FTI Consulting (FCN)

We’re cautious of FTI Consulting. Its decelerating growth and falling profitability suggest it’s struggling to scale down costs as demand fades.― StockStory Analyst Team

1. News

2. Summary

Why FTI Consulting Is Not Exciting

With a team of experts deployed across 30+ countries to tackle complex business challenges, FTI Consulting (NYSE:FCN) is a global business advisory firm that helps organizations manage change, mitigate risk, and resolve disputes across financial, legal, operational, and regulatory matters.

- On the plus side, its earnings per share have outperformed the peer group average over the last five years, increasing by 10.6% annually

FTI Consulting is in the penalty box. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than FTI Consulting

High Quality

Investable

Underperform

Why There Are Better Opportunities Than FTI Consulting

FTI Consulting is trading at $156.77 per share, or 20.1x forward P/E. This multiple is high given its weaker fundamentals.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. FTI Consulting (FCN) Research Report: Q3 CY2025 Update

Business advisory firm FTI Consulting (NYSE:FCN) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 3.3% year on year to $956.2 million. The company expects the full year’s revenue to be around $3.71 billion, close to analysts’ estimates. Its GAAP profit of $2.60 per share was 39% above analysts’ consensus estimates.

FTI Consulting (FCN) Q3 CY2025 Highlights:

- Revenue: $956.2 million vs analyst estimates of $945.2 million (3.3% year-on-year growth, 1.2% beat)

- EPS (GAAP): $2.60 vs analyst estimates of $1.87 (39% beat)

- Adjusted EBITDA: $130.6 million vs analyst estimates of $101.2 million (13.7% margin, 29% beat)

- The company reconfirmed its revenue guidance for the full year of $3.71 billion at the midpoint

- Operating Margin: 12.3%, up from 9.8% in the same quarter last year

- Free Cash Flow Margin: 19.6%, down from 22.9% in the same quarter last year

- Market Capitalization: $4.95 billion

Company Overview

With a team of experts deployed across 30+ countries to tackle complex business challenges, FTI Consulting (NYSE:FCN) is a global business advisory firm that helps organizations manage change, mitigate risk, and resolve disputes across financial, legal, operational, and regulatory matters.

FTI Consulting operates through five distinct segments, each addressing different aspects of business challenges. The Corporate Finance & Restructuring segment assists clients with business transformation, strategy development, transaction support, and turnaround services for distressed situations. When a retail chain faces bankruptcy, for instance, FTI might step in to negotiate with creditors, develop a restructuring plan, and guide the company through court proceedings.

The Forensic and Litigation Consulting segment provides investigative services and expert testimony for disputes and regulatory matters. Their Data and Analytics team might analyze millions of financial transactions to identify potential fraud patterns for a banking client facing regulatory scrutiny.

Through their Economic Consulting segment, FTI delivers economic analyses for antitrust cases, financial disputes, and international arbitration. For example, when two major telecommunications companies propose a merger, FTI economists might assess potential market impacts to help regulators determine if the deal should proceed.

The Technology segment offers digital risk management and e-discovery services, helping clients manage electronic data during litigation or investigations. Their Strategic Communications practice develops messaging strategies for situations like corporate crises, leadership transitions, or major transactions.

FTI generates revenue through billable hours and project-based fees, serving Fortune 500 corporations, global banks, law firms, private equity firms, and government agencies. The company maintains offices throughout the Americas, Europe, the Middle East, Africa, and Asia-Pacific regions, allowing it to support multinational clients with cross-border matters while providing local expertise in each market.

