H&R Block (HRB)

We wouldn’t buy H&R Block. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think H&R Block Will Underperform

Founded in 1955 by brothers Henry W. Bloch and Richard A. Bloch, H&R Block (NYSE:HRB) is a tax preparation company offering professional tax assistance and financial solutions to individuals and small businesses.

- Lackluster 5.3% annual revenue growth over the last five years indicates the company is losing ground to competitors

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

- Projected sales growth of 3.3% for the next 12 months suggests sluggish demand

H&R Block falls short of our expectations. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than H&R Block

High Quality

Investable

Underperform

Why There Are Better Opportunities Than H&R Block

At $38.94 per share, H&R Block trades at 8.1x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. H&R Block (HRB) Research Report: Q4 CY2025 Update

Tax preparation company H&R Block (NYSE:HRB) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 11.1% year on year to $198.9 million. The company expects the full year’s revenue to be around $3.89 billion, close to analysts’ estimates. Its non-GAAP loss of $1.84 per share was 2.8% above analysts’ consensus estimates.

H&R Block (HRB) Q4 CY2025 Highlights:

- Revenue: $198.9 million vs analyst estimates of $185.2 million (11.1% year-on-year growth, 7.4% beat)

- Adjusted EPS: -$1.84 vs analyst estimates of -$1.89 (2.8% beat)

- Adjusted EBITDA: -$265.8 million (-134% margin, 1.7% year-on-year decline)

- The company reconfirmed its revenue guidance for the full year of $3.89 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $4.93 at the midpoint

- EBITDA guidance for the full year is $1.03 billion at the midpoint, in line with analyst expectations

- Operating Margin: -161%, up from -164% in the same quarter last year

- Free Cash Flow was -$649.5 million compared to -$597.4 million in the same quarter last year

- Market Capitalization: $4.90 billion

Company Overview

Founded in 1955 by brothers Henry W. Bloch and Richard A. Bloch, H&R Block (NYSE:HRB) is a tax preparation company offering professional tax assistance and financial solutions to individuals and small businesses.

The company primarily operates in the United States, Canada, and Australia and has a strong physical presence with approximately 12,000 advisory offices. These physical locations are complemented by robust digital solutions, including a mobile app and Tax Pro Go for clients who want their taxes prepared remotely by a tax professional. This combination allows H&R Block to cater to a diverse client base with varying preferences for in-person or online services.

A key aspect of H&R Block's services is its focus on individual tax returns, offering assistance with federal, state, and local taxes. The company employs thousands of tax professionals on a seasonal basis who are skilled in identifying potential tax credits and deductions, ensuring clients receive the maximum refund. It also assists customers with refund anticipation loans, audit support, and tax planning assistance with issues like IRS notices and audits for an extra cost.

In addition to its tax offerings, H&R Block provides a range of related services including small business software through Wave Financial, debit cards through Emerald Card, and all-in-one mobile banking solutions through Spruce.

4. Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

H&R Block's primary competitors include Intuit (NASDAQ:INTU), Liberty Tax (owned by NextPoint Financial, TSX:NPF.U), TaxAct (owned by Blucora, NASDAQ:BCOR), and private company Jackson Hewitt.

