Bath and Body Works (BBWI)

We’re wary of Bath and Body Works. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why Bath and Body Works Is Not Exciting

Spun off from L Brands in 2020, Bath & Body Works (NYSE:BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

- Projected sales decline of 5.3% over the next 12 months indicates demand will continue deteriorating

- Lagging same-store sales over the past two years suggest it might have to change its pricing and marketing strategy to stimulate demand

- One positive is that its ROIC punches in at 47.2%, illustrating management’s expertise in identifying profitable investments

Bath and Body Works is skating on thin ice. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Bath and Body Works

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Bath and Body Works

Bath and Body Works’s stock price of $22.17 implies a valuation ratio of 8.9x forward P/E. Bath and Body Works’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Bath and Body Works (BBWI) Research Report: Q3 CY2025 Update

Personal care and home fragrance retailer Bath & Body Works (NYSE:BBWI) fell short of the markets revenue expectations in Q3 CY2025, with sales flat year on year at $1.59 billion. Its GAAP profit of $0.37 per share was 5.9% below analysts’ consensus estimates.

Bath and Body Works (BBWI) Q3 CY2025 Highlights:

- Revenue: $1.59 billion vs analyst estimates of $1.63 billion (flat year on year, 2.5% miss)

- EPS (GAAP): $0.37 vs analyst expectations of $0.39 (5.9% miss)

- EPS (GAAP) guidance for the full year is $2.83 at the midpoint, missing analyst estimates by 16.1%

- Operating Margin: 10.1%, down from 13.5% in the same quarter last year

- Locations: 2,478 at quarter end, up from 2,395 in the same quarter last year

- Market Capitalization: $4.34 billion

Company Overview

Spun off from L Brands in 2020, Bath & Body Works (NYSE:BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

While many retailers define themselves based on visuals and aesthetics, Bath & Body Works relies on the scents of their products. These scents are unique and diverse in range, and the company aims to rotate and update them on a seasonal basis in order to have fresh product every few months.

The core customer of Bath & Body Works is typically female, aged 18-45, who values self-care and indulgence. While consumers can buy generic or private label personal care products, the Bath & Body Works customer prefers the affordable luxury of higher-quality, specialty bath gels and moisturizers, for example.

The average Bath & Body Works store is around 3,000 square feet and typically located in shopping malls and strip shopping centers alongside other retailers. While stores are designed to be visually appealing, the main draw is the ability to test products and experience their scents. Bath & Body Works has an e-commerce presence, which was launched relatively late in 2006 when compared to other prominent retailers. The omnichannel approach gives the customer various options for shopping, returns, and exchanges. The e-commerce platform also features online-only promotions and customer reviews.

4. Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Retailers offering specialized personal care products include Ulta Beauty (NASDAQ:ULTA) and Victoria’s Secret (NYSE:VSCO) as well as department stores such as Macy’s (NYSE:M) and Kohl’s (NYSE:KSS).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $7.36 billion in revenue over the past 12 months, Bath and Body Works is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

