Exponent (EXPO)

We’re wary of Exponent. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Exponent Will Underperform

With a team of over 800 consultants holding advanced degrees in 90+ technical disciplines, Exponent (NASDAQ:EXPO) is a science and engineering consulting firm that investigates complex problems and provides expert analysis for clients across various industries.

- Smaller revenue base of $536.8 million means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

- Incremental sales over the last five years were less profitable as its 6.1% annual earnings per share growth lagged its revenue gains

- A bright spot is that its disciplined cost controls and effective management have materialized in a strong adjusted operating margin

Exponent’s quality is lacking. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Exponent

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Exponent

Exponent’s stock price of $71.89 implies a valuation ratio of 31.9x forward P/E. Not only does Exponent trade at a premium to companies in the business services space, but this multiple is also high for its fundamentals.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Exponent (EXPO) Research Report: Q4 CY2025 Update

Scientific consulting firm Exponent (NASDAQ:EXPO) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 19.1% year on year to $147.4 million. Its GAAP profit of $0.49 per share was 3.7% above analysts’ consensus estimates.

Exponent (EXPO) Q4 CY2025 Highlights:

- Revenue: $147.4 million vs analyst estimates of $128.1 million (19.1% year-on-year growth, 15.1% beat)

- EPS (GAAP): $0.49 vs analyst estimates of $0.47 (3.7% beat)

- Adjusted EBITDA: $34.71 million vs analyst estimates of $36.08 million (23.5% margin, 3.8% miss)

- Operating Margin: 19.8%, down from 22% in the same quarter last year

- Market Capitalization: $3.50 billion

Company Overview

With a team of over 800 consultants holding advanced degrees in 90+ technical disciplines, Exponent (NASDAQ:EXPO) is a science and engineering consulting firm that investigates complex problems and provides expert analysis for clients across various industries.

Exponent operates through two main segments: Engineering and Other Scientific, and Environmental and Health. The Engineering segment encompasses specialized practices like Biomechanics, Electrical Engineering, Human Factors, Materials Science, and Vehicle Engineering. The Environmental and Health segment includes Chemical Regulation, Ecological Sciences, and Health Sciences practices.

The company's consultants are called upon when organizations need to understand why something failed, assess potential risks, or navigate complex regulatory requirements. For example, when a consumer electronics manufacturer experiences battery failures in their products, Exponent's engineers might analyze the failure mechanism, determine the root cause, and recommend design improvements to prevent future incidents.

Exponent generates revenue by billing clients for consulting services on a project-by-project basis. Its diverse client base includes corporations, insurance companies, law firms, and government agencies. Many engagements begin when clients face litigation related to their products or services, need to understand the cause of an accident or failure, or require guidance on regulatory compliance.

The company maintains specialized testing facilities, including its Test and Engineering Center in Phoenix, Arizona, where consultants can perform complex analyses and simulations. This facility includes capabilities for vehicle testing, user experience research, and advanced materials analysis. Exponent's multidisciplinary approach allows it to assemble teams with the precise expertise needed for each unique client challenge.

Beyond reactive failure analysis, Exponent also provides proactive consulting to help clients prevent problems before they occur. This includes product development support, risk assessments, and regulatory strategy across industries ranging from consumer products and transportation to energy, healthcare, and chemicals.

4. Business Process Outsourcing & Consulting

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

Exponent competes with other technical consulting firms such as Charles River Associates (NASDAQ:CRAI), FTI Consulting (NYSE:FCN), and Rimkus Consulting Group (private), as well as with the internal engineering and scientific departments of large corporations and specialized boutique consulting firms in specific technical niches.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $554.8 million in revenue over the past 12 months, Exponent is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

As you can see below, Exponent’s 8% annualized revenue growth over the last five years was solid. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Exponent’s annualized revenue growth of 5.6% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Exponent reported year-on-year revenue growth of 19.1%, and its $147.4 million of revenue exceeded Wall Street’s estimates by 15.1%.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