5. Revenue Growth

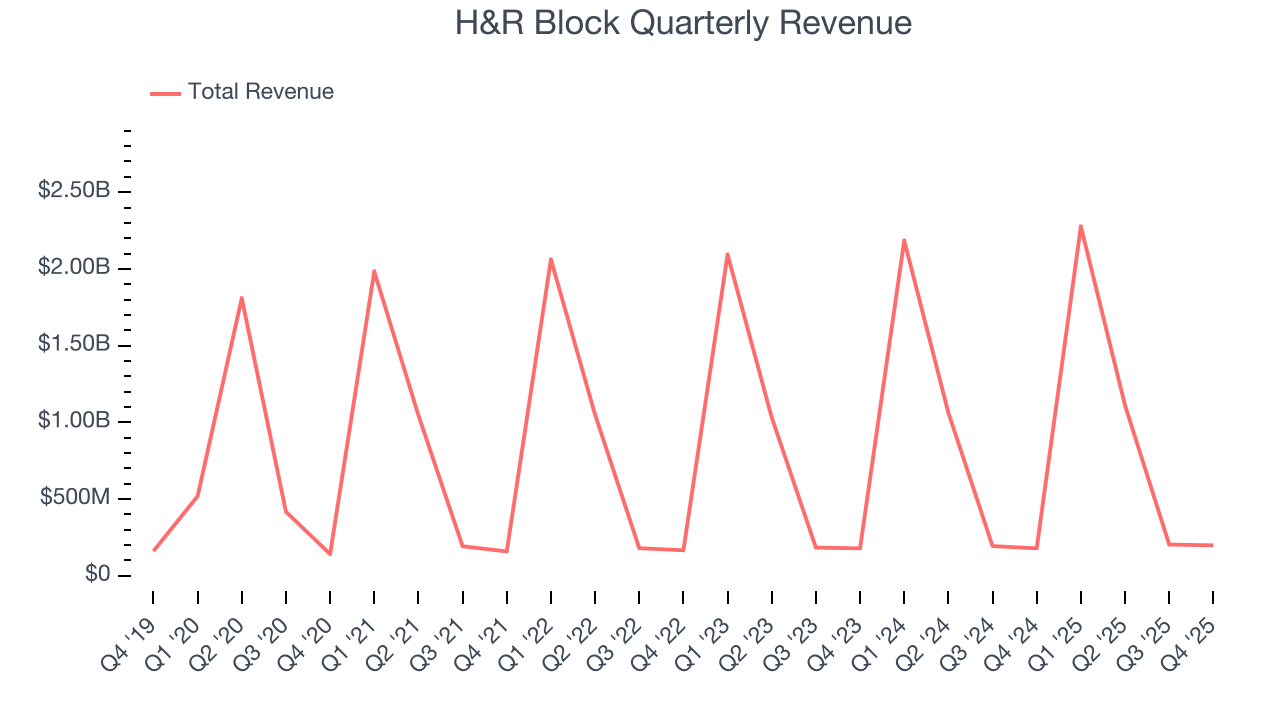

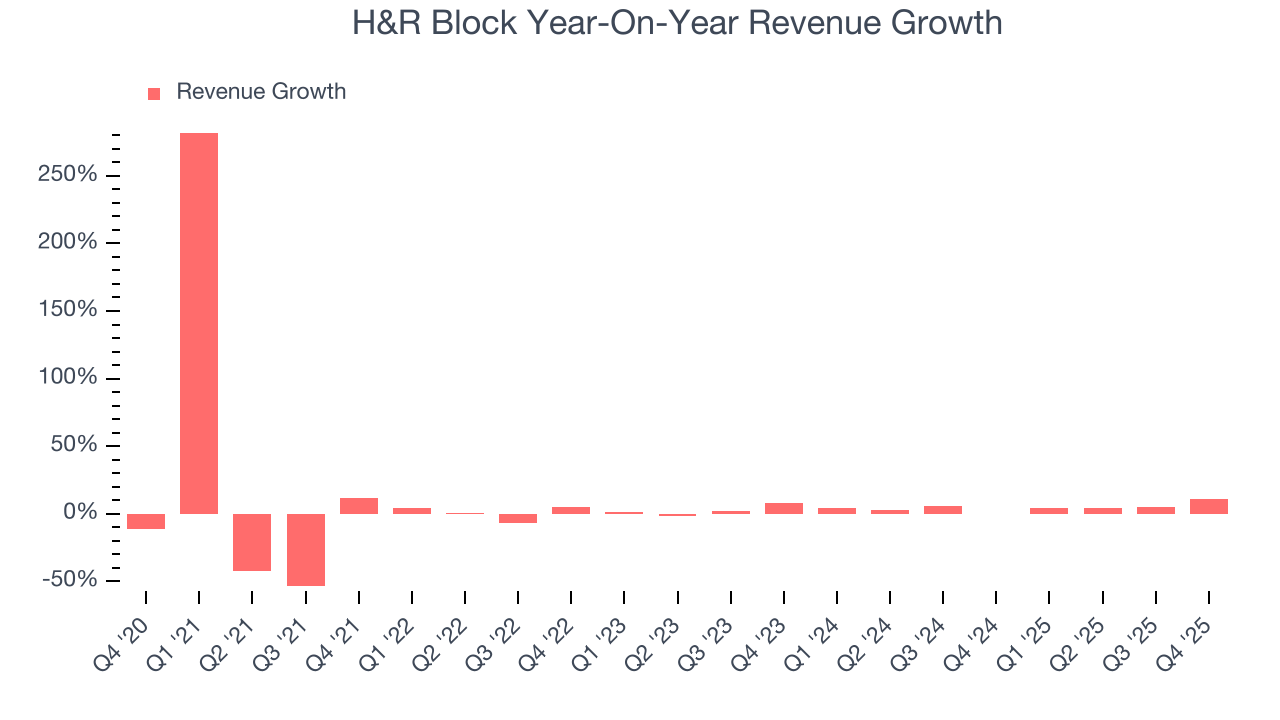

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, H&R Block’s 5.6% annualized revenue growth over the last five years was weak. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis. We note H&R Block is a seasonal business because it generates most of its revenue during tax season, so the charts in our report will look a bit lumpy.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. H&R Block’s recent performance shows its demand has slowed as its annualized revenue growth of 4.2% over the last two years was below its five-year trend.