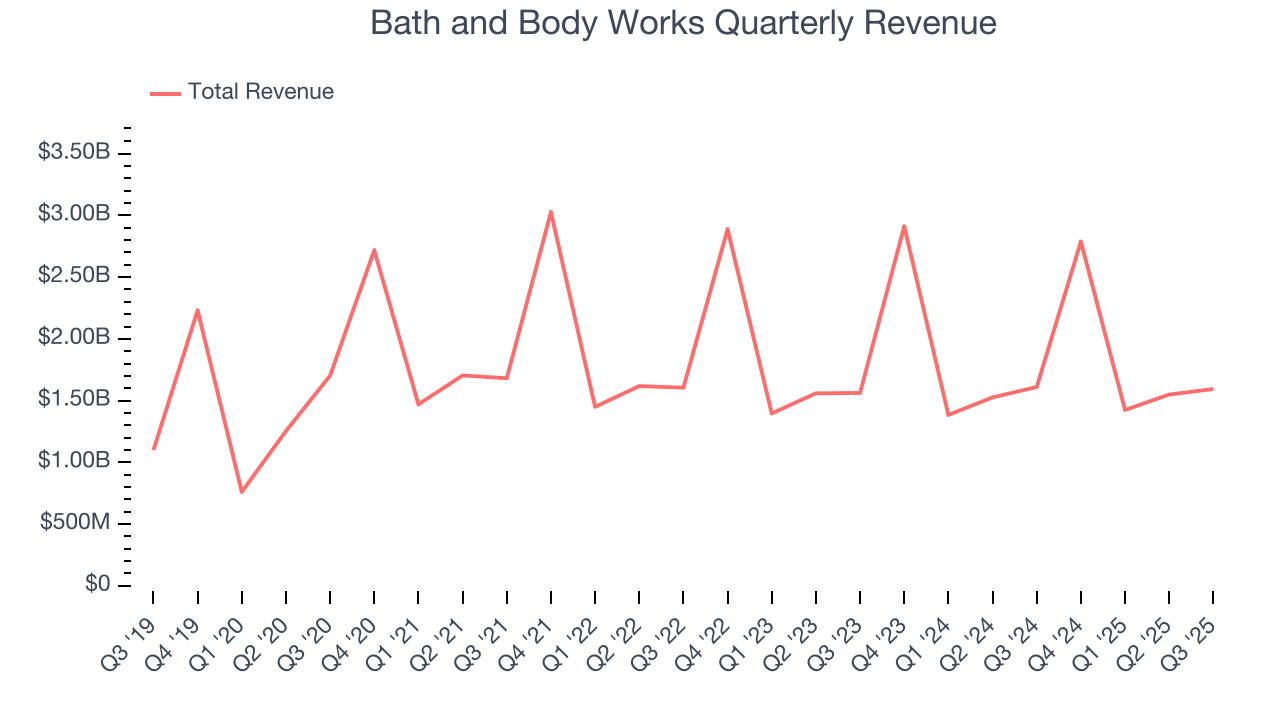

As you can see below, Bath and Body Works grew its sales at a tepid 6.1% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Bath and Body Works missed Wall Street’s estimates and reported a rather uninspiring 1% year-on-year revenue decline, generating $1.59 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and implies its products will see some demand headwinds.

6. Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

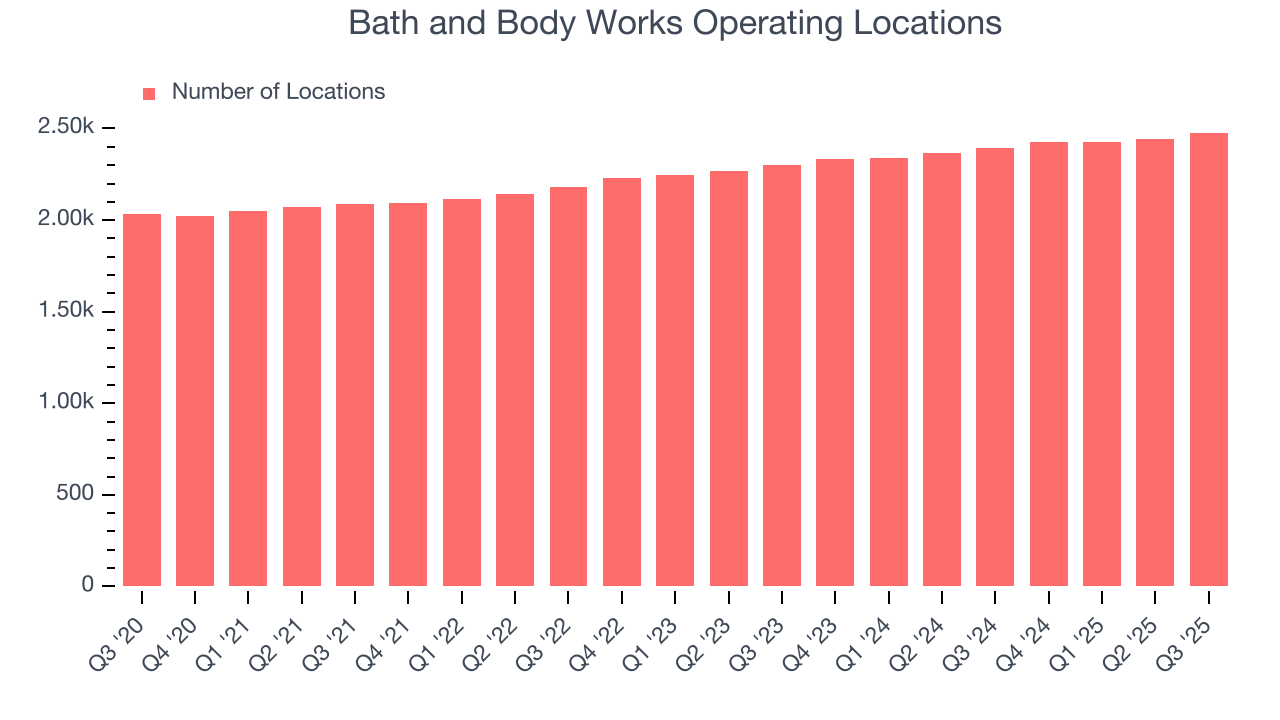

Bath and Body Works sported 2,478 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 3.9% annual growth, among the fastest in the consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

