1-800-FLOWERS (FLWS)

1-800-FLOWERS keeps us up at night. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think 1-800-FLOWERS Will Underperform

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

- Flat sales over the last five years suggest it must innovate and find new ways to grow

- Earnings per share fell by 25.5% annually over the last five years while its revenue was flat, showing each sale was less profitable

- Depletion of cash reserves could lead to a fundraising event that triggers shareholder dilution

1-800-FLOWERS doesn’t live up to our standards. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than 1-800-FLOWERS

High Quality

Investable

Underperform

Why There Are Better Opportunities Than 1-800-FLOWERS

1-800-FLOWERS is trading at $4.03 per share, or 0.2x forward price-to-sales. The market typically values companies like 1-800-FLOWERS based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

It’s better to invest in high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. 1-800-FLOWERS (FLWS) Research Report: Q4 CY2025 Update

E-commerce florist and gift retailer 1-800-FLOWERS (NASDAQ:FLWS) met Wall Streets revenue expectations in Q4 CY2025, but sales fell by 9.5% year on year to $702.2 million. Its non-GAAP profit of $1.20 per share was 39.5% above analysts’ consensus estimates.

1-800-FLOWERS (FLWS) Q4 CY2025 Highlights:

- Revenue: $702.2 million vs analyst estimates of $700.6 million (9.5% year-on-year decline, in line)

- Adjusted EPS: $1.20 vs analyst estimates of $0.86 (39.5% beat)

- Adjusted EBITDA: $98.12 million vs analyst estimates of $96.85 million (14% margin, 1.3% beat)

- Operating Margin: 10.6%, down from 11.7% in the same quarter last year

- Free Cash Flow Margin: 43%, up from 41% in the same quarter last year

- Market Capitalization: $257.2 million

Company Overview

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS began as a single flower shop in 1976. The company's early adoption of a toll-free number and its domain name offered a new method of direct consumer access and convenience in the flower delivery service industry.

Today, 1-800-FLOWERS offers a range of products beyond flowers, including gourmet foods, gift baskets, and unique presents. This expansion reflects the company's desire to become a one-stop shop for thoughtful gifts.

The company's revenue is primarily generated through its e-commerce platform, with seasonal peaks around Valentine’s Day and Mother’s Day, and its business relies on efficient delivery networks and convenience.

4. Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Competitors operating in the online retail of flowers and gifts industry include Amazon (NASDAQ:AMZN), Kroger (NYSE:KR), and Walmart (NYSE:WMT).