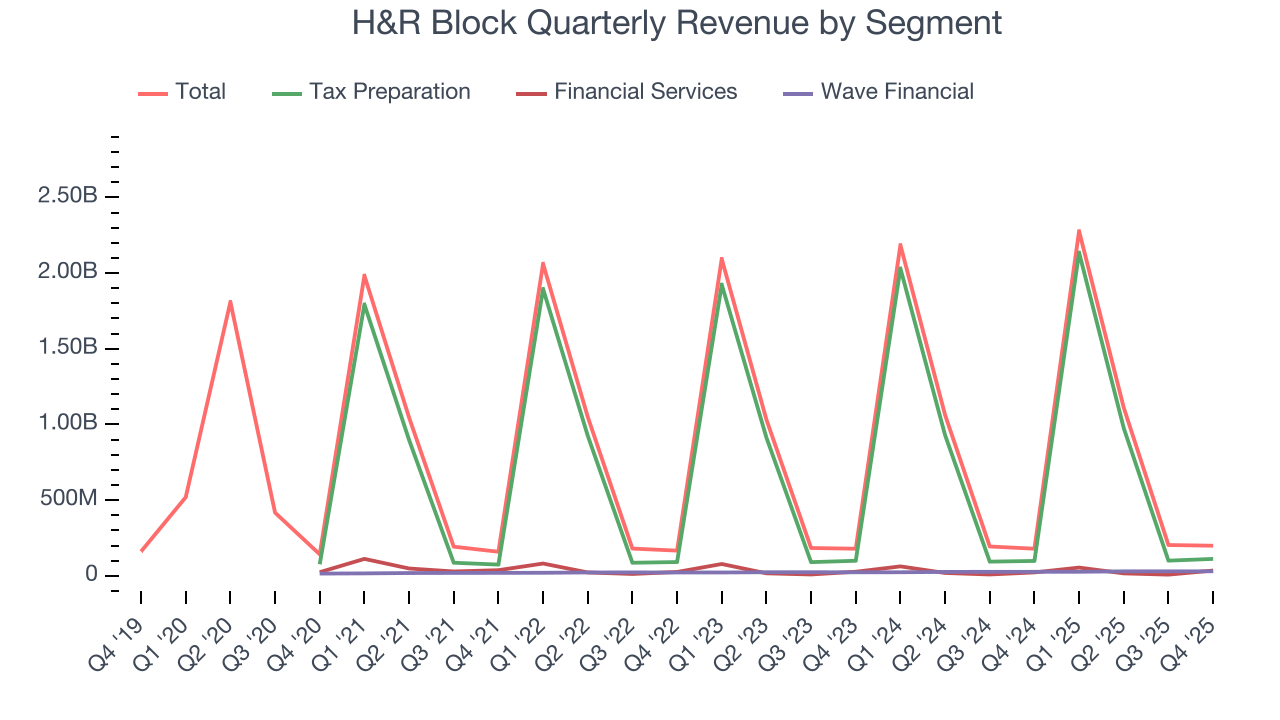

H&R Block also breaks out the revenue for its three most important segments: Tax Preparation, Financial Services, and Wave Financial, which are 56.2%, 17.5%, and 15% of revenue. Over the last two years, H&R Block’s Tax Preparation (DIY, assisted, add-on services) and Wave Financial (business software) revenues averaged 5.1% and 11.7% year-on-year growth while its Financial Services revenue (Emerald Card, Spruce, interest income) was flat.