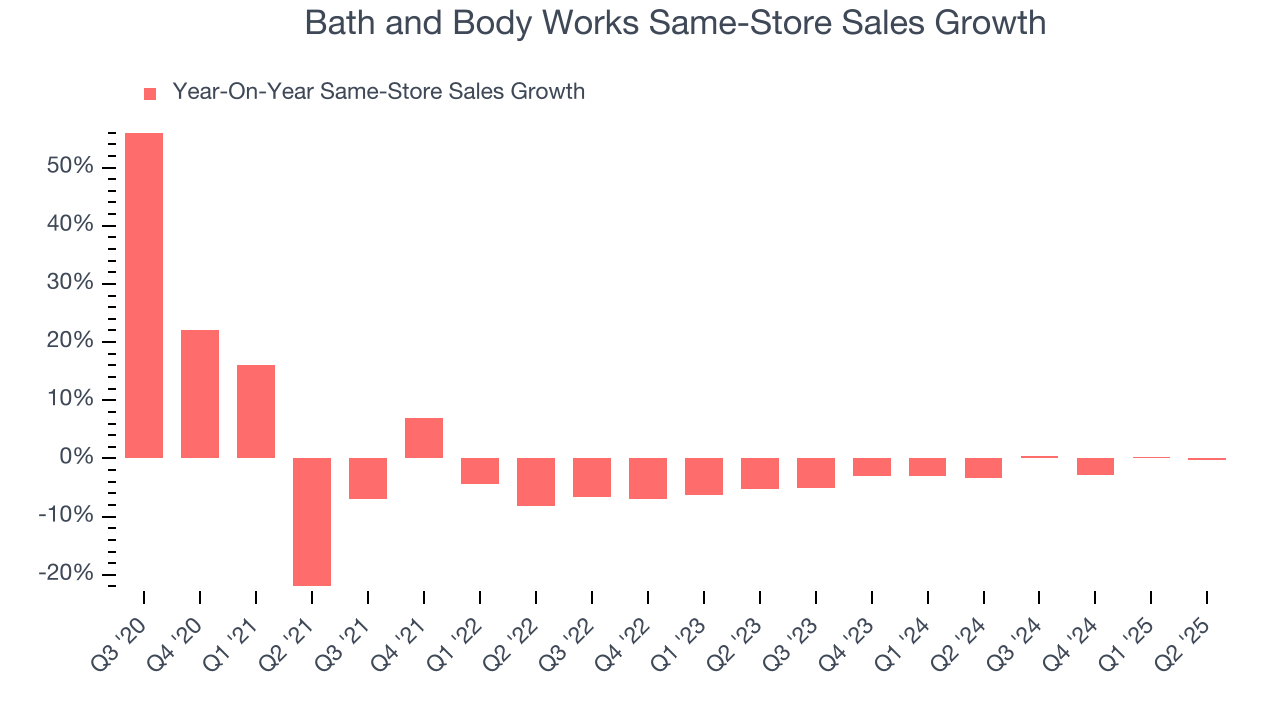

Bath and Body Works’s demand has been shrinking over the last two years as its same-store sales have averaged 1.7% annual declines. This performance is concerning - it shows Bath and Body Works artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

Note that Bath and Body Works reports its same-store sales intermittently, so some data points are missing in the chart below.

