National Vision (EYE)

We wouldn’t recommend National Vision. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think National Vision Will Underperform

Operating under multiple brands, National Vision (NYSE:EYE) sells optical products such as eyeglasses and provides optical services such as eye exams.

- Recent store closures reflect a shift toward streamlining existing locations to maximize efficiency

- ROIC of 3.1% reflects management’s challenges in identifying attractive investment opportunities, and its falling returns suggest its earlier profit pools are drying up

- Annual sales declines of 1.6% for the past three years show its products struggled to connect with the market

National Vision doesn’t meet our quality criteria. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than National Vision

High Quality

Investable

Underperform

Why There Are Better Opportunities Than National Vision

National Vision’s stock price of $26.96 implies a valuation ratio of 30.2x forward P/E. This multiple is high given its weaker fundamentals.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. National Vision (EYE) Research Report: Q3 CY2025 Update

Optical retailer National Vision (NYSE:EYE) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 7.9% year on year to $487.3 million. The company’s full-year revenue guidance of $1.98 billion at the midpoint came in 1% above analysts’ estimates. Its non-GAAP profit of $0.13 per share was in line with analysts’ consensus estimates.

National Vision (EYE) Q3 CY2025 Highlights:

- Revenue: $487.3 million vs analyst estimates of $473.4 million (7.9% year-on-year growth, 3% beat)

- Adjusted EPS: $0.13 vs analyst estimates of $0.13 (in line)

- Adjusted EBITDA: $41.82 million vs analyst estimates of $42.59 million (8.6% margin, 1.8% miss)

- The company lifted its revenue guidance for the full year to $1.98 billion at the midpoint from $1.95 billion, a 1.4% increase

- Management raised its full-year Adjusted EPS guidance to $0.67 at the midpoint, a 1.5% increase

- Operating Margin: 2%, up from -2% in the same quarter last year

- Free Cash Flow Margin: 6.2%, up from 0.9% in the same quarter last year

- Locations: 1,242 at quarter end, up from 1,231 in the same quarter last year

- Same-Store Sales rose 6.8% year on year (0.9% in the same quarter last year)

- Market Capitalization: $2.03 billion

Company Overview

Operating under multiple brands, National Vision (NYSE:EYE) sells optical products such as eyeglasses and provides optical services such as eye exams.

These brands are America's Best Contacts & Eyeglasses, Eyeglass World, and Vista Optical. There are minor differences between these brands but in general, all three sell eyeglasses, contact lenses, and sunglasses as well as offering eye exams. All three brands also focus on offering affordable options for a product category that can be costly, especially for customers without vision insurance.

National Vision’s core customer base includes value-conscious consumers who want solid-quality vision products and services without breaking the bank. These customers tend to care less about luxury brands and the latest trends, instead prioritizing affordability and convenience.

The average National Vision store is around 3,000 square feet and is typically located in strip malls and shopping centers. Many are located within Walmart supercenters or large supermarket chains. National Vision benefits from the foot traffic drawn by Walmart or Fred Meyer, and those large retailers receive some economic benefits from these arrangements and can offer their own customers a true one-stop shop with services like vision and photo as well as products like gas and petrol.

4. Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Competitors offering vision products and services include EssilorLuxottica (ENXTPA:EL) and Warby Parker (NYSE:WRBY). Private companies include Zenni Optical and MyEyeDr.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.92 billion in revenue over the past 12 months, National Vision is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, National Vision’s 2.3% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was sluggish as it closed stores.

This quarter, National Vision reported year-on-year revenue growth of 7.9%, and its $487.3 million of revenue exceeded Wall Street’s estimates by 3%.

Looking ahead, sell-side analysts expect revenue to grow 5.8% over the next 12 months, an acceleration versus the last six years. This projection is healthy and implies its newer products will fuel better top-line performance.

6. Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

National Vision listed 1,242 locations in the latest quarter and has generally closed its stores over the last two years, averaging 4.7% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

National Vision’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.7% per year. Given its declining store base over the same period, this performance stems from a mixture of higher e-commerce sales and increased foot traffic at existing locations (closing stores can sometimes boost same-store sales).