This quarter, H&R Block reported year-on-year revenue growth of 11.1%, and its $198.9 million of revenue exceeded Wall Street’s estimates by 7.4%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its products and services will face some demand challenges.

6. Operating Margin

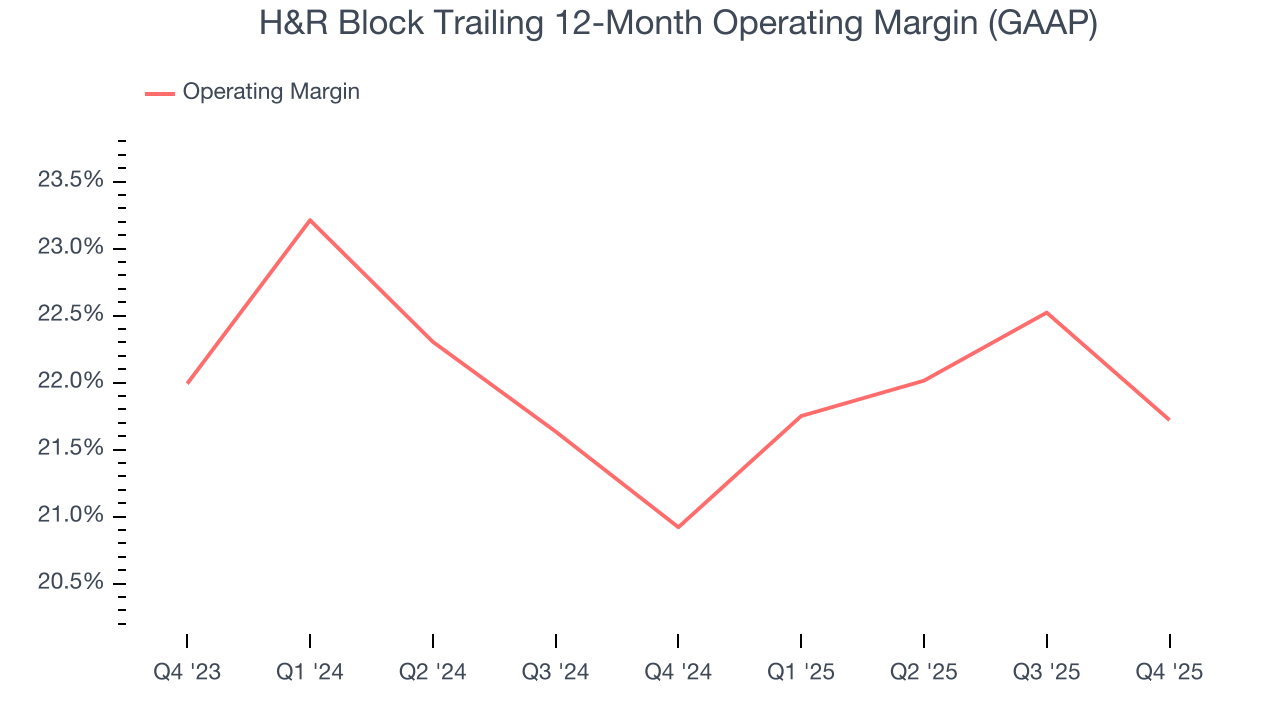

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

H&R Block’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 21.3% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, H&R Block generated an operating margin profit margin of negative 161%, up 3.3 percentage points year on year. Because H&R Block is a seasonal business, we prefer to analyze longer-term performance rather than one quarter.