4. Business Process Outsourcing & Consulting

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

FTI Consulting's competitors include other global professional services firms such as Alvarez & Marsal, AlixPartners, Berkeley Research Group, and segments of the Big Four accounting firms (Deloitte, EY, KPMG, and PwC) that offer advisory and consulting services.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

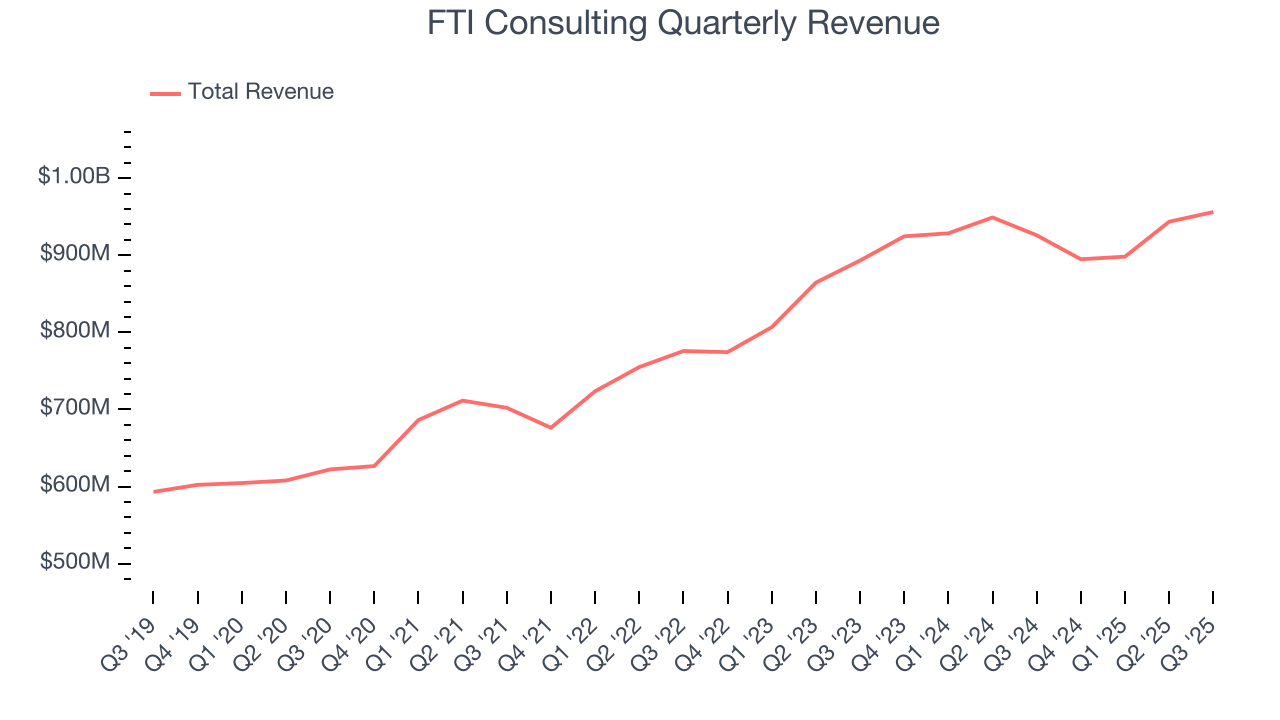

With $3.69 billion in revenue over the past 12 months, FTI Consulting is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

