TaskUs (TASK)

TaskUs catches our eye. Its exceptional profitability shows it’s a well-run company with a highly efficient business model.― StockStory Analyst Team

1. News

2. Summary

Why TaskUs Is Interesting

Starting as a virtual assistant service in 2008 before evolving into a global digital services provider, TaskUs (NASDAQ:TASK) provides outsourced digital services including customer experience management, content moderation, and AI data services to innovative technology companies.

- Annual revenue growth of 21.1% over the last five years was superb and indicates its market share increased during this cycle

- Disciplined cost controls and effective management have materialized in a strong adjusted operating margin

- A blemish is its below-average returns on capital indicate management struggled to find compelling investment opportunities

TaskUs has some respectable qualities. If you’re a believer, the price seems reasonable.

Why Is Now The Time To Buy TaskUs?

High Quality

Investable

Underperform

Why Is Now The Time To Buy TaskUs?

TaskUs is trading at $11.61 per share, or 7.6x forward P/E. When viewed through the lens of revenue growth, the current valuation seems quite attractive.

It could be a good time to invest if you see something the market doesn’t.

3. TaskUs (TASK) Research Report: Q3 CY2025 Update

Digital outsourcing company TaskUs (NASDAQ:TASK) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 17% year on year to $298.7 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $303.4 million was less impressive, coming in 1.4% below expectations. Its non-GAAP profit of $0.42 per share was 10.4% above analysts’ consensus estimates.

TaskUs (TASK) Q3 CY2025 Highlights:

- Revenue: $298.7 million vs analyst estimates of $291.8 million (17% year-on-year growth, 2.4% beat)

- Adjusted EPS: $0.42 vs analyst estimates of $0.38 (10.4% beat)

- Revenue Guidance for Q4 CY2025 is $303.4 million at the midpoint, below analyst estimates of $307.6 million