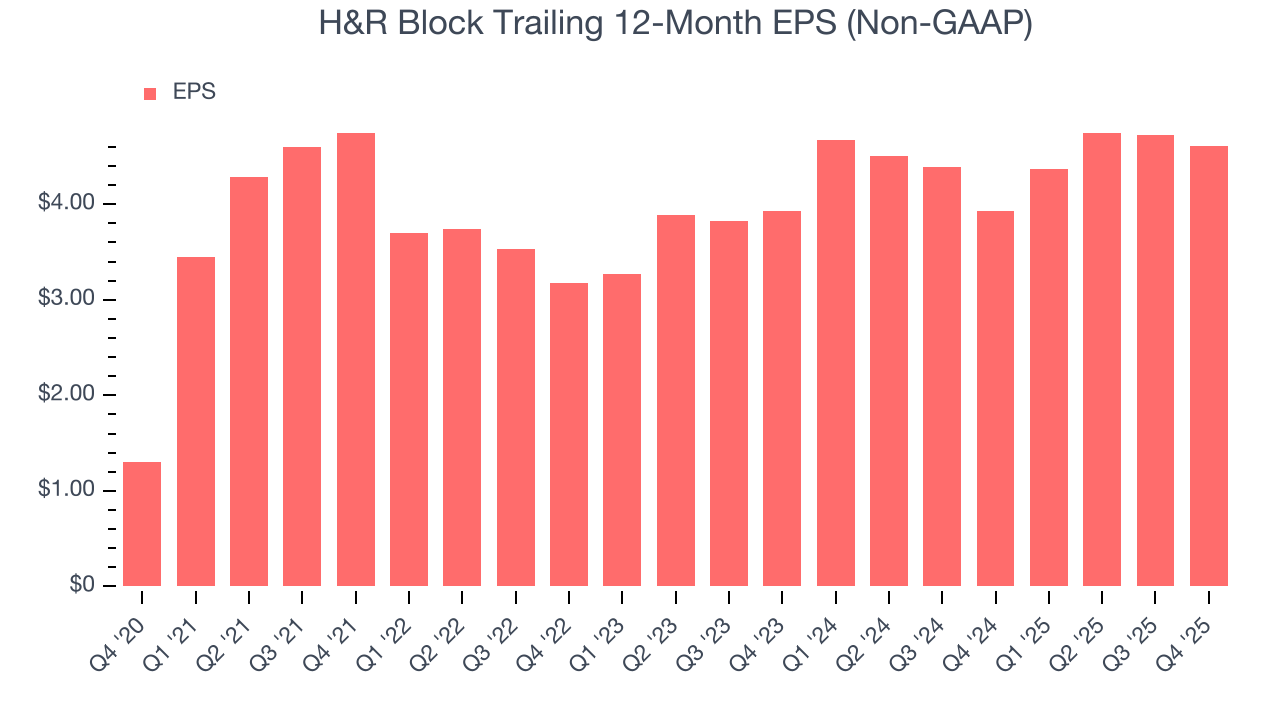

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

H&R Block’s EPS grew at an unimpressive 28.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 5.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q4, H&R Block reported adjusted EPS of negative $1.84, down from negative $1.73 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 2.8%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