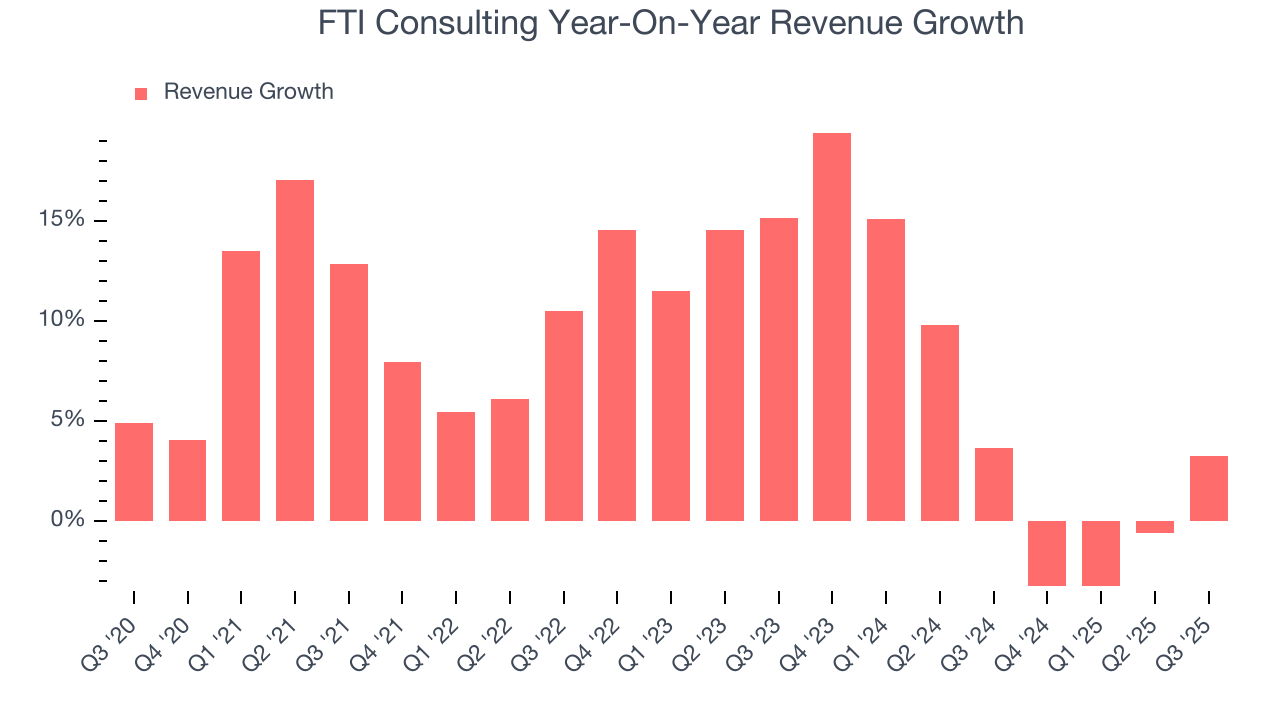

As you can see below, FTI Consulting grew its sales at a solid 8.7% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. FTI Consulting’s annualized revenue growth of 5.2% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, FTI Consulting reported modest year-on-year revenue growth of 3.3% but beat Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, similar to its two-year rate. This projection is above the sector average and indicates its newer products and services will help support its recent top-line performance.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

FTI Consulting has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.4%, higher than the broader business services sector.

Looking at the trend in its profitability, FTI Consulting’s operating margin decreased by 2.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, FTI Consulting generated an operating margin profit margin of 12.3%, up 2.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