7. Gross Margin & Pricing Power

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

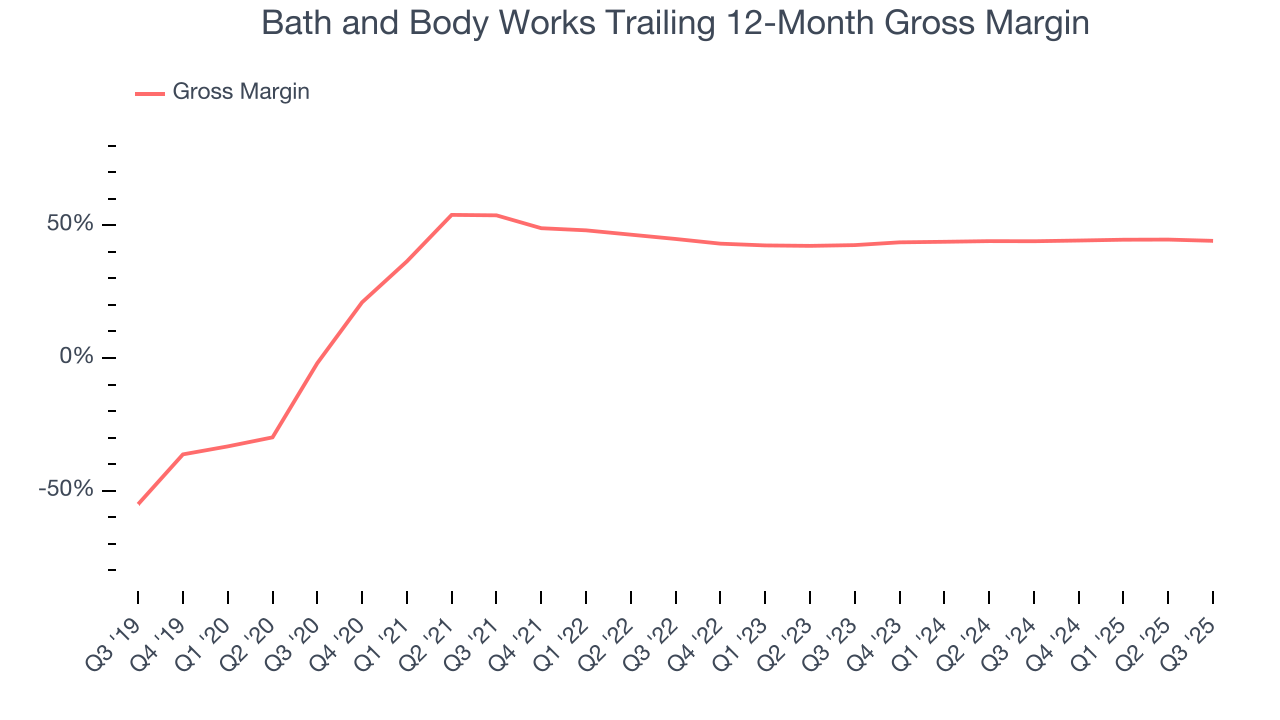

Bath and Body Works has great unit economics for a retailer, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an excellent 44.1% gross margin over the last two years. That means Bath and Body Works only paid its suppliers $55.94 for every $100 in revenue.

This quarter, Bath and Body Works’s gross profit margin was 41.3%, down 2.2 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