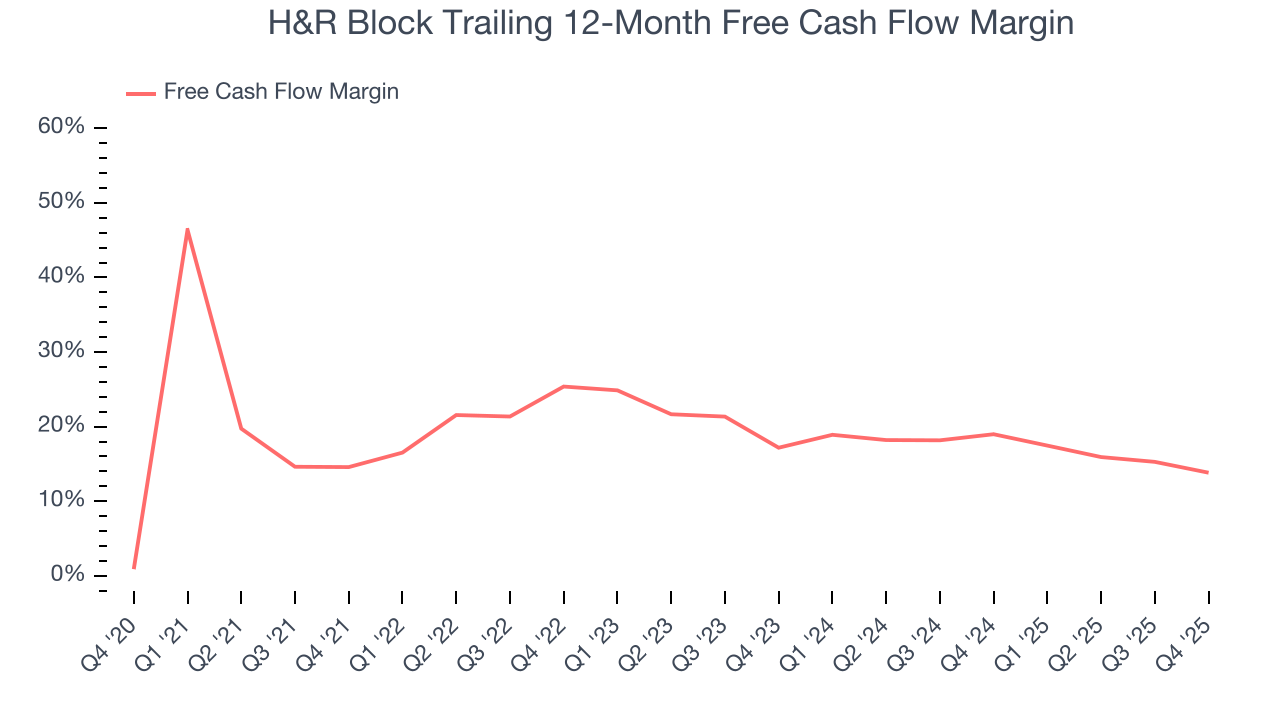

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

H&R Block has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 16.3%, lousy for a consumer discretionary business.

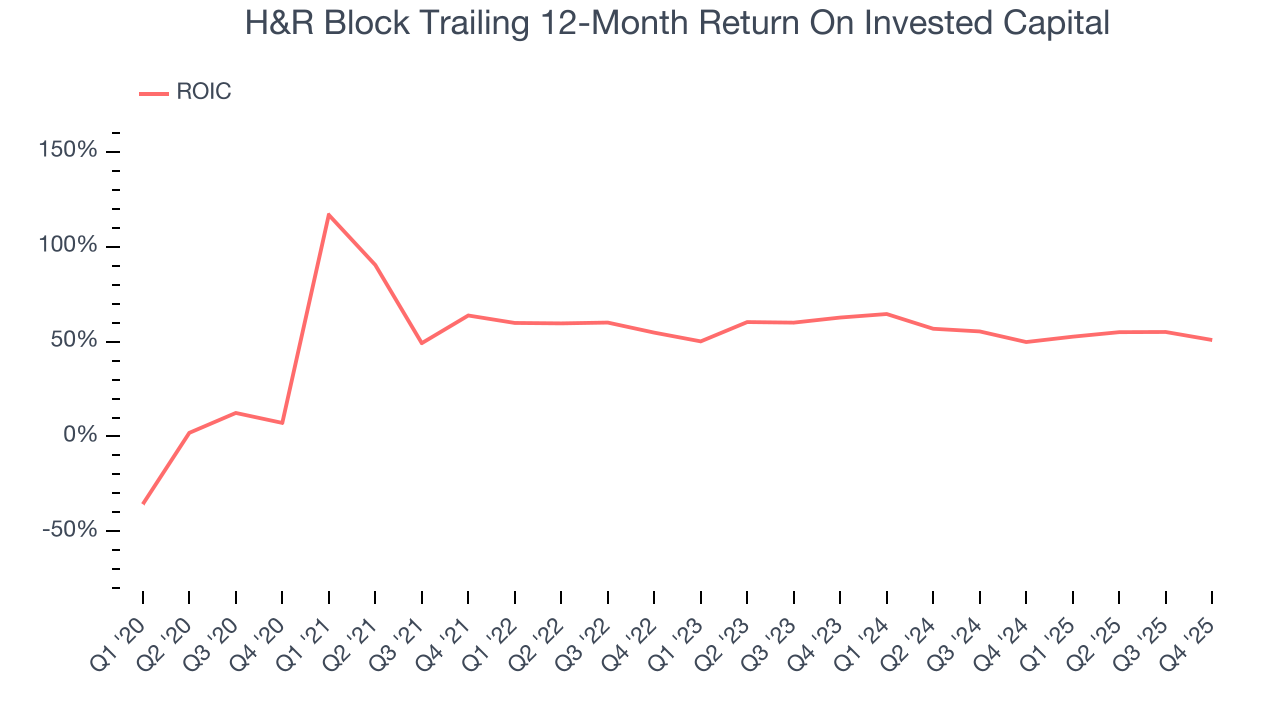

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although H&R Block hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 56.3%, impressive for a consumer discretionary business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, H&R Block’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

