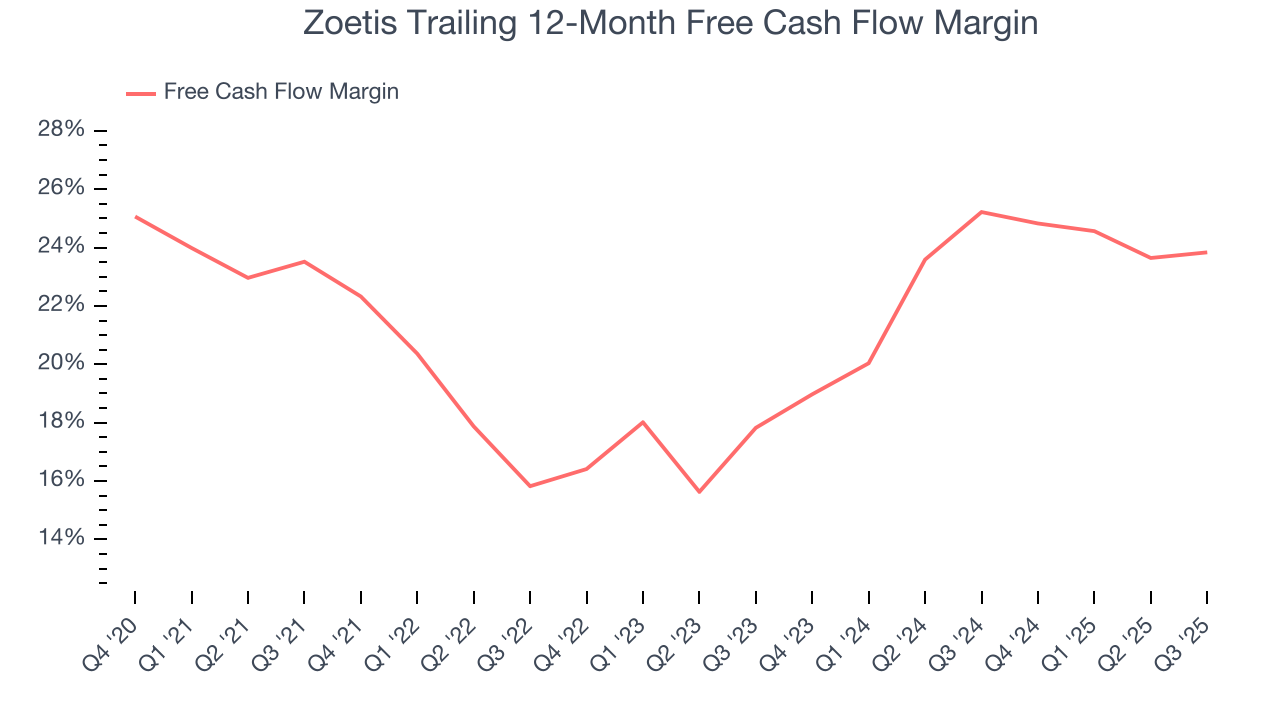

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Zoetis has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 20.9% over the last five years, quite impressive for a healthcare business.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Zoetis’s five-year average ROIC was 29%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Zoetis’s ROIC averaged 4.4 percentage point decreases each year. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

11. Key Takeaways from Zoetis’s Q4 Results

We enjoyed seeing Zoetis beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 4.8% to $134.82 immediately after reporting.

12. Is Now The Time To Buy Zoetis?

Updated: February 12, 2026 at 7:38 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Zoetis.

There are some positives when it comes to Zoetis’s fundamentals. Although its revenue growth was mediocre over the last five years and analysts expect growth to slow over the next 12 months, its impressive operating margins show it has a highly efficient business model. And while its diminishing returns show management's recent bets still have yet to bear fruit, its stellar ROIC suggests it has been a well-run company historically.

Zoetis’s P/E ratio based on the next 12 months is 18.9x. Looking at the healthcare space right now, Zoetis trades at a compelling valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $152.81 on the company (compared to the current share price of $134.82), implying they see 13.3% upside in buying Zoetis in the short term.