- Operating Margin: 12.7%, up from 9.5% in the same quarter last year

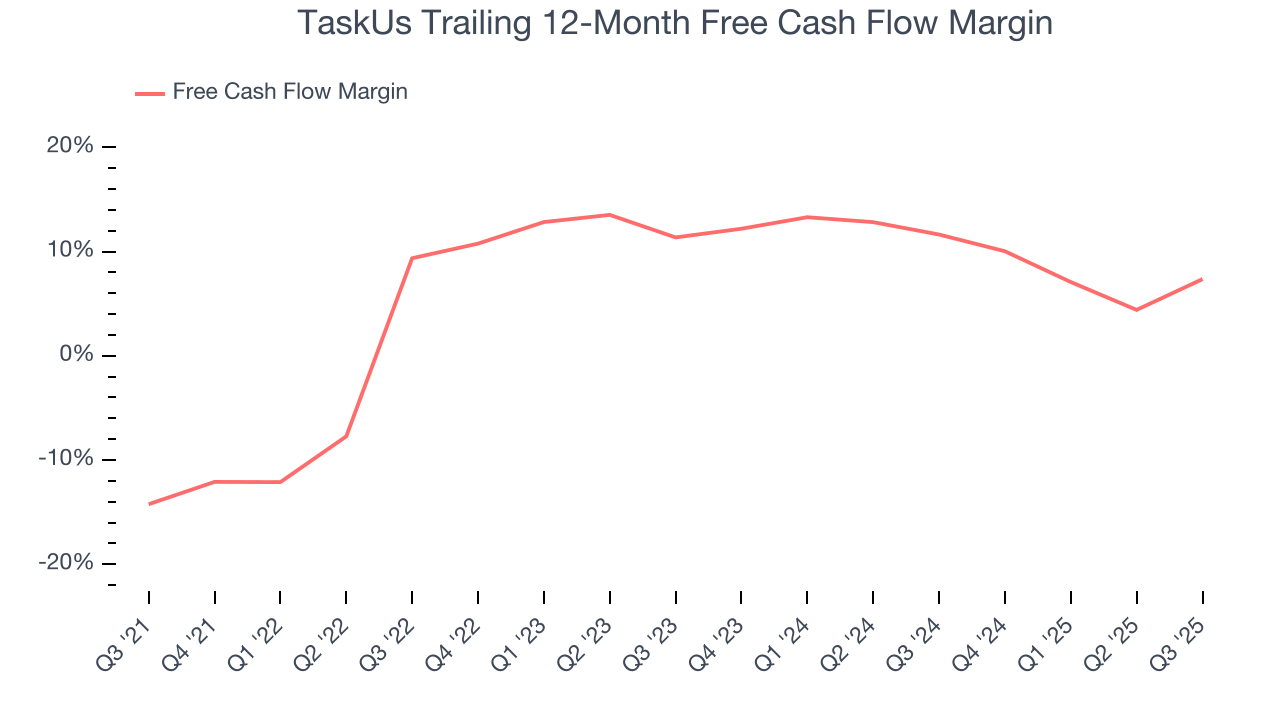

- Free Cash Flow Margin: 14%, up from 2.5% in the same quarter last year

- Market Capitalization: $1.12 billion

Company Overview

Starting as a virtual assistant service in 2008 before evolving into a global digital services provider, TaskUs (NASDAQ:TASK) provides outsourced digital services including customer experience management, content moderation, and AI data services to innovative technology companies.

TaskUs operates at the intersection of human expertise and digital innovation, helping clients navigate complex operational challenges. The company's services are organized into three main categories: Digital Customer Experience (Digital CX), Trust and Safety, and Artificial Intelligence Services.

In Digital CX, TaskUs handles customer support across multiple channels, with over 80% of this work occurring through non-voice digital channels like chat, social media, and in-app messaging. The company also provides training programs, sales support, and consulting services to help clients optimize their customer experience strategies.

The Trust and Safety division focuses on content moderation and risk management. Content moderators review user-generated material on digital platforms, identifying and removing policy-violating content while navigating complex cultural contexts. TaskUs has developed specialized wellness programs to support employees in this psychologically demanding work. The Risk and Response team handles identity verification, regulatory compliance, and fraud detection for clients.

TaskUs's AI Services division has become increasingly important as artificial intelligence applications have evolved. The company provides data annotation services that are crucial for training AI algorithms, labeling images, text, audio, and video to create the datasets that power computer vision, natural language processing, and other AI applications. Beyond annotation, TaskUs offers troubleshooting and remediation services for AI systems.

The company employs a flexible delivery model with options for on-site, remote, hybrid, and crowdsourced work. TaskUs maintains a global footprint with operations across 12 countries, with the Philippines serving as its largest market, housing approximately 63% of its workforce. This offshore and nearshore strategy allows TaskUs to provide cost-effective services while maintaining quality through standardized processes and local leadership.

4. Business Process Outsourcing & Consulting

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

TaskUs competes with other business process outsourcing companies including Teleperformance (OTCMKTS:TLPFY), TELUS International (NYSE:TIXT), and Concentrix (NASDAQ:CNXC), as well as specialized AI services providers like Scale AI and Appen (ASX:APX).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.14 billion in revenue over the past 12 months, TaskUs is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