In the latest quarter, National Vision’s same-store sales rose 6.8% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

7. Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

National Vision has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 56.6% gross margin over the last two years. That means National Vision only paid its suppliers $43.45 for every $100 in revenue.

In Q3, National Vision produced a 58.3% gross profit margin, in line with the same quarter last year. On a wider time horizon, National Vision’s full-year margin has been trending up over the past 12 months, increasing by 4.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold.

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

National Vision was roughly breakeven when averaging the last two years of quarterly operating profits, inadequate for a consumer retail business. This result is surprising given its high gross margin as a starting point.

On the plus side, National Vision’s operating margin rose by 1.2 percentage points over the last year, as its sales growth gave it operating leverage.

This quarter, National Vision generated an operating margin profit margin of 2%, up 3.9 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

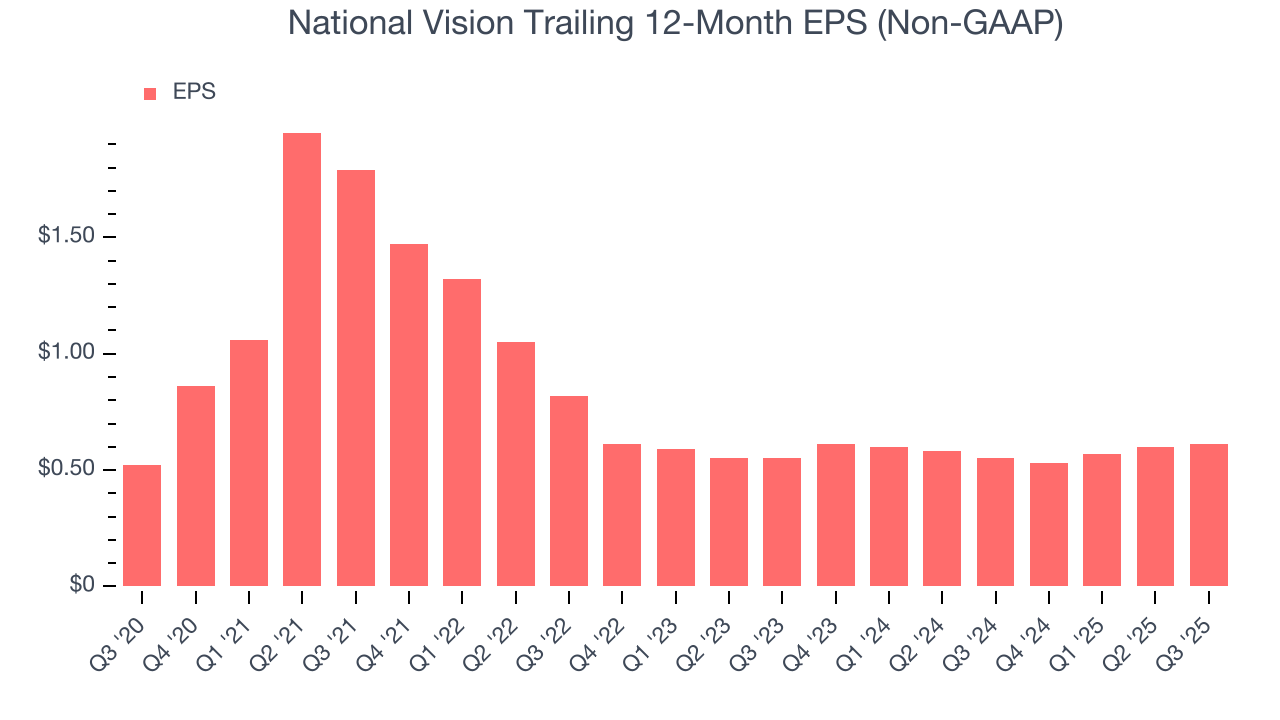

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for National Vision, its EPS declined by 9.4% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q3, National Vision reported adjusted EPS of $0.13, up from $0.12 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects National Vision’s full-year EPS of $0.61 to grow 47.9%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

National Vision has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 2.9% over the last two years, slightly better than the broader consumer retail sector.