5. Revenue Growth

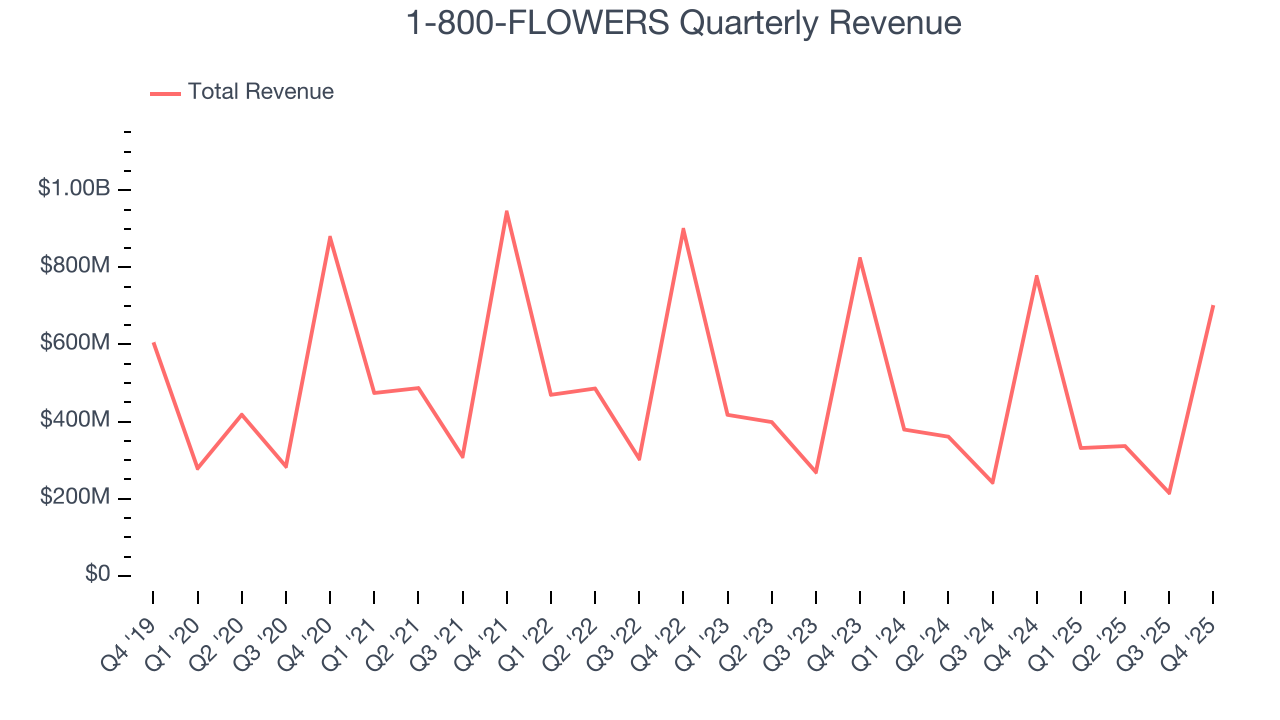

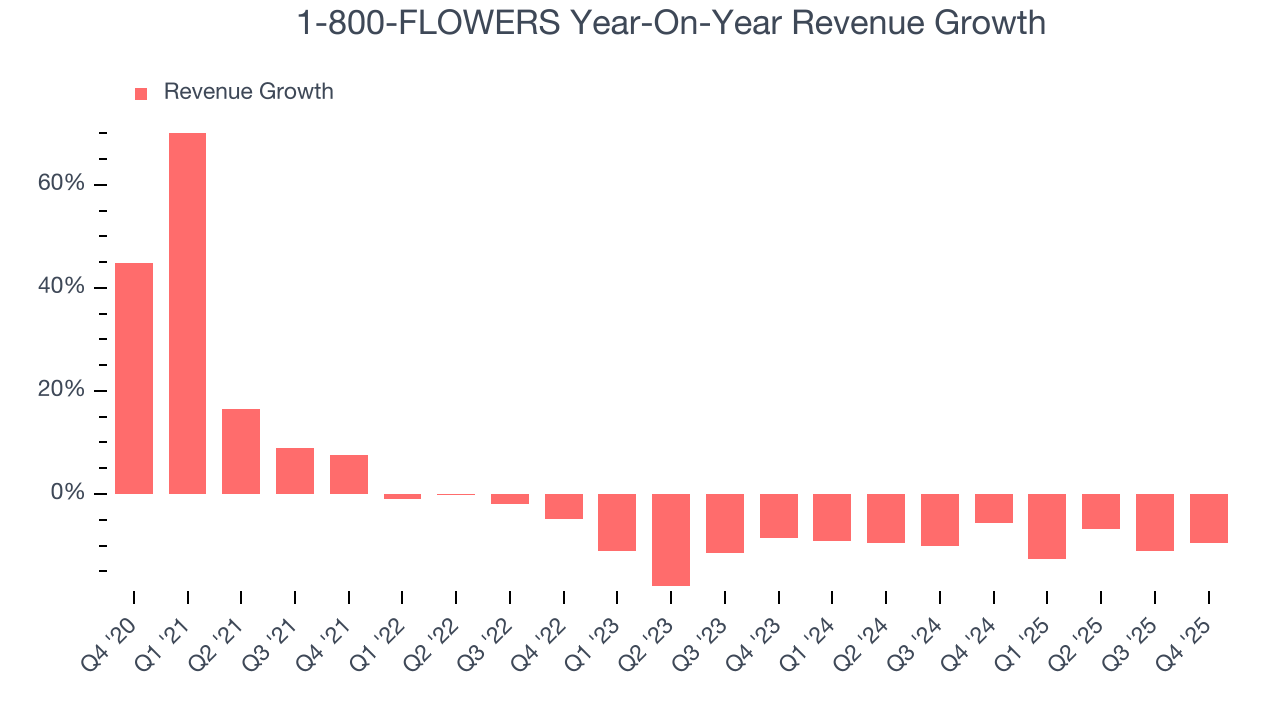

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. 1-800-FLOWERS struggled to consistently generate demand over the last five years as its sales dropped at a 3.1% annual rate. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. 1-800-FLOWERS’s recent performance shows its demand remained suppressed as its revenue has declined by 8.8% annually over the last two years.