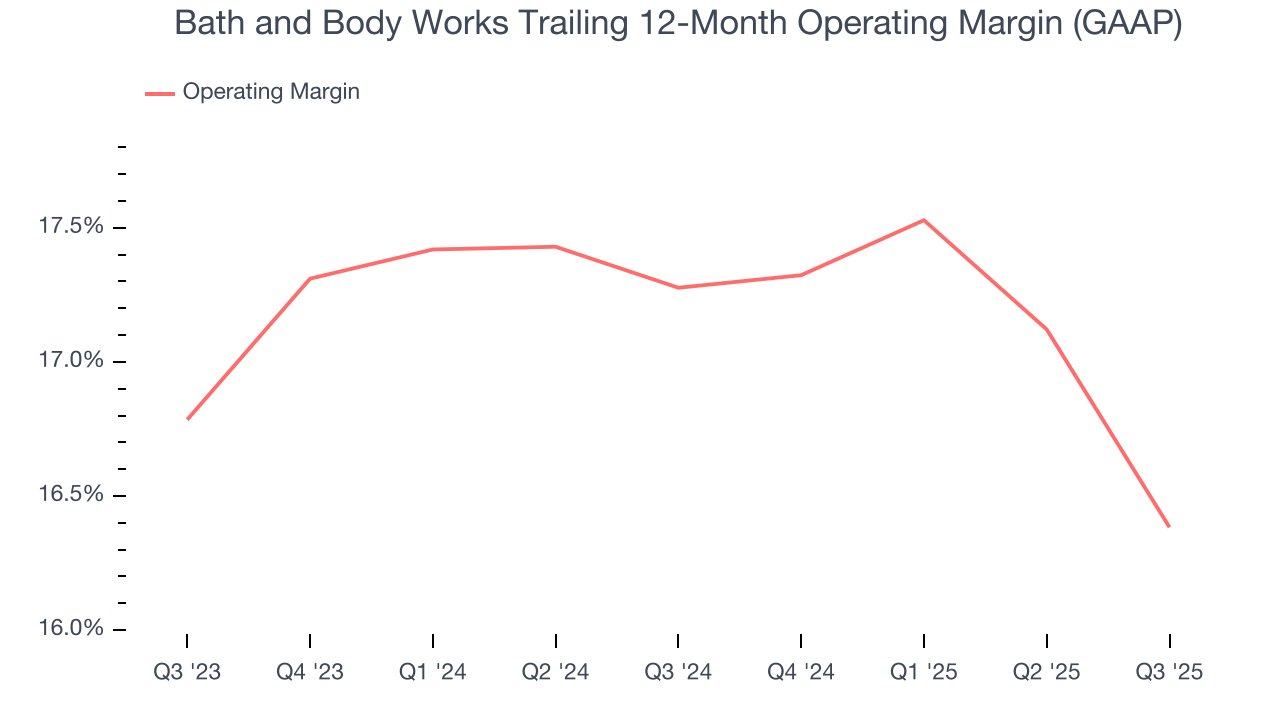

Bath and Body Works’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 16.8% over the last two years. This profitability was elite for a consumer retail business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Bath and Body Works’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Bath and Body Works generated an operating margin profit margin of 10.1%, down 3.4 percentage points year on year. Since Bath and Body Works’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

9. Cash Is King

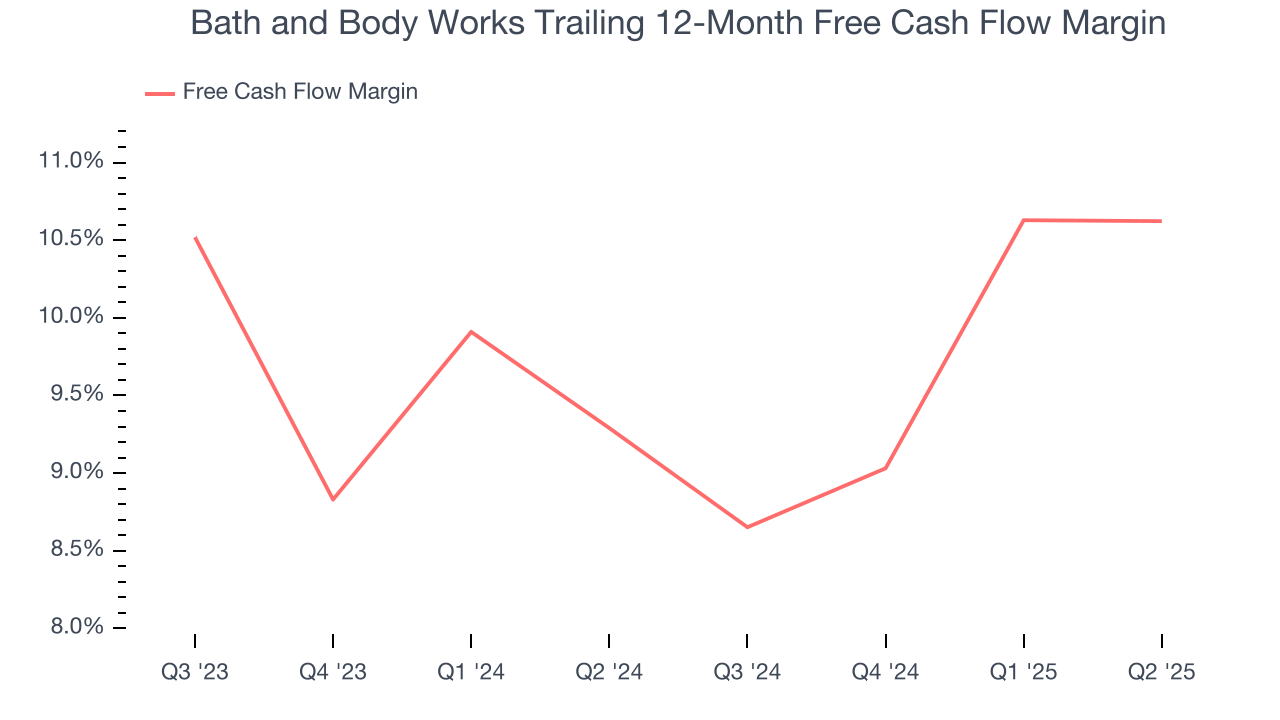

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Bath and Body Works has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer retail sector, averaging 12.1% over the last two years.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Bath and Body Works hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 47.5%, splendid for a consumer retail business.

