WeightWatchers (WW)

WeightWatchers keeps us up at night. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think WeightWatchers Will Underperform

Known by many for its old cable television commercials, WeightWatchers (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

- Annual sales declines of 12% for the past five years show its products and services struggled to connect with the market

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

WeightWatchers falls short of our expectations. There are more promising prospects in the market.

Why There Are Better Opportunities Than WeightWatchers

High Quality

Investable

Underperform

Why There Are Better Opportunities Than WeightWatchers

WeightWatchers’s stock price of $22.82 implies a valuation ratio of 14.1x forward P/E. Yes, this valuation multiple is lower than that of other consumer discretionary peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. WeightWatchers (WW) Research Report: Q3 CY2025 Update

Personal wellness company WeightWatchers (NASDAQ:WW) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 10.8% year on year to $172.1 million. The company’s full-year revenue guidance of $697.5 million at the midpoint came in 0.8% above analysts’ estimates. Its GAAP loss of $5.76 per share was significantly below analysts’ consensus estimates.

WeightWatchers (WW) Q3 CY2025 Highlights:

- Revenue: $172.1 million vs analyst estimates of $161.4 million (10.8% year-on-year decline, 6.6% beat)

- EPS (GAAP): -$5.76 vs analyst estimates of -$0.10 (significant miss)

- Adjusted EBITDA: $42.78 million vs analyst estimates of $28.97 million (24.9% margin, 47.7% beat)

- The company slightly lifted its revenue guidance for the full year to $697.5 million at the midpoint from $692.5 million

- EBITDA guidance for the full year is $147.5 million at the midpoint, above analyst estimates of $145.4 million

- Operating Margin: 4.7%, down from 18.6% in the same quarter last year

- Free Cash Flow Margin: 2.8%, down from 8.6% in the same quarter last year

- Market Capitalization: $331.6 million

Company Overview

Known by many for its old cable television commercials, WeightWatchers (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WW began as a weight loss-focused organization with Weight Watchers and has since rebranded into a comprehensive wellness brand. The company originally gained traction through its approach to weight management, combining dietary advice with group support meetings. This approach provided a community and accountability that differentiated it from other diet programs.

Initially, WW's member growth was fueled by in-person group meetings and public speaking events, enticing members to join. The company then expanded by franchising the Weight Watcher program to its graduates.

Today, WW's products include cookbooks, prepared food lines, and more, catering to a broader range of consumers. Its offerings are primarily subscription-based, and customers can participate both digitally and in person, receiving individualized support and coaching. WW also generates income from branded services and products, such as magazines, food guides, and licensing fees.

4. Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

WeightWatchers's fitness and wellness peers include BODi (NYSE:BODY), MyFitnessPal, Noom, Cult.fit, and Trainerize.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. WeightWatchers struggled to consistently generate demand over the last five years as its sales dropped at a 12% annual rate. This was below our standards and is a sign of lacking business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. WeightWatchers’s annualized revenue declines of 10.1% over the last two years suggest its demand continued shrinking.

This quarter, WeightWatchers’s revenue fell by 10.8% year on year to $172.1 million but beat Wall Street’s estimates by 6.6%.

Looking ahead, sell-side analysts expect revenue to decline by 13.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