This quarter, 1-800-FLOWERS reported a rather uninspiring 9.5% year-on-year revenue decline to $702.2 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Operating Margin

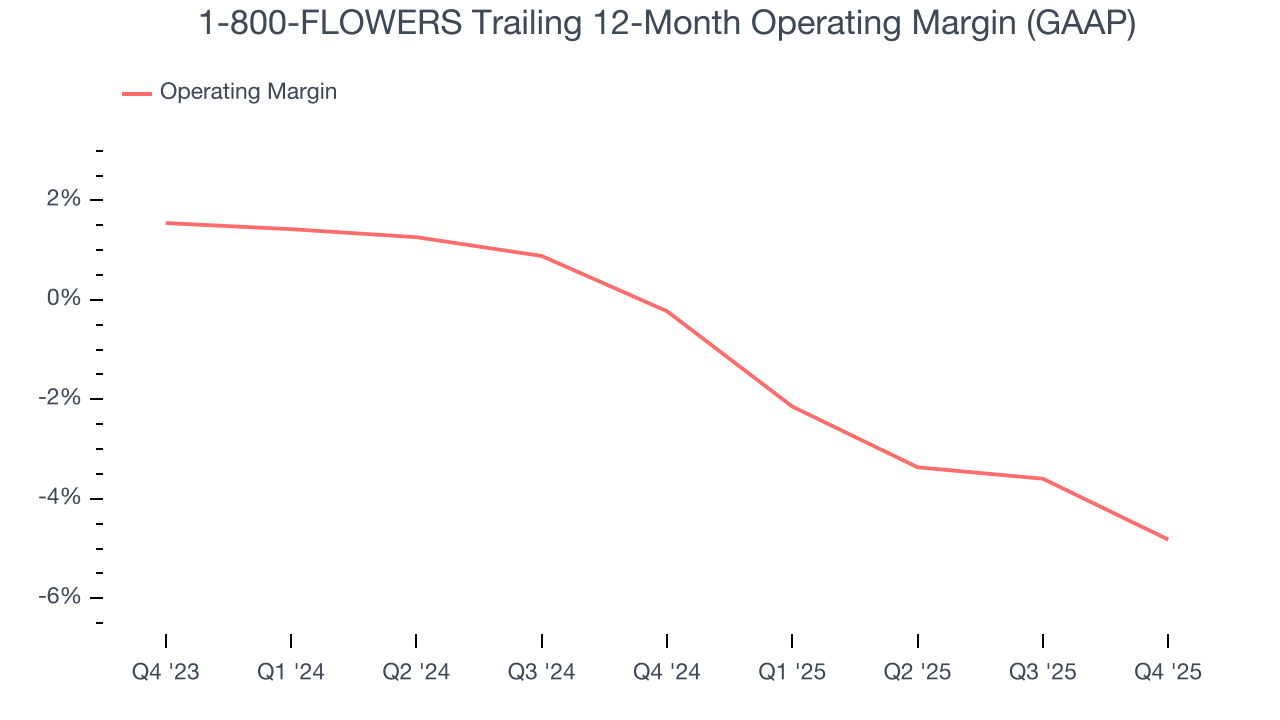

1-800-FLOWERS’s operating margin has shrunk over the last 12 months and averaged negative 2.4% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q4, 1-800-FLOWERS generated an operating margin profit margin of 10.6%, down 1.2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