11. Balance Sheet Assessment

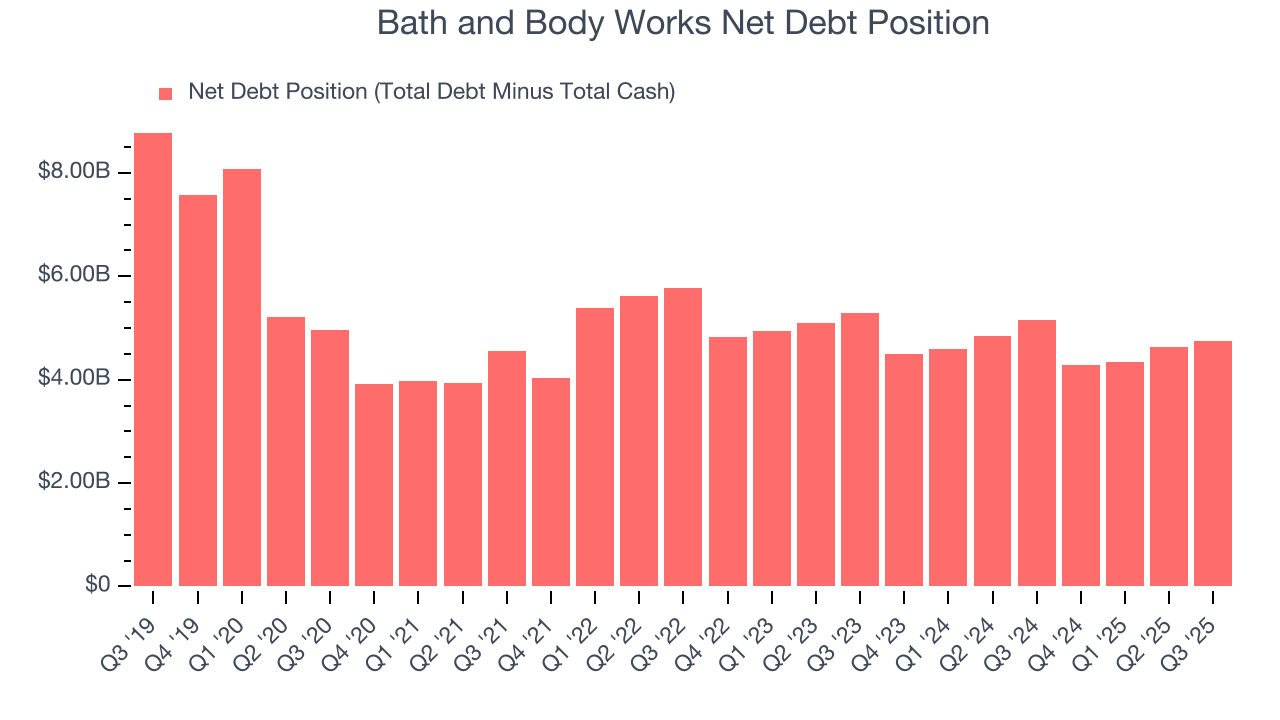

Bath and Body Works reported $236 million of cash and $4.98 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.48 billion of EBITDA over the last 12 months, we view Bath and Body Works’s 3.2× net-debt-to-EBITDA ratio as safe. We also see its $102 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Bath and Body Works’s Q3 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 16.1% to $17.66 immediately following the results.

13. Is Now The Time To Buy Bath and Body Works?

Updated: January 23, 2026 at 9:35 PM EST

When considering an investment in Bath and Body Works, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Bath and Body Works’s business quality ultimately falls short of our standards. First off, its revenue has declined over the last three years, and analysts expect its demand to deteriorate over the next 12 months. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its shrinking same-store sales tell us it will need to change its strategy to succeed. On top of that, its projected EPS for the next year is lacking.

Bath and Body Works’s P/E ratio based on the next 12 months is 8.9x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $24.54 on the company (compared to the current share price of $22.17).