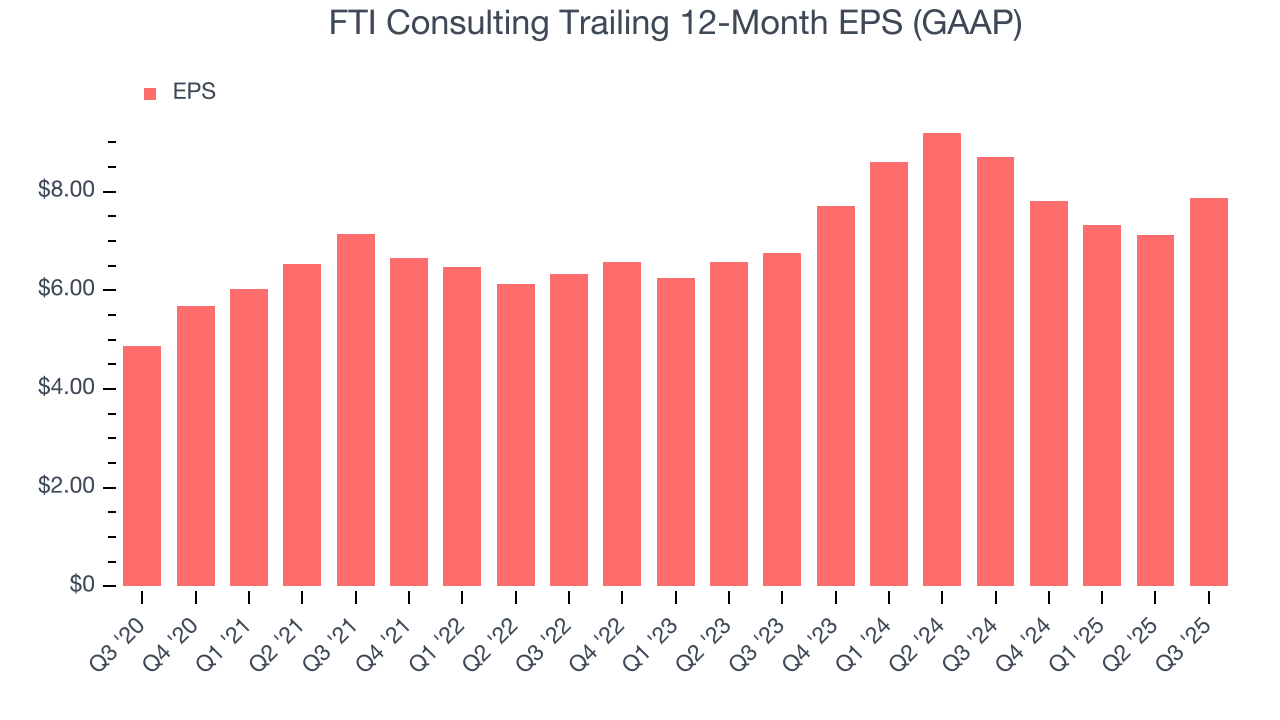

FTI Consulting’s solid 10% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Although it wasn’t great, FTI Consulting’s two-year annual EPS growth of 7.9% topped its 5.2% two-year revenue growth.