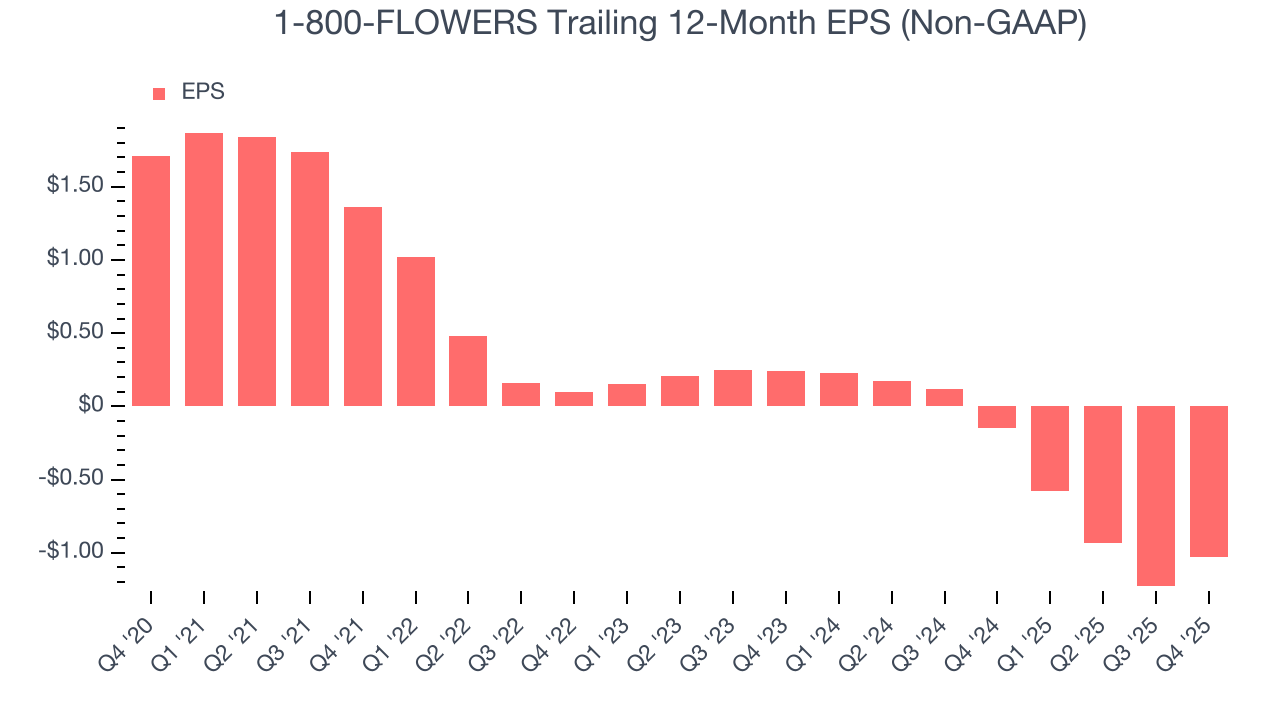

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for 1-800-FLOWERS, its EPS declined by 21.1% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, 1-800-FLOWERS reported adjusted EPS of $1.20, up from $1 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects 1-800-FLOWERS to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.03 will advance to negative $0.37.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