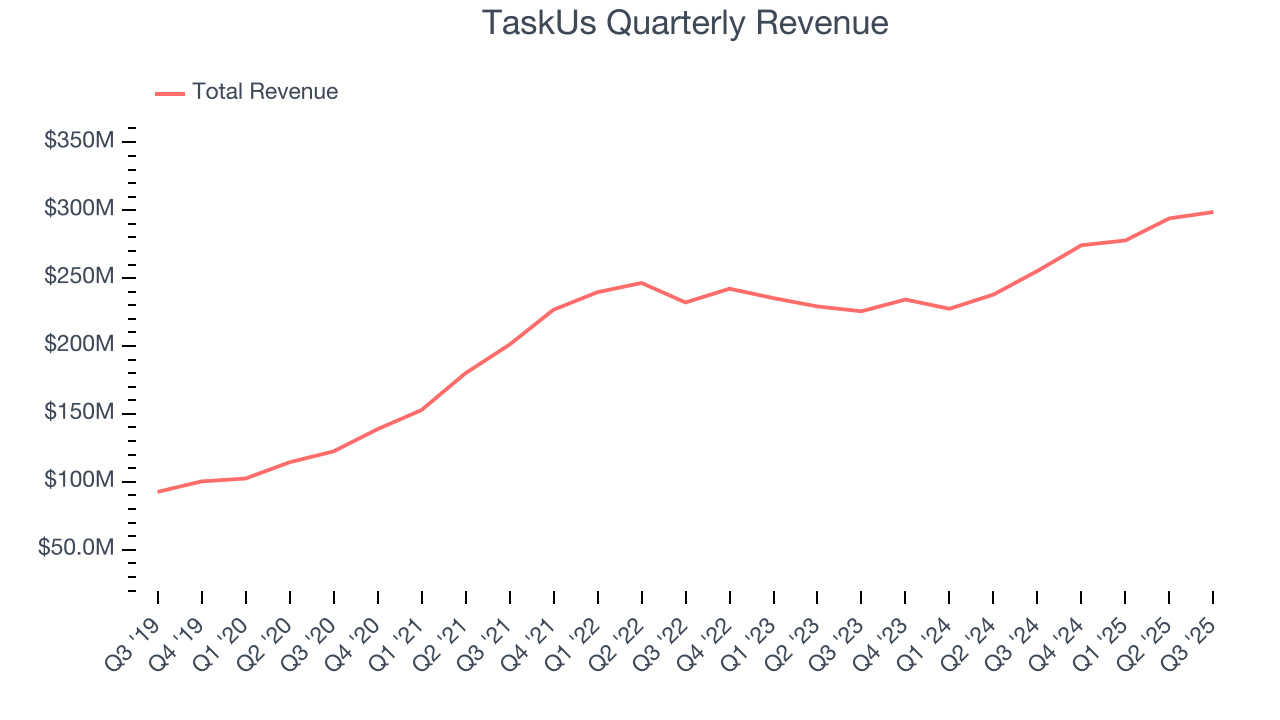

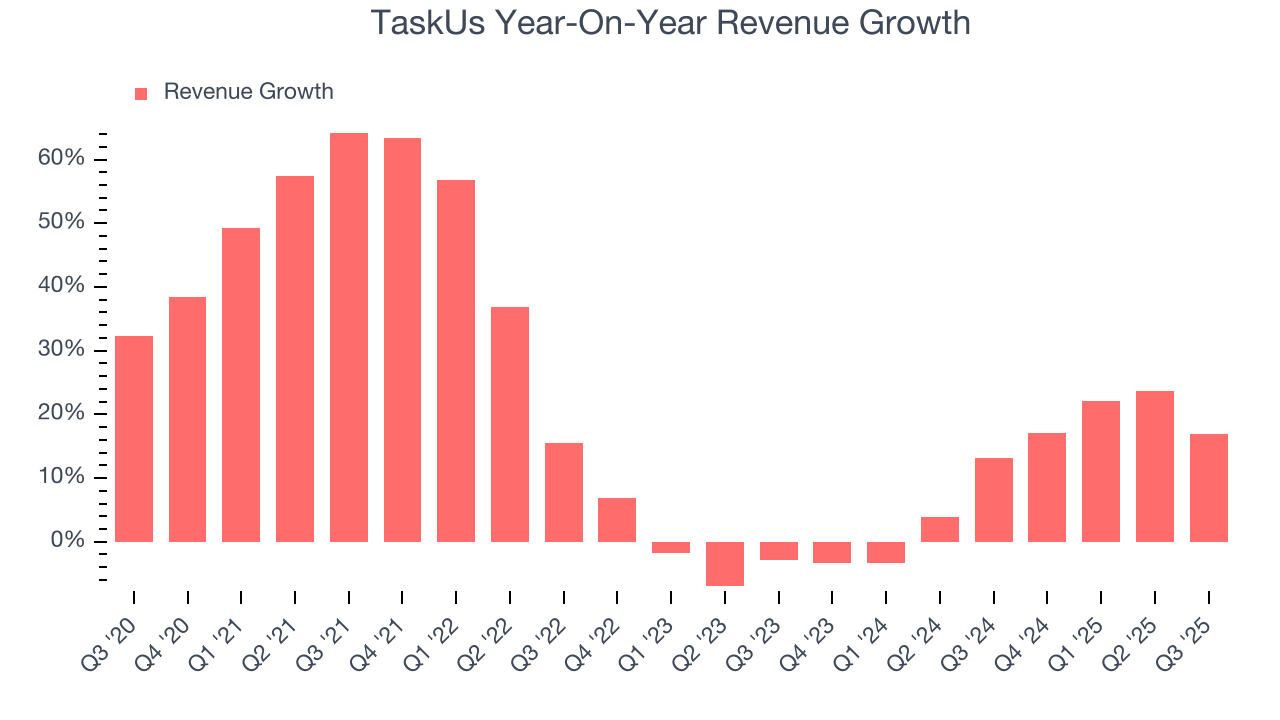

As you can see below, TaskUs grew its sales at an incredible 21.1% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. TaskUs’s annualized revenue growth of 10.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, TaskUs reported year-on-year revenue growth of 17%, and its $298.7 million of revenue exceeded Wall Street’s estimates by 2.4%. Company management is currently guiding for a 10.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.5% over the next 12 months, similar to its two-year rate. This projection is healthy and indicates the market is baking in success for its products and services.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