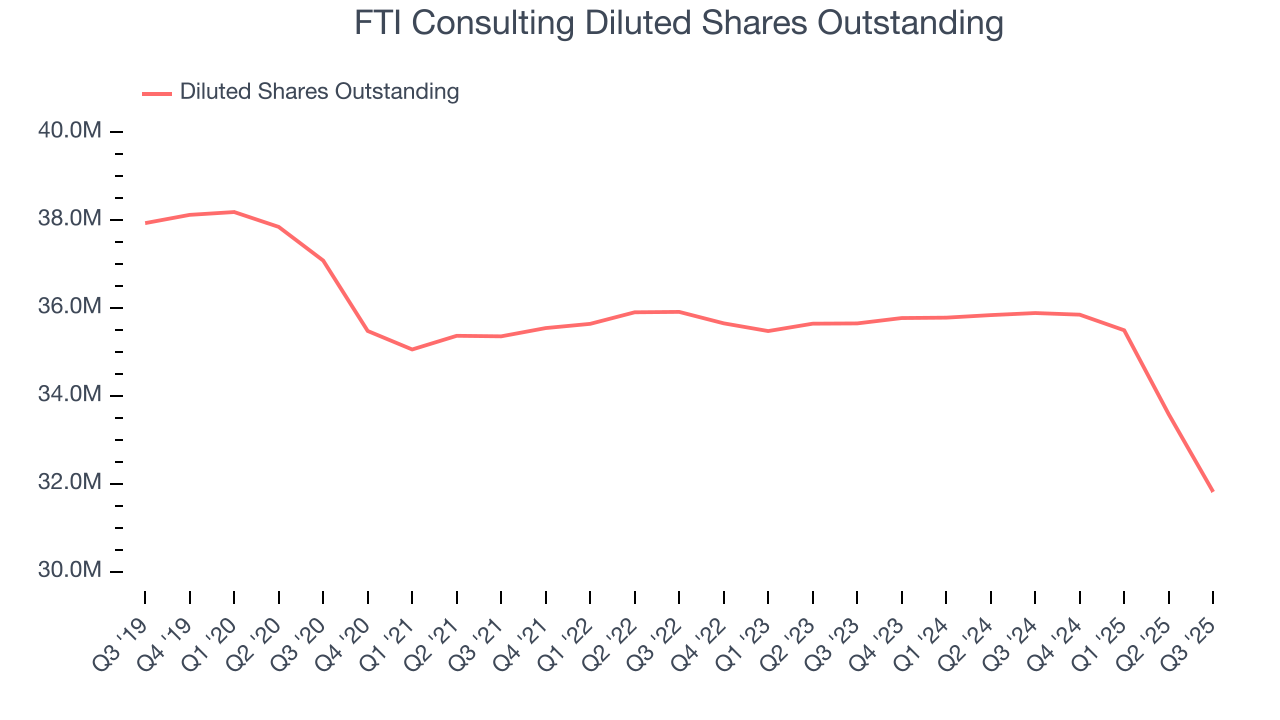

We can take a deeper look into FTI Consulting’s earnings to better understand the drivers of its performance. A two-year view shows that FTI Consulting has repurchased its stock, shrinking its share count by 10.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, FTI Consulting reported EPS of $2.60, up from $1.85 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects FTI Consulting’s full-year EPS of $7.86 to grow 5.6%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

FTI Consulting has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.3% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that FTI Consulting’s margin dropped by 9.1 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

FTI Consulting’s free cash flow clocked in at $187 million in Q3, equivalent to a 19.6% margin. The company’s cash profitability regressed as it was 3.4 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

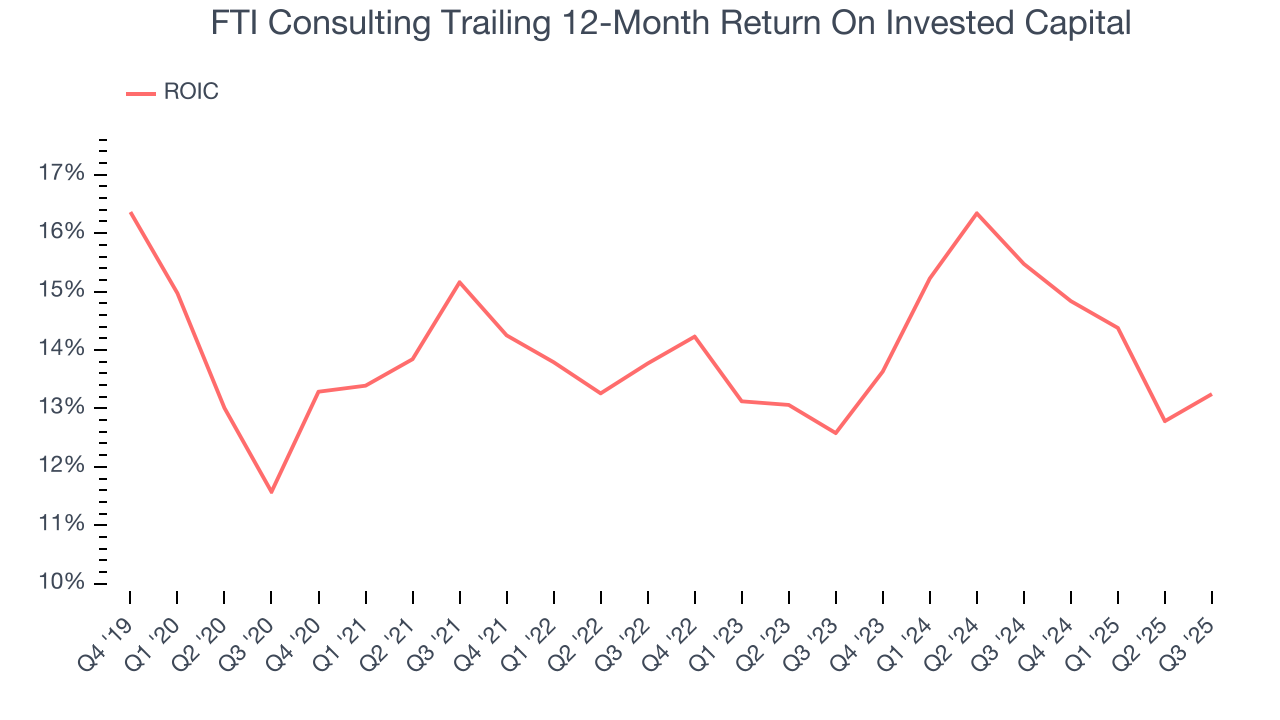

FTI Consulting historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 14%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, FTI Consulting’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