Taking a step back, we can see that National Vision’s margin expanded by 2.8 percentage points over the last year. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

National Vision’s free cash flow clocked in at $30.27 million in Q3, equivalent to a 6.2% margin. This result was good as its margin was 5.3 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

National Vision historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.1%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

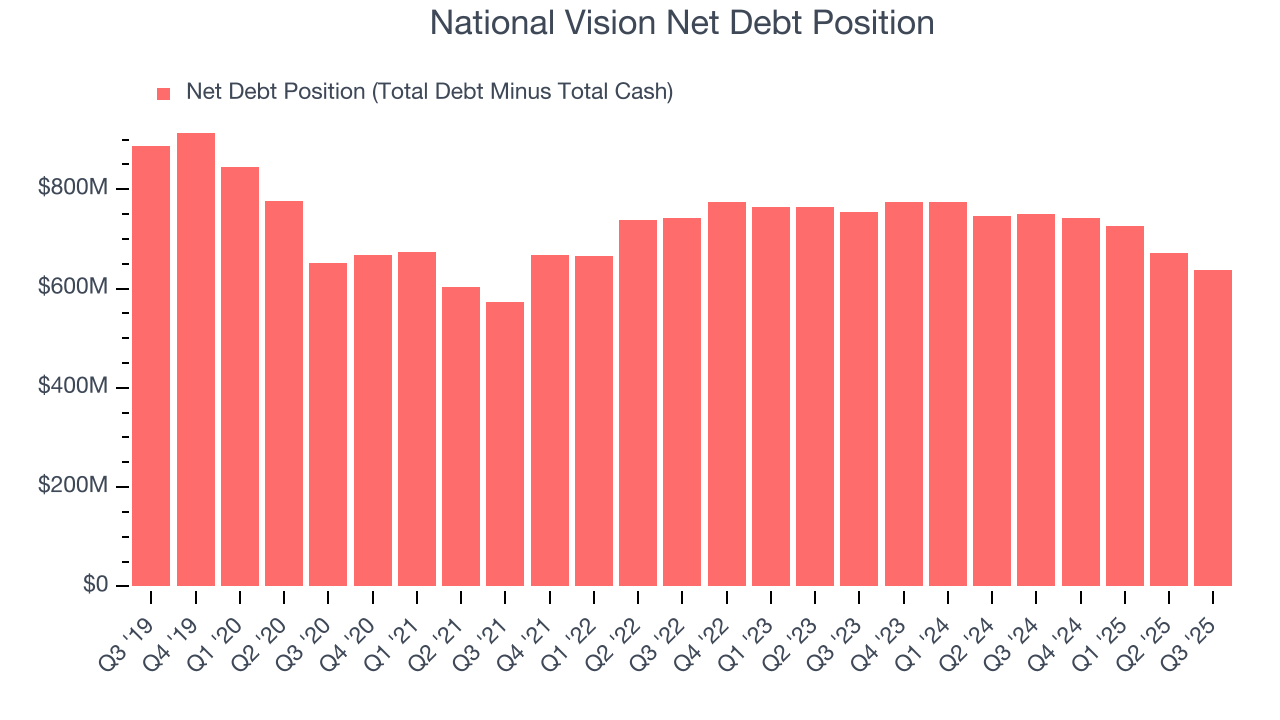

12. Balance Sheet Assessment

National Vision reported $56.03 million of cash and $693.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $177.9 million of EBITDA over the last 12 months, we view National Vision’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $9.29 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from National Vision’s Q3 Results

We enjoyed seeing National Vision beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its full-year EPS guidance missed. Overall, this was a mixed quarter. The stock traded up 4.9% to $26.88 immediately following the results.

14. Is Now The Time To Buy National Vision?

Updated: March 1, 2026 at 9:47 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

National Vision doesn’t pass our quality test. To begin with, its revenue has declined over the last three years. While its admirable gross margins are a wonderful starting point for the overall profitability of the business, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its declining physical locations suggests its demand is falling.

National Vision’s P/E ratio based on the next 12 months is 30.2x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $33.18 on the company (compared to the current share price of $26.96).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.