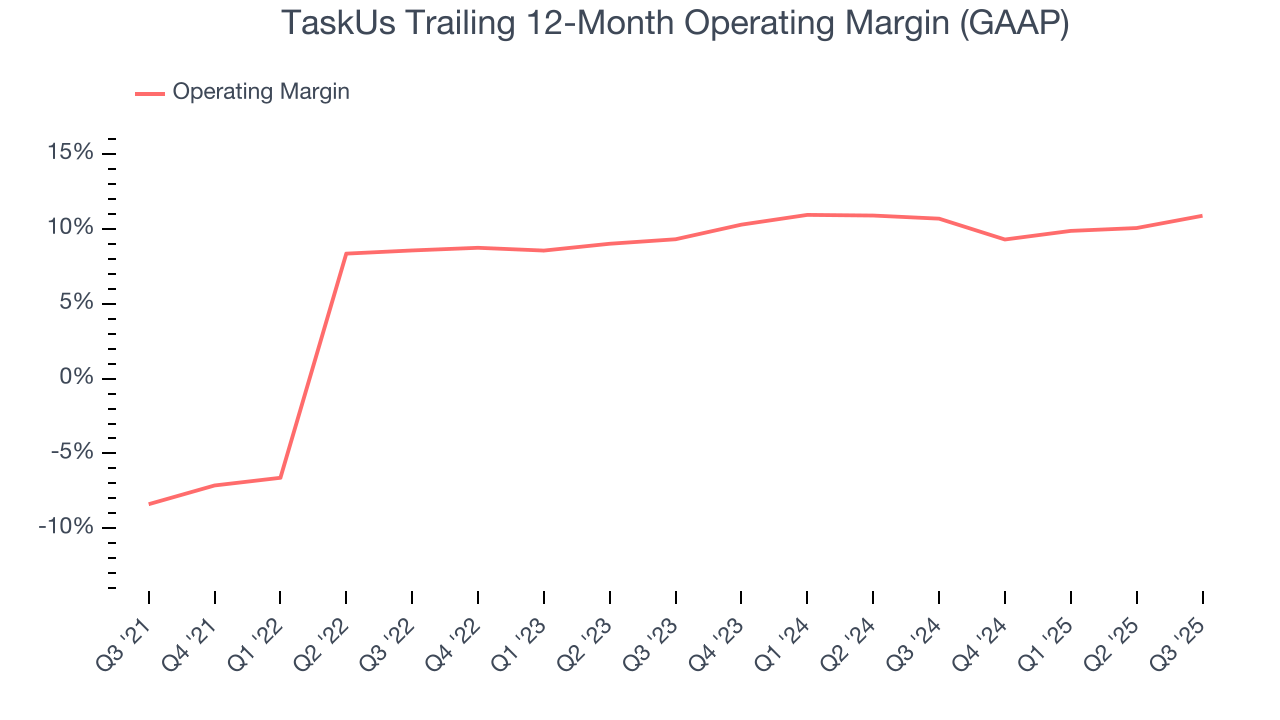

TaskUs was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.3% was weak for a business services business.

On the plus side, TaskUs’s operating margin rose by 19.3 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, TaskUs generated an operating margin profit margin of 12.7%, up 3.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