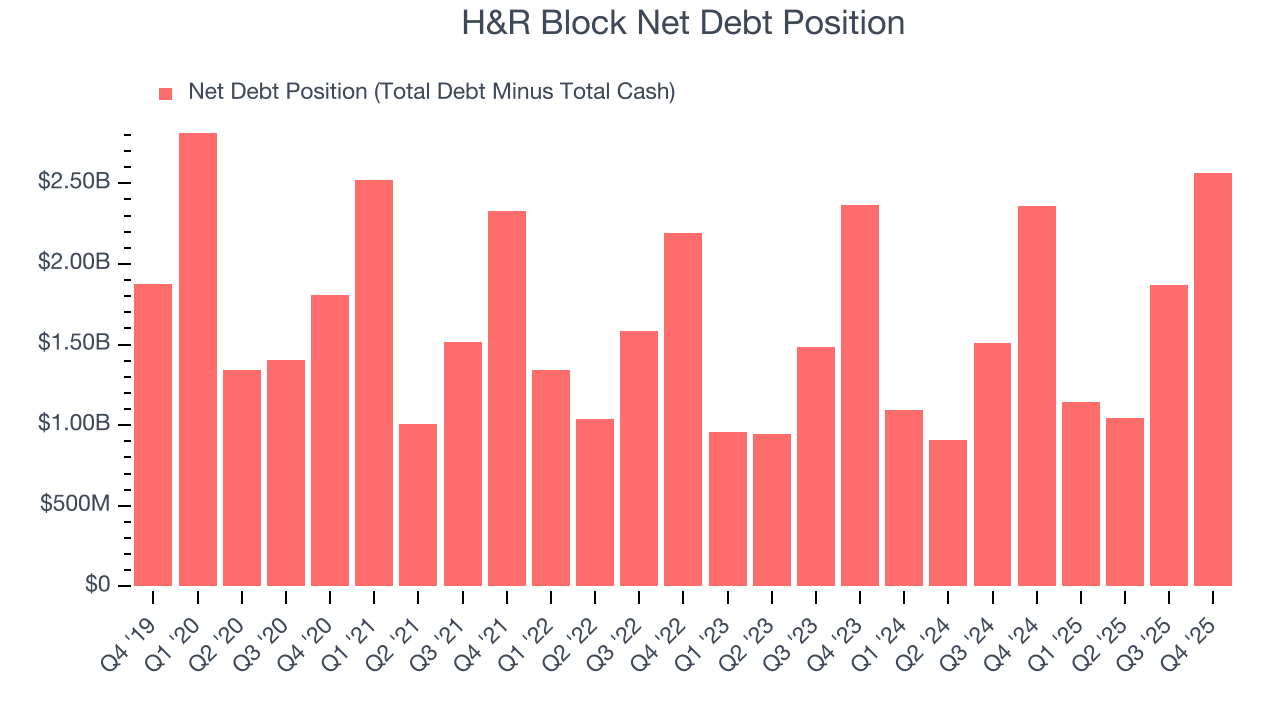

10. Balance Sheet Assessment

H&R Block reported $368.9 million of cash and $2.94 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $989.4 million of EBITDA over the last 12 months, we view H&R Block’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $34.54 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from H&R Block’s Q4 Results

We were impressed by how significantly H&R Block blew past analysts’ Financial Services revenue expectations this quarter. We were also glad its revenue and EPS outperformed Wall Street’s estimates. On the other hand, its Wave Financial revenue missed. Overall, this print had some key positives. The stock traded up 1.2% to $37.64 immediately after reporting.

12. Is Now The Time To Buy H&R Block?

Updated: February 3, 2026 at 4:22 PM EST

Are you wondering whether to buy H&R Block or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We cheer for all companies serving everyday consumers, but in the case of H&R Block, we’ll be cheering from the sidelines. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its market-beating ROIC suggests it has been a well-managed company historically, the downside is its projected EPS for the next year is lacking. On top of that, its low free cash flow margins give it little breathing room.

H&R Block’s forward price-to-sales ratio is 1.2x. The market typically values companies like H&R Block based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $55 on the company (compared to the current share price of $37.64).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.