10. Balance Sheet Assessment

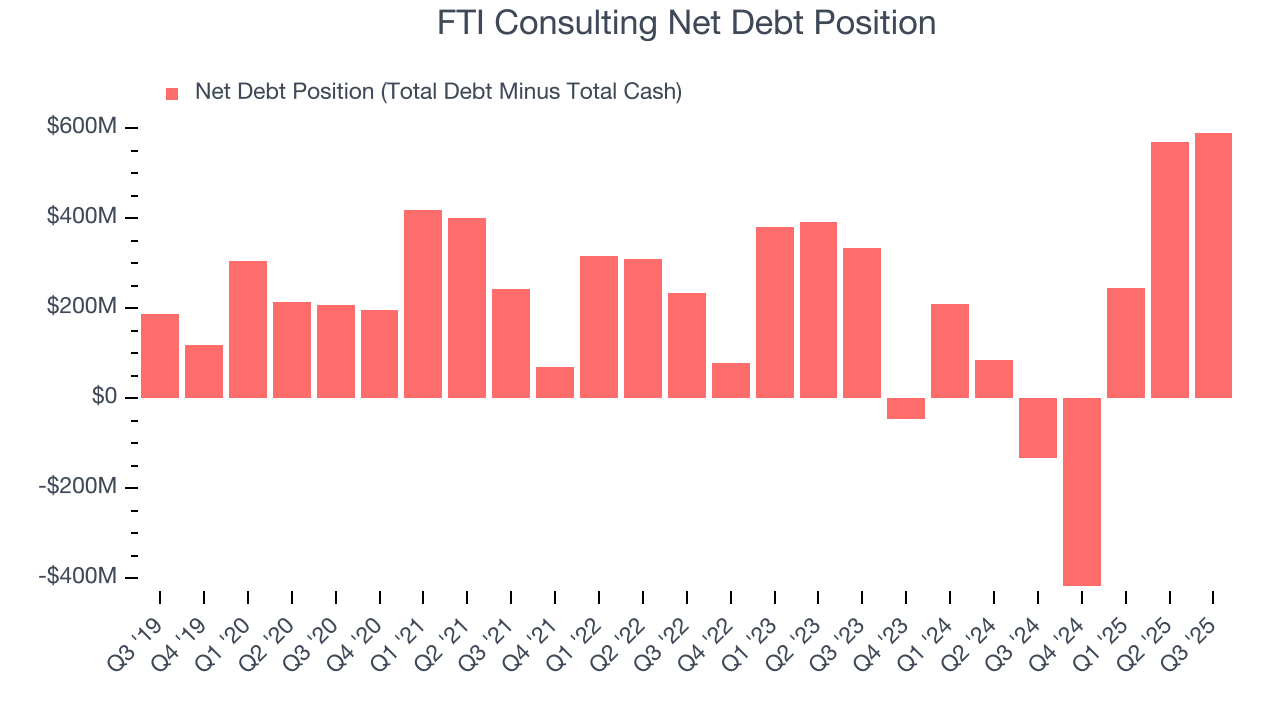

FTI Consulting reported $146 million of cash and $736 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $431.1 million of EBITDA over the last 12 months, we view FTI Consulting’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $7.73 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from FTI Consulting’s Q3 Results

It was good to see FTI Consulting beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance was in line. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.1% to $157.50 immediately after reporting.

12. Is Now The Time To Buy FTI Consulting?

Updated: February 12, 2026 at 11:06 PM EST

Before investing in or passing on FTI Consulting, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

FTI Consulting isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its cash profitability fell over the last five years. And while the company’s remarkable EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking.

FTI Consulting’s P/E ratio based on the next 12 months is 18.2x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $177.50 on the company (compared to the current share price of $160.55).