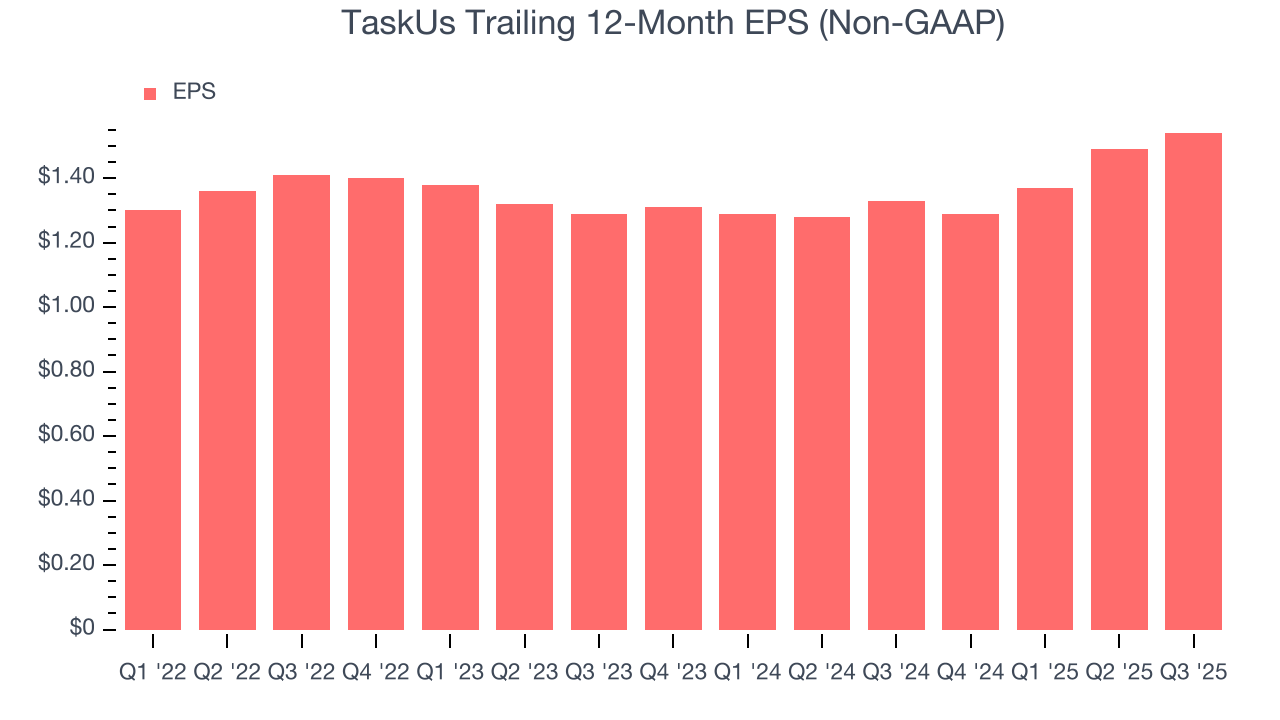

TaskUs’s full-year EPS grew at a decent 8.2% compounded annual growth rate over the last four years, in line with the broader business services sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

TaskUs’s unimpressive 9.3% annual EPS growth over the last two years aligns with its revenue trend. On the bright side, this tells us its incremental sales were profitable.