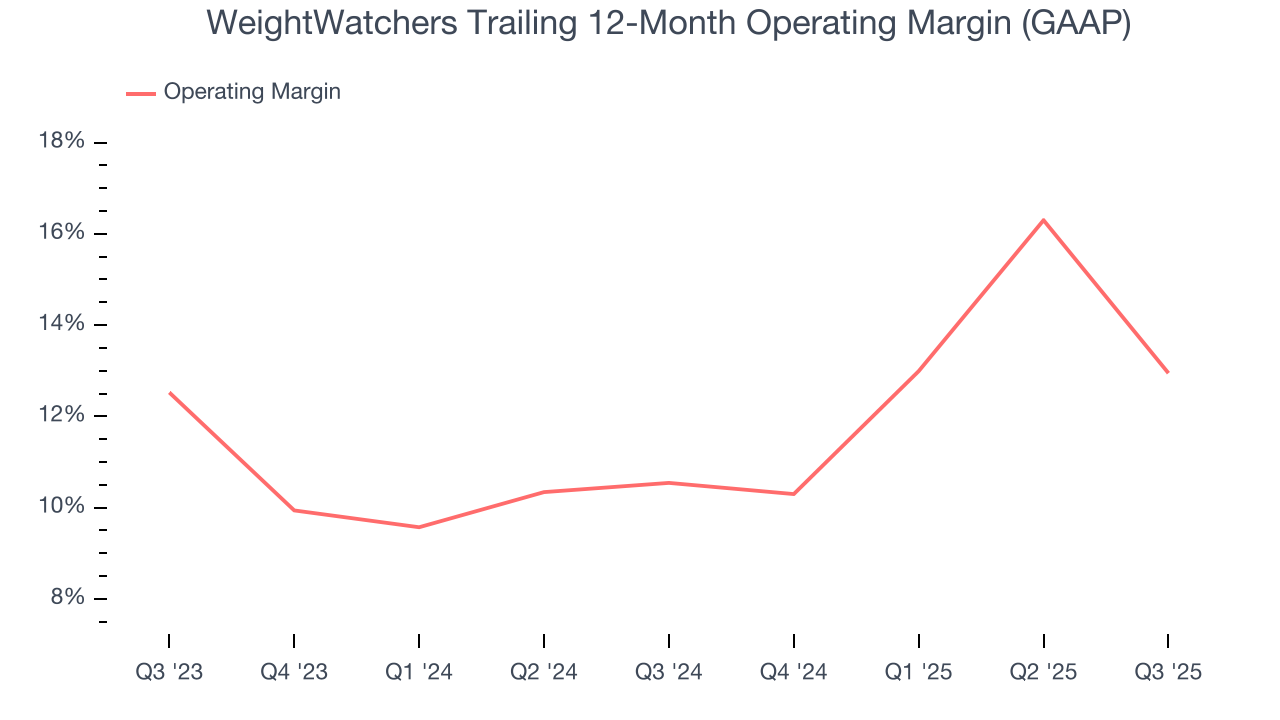

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

WeightWatchers’s operating margin has been trending up over the last 12 months and averaged 11.7% over the last two years. Its profitability was higher than the broader consumer discretionary sector, showing it did a decent job managing its expenses.

This quarter, WeightWatchers generated an operating margin profit margin of 4.7%, down 14 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

7. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While WeightWatchers posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, WeightWatchers’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 2.1%, meaning it lit $2.12 of cash on fire for every $100 in revenue.

WeightWatchers’s free cash flow clocked in at $4.73 million in Q3, equivalent to a 2.8% margin. The company’s cash profitability regressed as it was 5.9 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

Looking forward, analysts predict WeightWatchers will generate cash on a full-year basis. Their consensus estimates imply its free cash flow margin of negative 1.9% for the last 12 months will increase to positive 9.3%, giving it more money to invest.

8. Balance Sheet Assessment

WeightWatchers reported $177.6 million of cash and $468.9 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $142.7 million of EBITDA over the last 12 months, we view WeightWatchers’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $54.57 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

9. Key Takeaways from WeightWatchers’s Q3 Results

We were impressed by how significantly WeightWatchers blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. The stock traded up 5.5% to $35.01 immediately after reporting.

10. Is Now The Time To Buy WeightWatchers?

Updated: February 20, 2026 at 10:31 PM EST

When considering an investment in WeightWatchers, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

WeightWatchers falls short of our quality standards. While its Forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year, the downside is its number of members has disappointed. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

WeightWatchers’s P/E ratio based on the next 12 months is 14.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $46.17 on the company (compared to the current share price of $22.82).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.