6. Operating Margin

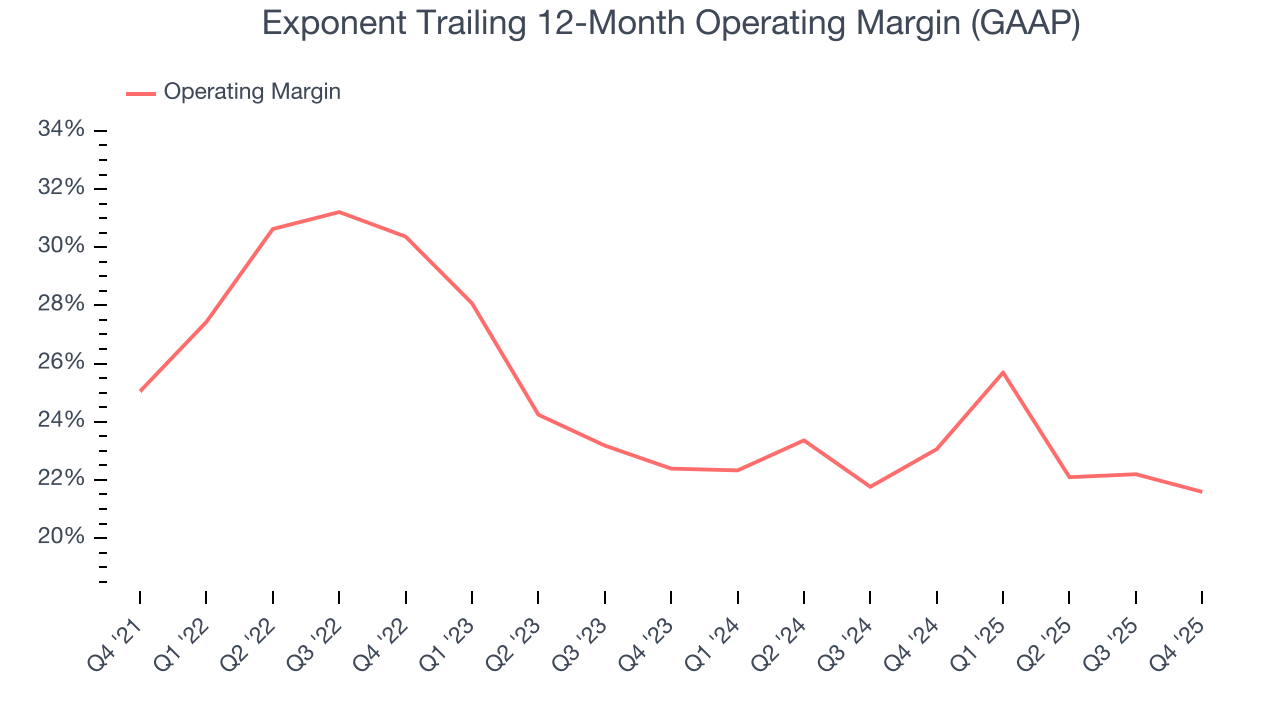

Exponent has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 24.3%.

Looking at the trend in its profitability, Exponent’s operating margin decreased by 3.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Exponent generated an operating margin profit margin of 19.8%, down 2.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Exponent’s unimpressive 6% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Exponent, its two-year annual EPS growth of 3.2% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Exponent reported EPS of $0.49, up from $0.46 in the same quarter last year. This print beat analysts’ estimates by 3.7%. Over the next 12 months, Wall Street expects Exponent’s full-year EPS of $2.07 to grow 7.8%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Exponent has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 22.3% over the last five years.

Taking a step back, we can see that Exponent’s margin dropped by 2.6 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Exponent hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 42.3%, splendid for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Exponent’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Exponent is a profitable, well-capitalized company with $221.9 million of cash and $82.83 million of debt on its balance sheet. This $139.1 million net cash position is 3.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Exponent’s Q4 Results

We were impressed by how significantly Exponent blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $70.83 immediately after reporting.

12. Is Now The Time To Buy Exponent?

Updated: March 10, 2026 at 12:12 AM EDT

Before investing in or passing on Exponent, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Exponent isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was solid over the last five years and Wall Street believes it will continue to grow, its diminishing returns show management's prior bets haven't worked out. And while the company’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its cash profitability fell over the last five years.

Exponent’s P/E ratio based on the next 12 months is 31.9x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $91.67 on the company (compared to the current share price of $71.89).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.