In Q3, TaskUs reported adjusted EPS of $0.42, up from $0.37 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects TaskUs’s full-year EPS of $1.54 to grow 9.1%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

TaskUs has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.3% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that TaskUs’s margin expanded by 21.6 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

TaskUs’s free cash flow clocked in at $41.96 million in Q3, equivalent to a 14% margin. This result was good as its margin was 11.6 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

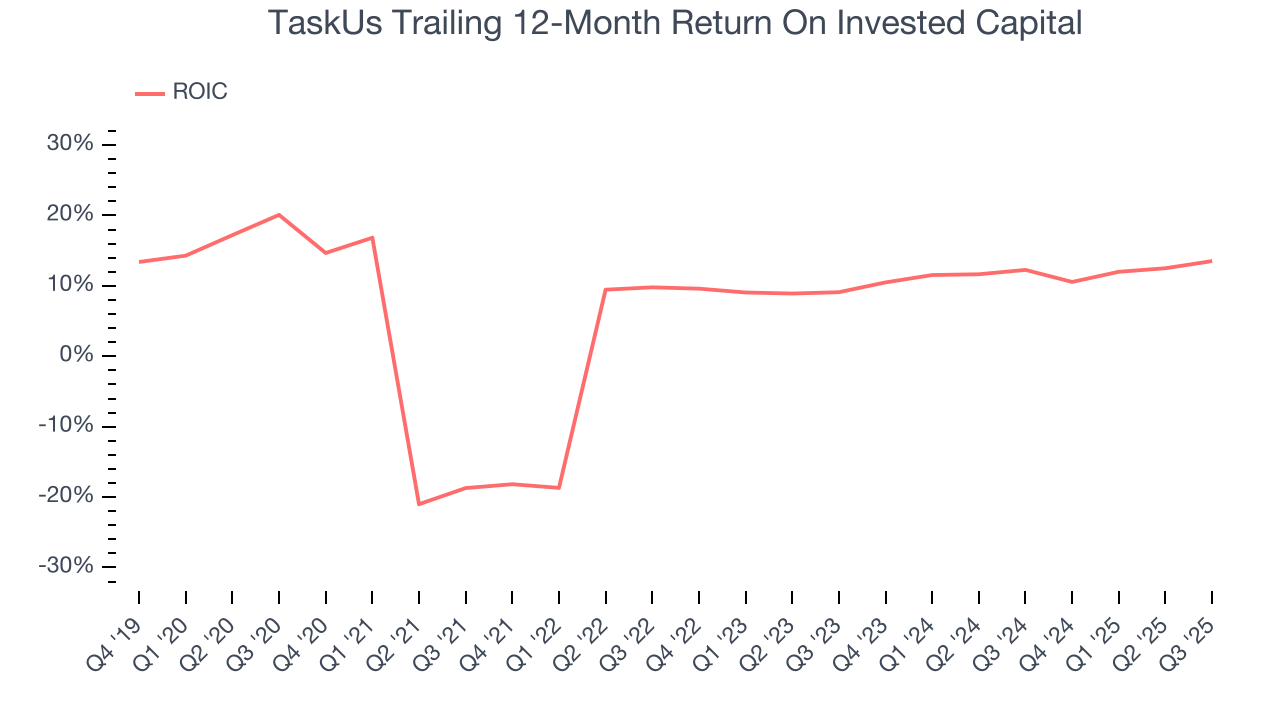

TaskUs historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.2%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, TaskUs’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Assessment

