Tractor Supply (TSCO)

Tractor Supply doesn’t excite us. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Tractor Supply Is Not Exciting

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ:TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

- Scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 3% for the last three years

- Gross margin of 36.3% is an output of its commoditized inventory

- On the bright side, its industry-leading 31.7% return on capital demonstrates management’s skill in finding high-return investments

Tractor Supply falls below our quality standards. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Tractor Supply

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Tractor Supply

Tractor Supply’s stock price of $50.59 implies a valuation ratio of 23.2x forward P/E. This valuation is fair for the quality you get, but we’re on the sidelines for now.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Tractor Supply (TSCO) Research Report: Q4 CY2025 Update

Rural goods retailer Tractor Supply (NASDAQ:TSCO) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 3.3% year on year to $3.90 billion. Its GAAP profit of $0.43 per share was 7.2% below analysts’ consensus estimates.

Tractor Supply (TSCO) Q4 CY2025 Highlights:

- Revenue: $3.90 billion vs analyst estimates of $3.99 billion (3.3% year-on-year growth, 2.4% miss)

- EPS (GAAP): $0.43 vs analyst expectations of $0.46 (7.2% miss)

- Adjusted EBITDA: $425.5 million vs analyst estimates of $459.6 million (10.9% margin, 7.4% miss)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $2.18 at the midpoint, missing analyst estimates by 5.6%

- Operating Margin: 7.6%, in line with the same quarter last year

- Free Cash Flow Margin: 1.5%, down from 7.2% in the same quarter last year

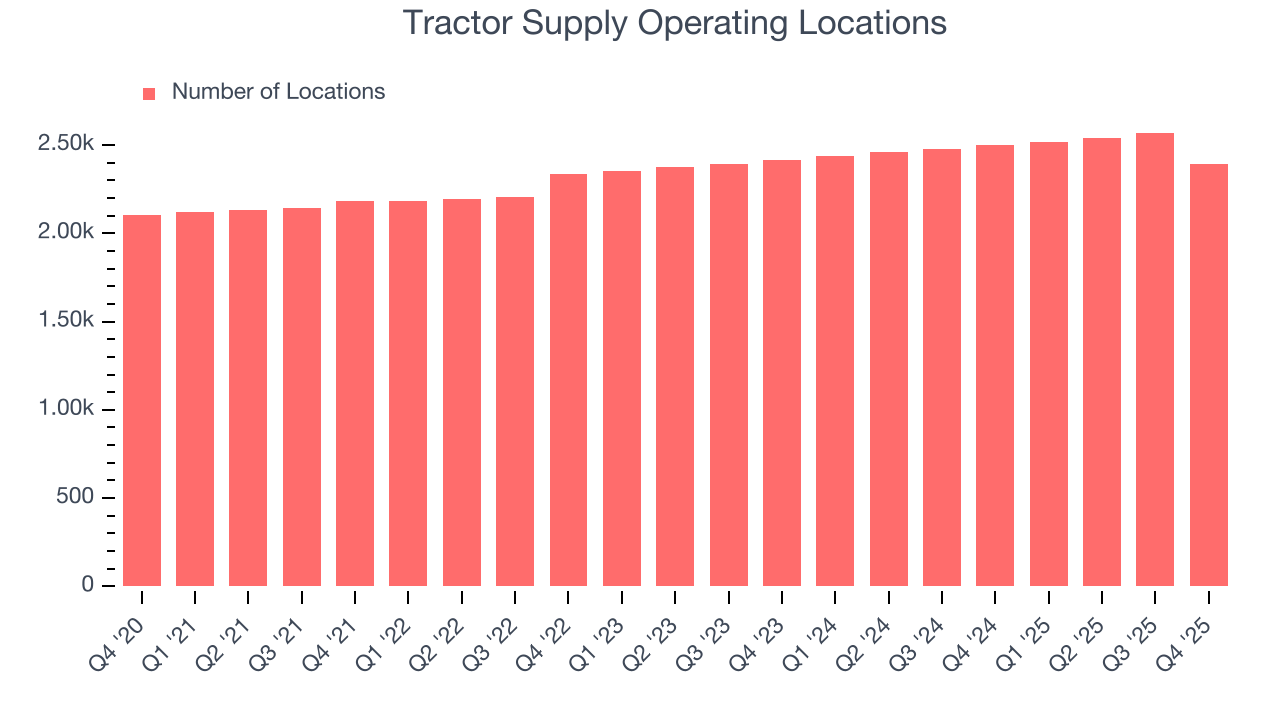

- Locations: 2,395 at quarter end, down from 2,502 in the same quarter last year

- Same-Store Sales were flat year on year, in line with the same quarter last year

- Market Capitalization: $29.14 billion

Company Overview

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ:TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

The core customer is typically a farmer, rancher, or general rural homeowner who tends to be handy, which explains the company’s tagline of “for life out here.” These customers make their living or heavily rely on their equipment, livestock, and land. They need a dependable source for essential supplies such as trailers for trucks, animal feed, and fencing supplies, all of which can be purchased from Tractor Supply.

Tractor Supply stores can vary in size, but the average location is fairly small at 15,000 feet with outdoor display and storage space for larger products and equipment. These stores tend to be located in rural and suburban shopping centers and retail plazas. Many of these rural areas don’t have a high density of other retailers, so Tractor Supply aims to be a nearly one-stop shop for customer needs.

The company established its e-commerce platform in 2007, and today, customers can buy online for home delivery or store pickup. The site and app also feature online-only deals and a blog about rural living that includes product reviews/comparisons, animal care guides, and primers on farming and agriculture.

4. Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Competitors that offer one or more overlapping product categories include Home Depot (NYSE:HD), Lowe’s (NYSE:LOW), and Petco Health and Wellness (NASDAQ:WOOF).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $15.52 billion in revenue over the past 12 months, Tractor Supply is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. For Tractor Supply to boost its sales, it likely needs to adjust its prices or lean into foreign markets.

As you can see below, Tractor Supply’s 3% annualized revenue growth over the last three years was sluggish.

This quarter, Tractor Supply’s revenue grew by 3.3% year on year to $3.90 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, an acceleration versus the last three years. This projection is particularly healthy for a company of its scale and indicates its newer products will fuel better top-line performance.

6. Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Tractor Supply sported 2,395 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 2.6% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Tractor Supply’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Tractor Supply should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Tractor Supply’s year on year same-store sales were flat. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

Tractor Supply has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 36.3% gross margin over the last two years. That means Tractor Supply paid its suppliers a lot of money ($63.66 for every $100 in revenue) to run its business.

Tractor Supply produced a 35.1% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Tractor Supply’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 9.7% over the last two years. This profitability was higher than the broader consumer retail sector, showing it did a decent job managing its expenses.

Analyzing the trend in its profitability, Tractor Supply’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Tractor Supply generated an operating margin profit margin of 7.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Earnings Per Share

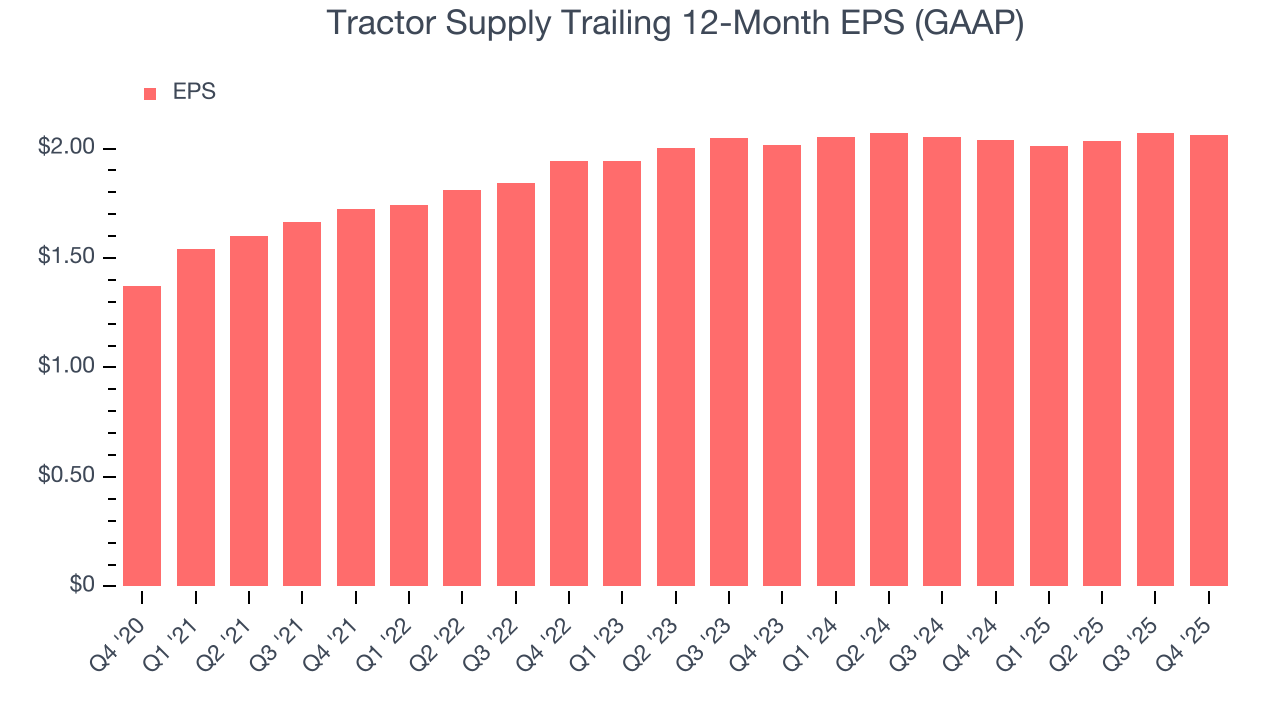

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Tractor Supply’s unimpressive 2% annual EPS growth over the last three years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Tractor Supply reported EPS of $0.43, down from $0.44 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Tractor Supply’s full-year EPS of $2.06 to grow 6.3%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Tractor Supply has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 4.5% over the last two years, better than the broader consumer retail sector.

Tractor Supply’s free cash flow clocked in at $59.28 million in Q4, equivalent to a 1.5% margin. The company’s cash profitability regressed as it was 5.7 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Tractor Supply hasn’t been the highest-quality company lately because of its poor top-line performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 31.8%, splendid for a consumer retail business.

12. Balance Sheet Assessment

Tractor Supply reported $194.1 million of cash and $5.94 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.96 billion of EBITDA over the last 12 months, we view Tractor Supply’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $35.44 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Tractor Supply’s Q4 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4.8% to $52.50 immediately after reporting.

14. Is Now The Time To Buy Tractor Supply?

Updated: March 6, 2026 at 9:48 PM EST

When considering an investment in Tractor Supply, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Tractor Supply isn’t a bad business, but we’re not clamoring to buy it here and now. Although its revenue growth was uninspiring over the last three years, its growth over the next 12 months is expected to be higher. And while Tractor Supply’s gross margins make it more difficult to reach positive operating profits compared to other consumer retail businesses, its stellar ROIC suggests it has been a well-run company historically.

Tractor Supply’s P/E ratio based on the next 12 months is 23.2x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $57.59 on the company (compared to the current share price of $50.59).