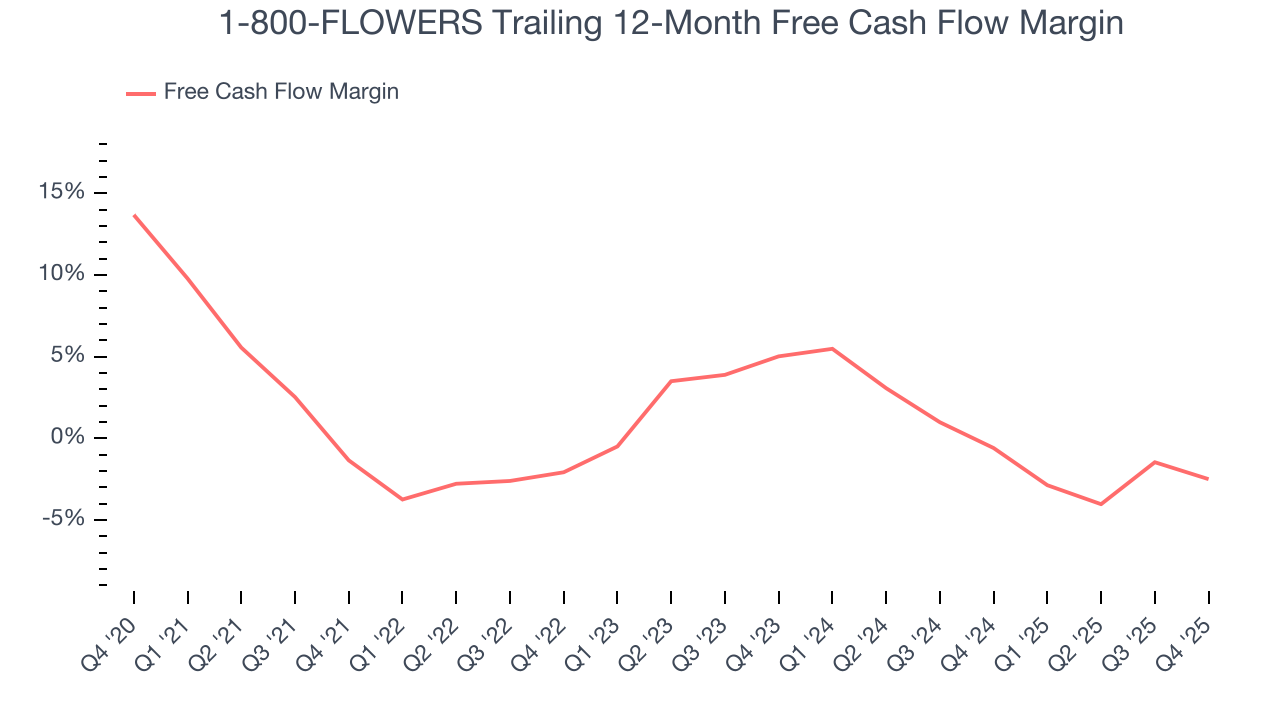

While 1-800-FLOWERS posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, 1-800-FLOWERS’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.5%, meaning it lit $1.49 of cash on fire for every $100 in revenue.

1-800-FLOWERS’s free cash flow clocked in at $302.2 million in Q4, equivalent to a 43% margin. This result was good as its margin was 2.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

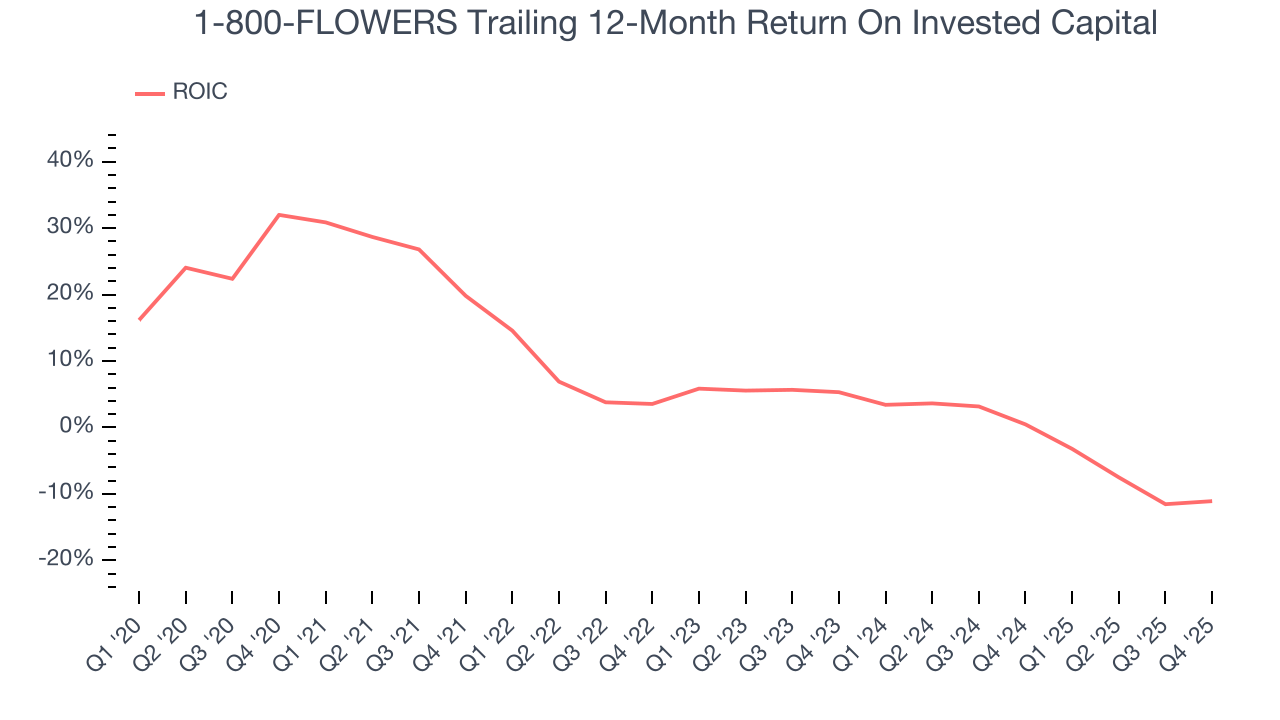

1-800-FLOWERS historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.6%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, 1-800-FLOWERS’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