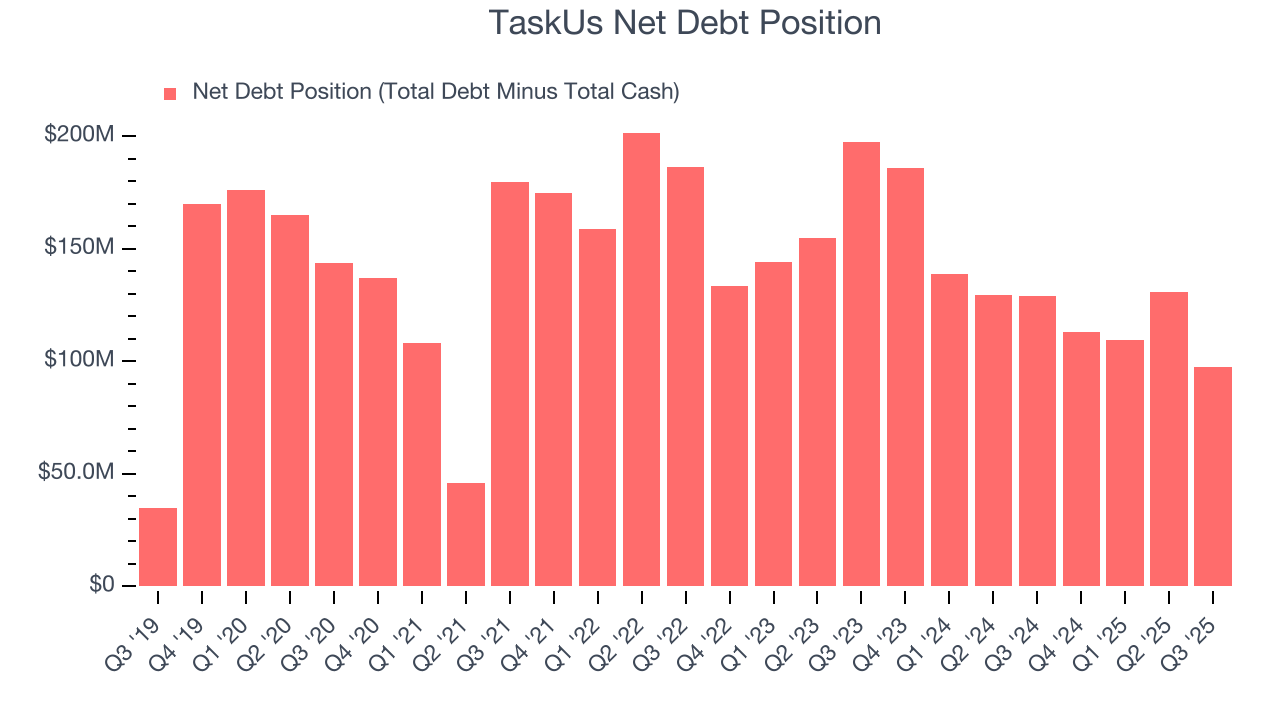

TaskUs reported $210 million of cash and $307.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $217 million of EBITDA over the last 12 months, we view TaskUs’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $2.59 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from TaskUs’s Q3 Results

It was good to see TaskUs beat analysts’ revenue EPS expectations this quarter, making for solid performance. On the other hand, its revenue guidance for next quarter slightly missed. Overall, this print was mixed. The stock traded up 6.4% to $13.30 immediately after reporting.

12. Is Now The Time To Buy TaskUs?

Updated: January 19, 2026 at 10:58 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

TaskUs possesses a number of positive attributes. First off, its revenue growth was exceptional over the last five years. And while its projected EPS for the next year is lacking, its rising cash profitability gives it more optionality. On top of that, its rising returns show management's prior bets are starting to pay off.

TaskUs’s P/E ratio based on the next 12 months is 7.6x. When scanning the business services space, TaskUs trades at a fair valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $15.90 on the company (compared to the current share price of $11.61), implying they see 37% upside in buying TaskUs in the short term.