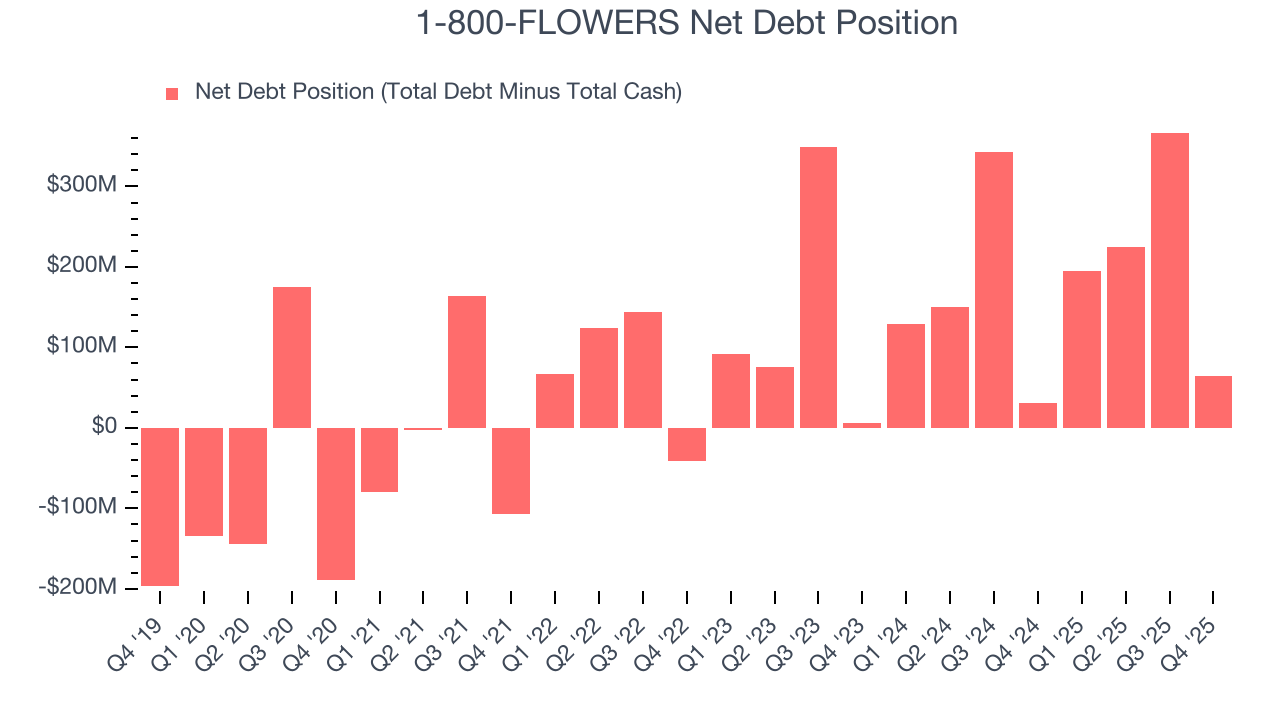

1-800-FLOWERS’s $257.7 million of debt exceeds the $193.3 million of cash on its balance sheet. Furthermore, its 11× net-debt-to-EBITDA ratio (based on its EBITDA of $6.01 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. 1-800-FLOWERS could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope 1-800-FLOWERS can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from 1-800-FLOWERS’s Q4 Results

It was good to see 1-800-FLOWERS beat analysts’ EPS expectations this quarter. Free cash flow margin was strong and improved from the same period last year. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 5.8% to $4.28 immediately after reporting.

12. Is Now The Time To Buy 1-800-FLOWERS?

Updated: January 29, 2026 at 7:42 AM EST

Before investing in or passing on 1-800-FLOWERS, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

1-800-FLOWERS doesn’t pass our quality test. For starters, its revenue has declined over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

1-800-FLOWERS’s forward price-to-sales ratio is 0.2x. The market typically values companies like 1-800-FLOWERS based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $6 on the company (compared to the current share price of $4.28).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.